2 minute read

VILLAGE OF BUFFALO GROVE, ILLINOIS

Management’s Discussion and Analysis (Unaudited)

December 31, 2022

Normal Impacts

Revenues

Economic Condition – which can reflect a declining, stable or growing economic environment and has a substantial impact on property, sales, income, utility tax revenues as well as public spending habits for building permits, elective user fees and volumes of consumption.

Increase/Decrease in the Village Approved Rates – while certain tax rates are set by statute, the Village has significant authority to impose and periodically increase/decrease rates (water, building and licensing fees, ambulance fee, etc.).

Changing patterns in Intergovernmental and Grant Revenue – (both recurring and non-recurring) – certain recurring revenue (state shared revenues) may experience significant changes periodically while non-recurring (one-time) grants are less predictable and often distorting in their impact on year-to-year comparisons.

Market Impact on Investment Income – the Village’s investment portfolio is structured to meet certain liabilities as they become due and the income generated is subject to market conditions that may cause the investment income to fluctuate.

Expenses

Changes in Authorized Personnel – changes in service demand may cause the Village to increase/decrease authorized staffing.

Salary Increase (general wage adjustments and merit) – compensation adjustments to ensure the Village can attract and retain high level employees.

Inflation – while overall inflation appears to be reasonably modest, the Village is a major consumer of certain commodities such as supplies, fuels, and parts. Some functions may experience unusual commodity-specific increases (e.g. fuel, road salt).

Current Year Impacts

Government Activities:

Governmental activities decreased the Village’s net position by $6.2 million to $30.5 million. Significant elements contributing to this net change are as follows;

Revenues:

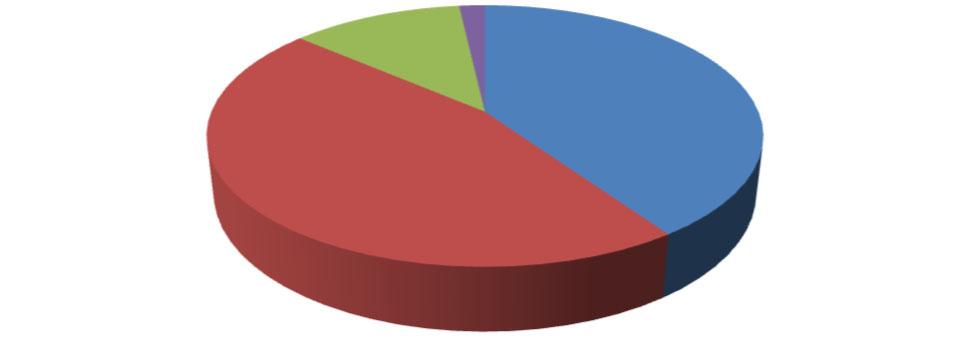

Revenues for the Village’s governmental activities for the year ended December 31, 2022 were $66.2 million, an increase of $7.0 million or 11.8 percent. Property taxes continue to be one of the Village’s largest sources of revenue (25.7 percent) at $17.0 million. There was a 0.69% increase in the corporate agency tax levy collected in 2022 as the counties were able to collect a higher percentage of taxes billed than in 2021. The corporate levy for 2022, to be collected in 2023, is funding Police and Fire Protection Included within the property tax revenues are the pension levies for the Police and Firefighter Pension Funds and IMRF/Social Security. The pension levies account for 37.2 percent of the property tax levy. Other taxes and intergovernmental revenue including sales tax, state income tax, utility tax, prepared food and beverage tax, hotel tax, and real estate transfer tax total $32.6 million or 49.2 percent of total governmental activities revenue.

VILLAGE OF BUFFALO GROVE, ILLINOIS

Management’s Discussion and Analysis (Unaudited) December 31, 2022

Grove 2022 Revenue by Source Governmental Activities

Charges for Service

Grants and Contributions

Property Tax

Sales and Use Tax

Income Tax

Telecommunication

Utility Tax

Property Transfer Tax

Other Taxes

Sales and uses taxes increased by $2.5 million compared to the previous year as retail sales remained strong throughout the year. Telecommunications taxes stayed consistent compared to prior year. Income taxes continue to rebound increasing $1.5 million from FY 2021, a 26.8 percent change. Utility taxes increased $0.1 million compared to the prior year. Property transfer taxes increased $0.4 million compared to prior year. Sales and use tax are key indicators for the Village of Buffalo Grove’s local economy and are improving year over year.

Expenses:

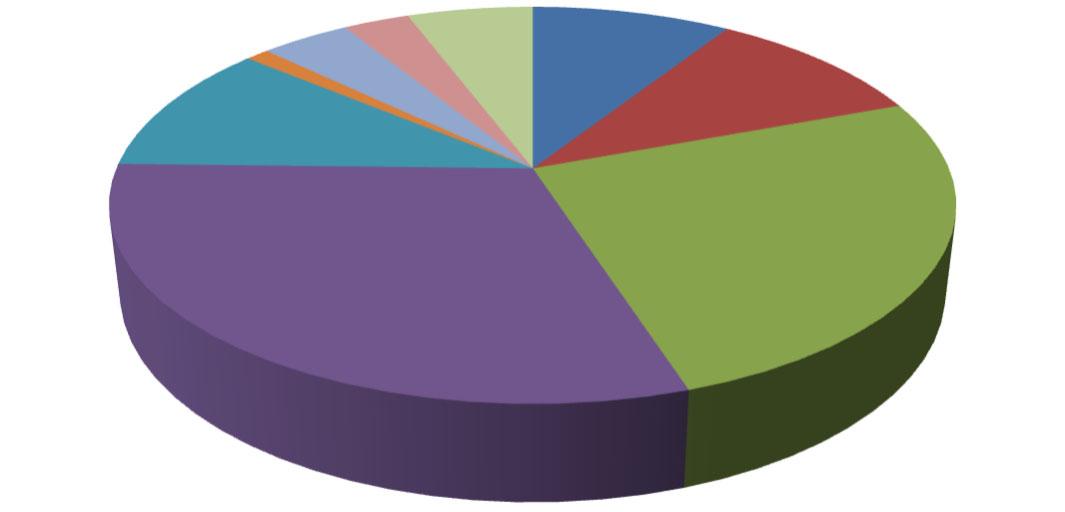

The cost of all governmental activities this year was $67.1 million, an increase of 65.3 percent from 2021 ($26.5 million). The largest increase was made in General Government expenses of $19.4 million (251.9 percent) in 2022 as the Village recognized developer expenses of $19 million in the TIF Fund as per a developer agreement for redevelopment of property located in the TIF District. Public Safety expenses increased by $6.9 million and Public Works stayed consistent to the prior year.