3 minute read

General Fund Revenues Expenditures

REVENUES & EXPENDITURES SUMMARY

The Town of Little Elm maintains a General Fund that reflects the Town's basic services, including public safety, public works, parks maintenance, development services, general government, etc. The chart below displays General Fund results for the Fiscal Year 2021 in cents to provide an easy to understand summary of activity (e.g., Property Taxes make up 43 cents of every $1 received; Public Safety accounts for 60 cents of every $1 spent; etc.)

14

from LICENSES & PERMITS

15

from OTHER

15

from SALES & USE TAX/FRANCHISE FEE 13

from CHARGES FOR SERVICES

43

from PROPERTY TAXES

6

for PUBLIC WORKS

15

for CULTURE & RECREATION

12

for GENERAL GOVERNMENT

7

for COMMUNITY SERVICES

60

for PUBLIC SAFETY

GENERAL FUND

The General Fund is the primary operating fund for Town services. It is used for all activities, except those legally or administratively required to be accounted for in other funds.

REVENUE

EXPENDITURES

UNASSIGNED FUND BALANCE*total does not include transfers and other financing sources

The unassigned fund balance is an indication of the amount of available resources the Town has at a point in time to fund emergencies, shortfalls, or other unexpected needs. In this analysis, only the General Fund information is reported. The Town's financial goal is to achieve and maintain an unassigned fund balance in the General Fund equal to 25% of budgeted expenditures. The remaining funds are used to stabilize the Town's budget over the coming years as we address our tremendous growth.

73%

UNASSIGNED FUND BALANCE

GENERAL FUND (CONT.)

REVENUE

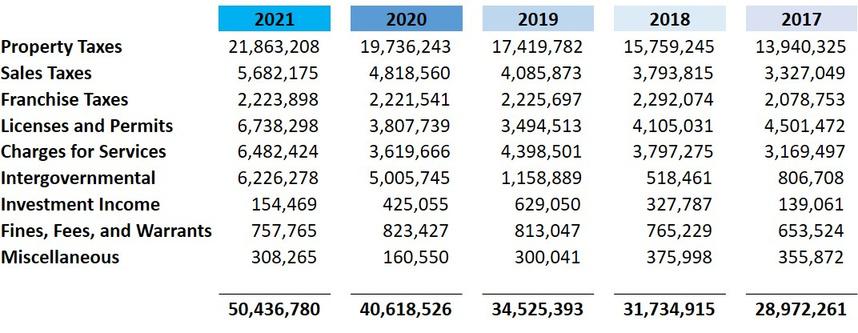

The General Fund saw an increase in property taxes and sales tax collections over last year. This is primarily due to increased property values and new growth within Little Elm. This, in turn, brings in more tax revenue to the Town that supports services. The Town also approved a new development known as Spiritas Ranch that will bring 2,100 homes into the community. The Town reported an increase in building permit revenue of 89% over last year. This and the growth in the community is a strong indicator that the economy is recovering from COVID.

The Town implements a five-year financial plan that allows the Town to look forward in order to meet the growth and service needs of the Town. The Town still continues to be conservative in revenue projections; however, the Town was able to lower the property tax rate to the community while increasing services for Public Safety, Parks and Recreation, and Public Works. Due to the strong reserves, forward planning, significant ongoing development, and conservative budgeting efforts, the Town received an increase in our bond rating from S&P and Moody’s. This means the Town is able to issue future debt at a lower cost to the residents, which in turn helps reduce the property tax rate related to debt.

Another significant revenue stream the Town received to assist in unforeseen COVID-related expenditures was the American Recovery Act Program that the federal government presented to municipalities. The Town has been allotted over $4.2 million that helps respond to public health and economic conditions.

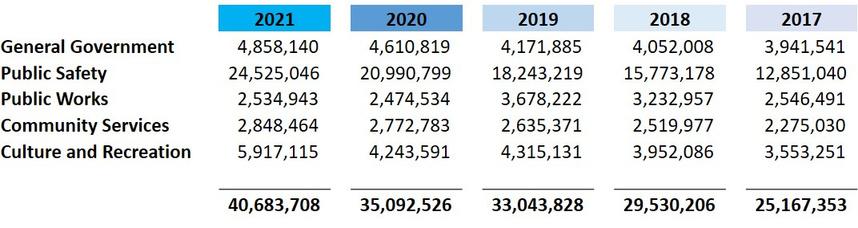

While the Town saw increases over last year’s expenditures, the General Fund budget to actual shows significant cost savings, which in turn is rolled into Fund Balance. With the future five-year financial plan, the Town is planning to draw down Fund Balance to provide more services due to growth and response to services needed within the Town. In alignment with its core value of innovation, the Town has continued to provide services in a virtual state, i.e., virtual court, online registrations, and permit applications.