6 minute read

STOCKS AND STOCK INDICES: THE BASICS

What are stocks and stock indices?

Stocks

If a company’s stock belongs to you, you own a piece or a share of that publicly traded company. In CFD trading, the stocks themselves are never purchased and owned. Your chance to make a profit depends on your speculation on their price change, as we shall soon see.

Stock indices

A stock index, such as the Dow Jones Industrial Average (Wall Street 30) or DAX 40 (the German Index), is an index that measures the value of a basket of stocks. In the case of the Wall Street 30 or DOW 30, it is made up of 30 top US companies, which currently include the following:

If the stocks within the DJIA (Wall Street 30) go up, then the index will move higher, and of course, the opposite is also true. DJIA is a price-weighted index, which means its value is derived from the price per share for each stock, divided by a common divisor. A higher-priced stock would have a bigger impact than a lower-priced one.

The stocks in the index change from time to time. In the case of the Dow Jones, a committee decides on the changes. The latest Dow Jones stocks that were added in 2020 included Salesforce (CRM), Amgen (AMGN), and Honeywell International (HON).

Stock Indices Full Name

Stock Indices Name On Deriv

ASX 200 Index Australia 200

Nikkei 225 Index Japan 225

AEX Index Netherlands 25

Euro STOXX 50 Index Europe 50 CAC 40 Index France 40

Deutsche Boerse AG German Stock Index DAX Germany 40

FTSE 100 Index UK 100

IBEX 35 Index Spain 35

S&P 500 Index US 500

Nasdaq 100 Stock Index

Tech 100

Dow Jones Industrial Average Wall Street 30

What makes a stock price go up or down?

A stock price will go up and down based on changes in supply and demand. If more investors want to buy a stock (demand) than sell it (supply), the price moves up.

If more investors wanted to sell a stock than buy it, there would be greater supply than demand, and the price would fall.

This is a very simplistic view, and in the real world, there are a few twists to this, but basically, if someone sells a stock, then someone else is buying it.

Which stocks can you trade via Deriv?

Deriv offers a selection of stocks you can trade on. This list is ever-growing. The main stocks that are currently available are listed in the United States, and you can trade them regardless of where you live.

The US remains the most important stock market, with household names like Apple, Microsoft, and Facebook, all having their main listings in the US.

The table below shows the current stocks that can be traded. New stocks will be added to the list regularly, so be sure to check deriv.com often.

Tech Financial Consumer Good Service Others

Stock specifications

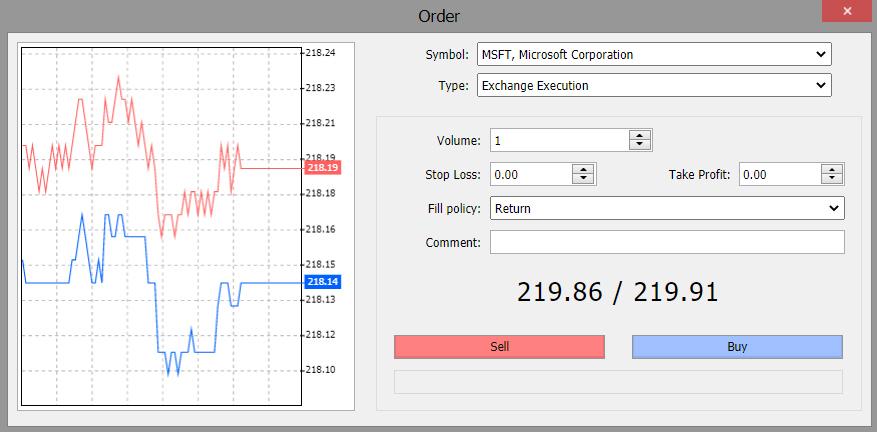

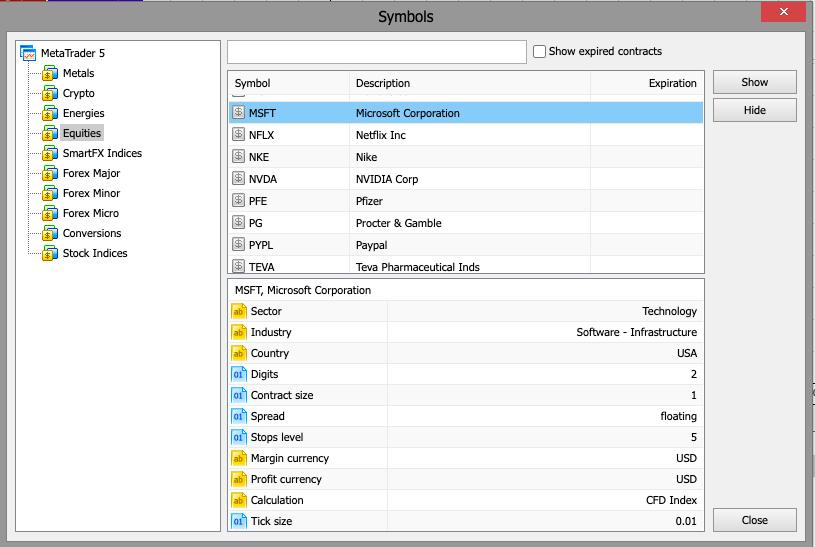

Each CFD listed with Deriv will have its own specifications that can be viewed on Deriv X1 or MT5. Here we see the example of Microsoft (MFST) on MT5. These specs will tell you the trading hours, minimum trade size, stop distances, and margin requirements. It will also tell you what types of orders are accepted.

Trading times

The official trading times for US stocks are 9:30 am EST (14:30 GMT) to 4:00 pm EST (21:00 GMT). Please keep in mind that GMT does not change for daylight saving time (DST), but EST, which is the time in the New York time zone, does change for DST.

Some brokers do offer pre-market trading and after-market trading. However, I tend to stick to the main trading times.

A tip: it is often said that inexperienced traders trade at the opening time, whereas smart money trades during the day or towards the closing. Something worth considering is waiting for the first 15 to 30 minutes to pass before making your first trade of the day.

Swap charges

Whilst Deriv charges no commission, there is a fee for holding a position overnight, namely, swap charges. A swap charge is a daily interest adjustment that will be made to your trading account to compensate for the cost of keeping your position open. To help you work this out, Deriv has a calculator tool that calculates the swap rate and required margin.As interest rates are at historic lows, it’s cheaper than ever to hold positions overnight, but you should still be aware that costs will build up over time and whether your trade makes a profit or loss, you still have to pay the funding charges.

Swap charges are calculated at the end of the day, now set at 23:59 GMT. Positions held through 23:59 pm GMT on Fridays will be charged for three days to cover the weekend. If you open and close a trade during the trading day, there will be no swap charges.

Example: a long CFD trade of Apple

You are long $1 a point shares of Apple (i.e. 10 shares). The current price is $127.50, which means the value of your shares is $1275.00. Most probably, you are only putting a fraction of this amount, let’s say 10% to keep it simple ($127.50 paid by you). This means $1147.50 needs to be financed. Let’s say the annual financing rate is 5%. 360 days are normally used for financing. So your daily rate is 5% divided by 360; in other words, 0.0139% per day.

What if I am shorting a stock via CFD?

When you are shorting a stock via CFD, you will incur a borrow charge. The borrow charge will be accounted for in a daily cash adjustment applied to your account. The charge varies according to the stock. The borrow charge, and the ability to hold a short position, can be changed at short notice.

Dividends

Many companies will pay stockholders a dividend, which is a distribution of their profits. Whilst holding a CFD does not make you a stockholder, in some cases, your trade will still factor in a dividend credit, or if you’re short, you will be debited for the dividend. Many companies don’t pay a dividend for their stock CFDs, however. It’s best to check a company’s investor relations website to find out if it pays dividend and learn other related details. For example, Apple presents a detailed record↗ of such information.

Example of a stock CFD trade

Imagine that I decided after some research that Microsoft (MSFT) is a good stock to trade, and I come to the conclusion that its price will go higher.

The quote I am given online is $219.86 bid (sell) and 219.91 ask (buy). As I want to buy MSFT, I will select the ask (buy) price, so I am buying at $219.91. If I were selling, I would be selling at the bid price of $219.86.