6 minute read

Financial Indicators

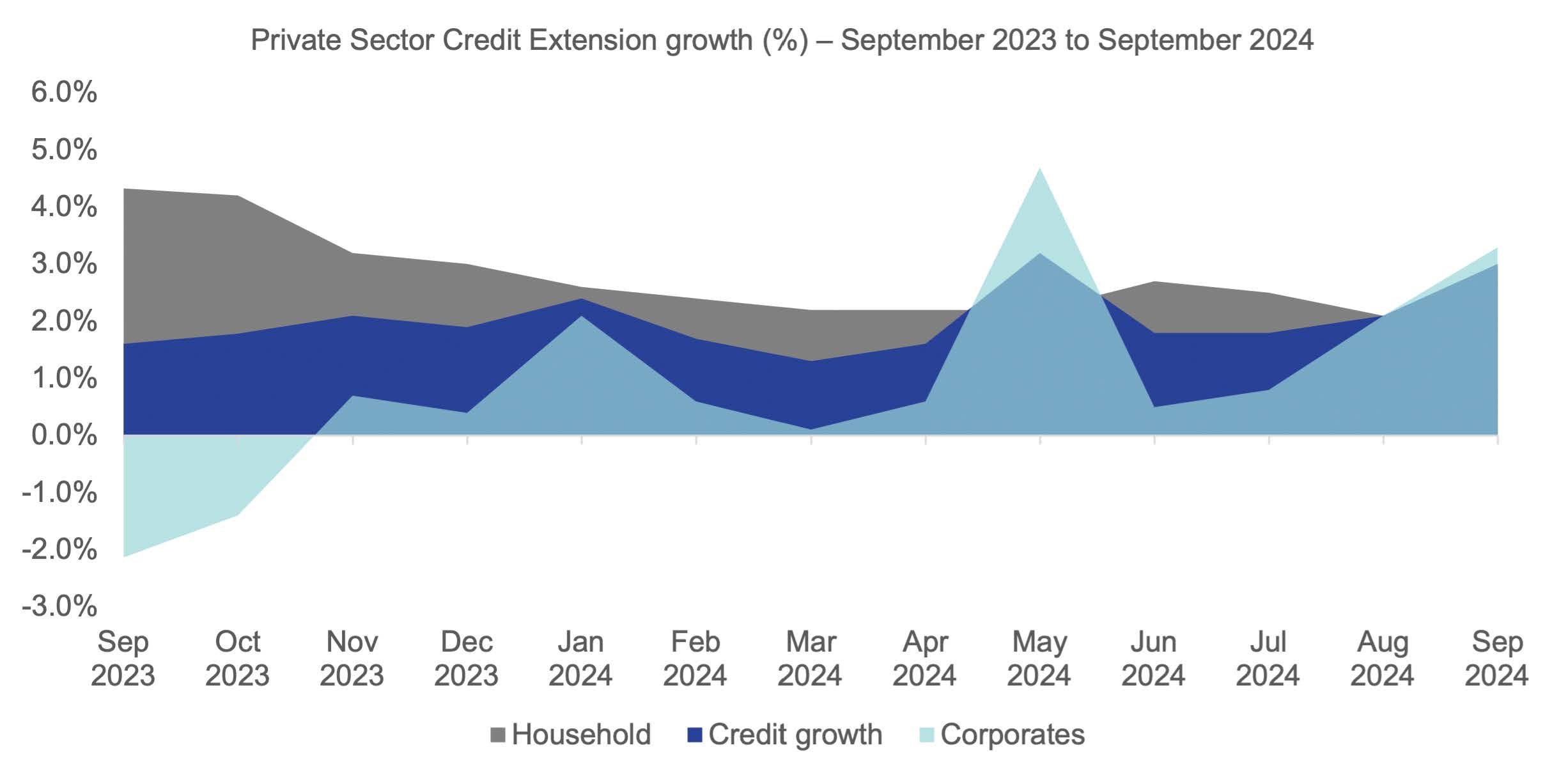

Private Sector Credit Extension (PSCE) maintained its upward trajectory for the third consecutive month, rising to 3.0% year-on-year (y/y) in September, compared to 2.1% at the end of August. This marks the second time this year that the PSCE rate has exceeded 3%, reflecting sustained growth momentum since April 2023. During Q3 2024, annual credit growth averaged 2.3%, an improvement over the 2.1% recorded in the same period in 2023.

The September increase in credit extension was supported by stronger demand from both households and corporates, attributed to easing monetary conditions. Year-to-date, credit growth has shown signs of improvement. Corporate demand led the rise, with credit growth reaching 3.3% y/y in September 2024, up from 2.1% y/y in August 2024 and a significant rebound from -2.1% y/y in September 2023. Household credit also rose to 2.9% y/y, the highest level this year, although slightly below the 4.3% y/y recorded in September 2023.

Corporates

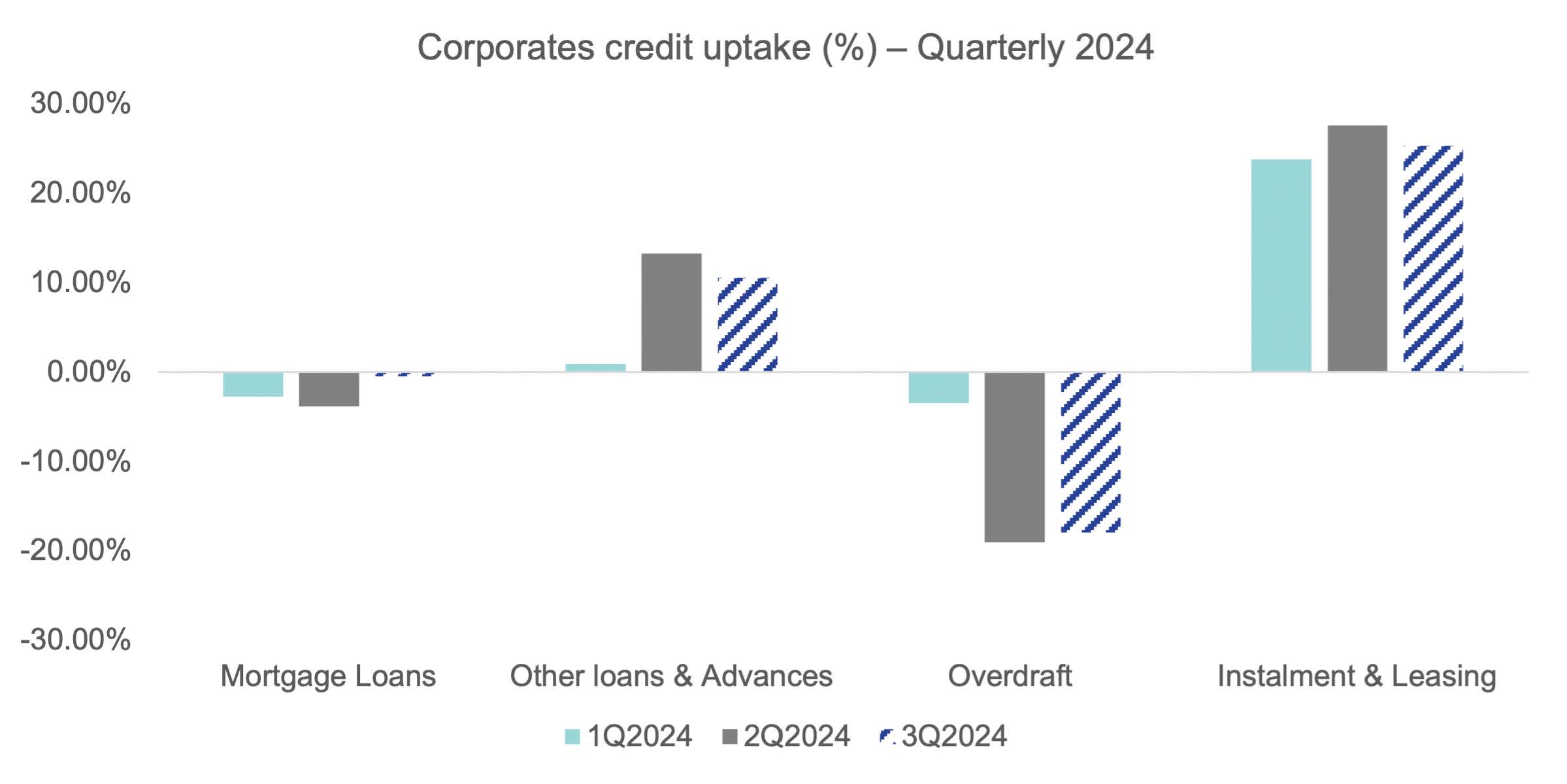

As of September 2024, Namibia's corporate debt stock reached N$46.7 billion, with annual credit growth rising to 3.3% (y/y). This uptick underscores growing investments in infrastructure, technology, and business capacity, signalling a positive economic outlook. Growth in corporate debt was broad-based, with notable gains across all business credit categories; notably, mortgage credit saw positive growth for the first time in over two years.

Corporate instalment and leasing credit surged by 25.0% y/y in September, an increase from 24.3% in August, reflecting strong business demand for leasing options. Mortgage loans to businesses also showed a marked improvement, rising from -0.7% y/y in August to 0.9% y/y in September 2024. This indicates a recovery in corporate real estate borrowing, likely driven by lower interest rates. Furthermore, overdrafts contracted by -11.8% y/y in September, an improvement from -18.8% in August, suggesting that businesses may be managing cash flows more efficiently or turning to alternative financing options.

In the third quarter of 2024, corporate debt instruments exhibited mixed trends. Other loans and advances, as well as instalment and leasing credits, experienced declines of 10.6% and 25.3%, respectively. These decreases may indicate cautious borrowing amid economic uncertainties. However, mortgage loans showed modest improvement, narrowing from -3.8% in Q2 to -0.47% in Q3 2024, indicating resilience in business investment. Additionally, corporate overdrafts saw a further reduction, moving from -19.03% to -17.97% by September 2024.

We project inflation to stabilize around 4.7% year-on-year by the end of 2024. However, inflation deceleration could be challenged by global supply chain shifts or import price volatility, given Namibia’s reliance on imported goods and fuel.

Households

Namibia’s household debt stock rose to N$67.8 billion in September 2024, reflecting a N$1.8 billion increase on an annual basis. Despite this growth, overall household credit expansion remains subdued, indicative of cautious borrowing trends amidst an evolving economic environment. Mortgage loans saw a decline of 0.8% year-on-year (y/y), reversing the 3.2% y/y growth observed in September 2023. This downturn in mortgage uptake can be partly attributed to the prior period of high interest rates, which likely dampened demand for home loans.

Other loans and advances recorded a massive increase of 6.9% y/y, from the 1.5% y/y growth seen in the previous month, suggesting more borrowing among households. This increase may indicate increased consumer confidence due to improved economic environment or ongoing adjustments to the interest rate environment.

Overdrafts declined by 9.1% y/y, an improvement from the 10.2% y/y decrease in August 2024. This trend could reflect reduced household reliance on shortterm credit to cover immediate expenses, possibly due to improved cash flow management. In contrast, instalment and leasing credit grew by 7.4% y/y, surpassing the 6.4% increase observed last year, indicating a rise in consumer spending on financed durable goods.

In the first quarter of 2024, household debt instruments displayed mixed trends. Mortgage loans experienced a modest decline of 1.27% compared to 1.67% in the previous quarter of 2024, signalling lower demand for housing despite lower borrowing costs. Other loans and advances saw a substantial increase of 3.27% from the -0.13% recorded in 2Q 2024, likely driven by enhanced consumer spending or possibly eased lending standards, allowing for broader access to non-mortgage credit. Meanwhile, overdrafts declined by 8.83%, suggesting a pullback in short-term household borrowing, which may indicate either more cautious spending behaviour or improved income stability. Instalment and leasing credit showed a healthy growth rate of 7.0% from the 6.43% recorded in 2Q 2024, possibly reflecting increased consumer financing for durable goods, such as vehicles and appliances.

SS Thoughts

The current repo rate in Namibia is 7.25%, with a prime lending rate of 11.00%. While these levels remain elevated, the recent reduction offers some relief to households and businesses by slightly lowering borrowing costs. In comparison, South Africa’s repo rate stands at 8.00%, and its prime lending rate is 11.50%.

Despite these adjustments, we expect private sector credit extension growth to remain modest in the short term due to the lag effect of rate changes, which often take time to impact the broader economy.

We project inflation to stabilize around 4.7% year-on-year by the end of 2024. However, inflation deceleration could be challenged by global supply chain shifts or import price volatility, given Namibia’s reliance on imported goods and fuel. The Bank of Namibia’s (BoN) ongoing monitoring of inflation dynamics will be crucial, as premature or aggressive rate cuts could reintroduce inflationary pressures, particularly if consumer demand strengthens rapidly.

The Bank of Namibia’s Monetary Policy Committee (MPC) is scheduled to meet again in December 2024, where we anticipate an additional 25 basispoint rate cut, bringing the repo rate to 7.00%. The BoN is expected to take a cautious approach, observing the effects of this easing before any further policy adjustments.

In conclusion, the BoN’s strategy of gradual rate cuts aims to control inflation while supporting domestic demand amid a slowing global economy. However, Namibia’s high reliance on resource-driven liquidity and foreign reserves exposes it to external shocks, which could complicate BoN’s efforts to maintain stability. Moving forward, structural reforms to diversify Namibia’s economic base and reduce cyclical dependencies are essential. These changes would not only strengthen economic resilience but also give BoN greater policy flexibility, laying a foundation for sustainable growth and stability amid evolving global conditions.

Simonis Storm is known for financial products and services that match individual client needs with specific financial goals. For more information, visit: www.sss.com.na