6 minute read

Financial Indicators

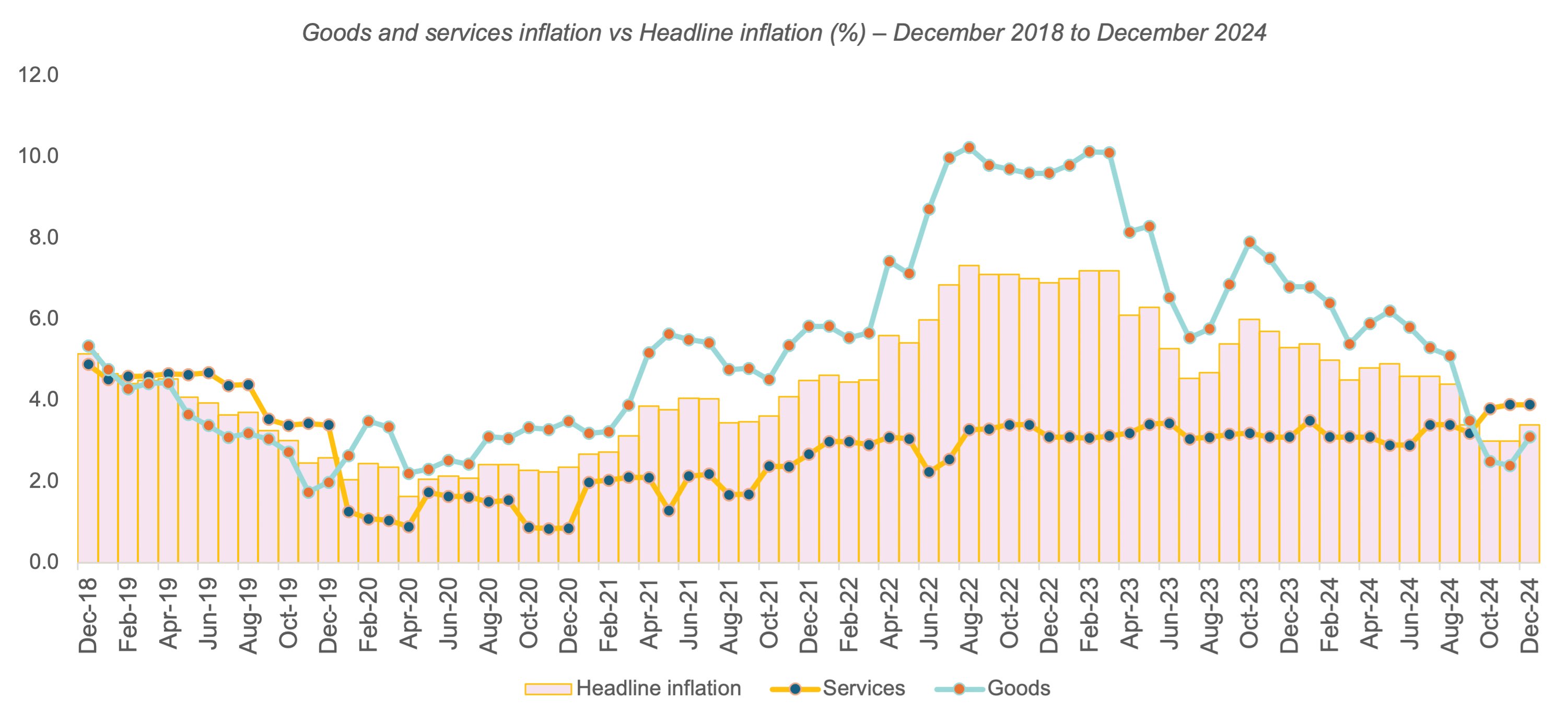

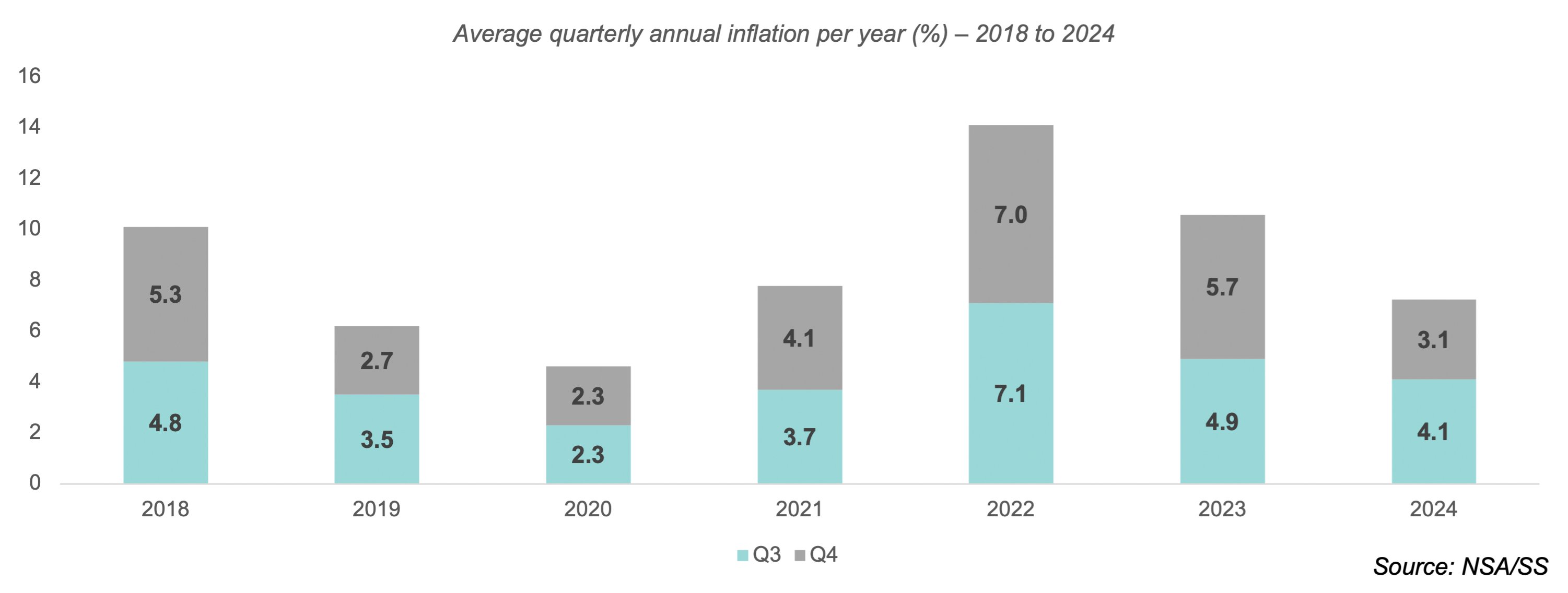

The December 2024 Inflation Report analyses Namibia's inflation dynamics, highlighting an environment of relative stability alongside emerging price pressures. Annual inflation increased to 3.4% in December from 3.0% in November, reflecting a marked deceleration from the 5.3% recorded in December 2023. The average inflation rate for 2024 was 4.2%, down from 5.9% in 2023, underscoring the broader trend of easing price pressures over the year. The December increase was driven by persistent inflationary contributions from key sectors, including transport, housing and utilities, and food and nonalcoholic beverages. On a monthly basis, inflation rose by 0.2%, slightly below the 0.3% recorded in November. The rise in inflation is largely attributed to global food price volatility, improved supply chain dynamics, and declining fuel prices relative to earlier months. Additionally, the effects of prior monetary policy easing have played a moderating role, alleviating more pronounced inflationary pressures.

As the year concluded, quarterly inflation for Q4 2024 stood at 3.1%, down from 4.1% in Q3 2024 and 5.7% in Q4 2023, underscoring improved stability in food and fuel prices. The year-to-date inflation rate averaged 4.2%, a notable reduction compared to the 5.9% recorded during the same period in 2023.

Inflation in goods contributed modestly to overall price levels, rising by 3.1% y/y in December. This marks a slight increase from November but remains well below the 6.8% recorded in December 2023. In contrast, services inflation exhibited a consistent upward trajectory, reaching 3.9% y/y in December, compared to 3.1% y/y a year prior. This trend reflects a growing contribution from services to overall inflation.

Key Inflation Drivers

Housing, Water, Electricity, Gas, and Other Fuels (28.4% of the Consumer Basket)

As the largest component of the consumer basket, this category recorded an inflation rate of 4.4% y/y in December 2024, up from 3.4% y/y in December 2023. The increase was primarily driven by higher rental costs (+3.0%), repair expenses (+2.5%), and water tariffs (+1.2%). However, electricity, gas, and other fuel costs declined by 8.1% y/y, largely due to the government’s electricity subsidy for the 2024/25 fiscal year. This subsidy mitigated some of the upward pressure stemming from other housing-related expenses, particularly in urban areas.

Transport (14.3% of the Consumer Basket)

Transport inflation turned negative, registering -1.4% y/y in December 2024, a marked reversal from the 4.0% y/y inflation recorded a year earlier. This deflation can be attributed to declining global fuel prices and improved logistics, which have eased operational costs for businesses and reduced financial strain on consumers.

What to Expect in January 2025

Historically, consumer spending rises during the early months of the year, leading to upward pressure on inflation categories such as food, transport, and leisure. Although this seasonal effect is temporary, it is anticipated to contribute to a modest increase in month-on-month inflation for January.

We forecast headline inflation for January 2025 to edge up to 3.5% y/y, with monthly inflation rising by 0.4%. Key contributors to this trend include:

• Food Prices: Seasonal demand for staples such as meat, beverages, and vegetables is expected to increase food prices by an estimated 0.5% m/m. While year-on-year food inflation is projected to remain resilient, a significant easing may only occur after supply expands during the upcoming harvest season.

• Transport Costs: Increased travel and heightened logistics activity in January are anticipated to drive a moderate rise in transport costs on a month-on-month basis, even as fuel prices remain stable.

• Housing and Utilities: Elevated energy consumption during the festive season is likely to spill over into January, leading to marginal increases in utility costs. Moreover, structural inefficiencies in the housing supply are expected to maintain upward pressure within this category, particularly in urban centres where demand consistently exceeds supply.

Broader Implications and Monetary Policy

Namibia’s inflation trends align with the global trajectory of easing price pressures, albeit with distinct local characteristics. In major economies, the United States recorded an annual inflation rate of 2.6%, while the Euro Area reported 2.3%, both benefiting from stabilising energy prices and subdued economic activity. Closer to home, South Africa’s inflation moderated to 2.8% y/y, driven by declining transport costs and a slowdown in food price increases.

In contrast, Namibia’s inflation, particularly core inflation, remains elevated, underscoring persistent structural challenges. Key inefficiencies in the housing and utilities sectors continue to exert upward pressure on prices, setting Namibia apart from its regional peers.

The Bank of Namibia has responded to these dynamics with a measured approach to disinflation. In 2024, the central bank implemented three successive 25 basis point rate cuts, bringing the repo rate to 7.0%. This accommodative policy stance aims to stimulate consumer spending and incentivise investment, laying the foundation for a broader economic recovery.

Looking Ahead: Monetary Policy Projections

We project the following for 2025:

• An additional 25 basis point rate cut in early 2025, reducing the repo rate to 6.75%.

• A likely pause in the easing cycle during the first half of the year, allowing time for the economy to adjust to recent rate cuts and for policymakers to assess inflationary developments.

Our Take for 2025

For 2025, we anticipate Namibia’s headline Consumer Price Index (CPI) will average around 4.0%, with core inflation stabilising at approximately 4.5%. This outlook assumes relative stability in global markets and continued monetary easing domestically.

However, an expected increase in global oil prices, currently at $77 per barrel, is projected to exceed $80 per barrel, driven by heightened geopolitical tensions under the Trump administration. Such an increase may exert upward pressure on transport costs, with potential spillover effects on food, housing, and hospitality prices.

Namibia’s recovery phase, alongside improving global and South African economic conditions, is set to create a supportive environment for investment opportunities across key asset classes. We highlight the following sectors as particularly promising:

• Real Estate: Declining borrowing costs are expected to stimulate housing demand, creating opportunities for developers and investors. Both residential and commercial property markets are likely to benefit from improved credit affordability and renewed consumer confidence amidst economic recovery.

• Fixed Income Markets: As interest rates approach their lower bound, longer-duration bonds present attractive return prospects. Investors stand to gain from locking in favourable yields, supported by stable borrowing conditions and continued rate cuts.

• Construction and Materials: The recovery phase is anticipated to drive cyclical demand for construction materials, spurred by increased industrial activity. Key projects, such as warehouse developments along the coast to support the burgeoning oil and gas sector, exemplify the sector’s potential. The cyclical nature of construction aligns well with rising economic activity and improving credit conditions, making it an attractive investment avenue.

Namibia’s recovery trajectory, coupled with a favourable monetary landscape, positions the economy for a promising 2025. Substantial investment opportunities in real estate, fixed income, and construction underline the country’s potential to capitalise on improving economic fundamentals, setting the stage for sustained growth.

Simonis Storm is known for financial products and services that match individual client needs with specific financial goals. For more information, visit: www.sss.com.na