7 minute read

10 Business Sectors That Are Shooting The Lights Out In South Africa

By Shumirai Chimombe and Veronique Anderson

1. Banks

The South African banking sector continues to maintain its position as the largest on the African continent. As of 2022, the aggregate tier 1 capital from the major South African banks reached US$42.2-billion according to Statista. Online banking is expected to continue its trajectory of growth in the coming years with fintech offering new technological banking solutions, and the entry of digital banks into the sector. In 2022, just over 44 percent of the country’s population reported using online banking. South Africa’s banking sector has significantly increased its customer base in the last decade. In 2023, almost 86 percent of the adults in the country had a bank account, compared to about 64 percent in 2014.

2. Life Insurance

The life insurance market has been experiencing significant growth in recent years. The KPMG South African Insurance Industry Survey 2023 indicated that gross written premium (GWP) for the life insurers surveyed increased by 4% from R275.2-billion in 2021 to R287.5-bn in 2022, and total shareholder funds increased by 2% from R169.2bn to R172.8-bn. This growth in demand is attributed to the growing awareness of the need for financial protection and the rising middle class. Customers are increasingly seeking life insurance products that offer not only financial protection but also investment opportunities and additional benefits such as health and wellness perks. One notable trend is the growing popularity of digital insurance platforms as clients are using these to research, compare, and purchase life insurance policies, prompting insurance providers to enhance their online presence and offer seamless digital experiences.

3. Exhibition And Conference Facilities

The Meetings, Incentive Travel, Conferences and Exhibitions (MICE) sector is on an upward trend, with South Africa becoming a sought-after destination for local and international conventions, symposiums and trade shows. The country has improved its global ranking as a business event destination, moving up five spots in the 2023 International Congress and Convention Association (ICCA) Global Ranking Report.

The sector is expected to grow from U$6.9billion in revenue 2019 to an estimated US$10.2-billion in 2028 according to South African Tourism, and this will significantly impact the economy through job creation, increased tourist numbers, and increased support for local businesses.

4. Consulting Engineering, Mining And Infrastructure

South Africa continues to be at the forefront in generating new construction projects in Africa, with the sector contributing an annualised added value of R109.5-billion to the GDP in the fourth quarter of 2023 according to StatsSA, and 3% to total output. In a boost for the sector, in 2020 the government launched the roll-out of its infrastructure investment programme to build critical network infrastructure such as ports, roads and rail, as well as in energy and power, and real estate across the country.

The mining sector is an important part of the economy and in 2023, contributed an added value of approximately R202.05 billion to the country’s GDP. The construction and mining industries provide immense engineering investment opportunities which are likely to increase with new projects coming onstream and the increased demand for the country’s high-value natural resources.

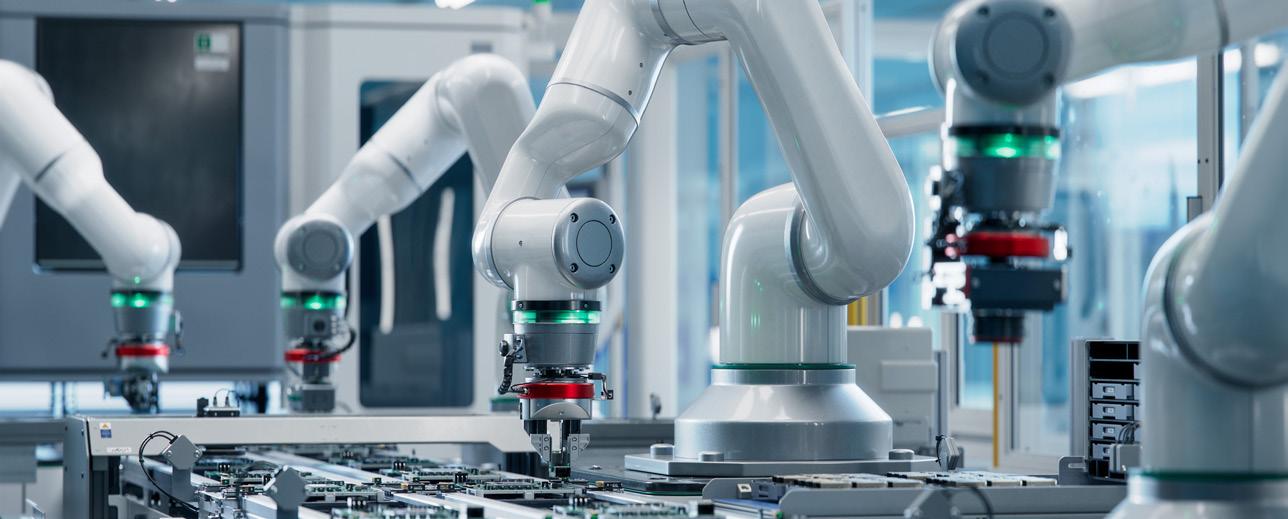

5. Industrial Products And Equipment

The capital goods sector plays an essential crosssectional role in the economy as its output of machinery and equipment is required for virtually all goods production processes. The industry has well-established markets in the mining, construction, and wider manufacturing sectors in South Africa and the region. In 2022 it accounted for 7.1% of South Africa’s total manufacturing value added. In 2021, income of the capital goods industry was concentrated in mining, quarrying, construction, and metallurgy, valued at R41-billion.

The sector receives government support through policy instruments such as localisation and preferential procurement, and the state’s commitment to spend more on infrastructure projects will present further opportunities for growth.

6. Hotels

The hospitality industry is one of the fastest growing and sustainable sectors in the country with the hotels market experiencing significant growth. Its revenue is estimated to reach US$1.16bn in 2024 according to Statista. This growth is driven by various factors such as rising demand by travellers for unique and authentic experiences, giving priority to sustainability, and local cultural immersion. South African hotels are responding to these trends by diversifying their offerings and focusing on sustainable tourism such as adopting green practices and supporting local conservation efforts.

The rise of digital platforms and online booking services has also made it easier for hotels to reach a wider audience and it is expected that 71% of the total revenue in this market will be generated through online sales by 2029.

7. Soft Goods

Retail is the third-largest sector and the second largest employer after the government, making it a key factor in the country’s economy. In its Statistical Release for Retail Trade Sales StatsSA reported that retail trade sales increased by 4,1% year-on-year in June 2024. One of the largest positive contributors to this increase was retailers in textiles, clothing, footwear and leather goods (6,1% and contributing 1,1 percentage points). In recent years, the performance of the retail sector has been influenced by changing consumer purchasing trends that have increasingly shifted online.

Clothing and fashion lead in e-commerce purchases, followed by the food and drink category, thanks to the increased popularity of take-out deliveries and online grocery shopping. The 2024 Online Retail Report by World Wide Worx revealed significant growth in South Africa’s online retail sector, which surged to R71-billion in 2023, representing a 29% increase from 2022.

8. Road Freight

The road freight sector remains the backbone of national logistics operations and currently accounts for 83.6% of all freight payload in South Africa. Road freight increased by 4.5% on a monthly basis in April 2024 against 1.2% in March signalling the second consecutive positive monthly growth rate following a downward trend that lasted almost a year. The government has introduced the National Infrastructure Plan 2050 prioritising key areas such as energy, freight transport, water, and digital infrastructure, which should create more opportunities for growth in this sector.

9. Telecommunications (Wireless)

Mobile lines dominate the telecommunications space, accounting for almost two-thirds of income for the sector. according to StatsSA. In 2022 mobile voice and data were the largest contributors to mobile lines, with SMS services showing a decline of 24% per annum, the second largest decrease in the sector. ADSL, which had been the largest generator of income in the internet access services category in 2019 declined sharply to third place during this period.

It was replaced by fibre-optic broadband which expanded by more than three-fold - a reflection of the changes in user trends and demand for services such as e-commerce, and smooth uploading and downloading of videos, podcasts, images and other information without interruptions.

10. Food Processors

The food processing industry is significant in its contribution to economic growth, job creation and international trade. Employment in the food industry increased by 1,9% in 2022 from a 0,8% growth in 2021. As a result, a further 4 160 jobs were created in 2022 compared to1 635 jobs created in 2021. Agro-processing is one of the sectors that is included in the government’s National Development Plan 2030 strategies to enable inclusive and efficient agricultural and food systems to increase employment and growth.