37 minute read

Steve Jones Sales Director, MIDEL, Singapore 38 Ashok Menghani Business Leader, Schneider Electric, Singapore

Despite Safer, faster, greener trains with MIDEL

An exclusive talk with Steve Jones, Sales Director, MIDEL, Singapore

Advertisement

Meet Steve Jones, Sales Director of MIDEL that leads the way in delivering transformer fire protection, environmental safety and cost savings for utilities and power and distribution transformer manufacturers since 1970.

Jones is a proven ester technology expert and worked with the largest and most respected companies in the transformer industry to help them deliver against their energy mega-trend challenges. He has hands-on experiences stretch's across distribution to large power transformers as well as specialist applications in traction and renewable energy on a global scale.

In a recent interaction with Urban Transport News, Jones shared very insightful thoughts about how MIDEL contributing to the world with safer, greener and sustainable solutions.

First, please tell our readers about your professional journey in the industry?

Having been born in a small town in the UK famous for its role in the birth of the railway age, trains have always been part of my life. Amazingly, the railway station in Crewe where I am from was built in 1837 – it is incredible to imagine what rail travel must have been like in those days and what a great engineering story to picture George Stephenson’s rocket passing through it. I began my professional career with a local rail company as an apprentice working on manufacturing and repairing all types of railway equipment from signalling to large bogie sets on rolling stock. I always had a great sense of pride when travelling on a train with family and friends knowing that I had made a little contribution to the safe and reliable operation of the journey. I then went on to spend the next 10 years supporting the development of rail technology and more recently traffic systems around the world. Now I still champion safer railway technologies here in Asia and have been fortunate to support innovation at leading operators such as Network Rail in the UK, SNCF in France and CRRC in China with its High-speed rail system.

What is the vision and mission of M&I Materials and how the company is planning its expansion in the Asia Pacific Region?

M&I Materials is a leader in commercialising materials for industry and science and proudly operates in over 70 countries. The brand in focus here is MIDEL ester transformer fluids and in Asia Pacific, our mission is to educate engineers on how challenging the status quo can make a significant difference to the performance of energy systems. It isn’t acceptable anymore to settle for ‘we have always done it that way’ – we want to greatly improve rail engineering governance. We are fortunate to have some of the worlds’ most advanced experts in this subject matter and help organisations make the change to ester fluids and give them the confidence to embrace the technology to the fullest; we have no plans to stifle the momentum that we have created.

In line with the United Nations sustainable development goals, one of our principal aims is to make energy systems more sustainable and reduce the impact on our planet which here means greener railways. If you look at alternative dielectric technologies that could be considered for traction or trackside such as mineral oil or silicone fluid, we cannot achieve that. To invest or specify in these materials makes little sense given the global appetite for them is in decline. This is what drives our passion for helping rail stakeholders make the transition to a more environmentally friendly rail network and our MIDEL ester fluids can be a catalyst for this change.

Please list some of your innovative products that are being used for the Railway & Transportation Industry? Who are your major clients in India?

Our synthetic ester transformer fluid MIDEL 7131 is the gold standard material for use in all traction and trackside systems. Although it debuted in rail back in the 1980s, we are still finding ways through strong application engineering to use it as a driver for innovation; helping equipment manufacturers optimise their transformers making them lighter, smaller and even more reliable. As rail travel continues to push the boundaries with faster trains, its application because even more critical given its built-in technical properties. No other dielectric fluid can perform at such a high level across such a demanding load profile which is why it is trusted by rail engineers the world over. In India we have helped the authorities the implement best practice from the European standard EN 45545 to raise the bar on safety provisions and already list leading operators like Delhi Metro, and Mumbai Metro as our long-term partners.

How the company ensures the quality of products in the global market? How do you differentiate your products from other competitors in the market?

The highest barometer for quality is that which you set for yourselves internally, and we are not prepared to compromise on that. Of course, our MIDEL products confirm to the strictest safety, quality and environmental standards and we make it our business to ensure everything is independently verified and tested thoroughly in the application. Without that how can you deliver confidence to the rail industry and the safety of millions of passengers every day? It is a very dangerous mentality in such a safetycritical industry to cut corners and compromise safety and performance for the sake of a tempting, small benefit in price. Core to our differentiation is how we can help the rail supply chain implement proven technology that is used in other parts of the world and that is something our team enjoys doing, as an example we have done this successfully in India. We regularly work closely with specifiers on how they can save valuable time by learning from what other leading rail operators have already done and fast-track their journey to make sure the specifications are current and future proof with the best dielectric materials to not only meet the demands of today but also in preparation for what we can expect for many years to come.

How Covid-19 outburst affects the M&I Materials’ business and the steps you have taken to overcome it?

The pandemic has affected many things in both our personal and professional lives, and that has meant we have had to adapt. The transition to digital interactions has been challenging but something we have embraced and our team in India have not missed a beat in attending to the needs of our customers. We have re-calibrated our approach and have produced lots of thought leadership content such as the 2 webinars we recently hosted on both rail infrastructure and traction and rolling stock. If you haven’t yet seen them, you should schedule it in your diary to do so and both are available on demand.

Interestingly, it has also allowed organisation and individuals to reassess priorities and that’s where our MIDEL technology has benefitted. It was all too easy before for engineers to be ‘occupied’ with solving the problems or challenges of ‘that day’ whereas now that the distractions are less, they have time to properly evaluate what is necessary for change and make better engineering judgments. It is quite common now for us to hear technical experts say, ‘why didn’t we do this sooner?’

We of course miss the physical interaction with customers, but right now we have a bigger purpose to serve in ensuring we unite to beat the virus and stop the spread. Like in our MIDEL products, safety should always remain the highest priority.

What are your expectations and presumptions on business growth in Post-Covid?

Our growth journey has not stopped during the pandemic and I do not see any reason for that to change postCOVID. We are very well positioned to help companies in both the energy space and more specifically rail make positive changes on safety and sustainability. We are passionate about making a difference and are proud to be doing this with various Indian railways and Metro rail projects. The government has made some impressive commitments to the future of rail transportation and have set aside significant investment to make those plans a reality. MIDEL will be there every step of the way to ensure it becomes an engineering success.

Anything else you want to share with our readers?

If MIDEL is new to you don’t hesitate to get in touch with our experts to understand more. You may like to get in touch with our Indian Team led by MIDEL Expert Mr. Amit Kumar.

How 5G will transfor m Rail Transport

The consumer messaging around 5G is well known: it will deliver better, more immersive experiences than previous generations while simultaneously enabling new services and capabilities. However, 5G can offer much more than this. It is a revolutionary technology that enables networks to perform at scale, adapt at pace and unlock new revenue streams. It will help transform transport, health, agriculture, manufacturing, entertainment, mining and other industries.

Its combination of speed and responsiveness – while seamlessly connecting people, machinery and automated processes – will provide solutions to some of society’s most compelling challenges.

5G will cover a wide range of use cases and related applications. These uses include internet of things (IoT), artificial intelligence (AI) and machine learning, augmented and virtual reality (AR and VR) and edge computing. While these technologies exist today, the networks currently supporting them constrain their full potential. The technological advances that 5G enables will differ by industry and application. However, all will allow data and communications solutions to create more efficient and sustainable business processes, improve consumer services and enhance users’ quality of life.

This explores 5G’s impact on rail transport operations and how it can help transport authorities restore ridership and revenue. Our next blog will further explore how shared 5G infrastructure can generate shared benefits. Transport authorities and their partners, such as mobile network operators and associated service providers, all stand to prosper from the opportunities 5G will create.

Shaun Newton Head - Products BAI Communications

5G: Built for Rail

COVID-19-related changes to consumer behaviour have accelerated the need for 5G. Transport authorities are under increased pressure to do more with less, facing drastic declines in passenger numbers and subsequent revenue losses. Rebuilding public trust and confidence in rail systems’ safety won’t be easy but is crucial to restoring profitability. 5G offers mission-critical capabilities that will

facilitate this task.

Currently, most transport systems worldwide are using – or are upgrading to – wireless control systems such as communications-based train control (CBTC), positive train control (PTC) and the European train control system (ETCS). Most of these systems still rely on cellular or WiFi networks designed in the 1990s. They’re proven technologies, but they can’t scale to support modern applications and use cases.

One result is that transport operators often install multiple different systems to handle the various safety, operational and passenger functions. These include voice, signalling, condition monitoring, closed-circuit TV (CCTV), heating, ventilation and air conditioning (HVAC) monitoring and passenger Wi-Fi systems. Installing a single wireless infrastructure – such as 5G – to manage all these functions simultaeneously, eliminates incompatibilities and maximises interoperability between systems.

5G offers significant improvements to latency, concurrent connection numbers, session transfer speed and reliability, and power consumption. These improvements make 5G ideally suited to connecting IoT sensors and devices. Bringing these onto a single, unified network will generate economies of scale and significant ‘network effects’ that will amplify their value and utility.

The 5G promise

On an operational level, 5G delivers efficiency, cost, productivity and security benefits. It enables technicians and operators to monitor railway networks in real-time. It also allows analysis of various systems related to power, passenger flows, facilities such as lifts and escalators, ticketing, signalling, staff and contractor management, and more.

Unlike other generational upgrades, 5G isn’t just about providing passengers with better download speeds and streaming while on board. Critically, it enables innovations that will restore public trust in mass transit, improve profitability and even create new revenue streams. These capabilities mostly revolve around real-time data feeds to provide service and rail network updates. They also include more pertinent safety-related information such as monitoring mask wearing, social distancing and on-train seating density.

Other adjacent innovations would enable passengers to connect to services outside the rail network. Such connections allow multimodal travel coordination and scheduling, even including online shopping and services. Coordinating click-and-collect groceries, dry-cleaning pickups or takeaway food orders etc. will help make the daily commute fast, convenient and time-saving. The Connectivity outlook report 2020 shows that the benefits of advanced technology are strongly desired, tellingly 85% of rail users are interested in 5G, and 83% support their city investing in a 5G network. 95% of rail users would be more likely to use the rail network in their city if technology-driven solutions were implemented.

Thus, the question for operators is no longer whether they should upgrade their networks to 5G – it’s when.

5G: Railway requirements are built-in

5G offers a seamless upgrade path from existing global systems for mobile communications-railway (GSM-R) wireless services for railway operators. GSM-R is a version of the 2G standard with additional requirements to make it suitable for railway systems. For almost three decades it has formed the backbone of railways’ wireless networks. But it’s out of date, and a new standard is required.

Industry bodies abandoned work on a 4G-based standard called LTR as 5G became imminent. Instead, work started on the Future Railway Mobile Communication System (FRMCS), a set of railway-specific requirements for 5G including latency, bandwidth, security and safety.

These requirements are part of the 5G standard, meaning it’s railway-ready from day one.

Better yet, many of the legacy 2G systems and 5G networks often share the same frequency bands, making upgrades far less disruptive than with previous generations. FRMCS offers a roadmap and upgrade path for public operators or private networks. Many railways have their own private 2G, GSM-R networks and it provides them with a seamless upgrade path to roll out 5G.

Operators can deploy new 5G systems alongside their 2G equivalents and switch over when they’re ready. There’s no need to ‘forklift’ out old systems or manage massive power network buildouts and hard cut-overs.

With 5G networks in place, operators will find they can connect seamlessly to other 5G devices. These include remote sensors on bridges, weather stations and traffic cameras. These connections will enable improved situational awareness and make it possible to anticipate maintenance needs and traffic surges, and adjust service frequencies and arrival times.

Finally, 5G wireless makes edge computing viable for transit operators. Edge computing decentralises servers and data centres to improve performance. With fast, lowlatency 5G connections, moving trains will transmit data as they pass a station or platform. These data transfers will keep essential systems updated and offer passengers fast and seamless streaming and connectivity.

5G: Enabling the stations of the future

5G makes possible the station of the future, where connected services combine to create a seamless travel experience.

Stations of the future will help passengers feel safe and connected. They – and the data networks they run on –facilitate the mobile, distributed modes of work we’re adopting in response to the COVID-19 pandemic.

Biometric ticket gates, information kiosks, live service apps, connected CCTV cameras and pervasive IoT devices will create an environment without physical ticket barriers. Navigation information to help travellers with accessibility requirements will transform stations into free-flowing and data-rich environments. Real-time data will stream to mobile apps, AR or even VR devices, headphones and smart glasses.

Station infrastructure will connect to low-cost wireless networks for real-time condition monitoring and predictive analytics. Elevators, escalators, HVAC systems, passenger announcements and information screens, and ticketing systems will share data and allow operators to adjust and optimise services in real-time.

Crucially, the tipping point for 5G is coming. In 2021 we will see greater device uptake by consumers. By 2022, travellers will expect continuous 5G connectivity throughout their journeys. • Connected sensors which can monitor rail networks • Warnings about out of order escalators, elevators and other disability access options • ‘Predictive maintenance’ systems which monitor the health, efficiency and safety of rail vehicles

These priorities reflect the public’s growing awareness that smart, data-driven systems can enhance their travelling experience and make their rail networks more efficient. 5G wireless, edge computing and other advanced technologies will enhance these systems.

Transport authorities that engage early with 5G will position themselves to roll out services, rebuild customer trust and restore lost revenue streams faster than those who fall behind. It’s not merely a matter of having ‘the best’ new technology; instead, it’s a matter of committing to efficient operations, improved safety and best-in-class customer relationships. These are the fundamentals of any successful business, making a commitment to 5G a business-positive, revenue-restoring, customer-centric ‘must’ .

While most network providers’ 5G deployments have focused on adding more network capacity, transit authorities are beginning to realise its potential to enable new operational solutions.

The public understands these benefits too. The Connectivity outlook report 2020 asked rail users to prioritise various connected systems. Their top three responses were:

Their improved performance will create new opportunities to share information, improving operational efficiency and customer experience.

5G and edge computing: an ideal combination for rail networks

One of 5G’s most promising enablers is the combination of ubiquitous connectivity with edge computing. Edge computing is a distributed network topology that uses localised infrastructure rather than centralised storage and

compute. It enhances network performance by locating data and applications closer to the endpoints they serve. Local processing maximises 5G’s capabilities, including improvements to latency, concurrent connection numbers, session transfer speed and reliability, security and power consumption.

This decentralised approach is well-suited to rail networks with their wide geographic distributions and the requirement to connect moving trains. With 5G and edge computing, operators won’t need expensive servers installed onboard their rolling stock to handle critical applications.

Track maintenance illustrates the potential benefits. Currently, most operators use a separate car for track inspection. By combining 5G and edge computing, every train can become a track inspection vehicle, with connected sensors generating high volumes of data in real time. In turn, this data allows for more granular analytics and a better understanding of how different parts of the physical network respond to use.

Neutral hosts: shaping connectivity’s future

Though 5G and edge computing are powerful when combined, deploying both at scale requires complex and dense networks, including more antennas, fibre, power, wireless cells, servers and data centres. The challenge is ensuring that these networks are designed, deployed and managed effectively.

In the rail transport context, trackside infrastructure upgrades can provide the transmission and backhaul capacity needed to deliver high-quality telecommunications services that fit today’s needs and are ready for tomorrow’s. The capital and operational investment required for these networks are significant. In most cases, network ownership and management are not feasible for a single Mobile Network Operator (MNO) to absorb, especially in an environment of increasing capital constraints.

One solution to these technical and financial challenges is to adopt the neutral host model. A Neutral-Host Network (NHN) is a third-party-owned cellular network that provides wholesale mobile coverage solutions to MNOs or other communications service providers (CSPs).

The NHN model is flexible, and in addition to upgrading, building and owning networks, neutral host providers can partner with transit authorities to build jointly owned private networks. This flexibility makes it easier for transit authorities to evolve their services and shield partner organisations from design, operational and other complexities, such as multi-operator support, edge-core integration and network optimisation. For transit authorities and MNOs, accessing a single, unified network infrastructure avoids the time, cost and potential service interruptions associated with each MNO installing their network hardware on platforms and trains.

These options represent various forms of network sharing that can enhance competition, improve utility for consumer and business mobile users, and enable government and municipal authorities to achieve their strategic, financial and other objectives.

Integration and opportunity

The neutral host model can play a significant role as cities learn how to manage COVID-19 and prepare for future public health concerns. Beyond ‘stations of the future’, we must build ‘cities of the future’. These cities will feature pervasive connectivity with smart devices gathering and sharing data in real-time. NHN providers bring such ambitions within reach by building the infrastructure and technology backbone required.

Respondents in the Connectivity outlook report 2020 nominated ‘transport and mobility’ as the top-ranked service they believed could be improved with better technology and connectivity. Similarly, 86% of rail users agreed that an ‘evolved’ rail network that allowed them to work effectively as they travelled would benefit them.

Public transport is a critical part of a city’s prosperity and its citizens’ wellbeing. Transport authorities are responding by evolving their offerings beyond getting people from ‘A to B’. Responding to the public’s desire to be connected while travelling and feel safe and secure while in transit is the key to restoring ridership and revenue.

Thus, transit authorities must design their networks to accommodate future demands as well as current needs. Designing with the future in mind will deliver the level of service demanded by consumers today and provide foundational network infrastructure for new and emerging services and applications.

From MNOs to transit operators and municipalities, there are many cases where neutral host models make good commercial sense. Innovative technologies and shared infrastructure can enhance consumer, business and public safety connectivity. By opening up areas that otherwise would be difficult to service and providing continuous, high-quality connectivity we can ensure that today’s networks are ready for tomorrow’s demands.

Ashok Menghani Business Leader Schneider Electric, Singapore

Ashok Menghani is a Business leader, an Entrepreneur, Firmly believes in Channels and Alliances, Services, Digital transformations and market share growth ensuring an accelerated and sustainable business. He is currently working with Schneider Electric, Singapore and taking care of the Singapore market including MRT, Singapore.

At the outsets, please accept our heartiest congratulations on the completion of your 10 years journey in Schneider Electric. Kindly tell our readers about your professional journey in the industry.

Thanks for the greetings.

Schneider Electric is the most progressive company in Energy Management and Automation space. I found many amazing leaders, colleagues and subordinates throughout the journey.

Almost every year there were new product launches or upgradations. If I look back there is a full transformation, thanks to EcoStruxure platform of connected products, edge control, apps and analytics.

Tell us about your role and responsibilities in Schneider Electric and your long-term vision for the company?

This is something great in Schneider electric, one can move to new role and responsibility every 3rd year onwards.

I joined as in-charge for Universal Enclosures activity in the year 2011 and established the channel network, built up the winning team etc.

3 years later I shifted to the “Power Products” business unit taking care of the International business in Greater India, Greater Thailand and Greater Vietnam. The global experience and working with a cross-cultural team offered great learnings to me. This was the time I become an inclusive leader with International exposure.

In the year 2017, I was given the responsibility of Channel management and transformation in Singapore.

The experience and exposure helped me to do the daunting task successfully and I look forward to coming back to India as and when I get the chance.

India is the fastest growing economy and I wish to be part of the Indian transformation journey for next 8-10 years before I retire.

Make-in-India, Hi-speed railway network, Metro railways, Smart Cities mission are some of the key initiatives which will not only transform Indian infrastructure but also put India as the factory for the world.

In short the learnings from global exposure, I would like to re-utilized for the Indian growth saga.

Please highlight some major contributions of the company in the railways and transportation sectors.

My Colleague Ashutosh Shukla, Director- Transportation & Mobility, is leading the Railway segment in India.

I can say that Schneider electric is offering solutions to the challenges of metro rail in India very successfully.

We offer open, interoperable, IoT-enabled system architecture and platform that delivers enhanced value around safety, reliability, efficiency, sustainability, and connectivity.

Schneider Electric solution aids Metro Rail networks in different areas like power delivery, environmental control, communication and services.

Recently the company has launched EcoStruxure Rail in India. Kindly highlights some salient features of this innovation and how will it help the rail & metro sectors?

EcoStruxure Rail is an enterprise-level end-to-end digital solution for metro rail to create collaborative environments for a safe, energy-efficient, reliable and sustainable rail infrastructure operation. This solution is targeted towards providing real-time awareness breaking silos, resulting in safe, comfortable, on-time operations, and effective passenger services into the Indian market. The advanced IoT-enabled EcoStruxure TM platform will aid metro rails in four main areas: power delivery, environmental control, communication, and services. It also increases the resilience of the system in case of cybersecurity attacks by providing solutions to avoid and detect intrusions at all levels: control center, telecom system and field devices. It improves the smart management, electrical safety, and atmosphere of Metro stations, as well as the operation of their systems, with solutions for Traction, Signaling, Distribution Power and Construction Management.

What are your takes on the metro rail, high-speed rail, RRTS, and urban transportation revolution in India?

Railways infrastructure has always been a lifeline for Indian socio-economics. Now we have the task to be the “Factory for the world” under the “make in India” mission.

Railways to provide economical, fast transportation till the sea-ports. Dedicated freight corridors are all set to do the job.

RRTS and Metro to ensure faster and convenient movement of the people to the workplaces.

How are the Covid-19 pandemic affecting the overall business of Schneider Electric and what are the strategies being adopted to minimize its effect on the company's business?

Covid19 is the most difficult period for India and the world. My heart goes with the customers, friends, colleagues and family as some lost their nears and dears. We have come up with solutions and support for the new normal. Our technology is helping many segments including railways to recover faster and reinstate operations.

Anything else you want to share with our readers.

I am very close to the Indian Railway.

In my father’s generation, almost everybody comes from Indian railways be it operations, commercial or signaling. My childhood was spent alongside railway tracks in railway quarters. My beloved father was Station Master when he retired.

I would like to tell one and all to remain resilient. The tough phase will be over soon.

Reach out to us for the newer technological solution, be it your home office or Institutional site.

As the tag line of Schneider Electric is “Life is On” and we ensure that life is on at all times.

Alain Spohr Managing Director, Alstom Transport (India & South Asia)

Climate change is the most crucial issue of our time and its implications are global in scope and unprecedented in scale. Growing urbanisation is one of the key contributors to climate change. Although the threat is poses to humanity is a global one, Asia may be particularly impacted. The continent is a global leader in rapid urbanization as it is home to 19 of the world’s top 20 cities, according to JLL. Additionally, 99 of the 100 most polluted cities in the world are located in Asia. The paradox is that a typical marker of economic progress is growth in demand for private transport. Unfortunately, it is estimated that Asia’s motorised transport will be responsible for 31 percent of the global aggregate CO2 emissions by 2030, up from 19 percent in 2006. The challenge for the continent is to ensure Life Quality Index of its cities, while maintaining economic growth and acknowledging the need for environmental sustainability. According to a recent study, Green transport is expected to overtake private cars in major cities across the world by 2030. India is swiftly taking great strides towards green mobility and transport. The efforts by the government and players in the mobility space are currently complying with the key objectives of sustainable development; enabling energy transition and climate change mitigation in transport, acting as responsible entities and making a difference to the lives of local communities, while simultaneously progressing towards a greener future. There is an urgent need to increase collaboration across sectors and within government departments in order to raise collective ambitions and develop specific policy pathways for transport.

Emissions of pollutants into the air has a significant negative impact on the environment. According to the annual 'State of Global Air 2020' report, around 6.7 million deaths were reported globally due to long-term exposure to air pollution in 2019 with China (1.8 million) and India (1.6 million) together accounting for more than half of such deaths. Researchers from McGill University stated that over half of the world's population lives without the protection of adequate air quality standards. Nitrogen dioxide (NO2) and particulate matter are two of the most dangerous air contaminants to human health. While stating that air pollution is globally the fourth highest cause of death, the report suggests that it is the largest risk factor for deaths in India.

After years of warnings, recent developments suggest that climate change is finally being taken seriously by governments and individuals. The challenge is huge and requires a massive change in mind set. Governments will need to make radical moves to mitigate the effects of the crisis, and one key area where effective action can be taken is public transport. With the global demand for passenger traffic expected to increase by more than double between 2015 and 2050, there is an urgent need to take substantive steps to cut emissions from transport. Sustainability is going to be the biggest game changer going forward. Building up infrastructure and developing energy-efficient, sustainable transport systems will be a key solution for curbing CO2 emissions. This can be achieved by designing and delivering sustainable global railway solutions that will contribute to limiting the rise in global temperatures to under 2°C and benefit everyone they serve. Decarbonizing transportation is integral to promote sustainability and positive climate change.

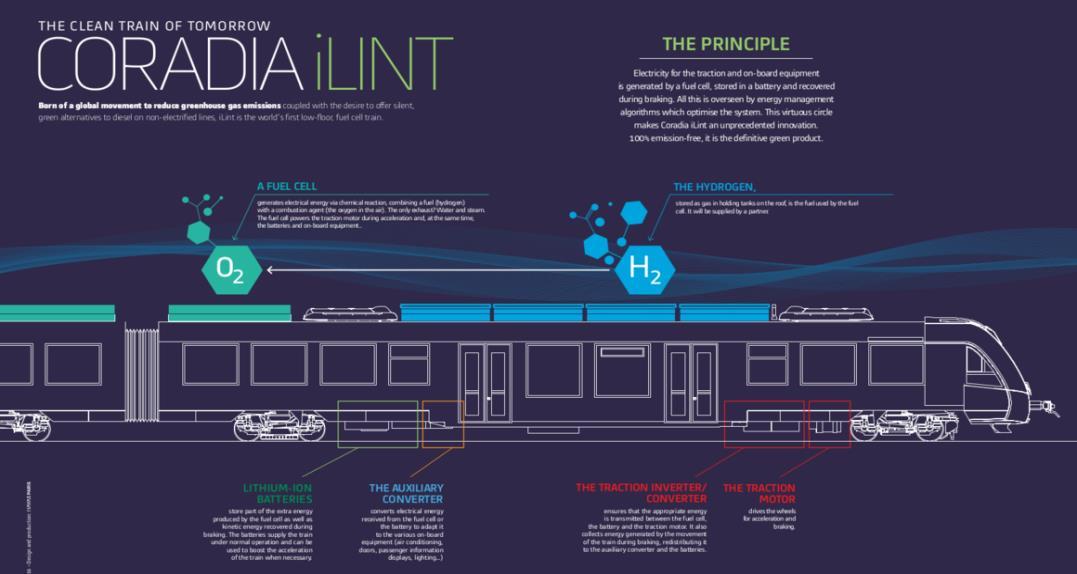

Leading societies to a low carbon future, Alstom develops and markets mobility solutions that provide the sustainable foundations for the future of transportation. Hydrogen is seen as a low-emission and efficient alternative to diesel, which ensures that the trains are environment friendly. When it comes to hydrogen cell powered trains, Alstom is

the only company in the world to have a product on tracks and not merely on the drawing board. The Coradia iLint is the world’s first passenger train powered by a hydrogen fuel cell, which produces electrical power for traction. This zero-emission train emits low levels of noise, with exhaust being only steam and condensed water. It is a perfect illustration for the company’s commitment to designing and delivering innovative and environmentally friendly solutions.

In line with the aim to facilitate a global transition to a lowcarbon transport system, it was at InnoTrans 2016 in Berlin that Alstom presented the Coradia iLint for the first time. The launch of the CO2-emission-free regional train that represents a true alternative to diesel power positioned the company as the first railway manufacturers in the world to develop a passenger train based on hydrogen technology. The Coradia iLint is special for its combination of different innovative elements: clean energy conversion, flexible energy storage in batteries, and smart management of traction power and available energy. Specifically designed for operation on non-electrified lines, it enables clean, sustainable train operation while ensuring high levels of performance. And just two years later, in 2018, the iLint entered into commercial service in Germany. This is the first time in the world that commercial trains powered by hydrogen-based cell have gone into use for transporting passengers. This zero-emission train is silent and only emits steaming condensed water and any excess energy is stored in iron lithium batteries on board.

This technology is gaining momentum quickly. Alstom has performed ten days of tests of the Coradia iLint hydrogen fuel cell train on the 65 kilometres of line between Groningen and Leeuwarden in the north of the Netherlands. The tests follow 18 successful months of passenger service on the Buxtehude–Bremervörde–Bremerhaven–Cuxhaven line in Germany, where total of 41 Coradia iLint have already been ordered. The latest tests make the Netherlands the second country in Europe where the train has proven itself a unique emissions-free solution for non-electrified lines. Alstom has received follow-up orders in Italy and France, led a pilot project in the UK and ran successful test runs in Austria, and Germany. Other countries already looking into buying their trains including U.K, Netherlands, Denmark, Norway, Italy and Canada.

The iLint was designed by Alstom teams in Salzgitter (Germany), the centre of excellence for regional trains, and in

Indian Railways in particular is committed to positive climate change and has undertaken various initiatives to meet its goal of transforming into a ‘Net Zero’ Carbon Emission Mass Transportation Network by 2030. It is making several coordinated moves towards sustainable mobility, which will play a key role in helping the government and businesses kickstart economic revival with renewed energy. Hydrogen fuel cell trains could be the next big thing, and this can be a technology that India looks forward to adapting in the coming years. As part of efforts to find alternative sources of fuel to power its trains, and to reduce reliance on fossil fuelbased energy sources like diesel and electricity, Indian Railways is experimenting with hydrogen fuel-cell-based trains as well as electrifying its tracks. This will address the energy requirements, improve its operating ratio and reduce the environmental impact.

As a global leader in sustainable mobility with proven expertise in building Hydrogen fuel-based trains, Alstom can support the government in achieving its emissions reduction targets and pave the way for improved and enhanced sustainable mobility solutions. Tarbes (France), the centre of excellence for traction systems. This project benefitted from the support of the German Ministry of Economy and Mobility and the development of the Coradia iLint was funded by the German government, as part of the National Innovation Program for Hydrogen and Fuel Cell Technology (NIP).

India’s move towards hydrogen powered trains

Development Financial Institution (DFI): Setting up of the National Bank for Financing and Development (NaBFID)

Debashish Mallick MD & CEO, IDBI (Asset Management)

The Bill for setting up the National Bank for Infrastructure Financing & Development (NaBFID) is now passed by the Lok Sabha. The Bill envisages setting up of a new government-owned Development Financial Institution (DFI) to facilitate flow of long-term funds for Infrastructure projects. The objective also includes issuance of guarantees and facilitating development of a bond and derivative market. Proposed Tax breaks will enable increasing cost-effective resource-raising. Infrastructure projects are predominantly financed by banks. Shorter term resource (liability) base of Banks, vis-àvis long gestation period of projects (assets) makes an asset liability mismatch endemic in such bank finance. Corporate bond market, despite numerous initiatives is yet to attain vibrancy. Availability of medium-/long-term funds for infrastructure projects has, therefore, experienced its fair share of difficulty. An institution to provide funds with commensurate tenor is expected to present a viable alternative for funding infrastructure. However, a DFI that is concentrated exclusively on medium/long-term infrastructure lending is likely to face substantial operational challenges.

History of DFIs in India

India had set up extremely successful DFIs such as Industrial Finance Corporation of India (IFCI) in 1948, Industrial Development Bank of India (IDBI) in 1964 and Industrial Credit and Investment Corporation of India (ICICI) in 1955. IFCI and IDBI were fully-owned Government of India (GoI) enterprises. The objective in setting up the institutions were to provide medium- and long-term project finance to Indian industries. Till about the mid-1990s, the DFIs were very effective in channelising such finance for industrialization of the country.

India had subsequently set up specialised DFIs to pursue medium-/long-term sector-specific credit flow, in contrast to the sector agnostic lending which the aforesaid DFIs engaged in. This includes attempts made twice in the past,

to set up a specialised DFI for infrastructure project financing. While, the first three DFIs had an extremely successful role with widespread reach and positive effect on industrial growth, the specialised DFIs in most cases remained small and had limited impact. Ironically, in later years, the said three DFIs faced difficulty in surviving in its original genre and revamped themselves into commercial banks. The specialised DFIs in most cases continue, albeit with limited impact. The DFIs set up exclusively for financing infrastructure projects have, however, not had the desired impact.

Financing activities

The DFIs extended term loan for setting up new units as also for expansion, modernisation, and rehabilitation of existing units. There were no sectoral restrictions (except for the small negative list). The DFIs could extend assistance to any industry, resulting in a well-diversified (less risky) asset portfolio. Tenor of the assistance was usually up to 10 years, with an initial moratorium of up to two years. Mortgage charge over fixed assets of the assisted company, was provided as loan security. Defaults were insignificant and the security package was found acceptable, without it being examined on the bedrock of enforcement efficacy.

Resources

The DFIs were funded by patient equity capital and preferential market access for raising medium-/long-term resources. Preferential access was in the form of channelising multilateral funding lines, fund flow from National Industrial Credit-Long-term Operations (NIC (LTO)) of Reserve Bank of India (RBI), issuance of Statutory Liquidity Ratio (SLR) and tax-saving bonds, and suitable enablers to attract funds available through capital gains and investment allowance reserves. There were other special provisions made in the Income Tax Act, which enabled access to medium-/long-term funds, which supplemented the other fund-raising avenues. DFIs were also permitted to intermediate external commercial borrowings (ECB) market for on-lending.

Market exclusivity

It was a plain vanilla arrangement, wherein DFIs borrowed medium-/long-term funds at fixed (specified) interest rate, in the bank/bond market, and on-lent for medium/longterm funding. In the absence of refinancing and/or downselling market, the DFIs held their loan assets till maturity. The maturity profile of the asset and liability book approximated closely. The credit authorisation scheme (CAS) restricted commercial banks in going for large ticket long-term lending. Access to ECB by corporates were not permitted. The capital market was narrow and shallow with fewer participants. The activity in the debt market was almost nil. Insurance companies and fund houses were either non-existent or were yet to warm to the idea of lowcost refinancing of the outstanding loans from DFIs to completed (mostly well-performing) projects. It was a period of bliss, in which the DFIs extended medium-/longterm loans to greenfield and/or brownfield projects, with a good interest spread, and held it long till maturity.

Transition

Progressive decline of DFIs started from mid 1990s—post the liberalisation era. Transition to a banking company happened around the turn of the century. With liberalisation, the DFIs lost their exclusive status and were unable to adapt and reinvent themselves in the new economic environment. Preferential access to funds was withdrawn in phases. The Credit Authorisation Scheme (CAS) was suitably relaxed to permit banks to extend large ticket long-term loans at significantly lower interest rates. The ECB market was opened up for direct access by corporates. With lower cost of funds, banks aggressively refinanced outstanding Development Finance Institution (DFI) loans, leading to asset-liability mismatch in the DFI books. Insurance companies, with their low fund cost, were also aggressive in the refinancing market, for corporate loan. With occurrence of loan defaults, DFIs realised that mortgage security was not robust and also difficult to enforce, vis-à-vis security by way of receivables/cash flow, as available to banks.

Likely challenges of NaBFID

India is today an attractive destination for foreign funds. Debt and equity capital markets are increasingly dynamic. Insurance companies, fund houses, etc. are active in loan/bond buyout and/or refinance, particularly for completed projects. Commercial banks are active lenders. In short, NaBFID is likely to face challenges of intense competition from multiple players. Necessary condition for the proposed DFI to sustain will be its ability to (a) retain low-cost advantage on a continuing basis, (b) withstand market competition, and (c) navigate challenges of asset inflexibility—exclusively infrastructure.

NaBFID is expected to face less challenge in mobilising low-cost resources upfront with appropriate government support, but it could encounter steep challenges in maintaining the cost advantage over a period of time, as the resources raised would have a fixed (specified) coupon with long maturity which may not be flexible. It would face competitive pressure in resource deployment as well as asset retention (refinancing by competitors). Risk of an inflexible asset book, would only add to the aforesaid difficulties.

Structural challenges

The funding environ would continue with strong competitors. Commercial banks are an integrated intermediary for both mobilising deposits and also onlending. As deposits are of mixed tenure and price, incremental growth in deposit/liability book ensures continuous repricing, which adjusts average cost and maturity on an ongoing basis. Other competitors, also operate on a favourable low-cost matrix. DFIs, on the other hand, are essentially lending vehicles created for the purpose of channelising medium- to long-term resources for specific purpose. Resources are raised by DFIs through financial instruments crafted to meet its specific needs. That makes resource raising costlier and inflexible for a DFI vis-à-vis a bank, with its implication on relative product pricing, and institutional asset and liability management (ALM) profile over time.

In the above context, certain suggestions from an risk mitigation outlook, are placed below:

• Refinance risk: As loans are refinanced, after project commences operation/attains stability, NaBFID may consider stipulating repricing option with suitable rate incentives, after implementation. Incentives may be designed carefully, so as to retain/exit the underlying loan, on asset quality considerations. • Cost/ maturity risk: Resources may be largely raised with a weighted average maturity to cover the implementation period of the portfolio loan assets, and not over long term, based on the “held to maturity” concept. This would help reduce cost and also impart flexibility in average cost and maturity, over time. • Security package: NaBFID should have security right over all present and future cash flows of the assisted company on pari passu basis along with other lenders, and not be secured by first charge over fixed assets only.

NaBFID may closely review and choose to be selective in fund-based lending and instead concentrate more on the following activities, which are prominently included in its mandate/ objective: • Non-fund-based business: Considering the high capitalisation of NaBFID and its quasi sovereign status, guarantees issued by NaBFID are likely to be well accepted. It may, therefore, look at having a large guarantee/NFB book, instead of concentrating on funding. • Corporate bond/debt market: NaBFID with its large capital base, government support, and systemic importance may concentrate well on strategies/modalities to harness resources for facilitating vibrancy in the debt market. This would then have a more beneficial long-term impact on infrastructure development than term lending alone.

DFIs in the past had taken steps to set up an efficient financial architecture of the country, comprising of screenbased trading, and setting up of depositories and rating agencies, amongst others. These have facilitated evolution of the financial market, and made it more transparent. Success of NaBFID in imparting bond/debt market vibrancy will well be an important and a positive step in continuation of India’s endeavour in developing a robust financial structure.