3 minute read

2.1 Trade volume, commodity and insurance predictions for 2023

To start 2023, TFG’s Brian Canup asked industry experts to provide their predictions on trade values, commodities performances and trade insurance.

After a tumultuous 2022, it is anyone’s guess what will happen in the coming year, but we are looking forward to another exciting year in the trade finance industry.

Will trade struggle in the face of persistent global inflation? How will commodities perform as China attempts to manage COVID-19? Will decreasing consumer confidence and demand impact global trade numbers? Will economic uncertainty impact trade credit insurance?

TFG asked Francoise Huang (FH), senior economist for Asia Pacific and Trade at Allianz Trade, John Miller (JM), chief economic analyst at Trade Data Monitor, and Richard Wulff (RW), executive director at ICISA, to give their thoughts on the 2023 trade environment.

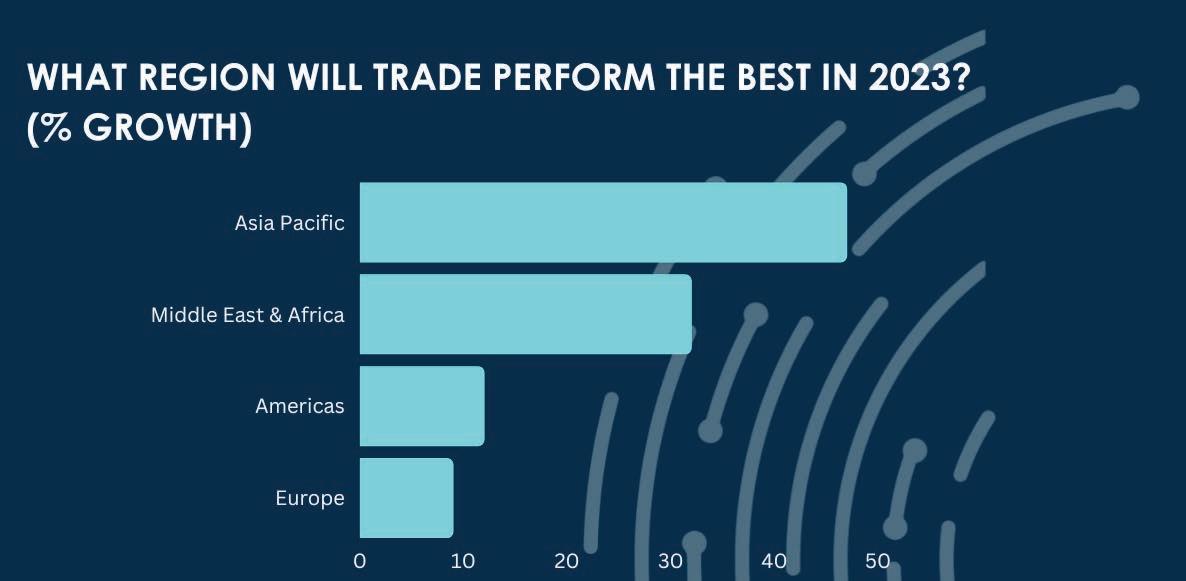

BC: What are your predictions for global trade trends in 2023?

FH: Global trade continues to slow as industrial activity recedes, despite the easing of supplyside constraints. Oversupply in the manufacturing sector has worsened since Q3 2022, notably in Europe. New orders and backlogs of work are at their lowest level since the pandemic in 2020.

Hence the manufacturing sector is expected to remain in recession in 2023 due to lower demand, mainly for consumerdriven industries, and a more pronounced destocking process from corporates in sectors where oversupply is highest. The largest cliff-edge is expected in cyclical sectors such as construction, consumer goods (electronics, household equipment etc.) and retail.

Supply chains should continue to normalise, supported by slowing demand and China’s progressive reopening. A manufacturing recession along with the continued slow recovery of services trade and a correction in price pressures mean that we expect global trade in goods and services to grow by only +0.7% in volume terms in 2023 and to contract by -1.3% in value terms (to $29.5 trillion).

A mild recovery should be possible in 2024, with global trade in goods and services growing by +3.6% in volume terms (i.e. roughly 1pp below the prepandemic long-term average) and a neutral price effect resulting from opposing sectoral trends.

Beyond the cyclical developments, trade and industrial policies will remain topical over the coming years.

Policymakers across the world seem focused on taking action to secure supply chains. Not all trade participants will be hindered by such protectionist measures, but global trade may be heading towards lower growth rates in the coming years compared to the pre-pandemic long-term average.

JM: In 2023, global trade growth will slow to 1%, according to the World Trade Organization, because of inflation, higher interest rates, weaker demand in the U.S. and Europe, protectionism, and a levelling-out after recovery from COVID-19.

Energy will dominate the global commodities market. Russian oil and gas is flowing to China, India and Turkey instead of Europe, which is discovering its appetite for U.S. liquid natural gas from Texas and Appalachian fracking wells.

China is losing export markets in favour of its domestic economy, but gaining traction in key sectors like automotive, pharmaceuticals and petroleum products.

As China loses some steam, its appetite for iron ore, nickel, copper and other industrial metals is slackening, and supply chains are migrating toward other big Asian economies like Vietnam, Malaysia and Singapore.

Boosted by domestic subsidies and spooked by rising geopolitical risk (which has led to import tariffs and export controls on computer chips and other strategic goods, and other forms of protectionism), companies are manufacturing closer to home. This nearshoring trend is especially prevalent in the U.S., where trade is increasingly unpopular.

Optimism for 2023

BC: What are the positive outlooks for 2023 trade?

JM: On the bright side, trade in electric vehicles, solar panels, windmills, and batteries and their ingredients is thriving. More businesses from Asia, Latin America and Africa are participating in global trade, and ports, canals, highways and rail lines continue to prove that global supply chains are robust, annually delivering over $30 trillion worth of goods.

Outlook for trade insurance in the new year

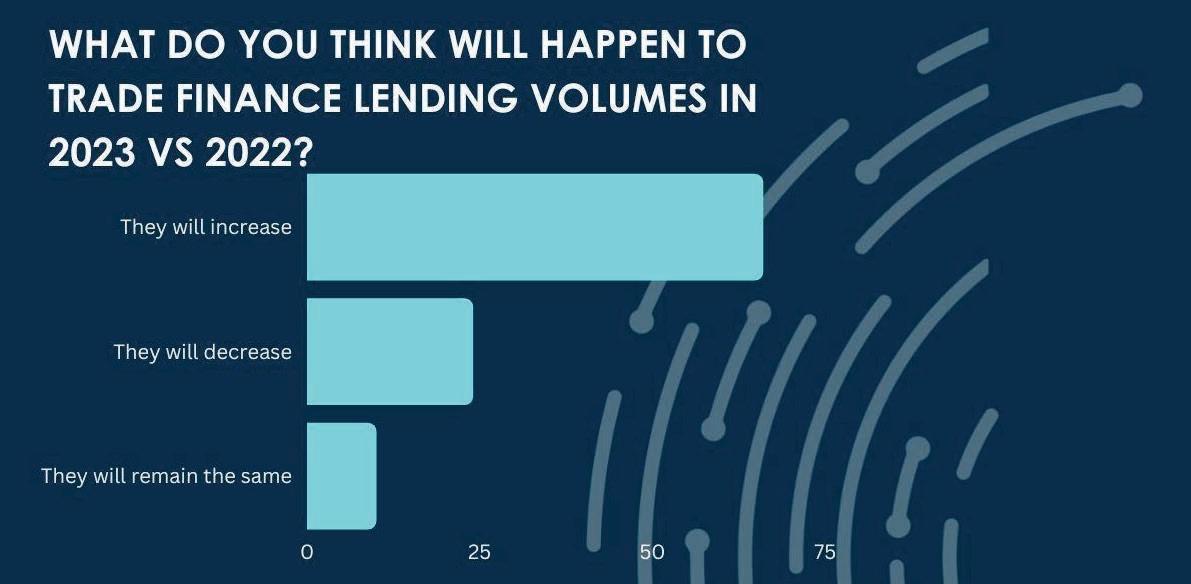

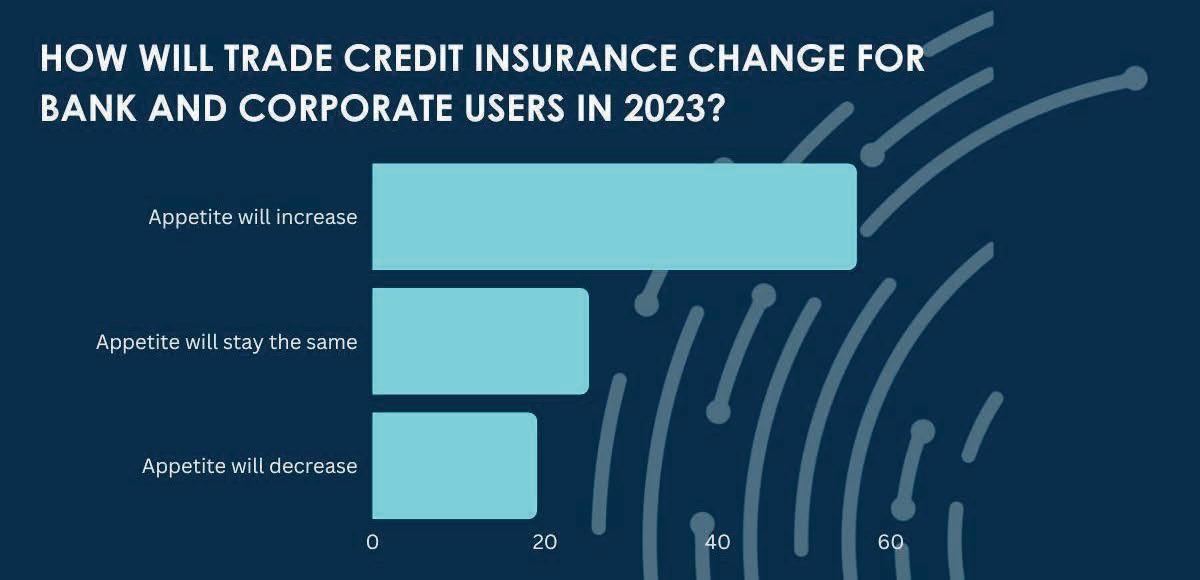

BC: What will the trade credit insurance environment look like in 2023 for bank and corporate users?

RW: After the pandemic, we had hoped for a recovery of the economic environment. However,

2022 was another tumultuous year, which increased the complexity and uncertainty for businesses all around the world. This will probably be reflected in the trade credit insurance business, with more companies looking for options to mitigate risk and support development. There are clear signs that this is leading to a higher demand for our products.

BC: Will 2023 see more insolvencies and defaults than previous years?

RW: Currently, with biggest credit insurers predicting an increase in insolvencies and claims, insurers will be paying close attention to risk quality.

At present, the EU is carrying out a review to ensure that credit insurance continues to receive appropriate recognition as a vital source of risk mitigation. This is an important component to ensuring liquidity in the economy whilst spreading risk among well capitalised and regulated entities, as both the banking and insurance sector are.

During this review, we have seen a continuation of the trend of increased demand for trade credit insurance acquired by financial institutions, for both single names and baskets of risk. The economic environment notwithstanding, we are confident of continued development of business relationships between the banking and credit insurance sectors to the benefit of the economies that we all help to support.

ROBERT BESSELING CEO Pangea-Risk

2.2