2024 Strategy

Key Strategies and initiatives were definedwhile consideringfour essential elements:

Clarity of VJ Role, Purpose and Deliverables

'Changing Perceptions, Shaping the Future' - Promoting Jersey, enabling tourism growth and building a prosperous and sustainable visitor economy.

Islandwide Collaboration

Listening to feedback, insights, expertise, forging strong relationships within our industry, Ports of Jersey, government and Jersey ALOs, to achieve best outcomes.

Government/MinisterialPriorities Alignment

Focus on growth from UK/Europe, visibility of 'Brand Jersey' and put sustainability, responsible tourism and inclusivity at the heart of our plans.

Transform the way we work to compete in a digital world, and invest in campaigns that deliver a strong ROI, targeting the most relevant visitor profiles and segments.

• Connectivity to UK

• Part of Common Travel Area

• Environment,Sea& Coastline

• Safety

• Wide rangeof activities

• Strongproductoffering

• Food anddrink

• Growth of new segments

• Sustainable product

• Increased destination attractiveness

• New source markets

• Shoulderseason dispersion

• Eventsled tourism

• Access to Europe

• Cooler summerweather

• Reduced bed stock

• Insufficient self-catering / Airbnb

• Seasonalclosures

• On-Islandoperatingcosts

• Comparative destination costs/ value

• Labourshortages

• Europeanconnectivity O

• ReducedVisit Jersey funding

• ComparativelyhighJerseyinflation

• Rising global interest rates

• Economicand political uncertainty

• Reducingaccommodationcapacity

UK customer sentiment for travel optimisticfor 2024. B2B partners are forecasting stronger demand overall.

Overall Consumer trends changing to later booking pattern.

Our marketing spend will be spread across the year with "always on" approach.

Maintain our key legacy customer segments, "Easy Explorers" (aged 55-74) and maximise impact via digital channels.

Target the "Moment Makers" (aged 25-44) younger, urban professionals with time and disposable income.

We will developcurated itineraries, targeting seasonal dispersal for these customers.

Build our awareness in UK, France, Germany, with easy to book, relevant and compelling products and itineraries.

We will prepare'easy to activate', sales & marketing frameworks, ready for new route launches.

Source: Visit Jersey/PwC/TTG

2023 data suggests a recovery for Total Visits* to 2019 levels by 2026, currently 68%.

Business & Visiting Friends and Relatives (VFR) are recovering faster than Leisure.

STR reports a 21% increase in Average Room Rates (ARR) over a two-year period from Aug 2021 to Aug 2023.

Total Visits is 91% of 2023 target and Total Spend is 98% of the target.

Leisure Overnight Visits 89% of 2023 target.

Average length of stay 4.7 nights.

Net Promoter Score (NPS) remains very high at 71.

Jersey RPI currently 10.9% making the island more expensive than competitor destinations.

*incl. all visit types and day trippers

Source: Visit Jersey Exit Survey run by 4insight 2023/STR

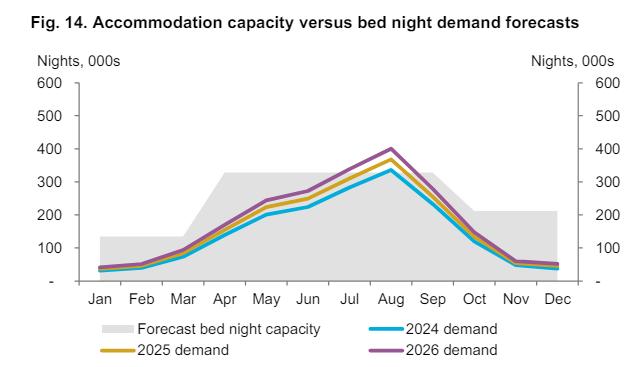

Airline passenger numbers estimated to get to 1.64m in 2024, as capacity expands further and to 95% of 2019 levels.

Meanwhile registered tourism bed stock* continues reducing each year, dropping 12% since 2019, from 10,590 units to 9,350 in 2023.

As passenger capacity grows, with the current bed stock we are at risk of not being able to provide beds for the visitor demand during our peak months.

*TourismRegisteredbedstockincludeshotels,guesthouses,selfcatering,hostelsandcampsites,it excludesestablishmentswithunder6bedsandAirBnB.Tothenearest10.

Source:OxfordEconomicsforecastMarch2023,GovernmentofJerseyRegisteredTourism Establishments

Industry feedback suggests that 2024 will be more competitive than 2023.

As airlines ramp up their capacity and other destinations promote aggressively, the market will become cluttered, making itchallenging for Jersey to cut through with a reduced budget, so vital we maximise every investment to drive ROI.

Our Key International source Markets

While the UK continues to attract the majority of visitors - 71% driven by strong connectivity, developing France - 14% and Germany2% is key. In addition, the 80th anniversary D-Day celebrations and Paris Olympics in summer 2024 represent an opportunity to target international visitors.

Building our future and transforming the way in which we work to compete in a digital world is vital to our success. A more detailed longer term plan will be produced post publication of governments Visitor Economy Strategy.

Future initiatives will include:

• Scoping out the agreed deliverables from the Visitor Economy Strategy.

• Investing in our digital platforms to ensure oursystems are up to date and compliant.

• Improving team productivity by enabling more self-service functionality in HR and finance.

• Improving the physical customer Experience, introducing a reimagined visitor centre in 2024.

• Inputting to plans for a world class visitor arrival and departure experience, collaborating with Ports of Jersey, Government and industry.

• Improving the digital customer journey, introduce a sales platform which has booking functionality to increase visitor spend pre/during stay.

• Enabling and training industry to diversify distribution channels to showcase all our island has to offer.

• Developing and elevating our Sustainability, Accessibility and Inclusivity credentials.

Our Purpose

ChangingPerceptions,Shaping the Future

PromotingJersey,enabling tourismgrowth to create a prosperousand sustainablevisitoreconomy.

Strategic Objectives Rebuild International Tourism

Key Initiatives

• Position Jersey as a diverse and sustainable destination.

• New creative and brand campaign.

• Prioritise seasonal dispersion.

• Target Easy Explorers (55+) and Moment Makers (25-44).

• Effective partnership marketing.

• Improve productivity.

Buildour future - Transformation (Year 1 of 3)

Buildour influence as a trusted voice Passionate, engaged and motivatedteam Enhanced Customer Experience ResponsibleTourism

• Transform the way we work to compete in a digital world.

• Audit Digital Customer Journey and improve.

• Open a reimagined Visitor Information Centre.

• Elevate our Sustainability story.

• Put responsible tourism at the heart of what we do.

• Promote accessible, inclusive products and experiences.

• Create meaningful differentiation around product pillars: Culinary, Well-being, Great Outdoors, History & Heritage.

• Support growth by shaping policy and providing actionable insights.

• Collate and share

• timely actionable insights.

• Improve data speed

• and access.

• Be the expert on Jersey tourism in the media, shaping perceptions and demonstrating value.

• Build our team.

• Optimise structure and skills to deliver strategy.

• Align and integrate individual/team objectives.

• Make learning and development a focus.

• Reduce staff turnover.

Enablers of growth Engaged and supportive stakeholders Technologyand dataled Effective and purposeful governance

on the Oxford Economics forecast March 2024

Visit