4 minute read

Cement Sector Overview

Building The Country From The Ground Up

By Sinazo Mkoko

According to the International Market Analysis Research and Consulting Group (IMARC) South Africa’s white cement market size is expected to reach 28,995.6 tonnes by 2028. Infrastructure projects such as highways, bridges, stadiums, and residential and commercial complexes all contribute to the growth of the cement sector.

Cement & Concrete South Africa (CCSA), a consolidated body taking the lead on all matters relating to cement and concrete in the country, stated that the cement industry has been under huge pressure due to different factors. “In addition to the general economic downturn the sector was hit hard by the COVID-19 pandemic lockdown and is now confronted by construction mafias that have sprung up across the country, which has a direct impact on the cement and concrete sectors.” - CCSA.

The Industry and Climate Change

CCSA said the climate change challenge to the industry’s sustainability lies in the “fact that cement manufacturing emits significant quantities of greenhouse gases, which impact South Africa’s decarbonisation commitments as it moves towards Net Zero within the framework of the Just Energy Transition (JET IP).

“As responsible stakeholders committed to playing our part in South Africa achieving its Nationally Determined Commitments (NDCs) in terms of the United Nations Framework Convention on Climate Change, the local cement sector has committed itself to ‘Vision: Net Zero Carbon’ by 2050,” -Bryan Perrie, CEO of CCSA.

“This includes an undertaking to decarbonise in accordance with the 1,5 ̊C global temperature increase pathway in the Paris Agreement and reinforced at COP26 held in Glasgow last year. The local cement and concrete sector has set key milestones for 2030 in accordance with South Africa’s Technical Reporting Guidelines and in line with the Intergovernmental Panel on Climate Change reporting framework.”

Construction and Infrastructure Development

Construction and infrastructure development in South Africa sit on the shoulders of the cement industry, with the government being a key player in the construction sector, accounting for about 40% of the country’s total infrastructure budget.

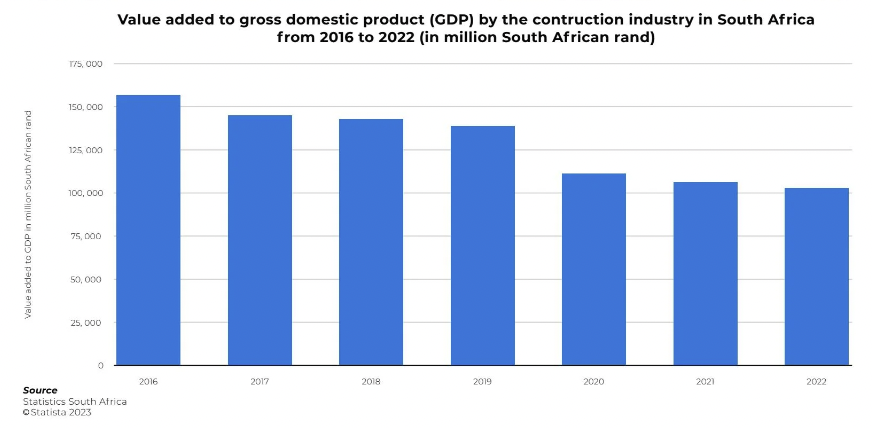

A minimum of 3% of the country’s GDP comes from the construction sector, and it is through this sector that the government is able to fulfil its mandate to enhance social needs, including sanitation, transportation, health, and education. The Department of Public Works and Infrastructure states that at least R117.5-billion in budget was allocated to infrastructure in the 2022/23 financial year, and it is estimated that government expenditure will total R903-billion over the next three years.

Speaking on the implementation of infrastructure investment projects, the department stated: “The Department of Public Works and Infrastructure (DPWI), through its entity, the Construction Industry Development Board (CIDB), has prioritised capacitation of the public sector to deliver infrastructure better and with greater urgency and efficiency. The government spent 70.6% of the total allocated infrastructure budget in 2019/20, and by 2020/21, this figure had improved mildly to 73%”.

“The government recognises the importance of construction as an ideal catalyst for economic growth and social development and a key creator of work opportunities, particularly for the emerging sector, which is one of the main generators of employment in the country. Every cent that goes back to the national coffers in unspent infrastructure budgets is an opportunity lost to the emerging sector and a threat to their survival and sustainability.”

Last year, the government promised to increase the construction of rural bridges as part of the Welisizwe programme to enable residents to safely reach schools, workplaces, and amenities. His Excellency, President Cyril Ramaphosa, confirmed during the 2023 State of the Nation Address (SONA) that 24 bridges in KwaZulu-Natal were currently under construction and that site preparations were being made for a further 24 bridges.

In its integrated annual report, leading cement producer PPC, stated that recovery of cement demand in South Africa remains dependent on the implementation of the much-awaited and needed infrastructure programmes as well as an improved macro environment. Chairman of the PPC Board, Jabu Moleketi, said: “While the past year presented challenges throughout our regions, we remain resilient. We see many opportunities for our business and believe that our trajectory remains strong with a multiskilled and passionate workforce.”

Sources: IMARC Group | PPC | Statista | EMR | Moneyweb | PPC | SA Gov