19 minute read

Business

EV renters caught in housing price squeeze

BY PAUL MARYNIAK

Executive Editor

Valley renters are increasingly finding themselves caught between rapidly rising rents and soaring home prices that make buying a house next to impossible.

Starter-home prices are rising seven times faster than a typical renter’s income, making saving for a down payment even harder, according to a new analysis by Zillow.

The online real estate marketplace earlier this month said its analysis shows first-time buyers need a year longer to save enough for a 20 percent down payment than they did in 2017 and must put away an additional $369 per month in the coming year just to keep up with the forecasted growth in home values.

But a report from Arizona Regional Multiple Listing Service on July 19 carried depressing news for any buyer, let alone first-timers: Year-over-year sale prices in the Phoenix metro region rose a whopping 46.26 percent in June and the current average price of a home is $507,936.

Realtor.com last week reported,“High demand for a limited supply of rental housing has resulted in skyrocketing prices across the nation – and desperation from those seeking more affordable housing options.”

Zillow noted, “Monthly payments can remain affordable even with a smaller down payment, and flexible work options are providing new opportunities for many to buy a home in a less-expensive city.”

That likely doesn’t include the Phoenix metro area, where various reports indicate that both rents and house prices are skyrocketing.

The Cromford Report, one of the

This 3,661-square-foot home on W. Kitty Hawk at the Chandler Airport recently sold for $1.55 million. Besides coming with an airplane hangar, the 16-year-old, two-story home has vaulted ceilings, a glass wall leading to the swimming pool and numerous amenities.

(Special to the STSN)

See RENT on page 23

Popular game store/restaurant coming here

SANTAN SUN NEWS STAFF

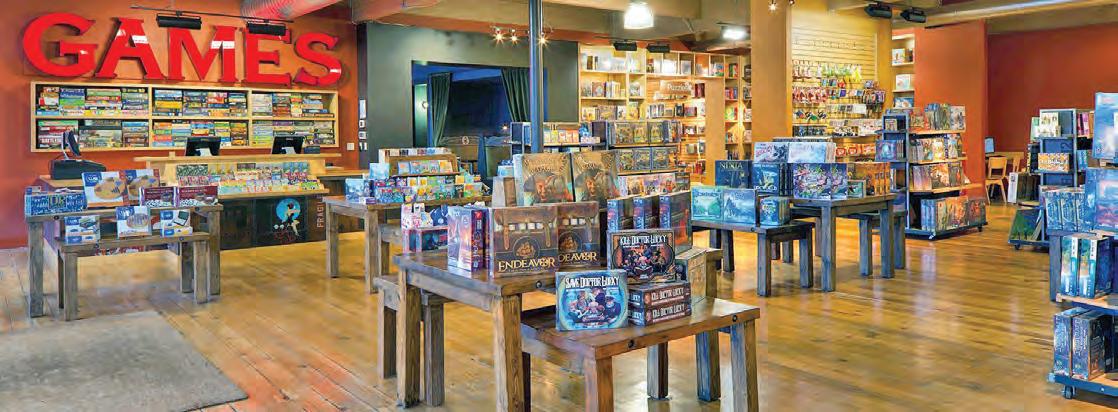

A unique “board game restaurant” is setting up shop in Chandler this year as it makes its first foray outside the Northwest.

Since 2011, Mox Boarding House has combined game retail sales, in-house game events and an eclectic dining menu at locations in Seattle and Bellevue, Washington, and Portland, Oregon.

Construction has already started on the 10,000-square-foot establishment at 1371 N. Alma School Road but the owners have not said when it would open. ”Mox Chandler will feature their signature retail, restaurant, and event space that customers have come to love from the Mox brand, all served with a unique twist for Arizona patrons,” the city said in a release, adding that it will also house two private rooms for rent and a large patio.

Guests will be able to borrow games from the huge game library for free while eating in the restaurant.

Mox offers over 1,000 game titles – including miniatures, board games, role-playing games, card games – and runs a kiosk to buy and sell Magic: The Gathering cards.

Mox is the retail arm of Card Kingdom, the world’s largest retailer of The Gathering cards.

“Stepping into a Mox Boarding House is an instant transportation to somewhere special,” stated Jorel Miller, director of Mox Boarding House.

“Each of our locations provide an opportunity to unplug and spend quality time with others. We offer a sense of community packed with a vast selection of games, good food, and craft beverages, for all seeking a unique experience in an environment like no other.”

Willamette Week in Oregon last year described Mox Portland as “a gilded palace of geeky delight.”

“With chandeliers hanging from vaulted ceilings and clean, heavy wood tables for playing, it’s a convincing rebuttal to the false assumption that all gaming stores must be cramped and devoid of congeniality,” the newspaper reported.

“Customers can crack open a freshly purchased game from the showroom or borrow one from the generous game library, then settle in at the expansive bar and restaurant, with full service at a table in the adjacent dining room.”

Along with a 20-handle tap list, the Portland Mox also started offering cocktails. Its menu includes soyglazed Biang Biang Brussels and honey gochujang lollipop wings, a cumin-roasted Peruvian Porn sandwich and smoked brisket friend rice. “It’s easy enough to order online to bring home along with your stack of board games, Magic cards or Warhammer figurines. It’s such a pleasant place to spend time, however, that you might as well sit a spell and, well, cast a few spells,” the newspaper wrote. About Mox: Founded in 2011 by brothers John and Damon Morris, Mox Boarding House is part of the Card Kingdom family of brands, which was founded in 1999.

Last month the Mox Portland celebrated its one-year anniversary with a block party that included entertainers, balloon artists, giant board games, a photobooth and game demos.

It also offered a prize wheel spin and gave swag bags to attendees.

The locations even offer a personal

Left: Like its Seattle outlet, all Mox Boarding Houses maintain a large retail space where it sells games of every description. Right: Mox Boarding House in Portland offers a spacious dining area where patrons also can play games while eating. (Facebook)

See HOUSE on page 24

RENT from page 22

region’s premier analysts of the Valley housing market, said the median sales price for homes in June was $400,000 – up 24.2 percent from a year ago.

That median is higher than the nation-wide home median price of $363,000 that the National Association of Realtors announced last week.

Noting the market appears to be cooling as inventory steadily increases, Cromford doesn’t expect home prices to fall – or even weaken – cautioning, “You would be mistaken if you think most sellers are asking less for their homes.”

It’s not only home prices that are soaring for renters.

Nationally, Realtor.com reported, the median rent hit a new high of $1,575 in June, up 8.1 percent compared with last year.

Phoenix is among the 44 of the nation’s 50 largest cities that “posted new highs, squeezing renters even tighter,” Realtor.com said.

Looking at markets with the largest year-over-year price increases and median rents in June, it said Phoenix’s median rent soared 20.9 percent to $1,590 – a higher median rent than the national figure.

“We are seeing an excessive amount of people showing up for rental properties and turning applications in, probably five times the amount it was a year ago,” one broker told Realtor.com.

“Similar to the shortage of homes for sale, the number of homes available to rent is historically low, driving prices up,” it said. “That’s hurting cashstrapped renters vying for places to live that fit in their budgets.”

The pandemic’s economic pressures “have not affected everyone equally,” said Danielle Hale, chief economist at Realtor.com. “There has been a lot of government support, so incomes remained steady for a lot of people, and for some Americans, incomes have risen.”

Realtor.com surmised the shrinking rental inventory may have been partly impacted by landlords “throwing in the towel” as restrictions like the eviction moratorium make it harder to manage properties and pay their own bills.

Phoenix is a good case in point. A memo to City Council last week shows that between March and this month, the city has shelled out $18.8 million in rental assistance to 2,492 households.

With only 43 percent of its rental assistance funds expended, the city now wants to “hire approximately 20 additional temporary employees with higher pay to attract more applicants and more highly qualified personnel,” the memo from the City Manager’s office states.

It also wants to “increase pay of existing temporary employees to encourage retention” and “add premium pay to staff providing services,” according to the memo.

“Across Arizona and the nation, a lot of protections “are still in place but are close to expiring,” Hale said. Renters who are ultimately evicted will need to find new housing going forward, making it harder to find a place to rent, he added.

Zillow based its analysis on a starter home price of $148,500.

“If an average renter household saves 10 percent of its income, it would take about six years and five months to save enough for a 20 percent down payment on today’s typical starter home worth about $148,500,” it said.

But Zillow also noted that in reality, the typical starter home – the median home in the bottom third of home prices – is worth $270,560.

“Without the equity from a previous home sale, first-time home buyers face more challenges in coming up with a down payment,” said Zillow economic data analyst Nicole Bachaud, adding:

“In a housing market where prices are rising at record rates, especially when compared to renter incomes, the ever-increasing sum of a 20 percent down payment can feel out of reach.

“The good news is that buyers who want to take advantage of today’s low mortgage rates can do so without putting a full 20 percent down – most conventional mortgages allow as little as 3 percent to 5 percent. That lower upfront payment comes with higher monthly payments, but the opportunity to build equity can outweigh those extra costs for many.”

Zillow forecasts 14.9 percent appreciation over the next year, which would mean renters need to save an additional $369 per month just to keep up.

Renters in California face the biggest barriers to saving for down payments. San Francisco renters earn nearly twice as much money as the typical U.S. renter, yet home prices are so high that it would take 17 years and five months 11 years longer than the national average to save enough to put 20 percent down on a local starter home.

Pegging a starter home price of $270,560 in Phoenix, Zillow said it will take 10 years and six months to put away enough for a 20 percent down payment but only just under three years for a 5 percent down. The difference in a mortgage payment at those percentages would be $1,133 and $1,551, respectively, it said.

“A smaller down payment, of course, comes with tradeoffs on the monthly mortgage payment, such as the private mortgage insurance lenders often require borrowers to carry,” Zillow said. “Buyers may decide the benefits of homeownership and the chance to build equity sooner outweigh the additional housing cost burden each month.”

Zillow also reported that its analysis found people of color who rent have even greater obstacles saving for a down payment.

“Because of differences in incomes and the lingering impacts of historical inequities, it is more difficult for Black and Latinx renters to come up with a down payment on their first home,” it said.

“It would take six years and one month for a white renter earning the median income, and four and a half years for an Asian American renter earning the median income to save for a 20 percent down payment on a starter home, compared with nine years and seven months for a Black renter, and seven years and eight months for a Latinx renter.”

LET’S TALK ABOUT YOUR MEDICARE OPTIONS.

Get answers to your important questions.

Cigna Medicare Advantage plans offer all the coverage of Original Medicare plus added benefits that may include: › $0 monthly premium › $0 medical and $0 pharmacy deductible › $0 primary care physician visits › $0 lab copay › $0 transportation to and from health services* › $0 copay for many prescription drugs › Over-the-counter allowance › Fitness program, dental, vision and hearing services › Telehealth Services – Virtual primary care physician visits, online or by phone

Call now to get help from a licensed Benefit Advisor. Shannon Farquharson

Cigna Medicare Advantage

(480) 215-0565

Monday to Saturday: 8.00am to 6.00pm Or visit www.cigna.com/medicare

*Plan-approved locations and restrictions may apply by plan. Under 60-mile one-way trips. All Cigna products and services are provided exclusively by or through operating subsidiaries of Cigna Corporation, including Cigna Health and Life Insurance Company, Cigna HealthCare of South Carolina, Inc., Cigna HealthCare of North Carolina, Inc., Cigna HealthCare of Georgia, Inc., Cigna HealthCare of Arizona, Inc., Cigna HealthCare of St. Louis, Inc., HealthSpring Life & Health Insurance Company, Inc., HealthSpring of Florida, Inc., Bravo Health Mid-Atlantic, Inc., and Bravo Health Pennsylvania, Inc. The Cigna name, logos, and other Cigna marks are owned by Cigna Intellectual Property, Inc. Cigna complies with applicable Federal civil rights laws and does not discriminate on the basis of race, color, national origin, age disability or sex. Cigna cumple con las leyes federales de derechos civiles aplicables y no dicrimina por motivos de raza, color, nacionalidad, edad, discapacidad o sexo. English: ATTENTION: If you speak English, language assistance services, free of charge are available to you. Call 1-888-284-0268 (TTY 711). Spanish: ATENCIÓN: Si habla español, tiene a su disposición servicios gratuitos de asistencia lingüística. Llame al 1-888-284-0268 (TTY 711). Chinese: 注意: 如 果您 使 用繁體中文, 您可以 免 費獲得語言援助服務. 請致電 1-888-284-0268 (TTY 711). Cigna is contracted with Medicare for PDP plans, HMO and PPO plans in select states, and with select State Medicaid programs. Enrollment in Cigna depends on contract renewal. © 2021 Cigna Y0036_21_92127_M 936621 b

HOUSE from page 22

shopper to help customers decide what game they want to buy for themselves or for a friend.

“In the end, all anyone wants is a place to go out and hang out with people and not be judged and be themselves,” John Morris told Wells Fargo Bank in an interview published on its website.

Wells Fargo Commercial Banker Kathi Ferrari called Card Kingdom “the most unique business I’ve served in my 18year career at Wells Fargo.”

“This is a business where the assets are cards – and not accounts receivables or real estate or equipment – and where the normal lending criteria are out the window,” she said.

She “immersed herself in the Card Kingdom world to learn everything she can about the unique business and community and to help the brothers avoid the pitfalls that can sink startups,” the bank said.

Now, Ferrari added, “It’s been fun to watch them grow and be so successful.”

John Morris told Wells Fargo their business “has doubled four times since we opened that store, and we now employ more than 250 people.”

The brothers also have a charitable giving foundation, Engage. It sponsors a game tournament called The Gauntlet that raises more than $100,000 each year for nonprofits, he said.

Their online business for Magic: The Gathering cards now ships to 88 different countries and territories.

“To me, Card Kingdom is a place that you can make anything happen,” Damon said. “I believe it’s a place that we can make the world a better place.”

The board game café concept went

over so well that Hasbro added a visit to Card Kingdom’s Bellevue Mox Boarding House in July 2015 as part of its board of directors meeting in Seattle — showcasing how the game could be marketed to high-end customers, according to Wells Fargo.

“We grew up buying and selling things at an early age,” said John Morris. “You don’t notice it as a skill. It’s just what we knew. But neither of us are sales people, so that was hard.”

Their younger brother, Aaron, was the first to get hooked on the Magic: The Gathering card game.

In the strategy game, considered the world’s most complex, players assemble and play decks of 60 cards using the spells and other special powers of their associated creatures and characters to finish off their opponents before the same can be done to them.

John Morris eventually bought the business from Aaron (called Magic Madness), and the business took off so fast that he was able to quit his day job as a software engineer in Minneapolis.

He started Card Kingdom from the basement of Damon’s house in 1999 and convinced Damon to join him as an equity partner in 2001.

Mox Boarding House offers a unique gaming experience like no other! Both locations have a huge selection of games, a game library, and a full restaurant with a wide selection of beers and wine on tap. (Facebook)

– Jorel Miller

At The Village, we care. About your health, your well-being, your fitness, your goals – and about our community, too.

Our employees and members work together to give back to charities and causes throughout the Valley. We also do small things that make a big impact. Like donating our old towels and tennis balls to local animal rescues and hosting annual water, sock and shoe drives for people in need. We’re committed to being a big part of your community. And we invite you to join ours.

Time for a mid-year check on your fi nancial condition

BY DR. HAROLD WONG

Guest Writer

Just like a doctor often gives a patient an annual or semi-annual physical exam, it’s time for your 2021 mid-year fi nancial checkup. Let’s look at your job situation, real estate, investments and tax plan.

Job Situation: Nothing is more important than having a secure and substantial source of income. For most people it’s their job and for some it’s their net profi t from their own business. Here are the key considerations: • Is your job secure or is there a substantial danger of lay-off s? • If so, what can you do to decrease the probability of being laid-off ? Do you volunteer for job duties and tasks that no one else wants? Have you added skills such as maintaining the company website and social media accounts that are essential to your company? • Are you networking and getting known in your industry so that you have several back-up jobs you can get on short notice if you get laid-off ? Real Estate: For most people it’s their primary home because very few have rental houses or other rental real estate. • With mortgage rates at all-time lows, have you refi nanced to get the lowest rate possible but kept the same number of years left on your old loan so that you keep reducing principal

without starting from the beginning? • With a 30-year fi xed rate loan, it’s not until year 22 that half of your payment goes to principal and half to interest.

It makes sense to have a 15-year loan instead of the standard 30-year loan if you can aff ord the higher monthly payments. • With our very hot summers, have you maintained your air conditioning units?

It’s recommended that you have at least one thorough service annually.

If you need to replace your AC units, understand that supply shortages may cause a 3-5 week delay in obtaining new units. • Consider paying $500-600/year for a good home warranty policy to cover most of the smaller items that go wrong in a house.

Investments: We have had an unprecedented 12-year stock market boom since the lows were reached March 9, 2009. • Are you comfortable with 80-90% or more of your total life savings in the stock market, which is typically what I have seen from the hundreds who have seen me for consultations in the last 12 years? • How would you cope if you lost 2550% of your life savings when the next stock market crash occurs? • Are you open to reducing risk by using the Rule of 100? Example: if you are 70-years-old, 100-70 means you should have no more than 30% of your life savings in the stock market. If the market crashes and you lose half of the 30%, you still have 85% of your life savings left.

Tax Plan: For many, total taxes paid (federal, state, and local) exceed any single other item of one’s budget, including housing or food. • Are you paying a professional for tax planning now to reduce your 2021 taxes; or do you just fi nd the cheapest person to fi ll out your tax return due on April 15, 2022? • In order to enjoy big business deductions such as the 26% solar tax credit and Section 179 expensing provision (where one can deduct 87% of the cost of business equipment), one must

“place that equipment in service” by 12/30/2021. That requires that you buy your equipment now as there are logistics delays in many factories. • What’s the impact on your family if you could save $10,000-$50,000+ of income tax each year?

Dr. Wong earned his Ph.D. in economics at University of California/ Berkeley and has appeared on over 400 TV/radio programs.

Free live seminars and lunch:

Saturdays, Sept. 18. And Oct. 9 at The Old Spaghetti Factory, 3155 W. Chandler Blvd., Chandler, starting at 10:45 a.m. Topic is “Double Your Social Security & Other Retirement Income and Pay Less Tax!” RSVP: Dr. Harold Wong at 480-706-0177 or harold_wong@hotmail.com. His website is www.drharoldwong.com.

Now in our 35th year! ARIZONA’S LONGEST-RUNNING EXPO IS HERE!

Wednesday, Nov. 3rd • 8am - 12pm Mesa Convention Center 201 N. Center Street | Mesa, AZ 85201 Healthcare | Retirement Living | Financial Leisure | Home Repair | Education Casinos | Tour & Travel and More...

Entertainment by MS. SENIOR ARIZONA

FREE PARKING! FREE ENTRY! Lots of Prizes and Giveaways INCLUDING a $100 CASH DRAWING Every Hour!