26 minute read

Buying Local

BUYING LOCAL

BY CHARNDRÉ EMMA KIPPIE

THINK LOCAL!

Supporting local is more important than you think.

Uplifting small local businesses could grow the economy by R200-billion

President Ramaphosa’s R200-billion target

SONA 2021 took place Thursday, 11 February 2021, and during his address of the country’s finances and manufacturing sector, President Cyril Ramaphosa emphasised that our economy could see major recovery come about if citizens continuously choose to make more local purchases, decreasing the need for imports.

“The second priority intervention of the Recovery Plan is to support a massive increase in local production and to make South African exports globally competitive. This will encourage greater investment by the private sector.

Key to this plan is a renewed commitment from the government, business, and organised labour to buy local”, said Ramaphosa. President Ramaphosa went on to encourage the public to buy products that are produced right here, inside our borders. Ramaphosa urges that a positive change in mindset, with consumers opting to purchase authentic South African goods, could potentially contribute an estimated R200-billion to the fiscus. Ramaphosa, deemed an ambitious dreamer by the masses, voiced strategic plans to lower the level of the country’s imports by 20% over the next five years. South African Leadership has their focus on revitalising the country’s manufacturing sector, with numerous plans set out to make South Africa’s exports ‘globally competitive’ once again.

“If we achieve our target, we will significantly expand our productive economy, potentially returning more than R200-billion to the country’s annual output. These efforts are supported by robust manufacturing support programmes”, he concluded.

Local products to look out for

President Ramaphosa has since indicated that there are a total of 42 products that will be encouraged for local purchase, and these will be made public knowledge in due course. However, he emphasised seven specific products as part of his SONA speech. These products include:

– Edible oils – Locally–produced furniture – Fruit concentrates – Personal protective equipment (PPE) – Steel products made in South Africa – Green economy inputs – South African-made sugar

SA businesses making waves - local produce to consider

CORICRAFT - TAPESTRY HOME BRANDS Coricraft is enthusiastic about producing and selling high-quality, budget-friendly furniture, and boasts an incredible range of modern and traditional homeware styles.

The company is well-known for their wooden furniture pieces and versatile couches. Coricraft designs and produces home furniture with the aim of manufacturing pieces that consumers can proudly add to their homes. Coricraft are famous for their exceptional quality leather couches, in various finishes. Each

couch is manufactured in South Africa at their couch factory in either Cape Town or Johannesburg. Their experienced furniture manufacturers are skilled at creating high-quality couches meant to last for years. The company has about 50 different walk-in furniture stores across Southern Africa, and also offers an online shopping experience.

STEELMOR INDUSTRIES Established by Hendrik van der Bijl, as the Iron and Steel Corporation (ISCOR) in South Africa, in 1943, stainless steel has been a major contributor to creating jobs and fostering industry development in South Africa - upholding strict standards of manufacturing excellence and quality.

Currently, stainless steel in South Africa remains in high demand across various industries, from medical to construction, industrial equipment, and even in the catering market. A booming stainless steel industry continuously stimulates our economy, promoting innovation, technology advancement and enhancing infrastructure across a broad spectrum of applications. Steelmor has played a leading role in this important market for more than 40 years, and is popularly regarded as a top stainless steel specialist and leading stockist and manufacturer of stainless steel products - right here on our home ground. ATYRE Created by the innovative young female designer, Reabetswe Ngwane, this local fashion brand is a premium producer and retailer of handmade bags that are not only beautifully designed and made to last, but friendly to the environment and socially inclusive. Atyre upholds a minimum wastage policy in their factory, where all fabrics are maximised to the best of their capabilities. The company has also created full time employment for 6 local community members, with numbers growing substantially. Atyre actively works with waste pickers who collect and trade recyclable materials for employment, to supply them with the tyre tubes.

Each item is handcrafted from sturdy, upcycled tyre material, and carefully selected textiles from local South African suppliers. The company’s vision is geared towards becoming a global leader in sustainable fashion, and a game changer in Africa. Atyre is committed to continually innovating the craft of bag making, to not only be ecologically friendly and sustainable, but also socially inclusive by working with local communities to eradicate poverty.

ILLOVO SUGAR AFRICA (PTY) LTD. Illovo Sugar is Africa’s biggest sugar producer, with extensive agricultural and manufacturing operations, in six African countries. Illovo produces raw and refined sugar for local, regional African, European Union (EU), United States of America (USA) and world markets, from sugar cane supplied by its own agricultural operations and independent outgrowers who supply cane to Illovo’s factories.

The organisation employs more than 12 000 people in permanent positions across the group, with a further 18 000 people employed on a temporary basis. The company aims to ensure reliable cost-effective energy supply, utilising bagasse and biomass generated from its operations Around 14 million tons of sugar cane are processed annually, by 12 sugar mills, under the group’s cane sugar integrated business sustainability model, maximising the use of all input materials with very few waste products. n

TOP REASONS TO BUY LOCALLY

• Local businesses tend to partner with other local entities, such as service providers, farms and banks. This enhances development, growth, and sustainability of the economy. • Buying local demonstrates national pride, showing confidence in locally made products. • South African products are tailored to meet uniquely South African needs and solve the issues that local economic sectors face - in a manner that international products cannot. • Local product demands create and save jobs - we are keeping markets open.

INVESTMENT BY MULTINATIONALS

BY JESSIE TAYLOR

Speeding up economic growth through Automotive investment

An almost R16-billion venture by Ford Motor Company is the start of what automotive industry leaders anticipate will be a bumper year for investment. The automotive giant announced plans to introduce new technologies and systems to grow the Ford Silverton Assembly Plant, as it increases the production of its all-new Ranger pickup truck next year.

An historical investment

The upgrades will mark the biggest investment in Ford’s 97-year history in South Africa, and is one of the largest-ever investments in the South African automotive industry, said Dianne Craig, President, Ford’s International Markets Group

“This investment will further modernise our South African operations, helping them to play an even more important role in the turnaround and growth of our global automotive operations, as well as our strategic alliance with Volkswagen,” said Craig.

The plant will also manufacture Volkswagen pickup trucks as part of the Ford-VW strategic alliance. The investment is worth around $1.05-billion (R15.8-billion), of which $686-million (R10.3-billion) would be invested in technology, upgrades and new facilities at theSilverton plant.

These include the construction of a new body shop with the latest robotic technology and a new high-tech stamping plant, both of which will be located on-site for the first time. Both facilities will modernise and streamline the integrated manufacturing process at Silverton while contributing to higher quality and reducing overall cost and waste. The company said it would hire around 1200 new employees to meet the expanded production needs. Ford’s private-public partnership with the government in the Tshwane Automotive Special Economic Zone (TASEZ) is a crucial step toward unleashing the new production capacity.

In addition to its representation on the TASEZ board, Ford also is working closely with the government and state-owned entities to develop a high capacity rail corridor between Gauteng and Eastern Cape. This will be a full-service line linking the TASEZ with Gqeberha /Port Elizabeth, which is home to Ford’s Struandale Engine Plant and the Coega Special Economic Zone.

“Ford’s investment in our South Africa manufacturing operations underscores our ongoing commitment to deliver everbetter vehicles to our customers in South Africa and around the world, while providing opportunities for our own employees, new team

members and our communities,” said Neale Hill, Managing Director, Ford Motor Company of Southern Africa.

The promise of more to come

However, the investment by Ford is just one of the ventures that will give the local economy a boost, believes The Automotive Business Council (Naamsa). Naamsa CEO Mikel Mabasa said the organisation anticipates several capital investments and commitments by manufacturers in the industry.

“The automotive industry’s performance over the past three decades has been dependent on the constructive collaboration and partnership with Government, and hence, the attraction of major investments into this sector have been stimulated by the longterm certainty and consistency provided by Government’s policy regime to support the sustainability and growth of this sector in the country,” said Mabasa.

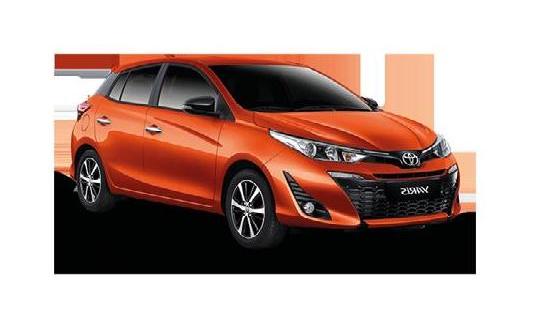

Significant investment pledges have also been received from several companies in Asia, Minister of International Relations and Cooperation Dr Naledi Pandor confirmed during the State of the Nation Address Debate. Companies such as Toyota, Isuzu, Tata Motors, Mahindra and Motherson Sumi have indicated they plan to expand their investments in South Africa.

Earlier this year, Toyota announced an investment of close to R3-billion to produce a new SUV at the manufacturing plant in Durban. The move stands to create around 1500 new jobs. The automotive industry has huge potential to bolster the local economy, and already contributes 6.4% to the Gross Domestic Product (GDP).

“The South African automotive industry remains the most dynamic manufacturing sector in the South African economy and is a significant driver of economic growth and development for the country,” said Mabasa.

“The SA Automotive Masterplan 2035 which is due for implementation from July 2021, will create a framework to secure even higher investment and production levels, and will continue to provide multinational vehicle and component companies the consistency they need to invest confidently in South Africa”. n

The automotive industry in numbers:

The number of employees in the manufacturing segment of the industry. The value created through the export of vehicles and automotive components. The number of international markets vehicles and components created in South Africa are exported to.

The percentage of the country’s manufacturing output the automotive industry accounts for. The total automotive revenue in South Africa in 2019.

Dianne Craig

President | Ford’s International Markets Group

ADVERTORIAL

Why suffer a sale when you can auction?

Selling your car can be a painful process. Apart from getting your vehicle salesready, you need to figure out a price and then deal with buyers trying to cut thousands off that figure. Then there’s the admin and safety aspect. Having prospective buyers coming to see the car and fielding questions and queries can not only be exhausting – during a pandemic, it can be dangerous as well.

In an industry-first, Woodford Bid – an established auction platform for selling cars to a large database of trusted dealers – is now offering the public the chance to list their personal vehicles on the website. That means that all you need to do is list via a simple, interactive platform – and then watch as verified dealers bid on your vehicle during weekly auctions, with the sale only going through once your reserve price is met. What’s more, you can sell for more than you expected, if the dealers keep bidding beyond your asking price.

After owing the bank around R350 000, she made the tough decision to sell her car, but was only being offered between R300 000 and R310 000 by local dealers and private buyers. After spending considerable time showing off her car, she decided to load her car via the Woodford Bid website, and within three days, the car was sold for R358 000.

During the auction, the seller will receive real-time notifications and updates, including when the reserve is met and when the vehicle is sold. There are no hidden fees or commission charged, other than a listing fee of R50 and an admin charge only once the vehicle is sold. The real appeal, however, is the

The real appeal, however, is the trusted group of buyers that the individual is selling to. All buyers are vetted dealers, who are guaranteed not to waste the time of the seller or have any payment issues.

Since launching the feature, Woodford Bid has already seen a great uptake in privately listed being purchased by dealers. In March 2021, more than 50% of these vehicles have been sold, at more than 10% above retail value, on average.

Woodford Bid will continue to update the platform and develop solutions that are aimed at providing the best experience and results for the public.

trusted group of buyers that already seen a great uptake If you would like to auction the individual is selling to. All in privately listed being your car on the Woodford Bid buyers are vetted dealers, who purchased by dealers. In platform, all you need to do are guaranteed not to waste March 2021, more than visit www.woodbid.co.za and the time of the seller or have 50% of these vehicles have select the “Sell Your Vehicle” During the auction, the seller will receive real-time notifications and any payment issues. been sold, at more than 10% tab. updates, including when the reserve is met and when the vehicle is sold. above retail value,There are no hidden fees or commission charged, other than a listing fee of The approach is undoubtedly Why suffer a sale when you can auction? on average. You can also contact Anton R50 and an admin charge only once the vehicle is sold. a game-changer for people Selling your car can be a painful process. Apart from getting your vehicle at Woodford Bid for further The real appeal, however, is the trusted group of buyers that the individual around the country wanting sales-ready, you need to figure out a price and then deal with buyers trying to cut thousands off that figure. Then there’s the admin and safety aspect. Woodford Bid will continue information: is selling to. All buyers are vetted dealers, who are guaranteed not to waste the time of the seller or have any payment issues. to sell their car, but don’t want Having prospective buyers coming to see the car and fielding questions to update the platform and anton@woodford.co.za to go through the headache and queries can not only be exhausting – during a pandemic, it can be dangerous as well. develop solutions that are The approach is undoubtedly a game-changer for people around the country wanting to sell their car, but don’t want to go through the of listing the vehicle in a public aimed at providing the best headache of listing the vehicle in a public space. space. Since launching the Luckily, there’s a new and easy way to sell your car AND get the price you experience and results Since launching the feature, Woodford Bid has already seen a great uptake You can also contact Anton at Woodford Bid for further information: feature, Woodford Bid has for the public. in privately listed being purchased by dealers. In March 2021, more than 50% of these vehicles have been sold, at more than 10% above retail value, In an industry-first, Woodford Bid – an established auction platform for anton@woodford.co.za selling cars to a large database of trusted dealers – is now offering the on average. public the chance to list their personal vehicles on the website. Woodford Bid will continue to update the platform and develop solutions Now you can That means that all you need to do is list via a simple, interactive platform – and then watch as verified dealers bid on your vehicle during that are aimed at providing the best experience and results for the public. AUCTION YOUR CAR TO OVER 1000 TRUSTED DEALERS If you would like to auction your car on the Woodford Bid platform, all you need to do visit www.woodbid.co.za and select the “Sell Your Vehicle” tab.weekly auctions, with the sale only going through once your reserve price is met. What’s more, you can sell for more than you expected, if the dealers keep bidding beyond your asking price. and get the price you wantYou can also contact Anton at Woodford Bid for further information: anton@woodford.co.zaTake Joyce*, for example, who successfully auctioned her 2017 Ford in March 2021 on the Woodford Bid platform. After owing the bank around R350 000, she made the tough decision to sell her car, but was only being offered between R300 000 and R310 000 by local dealers and private buyers. After spending considerable time showing off her car, she decided to load her car via the Woodford Bid website, and within three days, the car was sold for R358 000. The process to load and auction your car is not only simple and easy, it’s safe, secure and free from the hassle that’s associated with the logistics of Now you can Log On, AUCTION YOUR CAR TO OVER 1000 TRUSTED DEALERS Load, SELL and get the price you want Visit Woodford Bid

www.woodbid.co.za Log On, Load, SELL

Visit Woodford Bid

www.woodbid.co.za

FINANCIAL FITNESS

BY CHARNDRÉ EMMA KIPPIE

Understanding municipal financial management

Good financial management is essential for effective local delivery - here’s what you need to know

With so many demands for bettering our nation, financial management is critical for our local municipalities to be equipped for making a positive impact on local areas - transforming our land into a better place for all citizens. Councillors and members of the community dream of ‘ideal’ changes, however, these must be properly planned for in order to make a significant difference.

Councilors are tasked with the responsibility of approving and regularly tracking a municipality’s budget and spending behaviours. This task is completed in consultation with ward committees in order to maintain high standards. The reality, however, is that large amounts of funds are needed to execute all plans and projects in order for councilors to serve their communities. This is where effective financial management plays a vital role.

The role of financial management

Municipal financial management makes sure that sufficient funds are available to execute council policies. Councillors, committee members and government officials oversee these funds, making sure that these monies are handled attentively, with full transparently.

Good financial management is the driving force behind local delivery – local activists and ward committee members are required to properly understand municipal finance and budgets so that they’re able to engage councillors on important conversations regarding spending and development priorities.

Processes used in municipalities

At present, the following financial management processes are used and tracked in local South African municipalities:

Budgeting: Calculating what income the municipality will receive and correlating this with the expected expenditure, by preparing detailed plans and forecasts.

Safeguarding: Implementing controls to ensure that the income, capital and assets such as money, motor vehicles, computer equipment etc., are safeguarded against misuse, damage, loss or theft.

Financial Reporting: Monitoring actual income and expenditure and comparing this to the budget, through regular financial reporting and corrective action when needed. Auditing: Reporting financial results to all stakeholders by preparing municipal financial statements that are audited by the Auditor-General, who reports to Parliament.

The budgeting cycle and community participation

The financial year of South African municipalities runs from 1 July of each year to 30 June the following year. Municipalities must prepare budgets for each financial year. Council must approve these budgets before the new financial year begins, after proper planning and consultation with ward committees and other stakeholder groups in the area.

The approval of the budget is one of the most important tasks undertaken by councillors, after consultation with ward committees and other stakeholders. Ward committees need to investigate all parts of the budget which will affect the people in their community. Ward councillors should regularly call ward meetings to openly discuss the budget at hand.

All members of the community also have the right to call a special council gathering, in which the budget is reflected upon and voted on.

Operating budgets and capital budgets

The municipality’s operating budget includes all planned operating expenditure and income, for the delivery of all services to the community. ‘Operating expenditure’ involves the cost of goods and services from which there will be short-term benefit - services will be used up in less than 12 months. These include salaries, wages, repairs, operational hardware and devices, petrol, office stationery etc.

‘Operating income’ refers to monies received for services delivered for a short-term period, such as property rates, service charges, investment interest, and traffic fines.

On the other hand, the capital budget allocates money aside for estimated expenditure on long-term purchases and big investments, such as buildings, plots of land, motor vehicles, equipment and office furniture. These are considered to be municipal assets for more than a 12 month period.

A municipality’s capital budget must cater for all estimated costs for all items of a capital nature. These include the construction of roads, buildings and purchase of vehicles that are planned in that budget year.

Capital budget - includes big costs, such as replacing water pipes in a community, which you pay once-off to develop something, and how you will afford these costs.

Operating budget - includes the day-to-day costs and income to deliver municipal services, such as road workers’ wages and maintenance work.

Municipal income - where does it come from?

Municipalities need to make sure that there will be enough funds to cover all planned expenditures if they are to ‘balance the budget’. There are multiple sources of income that can be utilised by municipalities to finance their expenditure.

The main sources of capital budget financing include the following:

External loans - Monies received from a bank or other financial institution. This is the expensive way to finance the capital budget due to high interest rates in South Africa. These loans should only be used to finance the purchase of major capital items.

Internal loans - monies borrowed from internal ‘savings funds’ such as Capital Development Funds or Consolidated Loan Fund.

Contributions from revenue - When purchasing a small capital item, the small total cost can be paid for from the operating income in the year of purchase. This financing source is referred to as ‘contributions from revenue’.

Government grants - Municipalities may apply to the national government for grants for infrastructure development. The two main funds available are the Consolidate Municipal Infrastructure Programme (CMIP) and the Water Services Projects.

Donations and public contributions - Capital items or monies donated or sponsored by local and foreign donors. Public/Private Partnerships Capital costs paid for by means of partnerships between the private sector and the municipality - the private sector partner often has a profit motive in the service and capital being funded.

Main sources of operational budget financing

Property rates - annual tax paid by citizens based on the value of each property owned by individuals and businesses with private property.

Service charges / Tariffs - These are monies paid, by individuals and businesses, for measurable services, such as water, electricity or approval of building plans.

Fines - These include traffic fines, late library book fines, penalties for overdue payment of service charges, and assist in prompting citizens to obey democratic laws.

Equitable share - This refers to an amount of money that a municipality gets from the national government each year, to ensure that municipalities can provide basic service and develop their areas.

Keeping a healthy cash flow

The movement of money in and out of the municipality’s bank account must be properly maintained as funds are received and utilised. While a surplus is favoured, this won’t always be the case each month, as unexpected expenses come up.

When more funds have to be paid out than there is flowing in, your municipality could be heading for big financial problems. The municipality can, at that point:

1. Borrow funds from the bank (overdraft)

2. Borrow from another sphere of government (a loan or grant)

3. Increase the property rates and service charges which people must pay for local services to avoid bankruptcy

Hon Tito Titus Mboweni

Minister of Finance

However, it must be emphasised that none of these options will be good for your municipality’s reputation. A negative cash flow or deficit should be avoided as much as possible.

The Municipal Finance Management Act No. 56 of 2003 (MFMA)

The MFMA aims to modernise budget, accounting and financial management practices by placing local government finances on a sustainable footing in order to maximise the capacity of municipalities to deliver services to communities. It also aims to put in place a sound financial governance framework by clarifying and separating the roles and responsibilities of the council, mayor and officials. The MFMA is required by the Constitution, which obliges all three spheres of government to be transparent about their financial affairs.

It also forms an integral part of the broader reform package for local government, as outlined in the 1998 White Paper on Local Government.

The role of your ward committee

Your ward committee members all need to help maintain a positive cash flow for your municipality’s development projects, by:

Being a good example in paying your rates and service charges fully, and before the due date Encouraging all members of your community to pay their rates and service charges, on time

Challenging any waste of municipal money and asking for a proper explanation or investigation

UPCOMING EVENTS

BY CHARNDRÉ EMMA KIPPIE

WHAT TO LOOK OUT FOR

2-4 04

Easter Weekend

The Christian community will begin the Easter Weekend by observing Good Friday on the Friday before Easter Sunday. Easter falls under the Paschal season in the Christian Advent Calendar. Good Friday commemorates the crucifixion, and death of Jesus Christ.

Whilst Easter Sunday celebrates His resurrection. Families are encouraged to spend quality time together, attend church services and carry on the tradition of giving loved ones (especially children) chocolate eggs, as a symbol of new life and Jesus’ emergence from the tomb. Family Day will also be observed on Easter Monday, and is a time for strengthening bonds among family members, and going on vacation together.

As per the General Assembly, on 8 December 2005, it was declared that the 4 April of each year would be observed as the International Day for Mine Awareness and Assistance in Mine Action. Initiated by the USA and the United Nations, this day creates awareness around nations in which mines and explosive remnants of war pose a serious threat to the health, safety and livelihood of all civilians, or an obstacle to positive social and economic development at the national and local levels.

Victim assistance, risk education campaigns and advocacy will be top of the agenda on this day.

23

World Book and Copyright Day

World Book and Copyright Day is a celebration to encourage the enjoyment of books and reading.

Each year, on 23 April, celebrations take place all over the world to recognise the magical power of books, exhibiting a connection between the past and the future - a bridge between generations and across cultures and creeds. On this occasion, UNESCO and the international organisations representing the three major sectors of the book industry - publishers, booksellers and libraries - come together to commemorate the power of the written word. Schools often host special reading sessions and character dress up days to get young children more excited about literature and literacy.

Freedom Month

24

World Veterinary Day

Initiated in 2000, by the World Veterinary Association, World Veterinary Day highlights the amazing work that veterinarians around the globe have committed their lives to. Every year, a unique theme is chosen, assisting pet owners to remember the importance of the many important aspects of animal care, and how vets can aid in caring for these animals.

One continual topic of discussion is ensuring pet vaccinations remain up to date to prevent unnecessary spread of highly contagious virus, like Parvo. In 2020, the theme of World Veterinary Day was ‘Environmental protection for improving animal and human health’. This year, there will be a focus on Veterinarian Response to the COVID-19 Crisis.

26 27

World Intellectual Property Day

World Intellectual Property Day is commemorated annually, and was established by the World Intellectual Property Organization (WIPO) in 2000 to promote the importance of patents, copyright, trademarks and designs, and the manner in which they impact on daily life. This is a celebration of creativity, and ‘the contribution made by creators and innovators to the development of societies across the globe’. World Intellectual Property Day coexists with the 1970’s historical initiation of the Convention Establishing the World Intellectual Property Organisation’s commencement.

This year, resources will be made available to help small businesses with their intellectual property needs, and focus will be put on educating people on intellectual property rights.

Freedom Day

Freedom Day is the celebration of our country’s first democratic elections, held on 27 April 1994. This was when Nelson Mandela was voted President of our nation. These were the first postapartheid national elections to be held in South African where anyone could vote regardless of race.

The first democratic elections on 27 April 1994 gave birth to our constitutional democracy. For the majority of South Africans who had never voted before their dignity was restored and the country transformed to a nonracial, non-sexist and democratic society. In 2020, Freedom Month was celebrated under the theme ‘Valuing Our Freedom in Difficult Times’ - a theme that undoubtedly still applies today.