5 minute read

Expert Panel Predicts at Least Five Years Until Connecticut’s Economy Recovers from the Coronavirus Pandemic

By Hannah Providence

Connecticut Governor Ned Lamont has recently graced news headlines, optimistic about reopening the economy in May. “We can start thinking about how we’ll get our businesses back to business” he tells Fox News. The media echoes this notion as citizens yearn for assurance of a “return to normal,” But, even if businesses begin to reopen, a state of “normal” proves to be farther in the future. Will the Connecticut economy ever recover from the coronavirus pandemic? If so, how? When?

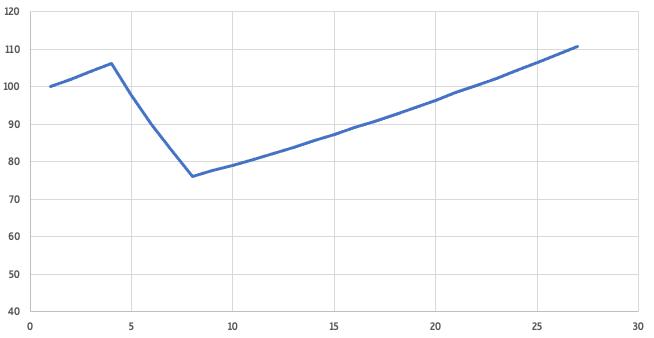

Figure 18: “L-Shaped” Recovery

Four of the five panelists voted the “L-Shaped” recovery as the most probable. The trend of GDP in this case is shown below.

The University of New Haven arranged for five expert economists and business professionals to help answer these looming questions. The panel consisted of two former trading partners at major banks, one professor of economics, one former CEO of a Connecticut-based global manufacturing firm, and the owner of a global consulting firm, also based in Connecticut.

Figure 19: Malaise

One panelist voted the “Malaise” trend as the most probable. In this instance, once GDP declines it remains stagnant at the minimum level.

Conducting a study using the Delphi technique — an iterative research method designed to predict practical solutions with limited data — the experts were able to narrow down the trends in the economy’s output, as measured by GDP, to two possible scenarios.

An “L-Shaped” recovery, in which GDP will decline drastically at first, but slowly climb back to the status quo. The majority of panelists determined this is the most probable trend and should occur over five years.

The minority vote ranked the “L-Shaped” recovery as only the second most probable trend, saying that Connecticut will not be able to recover so quickly. Instead, in this scenario, GDP will more than likely continue to drift below the pre-COVID level well beyond five years. This GDP trend is titled, “Malaise.”

The panelists defended their reasoning saying that this five-year maximum recovery could happen because of a few important factors:

• Safety precautions. The promise of a vaccine in the next few years will allow citizens to feel protected when leaving their home.

• Geographical advantages. Organizations will leave New York (the state leading the U.S. in coronavirus cases and deaths) in search of a safer location that is still in close proximity. Connecticut is one of the prime locations.

• Thriving service sector. Major players in Connecticut’s GDP will thrive because of the pandemic. Finance, professional, and other business services can operate remotely and are critical in recovery.

Getting back to the GDP level before the pandemic will not be easy. The experts predict that Connecticut will increase taxes to make up for current expenditures. Additionally, some of the dislocations taking place in the national/global economies will also have negative effects on Connecticut. These include disruption in supply chains, severely affected sectors like travel (including airlines) and hospitality taking a longer time to get back up to speed, and the unfolding credit deterioration in the below investment grade market, which is creating strong headwinds for medium-sized companies. The pandemic may also scare citizens into a period of excessive precaution when the economy reopens, where leaving their homes and engaging in once-normal activities are fewer and farther between, especially until effective therapeutics and vaccines are discovered and made available to the general population. All of these examples are evidence of a slow climb back to recovery.

However, there is a chance that CT will take longer than five years to get back on its feet, one expert points out. The state is not known for making wise decisions economically. In fact, some parts of the economy are still recovering from the 2008 market crash. So, the question is posed: if Connecticut can’t fix what happened in 2008, how will it be successful in recovering from this pandemic?

COVID-19 continues to keep government officials and citizens alike on their toes. But the predictions of these experts help visualize the state of Connecticut as we journey through this pandemic — and as we recover.

To learn more about the process of the study, see below:

The University of New Haven gathered five experts and identified five possible forms of economic recovery (or lack thereof) as they relate to GDP.

The Delphi technique requires all opinions of the experts to remain anonymous. Because of this, experts were asked to rank the five models of GDP from least to most likely to occur and send their submissions to a facilitator with an explanation behind their rankings. The facilitator in this case was a University of New Haven economics student.

Their judgments were analyzed quantitatively and qualitatively using data from both the rankings and explanations. These findings were summarized in a report that panelists had a chance to review prior to the panel discussion. In the initial round of ranking, the results were roughly evenly split among “L-Shaped,” “Malaise,” and a third scenario, “Whack-A-Mole.”

The discussion gave experts a chance to defend, via Zoom, the probability of some of these models before voting again for the most likely outcome. The facilitator gathered the votes anonymously and presented the results to the group.

Voting did not stop until panelists were able to reach a majority vote. This happened after the third round.

It should be noted that all experts agreed the economy is unlikely to bounce back from the current slowdown quickly and in a short period of time (“V-shaped”), and, on the other extreme, equally unlikely to fall into a deep recession (“Fubar”). The other model, “Whack-A-Mole,” — deemed the third most likely event to occur — implied that GDP would recover only to drop again as the coronavirus flares up periodically over time.

Hannah Providence ’21

Major: Economics

Hannah is an economics major at the University of New Haven with a minor in professional and technical writing. She is a part of the university’s Fast-Track Program and Honors Program. Hannah is a Liberty Initiative scholar, involved in research with the Economics Department at the University.

Hannah currently interns for Yale University in its ITS Department’s Business and Finance Office and the University of New Haven with the Admissions Department’s Enrollment Marketing team. This summer, Hannah will be interning remotely for the Federal Reserve Bank of New York.