UNCLE JULIO’S

KATY, TX (HOUSTON MSA)

2 FINANCIAL ANALYSIS UNCLE JULIO’S - KATY, TX PRICING & FINANCIAL ANALYSIS ANNUALIZED OPERATING DATA Year(s) Commencement Annual Increase 1-5 01/15/2016 $157,5006-10 01/15/2021 $173,250 10.00% Option 1: 11-15 01/15/2026 $190,575 10.00% Option 2: 16-20 01/15/2031 $209,632 10.00% Option 3: 21-25 01/15/2036 $230,595 10.00% Option 4: 26-30 01/15/2041 $253,654 10.00% NET OPERATING INCOME $173,250 Uncle

20526 Katy Fwy Katy, TX 77450 OFFERING SUMMARY Price $3,465,000 Cap Rate 5.00% Net Operating Income $173,250 Year Built 2013 Gross Leasable Area 10,299 SF Lot Size 2.117 Acres LEASE SUMMARY Lease Term 10 Years Lease Commencement 01/15/2016 Lease Expiration 01/14/2026 Remaining Term 2.5 Years Lease Type Ground Lease Roof & Structure Tenant Increases 10% Every 5 Years Options 4 x 5 Years For Financing Options, Please Contact: Greg Holley | Managing Partner High St Capital (O) 469-998-7200 | (C) 714.514.2990 gholley@highstcapital.com

Julio’s

Uncle Julio’s opened their first restaurant with a simple commitment to fresh ingredients and handcrafted recipes. From the very beginning, they served mesquite-grilled fajitas, crave-able guacamole, and other Tex-Mex favorites. Whether guests are celebrating with family, meeting over lunch, or on a date, they have a welcoming atmosphere at Uncle Julio’s. Over the past 30 years, they have opened 34 restaurants across 11 different states. Today, Uncle Julio’s restaurants continue to stand out with their distinct rustic-modern style, as well as their dedication to innovation, such as the swirl margarita and dessert pinata. This dedication and innovation has set Uncle Julio’s apart as they continue to offer a memorable experience for all of our guests.

COMPANY SUMMARY

Company

Uncle Julio’s Mexican

Ownership Private

Number of Locations 34 Nationwide

Years in Business 30+ Years

Headquarters Dallas, TX

Website www.unclejulios.com

COMPANY SUMMARY

Company

LCatterton

Since 1989, L Catterton has made more than 250 investments in leading consumer brands across all segments of the consumer industry. With approximately $30 billion of assets under management dedicated to growing middle market companies and emerging high-growth enterprises, we believe we are the largest and most experienced consumer-focused private equity group in the world. Our categoryfirst approach is aimed at truly understanding what matters most to consumers in order to subsequently identify the specific categories and companies that will benefit from those consumer preferences. At the heart of this approach is our constant pursuit of grasping how various types of trends—demographic, psychographic, technological, geographic, and socioeconomic—will drive and impact consumer preferences and purchasing decisions.

Ownership Private

Area Served Worldwide

Years in Business 34 Years

Headquarters Greenwich, Connecticut

Website www.lcatterton.com

3 PROPERTY DESCRIPTION UNCLE JULIO’S - KATY, TX TENANT OVERVIEW

• Ground Lease – Zero Landlord Responsibilities

• Frontage on Interstate-10 (Katy Fwy) Making the Property Visible to over 216,600 Vehicles Per Day

• Average Household income is $110,516 – Over 1.5X the National Average

• Uncle Julio’s Fine Mexican Food Operates 43 Locations Across 7 States

• Corporate Guaranteed Lease by Uncle Julio’s. $30 Billion Private Equity Firm, L Catterton, Acquired Uncle Julio’s in 2016

• L Catterton Has a Deep History in Restaurant Investments, Including Holdings in Such Companies as Bloomin’ Brands Inc., Cheddar’s Scratch Kitchen, First Watch and P.F. Chang’s China Bistro. Click Here for More Information

• Low Price per Square Foot to the 2.12 Acres of Land at $37 PSF

• Surrounding National Retailers Include – Sam’s Club, Best Buy, BJ’s Restaurant & Brew House, Olive Garden, The Home Depot, Ross, Conn’s, Target, Kohl’s, PetSmart, and Many More

SNAPSHOT

216,600

Estimated Vehicle Per Day

$110,516

Average Household Income

38.4%

Population Growth 2010-2022

270,771

Population: 5 Mile Radius

4 PROPERTY DESCRIPTION UNCLE JULIO’S - KATY, TX INVESTMENT HIGHLIGHTS

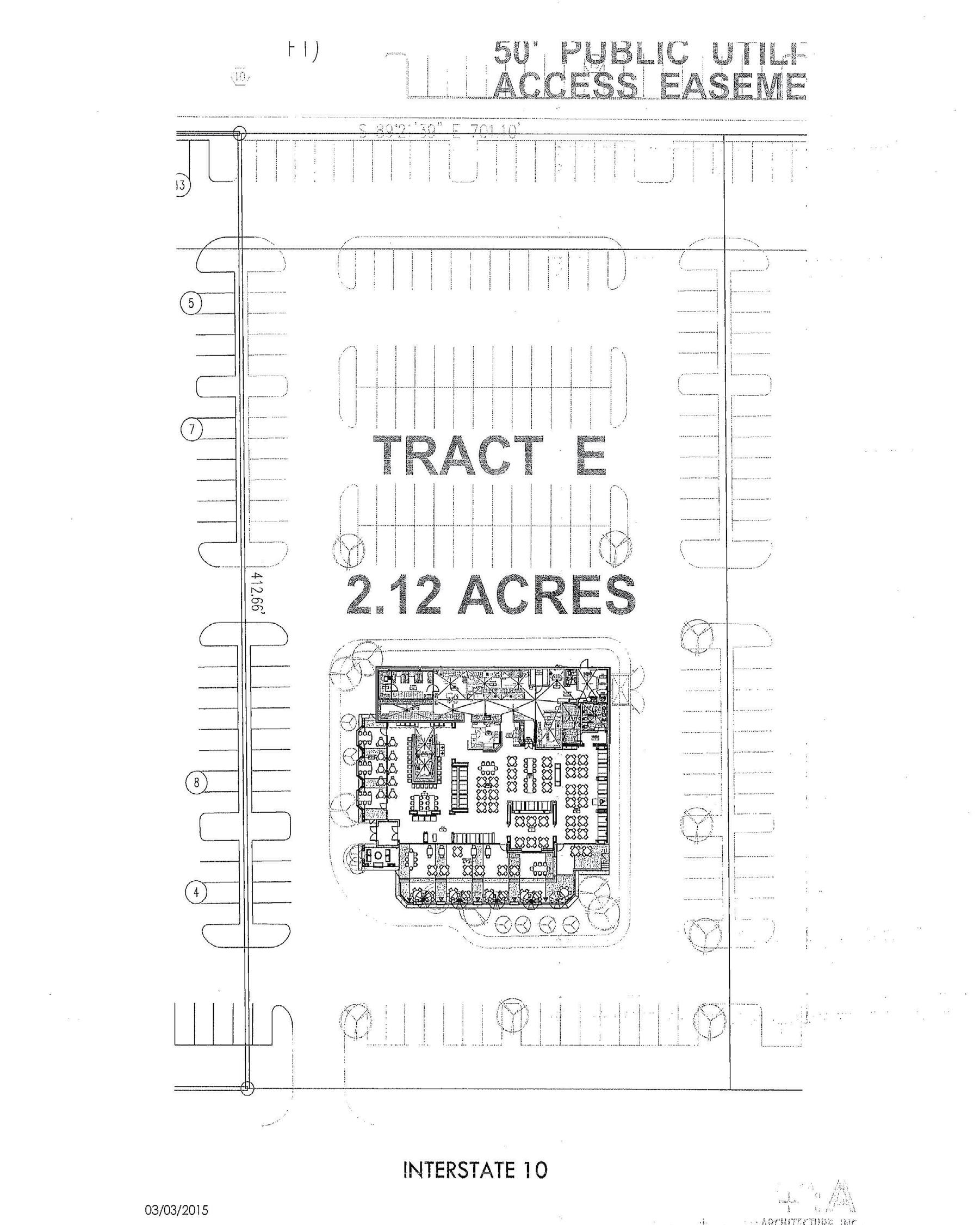

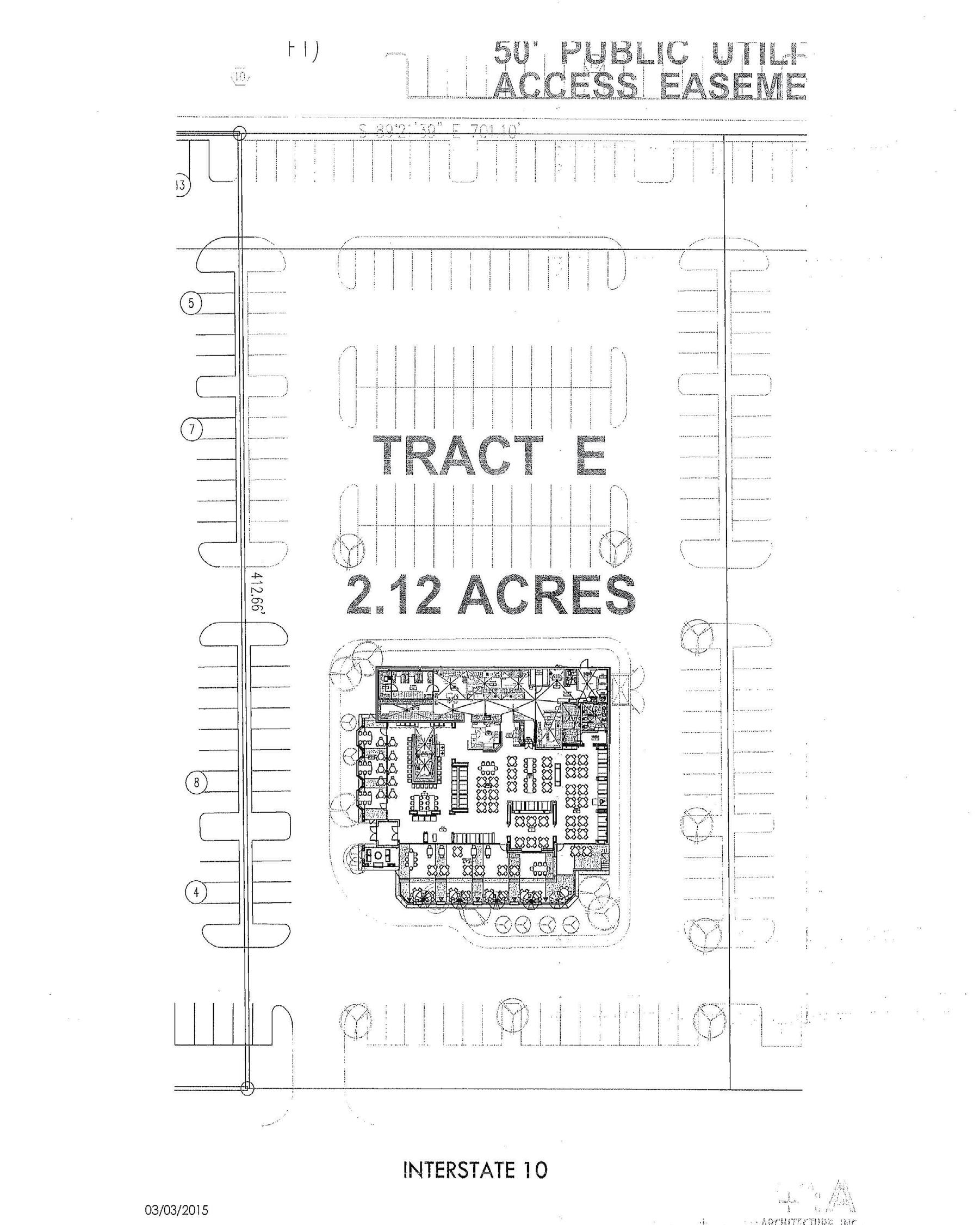

5 PROPERTY DESCRIPTION UNCLE JULIO’S - KATY, TX SITE PLAN

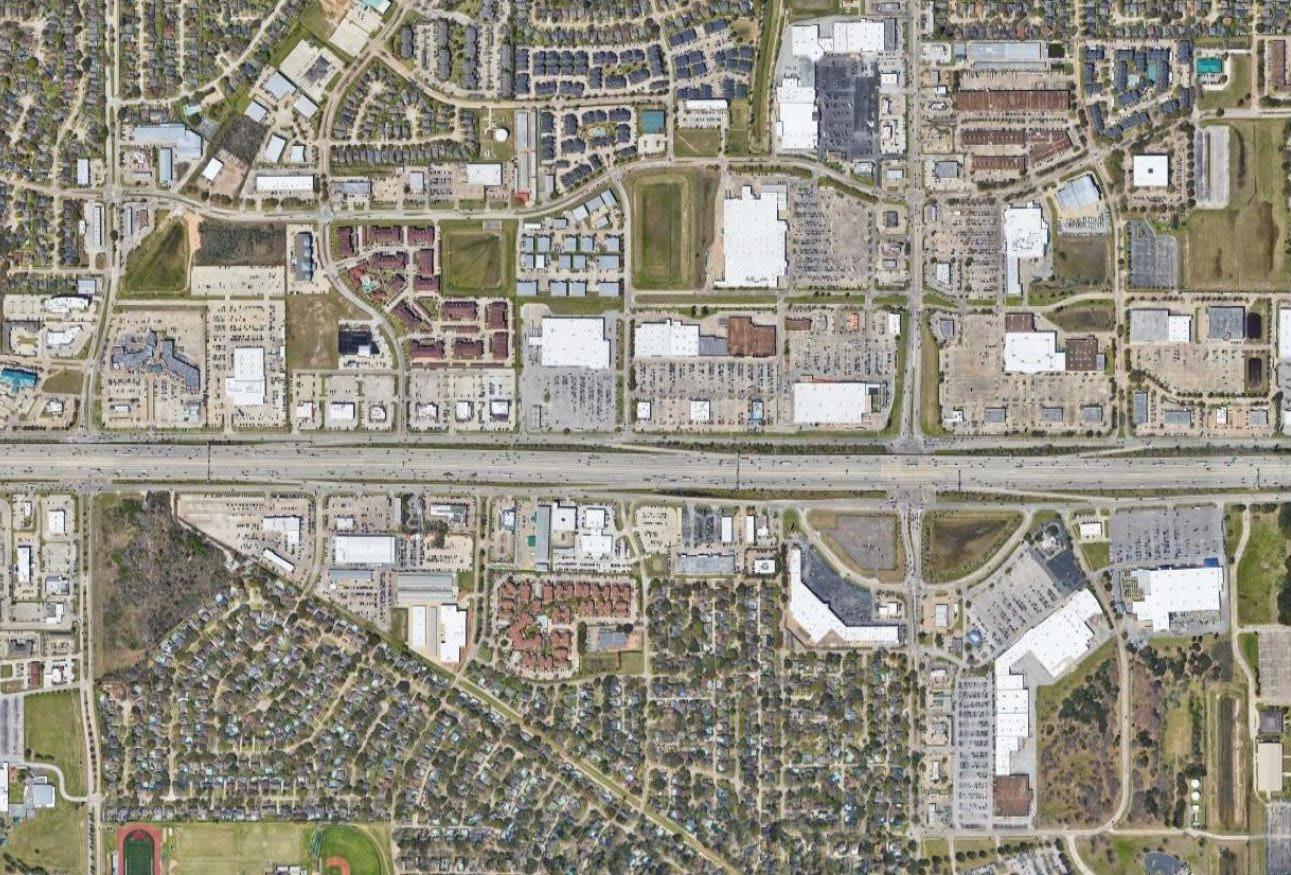

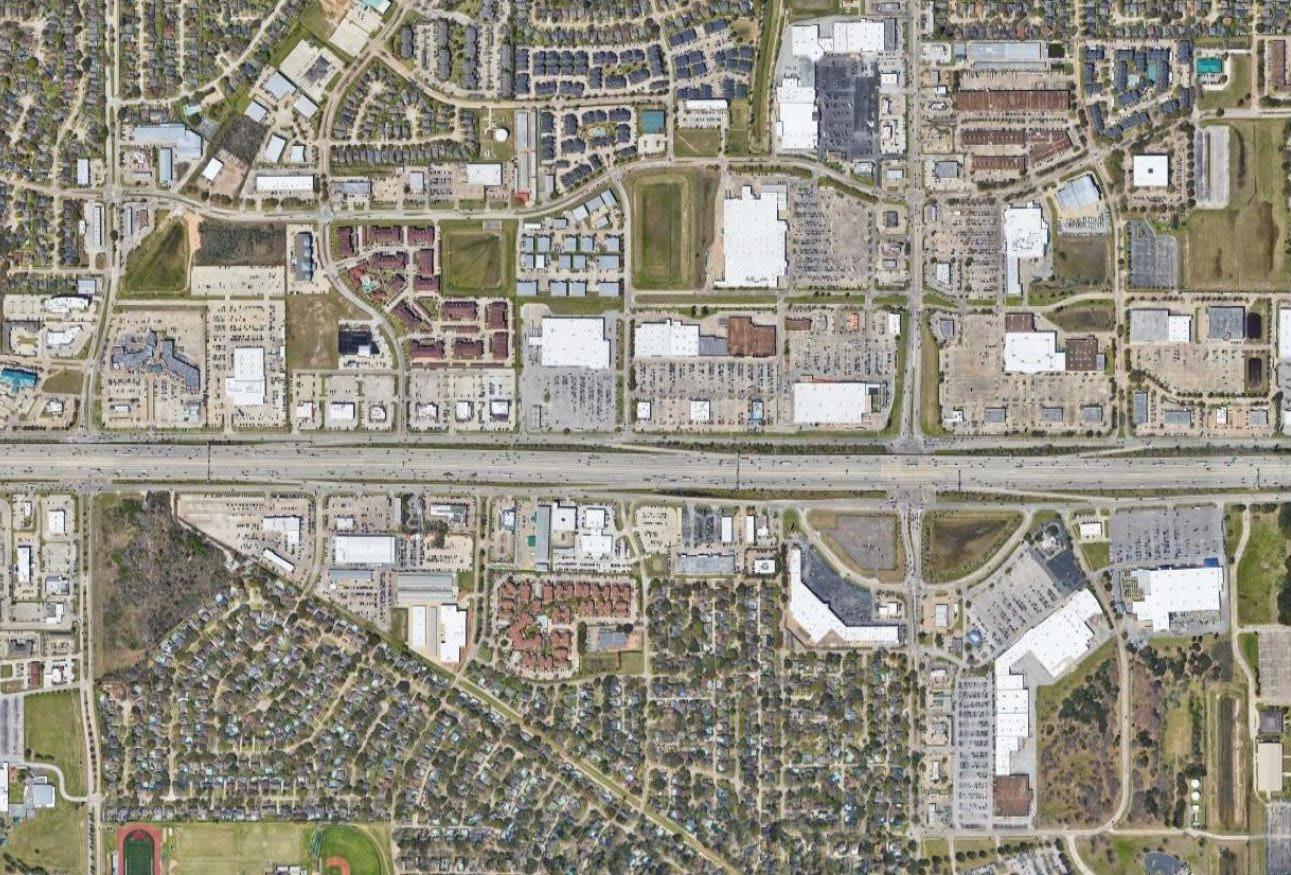

6 MARKET OVERVIEW UNCLE JULIO’S - KATY, TX AERIAL MAP KATY FWY 216,600VPD

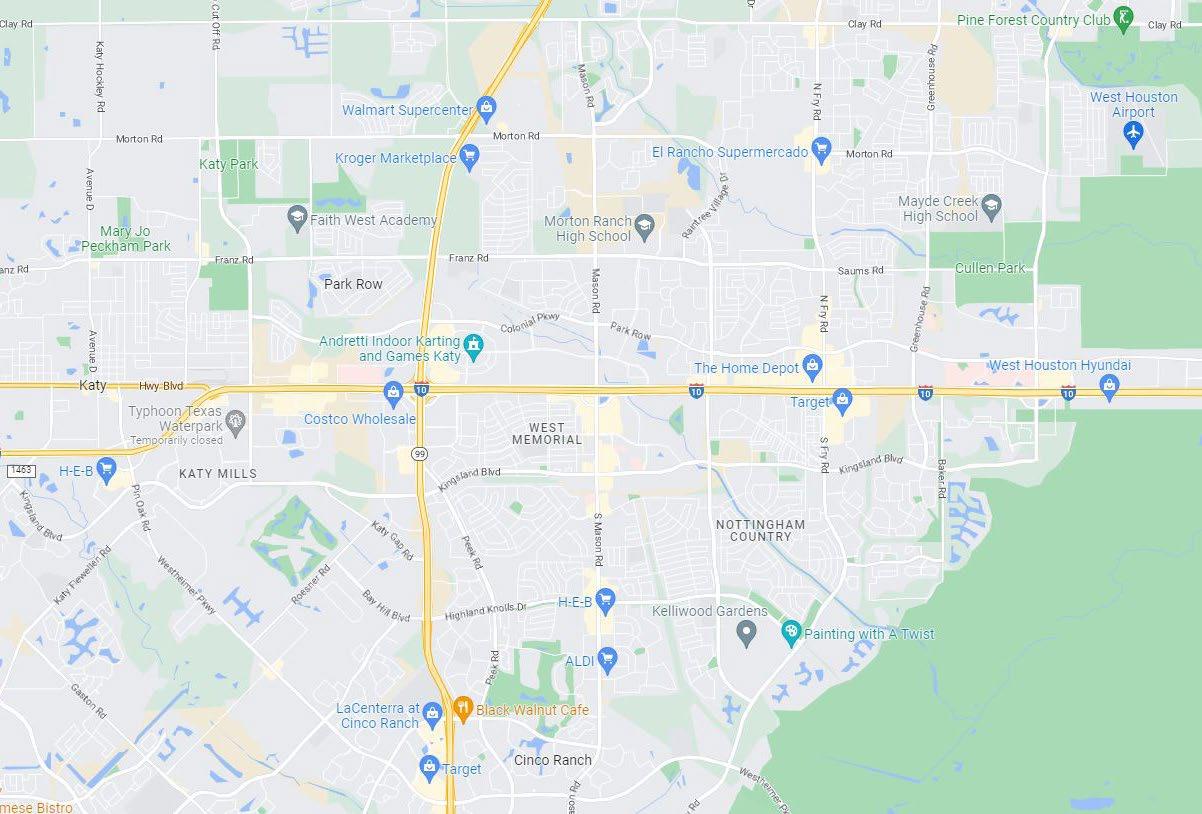

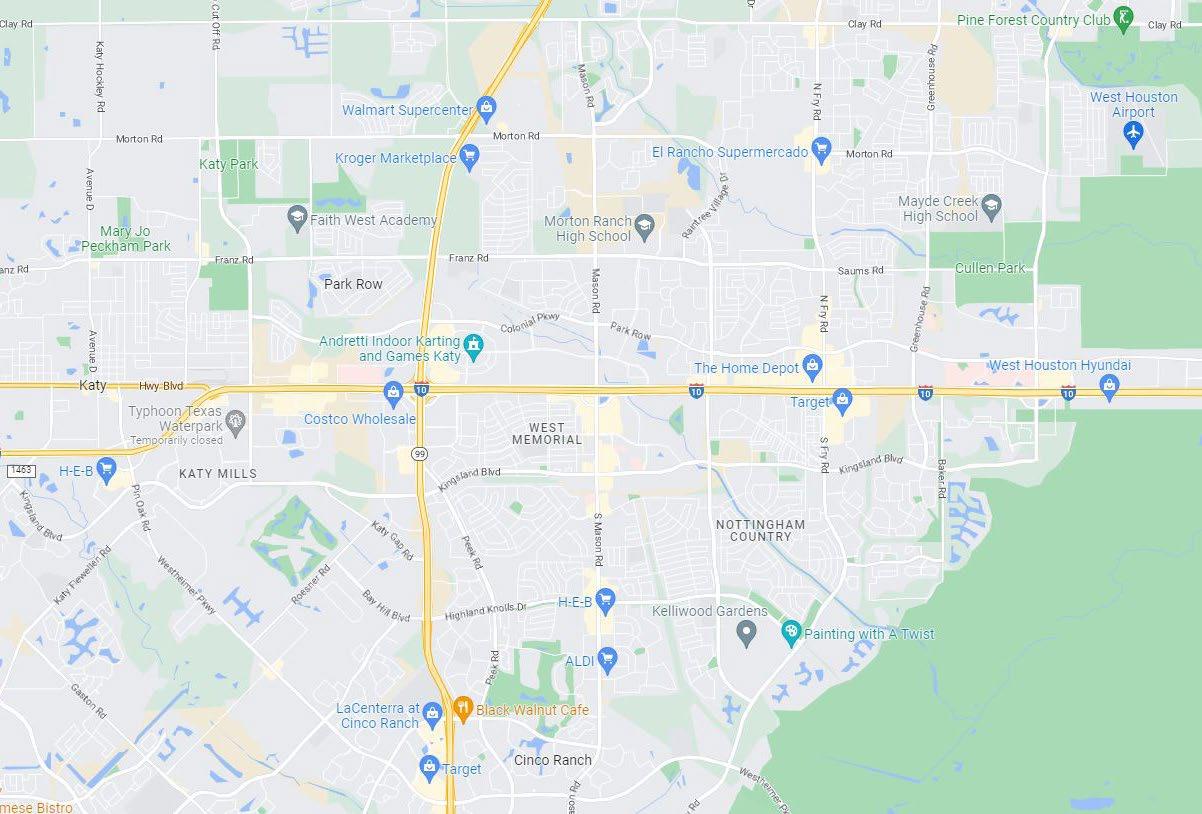

7 MARKET OVERVIEW UNCLE JULIO’S - KATY, TX LOCAL MAP

KATYFWY 216,600VPD

8 MARKET OVERVIEW UNCLE JULIO’S - KATY, TX AERIAL MAP

9 MARKET OVERVIEW UNCLE JULIO’S - KATY, TX AERIAL MAP 216,600 VPD

10 MARKET OVERVIEW UNCLE JULIO’S - KATY, TX REGIONAL MAP

OVERVIEW

The City of Katy is the hub of three counties - Harris, Waller and Fort Bend - and is located on Interstate 10, just 30 miles west of Houston. Katy offers companies and residents the benefits of proximity to urban amenities and conveniences, access to deep talent pools and resources, and the accessibility necessary for the affordable movement of people, goods, and services. The city, which had a U.S. Census Bureau estimated population of 21,894 in 2020, is known for its picturesque residential neighborhoods that serve as home to employees working along the Energy Corridor and beyond. The one-time railroad town and the area surrounding is now a hub of retail and industrial development, thanks in part to ongoing highway and infrastructure improvements.

Katy provides a high quality of life for its residents with award-winning master-planned communities and abundant green space for parks and recreation.

Katy ISD ranks among the top school districts in the country, and the cost of living is 5% below the national average. Many large, mid-size and small businesses call Katy home, and the City of Katy is proactive in keeping taxes low and continuing to make improvements to water, sewer, and street infrastructure and beautification projects to create

Katy, TX

a business-friendly environment.

Home to many of the world’s major energy companies and a variety of compatible industry clusters, the Energy Corridor is on the perimeter of and part of the Katy Area - closer to Katy than Houston for a reason: Katy is where their leadership and employees live and raise their families. The growing Katy Area is home to the headquarters of BP America, Shell Exploration and Production, and Wood. This concentration of major Energy Service companies has resulted in the area also becoming a leading business destination for a number of energy related engineering, research, consulting, and information technology operations. Other major industry sectors include manufacturing, finance and insurance, healthcare, and utilities.

The Katy area continues to feature an expansive amount of available land. As the Houston region continues to grow, the availability of land will continue to be an attractive option for both commercial and residential developers. The energy industry will continue to serve as a driver for growth in the region, with the Katy area at the epicenter of this growth.

11 MARKET OVERVIEW UNCLE JULIO’S - KATY, TX MARKET SUMMARY

12 MARKET OVERVIEW UNCLE JULIO’S - KATY, TX DEMOGRAPHIC STATISTICS Demographic data © CoStar 2021 1 Mile 3 Mile 5 Mile Population 2010 Population 13,635 114,676 196,004 2022 Population 18,794 137,082 270,771 2027 Population Projection 19,946 142,940 292,238 Annual Growth 2010-2022 3.20% 1.60% 3.20% Annual Growth 2022-2027 1.20% 0.90% 1.60% Median Age 33.1 35.3 34.8 Bachelor's Degree or Higher 25% 38% 38% U.S. Armed Forces 22 76 180 Population by Race White 13,995 100,814 195,557 Black 2,927 16,848 36,343 American Indian/Alaskan Native 223 1,329 2,522 Asian 1,123 14,500 29,163 Hawaiian & Pacific Islander 20 135 335 Two or More Races 506 3,457 6,851 Hispanic Origin 9,196 48,357 98,956 Housing Median Home Value $175,694 $217,559 $231,072 Median Year Built 2001 1997 2003 1 Mile 3 Mile 5 Mile Households: 2010 Households 4,799 38,310 64,118 2022 Households 6,594 46,552 89,671 2027 Household Projection 6,996 48,651 96,848 Annual Growth 2010-2022 3.20% 2.00% 3.50% Annual Growth 2022-2027 1.20% 0.90% 1.60% Owner Occupied 3,151 34,077 70,481 Renter Occupied 3,845 14,575 26,367 Avg Household Size 2.9 3 3 Avg Household Vehicles 2 2 2 Total Consumer Spending $198.2M $1.7B $3.3B Income Avg Household Income $82,112 $108,418 $110,516 Median Household Income $68,773 $83,700 $86,472 < $25,000 965 4,348 8,202 $25,000 - 50,000 1,294 7,851 14,603 $50,000 - 75,000 1,389 8,656 16,031 $75,000 - 100,000 1,040 6,955 13,074 $100,000 - 125,000 786 5,227 10,799 $125,000 - 150,000 470 3,843 7,492 $150,000 - 200,000 390 4,238 8,760 $200,000+ 258 5,433 10,710

Net Lease Disclaimer

STRIVE hereby advises all prospective purchasers of Net Leased property as follows:

The information contained in this Marketing Brochure has been obtained from sources we believe to be reliable. However, STRIVE has not and will not verify any of this information, nor has STRIVE conducted any investigation regarding these matters. STRIVE makes no guarantee, warranty or representation whatsoever about the accuracy or completeness of any information provided.

As the Buyer of a net leased property, it is the Buyer’s responsibility to independently confirm the accuracy and completeness of all material information before completing any purchase. This Marketing Brochure is not a substitute for your thorough due diligence investigation of this investment opportunity. STRIVE expressly denies any obligation to conduct a due diligence examination of this Property for Buyer.

Any projections, opinions, assumptions or estimates used in this Marketing Brochure are for example only and do not represent the current or future performance of this property. The value of a net leased property to you depends on factors that should be evaluated by you and your tax, financial and legal advisors. Buyer and Buyer’s tax, financial, legal, and construction advisors should conduct a careful, independent investigation of any net leased property to determine to your satisfaction with the suitability of the property for your needs.

Like all real estate investments, this investment carries significant risks. Buyer and Buyer’s legal and financial advisors must request and carefully review all legal and financial documents related to the property and tenant. While the tenant’s past performance at this or other locations is an important consideration, it is not a guarantee of future success. Similarly, the lease rate for some properties, including newly-constructed facilities or newly-acquired locations, may be set based on a tenant’s projected sales with little or no record of actual performance, or comparable rents for the area. Returns are not guaranteed; the tenant and any guarantors may fail to pay the lease rent or property taxes, or may fail to comply with other material terms of the lease; cash flow may be interrupted in part or in whole due to market, economic, environmental or other conditions. Regardless of tenant history and lease guarantees, Buyer is responsible for conducting his/her own investigation of all matters affecting the intrinsic value of the property and the value of any long-term lease, including the likelihood of locating a replacement tenant if the current tenant should default or abandon the property, and the lease terms that Buyer may be able to negotiate with a potential replacement tenant considering the location of the property, and Buyer’s legal ability to make alternate use of the property.

By accepting this Marketing Brochure you agree to release STRIVE and hold it harmless from any kind of claim, cost, expense, or liability arising out of your investigation and/or purchase of this net leased property.

Information About Brokerage Services

Texas law requires all real estate license holders to give the following information about brokerage services to prospective buyers, tenants, sellers and landlords.

TYPES OF REAL ESTATE LICENSE HOLDERS:

• A BROKER is responsible for all brokerage activities, including acts performed by sales agents sponsored by the broker.

• A SALES AGENT must be sponsored by a broker and works with clients on behalf of the broker.

A BROKER’S MINIMUM DUTIES REQUIRED BY LAW (A client is the person or party that the broker represents):

• Put the interests of the client above all others, including the broker ’s own interests;

• Inform the client of any material information about the property or transaction received by the broker;

• Answer the client’s questions and present any offer to or counter-offer from the client; and

• Treat all parties to a real estate transaction honestly and fairly.

A LICENSE HOLDER CAN REPRESENT A PARTY IN A REAL ESTATE TRANSACTION:

AS AGENT FOR OWNER (SELLER/LANDLORD): The broker becomes the property owner’s agent through an agreement with the owner, usually in a written listing to sell or property management agreement. An owner’s agent must perform the broker’s minimum duties above and must inform the owner of any material information about the property or transaction known by the agent, including information disclosed to the agent or subagent by the buyer or buyer ’s agent.

AS AGENT FOR BUYER/TENANT: The broker becomes the buyer/tenant’s agent by agreeing to represent the buyer, usually through a written representation agreement. A buyer’s agent must perform the broker’s minimum duties above and must inform the buyer of any material information about the property or transaction known by the agent, including information disclosed to the agent by th e seller or seller ’s agent.

AS AGENT FOR BOTH - INTERMEDIARY: To act as an intermediary between the parties the broker must first obtain the written agreement of each party to the transaction. The written agreement must state who will pay the broker and, in conspicuous bold or underlined print, set forth the broker’s obligations as an intermediary. A broker who acts as an intermediary:

• Must treat all parties to the transaction impartially and fairly;

• May, with the parties’ written consent, appoint a different license holder associated with the broker to each party (owner and

• buyer) to communicate with, provide opinions and advice to, and carry out the instructions of each party to the transaction.

• Must not, unless specifically authorized in writing to do so by the party, disclose:

ӽ that the owner will accept a price less than the written asking price;

ӽ that the buyer/tenant will pay a price greater than the price submitted in a written offer; and

ӽ any confidential information or any other information that a party specifically instructs the broker in writing not to disclose, unless required to do so by law.

AS SUBAGENT: A license holder acts as a subagent when aiding a buyer in a transaction without an agreement to represent the buyer. A subagent can assist the buyer but does not represent the buyer and must place the interests of the owner first.

TO AVOID DISPUTES, ALL AGREEMENTS BETWEEN YOU AND A BROKER SHOULD BE IN WRITING AND CLEARLY

• The broker’s duties and responsibilities to you, and your obligations under the representation agreement.

ESTABLISH:

• Who will pay the broker for services provided to you, when payment will be made and how the payment will be calculated.

LICENSE HOLDER CONTACT INFORMATION: This notice is being provided for information purposes. It does not create an obligation for you to use the broker’s services. Please acknowledge receipt of this notice below and retain a copy for your records.

Information

Regulated by the Texas Real Estate Commission

available at www.trec.texas.gov

IABS 1-0

exclusively

469.844.8880 STRIVERE.COM

listed