21 minute read

HOUSING COMMENTARY

REINZ HOUSE SALES: DOWN In April, sales nationwide plummeted by 78.5% year-on-year and in Auckland they fell by 68.8% year-on-year. This decline was because New Zealand was in level four lockdown which made it difficult for property sales to occur.

INTEREST RATES: DOWN The Reserve Bank’s emergency OCR cut in March was passed on by the banks. Rates have now dropped to unprecedented new lows and the situation is unlikely to change in the near future.

OCR: DOWN Prompted by the Covid-19 crisis, the Reserve Bank made an emergency 75 basis point cut to the OCR in March. This took it to a new record low of 0.25% – and it’s set to stay there for at least 12 months.

IMMIGRATION: DOWN In a bid to contain Covid-19, the Government closed New Zealand’s borders in March. This means that what will happen with migration, which was high but trending lower, is in unknown territory.

BUILDING CONSENTS: UP February saw consents nationwide rise by 4.7% from the month before, but that was off the back of a slight fall in January. In annual terms, consent issuance was at the highest level in 45 years.

MORTGAGE APPROVALS: UP Reserve Bank data shows mortgage lending overall in February was up to the highest level of any February in the last five years. Investor lending was at its highest level since February 2016.

Uncertain times ahead

No-one is sure of what’s to come for the housing market as we enter the postlockdown unknown but commentators agree the market is resilient and may not be down for long, writes Miriam Bell. N ew Zealand may be heading out of its extreme Covid-19 prompted lockdown, but uncertainty is set to plague the housing market throughout 2020. There’s some grim predictions of what might come economically and, as you’d expect, there’s also speculation that the housing market will follow a similar path.

As with the economic forecasts, there’s a broad range of opinions on how badly the market will be affected by the recession the country has moved into. These are unusual times so no-one can be too definitive. And that makes for uncertainty. But there’s also some common themes that have emerged from all the talk. And they provide some hope.

Market snapshot at lockdown

Given the lockdown began towards the end of March, the latest data releases serve to provide a picture of the market in March. That means it essentially establishes a baseline for the way the market was on entering lockdown.

As such it shows the market was performing strongly prior to the lockdown. In fact, it was heading guns blazing into recovery, characterised by healthy price growth and solid demand.

QV’s latest data had the average national value at $728,276 in March, which was an increase of 6.1% year- on-year and of 2.6% over the quarter. All 16 of the cities it monitors showed quarterly value growth for the fourth consecutive month, indicating market strength across the country.

Likewise, in Realestate.co.nz’s data average asking prices around the country were buoyant in March. The national average asking price up by 5.0% year-on-year to a record high of $711,696 and eight regions reached all-time highs.

And, according to REINZ, New Zealand’s median house price was up by 13.7% year-on-year to a record high of $665,000 in March. Additionally, eight regions – including a resurgent Auckland – also hit record median prices, after double digit annual growth.

Of particular note was the data on Auckland’s market. Across the board, the data showed the former powerhouse was roaring back into contention.

QV had its average value coming in at $1,066,035 in March, which was up 2.5% year-on-year and 1.8% over the quarter, while the REINZ data showed Auckland’s median house price had increased by 11.1% year-on-year to a new record of $950,000.

The data from Auckland’s biggest agency, Barfoot & Thompson told a similar story: the Super City was booming before lockdown. Both the average sales price ($993,528) and the median sales price ($925,000) were at new highs, up by 6.6% and 10.6% yearon-year respectively.

Barfoot & Thompson also had new listings and sales volumes in Auckland at their highest for some time. It had 1,763 new listings in March, which was the highest in 17 months, and its sales hit 1,096, which was the first time they were above 1,000 in a month for two years.

REINZ also recorded strong sales activity in Auckland, with sales up by 10.8% year-on-year from 2,083 to 2,307, which was the highest number of sales in four months. But here Auckland bucked the trend.

According to REINZ, sales activity nationwide dropped by 4.8% yearon-year in March, with 6,886 sales as compared to 7,213 in March last year. That was the lowest number of properties sold in the month of March in nine years.

At the same time, Realestate.co.nz’s data highlighted the ongoing shortage of housing stock, with the total number of homes available for sale nationwide down by 26.7% on March last year. New listings nationally were down by 16.5% year-on-year.

Property market will go on

REINZ chief executive Bindi Norwell says that, despite the drop in sales, the March data shows that before Covid-19 hit New Zealand’s shores, the property market was doing well.

In her view, how big the impact of Covid-19 is will depend on a huge number of factors. These include the level of unemployment; consumer and business confidence levels; people’s ability to access finance (and finance their own mortgages); and how long the wider economy takes to recover.

" Property is a long-term investment and the market will recover. However, the question is, how long it takes to recover." Tony Alexander

"We expect people to take a bit of a ‘wait and see’ approach when it comes to listing their property.

“But for those who have decided after four weeks of being locked in their ‘bubble’ that they don’t like their house anymore, they will be desperate for the chance to move, so there may be some great opportunities for those wanting to buy and sell in the coming months.”

However, QV general manager David Nagel is somewhat less optimistic. He says that everything changed on March 25 and nobody knows what post-lockdown market conditions will look like or how long they will last.

“What we do know is there will still be a property market. There will still be sellers, although likely only a fraction of what we’re used to. And there will still be buyers that have the means and confidence to purchase property.”

But he says that what happens to house prices will be determined by market forces and the changes in supply and demand. “The supply of houses for sale is likely to be reduced, while demand for buying a house is also likely to be down significantly.”

Transaction volumes will drop significantly from pre-lockdown levels and listings will dry up with only those having to sell, for work or financial reasons, wanting to enter an uncertain market, he says.

“Buyers that have the means will likely dominate the market but, with limited stock available, buyers will probably exercise patience and this could force prices down for vendors that have to sell. But by how much? Nobody knows.”

The market will take considerable time to settle to a new normal after the lockdown ends, Nagel adds. “With limited transactions after lockdown ends, we can expect a market filled with uncertainty at least through to the end of 2020 as the economy finds its feet again.”

Meanwhile, Barfoot & Thompson managing director Peter Thompson points out that market activity did continue through the lockdown, with buyers, sellers and agents utilising technology to progress sales.

It’s not possible to predict where the market will go in the short term, but people might want to look to the past and take a medium-term view of market prices, he says. “During the major economic downturns that occurred in 1987, 1997 and 2007 house prices did not decline beyond 5% at most. And following the declines, prices recovered within 12 to 18 months.” ✚

Help your client over the hump.

Flexible short-term second mortgage options.

Got a client who needs a little extra? We can help with flexible, short-term loans of up to $800,000 on residential or commercial property – far more than most second mortgage lenders.

Better yet, we’re an owner-operated Kiwi business with over 28 years in the finance industry, so you and your clients know you’re dealing with a reliable, trusted lender.

To give your clients that little bit extra, email grant@corefinance.co.nz or call 0800 667 366.

corefinance.co.nz

Advisers face the new world Advisers are bullish about business survival post-Covid-19, but bank processing and turnaround times remain the top issues for the sector, according to TMM’s annual survey.

2020 has proven to be a year of the unexpected. The Covid-19 pandemic has caused a new global financial crisis, with New Zealand under lockdown through March and April. The economic turmoil has seen the housing market grind to a near-halt, with a devastating impact for advisers.

While the pandemic has delivered a massive blow to shortterm profits, advisers remain hopeful that they will survive and emerge from the crisis. Just 10% of advisers said business survival post-Covid-19 kept them awake at night.

This year’s TMM Mortgage Adviser Survey underlines some of the key concerns facing advisers in this new and uncertain world. Advisers face a long road to recovery, and Covid-19 is likely to exacerbate some of the existing challenges facing the sector.

With house prices forecast by ANZ to fall by 10-15% this year, mortgage advisers have to contend with a downmarket in the near-term. Commission from settlements has plummeted, and Covid-19 could spell more danger than the GFC.

TMM asked advisers for their views on the biggest challenges and opportunities in the market. With banks under severe strain and tightening credit availability, turnaround times and loan applications were highlighted as issues most likely to keep advisers awake at night.

Advisers say turnaround times have worsened over the past year and in recent months, as banks cut costs and mortgage staff numbers. Brokers hold out little hope that banks will cut down application times in the year ahead.

The new global financial crisis comes as the industry embraces new industry regulation. Transitional licensing has been delayed until next year due to the virus outbreak, but most brokers have made up their minds about which licensing structure to take. 2020 is poised to be a year of significant change for the industry. Advisers expect to place more business with nonbanks and plan to offer new products to clients in the next 12 months. The question of whether to pursue more trail commission is likely to be a bigger issue in the year ahead.

Supporting advisers by Aaron Milburn, Pepper General Manager mortgages.

Pepper NZ is delighted to be sponsor of the annual TMM Mortgage Advisers Survey. As New Zealand's newest non-bank we are committed to supporting advisers and their clients and ensuring most importantly no Kiwi family is sitting at home not understanding what their financial options are.

In our opinion they can only get the full set of options from mortgage advisers.

We must continue to work together to get the message out about what advisers do and how important they are to the financial sector of New Zealand.

Given advisers generate around 37% of mortgage sales vs banks we have a long runway ahead full of opportunities. Pepper NZ will be there with you every step of the way. Over 80% of advisers have been in the business for more than two years and whilst that is a positive it may be said that the more we can introduce what advisers do to more of New Zealand then that will also bring new talent into the industry and importantly succession. Turnaround times continue to be the biggest concern and advisers should continue to challenge lenders to invest in technology and back office process improvement to not only assist, but also most importantly improve the customer experience.

It is great to see more advisers having a better year with over 70% seeing an increase in volume and some seeing 25% uplifts which shows more and more Kiwis need advisers’ help and we need to continue together to get the message out there.

For Pepper NZ it is so pleasing to see advisers already sending nearly 3:10 deals to the non-bank sector and even more exciting to read that 4:10 advisers will be looking to the non-banks like Pepper NZ to solve more of their customers' needs.

Strong lending in financial year

The lending market looked rosy before the onset of Covid-19. According to our survey respondents, about 73% of advisers settled more loans in 2019/20 than the previous financial year. About 31% of advisers said they settled 25% more than the year before.

Only one in five said they settled a lower amount than the 2018/2019 financial year. Last year was underpinned by a rapidly rising housing market, with record-low interest rates supporting house price growth.

Advisers were bullish about the growing adoption of third-party advice, and predict more borrowers will turn to specialists for their property finance needs.

“More people realise that brokers do it better than banks,” said one respondent. “We’ve more than doubled our revenue, and the growth is due to staff, clients and referral partners,” said another. “This is due to our unique points of difference, offering more insight to our clients.”

Several mortgage brokers fresh to the industry took part in this year’s survey and reported positive signs for their businesses.

“This was my second year in operation,” said another adviser. “My main source of business is referrals from clients I helped, and word of mouth. Hopefully, as I continue to provide my clients with good service, this will help in the years to come.”

Was the volume of loans settled this financial year (to March 31) higher than last year?

ANZ dominates the big four

The big four continue to dominate the home loan market. About 51% of advisers said the top four banks: ANZ, ASB, BNZ and Westpac, made up between 75% and 89% of their business.

Four in five advisers said smaller banks, such as TSB and SBS, accounted for 1-24% of their settlements.

More than 87% of advisers said specialist non-banks accounted for 1-24% of their business, indicating their rising status in the New Zealand market.

Advisers picked their favourite banks of the big four and smaller competitors. About 40% of advisers said ANZ New Zealand, the nation’s largest bank, was their preferred big bank.

Mortgage advisers originated 43% of ANZ New Zealand’s home loans, according to the bank’s latest accounts.

ANZ was the top choice for brokers despite a tumultuous year in which CEO David Hisco departed amid an expenses scandal, and the bank was criticised over capital modelling failings.

Second was ASB, taking about 23% of the vote, slightly ahead of Westpac, which received 17% of the vote.

BNZ was the least favourite “big four” bank, accounting for just 7% of the overall vote. Mortgage advisers originated 29.2% of BNZ’s home loans as of March.

One adviser said ANZ had a better customer service function than its rivals: “I’m relatively happy dealing with each of the big four. However, ANZ does seem to have a quicker turnaround time and decent communication.”

SBS the most-popular small bank

Of the smaller banks, SBS came out on top.

About 29% of advisers chose SBS as their preferred smaller lender, edging The Co-operative Bank, which was selected by 25% of respondents.

One respondent said SBS was the “only one that’s competitive”, but another warned “things were changing” at SBS in recent months.

TSB came in third, chosen by 23%. TSB rated strongly for customer service and flexibility. One said TSB was “lending above 80% LVR, with good rates for borrowers,” while another added TSB “is willing to workshop” and communicate with brokers

A marginal number of advisers chose HSBC and Kiwibank. The latter is setting up a broker unit to distribute home loans later this year.

While not listed as an option on our survey, several advisers also selected Sovereign as their preferred small bank.

Non-banks set to boom

Non-bank, second-tier lenders are poised to capture more business in the coming year as banks tighten up in the face of Covid-19.

Advisers plan to place more business with the likes of Pepper, Resimac, Avanti and FMT this year.

About 38% of advisers said they would place more business through non-banks in the next 12 months.

About 31% said they would place the same amount of business with non-banks. Only 1% said they would place less business with non-banks. As one adviser said: "Avanti & Pepper are good options."

Over the next 12 months, what amount of business will go to non-banks compared to last year?

What keeps you awake at night?

019

The mortgage application process continues to plague advisers.

Asked “What keeps you awake at night?”, 18% of respondents said turnaround times. Turnaround times were also the biggest issue for advisers in 2018 and 2019.

A total of 15% of respondents chose “getting applications approved”, underscoring difficulties faced by advisers on a daily basis. →

The results reflect growing concerns about turnaround times and applications as banks face the strain of Covid-19. Conditions could become more strained over the coming year.

The Mortgage Supply Company’s David Windler expects turnaround times to worsen in the near term, with banks under pressure processing hardship requests and looking after existing customers.

“We’ve gotten to a situation where banks have justifiably switched resources to their existing customer base and are restricting new-to-bank business. That’s bread and butter for advisers. This is a shifting landscape. At the moment, in level three lockdown, we have no idea what the consequences will be.”

Second-tier lenders have a reputation for faster application decisions than their bank rivals. But Windler warns the Covidcrisis will even hit non-bank turnaround times.

“Non-banks will be looking at their LVR positioning and will be more conservative in their credit policies,” Windler adds.

Only 10% of respondents said business survival post-Covid-19 was the main issue keeping them up at night. Meanwhile, 12% said finding new clients was a big concern.

Advisers have adapted to the challenges of working from home during the Covid-crisis. A total of 79% of respondents said working remotely “was not an issue” for them.

Thinking about the biggest issues facing your business, please rank them from most concerning to no concern at all.

Advisers plan for the new regime

Advisers have had ample time to get to grips with the details of the new Financial Services Legislation Amendment Act (FSLAA) changes, and most appear to have their minds made up about how to approach the new regime.

According to our survey, 68% of respondents plan to work beneath their dealer group’s FAP, allowing their aggregator to handle the regulatory and compliance burden for them.

Most groups in the market, including Astute Financial and NZFSG, encourage their members to work under their financial advice provider (FAP) licence.

Other groups, including Newpark Home Loans, want advisers to become their own FAP and control their licensing. That model is favoured by about 25%, or one in four advisers.

Andrew Scott, general manager of Newpark Home Loans, said he was not surprised by the finding, and urged advisers to consider the conditions of working under a group FAP.

He added: “You don’t want to find out there are issues you don’t like later down the track, because that’s when disputes happen.”

The new regulatory regime has scared a few people away from the sector. About 2% of our respondents plan to leave the industry when the new regime kicks in.

Transitional licensing for the new regime has been delayed from its initial June deadline amid the Covid-19 pandemic. Over 4% of advisers remain undecided about whether to work under a FAP or become their own FAP entity.

The prospect of the new regulatory regime has caused some advisers to change their group. According to our survey, 15% of advisers have switched group over the past year.

Trail commission

This time last year, mortgage advisers were braced for the impact of the Royal Commission in Australia, as concerns were raised about the future of trail commission.

In Australia, no tangible changes to trail have yet been felt. Over here, advisers wonder whether trail might be a more viable and stable business model for the industry after Covid-19.

According to our survey, trail makes up 1-25% of income for the majority (68%) of brokers.

For 20% of advisers, trail accounts for between 25-50% of total income.

The Covid-19 pandemic has prompted some industry figures to question whether trail may be a more suitable model. But will it change how advisers operate?

Over 18% of advisers plan to place more business with trail-paying lenders, including Westpac and BNZ, and AIA/ Sovereign over the next year. About 57% of respondents say they won’t seek more trail following the pandemic.

Newpark’s Andrew Scott was “surprised” most advisers do not plan to bolster trail income.

“I’m surprised they are not thinking longer-term, as opposed to surviving on upfront. You do leave yourself rather vulnerable to market events like Covid-19,” Scott added.

Windler believes advisers should use trail to weather another financial crisis in the future.

“Any adviser experiencing this now must be vowing not to go through this again,” Windler says.

“I believe that post-Covid-19 banks that pay trail will receive more income than they did before. I’d be surprised if that were not the case.”

Will the Covid-19 lockdown make you place more business with lenders who offer trail?

What products would you add?

The Covid-crisis has battered the housing market and forced lenders to reassess whether they take on new home loan customers. The economic shockwaves are set to be felt for years and have prompted some advisers to rethink their business models.

One in three advisers say they will look to new business areas once the worst of the crisis is over. Diversification is viewed as one way to bring in extra revenue and safeguard advisers’ financial future.

Major groups, including NZFSG, have encouraged advisers to extend their offering in asset finance and other areas.

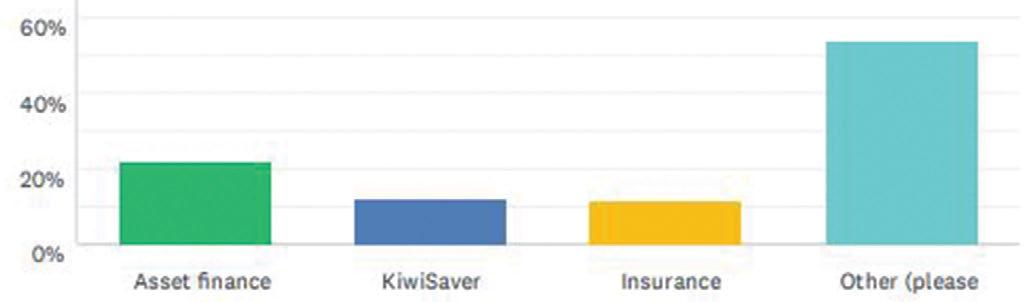

About 22% of advisers would add asset finance to their current businesses. Roughly 12% chose KiwiSaver and insurance as new potential business streams.

NZFSG’s head of growth Bruce Patten said advisers could benefit from other business lines. “It’s just an extension of providing the full financial solution to their clients,” he added.

“We have provided solutions for our advisers to write or refer business in asset finance for the past few years,” Patten added. “They probably see it as more of an opportunity now that they have time to look at other revenue sources.”

“So that you have the greatest share of their wallet and are seen as their financial adviser for all things finance,” Patten added .

Advisers offered insights into their plans for the year ahead.

One said they would “potentially look to add financial planning and portfolio reviews, subject to compliance”. Another respondent plans to “move towards AFA/investment and more insurance, too”.

Reverse mortgage market set to grow

Reverse mortgage products are relatively new in New Zealand, and it appears brokers are far from convinced about them.

Home equity release schemes are tipped to rise in popularity, but only 39% of advisers would like to find out more about the products. 46% of advisers have no interest.

Are you interested in finding out more about home equity release products?

Trade body yet to convince advisers

With a global recession to contend with and a new regulatory regime on the way, advisers remain unconvinced about the merits of trade organisation Financial Advice New Zealand.

According to our survey, 47% of advisers are members, while 42% are not. A total of 11% are undecided, years on from its formation. ✚

Are you a member of Financial Advice NZ?