andInvestingRetiring

L ast month I listened to an Apple News In Conversation podcast featuring an interview with Steve Lopez, author of Independence Day: What I Learned About Retirement From Some Who’ve Done It and Some Who Never Will

In his mid-60s and considering retirement for himself, Lopez, an L.A. Times columnist, interviewed a wide array of people—a priest, a rabbi, a couple of famous comedians, as well as plenty of non-famous folks—seeking advice on becoming a retiree.

Norman Lear told Lopez he will never retire. “Life,” he says, “is about swinging in a hammock…if something gets you out of the hammock, that’s all you need.”

At 96, Mel Brooks, who also says he’s not retiring, suggested Lopez work part time so that “you get to do what you love to do, and you get to find out if there’s something else you might love just as much.” In other words, don’t make a drastic change without first trying it on.

Lopez also spoke with people who are traveling around the world on sailboats, and others whose finances didn’t work out as hoped and are now working shifts in big box stores.

What I learned from the podcast is pretty basic…there’s no one-size-fits-all when it comes to retirement.

Stephanie Adler Calliott, Bernie Mayer, and Ed Karotkin—three people with different working professions (finance, social work, physician)—share in this section what their retirement lives are like. One thing they have in common: they are happy with their decisions! The interviews begin on page 20.

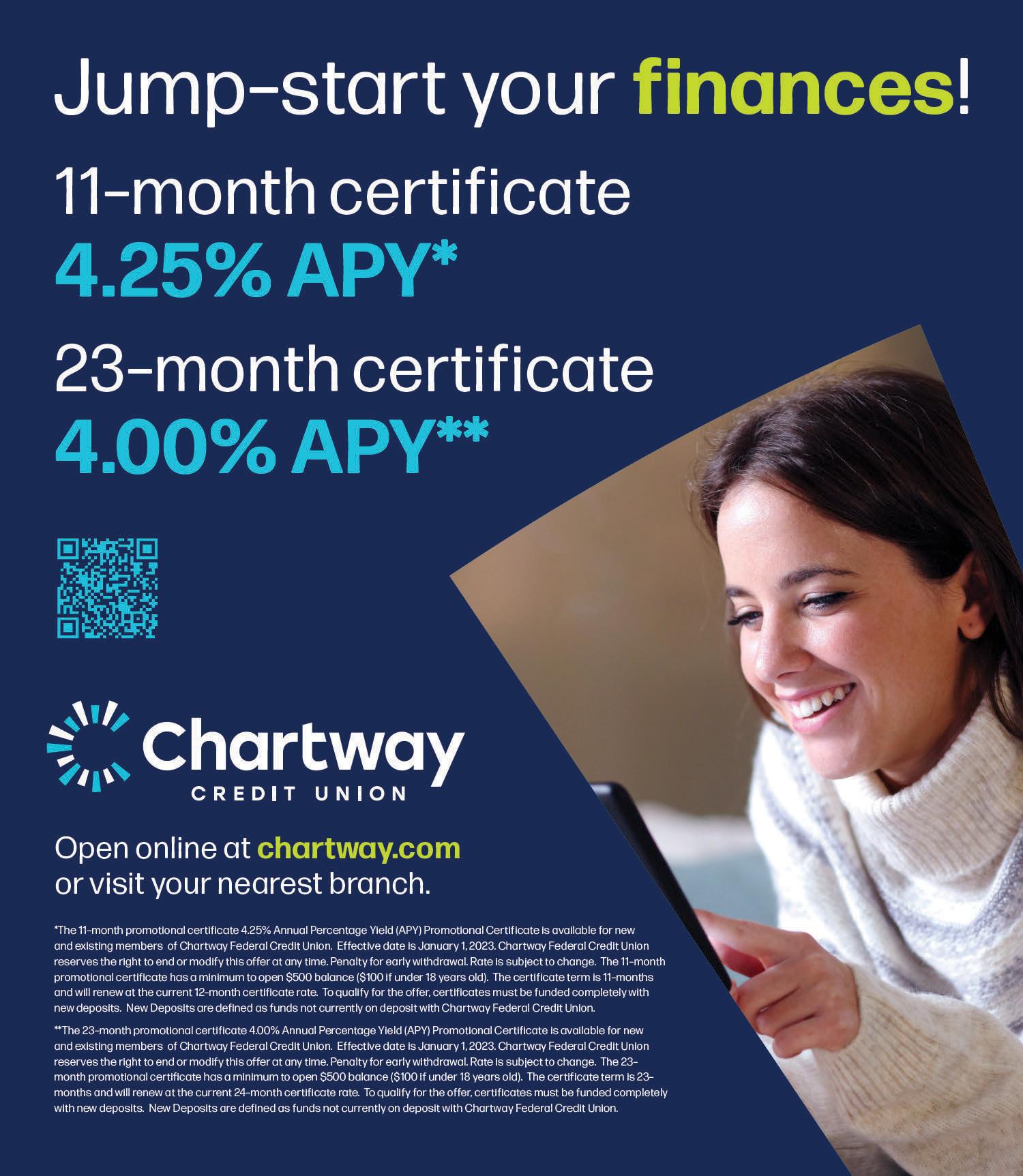

Investing and planning for retirement are crucial to eliminating the “Am I going to run out of money?” concern. Jeff Chernitzer, a personal financial specialist, offers some general advice, including questions everyone considering retirement should ask themselves. Page 18.

Of course, there’s more, including an interview with Sandee Lefcoe, who at nearly 80, just created an online puzzle/word game.

Whether you’re retired, thinking about it, or just starting your career, we hope you find this section interesting and inspiring. And even though you might enjoy lazy days swinging in your hammock, we hope you also find an exceptional reason to get out of it.

Terri Denison Editor

The question looms for most everyone in the workforce: When will I know I’m financially prepared to retire?

Jeffrey S. Chernitzer, CPA/PFS (Personal Financial Specialist), a wealth advisor with Buckingham Strategic Wealth, agreed to offer Jewish News readers some areas to consider and questions individuals should ask themselves when planning for their future.

Jewish News: How long have you been working with clients on their retirement plans?

Jeff Chernitzer: More than 30 years.

JN: When should planning for retirement begin?

JC: There is a Chinese proverb that says, “The best time to plant a tree was 20 years ago. The second-best time is now.”

Time, spending, and saving are the three biggest factors to consider when thinking about retirement. These are also the three areas that you have the most control over, as well. It is never too early to start planning for the future.

JN: What questions should people answer before making the decision to retire? Or, as they work towards that goal?

JC: Two things come to mind: Are you financially ready? And are you mentally prepared? Think about how you will spend your time in retirement. We have seen people fully prepared for the financial aspects of retirement choose to go back to work because they so strongly identified with their profession that they couldn’t stay away from it.

It’s important to think through what you will do with the extra time you will have when you stop working. Often, individuals will choose to continue working later in life, but perhaps part-time. Either way, it’s important to have a plan in place so that work is optional, not a

requirement.

JN: How do you help clients prepare for retirement?

JC: We use a holistic planning approach in addition to asset management. We help clients with tax planning, cash flow planning, Social Security planning, estate planning, charitable giving, and business transitions. Beyond the financial aspects, we work with clients to plan for the legacy they wish to leave for their family and community.

JN: How does someone know they will be financially secure in retirement?

JC: This is a difficult question. A technical answer, or the general rule of thumb, is that your money will last you for 30 years if you only take out 4% of your investable assets per year. That can be a helpful gauge for someone considering their security in retirement. However, even the best financial plans are subject to change. Whether it’s tax rates, inflation, market performance, or health status, we do not have full control over all the variables involved in our financial lives. Unfortunately, not everyone can plan for every eventuality. The best financial plans are flexible.

Great software tools are available that allow you to use your information to get

a projection on what retirement may look like in your circumstance.

JN: Is there a magic age for retirement? How does someone know they will be financially secure in retirement?

JC: The magic age is the age you want to retire. There are some folks who want to retire early, perhaps in their mid/late 30s who live minimally in their 20s to make that a reality. There are others who are searching for a more balanced lifestyle and stick to the “tradition” of retiring when they reach Social Security age. Some people would choose to retire early if they had the financial means to do so. Others have the financial means to retire early but love their work and choose to work their whole life.

JN: Have you had clients retire before they were fully prepared? With what results?

JC: We have had clients retire even though the software I mentioned earlier predicted they were not financially prepared, but they knew that they may have to make lifestyle changes sometime in the future as a result.

JN: What is your #1 piece of advice for anyone contemplating retirement?

JC: Seek professional guidance from a fee only advisor to help develop a plan. It’s important to find an advisor who will take into consideration both the financial and emotional aspects of planning for your financial future.

JN: Last words?

JC: I would encourage you, even if you don’t feel prepared or that you aren’t where you should be at this point in your life, many people will live into their 90s and older, so start planning today. It’s not too late!

Jeff Chernitzer, CPA/PFS, may be reached at jchernitzer@buckinghamgroup.com or 757-533-4103.

A scholarship that Bernard’s daughter, LucySpigel Herman, created at the community foundation to honor him helps future architects pay for their education.Jeffrey S. Chernitzer.

With

Jewish News: Where were you educated?

Stephanie Adler Calliott: I attended the University of Maryland College Park and had the best four years as a Terp. My college roomies and I are still very close.

JN: What was your work history?

SAC: When I graduated from college, I wanted to be an actress or a bank branch manager. With zero talent, the actress thing didn’t work out. I applied to and got turned down by every bank Management Associate program in Virginia, Maryland, and DC. So, I put my typing skills to work and started out as a glamorous college-educated hourly temp with a brokerage company. So much for starting at the top! I got my licenses, said YES to everything,

and then spent almost 30 years in executive management at Bank of America and Wells Fargo Wealth Management—helping families create, grow, manage, and distribute their wealth. I followed that with eight years as SVP at Children’s Hospital of The King’s Daughters helping people give the gift of good health to children who needed it. Meaningful work at both ends of my career.

JN: When did you retire? SAC: I retired in 2018.

JN: What convinced you to take the leap?

SAC: Retirement can be a blindfolded leap into the unknown, which can either invigorate or frighten you. I have found retirement to be a gift of joy—saying “yes” to things I’d never had enough time to

enjoy such as visits to the fields in Pungo, birthday lunches on a weekday, babysitting grandchildren, reading a book in the middle of the day, learning pickleball, traveling mid-week, more cooking, more mahj, and many hours of nothing.

JN: Did you have a plan for what you would do with your time?

SAC: I knew I’d find new things to do, but waking up that first morning with an empty calendar was a big change. I didn’t have a “from-now-on-I’ll-do-this” plan, but I knew the things I wanted to do more of.

JN: Now that you’re a grandmother (yikes!), how has that impacted your retirement days?

SAC: I never knew how much joy I’d find in grandchildren. Some women grow up wanting to babysit, become mothers, and ultimately grandmothers. I always worked, and when my son asked “Mom, now that you’re retired, do you want to babysit a few days/week?” I was frozen with fear. Yikes. What if I’m not good at this? What if I’m not that woman? What if I don’t like it? But of course, I said “uh, sure. I’d be happy to help.” It was a great gift. I knew right away that I WAS that woman. I WAS good at it. I WAS lucky to have this opportunity. I didn’t know my heart could get any bigger. And I cannot get enough of it.

JN: Where do you volunteer? Do you have a favorite place?

SAC: I resigned from a lot of boards when I retired. I stayed involved in some civic activities (chair of the Norfolk Retirement System, vice chair Virginia College Building Authority, and as a jury commissioner) and some community activities (United Jewish Federation of Tidewater, ACCESS College Foundation). My favorite place is with my family.

JN: Do you use your professional skills in some of your volunteer work?

SAC: Women are not always kind to each other in the workplace. Competition has a way of creating friction—some try to outrun other talented versus pulling them alongside. So, I’ve tried to mentor women in many aspects of that juggling act—collaboration at work and a healthy home life. It’s not always easy. But it’s always worth it.

JN: Do you have any days just to relax? If so, what do you do?

SAC: Every now and then I do a little bit of nothing. But my most enjoyable days are filled with activity, family, and good friends.

JN: Did you start picking and preserving after you retired?

SAC: I remember my friends asking, “want to go strawberry picking with us tomorrow?”

And I’d respond “uh, no. It’s a Wednesday. I’m working.” “Take the day off!”

And I’d reply, “I’m not taking a vacation day to go strawberry picking!” But once I retired, I found myself picking peaches, strawberries, blueberries, blackberries, figs, and buying bushels of corn and tomatoes. The next thing I knew, my sister taught me how to can and I was up to my elbows making jams, salsa, sauces, and relish. It was and still is so much fun. And delicious!

JN: You always seem to be connecting… house hunters with sellers, room seekers with landlords, volunteers, etc. Did you do this pre-retirement?

SAC: I’ve been a connector. From day one. Can’t turn that off!

JN: What about travel? Are you and Don and/or your sisters able to hit the road more often?

SAC: We love to travel. We do family trips, friend trips, and college roomie trips. The gift of free time has just increased the ability to go and do.

JN: What has been a favorite destination?

SAC: There are so many beautiful places to visit and I’ve been fortunate. On paper, it sounds extravagant. In real life, it was joyful and fulfilling: biking the San Juan Islands, a jeep ride on safari, a cooking class in Greece, the markets in Italy, hiking in Croatia, the beauty of Lake Louise, cooking hotdogs over a fire pit at Douthat State Park, a lobster roll on a working dock in Maine. The best money I’ve ever spent has been on travel. And the trip I’ll remember forever is the April 2018 one to Israel with my sisters and our dad—a lifelong dream destination for him.

JN: In general, are you glad you retired? Do you ever miss working?

SAC: Retirement has been great. The timing. The opportunity. The benefits. I loved working. And I love not working. I find that I’m happiest wherever I am.

JN: Do you feel any healthier? Less stressed?

SAC: Free time can definitely lead to a healthier lifestyle.

JN: Do you have any advice for someone considering retirement?

SAC: My husband once read that a happy and fulfilling retirement depends on your having 12 “things.” It doesn’t matter what they are. Hobbies. Activities. Things that are yours. Maybe your list is tennis, reading, family, gardening, coin collecting, etc. It doesn’t matter. People who retire with nothing other than their job may have a difficult time. My list is long. I wish I had more time to do everything.

JN: Last comments?

SAC: Do what makes you feel good. Not at the expense of others, of course. Be charitable. Be kind. Be grateful. Be good. Be you.

Terri Denison

Jewish News: Where are you from and where were you educated?

Bernie Mayer: I am from Cincinnati, Ohio. My undergraduate degree was from Miami University (Ohio), and I completed my Master of Science in Social Work at The

University of Louisville (Kent School of Social Work).

JN: When and why did you move to Tidewater?

BM: My wife, Debbie, and I moved to the area in 1982. I had secured employment at The Barry-Robinson Center as a counselor.

JN: What was your work history?

BM: For the last 20 years of my career, I was a Liaison Counselor with the Southeastern Cooperative Educational Programs (Secep). I worked in both Virginia Beach and Chesapeake. My school programs served children with an emotional disability. Experiences prior to this included employment in residential treatment with children. Also, prior to graduate school I was employed as a youth counselor at a community center in the inner city of Cincinnati (1976-1977).

JN: When did you retire?

BM: June 2014

JN: What convinced you to take the leap?

BM: I realized during my last year of employment that I had given all that I could give, and I needed a change.

JN: Did you have a plan for what you would do with your time?

BM: I had a partial plan which included: I would increase my musical performance (I started performing in a band when I was 14 years old, usually playing Bar/Bat Mitzvah parties for folks a year younger). Another idea was to increase my time to exercise. Finally, I knew that I would do some volunteering. I just did not have a plan yet where I would volunteer. I decided to take that first summer off and just rest. Then in the fall, I started thinking about where I would volunteer.

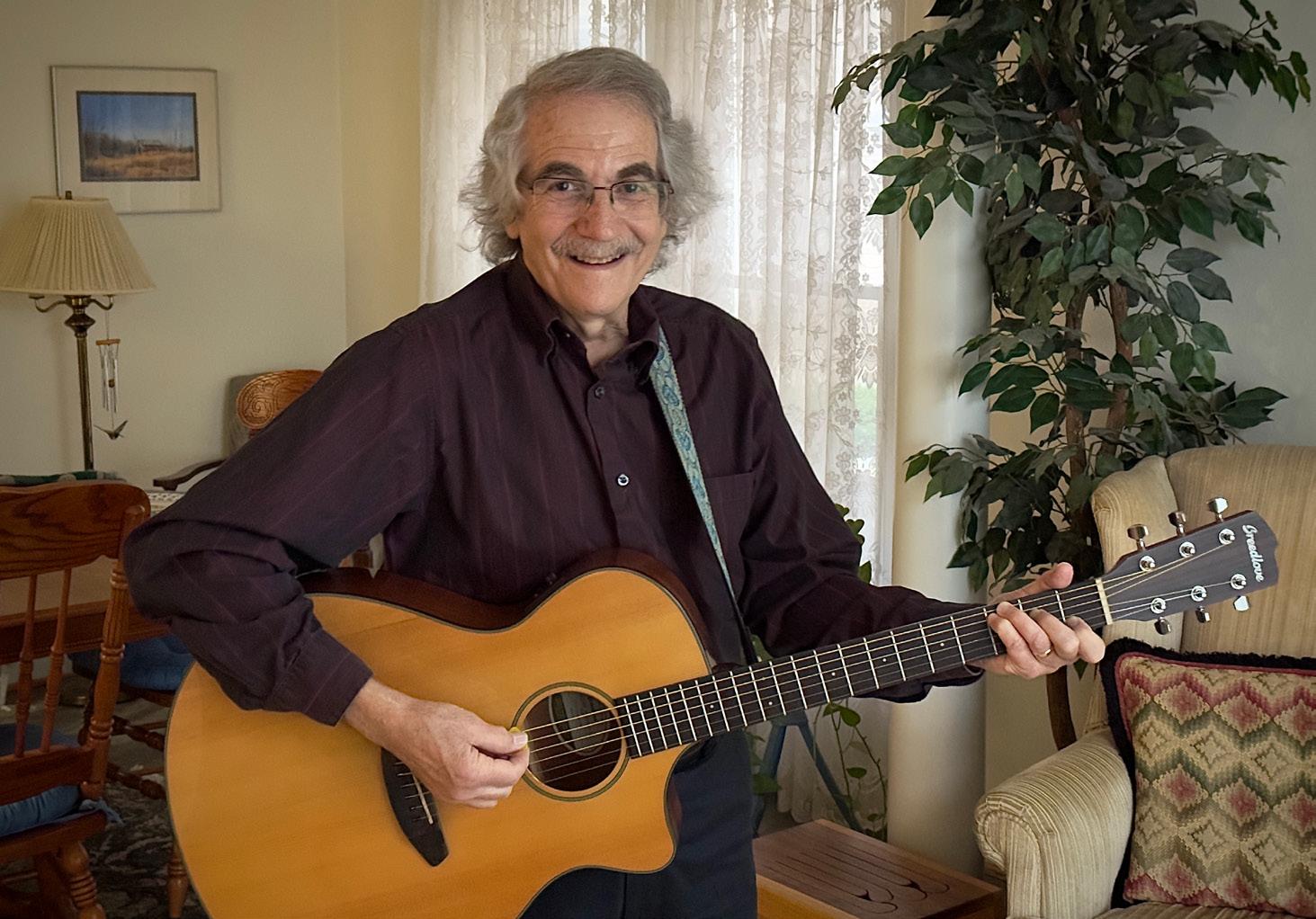

JN: You’re a musician, did you desire more freedom to play and entertain?

BM: I wanted to increase my performing, but not substantially. I realized that I could

do more during the week if I desired. Presently I perform in a duo a couple of times a month at an area restaurant. I play the guitar and violin. I am also participating in a co-songwriting project with Gene Lempert, a local songwriter.

JN: Where are you volunteering? Do you have a favorite place?

BM: I volunteer at several places, through different organizations:

• Jewish Family Service Meals on Wheels since 2014. In addition, I’ve volunteered with JFS (other programs) for more than 25 years (as needed).

• Prime Plus Adult Day Services in Norfolk since 2014 (I sing to the participants and I have read to them in the past). I am there two days every week for one hour each time. Also for two years I have performed one hour a week at the M.E.Cox Center, also a program of Prime Plus.

• BeAR (Be a Reader) at Williard Elementary School in Norfolk.

• Kroc Center two days a week, assisting children with their homework and sitting in on their music program.

• ForKids on an occasional basis. In the past I participated in their after-school homework program.

Each of the volunteer activities is equally special to me. I really enjoy singing to seniors very much.

JN: Do you use your professional skills in some of your volunteer work?

BM: I am applying my knowledge of working with people to each activity. It allows me to be patient and empathetic. Of course, having the musical background has assisted in performing at the senior programs.

I try to set aside time to exercise throughout the week. Also, I have days where I do not go anywhere and do not keep to a schedule. During those times I listen to music or watch sports shows. I think a good balance of activities and non-activities is important in retirement. Sometimes I have lunch with former co-workers, as well.

JN: Did you start walking with your friend after you retired?

BM: One of my weekly activities is walking with a good friend with whom I

worked for many years. We started walking together after we both retired. It is something that both of us try very hard not to miss.

JN: What about travel? Are you and Debbie able to hit the road more often?

BM: What is most significant is that since I was no longer restricted to just summer, spring and winter breaks, we are able to travel in the fall or spring. We have increased our travel time since I retired.

JN: What has been a favorite destination?

BM: We have enjoyed going to music festivals in the eastern part of North America. We have especially enjoyed going to Florida and Canada for festivals.

JN: In general, are you glad you retired? Do you ever miss working?

BM: I am very glad that I retired. I believe the volunteering that I am doing is sufficiently taking the place of the desire to be working. I get a lot of satisfaction from still helping others. Also, being able to apply my musical ability is appealing.

JN: Do you feel any healthier? Less stressed?

BM: The answer to both is “Yes!” I have much more time to walk/work out and sometimes see other retired folks who are my friends.

JN: Do you have any advice for someone considering retirement?

BM: The main thing I would say is to really weigh the pros and cons of retiring (don’t be impulsive about the decision). Try to imagine yourself retired and then decide if that is something you could live with at this time and in the next few years. Talk it over with others that have been retired and see what their experience has been (both good and bad).

JN: Last comments?

BM: After retirement take a lot of time to decide the next step(s). Volunteering has really worked for me.

Estate planning is more than numbers on a spreadsheet. It’s your life. And it’s how you transform your life’s work into a plan that protects your family and pays your values forward. At Kaufman & Canoles, our experienced Estate, Trust & Wealth Transfer team offers personalized business and financial advice—proactively planning, finding sophisticated solutions and creating a custom strategy that minimizes taxes both now and in the future. We can. And we will.®

Jewish News: Where were you educated?

Edward Karotkin: I earned my Bachelor

of Science degree at Union College, Schenectady, New York; and attended medical school at Wake Forest, formerly Bowman Gray School of Medicine.

JN: What was your work history?

EK : I have been on the faculty of EVMS since 1978 in the department of pediatrics and division of Neonatal/Perinatal Medicine.

JN: What brought you to Tidewater?

EK : The opportunity to join a relatively new medical school and participate in its growth. Also, the weather and Jewish community.

1917

Making your arrangements in advance is one of the best ways to show your loved ones that you care about them.

Our Family Service Counselors have the training and experience that will help you in the process. Our services include a free funeral cost estimate, and we offer many options for financing. Visit our web site for a three-step Pre-Arrangement Guide or contact the Altmeyer Pre-Arrangement Center directly at 757 422-4000

Approved by all area Rabbis and Chevrah Kadisha

JN: When did you retire?

EK : I stopped seeing patients actively this past July 2022. I’m still teaching, interviewing prospective pediatric residents, and doing some medico-legal consulting.

JN: What convinced you to take the leap?

EK : It was time, I will be 80 in a few weeks.

JN: Did you have a plan for what you would do with your time?

EK : I do have a plan: pursuing more time sailing, working in my metal studio at home, and spending more leisure time with family.

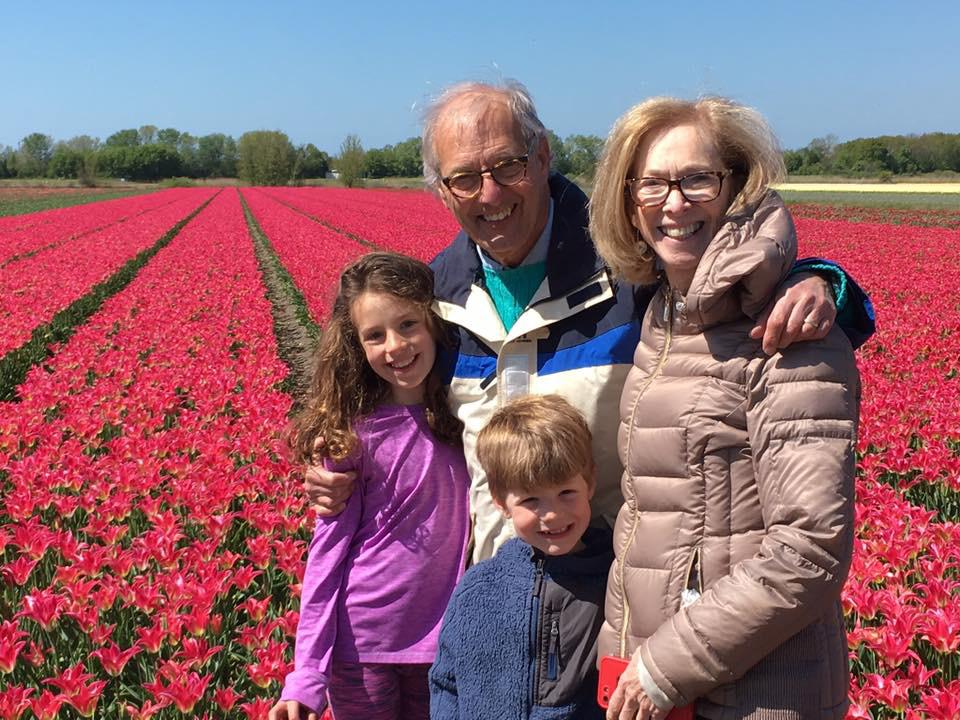

JN: Do you plan to spend more time with your grandchildren and did they impact your decision?

EK : Spending more time with grandchildren did impact my decision to some degree.

JN: Even when you worked full-time, you did a lot of volunteer work…both fascinating medical trips and general assistance with local organizations…Jewish, medical, and others. Do you plan to continue?

EK : I do plan to continue volunteer work, but probably not as much as I did a few years ago.

JN: Do you have any days just to relax? If so, what do you do?

EK : No real days set aside to relax. I like being busy. A few hours a day to read is great.

JN: You’re a sailor. Do you plan to take more and longer trips?

EK : We do plan to take more trips. We have a 46-foot sailboat and plan to take a few 10–14 day trips up the Chesapeake Bay this summer.

JN: What about travel? Do you and Betsy hope to travel more often?

EK : We do hope to travel a bit more, although we are perfectly happy to be home. Often the best part of a trip is coming back to our home.

JN: What has been a favorite destination?

EK : We have probably two favorite destinations: Skiing out west in Aspen or Park City—although we have “hung up the skis.”

I will give my relatively new ski boots to my son. Not sure he wants the onepiece outfits, although they will probably come back in style.

JN: In general, are you glad you retired? Do you miss working?

EK : I am happy I retired. I had a great career and think retiring at age 79 represents a pretty good run. I enjoyed my time as a neonatologist but can’t say that I am sad or miss getting up in the middle

of the night to see a sick baby.

JN: Do you feel any healthier? Less stressed?

EK :I feel great and never really felt stressed in my job as a physician.

JN: Do you have any advice for someone considering retirement?

EK : My only advice would be to make sure you have interests to keep you occupied during your retirement years and have enough savings to enjoy this period in your life.

JN: Last comments?

EK : One of the best choices Betsy and I made was to move to Tidewater in 1978 and start a career here and become involved in our Jewish community. The

area has proven to have just about everything we could wish for in a community.

New chapters and challenges seem to have always been the norm for Sandee Lefcoe. During the early years of her marriage, for example, she worked at the University of Virginia Hospital in Recreational Therapy in the psychiatric unit. Then, with one of her best friends, she started a stationery business where they helped people with invitations for Bar/Bat Mitzvahs, weddings, and other events.

“My husband, Vann Lefcoe, passed away in 1996,” says Lefcoe. “A few years later, I started Suited For Success in his memory where I provided free clothing to men and women going back to work who couldn’t afford to buy appropriate clothing.”

Lefcoe’s first grandchild was born several years later, and on the plane home, she began writing about his bris, which turned into the beginning of her writing children’s books. Meet Penny P. Parker was one of her first books, followed by Darcy Darling Girl Detective. Others may be found on Amazon by searching Sandra Ellen Lefcoe.

During COVID, knowing that many people weren’t working, and children were home most of the time, Lefcoe says she wanted to do something that was fun and free for them. “I started a blog, which

can be found at pennypparker. com. My character from one of my books is the narrator of the blog.”

Her latest project is a word game/puzzle. “I have been doing puzzles since I was a kid. My mother was a puzzler and that’s how I got started at a very young age. A year ago, I was playing a new online game and thought to myself how much fun it would be to put together a game of my own. And, so I did.” Lefoce’s game, Puzzle Yuzzzle, went Live on Saturday, January 21, 2023.

“I refer to it as a word game rather than a puzzle,” she says. There are five questions. After answering each question correctly, players take the first letter of each answer and unscramble the letters to make The Word of The Day. Each puzzle is available to play for 24 hours, with a new game every day.

“It’s lots of fun and the whole family can participate,” she says.

Play Puzzle Yuzzle at puzzleyuzzle.com.

“I don’t believe you’re ever too old to follow your dreams,” muses Lefcoe. “I will be 80 this year.”

the areas explored with a check-up, include:

• Getting a thorough debt analysis to see if it is possible to consolidate debt and lower rates or monthly payments.

• Creating a plan to balance long- and short-term money goals.

• Ensuring you are getting the most from your accounts.

Visit Dollar.Bank/Appointment to schedule a financial check-up at one of the 13 offices in Virginia.