2 minute read

2.3 Letter of credit usage

Among all respondents, there was a near-equal split between those that use and those that do not use letters of credit (LCs).

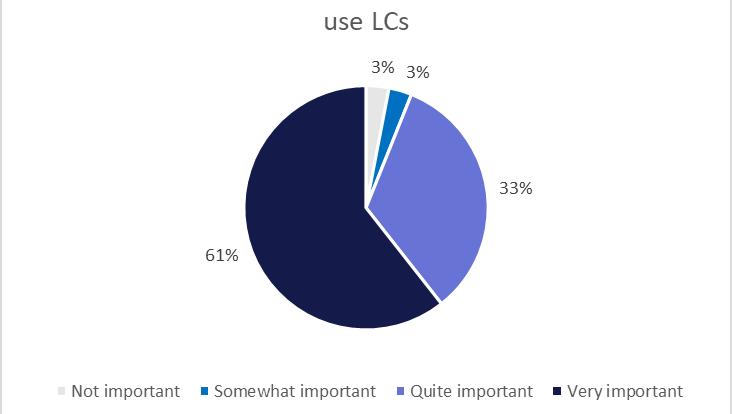

Among those that use LCs, nearly all consider them to be of significant importance to their operations.

Some 61% said LCs are “very important” to their operations, and 33% said LCs are “quite important” to their operations.

Only 6% of firms that use LCs consider them to be “not important” or “somewhat important”.

Firms that use letters of credit

Perceived importance of LCs among firms that use LCs

Why firms do not use LCs

Of the firms that do not use LCs, 47% said they have never needed to use one, and 31% said they do not consider them a business imperative.

Only 16% of respondents that do not use LCs cited a lack of knowledge as the reason why, and 6% said they avoid using LCs because their customers prefer to avoid them.

Firms that use LCs showed a higher interest in the services of the new entrant than those that do not use LCs.

Even at the 4%-8% price point, 81% of firms that currently use LCs said that they would be interested in the services offered by the new entrant.

This is significantly higher than the 77% of firms not using LCs that said they would be generally interested in the new entrant.

This is also higher than the 71% that said they would be interested at the 4%-8% price point.

Firms interested in trade finance services based on LC use

Percentage of firms interested in new trade finance services generally Percentage of firms interested in new trade finance services at 4-8% p.a.