UNIT CHAPTERS:

EDITOR IN CHIEF:

Laryssa Latt

AUTHORS:

Lucy Song

Matthew Davies

DESIGNERS:

Aaron Yuen

Katherine Lu

Oscar Yin

Software: Canva

© University Network of Investing & Trading 2024

1 The information in this free guide is provided for the purpose of education and intended to be of a factual and objective nature only The University Network for Investing and Trading (“UNIT”) makes no recommendations or opinions about any particular financial product or class thereof

2 UNIT has monitored the quality of the information provided in this guide However, UNIT does not make any representations or warranty about the accuracy, reliability, currency or completeness of any material contained in this guide

3 Whilst UNIT has made the effort to ensure the information in this guide was accurate and up-to-date at the time of the publication of this guide you should exercise your own independent skill, judgement and research before relying on it This guide is not a substitute for independent professional advice and you should obtain any appropriate professional advice relevant to your particular circumstances

4 References to other organisations are provided for your convenience UNIT makes no endorsements of those organisations or any other associated organisation product or service

5 In some cases the information in this guide may incorporate or summarise views standards or recommendations of third parties or comprise material contributed by third parties (“third party material”) Such third party material is assembled in good faith, but does not necessarily reflect the views of UNIT or indicate a commitment to a particular course of action UNIT makes no representations or warranties about the accuracy, reliability, currency or completeness of any third party material

6 UNIT takes no responsibility for any loss resulting from any action taken or reliance made by you on any information in this guide (including, without limitation, third party material)

In this publication you will find insights of the programs available from UNIT's sponsor companies, a description of diverse career paths in finance, tips for internship applications, interview and assessment centre preparation, subject selection help, and much more!

For those starting their university journey, we encourage you all to make the most of your university experience and take advantage of any opportunities that come your way It is never too early to start thinking about your professional development and we hope that this guide will help alleviate any stresses or dilemmas you may face along the way

One way to be introduced to the world of finance, and to prepare yourself is to learn and begin to understand the bigger picture and the state of the economy

From the wider global economy to stock markets and the world’s most well known equities, the year of 2024 was no doubt another turbulent year 2024 saw many changes, challenges, but also opportunities and the emergence of new innovations and developments.

At the start of 2024, the global economic environment was marked by investor optimism, fuelled by expectations of US interest rate cuts and an ongoing enthusiasm for AI This drove robust gains in the global stock markets during the first quarter However, as the year progressed, the pace of monetary easing fell short of expectations, due to the US’s resilient economic data, including strong consumer demand and robust employment levels In September, the Fed finally cut interest rates by 50 basis points for the first time in more than 4 years, leaving it in the 4 75-5 0% range This was followed by two additional cuts in November and December, closing the year with rates in the 4 25-4 5% range

Conversely, Australia did not follow suit with their rate cuts, due to persistently high underlying inflation The RBA kept the cash rate unchanged at 4 35% throughout the entire year, however, there is growing confidence that inflation is moving sustainably towards target, raising the likelihood of a rate cut as early as February 2025

Geopolitical tensions showed no signs of abating in 2024, with the Russia-Ukraine war intensifying further and the Middle East conflict spilling over into neighboring regions, adding new layers of complexity to an already volatile global landscape Yet, despite these challenges, commodity markets have generally adjusted to these changing conditions, assisted by the US ramping up oil production to bolster supply

Of all the prospects that come with pioneering technology, AI is clearly reshaping how we work and produce content From the rapid saturation of generative AI such as ChatGPT, to more concerning applications like deep fakes - artificial intelligence is without a doubt one of the most fascinating topics. Amid strong sales of computer chips and batteries, technology and growth stocks were some of the strongest performers in 2024 The US tech-heavy Nasdaq surged 31 97%, driven largely by the ‘Magnificent 7’ stocks, which include Apple, Microsoft, Alphabet, Meta, Nvidia and Tesla.

Despite the fact that recession concerns appear to have eased, the outlook remains uncertain, where geopolitical factors are expected to be a major source of volatility and important influence on global economic developments in the year ahead. As much as the world continues to support the tech boom, there are increasing fears that the speed at which the space is growing is largely outpacing the ability for regulators and governments to intervene before it gets out of control.

At its core, finance can be defined as the management of money and practice of allocating monetary resources under conditions of risk Finance can be split into three distinct categories; public finance, personal finance, and corporate finance

This guide will be mainly focusing on career opportunities within corporate finance, where you will learn about the financial markets, and how companies finance their activities through different capital sources, make choices about major investment decisions and the risks involved, and how it delivers value to all its shareholders

Financial services refer to the services provided by the financial industry and organisations involved in the management of capital. Such organisations may include banks, investment banks, insurance companies, asset management firms, and stock brokerages Its clients include individuals, businesses, non-profit organisations, and government agencies.

The financial services industry offers a broad range of career opportunities that cater to different skills and interests As such, employers will have different expectations in regards to your personal and professional qualities as they assess your compatibility for the role

Investment banks are institutions driving the growth of public and private companies, acting as the intermediaries which fuel these companies with capital - the monetary means of growth.

Investment bankers generally hold the role of corporate financial advisors. In this capacity providing various financial advisory and capital market services to corporate and government clients involved in public and private equity raisings and corporate restructuring Investment banks assist in large, complicated financial transactions and are the driving force behind headline IPOs, billion-dollar mergers, and cross-border investment deals.

In facilitating transactions, investment banking refers to working in firms on the sell-side - from traditional underwriting and selling securities to raise investment capital to advising complex M&A deals and for growth and expansion and industry consolidation.

Transactions involving the sales of entire companies can easily be in the millions, making for highly lucrative commissions, and a hugely profitable business These efforts often take months of work, with bankers often working long hours during live-deals to fine-tune transactions Some deals can take over a year of early engagement before action, and typically many more months before the deal is closed

Investment bankers need to not only understand the market but are excellent analysts and problem solvers who can communicate clearly and effectively and have impeccable attention to detail, even after hours of pouring over Excel spreadsheets

The investment banking industry can be split into three different tiers:

The Bulge Bracket makes up the world’s largest investment banks, whose clients are usually large corporations, institutions and government entities As a catchall term for this class of large global investment bank, "bulge bracket" commonly refers to Bank of America Merrill Lynch, Goldman Sachs, Barclays Capital, Credit Suisse, Deutsche Bank, JPMorgan Chase, Citigroup, Morgan Stanley, and UBS.

While on a smaller scale to the US market, Australia has several notable home-grown investment banks, led by Macquarie Bank and more recently, Barrenjoey and Jarden On another level, Australia has some well-regarded boutique investment firms including Luminis Partners, Allier Capital and Azure Capital, and its Big 4 Banks investment banking divisions (i e institutional banking)

Product Groups Industry Groups

Mergers and Acquisition (M&A)

Equity Capital Markets (EQM)

Debt Capital Markets (DCM)

Leveraged Finance Level (LevFin)

Corporate Restructuring (RX)

Structured Finance

Technology, Media and Telecom (TMT)

Healthcare and Life Sciences

Financial Institutions Group (FIG)

Oil and Gas (O&G)

Consumer Goods and Retail

Financial Sponsors Group (FSG)

The industry coverage groups are exposed to deals across all product categories, but only withinaspecificindustry.

Theproductgroupsspecialiseintheexecutionofaparticulartypeofcorporateaction Atahigh level, product groups give breadth in terms of industry exposure but specialisation in terms of dealtype

M&A teams will be responsible for working on both sell-side and buy-side M&A transactions across all of the bank’s different industry groups M&A provides buyers looking to achieve strategic goals via inorganic growth strategies as an alternative to organic growth, while giving sellers the opportunity to cash out or share in the risk and reward of a newly formed business.

The M&A group is widely perceived as the most modelling-intensive and technical product group relative to other groups

Capital Markets are often separated into two streams that help their clients raise funds via the capital market

Debt Capital Markets (DCM) teams provide advice on raising funds through the trade of debt securities, including corporate bonds, government bonds, credit default swaps etc DCM teams are typically exposed to a wide range of clients as debt can be raised for corporations, agencies and sovereign entities. Clients are looking to access a global pool of investors looking for opportunities in acquisitions, and facilitate the refinancing or restructuring of existing debt

Equity Capital Markets (ECM) teams are focused on raising equity for clients through the capital markets - meaning that a company sells a certain amount of ownership in the company in exchange for cash

When working for ECM, deals can involve initial public offering (IPO), executing followon offerings for public companies wanting to raise additional equity capital, as well as secondary offerings, of selling existing shares to other investors

Investment management refers to the selection, monitoring and allocation of a client’s assets in order to meet specific mandated investment performance objectives. Investment managers are entrusted with a client’s cash and have a fiduciary duty to invest that cash according to predetermined investment philosophy and process

Investable assets may lie in both the public (shares, fixed income, derivatives, commodities and currencies) and private markets (venture capital, infrastructure and real estate) In investing large sums of cash, firms in the field of investment management are described as being on the buy-side of corporate finance.

Clients can range from institutions - such as insurance companies, corporations, charities and university endowment funds, to private high net worth individuals

Investment due diligence refers to the research, monitoring and assessment of potential investment opportunities An investment manager ’ s performance is often compared to an index benchmark such as the S&P 500 or ASX200 Some other commonly used benchmarks include MSCI and Bloomberg indexes which show performance across many international countries and regions Bond benchmarks, or inflation, can also be used to great effect in certain instances

As such, any deviations in the constituents and weighting of a fund’s portfolio are expected to generate above-benchmark returns (i e alpha) Beyond consistent client communication regarding performance and any changes to asset allocation, these interactions become especially important during periods of market downturns when risk of fund withdrawal is highest.

Employers in Australia are required to pay a percentage of employee earnings into a super account, which are managed by selected funds

The money provided through these super contributions does not sit idly until it is withdrawn at retirement, the fund is responsible for managing and investing the money in a variety of asset classes depending upon the superannuation product chosen

A super fund is generally more conservative due to the nature of its client base, opting for diversification across a range of asset classes to offset idiosyncratic risk Furthermore, due to the more community oriented nature of such investment, they also possess a proactive stance towards sustainable and ethical investing and are subject to high regulations from APRA.

Hedge funds and other managed funds serve largely the same function of generating a return on investors’ wealth through a managed portfolio, but there are large differences in methodologies and investment approaches Hedge funds are not restricted by many of the regulatory requirements enforced on super and mutual funds, nor are they required to disclose strategies and abide by mandates. Moreover, hedge funds are mostly targeted at high-net-worth individuals, with greater investment flexibility including using strategies such as hedging

Private equity (PE) funds invest in the private markets and provide financing to unlisted businesses. PE funds pursue growth and seek to invest in businesses where there is an opportunity to eventually sell at a higher multiple, with the aim of recovering the investment by selling the organisation or taking it public later. The holding period is often 3-5 years and usually involves private equity owners taking an active management approach The key skill required to work in private equity is the ability to source opportunities and investigate their viability Overall, private equity would be attractive for those interested in not just investing in businesses, but also playing an active ownership role in devising and executing a growth strategy

Similar to private equity funds, venture capital invests in high-growth potential companies, primarily startups and early-stage businesses which have high long-term growth potential Venture capital generally provides financing in exchange for equity and this allows venture capitalists to have oversight over management decisions Many funds also provide strategic advice, access to existing customer networks and industry expertise in addition to financing Dealsourcing is the key skill required to work in venture capital and the majority of time will be spent meeting with entrepreneurs and networking Unlike private equity, valuation and financial modelling play a more limited role given the pre-revenue status of many potential investments

The world’s global markets run 24 hours a day with markets operating across time zones in different areas of the globe They involve everything financial from equities, fixed income, derivatives, currencies, and a growing range of alternative assets such as cryptocurrency

‘Sales’ and ‘trading’ are two distinct but complementary operations. The function of a sales and trading division within an organisation is to ensure both the accurate structuring and orderly sale of financial products to institutional investors and other clients Note that agency trading is client-focused, and should not be confused with proprietary trading which focuses on investing the company ’ s own money

The sales team effectively works to sell financial products to clients - generally financial institutions and high-net-worth individuals looking to buy equities, fixed income products, or any other financial instruments to meet their specific needs Once the sales team has confirmed an order with a client the traders are responsible for completing the order in the market

Unlike the chaotic ‘trading pits’ depicted in iconic Wall Street movies, trading floors in large investment banks today operate in a much more orderly manner On a trading floor today, you will find a large open room filled with long desks with multiple monitors sectioned off per person and grouped according to the fields of trade The large amount of data displayed on the screens are essential in providing the traders with live data, blue-chip price swings, and other headline variables Traders are required to multi-task continuously, constantly assessing risk, calculating the best timing to execute trades, and keeping up to date with client requests.

Bloomberg is a key financial information service that all banks and traders have access to - it is more or less the all-in-one portal to relevant news and public financial data

To trade, industry experts generally use in-house trading platforms to execute their orders. Popular platforms include FlexTrade, Fidessa, and Goldman’s REDIPlus platform. Typically, a firm that offers sales and trading will have other divisions that complement this function

Sales and trading are inextricably linked to the work of financial analysts, who design and formulate bespoke financial products catering to the requirements of particular clients. These financial products may be as obscure as collateralised mortgage obligations or asset-backed securities or as simple as futures contracts Additionally, the research division, which produces reports on financial markets, works with sales and trading to provide research to clients in the hope of being mandated to execute their trades

A stockbroker is an entity or individual that trades (buys and sells stock) on someone else’s behalf and charges a commission for it It is one of the first professions to have taken root in the finance industry; as long as there have been markets, there have been stock brokers Historically, the functions of investment advice and order execution were deemed as inseparable facets of stockbroking Nowadays, discount brokers which charge moderate commissions and provide no investment advice, have turned the industry on its head.

Stockbrokers, whether they are actual brokerage firms or individual broker-dealers, are often registered investment advisors and have the necessary certification by the regulators of exchange to execute trades – something which ordinary retail investors are not allowed to do In other words, if you need to buy a stock at a certain price, you tell your stockbroker and they do it for you, taking a slice of the pie along the way of course.

Proprietary trading can be viewed as an additional or peripheral function in an organisation The company is utilising a portion of its capital to trade in order to generate extra profits, boosting the overall financial position of the company instead of earning commissions by trading on behalf of its clients It constitutes an additional stream of income separate from the company ’ s primary business

Proprietary trading is popular, particularly amongst brokerages, as they feel that they have a competitive advantage over other players in the markets

Proprietary trading is very similar to managing endowments at elite charitable institutions and universities around the world, whereby a professional investment team makes use of dormant money to generate surplus income. An ideal example would be that of a proprietary trading desk at a brokerage firm, where the broker is making profit in two ways: one, by earning commission by trading on behalf of other people, and, secondly, by directly trading in the markets.

One of the major benefits of working in trading, as compared to many other finance jobs, is that once the stock market closes (around 4-5pm) your responsibilities wind down, since you ’ re not able to buy or sell stocks after that time As such, the work-life balance could be outstanding. You’re also given the opportunity to build a strong client network

If you have ever come across a live price chart feed on a trading terminal or have simply looked at live tickers on the market floor, you can deduce immediately that numbers have a huge role to play in trading and stockbroking Therefore, a natural affinity for numbers, percentages and ratios is highly desirable

Quantitative proprietary trading firms will usually require extensive mathematical, statistical, or computer science knowledge over a finance background. Other discretionary trading firms may not require any specific skills as they’ll have training programs to teach you the technical trading methods

Finally, other prop trading firms may require fundamental valuation knowledge which is most suited to the typical finance skillset. Boosting your presentation and soft skills can provide you with an edge over other applicants in this client focused industry

Professional services encompass a broad range of various occupations, but ultimately a career in professional services involves providing support and specialist advice to clients. These clients are also diverse and can include small-medium enterprises, multinational corporations, governments to not-forprofit organisations

Professional services offer a diverse working experience, with much of the work will be project-style and client-based rather than performing a set of daily tasks - providing an exciting opportunity for existing skills to be applied in various different scenarios The teams and people you work with will also be diverse in both experience, background and personality As you work on each project, you will be constantly liaising with the client, developing fruitful relationships which may prove invaluable in the future

The Big 4 firms – KPMG, Deloitte, EY and PWC– are the four largest professional service networks in the world, offering services in various business areas, most prominent among which are: auditing and accounting; advisory and consulting; tax, risk and legal advice

As part of a Transactions/Corporate Finance team, your role is to advise clients on how to best allocate and acquire capital. This may involve developing financial models, identifying M&A opportunities, compiling data on past transactions and preparing due diligence presentation materials.

In Auditing/Assurance, you will be responsible for assessing the legitimacy of financial reports and providing confidence for the external stakeholders of businesses like investors, suppliers and regulators. This may involve helping clients adjust to new accounting standards and liaising with clients to obtain information to fulfil regulatory requirements.

Advisory/consulting offers the most varied work experience You can expect to spend time researching current regulatory developments, constructing financial models, reviewing client business practices and contributing to strategy recommendations Some consulting services may include Strategy analytics, human capital, core business operations, enterprise technology, and more

A typical day in the Tax team may involve identifying and implementing strategies to minimise tax liabilities, maximise tax incentives and researching and evaluating the impact of upcoming tax issues

Management consulting is working with businesses to identify solutions to problems to maximise business performance, improve business processes, and increase revenue Management consultants are professional experts who provide solutions and strategies to improve the financial and operational health of an organisation The recommendations made by management consultants are backed by large amounts of research and data

Clients hire management consultants primarily as objective third-party analysers of an organisation, including businesses, government institutions, nonprofits, and more Working with management, strategy consultants help to define goals, assess the current situation, build actionable strategies that consider timelines, resources, and potential obstacles

Other times, these organisations simply come across problems they’ve never experienced before Management consulting firms who have worked on similar projects for other clients are able to provide their industry expertise and advice A strategy consultant helps organisations stay competitive in their respective industries and fields by providing tailored advice and guidance on strategy development.

Management consultants offer their expertise to businesses in several domains These may be general or very specialised and include: Business strategy, restructuring, Strategic management, Risk management, M&A, Digital transformation, Business processes Management consultants perform in-depth analysis and research relating to the areas they are working on within an organisation You'll need to remain objective and unbiased to provide a clear perspective of the problems that need solving

Management consultants are hands-on when it comes to implementing the solutions they identify You'll work with teams to deliver and monitor solutions, working directly with senior management.

The top 3 management consulting firms - or colloquially known as MBB - refers to McKinsey & Co (McKinsey), Bain & Company (Bain) & Boston Consulting Group (BCG) While they are not the largest firms, they are the most prestigious in the industry with a focus on pure strategy Clients trust them to provide exceptional quality work and they have earned their reputation as a result. Part of this reputation is derived from their diverse clientele which includes multitudes of Fortune 500 companies that rely on MBB consultants for complex and large-scale restructuring initiatives

The rest of the market comprises mid-tier / boutiques as well as the Big 4 (KPMG, EY, Deloitte & PwC) previously mentioned - who do have strategy consulting arms that compete with MBB firms, the bulk of their business remains related to accounting.

MCKINSEY & COMPANY, BCG, BAIN

NOUS GROUP, ALTMAN SOLON, ACCENTURE STRATEGY

Management consulting is one of the most sought-after fields in the business world, boasting the potential for lots of air travel, working on complex business problems, and exposure to top level management. While all these truly are great components of management consulting, the reality is that the industry is not for everyone

Management consulting firms offer an amazing learning opportunity for consultants at all levels.

This is due to a few reasons:

Work with the largest companies in the world

Exposure to top level management

Learn from and work with intelligent and driven colleagues

Skills development & expertise

Management consulting firms offer a unique opportunity to learn from a broad range of people, problems, and industries

Different locations and teams

Exposure to a wide range of objectives across multiple projects

Projects across various different industries

These experiences also offer an amazing chance to develop skills that are attractive to employers in various other fields, including private equity, start-ups, and corporate strategy roles, offering a diverse set of exit opportunities

Fast client turnover & lack of tangible results

While the variety and pace can be stimulating, management consultants rarely get to see the results of all their hard work because as soon as a project is over, they need to move onto the next one

Working with some of the largest companies in the world means the stakes are usually quite high Time can often be consumed with client and team meetings, interviews, workshops, problem solving, focused group discussions, and client communication The industry is extremely fast paced and there are constant deadlines that result in long hours.

Retail banking - or consumer banking - refers to the mass-market banking in which individual customers (like you and me) use local branches of larger commercial banks. Generally, this service aims to encompass all the financial services that may be required by an individual retail client Retail bank’s representatives cater for individuals and small businesses by providing an entire suite of services including; savings, checking accounts, mortgages, personal loans, internet finance, and certificates of deposits

The ‘Big Four’ banks of Australia - Australia and New Zealand Banking Group (ANZ), Commonwealth Bank of Australia (CBA), National Australia Bank (NAB) and Westpac Banking Corporation (Westpac) - are the main competitors in the Australian retail banking sector and are all ranked among the world’s 50 safest banks

The retail banking industry in Australia has always aligned itself to the ever-changing consumer demands, by fine-tuning its services and customising its products. As a one-stop shop for all retail financial services, retail banks have a diverse range of services for which employees can specialise in and transfer between

Retail bankers play a vital role in the financial industry by helping individuals manage their finances and achieve their goals This is a rewarding position that offers plenty of opportunities for career advancement within the retail network and other areas of the firm Given below are some of the functionalities provided by banks, as on date, which give customers the ability to carry out a growing range of financial tasks on-the-go.

Mobile payments - This is facility provided by Commonweatlh Bank to make Mastercard PayPass puchases This allows payments to be made by tapping the phone at a merchant’s terminal, where such payments are accepted (on smartphones where this app is not supported, a device called PayTag allows customers to use this facility)

Cardless Cash - This app allows the cutomer to withdraw from accounts without using a card. The app also has a feature where the customer can even allow someone else to collet the money by nominating them through the app.

P2P payments - Payments can be made to a registered Australian mobile number (limited to Australian bank accounts

Other services include setting a limit on daily transactions, BPay for bill payments, checking transaction history, checking balance, and making transactions between accounts of the same or different banks

Financial support roles comprise mostly of middle & back office roles – which include human resources, investor relations, compliance, accounting, IT support and many more While these roles tend to be non-revenue producing, they are nonetheless an essential part of financial services –ensuring that the front-office is able to run smoothly, that operations and accounts are all in check, and risk is being effectively managed In general, the work in financial support roles tend to be less pressured as they are non-revenue generating, and they aren’t communicating with clients as often.

Evaluating the riskiness of front office activities and ensuring that deals are being effectively processed

Responsible for the objective review and challenge, oversight, monitoring and reporting of a firm’s internal material risks - both financial and non-financial Credit, Market Risk Regulatory Affairs and Aggregate Risk Financial Crime Risk Compliance Operational Risk Behavioural Risk Enterprise Support Internal Audit

Financial management is all about monitoring, controlling, protecting, and reporting on a company ' s financial resources Companies have accountants or finance teams responsible for managing their finances, including all bank transactions, loans, debts, investments, and other sources of funding.

Treasury : managing the funding, capital and liquidity position, helping to manage balance sheet risk

Finance : provide financial management and control advice, management reporting and forecasting, regulatory and tax reporting and business advisory services

Tax : provide advisory services and technical support to ensure the business meets tax compliance obligations

Drives the operational effectiveness of the business and brings together specialist support services in a variety of fields

Digital Transformation & Data

Human Resources

Business Services - Corporate real estate & procurement

Business Improvement & Strategy

These roles have decent upside potential without some of the stress or pressure you may hear of careers in the ‘front’ office and offer a stronger work-life balance. Working in these supporting roles will allow the individual to specialise in a particular area of expertise, such as accounting, IT, or strategic management This is more suited to an individual who wants a linear career path in a specialised area, as opposed to the diverse work a consultant may have.

Furthermore, it is possible to specialise in areas that don’t use the typical finance skill set and employers are increasingly focusing on transferable soft skills over technical hard skills, and seek students who are well-rounded and interdisciplinary - which offers great opportunities for students who do not study a finance or related major.

Currently, one of the hottest sectors is the fintech industry, which encompasses a broad range of businesses and roles As the name suggests, fintech refers to the intersection between “finance” and “technology” and a career in this industry involves devising technology based solutions to collaborate with or disrupt the financial services industry Working in fintech provides the opportunity to help drive products and services that can have a real and significant impact on people’s lives

The COVID-19 pandemic has played a key role in FinTech’s growth in Australia and there are plenty of established organisations engaged in fintech, notably the big banks Lockdowns changed how customers and companies engaged in business, and those changes are expected to have a lasting impact.

As a career path, it’s attractive to those who are looking to work with and be part of the latest technological innovations, while still being part of the world of finance

Fintech is a diverse sector, and a characteristic of the entire fintech industry is the sheer number of roles that are available, and will continue to expand as businesses continue to migrate into the digital ecosystem:

For less technology-focused individuals, a suitable role is product manager. Their responsibility is to forge strategic partnerships with financial institutions and merchants to create solutions with a large number of use cases and understand client needs to develop an innovative solution Like other industries, they work with various departments throughout the product life cycle to conceptualise the product and bring it to market

Compliance within the fintech sector involves several responsibilities associated with ensuring that all relevant governmental regulations are recognised and followed Examples include privacy policies, EULAs (end-user licence agreements), corporate governance, and storage of proprietary data. Knowledge of relevant legal requirements and concepts such as ESG (environmental, social and governance) principles is a must

Much of the success of fintech products depends on consumers ' enjoyment of using the product. UX/UI (user experience and user interface design) roles are also being increasingly coveted as banks and fintech companies seek to make their applications user-friendly and intuitivemaximising the functionality and the overall ‘look’ of the app.

LinkedIn kicked off 2020 with the news that blockchain is the most indemand skill in developed markets Blockchain developers have high level technical skills, starting with front and back-end web development, with a deep understanding of data structures, cryptography and smart contracts

The demand is strongest for app and site developers, especially iOS, Android, SRE and full-stack developers

This group forms the crux of fintech companies and are responsible for translating business ideas into tangible innovations.

Data science is important in fintech as it enables companies to make datadriven decisions through identifying trends, making predictions, and optimise their operations to deliver better financial services to their customers A fintech data scientist primarily focuses upon the analysis of hard data such as fraud detection, client acquisition and algorithm-driven financial planning

Develop a system with a checklist of processes to make your time hunting for a job shorter and less anxiety-inducing. This system should include:

Identifying your target industry and universe of organisations

Allocating a realistic amount of time per week to research employers

Setting attainable, quantifiable goals (the number of job applications/coffee chats/ interviews a week)

Keeping on track the progress of each application

Like in any venture in finance, diversification is key and try to go beyond just applying for advertised jobs in your search. Try your hand at cold-emailing, reaching out to mutual contacts and university alumni in the industry or leveraging university careers centres and job boards

Make sure to conduct thorough background research and tailor your communication accordingly as to not approach with a lack of passion and interest

Having a LinkedIn is a good start, but there is much more you can achieve through your profile. Consider your profile from a prospective employer’s perspective and use your social media presence as a selling point This can mean showcasing your projects and achievements such as case competitions, writing blog articles or opinion pieces and attending university society events

You can also boost your presence by following and liking posts from prominent organisations in your target industry.

Knowing yourself is key to communicating with prospective employers and this means being able to identify your key traits:

Goals

Strengths

Weaknesses

Communication style

Key experiences

Ultimately you want to be able to confidently sell yourself as a potential employee and clearly articulate what sets you apart from everyone else. The best way to do this is develop a succinct, interesting and memorable ‘Elevator Pitch’

Most importantly remain persistent! Even when incorporating all of the above into your job search, the market will always be competitive for students and it is imperative that you keep your chin up despite any roadblocks or rejections that you may face

Focus on what you did in the job and use action verbs to start each point

Avoid using the generic descriptions of the jobs you originally applied for or held

Quantify and be specific about your accomplishments

Prioritise detail about your current or recent jobs

It is ok to mention past roles even if unrelated to the role you want to pursue nowjust make it brief

Keep it under two pages

Use a logical format and wide margins and clear headings

Selectively apply bold or italic typeface to guide the reader’s eye

Use bullets to call attention to important points

Avoid cluttered and complicated layouts and tables

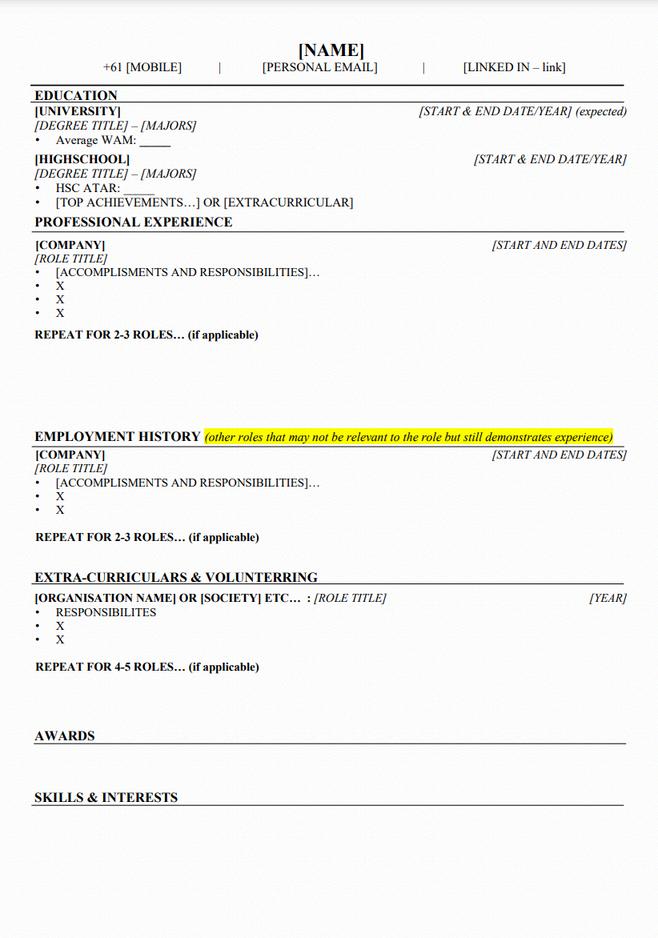

EXAMPLE CV TEMPLATE

This is the hallmark of a memorable cover letter Not only does it differentiate you from other applicants, but a story also gives your application a sprinkle of authenticity and persona How? Craft a story into your letter detailing the why and the how, stepping the reader through how you have come down your path, what makes you the person you are, and why you have decided on them as an employer

This is probably the most cliché tip you ’ re ever going to get, but it is an essential one nonetheless. Always relate your prior experiences, whether it is in volunteer work, an internship, or even a part-time role that you ’ ve had, to the actual role that you ’ re applying for Be sure to clearly and concisely outline why those past experiences specifically make you a desirable applicant for the particular role that you ’ re applying for

First impressions matter! There is no going past this reality Do this by keeping your cover letter visually appealing and easy on the eye. Now, by ‘visually appealing’ we don’t mean colour coding the document- you could if you like - but just make sure that you divide the points that you ’ re making into individual paragraphs. For instance, in the first paragraph start off with introducing yourself, in the second paragraph highlight your prior experiences, the third could be on why you ’ re applying for the role, and in the last one you can convey how much you really want it All in all, keep it nice, tidy and visually simple

This is extremely important We can’t stress it enough Do some research about the company and the role that you ’ re applying for. Look for unique characteristics and be sure to mention them in the cover letter to demonstrate that you ’ re genuinely interested in working in the company. For instance, a particular company might have generous study leave programs for employees. Mentioning things like these not only demonstrate your passion but also set you apart from the crowd and under a page.

Make sure you have a good understanding of the company and what you are signing up for! Ensure that you have read up on some of the skills that the job requires, and that you are up to date with current affairs and business news and trends.

That being said, you will not be expected to know the answers to every single question It is okay to say “I don’t know,” but it is always advisable to show your interviewer that you are willing to learn and even speculate as to what the correct answer may be.

Remember, you are always selling yourself in an interview! Make it a point to tell and show your interviewer why it is they that should be hiring you Do you think you have great communication skills and the ability to perform in team situations?

Ensure you prepare some anecdotal examples of where you have excelled in such situations Better yet, show your interviewer evidence of your skills!

Whilst it is important to sell your good qualities, it is important not to give off an arrogant or overconfident image either. Moreover, employers want to see you recognise your own weaknesses, as well as develop a plan of action to improve upon them Not all people are perfect, and a degree of humility and honest self-reflection is an important demonstrator of someone who is willing to accept their shortcomings and constantly seek growth and development.

Being nervous is normal! Anyone would be if placed in such a high-stress situation, with so much at stake However, try not to let it get in the way of the interview Fidgeting and constantly shifting eyes are a dead giveaway of someone who is both extremely nervous and lacking in confidence. Plant your hands somewhere firmly, and do your best to maintain eye contact throughout

05 07

TAKE YOUR TIME

In tandem with tip number 4, make sure to take your time during the interview This can help with the nervousness and reduce the amount of stuttering and ‘ um ’-ing If you are asked a question which you are unable to answer off the bat, it is perfectly fine to ask for the interviewers to give you a moment to think Again, moderation is key! You shouldn’t be doing this after every single question, nor should you remain silent while pondering. Awkward silences are not fun for either party!

SMILE AND LAUGH 06 STAY ENGAGED

Smiling and laughing is a great way to dispel the often exaggerated tension and formality in an interview Your interviewers are human too and a lighthearted comment may lead you to a lengthy conversation

This is also a great opportunity to show off your sense of humour, personality, and ability to communicate with others

Finally, make sure you remain engaged throughout the interview Wandering eyes and asking interviewers to repeat questions are all signs that you are not interested in the job you have applied for, and is understandably a huge red flag against you! A great way to show your engagement is to ask the interviewers questions about the job you have applied for. What other technical skills will you need? Where does your division fit into the greater company structure? Asking questions shows a keenness to learn, and genuine interest in the firm

tre is a huge achievement! me screening, numerous e or video interviews to be s is a testament to your to succeed in the position you ’ ve been invited to the you All that’s left for you to

by companies to gain a are, your teamwork and

centre, it is vital that you

and the role you have portant thing to prepare ack of dedication and enefits you as well - how he job if you don’t know both individual

y,

ntre will differ in some y 10-20 other candidates revolve around group ase studies, role-playing mes or presentations. In complete some solo terviews economic news, or modelling) are not always neral awareness of the reciated and will often es

Often the hardest part of networking for university students is getting started, especially when they do not know anyone working in the industry

To start, join societies and look out for networking events held throughout the semester. These events tend to be educational and an easy-going environment that makes it ideal to meet other professionals with many attendees being well connected with alumni working in a variety of different roles

A simple greeting may be all it takes to start a conversation after that, you can let your curiosity drive it. More often than not, the directors or alumni you ’ re speaking with have been in your position before and fully understand your nervousness Make sure you try to relax, and make the most of the opportunity

It's important to ensure that you dress in a way that represents you and gives off the right perception. Networking events can range in formality but usually can be categorised as the following - commonly indicated in event details

Business formal: this calls for the complete formal business attire, including a full-suit with a buttondown shirt, slacks/skirt, blazer, a tie for men and often heels for ladies This will usually be the appropriate dress code for cocktail networking events and networking with professionals from the banking industry.

Business casual: also known as smart casual attire, gives a bit more flexibility and depending on the setting or type of networking event, jeans and sneakers may be acceptable Just remember that you are still at a work-related event and will need to balance your attire with professionalism

When in doubt, nothing brings together a professional outfit quite like a blazer dress it up or down to meet your needs.

Remember that confidence is often the best accessory, which can be very helpful when dealing with the nervousness of trying to connect with industry professionals.

Remember that you are having a conversation with them, so to a certain extent, let them figure out what makes you brilliant rather than spewing your fiercely memorised facts about recent market conditions or numbers from recent deals of each firm

If you are truly interested in the industry, then you will no doubt have questions about it. Company representatives will feel appreciated when they can enlighten you, so don’t be afraid to ask Equally as important as asking is sharing, whether that be an appropriately funny story or some concern for the state of financeopen up to them, and they might just open their doors for you.

IIf you made one good connection out of the hundred you spoke to at an event, try and follow up with them. Ask them to catch up for a coffee in the future, connect with them on LinkedIn if it’s appropriate, and if you ’ re applying for a job at their firm ask them for some more information on the position A one-on-one personal connection is worth a lot more than vaguely knowing ten people you met once Plus, it gives you the opportunity to ask questions that you might not be able to ask at a large event

Additional note: If someone does meet with you for coffee, make sure to send them a thank you email/message afterwards

The Chartered Financial Analysts (CFA) Program is a 3-staged education curriculum (Level I, Level II and Level III), involving three corresponding exams that tests the fundamentals of investment tools, valuing assets, portfolio management, and wealth planning

The CFA Program is typically completed by those with backgrounds in finance, accounting, economics, or business.

The CFA Program provides a strong foundation in advanced investment analysis and real-world portfolio management skills Ongoing input from industry experts ensures that the curriculum remains relevant and prepares charterholders to enter today’s market

CFA charterholders occupy a range of investment decision-making roles, typically as a research analyst or portfolio manager CFA charterholders go on to enjoy lifelong careers in asset and wealth management, investment banking, commercial banking, and consulting, alongside a diverse range of career paths in and outside the industry

Value in an Evolving Industry

As a globally recognised credential in the investment management profession, the CFA® designation is a mark of distinction, and investment firms know it represents a higher standard

To become a regular Charterholder, you must acquire four years of professional work experience in investment decision making before, during or after completion of the Program.

Requirements

3 exams & one of the following: Bachelor’s degree Be within 23 months of graduation from the date you sit for the Level I exam Combination of 4,000 hours of full-time work experience and university education accrued over min. 36 months

Master’s Degree (23 years)

4 exams, bachelor’s degree, & 150 schooling hours

1 exam, bachelor’s degree with coursework in financial planning, and 4,000–6,000 hours of work experience

Recognition

The Careers and Employability Office (CEO) is the University of Sydney’s Business School’s tailored careers service for students seeking advice on careers paths, job applications and general employability

B1 level of Abercrombie Business School

Building

Hours

Every teaching weekday, 1-4pm for drop in for a chat

Services

Drop-in

Student careers leaders who can offer you advice on your resumé and the job application process

Book a Private Meeting

Experienced career consultants who can help you plan your career and make the best of your university experience

Online Resume Reviews (after week 5)

Interviews Feedback (throughout the semester)

Workshops and Activities Series

Mock interviews and mock assessment centres

Employer Networking Events

Make sure to keep an eye out on your university email for the CEO Newsletter and event updates to ensure you don’t miss any of these events

For first years, look out for events specific to first years and pre-penultimate years in the events calendar, which often outline how to ensure that you are prepared for internship and graduate applications in the future.

“Very often as a little girl, then as a young woman, I have suffered my lot of discrimination I was brought up with brothers; I grew up in a boys’ world You have to elbow your way in Every day, you have to prove yourself and convince - move forward and challenge yourself. And doubt all the time. It’s a question of not so much pushing the boys out of the picture, but making the whole frame bigger so that both men and women access the labour market, contribute to the economy, generate growth, have jobs, and so on ”

- Christine Lagarde, Managing Director of the IMF

Recently, the finance industry has been swept with tides of change, as businesses and financial institutions recognise the importance of gender diversity Women bring unique skills, and are more likely to possess traits such as empathy, trust-building and listening to others - essential skills in the finance industry.

Impressive statistics paint images of progress, with Top 20 ASX boards reach 40% women representation (as of August 2023) Female representation is improving: The latest AICD Gender Diversity Report noted similar findings, with 35.6% of ASX 300 board seats being held by women and 67% of ASX 300 boards having more than 30% female representation. There are now no boards in the ASX 200 without women

Though, many reports begin to put a spotlight on the stubbornly low number of women in csuite executive director roles, highlighting that the change has been in the appointment of women to non-executive director roles.

Therealityisnotasrosy,withthefinanceseaofopportunitystilldominatedbymenMenare stillpromotedatmateriallyhigherrates,fuellingperceptionsofa“glassceiling”forwomen. Companiesarestillreportingpoorfemaleretentionratesandadroughtoftalentedwomen withslowprogresstowardsgenderparityacrosstheindustry.

InAustraliaandaroundtheworld,firmsarerisingtotheoccasion,introducingflexiblehours, parentalleavemeasuresandmentorshipschemestosupportfemaleemployees-withpace pickinguppost-COVID.

TheAustralianCouncilofSuperannuationInvestorshasalsovowedtovoteagainstthereelectionofincumbentdirectorsonallmaleboards,whileadvocacyorganisationssuchas WomeninFinanceandBanking,andMaleChampionsofChangehavecommittedtothe “significantandsustainableincreaseintherepresentationofwomeninleadership"

Improvingfemalerepresentationiscrucialtobroadeningcognitiveandexperientialdiversity, widelyacknowledgedtoenhancedecisionmakingwithinfirms Femaleempowermentin financialservicesthereforehasthepotentialtomakewavesinfinancialservicesbydrivingthe diversityofthought,whichultimatelybreedsinnovation.

“don’t let boys have all the fun and miss out on what could be very exciting careers”

Macquarie Group CEO Shemara Wikramanayake :,

AU/NZ Graduate and Internship opportunity

locations:

Sydney Melbourne

Brisbane

Perth

Auckland

Departments:

Accounting

Asset Management

Corporate Operations

Strategy and Projects

Equities research, M&A, Advisory Treasury and Markets

Retail Banking

Risk

Technology

Key Application Dates:

2025/26 Summer Internship Program

Opens: 6 May 2025

Close: 22 July 2025 (Melbourne and Perth); 5 August 2025 (Sydney and Brisbane)

2026 Graduate Program

Opens: 25 February 2025

Close: 1 April 2025

Application Process:

Application opening and closing dates are listed on our Macquariecom/graduates for more details and to apply

Macquarieisaglobalfinancialgroupprovidingclientswithassetmanagement,retailandbusinessbanking, wealthmanagement,leasingandassetfinancing,marketaccess,commoditytrading,renewablesdevelopment, specialistadvisory,capitalraisingandprincipalinvestment

Oursizeandinternationalpresencemeansyourworkcantakeyouanywhere acrossbusinessgroups, disciplines,sectorsandborders Withemployeesandofficesin34marketsaroundtheworld,we’reatrulyglobal organisation

AtMacquarie,you’reempoweredtoshapeacareerthat isfulfillingandcreatesvalue whetherthat’sinvesting inessentialinfrastructure drivingtechnological innovation givingbacktoourcommunitiesor expandingyourexpertiseintonewareas

You’llbepartofaculturethatwelcomesdiverseideas andperspectives,thatvaluesallidentities,andthat connectsyoutoanempoweredandengagedteam,so youcanmakeyourownkindofcontribution

Nomatterwhatyoustudied,therecouldbeaplacefor youatMacquarie Weconsiderapplicationsfromall degreebackgroundsforourPrograms

Yourdevelopmentjourneydoesn’tstopatthe completionofourGraduateProgram Allofourpeople aresupportedtoinvestinthemselvesandgrowtheir impact

You’llbeencouragedtodiscoveryourowncareer pathandwillbesupportedtogrowandlearnalong thewaythroughaccesstoawiderangeofongoing learninganddevelopmentopportunities designedto helpyougrowyoursoftandtechnicalskills

OurSummerInternshipProgramoffersyouvaluable practicalexperiencetosetyouupforasuccessful careeronceyoucompleteyourstudies

You'llgettoworkonimpactfulprojects,buildnew skills exploreinterestingfieldsanddochallenging work

Workingalongsideindustryexperts youwillreceivea structuredinduction,on-the-jobtrainingand networkingopportunitieswithyourfellowsummer interns

OurProgramrunsfromDecembertoJanuaryofeach yearfor10-12weeks Weofferavarietyofinternships acrossarangeofareasforstudentswithalldegree backgrounds

SummerInternsareeligibletobefast-trackedforour GraduateProgram

OurGraduateProgramoffersalearningenvironment designedtocreateourfutureleaders We’relooking forthebestmindstohelpmanage,develop,advise, financeandtrade

Yourcareerdevelopmentstartswithatailored orientationatourglobalheadquartersinSydney You’llthenembarkona12–24monthstructured programwithon-the-jobtraining,accesstosenior leadersandacomprehensiverangeofinternaland externallearningopportunities

Wehavedesignedourgraduatedevelopment experiencetohelpyoubuildconnectionsandsetyou upforsuccess Asacohort you’lllearnfromour leadersandsubjectmatterexpertsonhowtofind purpose,buildresilience,understandyourstrengths, managepersonalfinances interpreteconomictrends andbuildameaningfulcareer You’realso empowered,withsupportfromyourmanager,toseek outotherlearningopportunitiesalignedtoyour professionalgoals

WeofferavarietyofGraduateProgramsacrossa rangeofrolesandinvitestudentsfromalldegree backgroundstoapply

Susquehanna is a global quantitative trading firm founded by a group of friends who share a passion for game theory and probabilistic thinking Our rigorous and analytical approach to decision making has led Susquehanna to become one of the largest and most successful proprietary trading firms in the world. In offices around the globe, our employees are relentless problem solvers who collaborate to make optimal decisions.

Susquehanna fosters a culture where ideas can come from anyone, regardless of experience or tenure. Employees are encouraged to challenge the norm and offer new ideas that help the firm grow Through mentorship, collaboration, and work experience, employees will continue to learn throughout their careers, while helping to develop newer team members along the way.

WE LOOK FOR STUDENTS STUDYING IN A VARIETY OF FIELDS INCLUDING

• Computer Science

• Maths

• Finance

• Actuarial Science

• Engineering

• Information Technology

Visit Susquehanna’s Raise Your Game Blog to learn more about game theory and decision science, with posts written by our expert gamers at raiseyourgame.com.

• Located in the heart of Barangaroo, our top floor office gives you some of the best views of Sydney

• Fully-stocked kitchens with free breakfast, lunch, and snacks provided everyday

• A relaxed dress code where jeans and sneakers are the norm, with shorts all summer long

• Get to know your coworkers with events like our office poker tournament, game nights, Friday night drinks, and family summer day out

• Relocation benefits available for candidates outside of New South Wales and housing provided for all interns

Our 10-week program runs from late November to early February.

The trading internship provides an in-depth exploration of option theory and decision making by using strategy games like poker. Interns collaborate closely with traders and researchers on real-world projects that impact the trading business

The technology internship places interns directly into teams that develop powerful trading systems, including large-scale computations, real-time systems, high-performance computing, and big data. This hands-on experience helps all interns gain a deep understanding of the business and build relationships with full-time employees.

We hire new graduates in trading, technology, quantitative research, operations, and equity research in our Sydney office We are looking for candidates with exceptional quantitative, analytical, and technical skills who want to use their skills to solve real-world problems Successful candidates will be data-driven and details-oriented and love solving challenging puzzles and problems.

Susquehanna hosts Discovery Day each year to give pre-penultimate year students an opportunity to learn more about what a day in the life of a trader or researcher at Susquehanna looks like. Susquehanna is renowned for its industry-leading education program, and our Discovery Day will provide you with insight into our internship and graduate programs

Applications open at the start of the year and positions are filled on a rolling basis. If you are interested in applying to our internships or graduate roles for next year, our Expression of Interest postings are currently listed on sig.com/careers.

Trading and quant applicants will need to focus on learning probability, combinatorics, and single variable calculus. Software Development applicants will be asked to demonstrate their knowledge of object-oriented programming in C#, Java, Python, or C++.

Many of our roles accept international students who are attending university in Australia, as well as permanent residents of New Zealand.

Office Locations:

Australia & New Zealand: Sydney, Melbourne, Perth & Auckland

And in all major financial centres across 50+ countries!

Departments:

Global Banking

Global Markets

Wealth Management

Asset Management

Key Application Dates:

Graduate Trainee Program (TBC – Mid march)

Applications close (TBC –beginning of April)

Women’s Insight Program *Now Open*

Applications close 10

March 2025

Women’s Insight Program is on the 17th and 18th March 2025

Investment Banking Development Challenge

Applications open (TBC –beginning of April)

Applications close (TBC –beginning of May)

Summer Internship application closing deadlines

Sydney: 5 August 2025

Melbourne/Perth: 22 July 2025

Application Process:

The application process typically involves submission of your CV, academic transcripts and a cover letter detailing your interest in the banking sector

Successful candidates will be invited to compete psychometric testing and a pre-recorded video interview

The final stage will consist of in person interviews before successful candidates are offered a role

UBS is a global firm providing financial services in over 50 countries UBS provides corporate, institutional and wealth management clients with expert advice innovative solutions execution and comprehensive access to international capital markets

UBS Australia offers advisory services and provides in-depth cross-asset research along with access to equities foreign exchange, and selected rates and credit markets, through our Global Banking and Global Markets business units Our Wealth Management business delivers individual wealth management solutions for individuals and families

We are an active participant in capital markets flow activities, including sales, trading and market-making across a range of securities

We know that development opportunities are important to you and we want to make sure you you'll be successful Thats why our graduate training program is designed to ensure that youll have an in-depth introduction to our firm and the business you will be part of You'll start your UBS experience by participating in UBS Discovery, a training program that will bring you up to speed on our industry, strategy, capabilities and culture As you move into your target business youll benefit from both business-specific and firm-wide on- and off-the-job training that will ensure you are a confident and competent contributor from day one

We value global mobility and encourage all our employees to explore opportunities across our 50+ offices worldwide

A curious mindset Drive and resilience

Accountability and integrity Collaborative team players Diversity of degree backgrounds

As a university student in your penultimate year of study this can lead you into a wide variety of opportunities within UBS Many university students can explore their pathway into investment banking by participating in our Junior Talent programs, which we have on offer yearly In fact, successful candidates from our Women’s Insight Program and Investment Banking Development Challenge may receive early 2025-26 Summer Internship offers You’ll have plenty of opportunities to develop new skills and make contacts along the way If you have a successful internship experience, you may get an offer to return for our Graduate Talent Program after youve completed your studies

For10weeks,ourinternswillberightattheheartofourbusinessandtakepartinourday-to-day operations Alongwiththeskillsandrelationshipsyouwillgain,you’llgetaninvaluablehands-on experienceofwhatitwouldbeliketoworkatUBSasagraduateandinsightintowhatmakesusagreat placetowork Finally,ifyouperformwellduringyourinternshipwithus,youcanalsoreceiveanoffertojoin ourGraduateTalentProgramfollowingyourgraduation!

OurGraduateTalentProgramlasts18to24months You’llbedirectlyinvolvedinday-to-dayoperations, workingwithprofessionalsandgainingfirst-handexperienceofourbusiness Aswellason-the-joblearning, you’llgettrainingonthefinancialmarkets ourproductsandothercorebusinesstopics Rotational assignmentsarealsoavailableaspartoftheprogram Besidesallthat,you’llattendnetworkingevents, cross-businessclassesandsocialoccasionswhereyou’llgettoknowus

Office Locations:

Australia & New Zealand: Sydney, Melbourne, Perth & Auckland

And in all major financial centres across 50+ countries!

Departments:

Global Banking Global Markets Wealth Management Asset Management

Key Application Dates:

Graduate Trainee Program (TBC – Mid march)

Applications close (TBC –beginning of April)

Women’s Insight Program *Now Open*

Applications close 10 March 2025

Women’s Insight Program is on the 17th and 18th March 2025

Investment Banking Development Challenge Applications open (TBC –beginning of April)

Applications close (TBC –beginning of May)

Summer Internship application closing deadlines

Sydney: 5 August 2025

Melbourne/Perth: 22 July 2025

Application Process:

The application process typically involves submission of your CV, academic transcripts and a cover letter detailing your interest in the banking sector

Successful candidates will be invited to compete

psychometric testing and a pre-recorded video interview

The final stage will consist of in person interviews before successful candidates are offered a role

Office Locations:

Sydney, Melbourne, Perth and Abu Dhabi

Departments:

Corporate Finance

Equities

Fixed Income Research

Key Application Dates:

Applications for our winter internship program open in February

Applications for summer internship program open in May

Application Process:

Our applications will open on the Barrenjoey website Apply with your resume and transcript

Barrenjoey is a proudly Australian full-service financial services firm We’re majority staff-owned and locally managed, with global reach through our strategic partnership with Barclays We’re a dynamic, entrepreneurial company aiming to deliver great ideas and results for our clients We’re also passionate about driving positive social outcomes for communities Barrenjoey officially launched in September 2020 with the capital and funding support of our foundation investors, Magellan and Barclays Today, we employ over 370 people and have teams based in Sydney Melbourne Perth Hong Kong and Abu Dhabi

On-site café in our Sydney headquarters

Five additional days of annual leave, to cover our end of year office closure period

The opportunity for all team members to be a shareholder

Learning and development opportunities

One day of volunteering leave per year, to give back to our community

Employee Assistance Program providing confidential counselling support

Novated car leasing, allowing permanent employees to salary package a car lease

Discounted private health insurance, gym classes and membership

Various partnerships with organisations to support the mental physical and financial wellbeing of our team

Strong academic record

Genuine interest in finance

Strong communication skills

Self-starter with a curious mindset

Strong problem-solving abilities

Ourinternshipisastructuredprogramthatofferstraining mentorshipandhands-onexperience withthe potentialtoreceiveafull-timegraduateoffer

Ourprogramoffersacarefullycuratedinduction trainingandhands-onexperiencedesignedtokick-start yourBarrenjoeycareer Thereisalsotheopportunitytoattendtrainingoverseasduetoourunique partnerships,givingyoutheabilitytobetrainedbyexternalexpertsandnetworkmorebroadly Graduate Program

Office Locations:

Sydney Melbourne Brisbane

Adelaide and Perth

Departments:

Risk, Digital, Corporate, Institutional Bank, Brand & Marketing Consumer Business & Wealth , CS&O, Finance & Accounting, Global, Transaction Services Group Treasury, Procurement, Property, Protective Services, Technology - Rotational Technology - Specialist, Transformation, Financial Markets & Treasury HR

Key Application Dates:

Application for the Westpac Institutional Bank – 03rd March

– 01st April 2025 Applications for all other programs including Internships

– Mid July – Mud August 2025 wwwwestpaccomau

Application Process:

1 Online Application – This only takes approximately 10 minutes to complete and submit online

2 Online Assessments - You'll be invited to complete a series of online assessments - in some cases this may only be 48 hours So, make sure you keep an eye out on your emails and remember to check your junk/spam folders

3 Video Interview – You’ll then be invited to complete a short, prerecorded video interview – this is where we will get to know more about you and your ‘Uncommon Mind’

4 Assessment Centre – Final stage of the application will involve a behavioural interview, a business-related case study and a group activity Maximise this experience by asking questions and find out if this is the right fit for you – it’s time to grill us too!

5 When will you hear from us? What happens now - The hard part is over so don’t stress if you haven’t heard back from us, we are reviewing your application carefully and giving it a lot of consideration Once your application has been reviewed we will reach out to you as soon as possible

We have created a Student Application Guide that shares some helpful tips to help YOU succeed!

Westpac is Australia’s first bank and oldest company For over 200 years we have played an important role in the economic and social fabric of Australia Westpac provides a broad range of consumer business & institutional banking and wealth management services through a portfolio of financial services brands and businesses Our purpose is to create better futures together – it’s what we do, who we are and why we come to work every day

We’re looking for uncommon minds to join our Graduate Program Candidates who expect to contribute from day one and have an impact Challenging and rewarding – our programs will get your career off to a flying start

Expect to contribute from day one and have an impact on the business

Expect plenty of opportunities to get involved in grad life where you can build your networks and friendships with those you work with including business leaders project leads and program sponsors

Expect to be able to give back Join numerous communities, volunteering and sustainability initiativesrounding out your whole work life experience

Get a taste of what it’s like to work with us – our Summer Intern Program is a great way to explore a career with Westpac

We’re looking to fill our programs with original thinkers and innovators from all degrees of study We embrace diversity, recognising the value people bring to us with their individual differences, qualities, ideas and insights

You must be an Australian or New Zealand Citizen or an Australian Permanent Resident at the time of application

Be in the final year of your degree or have completed an Undergraduate or Postgraduate degree within the past three years at the time of application

Grad Testimonial:

Lenna, Technology (Specialist Areas) – Cybersecurity.

1 What was the first 6 months like? What did you really enjoy?

I felt very welcomed and was given a lot of support by those in my team and my division It was heartwarming to see how everyone was excited about getting to know a new team member The highlight of the 6 months was the coffee meet-and-greets, where I had the chance to connect with colleagues in a more relaxed setting I also really enjoyed the freedom in choosing the direction of my Grad Program journey; we had the choice of securing our next rotation ourselves or to select from a list of opportunities It was empowering to have a level of control over our career development

2. Was your position with the Westpac Group Grad Program as you expected it to be? Did anything take you by surprise?

It surpassed my expectations, to be honest I received so many insights and advice from my Grad Buddy, mentors from the team and across the division I was not expecting to meet my Grad Buddy and my first rotational Manager and colleagues before I started the Grad Program, which made me feel at ease in my first week Most of all, I was really surprised about how almost everyone in the Cybersecurity division had been a former Grad and to me that says a lot about the strong workplace culture

3. Everyone is keen on maintaining work/life balance, with that in mind, what is the longest day you had to put in and did you work weekends at all?

I have been lucky enough to not have worked a long day past the typical 9am-5pm or weekends I was able to shift and split my 9am-5pm hours to fit university in between

4 On a day-to-day basis, what did you work on?

My first rotation was with the Application Security team so my day-to-day involved being upskilled in source code reviews to find vulnerabilities and technical consultations with developers My second rotation was with the Red Team – unfortunately, I cannot say much about my day-to-day due to confidentiality, but every day was an exciting challenge!

5 Have you worked on any projects at Westpac Group, if yes, what projects?

I worked on a project with three other Grads that were in the same division as me, but from different teams It was a project to identify any inefficiencies in the current processes across the division and to come up with suggestions on how these processes could be improved This was a great opportunity for us to really get to know the ins-and-outs of our division, and to make our mark

Join our 10-week paid Program Designed so that you get a real insight into the diverse opportunities at Westpac Group – the summer intern program gives you what you need to make an informed career decision The program runs from Early December to February for 10 weeks and gives you the opportunity to be considered for the graduate program

Summer Intern Programs Streams on Offer

Corporate & Institutional Banking (CIB) - Fast-track your career with CIB, by building relationships and developing relevant market expertise to tailor solutions to meet our customers’ needs

Financial Markets & Treasury (FM) - Play your part in FM supporting our customers navigate the complexity of financial markets while managing the bank's key market and funding risks

Global Transaction Services (GTS) - Work in a dynamic environment centred around delivering working capital solutions for the nation’s largest corporate and institutional clients as well as innovative and cuttingedge payment solutions for all of Westpac Group

When you start: You’ll start with us as a permanent employee in February each year Your program will vary based on the business area where you choose to work Explore the business area choices above to find out more

Throughout the program: We’ll provide loads of learning and support to help you make the most of the experience The program is structured to help you identify your focus areas Tailored training sessions build and strengthen your technical and soft skills - accelerating your personal and professional career development

The day to day: You’ll complete a rotational program to help you to learn about different parts of your business area It’s packed full of different roles, teams and project experiences At the end of your program, you’ll be supported to find a role that best suits your capabilities and interests

Office Locations: Sydney Melbourne Brisbane Adelaide and Perth

Departments:

Risk, Digital, Corporate, Institutional Bank, Brand & Marketing Consumer Business & Wealth , CS&O, Finance & Accounting, Global, Transaction Services Group Treasury, Procurement, Property, Protective Services, Technology - Rotational Technology - Specialist, Transformation, Financial Markets & Treasury HR

Key Application Dates: Application for the Westpac Institutional Bank – 03rd March – 01st April 2025 Applications for all other programs including Internships – Mid July – Mud August 2025 wwwwestpaccomau

Application Process:

1 Online Application – This only takes approximately 10 minutes to complete and submit online

2 Online Assessments - You'll be invited to complete a series of online assessments - in some cases this may only be 48 hours So, make sure you keep an eye out on your emails and remember to check your junk/spam folders

3 Video Interview – You’ll then be invited to complete a short, prerecorded video interview – this is where we will get to know more about you and your ‘Uncommon Mind’