1 minute read

Contracts for difference (CFDs)

A contract for difference is a contract that gives you the chance to earn a payout by correctly predicting the price movement of assets without owning them. CFDs are available on a range of financial and synthetic markets and can be traded via MT5. A CFD gives you exposure to a market and allows you to go long (trade for price to go up) or short (trade for price to go down). The CFD will continue trading until you close it or it gets stopped out. Stop out occurs when your margin level (percentage of equity to margin) reaches a certain level that depends on your account type. Before this, your account will be placed under margin call which also depends on your account type. This does not affect your ability to open new positions; it serves to alert you that your floating losses have added up to a certain level. It is best that you top up your account to keep your positions open. Another option is to close losing positions or set a stop loss to prevent your losses from becoming bigger.

Why access MT5 through Deriv

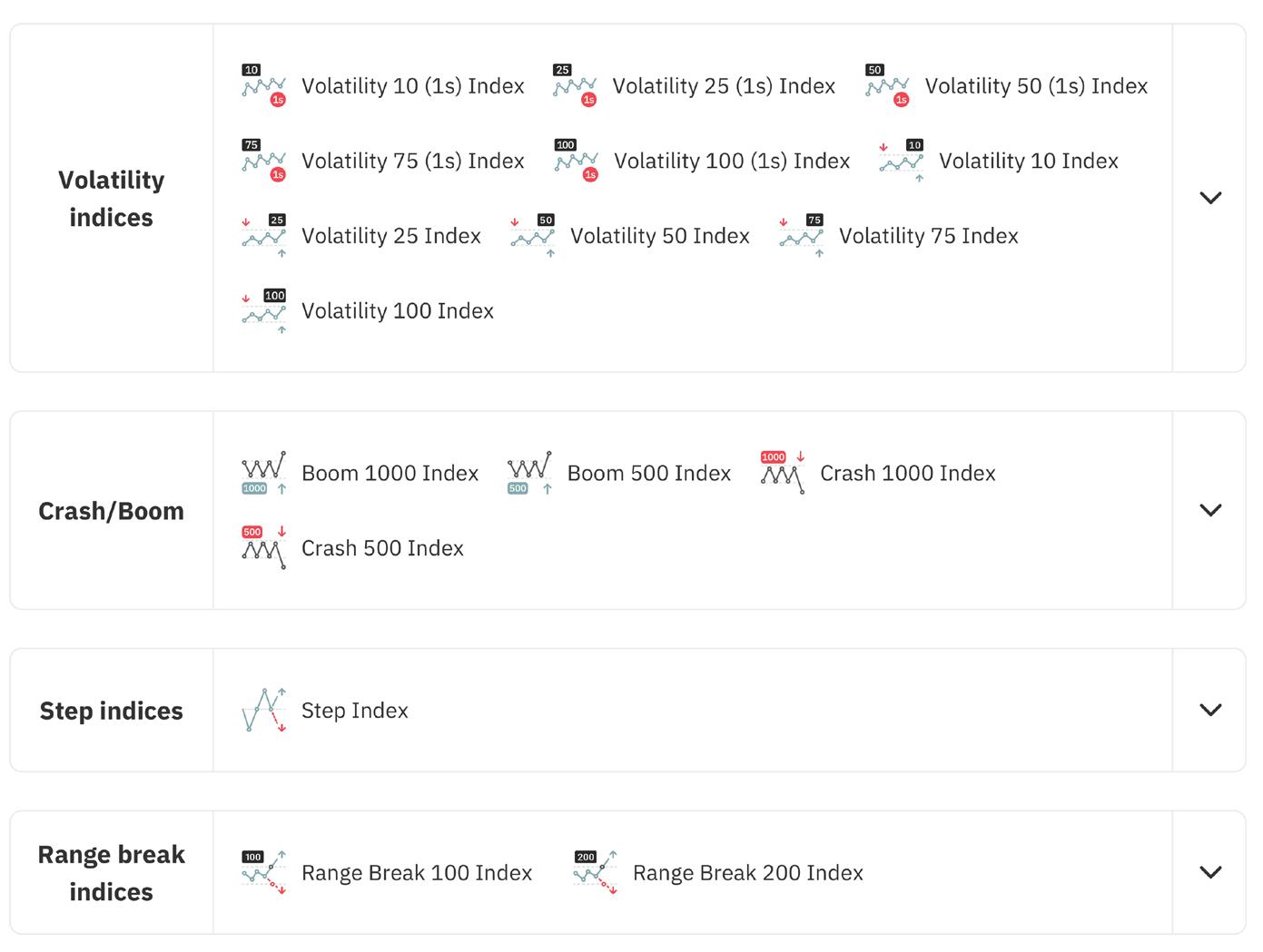

Whether you’re a new or experienced trader, you can easily access the MT5 platform via DMT5. As a Deriv client, you can then trade CFDs on our unique synthetic indices. Select Deriv as your broker to gain access to synthetic indices. You can use a demo account to practise margin trading or switch to your real account and trade CFDs for a real profit or loss.

Other MT5 features

MT5 also offers a massive selection of plugins that allow automated trading. To see how Deriv makes it easy for you to automate your trades, read Appendix G on DBot. It also provides a virtual private server (VPS), which means that for a small monthly fee, your trading systems can run on a remote computer without needing to tie up your phone or laptop. This also means you’re not relying on your internet connection.