6 minute read

BUSINESS

Chandler events firm bouncing back from shutdown

BY KEN SAIN

Arizonan Staff Writer

Robb Corwin remembers the date everything changed.

“March 13 was doomsday,” Corwin said, recalling the 2020 directive closing businesses his to shut down because of the pandemic. As chief executive officer for Forty8 Live, a Chandler-based events company that put on the Cajun Festival last month, he said the shutdown “was excruciating.

“And, and that doesn’t come close to describing how hard it was,” Corwin said. “It was probably the hardest two weeks of my 35 years of being in business.”

Corwin said the shutdown order hit them hard.

“We had multiple events going that day, we were opening gates,” he said. “Laying people off, not knowing what was coming, trying to figure out how I was going to take care of all our employees … that was hard.

“Thank God events are back.”

And so is Corwin’s company, which had been the HDE Agency until this year. Corwin acquired HDE Agency in 2018 and decided to change the focus this year, renaming his company Forty8 Live with a goal of producing 12 big events in 2022. He said the new name reflects a focus on the nation’s 48th state, but its events won’t limited by that since there are plans to produce events nationally. Firty8 Live bills itself as a “national event company that provides turn-key solutions for start-up concepts to the well-established branded clients” and “creates, books, produces, and markets live events from festivals, concerts and civic celebrations to corporate events and private themed special events.

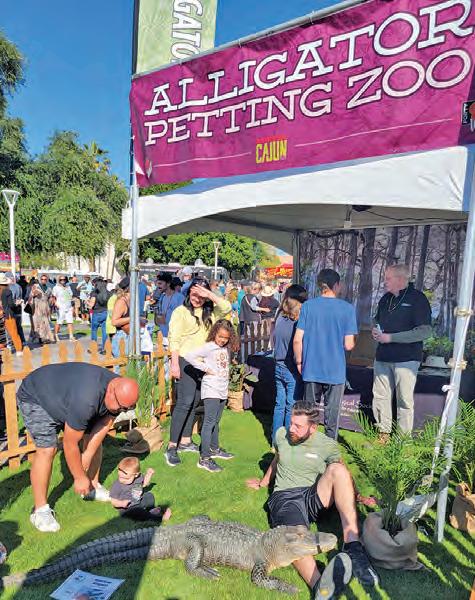

“Our goal is to produce signature events that produce a significant economic impact in the community, create a memorable experience for the attendees and deliver results that exceed expecLeft: Last month’s Cajun Festival in downtown Chandler was organized by Forty8 Live, a Chandler promotion company. Right: Forty8 Live’s recreation of Bourbon Street in New Orleans was a special addition to the Cajun Fest in downtown Chandler. (Special to the Arizonan )

tations for our partners,” it says on its website.

Corwin said he knows the pandemic hasn’t completely gone away and that his company is doing everything it can to protect people at their events.

“We space things out – more spatial awareness,” he said. “We space out our lines, have glass between the ticket takers, and we sanitize the whole space, and our disinfectant lasts for days.

“There’s a lot that goes into COVID protocols that we’ve never had to experience before,” Corwin said. “It’s expensive, but it’s a necessary thing we have to do to make people feel comfortable going out.”

Corwin is also CEO of the Pride Group, another events business. He said he has started dozens of companies. He said one thing of Forty8 Live’s specialities is staging successful events. “We figure out how to make it profitable, that’s what we’re all about,” Corwin said. “We book talent, book entertainment, we come up with themes. And we end early, so we can help out other businesses in the area. So he expected after the Cajun Festival ended people would fill up the bars and restaurants in downtown Chandler. The theme for the Cajun Festival had a very New Orleans feel. Guests entered by walking down Bourbon Street and there were people on top tossing beads down to everyone.

“We hope events like this will embed us in.” Upcoming Forty8 Live events are the KNIX Barbecue and Beer festival in downtown Chandler on March 26, the Great American BBQ throw down in Surprise in April and the Rockin’ Taco Street Fest in September. The company will also put on Oktoberfest for Gilbert in October.

THE CHANDLER ARIZONAN | WWW.CHANDLERNEWS.COM | MARCH 20, 2022

No good reason not to convert to a Roth IRA

BY DR. HAROLD WONG

Guest Writer

The more your traditional IRA or 401k grows, the more the eventual tax, either through Required Minimum Distributions (RMDs) that start at age 72 or whenever you withdraw money to enjoy. It’s all taxed as ordinary income.

The only way to avoid this ticking tax time bomb is the Roth IRA Conversion. There are two major benefits to a Roth IRA Conversion and the first is that no matter how much you earn, there is no tax for the rest of your life; your spouse’s life; and the first 10 years your heirs (typically kids) inherit the Roth IRA. The second major benefit is that there is no RMDs with a Roth IRA. Unlike with a traditional IRA or 401k, the government cannot tell you to distribute an increasing RMD each year that is fully taxable.

Over the last 12 years, thousands have attended my free seminars. Only 2% have $30,000 or more in a Roth IRA. There are two major reasons. The first is that they won’t give up the ability to reduce each year’s taxable income by contribution to a traditional IRA or 401k.

However, this is a tax trap that will result in much more tax paid than saved over their lives. The second reason is that once you have reached retirement age, you can’t stomach the high tax that results from converting $200,000-$1 million+ to a Roth IRA, which increases taxable income by that much.

What if there was a way to eliminate 100% of the federal tax that resulted from a Roth IRA conversion?

The most powerful way to reduce tax on high taxable income (whether generated by high wages or profits; selling stock or real estate; or doing big Roth IRA Conversions) is buying and leasing out solar business equipment.

On a $65,000 solar deal, the 26% federal solar tax credit and Section 179 (which allows one to deduct 87% of the $65,000 cost of the equipment in the year it’s “placed in service”) is enough to offset all the federal tax on the first $170,000 of federal taxable income for a couple filing married, joint return.

A common misconception is that a Roth IRA Conversion does not make sense if one is older. Case Study: Dave is a widower age 85. He was scammed over $3 million by a Wall Street investment firm. He still has $1 million financial assets, including $335,000 in a traditional IRA. His #1 priority is to leave assets to his three kids. His youngest child is a son that can average at least a 20% annual return in real estate investing.

Dave should immediately convert the entire $335,000 to a Roth IRA. In 17 years, assuming Dave lives until 92 and then the kids enjoy 10 years of tax-free growth after inheriting the Roth IRA, it will become a total of $7.5 million taxfree. Split equally between the three kids, each will have $2.5 million tax-free. The Roth IRA Conversion allows Dave to leave more than he thought possible to the kids, even after being scammed $3 million+ by Wall Street.

You’re never too old to do a Roth IRA Conversion. You need earned income to make an annual contribution to an IRA, but no earnings are required to do a Roth IRA conversion. Free live seminar and lunch: 10 a.m. March at Hyatt Place, 3535 W. Chandler Blvd. Chandler, followed by a free lunch at 12:15 pm catered by La Madeleine French Café. The topic is “Roth IRA Conversions: Tax-Free at Any Age!”

To RSVP for the seminar or schedule a free consultation, contact Dr. Harold Wong at 480-706-0177 or harold_wong@hotmail.com. His website is drharoldwong.com.

Dr. Harold Wong earned his Ph.D. in economics at University of California/ Berkeley and has appeared on over 400 TV/radio programs.

Senior Lockbox Program

Chandler Police offers a Senior Lockbox program, providing lockboxes for emergency personnel to gain access to the senior’s home after being summoned for emergency purposes. chandlerazpd.gov/communityprograms/lockboxes-for-seniors