THE UTAH ASSOCIATION OF CERTIFIED PUBLIC ACCOUNTANTS

VOL 3 · SUMMER 2024

THE

ON THE CAMPAIGN TRAIL TO STATE AUDITOR WITH RICKY HATCH, CPA

JOURNAL ENTRY

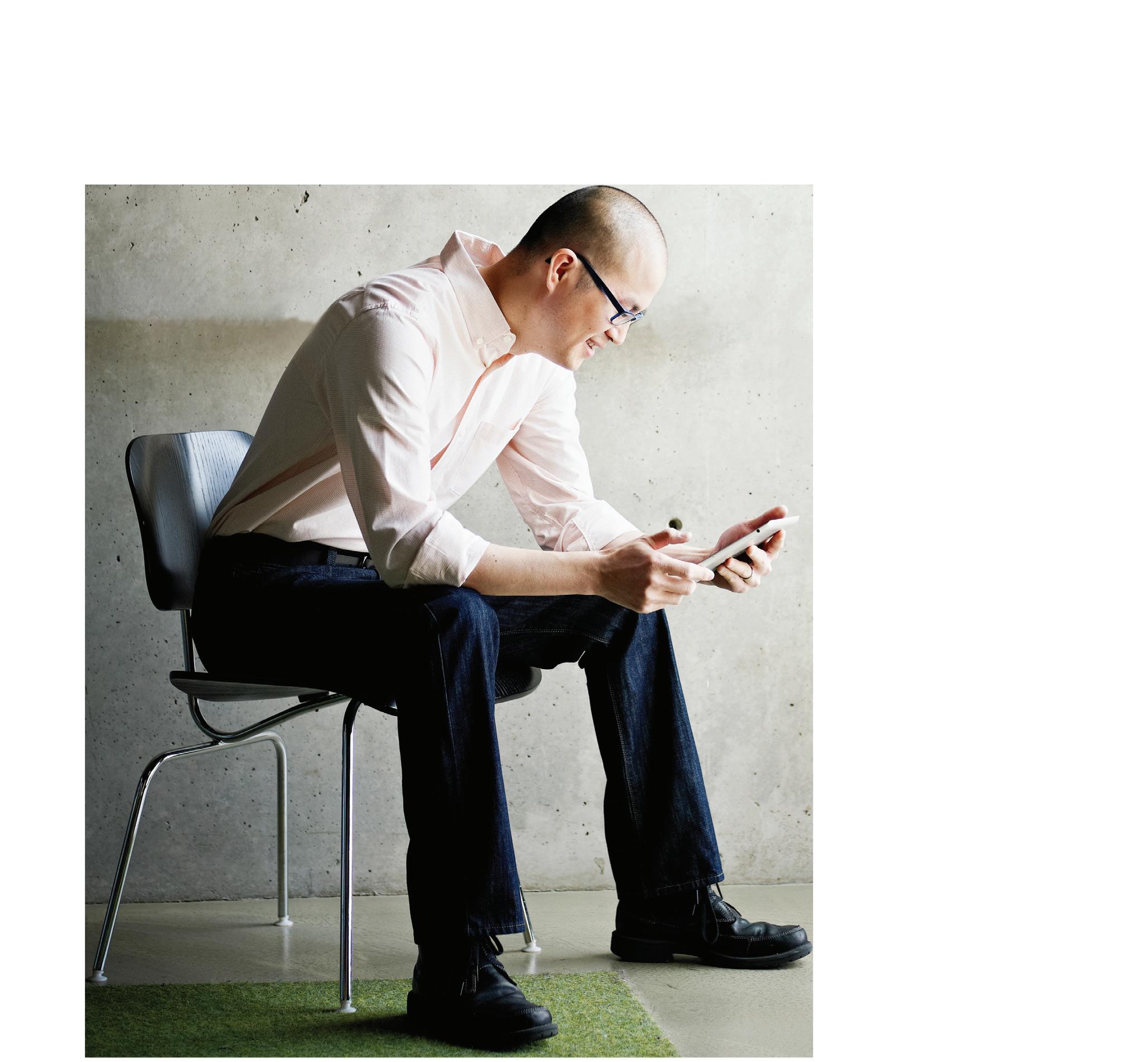

Ask about our entrance exam waiver. Currently accepting applications. Apply now! 3 DELIVERY OPTIONS: WITH Face-to-face Live Broadcast Interactive Online Chris Tibbitts 2021 Utah State MBA Graduate UtahStateMBA.com It’s Worth It!

Utah Association of Certified Public Accountants

15 W. South Temple, Suite 1625

Salt Lake City, UT 84101

801-466-8022

mail@uacpa.org www.uacpa.org

Managing Editor

Amy Spencer

as@uacpa.org

2024 – 2025

UACPA Executive

President: Jason Tomlinson, CPA

President-Elect: Dan Frei, CPA

Vice President: Amy Anholt, CPA

Treasurer: David Peaden, CPA

Secretary: Shalaun Howell, CPA

Member-at-Large: Clinton Armstrong, CPA

Member-at-Large: Marci Butterfield, CPA

Emerging Professionals: Ariane Gibson, CPA

Immediate Past President: Dustin Wood, CPA

AICPA Council: Stacy Weight, CPA

CEO: Susan Speirs, CPA

UACPA Staff

CEO: Susan Speirs, CPA

CPE Director: April Deneault Communications & Marketing Director: Amy Spencer

Financial Director: Tom Horn, CPA

Cover Photo by Chris Wood, robertwoodphotography.com

UACPA Statement of Policy

The Journal Entry is published four times a year by the Utah Association of Certified Public Accountants (UACPA). The opinions, views and articles expressed in this magazine are those of the authors and not necessarily those of the UACPA. This magazine should not be deemed an endorsement by the UACPA or its committees or editorial staff of any views, opinions or positions contained herein. Copyright © 2024 Utah Association of Certified Public Accountants

THE JOURNAL ENTRY | SUMMER 2024 3 CONTENTS SUMMER 2024 President’s Message 4 CEO’s Message 5 Cover + Articles Feature: Pilgrimage to State Auditor 6 Feature: Get to Know Ricky Hatch 11 Sheila Srivastava Runs for Salt Lake County Treasurer 12 Get to Know Sheila Srivastava 15 By the Numbers: Students Pursuing Accounting 16 Preparing for a New Strategic Plan 18 Health and Wealth Planning 20 Membership New Members and Student Affiliates 22 Members in the News 23 Board Question 24 Board Brief 25 UACPA Staff Chat 25 Comic: Generally Excepted 26 Meet a Member: Garry Hrechkosy, CPA 27 Continuing Education UACPA Virtual Courses for 2024 28 Leadership Academy 32 Golf Tournament 33 UACPA Mission 34 100% Membership Organizations 34

Board

Political primary season is upon us. Over the next few months you will see more signs, get more calls and hear more advertising for political candidates, begging for your support and participation. However, much like tax deadlines, the election season comes and goes. The real business gets done outside the “busy season,” when we have time to step back and look at the issues in a new light or from a different angle.

In the last Journal Entry, I called for your participation to tell your CPA story and share what you love about being a CPA. This is a grass roots effort to shift the focus of the CPA image. At the 2024 Spring Meeting of AICPA council, there was talk of focusing on the CPA image as part of their pipeline initiatives, so we will be seeing more efforts around the nation. We are all in this together and can achieve success much greater than each of us individually.

Thank you to those who have shared your story. I’ve heard some at chapter meetings or in one-on-one conversations. What stands out most is each person has their own story of what brought them into the profession and why they love being a CPA. That may be one of our biggest strengths: diversity. Sound financial advice is to “diversify your stock portfolio,” the same can be said about the CPA profession: The diversity of our backgrounds, talents and interests makes us stronger and will help us navigate the

PRESIDENT’S MESSAGE JASON TOMLINSON, CPA

challenges of the future. But, that means we need your participation to help us diversify the profession with your experience.

There are many ways to get involved within the CPA profession. You may choose committee involvement, attending chapter meetings or conferences, mentoring a younger CPA or just participating in a survey and providing your thoughts and feedback. Some ways may work better at different times in your career. Despite the different ways to get involved, each one yields the dividends of a successful and fulfilling career and will benefit you, as well as the profession.

Over the last year or two, we have discussed the requirements to qualify to become a CPA. Some states are starting to suggest changes to their laws and we are working to stay on top of all the discussions and find solutions that works best for everyone going forward. This is not an easy process; I have been privileged to have a ring-side seat as the “sausage is being made.” I am confident that we will come out of this stronger as a profession, because of the dedication of those involved to see it be a success.

Let me say it again, I love the diversity of the CPA profession. We all have a common foundation; we are able to grow our careers and make change in the world according to our own interests, skills and personalities. Thank you for your involvement, thank you for your efforts to make the CPA profession a valuable career choice and thank you for taking the time to give back to the world a portion of what you have received. n

THE JOURNAL ENTRY | SUMMER 2024 4

CEO’S MESSAGE SUSAN SPEIRS, CPA

As described in the Utah Constitution, Article VII, the state auditor shall “perform financial post audits of public accounts.” The Utah code, Title 67, Chapter 3, further details the role of Utah’s state auditor. “The state auditor shall be the auditor of public accounts and as such shall be independent of any executive or administrative officers of the state.”

Additionally, the state auditor shall “audit each permanent fund, each special fund, the General Fund, and the accounts of any department of state government or any independent agency or public corporation on a regular basis as the auditor shall determine necessary or upon request of the governor or the Legislature. These audits are to be performed in accordance with generally accepted auditing standards and other auditing procedures as promulgated by recognized authoritative bodies. The audits shall be conducted to determine honesty and integrity in fiscal affairs, accuracy and reliability of financial statements, effectiveness and adequacy of financial controls, and compliance with the law, as the auditor shall determine necessary.”

For several years, our members have been frustrated that we have not had a CPA as our state auditor. When John Dougall, our current state auditor, indicated that he was not going to run for another term, Ricky Hatch, a CPA and Weber County auditor, decided to take on the challenge. We are proud to support him, a fellow UACPA member, and ask for your support as this is a statewide race. Ricky will face Tina Cannon in the June 25 primary election. To find out more or contribute to Ricky’s campaign, visit uacpa.org/stateauditor.

UPDATING THE STRATEGIC PLAN

We are updating our strategic plan this year. As an organization, we believe we must be forward thinking. Why strategic planning?

Vision and Direction: Strategic planning defines our mission, vision, and values. It provides a clear direction, aligning our team’s efforts with the broader organizational goals and fostering a sense of purpose and unity.

Resource Allocation: By identifying priorities and setting clear goals, strategic planning helps us allocate resources efficiently.

Adaptability: The CPA profession is dynamic, with new challenges and opportunities arising constantly. A wellcrafted strategic plan allows us to anticipate changes, adapt proactively, and stay ahead of the curve.

Performance Measurement: Strategic planning establishes benchmarks and performance indicators. Regularly measuring our progress against these metrics enables us to remain on track to achieve our goals.

Sustainable Growth: Strategic planning is about ensuring sustainability. It balances short-term achievements with long-term aspirations, fostering resilience and enabling us to thrive in a world of chaos.

We’ve held focus groups with various sections of our membership and have surveyed our members. We encourage you all to participate, as your insights drive what we do. n

THE JOURNAL ENTRY | SUMMER 2024 5

Photos by Chris Wood, robertwoodphotography.com

Photos by Chris Wood, robertwoodphotography.com

PILGRIMAGE TO STATE AUDITOR FEATURE UACPA MEMBER RICKY HATCH IS ON THE BALLOT

BY AMY SPENCER

AfterJohn Dougall was elected to the Utah State Auditor position in 2012, UACPA members made it clear that a CPA should be in that office. With John’s term coming to an end, there is renewed hope that there will be a CPA in that position. Weber County clerk/auditor, Ricky Hatch, CPA has put his name in the race and will face off in the primary election on June 25, 2024.

Ricky, the youngest of eight children, was born and raised in Sandy, Utah. He graduated from Alta High School in 1985 and earned his Master of Accountancy with honors from Brigham Young University. Ricky wanted to be a CPA from the time he was a teenager. He had a church leader who was a CPA, and recognizing that he was good in math and seeing the potential to be financially successful, he set his sights on earning the designation. “I liked how [my church leader] said that everyone needs a good accountant, and that accounting gives you a great background if you want to pursue other interests,” Ricky adds.

Ricky’s career began as an IT auditor with PwC in Los Angeles. Five years later he took an assignment in Warsaw, Poland, to establish an IT audit practice and consulting service. After that 18-month assignment, he became a project analyst for Parametic Technology Company at their headquarters in Munich, Germany, then moved to PTC’s Massachusetts office. In 2002, Ricky and his family returned to Utah where he and his wife opened, ran and taught at a private school in North Ogden. This led to him becoming the CFO and COO of Kimber Academy’s 14 schools. Ricky landed his next position at Jetway in Ogden, where he worked for five

years before being elected as Weber county clerk/auditor in 2010.

CIVIC ENGAGEMENT

While teaching, Ricky recognized the importance of civic engagement. “I decided that I needed to practice what I preached. My little town of Farr West had an opening for a planning commissioner. I made an appointment with the mayor and asked him [about the position] and how I could help. I served on the planning commission for about eight years and learned a tremendous amount about land use and governance,” Ricky says. In 2002, he attended his first neighborhood caucus meeting. “The attendees included me and four grandmothers from my church. They welcomed me and immediately made me the precinct chair, a county delegate, and a state delegate.” Ricky was eager to learn about these positions. He soon was elected as a legislative district chair, served on the Utah GOP Audit Committee and as the GOP County Party Treasurer.

Ricky learned about the Weber county clerk/auditor position and how they are responsible for managing the county’s elections and finances, which he says are both deep passions of his. “That is when I put my hat in the ring.”

We asked Ricky about what he could bring to the role as Utah State Auditor.

WHY IS IT IMPORTANT FOR A CPA TO HOLD THE OFFICE OF STATE AUDITOR?

There are several reasons why a CPA brings more value to the state auditor’s office. First, the knowledge and the

Continued on pg. 8

THE JOURNAL ENTRY | SUMMER 2024 7

Continued from pg. 7

experience needed to become a CPA make a great training ground for understanding the concepts of risk and control. This understanding provides a foundation by which the state auditor evaluates the audit universe within the state and helps identify key areas to audit. Second, even though all public officials should possess the highest level of ethics, being a CPA makes ethical behavior mandatory, per state law. Because the CPA designation carries a level of prestige and trust, our Legislature has codified adherence to the AICPA’s Code of Conduct and requires ethical training every two years. Finally, the position of state auditor needs to engender the trust of the citizens. The citizens need to know that the state auditor has the skills and integrity to conduct professional, objective audits, and the title of CPA is the best guarantee out there to the ensure that taxpayer dollars are managed wisely, and that the financial health of our state is maintained for future generations.

WHAT ARE THE RESPONSIBILITIES OF THE STATE AUDITORS?

Overall, the responsibility of the Utah State Auditor’s office is to provide independent and objective oversight of the financial operations of Utah’s state and local governments. This helps ensure that taxpayer dollars are used efficiently, effectively, and transparently. The state auditor can also conduct performance audits to evaluate government programs and departments.

Since I haven’t previously worked in the state auditor’s office, I would spend the first six to 12 months observing, asking questions, researching, and getting to know the environment and the people in the office. There’s plenty I don’t know, and I think it could be harmful to make any dramatic changes based on incomplete information. However, based on my understanding, there are a few things I would work on right away:

1. Further support for the core financial audit side of the office. I’ve heard it is bottom heavy, that some key management positions are close to retirement, and that it hasn’t felt as much love as it should. The financial audits of the state and state agencies are the only constitutionally mandated duties of that office, so this side of the office needs full support.

2. Improve relationships with local governments. I want to strengthen trust with all levels of government and increase upfront collaboration. In addition to identifying

deficiencies, I’d like to collaborate up-front with agencies to prevent deficiencies from happening in the first place — kind of like putting a fence at the top of a cliff rather than an ambulance at the bottom.

3. Enhanced, proactive transparency. I can see a more push-oriented public outreach mindset, and audit reports that have plain-language summaries so that nonaccountants can better understand them.

4. Preemptive risk management. I’d like to strengthen the approach to identifying and mitigating financial risks. Further utilizing data analytics, continuous auditing techniques, and artificial intelligence, we may be better able to detect and address issues before they escalate.

HOW DOES YOUR EXPERIENCE TRANSLATE TO THE DUTIES

OF THE

OFFICE

YOU WOULD

OVERSEE?

“I’ve been auditing for over 30 years. I’ve conducted and managed financial audits, election audits, forensic audits, compliance audits, and performance audits. I also have auditing and accounting experience in the private industry (about 17 years) on both coasts and two continents, with clients such as Wells Fargo Bank, Disney, Masterfoods, General Dynamics, Johnson & Johnson, California institute of Technology, and Sony Pictures. I managed the nationwide SAS 70 audits for Electronic Data Systems’ check processing service. These audits were the precursor to the Sarbanes-Oxley (SOX) audits in the early 2000s after the Enron and WorldCom scandals.

I’ve also been on the auditee side, helping auditors examine controls and balances in my accounting departments.

The elected office of state auditor is mostly a management position, and having performed all aspects of audits will help me better understand and meet the diverse needs of the state auditor team. I’ve managed divisions and projects that are similar in size to the state auditor’s office, including a worldwide implementation of Oracle’s 11i accounting system for Parametric Technology Corporation.”

TELL US ABOUT YOUR VOLUNTEER EXPERIENCES.

“I currently represent the nation’s 3,069 counties on the Governmental Accounting Standards Advisory Council (GASAC), which advises the Governmental Accounting Standards Board (GASB) in the creation of governmental accounting standards that must be used by all state and local governments across the country. This

THE JOURNAL ENTRY | SUMMER 2024 8

council has 35 members, which include academics, attorneys, auditors, accountants, investors, bond rating agencies, CPAs, and government accountants. I have served on the GASAC’s executive committee for two years.

I’ve used both my financial and IT audit experience to help strengthen the auditing of elections in Utah and across the country. In April, I was asked by the Institute of Internal Auditors in Salt Lake to give a presentation on auditing elections.

I helped create a national resource that improves the auditing of elections. I helped national election experts apply auditrelated principles to election processes. In 2022, I participated in an inaugural discussion of establishing best practices for auditing elections. I’ve helped the Utah Legislature pass two bills that now require additional election audits: a voter registration audit process and an election system hash validation audit, which is required by law in two other states.

I have served on two independent panels that helped create a code of ethics and code of conduct for election officials across the country. One panel was sponsored by the

American Law Institute at NYU and led by Dr. Charles Stewart of M.I.T., and the other panel was convened by the National Association of Election Officials, in partnership with Auburn University. I was the only person to participate on both panels.

I served on Utah’s Private Activity Bond Authority Board for six years. Other board members and stakeholders frequently expressed appreciation for, and sometimes playful teasing about, the highly detailed questions that I asked in the meetings. Details matter, and I like to dig.”

HOW DOES YOUR EXPERIENCE

TRANSLATE TO THE STATE AUDITOR?

“I’ve been the Weber County Auditor and Clerk for the past 13 years, so I have governmental accounting and auditing experience. In this role, I’ve managed a department about half the size of the state auditor’s office, including all of the administrative, managerial, and leadership duties this role entails.

County auditors interact frequently with the state auditor’s office. I’m fortunate that my county comptroller is a former

Continued on pg.

THE JOURNAL ENTRY | SUMMER 2024 9

10

Continued from pg. 9

employee of the state auditor’s office. He has been an invaluable source of information on how that office has functioned in the past and how they can better support and hold accountable local governments.

I’ve frequently worked with the current state auditor, John Dougall, on audit-related topics and legislation such as segregation of duties for different forms of local governments and the ideal composition of audit committees for local governments.”

AS A CANDIDATE, WHAT DO YOU SEE AS THE TOP CHALLENGES FACING UTAH AND HOW CAN YOU HELP

RESOLVE THEM? Especially now, with high public skepticism of government, enhancing transparency and ensuring accountability are crucial, helping reassure citizens that their government is working in their interest, monitoring and reporting on how taxpayer dollars are spent.

Transparency. The state auditor’s office helps ensure that both state and local governments operate with openness, giving citizens and stakeholders a clear view into their operations and financial management. Through audits, the auditor ensures that these entities are

• reporting their finances accurately

• operating in compliance with established laws and regulations

• spending taxpayer dollars efficiently

Transparency is one of the best tools for deterring corruption and mismanagement.

Accountability. Public officials and entities are answerable to the citizens for their actions and decisions. The state auditor’s office helps enforce accountability by scrutinizing the financial and operational activities of state and local governments. The findings from these audits can lead to significant changes in policies or practices, can initiate disciplinary actions, and even lead to legislative reforms. This role checks for mismanagement, but more importantly, it reassures the public that the government remains responsible for its actions and committed to rectifying its mistakes.”

IN YOUR PREVIOUS EXPERIENCE, HAVE YOU PERFORMED OR LED A TEAM TO UNCOVER FRAUD, WASTE OR ABUSE?

In Weber County, employees used to accept lower pay for higher benefits. In the past few years, in order to attract more employees, the county increased the pay, a good thing. However, while increasing the pay, the county also kept the higher benefits, including what I called a “Cadillac” benefit program offering five-years of health insurance for retired employees. Well, our county finances couldn’t sustain both high pay and high benefits, so my team and I worked with our county commission and HR department to restructure the retirement health care package. We worked hard to make sure that employees who were retired or nearing retirement would not be unduly harmed, so we created a 10-year phase out of this benefit. This phase out gave employees several years to choose the option that was best for them. We’re currently in the 8th year of that program and are on track to save $23 million in Weber County taxpayer money.

Back in the 90s, I remember being part of a forensic audit team that worked to confiscate and evaluate computers and system data for Sunrise Medical, Inc., uncovering a significant fraud that led to an investigation by the Securities and Exchange Commission. I remember meeting with team members in a hotel room prior to the confiscation, having technicians check the room for bugs and wires, and then showing up unannounced at the corporate headquarters and performing analysis on the computers to uncover the accounting fraud.

HOW DO YOU PLAN TO ENGAGE WITH TAXPAYERS AND STAKEHOLDERS TO GATHER FEEDBACK AND ADDRESS THEIR CONCERNS ABOUT GOVERNMENT FINANCES?

First off, I have always admired how John Dougall has traveled the state, visiting with government officials and taxpayers from every county. I intend to continue that best practice. Fraud hotlines are perhaps the biggest deterrent to and identifier of fraud, waste, and abuse. I will continue to support and respond to the concerns expressed through the hotline. And lastly, focusing on trust and collaboration will create more open dialogue about concerns. n

THE JOURNAL ENTRY | SUMMER 2024 10

Continued from pg. 9

LEARN MORE ABOUT RICKY

WHAT WOULD SURPRISE PEOPLE TO KNOW ABOUT YOU? I love to read and write. I have been writing a short weekly email to friends and family since the mid-’90s. I haven’t been as regular over the past few years, but I still love to write. I also like to sing and perform, especially with my seven siblings, all of whom are better singers and performers than I am (at the 2024 GOP state convention, six of them sang jingles and songs about me). I’m deeply religious, a member of the Church of Jesus Christ of Latter-day Saints, but I don’t want people to feel like I’m pushing my beliefs onto them, so I tend to be quiet about that. As an adult, I taught myself to play the following instruments (not super well, just at a basic level): piano, harmonica, recorder, and bagpipes (very basic level with the bagpipes). I was in a train crash in the ’90s. I obtained my solo pilot license in high school and once dropped leaflets over a girl’s house to ask her to a school dance. I’ve been skydiving three times. I still speak French, albeit slowly, and when I lived in Poland, I was conversant in Polish.

WHAT DO YOU LIKE TO DO OUTSIDE OF WORK? I like to read and keep a spreadsheet of every book I’ve read since college (362 so far, about 40,000 pages). I love the outdoors, especially hiking. I try to hike several times a week, even if it’s just for 20 minutes. In 2019, I hiked King’s Peak, the highest peak in Utah. My dream is to climb Mt. Kilimanjaro. I love to watch movies and go to the theater for concerts, symphonies, plays, musicals, and community performances. I like to play racquetball. I also love coaching little league baseball, which I’ve done for several years, even though I don’t have children on the teams. I like to watch all kinds of sports as well.

WHAT IS YOUR FAVORITE BOOK? That’s a really hard one, because I have so many! Aside from religious texts, here are some books that changed my life: Jurassic Park (the first book I read for pleasure as an adult), The Seven Habits of Highly Effective People (has dramatically influenced how I organize my work and live my life, including my interactions with others in my current job), Up From Slavery, Leadership and SelfDeception, and of course, Les Miserables.

“I am the 8th great grandson of William Bradford, who came as a Pilgrim to the New World on the Mayflower and who served as governor of Plymouth Plantation over a span of 35 years. I feel quite an affinity for him. I’ve read his book, “Of Plimouth Plantation” in the original old English language. When I was serving on the Constitution Day Committee of Utah, we discussed having an activity for boy scouts featuring many historical figures. The Committee members asked if I would portray William Bradford, that I reminded them of him, not knowing that I was his direct descendant. I have portrayed him over the past 12 years to groups as large as 1,200 people.”

WHAT ADVICE DO YOU LIVE BY? Here are a few things: Each of the Seven Habits by Stephen Covey. I especially like “Seek first to understand, then to be understood.” This mindset is crucial, especially in the world we currently live in. I also love “Begin with the end in mind,” “Be Proactive,” and “Think Win/Win.” My mom always told me, “If you can’t say anything nice, don’t say anything at all.” There is an old Arab proverb: “The mouth should have three gatekeepers: Is it true? Is it kind? Is it necessary?” My dad told me in his 80s: “Take time to weep every day.” I take that to mean that it’s OK to feel and display emotion, and we should actively look for and savor the deep, wonderful moments in life. n

THE JOURNAL ENTRY | SUMMER 2024 11

FROM SMALL TOWN TO SALT LAKE COUNTY

HOW SHEILA SRIVASTAVA HAS PREPARED TO SERVE AS THE SALT LAKE COUNTY TREASURER

BY AMY SPENCER

Sheila Srivastava spent most of her youth in Fillmore and Holden, Utah. Born in Orange, California, she moved to Utah when she was 9 years old, where she was raised by a single mother who relied on welfare and food stamps. “I remember sitting on the floor listening to my mom and grandma lamenting over the rising cost of a loaf of bread and a gallon of milk. They didn’t know how we were going to get by,” Sheila says, adding that her mother worked three jobs to make ends meet and to send her to school. “I am proud to say that I am the first person in my family to graduate from college.”

Sheila earned her bachelor’s degree in accounting from the

University of Utah. After earning her CPA license, she worked for multiple accounting firms before starting her own practice. Over the course of three decades, Sheila has performed audits, prepared taxes, uncovered fraud, acted as a part-time in-house CFO, and prepared budgets. Between the experience and her desire to serve the public, Sheila says she jumped at the opportunity to run for Salt Lake County Treasurer.

The mother of two reflects on her humble beginnings, “I would have never thought that someone like me would be able to run for public office and have the opportunity to serve 1.2 million people.”

Sheila shares her thoughts about the position and what drives her to serve.

THE JOURNAL ENTRY | SUMMER 2024 12

WHAT ARE THE RESPONSIBILITIES OF THE SALT LAKE COUNTY TREASURER?

The treasurer is responsible for billing, collecting, distributing, investing and protecting the revenues that flow through Salt Lake County, which come primarily from taxpayer dollars. This adds up to a budget of approximately $2 billion that serves approximately 1.2 million people. The Salt Lake County Treasurer currently serves as the chair of the Utah State Money Management Council and participates in activities with the Utah Association of Counties. I look forward to being a collaborative partner with my fellow elected officials in and outside of Salt Lake County to build a better and stronger community for all of Utah.

HOW DOES BEING A CPA HELP YOU QUALIFY FOR THIS POSITION?

In order to receive this professional license, I was required to complete my accounting degree, 2,000 hours of professional experience, pass the CPA Exam, and pass an AICPA Code of Conduct and Utah law exam. This license is monitored by the Division of Occupational and Professional Licensing and requires semiannual reporting of continuing professional education in order to maintain licensure. My audit experience built a strong foundation that has benefited me throughout my career. I am bound by the CPA professional ethical code of conduct, which continues to guide my work with every position I serve in. Over the years, I have gained strong skills that would not have been attainable without this valuable experience and stringent requirements.

WHAT ARE SOME OF THE CHALLENGES OF RUNNING FOR THIS POSITION?

Running for public office and fundraising are challenges for most people. Donors typically overlook candidates running for treasurer, because it is not a policy making position. Most donors want to donate to candidates who will advocate for their issues and interests. I am working hard to create awareness of the importance of the treasurer position and the need to maintain professionalism in this office. I was able to grow my accounting practice by word of mouth alone. I never posted a single advertisement or hunted for work. It all came through referrals. As a candidate for office, I have to sell myself every single day. I have to be vulnerable and ask people for help and money and trust, which in my private practice all came as a direct result of my reputation. Being vulnerable doesn’t come naturally for me, and I have had to work hard to put myself out there.

I am also a woman. Sadly, some people have the misconception that men are better with money and stronger in the professional work place. When elected, I will be the first woman ever to serve as Salt Lake County Treasurer since 1852 when they started keeping track! That glass ceiling is coming down, and I am ready to take my seat at the table!

HOW DOES YOUR PROFESSIONAL EXPERIENCE TRANSLATE TO THE DUTIES OF THE COUNTY TREASURER?

My decades of experience have taught me to be careful and meticulous in my work — to stand strong and trust the numbers. They never lie. I have become an expert in financial analysis, budgeting, forecasting, and strategic planning. I can spot inconsistencies, implement internal controls and safeguard the assets of every organization I work with. I am mission driven. When making decisions, I always challenge my clients to ask themselves how this decision will help serve their mission. I have been a professional serving as the liaison between management and boards of directors and provided informative reporting that prepared them to make the best decision for the people they serve with confidence.

As Salt Lake County Treasurer, I will be serving the county’s mission to provide honest, open, efficient and ethical government that is fiscally responsible, accessible and responsive to Salt Lake County’s needs. Our Salt Lake County Council is essentially our board of directors, and our budget primarily comes from the pockets of our residents and taxpayers. I have experience working with municipalities, elected officials, and federal grant contract management. This wealth of experience uniquely qualifies me to step in and serve my neighbors.

WHAT ARE THE DIFFERENCES BETWEEN YOU AND YOUR OPPONENTS?

The primary difference between myself and my opponent is that I am the only candidate with CPA licensure and professional accounting and auditing experience. I am the only candidate with a publicly verifiable professional license that voters can trust. I have a background in analyzing data and fraud detection. n

Get to know Sheila on pg. 14

THE JOURNAL ENTRY | SUMMER 2024 13

LEARN MORE ABOUT SHEILA

WHAT LED YOU TO BECOME A CPA? As I watched my family struggle as a child, I became determined to understand money and prepare myself to be financially independent and secure. I am exceptionally good with numbers and I love puzzles. Accounting feels like a puzzle for me. There is a place where each transaction fits the best and there is no question because everything has to balance. I am just as satisfied completing a financial statement as I am finishing a difficult puzzle. Becoming a CPA was what came most naturally to my personality.

WHAT WOULD SURPRISE PEOPLE TO KNOW ABOUT YOU? “Even though my personality seems very outgoing, I am naturally an introvert and most enjoy quiet times with my family. I was the self-proclaimed roller-skating queen of Clinton Street where I grew up. I was the president of my drill team in high xchool. I lived on a tiny ranch in Holden, Utah, where I loved to feed the chickens and the cows and pick rocks from the garden. I had a cow named Isabella for a best friend. I am a vegetarian.”

WHAT DO YOU LIKE TO DO OUTSIDE OF WORK?

• “I love to garden…mostly harvesting. My husband does the planting and I do the harvesting. We love to cook and eat from our garden.

• I love to make and decorate birthday cakes. My children call me the ‘master birthday cake maker.’

• I love to ride my new bike. I have a basket so I can go grocery shopping with it. She still needs a name.

• I love spending quiet time snuggling up with my dog and my husband with a beautiful cup of coffee before starting every day. I am a domestic barista!! If you are my friend, I will make you the best cup of coffee you have ever had.

• I am happiest when doing absolutely anything with my family.

• I LOVE yoga!

• I love hiking, camping and spending quiet time in nature.

•

WHAT IS YOUR FAVORITE BOOK? “My latest favorite reads for pleasure were Lessons in Chemistry by Bonnie Garmus, The Girl with the Louding Voice by Abi Daré, Where the Crawdads Sing by Delia Owens, and The Power of Ritual by Casper ter Kuile. I also love thumbing through cookbooks.”

WHAT ARE SOME OF YOUR GOALS, BOTH PERSONAL AND PROFESSIONAL? I recently retired from my accounting practice. My next professional goal is to be the first woman ever to serve as Salt Lake County Treasurer beginning on January 1, 2025! I believe everyone has a right to financial independence, and I would love to contribute to helping people achieve that end.

Personally, I want to read more books, spend as much time in the outdoors as possible, live every moment of my life to the fullest, and embrace every opportunity to learn from my fellow humans!”

WHAT ADVICE DO YOU LIVE BY? Always look forward. Be kind. Be patient. Be honest. Be unapologetically and authentically yourself. And most importantly, be fully present with the people you are with. The greatest gift in life is your relationships. I believe in presents of presence. n

THE JOURNAL ENTRY | SUMMER 2024 15

Continued on pg. 10

BY THE

NUMBERS

CPA EXAM CANDIDATES

79

PERCENTAGE OF STUDENTS WHO BELIEVE AN ACCOUNTING CAREER WILL DELIVER LONG-TERM CAREER BENEFITS

These numbers reflect EY’s accounting professional of the future survey from Nov.2023.

PERCENTAGE DECREASE IN STUDENTS EARNING A BACHELOR’S IN ACCOUNTING SINCE 2015 7

58

50

PERCENTAGE DECREASE IN PEOPLE TAKING THE CPA EXAM BETWEEN 1990 AND 2021

PERCENTAGE OF STUDENTS WHO SAY THE FOLLOWING IS IMPORTANT TO WORK WITHIN THE ACCOUNTING PROFESSION:

• 76% – COMMUNITY ENGAGEMENT

• 81% – POSITIVE ESG IMPACTS

• 79% – DIVERSE TEAMS/WORK ENVIRONMENT

PERCENTAGE OF STUDENTS WHO SEE PROMISE IN ALTERNATIVE PATHWAYS TO CPA LICENSURE

THE JOURNAL ENTRY | SUMMER 2024 16

Embracing AI in HR for Better Onboarding

What’s the impact of artificial intelligence (AI) on new hire onboarding and human resources (HR) professionals? Paychex surveyed 309 HR professionals and 1,003 recent hires to uncover how technology and the use of AI impacts the hiring and onboarding process.

Key Takeaways

• 48% of new hires surveyed describe their postonboarding training as somewhat inadequate.

• Nearly 3 in 10 employees dissatisfied with their onboarding experience plan to look for a new job within the next three months.

• AI-onboarded employees are 30% less likely to quit within a year than those onboarded without AI.

• 65% of HR professionals surveyed believe using AI in onboarding will improve employee retention.

While AI has streamlined onboarding, employees can still feel overwhelmed by the information overload during their first weeks on the job. Both new hires onboarded with and without AI suggest the need for more transparent communication of job expectations and performance metrics during onboarding (45%), and 35% of those onboarded with AI shared this sentiment.

Onboarding Pros and Cons for HR Leaders

HR professionals who have embraced AI for onboarding highlight its most significant benefits:

• 53% report a reduction in onboarding time

• 38% say it decreases associated costs

• 43% note streamlining administrative tasks

• 65% believe AI will improve employee retention

Yet, these advancements come with challenges

For instance, 42% of HR professionals using AI for onboarding cite technical integration difficulties Partnering early with IT professionals can help HR professionals streamline AI implementation and provide a seamless integration with existing systems and workflows.

For HR departments not yet utilizing AI, 40% of those surveyed attribute the delay to a lack of in-house AI expertise. Decision-makers may consider investing in targeted training programs and workshops for HR staff to help enhance their skills and confidence in using AI technologies.

The Future of HR in Employee Integration

From reducing turnover to ensuring new hires are satisfied and well-prepared, HR professionals are turning to AI to help improve onboarding challenges that new hires often experience.

Using AI, HR professionals can set new employee integration standards, prioritizing effective communication and tailored training while maintaining the essential human touch.

Learn more about the survey methodology and insights here

© 2024 Paychex, Inc. All Rights Reserved. | 05/13/24

STICKING TO A STRATEGIC PLAN

CREATING A MAP TO SUPPORT THE FUTURE OF THE UACPA AND THE PROFESSION

BY MACKEY SMITH

It has been a pleasure serving the UACPA over the years; we are excited to announce an upcoming update of the strategic plan.

Before we jump into the planning process, it is important to clarify what the plan is and is not. A strategic plan is meant to identify and map out the priorities of an organization, along with key action items and success metrics. A strategic plan is not meant to articulate day-to-day operations, nor capture every single thing the organization will work on over the next three or four years. The plan is meant to articulate the priorities of the organization and provide structure for what the organization will work on to address the emerging (and already emerged) trends facing the profession. As CEO Susan Speirs frequently states, “I use the strategic plan to guide every major decision we make. This helps our team to focus our efforts on what matters most to our members.”

THE CURRENT PLAN

The current strategic plan was adopted in 2021. The process in creating the plan included several member focus groups, a survey to the entire membership, and thorough market research. The result of this eight-month process resulted in the following priorities:

1. Advocacy — Be recognized as the most trusted voice for Utah accounting professionals through quality advocacy efforts

2. Membership Development — Develop a strong membership base through increased partnership with other organizations to provide expanded CPE and networking opportunities

3. Member Engagement — Foster engagement by establishing the UACPA as the professional home and key networking resource for accountants in Utah

4. CPA Pipeline — Partner with educational institutions and employers to attract bright, capable, high-integrity students to accounting and encourage them to become CPAs

The dedication from the UACPA team in these focus areas has resulted in major wins:

• Supporting pipeline initiatives through Money Camp at Weber State University and Cache Camp at Utah State University

• Connecting with members in business & industry by creating the Business & industry Council and holding regular CPE lunch and learns and business tours

• Worked with several educators at Utah’s universities to include accounting in their STEM programs

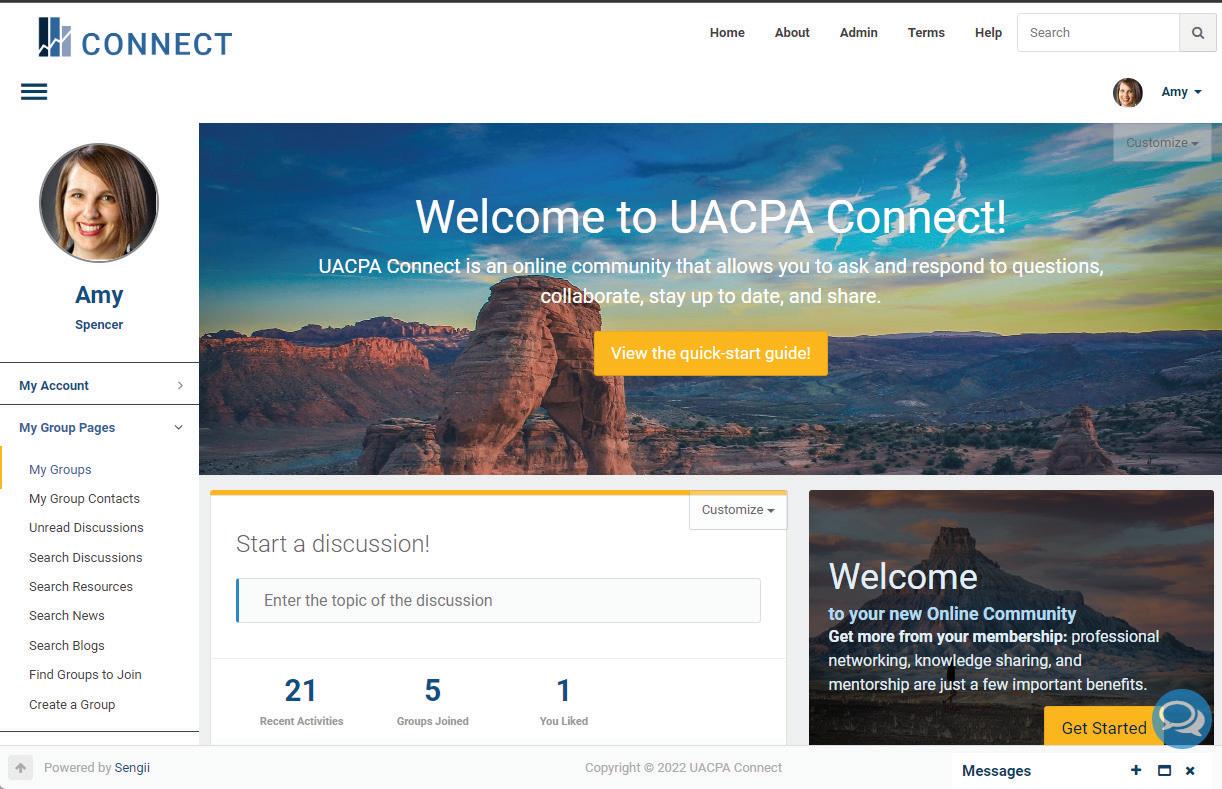

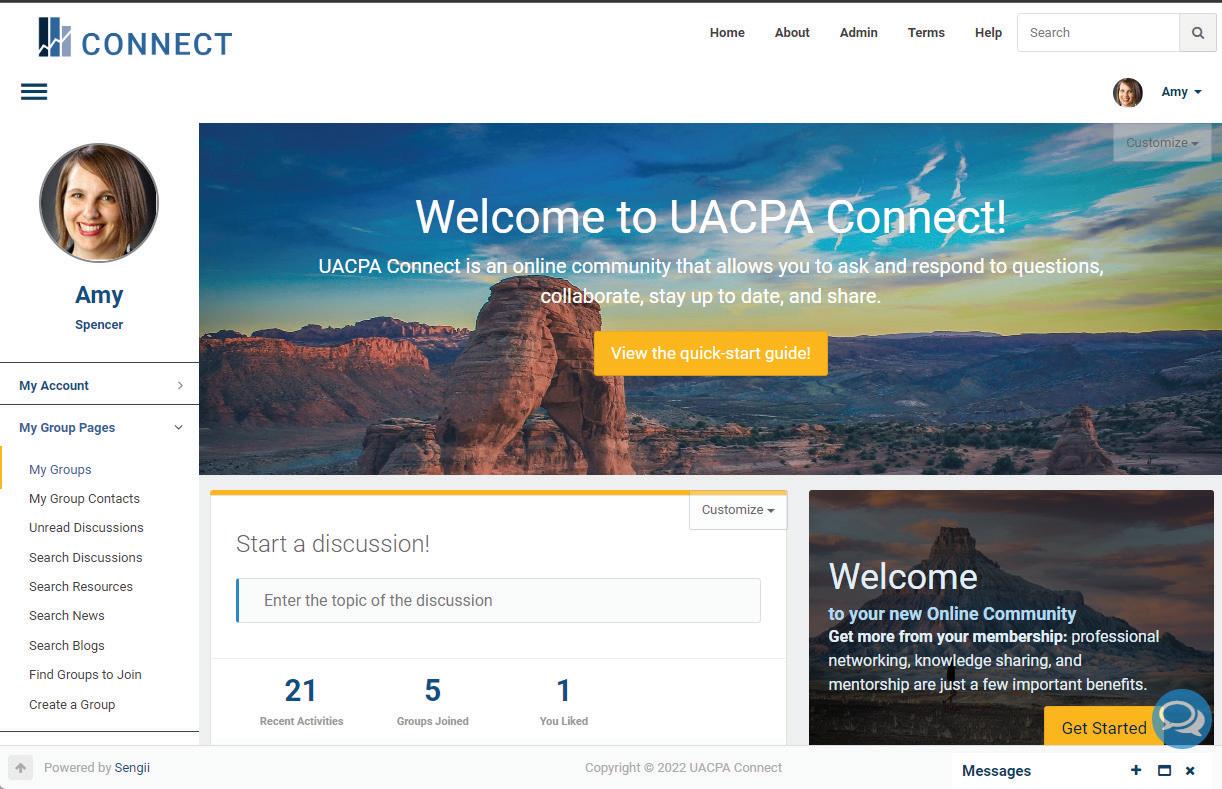

• Creating CONNECT, an online community for UACPA members to communicate with committees, network and get questions answered

These wins reflect a wonderful trait about the team — the plan doesn’t just sit on a shelf. The team cares to learn about your priorities and then work their best to achieve those priorities.

CREATING THE NEW PLAN

As the grammatically incorrect proverb states, if it ain’t broke, don’t fix it. The new process for updating the strategic plan will mirror the process used in creating the existing plan. We have already conducted focus groups with several segments of the profession, including large and mid-sized firms, small firms, CPAs in industry, nonprofits and government, and educators. Survey responses are trickling in, and the survey will be live through the summer. Our aim is to include as many stakeholders from the profession as possible to ensure that the new strategic plan reflects the ever-evolving priorities of its members. From there, staff and the board will meet in the fall to refine the new plan, with eventual rollout to take place in January 2025. While we don’t anticipate priorities to radically shift from 2021, the nuances of these priorities have evolved, and a refined strategy will be essential to do all within the association’s power to strengthen the profession in Utah.

If you would like to be involved in this process, please reach out to Susan Speirs, ss@uacpa.org. We welcome your support and are excited to see what the future brings!

“Give me six hours to chop down a tree and I will spend the first four sharpening the axe.” ― Abraham Lincoln n

Mackey Smith is the vice president of people and strategy consulting at Herbein + Company, Inc., A Pennsylvania-based CPA and advisory firm. He regularly works with CPA firms and CPA state associations on strategic planning, staff retention, leadership development, and executive coaching. Mackey loves making new friends, so contact him at dmsmith@herbein.com.

THE JOURNAL ENTRY | SUMMER 2024 19

HEALTH AND WEALTH

EXAMINING THE INTERSECTION OF MEDICARE AND TAX PLANNING FOR CPAS

BY AL KUSHNER

In an era where healthcare costs are a significant concern for retirees, understanding the intricacies of Medicare becomes crucial for CPAs tasked with advising clients on retirement planning. The intersection of Medicare and tax planning is a complex area that presents both challenges and opportunities for CPAs striving to provide comprehensive advice. There are key aspects of Medicare that CPAs should be aware of, offering strategies to integrate healthcare planning into their tax advising practices effectively.

U NDERSTANDING MEDICARE’S STRUCTURE

At its core, Medicare is divided into four parts:

Part A (Hospital Insurance): Covers inpatient hospital stays, care in skilled nursing facilities, hospice care, and some home health care.

Part B (Medical Insurance): Covers certain doctors’ services, outpatient care, medical supplies, and

THE JOURNAL ENTRY | SUMMER 2024 20

Part C (Medicare Advantage Plans): Offers an alternative way to receive Medicare benefits through private insurance companies approved by Medicare.

Part D (Prescription Drug Coverage): Adds prescription drug coverage to Original Medicare, some Medicare Cost Plans, some Medicare PrivateFee-for-Service Plans, and Medicare Medical Savings Account Plans.

Each part of Medicare has distinct implications for tax planning, most notably through premiums, deductibles, and out-of-pocket expenses, many of which are influenced by the client’s income level.

KEY TAX CONSIDERATIONS

Income-Related Monthly Adjustment Amount (IRMAA)

IRMAA is a surcharge that high-earning individuals must pay in addition to their Part B and Part D premiums. CPAs should note that IRMAA is determined by the client’s modified adjusted gross income (MAGI) from two years prior. Therefore, thorough income planning is paramount to managing or mitigating these additional costs.

Health Savings Accounts (HSAs) and Medicare

HSAs offer a triple tax advantage and can be a strategic tool in healthcare planning. However, once clients are enrolled in Medicare, they can no longer contribute to an HSA. Planning contributions and distributions around Medicare eligibility can optimize tax benefits and healthcare savings.

Deducting Medical Expenses

For clients who itemize deductions, certain unreimbursed medical expenses exceeding 7.5% of their adjusted gross income (AGI) can be deducted. This can include some Medicare premiums and out-of-pocket costs, creating potential tax-saving opportunities.

Strategies for CPAs

1. Proactive Income Review: Regularly review clients’

incomes to anticipate IRMAA surcharges and devise strategies to minimize their impact. This can involve strategically timing retirement distributions or Roth conversions.

2. HSA Planning: Advise clients nearing Medicare eligibility on maximizing HSA contributions before enrollment and strategies for using HSA funds to cover qualified medical expenses, including Medicare premiums.

3. Tax Deduction Optimization: Ensure clients know the potential for deducting Medicare-related expenses and advise on record-keeping practices to substantiate these deductions.

4. Education and Communication: Keep clients informed about the latest Medicare changes and potential tax implications. Clear, proactive communication can help manage expectations and facilitate smoother transitions into retirement.

CONCLUSION

For CPAs, integrating Medicare into tax and financial planning offers a pathway to delivering added value to clients navigating the complexities of retirement. By staying informed on Medicare policies and leveraging tax-planning strategies, CPAs can guide clients through optimizing their healthcare options while minimizing tax liabilities. In doing so, CPAs reinforce their role as indispensable advisors in their clients’ financial lives.

This evolving landscape underscores the importance of continuous education and adaptability among CPAs to effectively meet their clients’ needs. CPAs can ensure their clients achieve a financially secure and well-planned retirement by focusing on the interplay between Medicare and taxes. n

Al Kushner is an award-winning Medicare expert with a prosperous career spanning nearly four decades in the medical insurance industry. Kushner has been recognized by peers for his contributions to the field. He can be reached at media@ virtualmedi.care for insights grounded in extensive hands-on experience.

THE JOURNAL ENTRY | SUMMER 2024 21

preventive services.

NEW MEMBERS

Congratulations to the following individuals who were approved for membership in the UACPA as of May 31, 2024.

Rory McDonald Dominion Energy

Stephen B. Nance

DrillDown Solution

Garrett A. Gneiting

Kollin Keller

Eide Bailly, LLP

Elton Tanner

Ernst & Young LLP

Nathaniel Corry K&C, CPAs

Abby Clayton KPMG LLP

Justin Humphreys

Ryan Luetkemeyer

Ryan Ollivier

Rosendo Rocha

Moss Adams LLP

Thomas Clements

PricewaterhouseCoopers LLP

Gavin Nadauld

Tanner LLC

Michelle Rankin

Utah Valley University

Jason Barton

Jeff J. Jensen

Noelle M. Sanford

Kelsey Wallace

Student Affiliates

Brigham Young University

Lauren Sam

Ethan Plothow

Yiyi Liu

Taylor M. Stoll

Matthew D. Bailey

Elliana Fogh

Laramie Kimball

Matt Bailey

Isabel Vidal Sandoval

Megan Arnold

Cannon Hamilton

Richard Knapp

Shawn McDougal

Dillon Atkinson

Luke Jardine

Jordan Cox

Leah Hathcock

Joseph Faylor

Lance Larson

Olivia Lundgreen

Davis High School

Ethan Derington

Salt Lake Community

College

Matheus De Almeida Silva

Southern Utah University

Kiernan Burke

Bodell Nielson

Adam Freitas

Emily Rhodes

Suzanne Stewart

Mitchell Pyle

University of Utah

Isaac Z. Williams

Andreus Guerra

Jade Wimmer

Ryleigh Hertzberg

Alexandra Nakamura

Miyoun Chon

Tracy Chao

Cesar Feria

Jack VanDerHeyden

Julia Allen

Utah State University

Matthew Saunders

Shealee Calder

Caleb Baker

Cassidy Zapalac

Utah Tech University

Madelynne Crawford

Brayden Peacock

Paige Palmer

Joshua Turner

Brayden Miller

Joshua Weiland

Merick Johnson

Jared Armstrong

Trinide Holt

Harrison Beazer

Tess Heaton

Sedrik Ranjbar

Zachary Aguero

Benjamin Werner

Kent Mangum

Stephen Hadlock

Haylie Reil

Dylan Turner

Rachel Wanlass

Koyo Araki

Utah Valley University

Conner Mariluch

Laura Randall

Hunter Stuart

Kayla M. Smith

Karli V. West

Colby Scott

Kaisley Larsen

Shannon Reyneke

Terrika Kennedy

Mandy Kubal

William Schmidt

Kristin Hays

Savanah Martinez

Addison Bryner

Gisselle Gillespie

Lucy Maier

Samantha Lloyd

Junior Morris

Terrika Kennedy

Tom Young

Ellery Orton

Sabrina Lund

Kale Sharp

Chryslynd Uson

Michaela Lofgreen

Alexis Heugly

Spencer Kimball

Yuwen Xu

William Weatherford

Andrew Marshall

Weber State University

Sarah Diamond

Hadley M. Linford

Angie Light

Andrew Pagano

Woods Cross High School

Nathan Gill

THE JOURNAL ENTRY | SUMMER 2024 22

MEMBERSHIP

MEMBERSHIP

MEMBERS IN THE NEWS

Do you or your firm have news to share? Send the details to Amy Spencer, as@uacpa.org

The AICPA has announced 40 winners of the 2023 Elijah Watt Sells Award, which is given to CPA candidates who obtain a cumulative average score about 95.50 across all four sections of the Uniform CPA Exam, pass all four sections on their first attempt and have completed testing in 2023. We are thrilled to share there are three award recipients from Utah

• Harrison Baker graduated from University of Utah with a bachelor’s in accounting, a bachelor’s in information systems and a Master of Accounting with an emphasis in business analytics. He works at Ledgenomics in Salt Lake City.

• Parker Jackson graduated from Brigham young University with a bachelor’s and master’s in accountancy. He is working at KPMG in Salt Lake City.

• Elise Chase graduated from Brigham Young University with a bachelor’s in accounting and a Master of Accountancy. She is working at Deloitte in Salt Lake City.

Each winner receives a plaque and digital badge. The Elijah

Watt Sells Award program was established by the AICPA in 1923 to recognize outstanding performance on the CPA Exam.

David Peaden, who has served on the UACPA’s Emerging Professionals council and is currently a UACPA board member, is among the 24 staff members who have been added as partners at Eide Bailly. David has been with Eide Bailly for 13 years where he has been an audit manager and national assurance senior manager.

Haynie & Company earned the No. 85 spot in Accounting Today’s 2024 Regional Leaders and Top 100 Firms. Accounting Today ranks firms nationwide and highlights those who stand out in accounting and consulting.

Tanner LLC received the Best of State Award in Accounting Business Services. The recognition comes from the Best of State selection committee who note their professional services and commitment to client service, impactful outcomes, and unwavering dedication to providing exceptional accounting services.

Members enjoy reading about movers and shakers in this feature.

THE JOURNAL ENTRY | SUMMER 2024 23

Share Your News! Tell us about your new job, firm updates and highlights.

them to Amy Spencer, as@uacpa.org We want to share your updates

Send

BOARD QUESTION WHAT IS A NEW SKILL YOU ARE WORKING ON OR WOULD LIKE TO DEVELOP?

Jason Tomlinson, CPA

“I joined my kids’ karate studio, mostly for family bonding and cardio. Now it is stretching me, literally and physically.”

Dan Frei, CPA

“I am going to say the skill I would like to develop is time management.”

David Peaden, CPA

“I would like to become a better writer. I want to develop the skill to be more descriptive and creative and would love to write a book someday.”

Amy Anholt, CPA

“I admire so many who possess skills that I don’t. Particularly those with brilliant minds that amaze me, and those in the arts. I’d love to learn to play the piano again. I played a little as a child. Music is a universal language with the power to make connections to last a lifetime!”

Ariane Gibson, CPA

“I have a large garden and would love to continue to learn more and expand my skills in that area.”

Marci Butterfield, CPA

“I have started making rag quilts for special occasions and thankfully it is a very forgiving process, but I am hopeful that it becomes easier and that those that receive these gifts will cherish them and know that they were made with love.”

Shalaun Howell, CPA

“My relationship with pie crusts has been incredibly painful. I’ve tried about 30 recipes, what feels like 100 different ‘fool-proof’ tips, and the crust is still the most stressful part of Thanksgiving. So, it is crust or bust between now and November.”

Clinton Armstrong, CPA

“The one skill that I am working on is ‘marketing.’ Clients need to know what services that can be provided before contemplating purchasing those services.”

Dustin Wood, CPA

“I would like to, and need to, improve my listening skills. Too often I forget about having two ears and one mouth, and I typically find myself thinking about what I am going to say to someone next rather than focusing on what they are communicating to me.”

Stacy Weight, CPA

“A new skill I would like to pick up is to learn Pilates. I’m at a good place in life to finally take some time and focus on me.”

THE JOURNAL ENTRY | SUMMER 2024 24

BOARD BRIEF

THE LATEST ACTIVITIES WITH THE BOARD

• The board ratified the Compensation Committee’s evaluation of Susan Speirs for the prior year.

• This will be the year we update our strategic plan. Mackey Smith was invited to participate in the process and road map so that we can update membership in January 2025.

• Updates from the State Board of Accountancy meeting were shared. The board discussed a case of a CPA franchise website that helps users find bookkeepers, tax preparers and CPA services. The structure of the franchise was discussed as it does not seem to be in line with statute and how CPA firms should be structured. Also discussed is the CPA Exam fee increase and the long turnaround of exam scores.

• An update of AICPA Regional Council was given. Of interest, was the continued work of the National Pipeline Advisory Group (NPAG) and the work they are doing around time and cost of education, making the academic experience more engaging, enhancing the employee experience, strategies to expand paths for the underrepresented at every stage, providing better support for CPA Exam candidates and telling a better story of what we do.

• Preparation for the June 7 Leadership Council agenda. We discussed alternative pathways to licensure as it relates to the marketplace and language to remove barriers to entry.

STAFF CHAT

WHAT IS A NEW SKILL YOU ARE WORKING ON OR WOULD LIKE TO DEVELOP?

Amy Spencer

“The skill I want to develop is to become an early-morning meditator. I have been able to tame my overactive brain through mindfulness, but I aim to reach the next level of stillness.”

April Deneault

“I would like to learn to be a better cook. I want to learn new healthy and delicious recipes that will make my family say ’wow, April made this.’ “

Tom Horn, CPA

“I’m working on my pickleball skills since I’m basically retired.”

Susan Speirs, CPA

“In what little spare time I have, I am working on creating more intricate quilts that are ultimately given away. I would like to learn how to make Kouign- Amanns with a lavender infused sugar base.”

THE JOURNAL ENTRY | SUMMER 2024 25

THE JOURNAL ENTRY | SUMMER 2024 26 • Send messages to UACPA members • Ask questions and learn from other CPAs • Collaborate and share ideas with like-minded professionals • Find discussions or create a new one CONNECT WITH UACPA MEMBERS Get Started! Select CONNECT at UACPA.org or visit connect.uacpa.org.

Garry

Hrechkosy (her-wreck-uh-see) was born and raised in Sandy. His father played in the NHL and worked for Coca-Cola, the University of Utah and Texas A&M. His mother worked for 30 years in child support enforcement for the state of Utah. Garry’s first job was in concessions for the University of Utah’s Athletic Department. He later attended the University of Utah, earning a bachelor’s and master’s in accounting. During his junior year, Garry was president of his fraternity Sigma Phi Epsilon, senator for the business college and working on his thesis for his honor’s degree. His career initially took him to PwC in Dallas where he lived for almost three years before moving to California then ultimately returning to Utah. In 2020, Garry left public accounting to join MX Technologies as the head of accounting. Garry and his wife, Jill, live in Murray with their three daughters.

What was your experience running for Salt Lake County Auditor? In 2018, I ran for Salt Lake County Auditor on the platform that we needed a CPA running the auditor’s office. It was during this campaign that I realized the value of the certification, but also realized how few people knew what it meant. Ultimately I lost the election by less than 5% but gained so much as my first child, Grace, was born during the campaign.

MEET A MEMBER

GARRY HRECHKOSY, CPA

How did you get involved with Murray City Council? I have always had a passion for politics. [After losing the Salt Lake County Auditor race], I still felt like there was something more for me to do. When I joined the Murray City Council, I had the opportunity help the council navigate challenging tax increases and complex situations. I enjoyed making a difference and seeing the city employees grow and own their areas. I believe that there is so much that we as CPAs and financial professionals can provide citizens and governments.

What led you to become a CPA? It was a requirement for work and to promote at PwC, but now I see how much more value it has in my life. It is a representation of hard work, honesty, and integrity.

What do you like about being a CPA? I believe that it is a very prestigious and strong certification that is applicable in many areas of business and our world.

What would surprise people to know about you? I love spending time in my yard gardening and making my yard look great. I also love a good puzzle.

What is your favorite book? The Little House is my favorite book, as it has a great message and means that I am spending time with my daughters.

What do you like to do outside of work? Spend time with my wife and three daughters. I like watching sports and Oscarnominated films.

What are some of your goals both personally and professionally? I have professional goals to achieve the CFO level. I also hope to make a run for Congress.

What advice do you live by? Surround yourself with the finest people, people who want to see you succeed, people who challenge you, people who bring diverse perspectives. Don’t be afraid to set boundaries with people who don’t enhance your life. n

THE JOURNAL ENTRY | SUMMER 2024 27

UACPA Virtual Courses

THE JOURNAL ENTRY | SUMMER 2024

CPECourseSchedule Register online at uacpa.org/cpe. July 7/10/24 8 Strategies in Charitable Giving: Unveiling Financial and Estate Planning Techniques Arthur Werner $280 $330 7/16/24 8 K2’s Microsoft 365/Office 365 - All the Things You Need to Know* Lawrence McClelland $275 $375 7/17/24 8 K2’s Small Business Internal Controls, Security, and Fraud Prevention and Detection* Lawrence McClelland $275 $375 7/18/24 4 K2’s Excel Charting and Visualizations* Lawrence McClelland $180 $205 7/18/24 4 K2’s Best Word, Outlook, and PowerPoint Features* Lawrence McClelland $180 $205 7/18/24 4 Navigating Your Client Through the IRS Appeals Process Pamela DavisVaughn $175 $200 7/23/24 8 Estate Planning for 2024 and Beyond Arthur Werner $280 $330 7/25/24 8 Social Security and Medicare: Planning for You and Your Clients Arthur Auerbach $280 $330 7/30/24 4 K2’s An Accountant’s Guide to Blockchain and Cryptocurrency* Steve Yoss $180 $205 7/30/24 4 K2’s Artificial Intelligence for Accounting and Financial Professionals* Steve Yoss $180 $205 7/30/24 8 Tax Planning Based on Form 1040 Arthur Werner $280 $330 7/31/24 4 K2’s Advanced QuickBooks Tips and Techniques* Steve Yoss $180 $205 7/31/24 4 K2’s Case Studies in Fraud and Technology Controls* Steve Yoss $180 $205 August 8/2/24 8 K2’s Next Generation Excel Reporting Lawrence McClelland $270 $320 8/5/24 8 Estate Planning Strategies: Advanced Techniues and Tools Arthur Werner $325 $375 8/8/24 8 A Practical Guide to Trusts: Maximizing Financial, Estate, and Asset Protection Strategies Arthur Werner $270 $320 8/13/24 2 Retirement Planning Update Everything that you Need to Know Mary Jane Hourani $105 $120 8/14/24 8 K2’s Excel Pivot Tables for Accountants Lawrence McClelland $270 $320 8/19/24 8 Postmortem Estate Planning: Navigating Decendent’s Estate Issues Arthur Werner $270 $320 8/20/24 8 K2’s Business Continuity - Best Practices for Managing the Risks* Brian Tankersley $275 $375 8/21/24 8 K2’s Microsoft Access - Tables, Queries, and Beyond* Brian Tankersley $275 $375 8/22/24 8 K2’s QuickBooks for Accountants* Bian Tankersley $275 $375 8/26/24 8 Estate Planning Issues for the Non-Traditional Client: Navigating Legislative Changes and Maximizing Techniques Arthur Werner $270 $320 DATE CPE COURSE TITLE INSTRUCTOR MEMBER FEE* NONMEMBER FEE * Members receive a 10% discount when registering at least 2 weeks in advance. AICPA members receive an additional $30 off the price of some 8-hour courses. Log into account to see applicable discount. ALL IN ONE ETHICS (VIRTUAL) Friday, Oct. 18 | 8 - 11:30 a.m. | CPE: Four (4) hours; 1 hour Utah Laws & Rules and 3 hours Ethics

THE JOURNAL ENTRY | SUMMER 2024 29 september 9/6/24 8 Preparing Not-for-Profit Financial Statements Martha Lindley $280 $330 9/10/24 2 IRAs: What You Need to Know About Contributions, Conversions and Distributions Gregory White $105 $120 9/10/24 8 K2’s Advanced Excel Lawrence McClelland $270 $320 9/11/24 2 Combating Internal Fraud Karl Egnatoff $105 $120 9/11/24 2 Conflicts of Interest - A New Approach James Rigos $105 $120 9/13/24 8 Advanced Topics in a Single Audit Diane Edelstein $270 $320 9/13/24 4 Preparation and Compilation Engagements Under the SSARS Hunter Cook $175 $200 9/16/24 8 CFO - Advanced Profit Enhancements Robert Berry $280 $330 9/17/24 8 Annual Update for Accountants and Auditors Bruce Shephard $270 $320 9/18/24 8 Advanced Audits of 401(k) Plans: Best Practices and Current Developments Robert Bedwell $280 $330 9/18/24 8 Income Tax Accounting Dennis Riley $270 $320 9/19/24 2 Complying with the Corporate Transparency Act: A Guide for Client Protection Arthur Werner $105 $120 9/20/24 2 Guide to the Corporate Transparency Act for Accounting and Finance Professionals Nicola Joseph $105 $120 9/24/24 8 K2’s Next Generation Excel Reporting* Lawrence McClelland $275 $375 9/24/24 4 Finance Business Partnering: Successful Business Models and Strategic Choices Clare Levison $175 $199 9/24/24 2 Guide to Partner Capital Account Reporting William Dowis $105 $120 9/25/24 4 K2’s Data Analytics For Accountants and Auditors* Lawrence McClelland $180 $205 9/25/24 4 K2’s Implementing Internal Controls in QuickBooks Environments* Lawrence McClelland $180 $205 9/25/24 8 Audits of ERISA Plans with a Focus on 401(k) Plans Joann Cross $270 $320 9/25/24 8 Surgent’s Comprehensive Guide to Tax Depreciation, Expensing, and Property Transactions Arthur Auerbach $280 $330 9/26/24 4 K2’s Improving Productivity With Microsoft 365/Office 365 Cloud Applications* Lawrence McClelland $180 $205 9/26/24 4 K2’s Introduction To Excel Macros* Lawrence McClelland $180 $205 9/26/24 2 Bankruptcy Basics: Understanding the Reorganization and Liquidation Process in These Uncertain Economic Times Lydia Stutesman $105 $120 9/27/24 8 The Complete Guide to Estate Administrations: Navigating the Role in Estate Planning Arthur Werner $270 $320 9/27/24 4 Employer’s Handbook: Health Care, Retirement, and Fringe Benefit Tax Issues Michael Reilly $175 $200 9/30/24 2 IRS Audit and Appeals Process: Protecting Your clients Gregory White $105 $120 9/30/24 8 K2’s budgeting and Forecasting Tools and Techniques Brian Tankersley $270 $320 OctOber 10/8/24 8 Surgent’s Handbook for Mastering Basis, Distributions, and Loss Limitation Issues for S Corporations, LLCs, and Partnerships Michael Reilly $280 $330 10/8/24 8 Forensic Accounting: Fraud Investigations Anne Marchetti $270 $320 10/9/24 4 Annual FASB Update and Review Philip Marciano $175 $200 10/10/24 8 CFO - Chief Reviewer Steve Boussom $280 $330 10/10/24 8 How to Settle a Client’s Estate Inibehe Adesanya $280 $330 10/15/24 4 Critical Issues That CPAs in Industry Will Need to Face This Year Carl Schultz $175 $200 10/15/24 8 K2’s Business Continuity - Best Practices for Managing the Risks Brian Tankersley $270 $320 10/16/24 8 Governmental Accounting and Auditing Update Roger Cusworth $270 $320 10/16/24 2 Professional Fiduciary Duty James Rigos $105 $120 10/17/24 8 CFO - Employees Today and Tomorrow Brian Maturi $280 $330 10/21/24 8 Current Developments and Best Practices for Today’s CFOs and Controllers Arthur Pulis $280 $330 10/22/24 2 Defining Where and Why Internal Controls are Needed Karl Egnatoff $105 $120 10/23/24 4 Guide and Update to Compilations, Reviews, and Preparations Robert Wells $175 $200 DATE CPE COURSE TITLE INSTRUCTOR MEMBER FEE* NONMEMBER FEE

THE JOURNAL ENTRY | SUMMER 2024 30 OctOber cOntinued 10/25/24 8 A Comprehensive Guide to Optimizing Retirement Planning: Maximizing Your Clients’ Financial Future Arthur Werner $270 $320 10/25/24 4 Guide to Payroll Taxes and 1099 Issues Arthur Auerbach $175 $200 10/28/24 8 Surgent’s Annual Tax-Planning Guide for S Corporations, Partnerships, and LLCs Inibehe Adesanya $280 $330 10/29/24 4 K2’s Microsoft Teams* Steve Yoss $180 $205 10/29/24 4 K2’s Securing Your Data: Practical Tools for Protecting Information* Steve Yoss $180 $205 10/29/24 8 Preparing Individual Tax Returns for New Staff and Paraprofessionals Michael Reilly $280 $330 10/30/24 4 K2’s Small Business Accounting Shootout* Steve Yoss $180 $205 10/30/24 4 K2’s Technology Update* Steve Yoss $180 $205 10/31/24 4 K2’s Testing and Auditing Excel Workbooks* Steve Yoss $180 $205 10/31/24 4 K2’s Top PDF Features You Should Know* Steve Yoss $180 $205 10/31/24 8 Hot IRS Tax Examination Issues for Individuals and Businesses Joel DiCicco $280 $330 10/31/24 8 K2’s Business Intelligence, Featuring Microsoft’s Power BI Tools Lawrence McClelland $270 $320 nOvember 11/1/24 4 Individual Income and Tax Compliance Annual Update Richard Lahijani $174 $199 11/4/24 8 Fiduciary Income Tax Returns - Form 1041 Workshop with Filled-in Forms Inibehe Adesanya $280 $330 11/5/24 4 The Bottom Line on the New Lease Accounting Requirements Roger Cusworth $174 $199 11/5/24 8 The Year’s Best Income Tax, Estate Tax, and Financial-Planning Ideas James Gardner $280 $330 11/6/24 4 Pass-through and Corporate Annual Tax Update Richard Lahijani $174 $199 11/6/24 8 K2’s Case Studies in Fraud and Technology Controls Steve Yoss $270 $320 11/6/24 8 Multistate Taxation Bruce Nelson $270 $320 11/7/24 2 Cybersecurity Issues for the Professional Arthur Werner $105 $120 11/8/24 2 Internal Control Fundamentals Melissa Galasso $105 $120 11/11/24 8 Maximizing Fringe Benefits: Strategies for Business and Personal Needs in 2024 and Beyond Arthur Werner $270 $320 11/11/24 4 Gaining a Competitive Advantage: Critical Skills for CFOs and Controllers William Allen $175 $200 11/12/24 4 Introduction to Forensic Accounting Joel DiCicco $175 $200 11/13/24 8 Winning the Fraud Battle in the Digital Age: Prevention and Detection Frank Gorrell $280 $330 11/13/24 4 Tax, Estate and Financial Aspects of Cryptocurrency Arthur Werner $185 $210 11/15/24 8 CFO - The Effective CFO Anita Layton $280 $330 11/15/24 8 Federal Tax Update - Individual and Business Current Developments and Pat Garverick J. Patrick Garverick $325 $375 11/18/24 8 K2’s Excel Essentials for Staff Accountants Lawrence McClelland $270 $320 11/19/24 2 Form 1120S - Preparation and Analysis Mary Jane Hourani $105 $120 11/19/24 8 The Best S Corporation, Limited Liability, and Partnership Update Course by Surgent Michael Reilly $280 $330 11/19/24 4 K2’s Working Remotely - The New Normal* Brian Tankersley $180 $205 11/19/24 4 K2’s Advanced QuickBooks Tips and Techniques* Brian Tankersley $180 $205 11/20/24 1 How ESG Reports Can Help with Recruitment & Retention Donny Shimamoto $50 $60 11/20/24 4 K2’s Excel Tips, Tricks, and Techniques for Accountants* Brian Tankersley $180 $205 11/21/24 4 The Most Critical Challenges in Not-for-Profit Accounting Today Martha Lindley $175 $200 11/21/24 4 K2’s Advanced Excel* Brian Tankersley $180 $205 11/21/24 4 Reviewing Individual Tax Returns: What Are You Missing? Gregory Carnes $174 $199 11/22/24 2 Becoming a Tax Ninja: Lightning-Fast Depreciation Gregory White $185 $210 11/22/24 8 Forms 1120-S and 1065 Return Review Boot Camp for New and Experienced Reviewers Michael Reilly $280 $330 11/25/24 4 Federal Tax Update for Business with Greg and George Gregory White $185 $210 11/25/24 4 Federal Tax Update for Individuals with Greg and George Gregory White $185 $210 DATE CPE COURSE TITLE INSTRUCTOR MEMBER FEE* NONMEMBER FEE

THE JOURNAL ENTRY | SUMMER 2024 31 december 12/4/24 2 Winning Tax Season with Better Workflow & Capacity Management Frank Stitely $105 $120 12/4/24 8 K2’s QuickBooks for Accountants* Brian Tankersley $275 $375 12/5/24 8 K2’s Small Business Internal Controls, Security, and Fraud Prevention and Detection* Brian Tankersley $275 $375 12/5/24 8 The Complete Guide to Preparing Forms 706 and 709 Arthur Werner $280 $330 12/5/24 4 The Bottom Line on the New Lease Accounting Requirements Daryl Krause $174 $199 12/6/24 8 Applying the Uniform Guidance in Your Single Audits Eric Formberg $270 $320 12/5-6/24 16 UACPA’s Annual Conference - Virtual & In Person Various $390 $500 12/9/24 4 Financial Statement Disclosures: A Guide for Small and Medium-Sized Businesses Kenneth Levine $175 $200 12/9/24 8 K2’s Excel Essentials for Staff Accountants* Lawrence McClelland $275 $375 12/10/24 8 K2’s Technology for CPAs - Don’t Get Left Behind* Lawrence McClelland $275 $375 12/10/24 4 CFO - Management Superpowers Bob Mims $280 $330 12/10/24 4 Reviewing Partnership Tax Returns: What Are You Missing? Richard Lahijani $174 $199 12/11/24 8 K2’s Excel Pivot Tables for Accountants* Steve Yoss $275 $375 12/12/24 8 K2’s Excel Best Practices* Steve Yoss $275 $375 12/12/24 8 Construction Contractors: Accounting and Auditing Thomas Sheets $270 $320 12/12/24 4 Federal Tax Update for Business with Greg and George Gregory White $185 $210 12/12/24 4 Federal Tax Update for Individuals with Greg and George Gregory White $185 $210 12/13/24 2 Cryptocurrency Taxation: Nuts, Bolts and Tax Law Updates Shehan Chandrasekera $105 $120 12/13/24 4 K2’s Better Productivity Through Artificial Intelligence and Automation Tools* Steve Yoss $180 $205 12/13/24 4 K2’s Ethics and Technology* Steve Yoss $180 $205 12/13/24 8 Surgent’s Top 10 Tax Topics This year Michael Reilly $280 $330 12/16/24 8 Federal Tax Update - Individuals (Form 1040) with Pat Garverick J Patrick Garverick $325 $375 12/16/24 4 K2’s Excel Charting and Visualizations* Lawrence McClelland $180 $205 12/16/24 4 K2’s Mastering Advanced Excel Functions* Lawrence McClelland $180 $205 12/17/24 8 K2’s Microsoft 365/Office 365 - All the Things You Need to Know* Lawrence McClelland $275 $375 12/17/24 8 CFO - Corporate Performance Management Gary Cokins $280 $330 12/17/24 8 Federal Tax Update - C and S Corporations, Partnerships and LLCs (Forms 1120, 1120S and 1065S) with Pat Garverick J Patrick Garverick $325 $375 12/18/24 1 Exploring the A-B-C-D of the Digital Age and Their Impact on Accounting Donny Shimamoto $50 $60 12/18/24 1 How Automation and AI are Enhancing Management Accountants Donny Shimamoto $50 $60 12/18/24 8 K2’s Next Generation Excel Reporting* Lawrence McClelland $275 $375 12/18/24 8 The Complete Guide to the Preparation of Form 1041 Arthur Werner $280 $330 12/19-20/24 16 Rocky Mountain Technology Conference* Variou2 $440 $520 12/30/24 4 K2’s Case Studies in Fraud and Technology Controls* Brian Tankersley $180 $205 12/30/24 4 K2’s Artificial Intelligence for Accounting and Financial Professionals* Brian Tankersley $280 $205 12/31/24 8 K2’s Accountant’s Guide to QuickBooks Online* Brian Tankersley $275 $375 DATE CPE COURSE TITLE INSTRUCTOR MEMBER FEE* NONMEMBER FEE

The Emerging Professionals Leadership Academy helps new CPAs develop leadership skills with an exclusive group of professionals.

The academy will help you keep pace in the profession and excel as a leader. CPAs will gain the tools and training to propel them into the future at this intensive and rewarding retreat. You will learn how to make your ideas clear and how to inspire others throughout your network.

Attendees receive 24+ hours of CPE while building leadership foundations and relationships with their colleagues. uacpa.org/leadershipacademy

NOV. 6 – 8 , 2024 | ZERMATT RESORT Leadership Academy

UACPA MISSION

MISSION

The UACPA leadership supports and challenges members through advocacy, professional education, leadership development, networking, and community service to help them succeed in a competitive and changing world.

VISION

At the UACPA, our vision is to be a world-class professional association essential to our members.

We unite a vibrant community of CPAs to enhance the success of our members and champion the values of the profession; integrity, competency, and objectivity.

VALUES

Advocacy

The UACPA represents the profession at the Legislature and other regulatory bodies and promotes the value of the CPA to employers, the business community, and the public at large.

Leadership & Service

The UACPA provides leadership and service within the profession, within the UACPA, and within the community.

Professional Development

The UACPA supports and encourages continuing education and leadership development.

Professional Community

The UACPA reinforces peer accountability to encourage members to maintain integrity and high ethical standards. It provides member-tomember networking opportunities and networking opportunities with other professions. It values belonging to a distinguished organization and believes that we serve as the primary resource and point of contact for Utah CPAs.

Diverse Population Outreach

The UACPA believes in reaching out to under-represented populations, those returning to the profession or choosing it as a second career, and other professions.

CONGRATULATIONS

100% FIRMS

Congratulations to the firms and businesses currently participating in the UACPA’s 100% membership program. This demonstrates their commitment to the profession, to the association’s high ethical standards and lifelong learning.

• Adams & Petersen, CPAs

• CBIZ MHM, LLC

• CLA (CliftonLarsonAllen LLP)

• CMP

• Davis & Bott, Certified Public Accountants, L.C.

• Eide Bailly

• FORVIS

• Haynie & Company

• HBME

• HintonBurdick

• Jones Simkins LLC

• Savage Esplin & Radmall, PC

• Squire

• Tanner LLC

• WSRP

Firms with 10 or more full-time CPAs are eligible to be a part of the 100% membership program. Call our membership team to sign up, 801.466.8022.

THE JOURNAL ENTRY | SUMMER 2024 34

Charles E. Johnson

June 15, 1936 – Jan. 7, 2024

Member since 1962

Joseph S. Call

Aug. 31, 1951 – May 18, 2024

Member since 1980

John Michaeli

Dec. 10, 1963 – April 24, 2024

Member since 2004

THE JOURNAL ENTRY | SUMMER 2024 35 Exclusive Savings for Utah Association of CPAs Invest and expand your expertise with exclusive offers from Wolters Kluwer. Get access to expertly-written content and continuing professional education that meets requirements and works with your busy schedule. CCHCPELink.com/UACPA Members Save 25% Listen to Conversations with UACPA Members on the Money Making Sense Podcast. Find it wherever you listen to podcasts.

IN MEMORIAM D

CPACharge has made it easy and inexpensive to accept payments via credit card. I’m getting paid faster, and clients are able to pay their bills with no hassles