24 minute read

COVER STORY

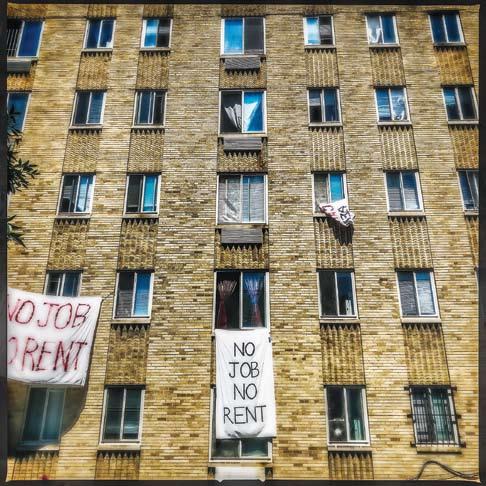

Path of Lease Resistance

As the pandemic drags on, tenants and housing advocates report hostile confrontations with property managers over unpaid rent.

Advertisement

By Morgan Baskin

Photographs by

Darrow Montgomery

The first time she remembers protesting in the region, about 10 years ago, Tara Maxwell was outside the Virginia home of Supreme Court Justice Clarence Thomas. His wife Virginia, the target of Maxwell’s ire that day, is a prominent right-wing lobbyist and current adviser to President Donald Trump’s administration.

“If I can protest at Clarence Thomas’ house, I can protest at anybody’s house,” Maxwell says dryly. “It doesn't bother me.”

So when Maxwell, an independent contractor with experience in law enforcement and political consulting, moved into the Park 7 Apartments on Minnesota Avenue NE last August, she was not afraid to raise hell over problems with her living conditions.

To start, she says, there was the persistent gas leak from her stove. Then there were the cockroach-infested washing machine and dryer, and the roaches she’d find scaling the walls of her building’s hallways. Little did she know that Park 7––which opened in 2014––was notorious among housing advocates for its poor management, with maintenance requests often languishing for months without resolution.

“This is my home,” Maxwell says. “I shouldn't have to feel, you know, oppressed and bullied and harassed, just to be able to live here. And I should be able to have decent amenities and maintenance repairs. I shouldn't have to fight and argue for that.”

Months after Maxwell moved in, D.C. Attorney General Karl Racine announced that Park 7 Residential LP, a Maryland-based corporation owned by prominent local developer Chris Donatelli, would refund nearly half a million dollars to 470 current and former tenants of the building who were improperly charged for water use, which had falsely been marketed as included in rent. (Neither Donatelli nor a spokesperson for Park 7 responded to City Paper’s emailed requests for comment. When City Paper called Donatelli, he cited a conflicting meeting and said he would call this reporter back. He did not do so before press time.)

Of the 377 units at Park 7, 362 are affordable, or rented below market rate, and many of the tenants are low-income workers, seniors, and people with disabilities.

By June, when it was clear that the economic effects of the pandemic were far from over, Maxwell notified Park 7 Residential via email that she was going on a rent strike and would withhold rent payments. Shortly thereafter, she began surveying her building to see if anyone else would join her. She’s not the only one––Stephanie Bastek, a DC Tenants Union board member who has been organizing Park 7 tenants for three years, estimates that 28 families are on rent strike, and that 94 have signed onto a letter demanding rent forgiveness.

Meanwhile, as conditions at Park 7 continued to deteriorate this spring, one of Donatelli’s other property companies received between $150,000 and $300,000 in a Paycheck Protection Program loan meant as pandemic relief, public records show.

“What's funny to me is that the argument all these landlords are making when they're pressuring tenants and assigning payment plans is, ‘We need your money to pay management, we need your money to make sure that, like, the building runs smoothly,” Bastek says. “And that seems like a total lie.”

Maxwell began seeing tweets from the DCTU as it organized rent strikes across the city and reached out to the group, not realizing initially that it was already working with Park 7 tenants. In August, she linked up with the DCTU to canvas one of Donatelli’s other, more well-maintained properties: Highland Park in Columbia Heights, a mixed-use complex located above the neighborhood’s Metro stop, where studio apartments rent for about $1,900 Jewel Burgess, Park 7 resident

a month and a two-bedroom can run $4,200.

COVID-19 has affirmed what Maxwell already believed to be true about the city in general, and her apartment in particular: That living in a building of lower-income residents makes them less visible, and their concerns less acute, to people in positions of power than they would have been if they had more resources.

The canvassing group, which included a resident of Highland Park and two from Park 7, arrived at the building around 4 p.m. on Aug. 12, and spent about an hour and a half knocking on doors. They visited 15 apartments, handing out fliers that read, “Your landlord discriminates.”

“At Park 7, Donatelli has failed to maintain sanitation [standards] under COVID, consistently intimidates tenants organizing, and refuses to pay for extermination. Children have nowhere to play but by the trash,” the flyer continued.

Maxwell thought the afternoon was going pretty well. Most of the Highland Park tenants who answered their doors politely took the fliers, and several asked questions about the conditions at Park 7. Even though none asked her to leave or expressed annoyance, Maxwell says around 5:30 p.m., Jason Sadlack, one of the managers of the property, stopped the organizers in a hallway and told them to leave. When they didn’t, he asked a colleague to call the

police, according to Maxwell. (Sadlack did not respond to City Paper’s request for comment.)

Video clips of the incident recorded by DCTU activists show a male and a female Metropolitan Police Department officer repeatedly telling the organizers to vacate the property, despite the fact that they were accompanying a Highland Park resident and behaving lawfully.

“The Tenant Bill of Rights allows us to organize,” an organizer tells the officers pointedly but calmly. “We are legally allowed to be here.” D.C. law says that landlords “may not interfere with the right of tenants to organize a tenant association, convene meetings, distribute literature, post information, and provide building access to an outside tenant organizer.”

“The thing is, I know y’all the guest of him, but because y’all passing out these fliers, they don’t want you here,” the male officer responds.

“What law are we violating?” two organizers ask over and over. Although the officers do not cite one, the male officer tells the activists, “Management wants y’all to leave, now y’all have to leave.” The whole group grows more and more agitated, and people begin speaking over each other for several minutes.

“If they want y’all locked up, we have to lock you up,” the male officer says at one point. “You haven’t told us what laws we’re violating,” the organizers repeat. (A spokesperson for MPD says that there is no incident report for the event, but wrote in an emailed statement, “We are looking into the matter to see if there were any policy violations in this incident.”)

For renters across D.C., it is not enough that the pandemic has caused hundreds of thousands of them to lose their jobs, savings, sources of stability, and, in some cases, loved ones. They must now contend with what many tenants and housing advocates say are hostile confrontations with property managers over unpaid rent, ranging from threats of eviction to disputes about living conditions and payment plans. At many buildings, this is happening as property managers continue to disproportionately enjoy federal and local financial assistance in the form of PPP loans, eviction prevention funds, and mortgage forbearances.

“I think what's problematic is landlords applying for and receiving these loans on the premise that they can't cover their expenses because the tenants are unable to pay their rent, and then turning around and demanding and collecting the rent from the tenants anyway,” says Rachel Rintelmann, a supervising attorney at the Legal Aid Society of D.C. “Between the federal money and the rents that are eventually going to be repaid by tenants in order to avoid eviction, it's actually not impossible that some of these landlords may come out ahead after this crisis.”

According to court records, Donatelli’s company, Park 7 Residential LP, filed writs of eviction for eight Park 7 tenants between March 11, when Mayor Muriel Bowser issued a COVID-19 stay-at-home order, and April 27. The cases include complaints about unauthorized pets, nonpayment of rent, and excessive noise, representing a small fraction of the District’s total eviction filings over that period.

Property managers initiated eviction proceedings against nearly 1,300 people between March 16 and May 5, according to data compiled by Stomp Out Slumlords, the housing

advocacy arm of the Metro D.C. chapter of the Democratic Socialists of America. D.C. Superior Court records show that even more eviction cases have trickled in since then, although they’ve dropped off in number.

Many of these eviction filings came from companies that have benefited the most from local and federal assistance related to COVID-19. Urban Investment Partners, for example, received between $1 million and $2 million in PPP money, yet it and its subsidiaries filed at least 79 writs of eviction after the stay-at-home order went into effect. Borger Management, Inc., the recipient of between $350,000 and $1 million in PPP funding, has filed 42 writs of eviction, and Gelman Management Company, which secured between $1 million and $2 million, filed 25. (The U.S. Small Business Administration has not shared

Meridian Heights

Park 7

specific PPP loan amounts, only ranges.)

And while the D.C. Council made it illegal for property managers to evict tenants for the duration of the public health emergency and for 60 days after, the Landlord and Tenant branch of D.C. Superior Court, where eviction cases are heard, said it would not automatically dismiss the cases filed during that time. Many of those cases are still pending, and given the backlog of housing cases from before the pandemic, it’s unclear how quickly they will be resolved.

These are just the documented cases. What’s harder to tell is how many people have endured harassment from their landlords, whether that be in the form of hostile payment notices or dumping tenants’ belongings on the street. The DCTU has outright stopped a handful of extrajudicial evictions, including one in late July in Prince George’s County, where activists physically blocked the landlord from kicking out his tenants. And in Virginia, a high-eviction state, according to data from the Eviction Lab at Princeton University, some tenants have received five-day “pay or quit” notices from their landlords this summer, despite a ban on evictions.

Jennifer Berger, an attorney who heads the Office of the Attorney General’s social justice office, says her team has already issued dozens of cease-and-desist letters to property managers of various sizes for pandemicrelated housing violations. Those violations include eviction threats as well as illegal rent increases and charges for amenities that tenants can’t use under current coronavirus restrictions, such as gyms. Berger has also heard from tenants whose landlords have entered their homes during the workday in alleged attempts to intimidate them.

“There's the explicit ‘pay or move’ kind of stuff,” Berger says. “And then there's also just the harassment because [tenants] aren’t paying, with hopes that it's so unpleasant that the tenant will leave.”

There are two main financial issues that property managers are facing right now, says Randi Marshall, the vice president of government affairs in D.C. for the Apartment and Office Building Association of Metropolitan Washington, a trade group of residential and commercial developers and property managers who operate in the D.C. area. (Prior to joining AOBA, Marshall most recently worked as a senior police advisor on housing and land use issues for D.C. Council Chairman Phil Mendelson.)

The first, which is most common among market-rate and luxury-priced rentals, is an abnormally high vacancy rate. Many college students who might otherwise be renting offcampus are now staying at home to save on rental costs, and workers who live in higherpriced buildings are choosing not to renew their leases. On the whole, AOBA members who operate market- to luxury-priced buildings anticipate seeing a 10 percent vacancy rate, nearly double the norm. “There is a crisis in leasing,” Marshall says.

The second issue is faced most acutely by renters of affordable and below-market rate housing, likely occupied by lower-income tenants whose homes are not subsidized by local or federal housing vouchers. These units, Marshall says, have been “hit hardest by tenants’ inability to pay rent.”

“It’s kind of the middle, low-to-middle buildings that are facing the biggest vulnerability when it comes to how do you [financially] sustain these buildings,” Marshall says.

She says that, for a number of reasons––higher utility costs in master-metered buildings due to more tenants working from home; a decrease in timely rental payments; an uptick in private trash pickup; buying PPE for employees––the pandemic has been costly for building operators.

One of the largest pools of assistance funds available for developers and property management companies are PPP loans, which were designed to subsidize payroll costs for businesses that have been financially impacted by the pan

demic. Business operators can also apply for total loan forgiveness––though the process is complicated––if they meet a number of spending criteria. PPP loan recipients are eligible for forgiveness even if they use a portion of the money on other operating costs, like rent, utilities, and interest on mortgages.

According to PPP loan information released this summer by the SBA, more than 40 D.C.-based property management, development, and construction companies, including ubiquitous players like UIP Companies, Douglas Development Corporation, Blue Skye Construction, Bernstein Management Corporation, and MidAtlantic Realty Partners, have received PPP loans. Some range from $150,000 to $300,000; others are between $2 million and $5 million. (In several cases, as for UIP, Borger, the Peebles Corporation, and Cafritz Interests LLC, those loans were approved by EagleBank, the Bethesda-based bank whose former CEO Ron Paul allegedly engaged in an inappropriate business relationship with erstwhile Ward 2 Councilmember Jack Evans. Ben Soto, the finance director for the nascent campaigns of Mayor Bowser and lame-duck Ward 4 Councilmember Brandon Todd, sits on EagleBank’s board.)

Property owners have other, more specific forms of financial relief available to them. The CARES Act, for one, created new tax advantages for multifamily property owners. And for properties financed through federally backed mortgages, as roughly two-thirds of properties in the country are, owners are entitled to defer payments for at least 90 days. Marshall says many property managers are electing not to apply for federal assistance, adding that these options “are not as attractive as many people might feel it is. Many of those loans have high interest rates, and that’s money you wouldn’t have to pay interest on before.” PPP loans, according to the SBA, have a one percent interest rate.

In D.C. specifically, programs like the Emergency Rental Assistance Program also provide tenants who are short on rent and face eviction the money they need to make payments on time. Although renters cannot legally be evicted right now, many continue to file ERAP applications, according to data provided by a spokesperson for the Department of Human Services: 1,477 people applied for funds between March 11 and Aug. 3, just 453 fewer applications than the same period last year.

How businesses are using those funds is less clear. There is little, if any, local or federal oversight over PPP spending, and few strings attached to the money that companies claim will make or break their operation.

In some cases, those resources have allowed property managers to pass along their savings to renters. The J. Alexander Management Company, which owns and operates the New Hampshire & First Apartments near Fort Totten, notified tenants this summer that those who lost income due to the pandemic would be eligible for a combined rent forgiveness and payment arrangement plan: For every $100 of their rent tenants pay each month for the next year, the company will knock $200 off. Beyond those 12 months, the company will reduce rent by $300 for every $100 the tenant spends, according to a letter the company circulated to tenants. The SBA’s PPP database shows that J. Alexander received between $150,000 and $300,000 in PPP loans. (A spokesperson for J. Alexander did not return City Paper’s request for comment.)

“They are offering some rent forgiveness,” says Katharine Richardson, an organizer with the DCTU. “They said, ‘We've got this PPP money, and we'll share it with our tenants.’”

Renters have comparatively fewer paths to financial assistance than property owners and managers. While U.S. residents received a $1,200 stimulus payment from the Treasury Department this spring, that money is long out of sight for those who lost their jobs, if they received it at all. Locally, in addition to the eviction moratorium, the D.C. Council also implemented a new regulation under the Coronavirus Support Emergency Amend

ment Act of 2020 that requires property managers and owners to negotiate new rental payment plans with tenants who request one, with a minimum of a one-year repayment term to keep monthly payments low.

But that presents an obvious problem: If a renter has lost her job and has no source of income, making her unable to pay rent, she certainly won’t be able to commit to a year’s worth of monthly payments plus a percentage of what she previously owed. In practice, that is, payment plans look a lot like taking on rental housing debt.

The majority of building managers that Richardson has worked with haven’t shown a willingness to go beyond what the law requires to accommodate renters. On 15th Street NW in Columbia Heights sits a 60-unit building called Meridian Heights. Since April, Richardson has helped organize about 40 families in the building to push for collective rent forgiveness, many of them Latinx immigrants who work in the service industry and have lived there for years. Importantly, many of these tenants, some of whom are on a rent strike, aren’t eligible for existing government assistance because of their immigration or worker statuses.

“It’s primarily people who just don’t have the money to pay [rent],” Richardson says, “a lot of restaurant workers, people who worked in cleaning, building maintenance.” In the long term, those striking and their supporters hope that Cobalt Property Group, a South Carolina-based real estate investment firm that owns the building, and NOVO Properties, its management company, will offer some form of rent forgiveness. The majority of tenants pay between $1,500 and $2,000 a month for studio or one-bedroom apartments.

And while they use the language of the “cancel rent” movement, the strikers and their asks, as outlined in a May letter to NOVO and CPG, are more specific: Rent forgiveness for the months of March, April, and May, and more broadly, a rent repayment plan that wouldn’t see tenants increasing their monthly payments.

“NOVO’s response has been, ‘We want to do everything we can to help people stay in their homes, but, like, you’ve got to pay all this money,’ so not necessarily offering a real solu

Stephanie Bastek

tion,” Richardson says.

“We are totally empathetic to what people are facing,” says Brett Summers, a managing partner at NOVO. But, he says, the building’s owners haven’t agreed to rent forgiveness, or to negotiating “as one individual body.” He says NOVO has sent notices in Spanish and English “saying we’re willing to have those meetings. We’re willing to do Zoom calls to negotiate.”

Summers notes that NOVO also manages CPG’s other multifamily building in D.C., an apartment complex on Sherman Avenue NW. “DC Tenants Union organized Sherman in June, and we went from 98 percent [rent] collection at Sherman in May to 50 percent in June,” he says. “I found it interesting, because we didn’t have a collection issue before, even though COVID had been in place for a couple months. I’m not saying residents aren’t having financial hardship, but people were finding ways or had resources to pay rent.”

Meanwhile, Meridian Heights’ tenants were growing increasingly frustrated. In May, Don Pavon, a tenant organizer and fixture of the building, died of COVID-19. At the same time his wife had to launch a GoFundMe to help raise money to repatriate his body to Honduras, the tenants allege that NOVO threatened to evict her from the building because she wasn’t listed on the lease. (“Totally false,” Summers says. “An inflammatory social media story just designed to activate and enrage residents.”)

Aside from grieving the loss of a friend, tenants were also worried about contracting the virus themselves, and about the general state of the building. Video of the property taken over the course of the spring and summer show dumpsters overflowing with garbage bags, piled in stacks around the bins. “It’s not safe,” one tenant narrating the video says. In what they describe as the absence of regular or thorough cleanings from NOVO, tenants donned masks and long rubber gloves to sweep and sterilize common areas. Other videos show small cockroaches crawling across the lobby’s black-and-white tiled floors.

On all these counts, Summers denies that the company was in the wrong. In addition to sending a pest control company to treat the building “top to bottom” in early August, Summers says that while the private trash hauler they contract with might have gotten backed up, the building “never did not have a trash hauler.”

“What has become clear to us is that tenants did not report repair and maintenance issues” at the outset of the pandemic, Summers says. “It’s evident now that we’ve received an enormous number of requests since the rent strike has come into play.”

Public documents reveal that NOVO, which manages 19 properties in D.C. alone, has received financial assistance during the course of the pandemic. NOVO Development Corp. received between $350,000 and $1,000,000 in PPP loans, SBA documents show. And a document breaking down the financial status of roughly 60,000 federally backed mortgage for multifamily apartment buildings with federally-backed mortgages in the country shows that, in a good year, Meridian Heights has a comfortable budget surplus: close to $690,000 in reported revenue, and expenses and debt service totaling $515,304, leaving about $173,000 in gross revenue. (“Financially, [the pandemic] hasn’t been as significant as we may have feared, but there’s definitely been a reduction in collective incomes,” Summers says.)

After declining to collectively bargain around new rental payment terms, NOVO began contacting residents individually, encouraging them to sign individual payment plans. When some declined to do so, the company sent them a second letter. “By signing below, I certify that I have been given an opportunity to enter into a payment plan … I AM DECLINING THIS PAYMENT PLAN,” the document says. Richardson believes that it’s the company’s way of teeing up a win in court should the company decide to pursue evictions once D.C.’s moratorium lifts this year: “If they go to court [for an eviction], they can be like, ‘Look, we have this documentation that tenants rejected their right to have this payment plan,’” she says “We're seeing a lot of landlords sending notices to tenants––really aggressive notices, in some cases. Sometimes they are offering the repayment agreements that they're required to enter into with tenants under the law. But the problem is, sometimes they're offering repayment agreements that don't comply with the law,” Legal Aid’s Rintelmann says. “They're offering repayment agreements that are, you know, just completely impossible for tenants to comply

Chris Donatelli’s residence

with, or they’re adding terms like, ‘You agree that not only will you repay the balance, but you will pay your rent on time each and every month for the next year,’ which is not permissible under the law.”

AOBA’s Marshall notes that, in general, many tenants who live in AOBA members’ buildings have proven reluctant to reach out to their property managers about potential payment plans. One of AOBA’s members, who Marshall declined to name, operates about 7,000 units of rental housing; of the 300 tenants who have fallen behind on rent, the company reported that only 30 people entered into payment plans.

It could just be that it’s too soon for many renters, particularly the newly unemployed, to agree to a new payment plan. How are you supposed to commit to a new rent schedule when you can’t find a job and don’t know how much money you’ll make when you do?

“When you look at the relief that is provided to tenants, or that has been discussed, it's always temporary relief, and it's never really complete,” Rintelmann says. “They really fail to acknowledge that many, if not most, lowincome workers will not be able to resume making full rental payments, let alone rental payments plus a repayment portion, any time in the near future. And so these plans, in some ways, just prolong the crisis for a lot of low-income families.”

The sun is setting on the Capital Memorial Seventh-Day Adventist Church in the tony enclave of Forest Hills, and across the street, the lights are on inside Donatelli’s $6.2 million mansion.

Donatelli bought the property, Forest Hills’ only landmarked home––built in the Shingle style in the late 19th century and dubbed the

Tara Maxwell

Owl’s Nest––in 2006. Sitting on two acres of land, it’s tucked back from the street behind towering trees, and Donatelli spent a nice sum doubling the home’s square footage when he renovated the property. There are turrets and stained glass windows, a pool, and a miniature golf course. Donatelli, his wife, and their four children “take pleasure in the quirks and whimsical touches in their historic home,” a 2013 real estate feature in the Washington Post muses.

And on a balmy evening in mid-August, the block is quiet; it’s punctuated only by the chatter of Little League stragglers practicing their swings at the baseball diamond across the way and the soft fuzz of radio jazz stream

ing in the park next door. But the DCTUn has other designs for the night.

About three dozen tenant organizers, plus a smattering of tenants from Park 7, donned face masks and black T-shirts to disrupt Donatelli’s dinner hours. Bearing cardboard signs, white sheets, and flags, all emblazoned with slogans like “cancel the rent” and “rent strike,” the crowd parked themselves in the concrete driveway of the Adventist Church, using Donatelli’s home as a backdrop for their demonstration against his management practices.

“Chris Donatelli, you are oppressing and exploiting your tenants,” Park 7’s Maxwell says with gusto into a mic that’s been hooked up to an amp, staring down Donatelli’s house. “We are in a health pandemic and that doesn’t seem to bother you.”

She pauses, the end of her words bouncing down the block. One of Donatelli’s neighbors steps onto his balcony and begins filming the scene. Others who live on the street wander down to suss out where the noise is coming from.

There are the poor housing conditions, sure. There is also the small fact that many people simply cannot afford their rent anymore. But mostly, it seems, there is anger over Donatelli’s blanket refusal to engage with tenants about these concerns. Responding to an email from a Park 7 renter that said “tenants are putting up with so much and are expected to be quiet”—one of the few times he replied to tenants who requested a meeting with him—Donatelli wrote, “God bless you [and] our team during this difficult time.” He added a prayer emoji.

“You’re sitting in your home on the hill with your round driveway, but we’re sitting in fear,” Maxwell says to cheers from the crowd assembled behind her. “You can live pretty much anywhere you want. We don’t have that luxury. Cancel the rent.”

The street traffic grows: Two teenage boys whiz by on skateboards, stopping at the outskirts of the crowd to listen in. A handful of Donatelli’s neighbors, all of them older and white, stop to ask this reporter with genuine curiosity just what’s going on here. They’ve never seen anything like this in their neighborhood, they say. Behind Maxwell, an activist twirls a flag in the air that reads “RENT STRIKE.”

At the mic, another Park 7 resident surveys the crowd. In this neighborhood, “you see kids playing soccer, you see kids skating,” she says, eyeing the skateboarders. But in Ward 7, which has been hit hard by COVID-19, she says, kids are too scared to play in the street. “You don’t see nobody skating. They’re afraid to come out.”

On internet forums for the unemployed trying to navigate arcane unemployment insurance systems, people across the country with $10 to their names ask where you can go to make a hundred bucks a week for transfusions of blood plasma. Some suggest that fertile women sell their eggs. Washingtonians best each other with the number of times they’ve tried to reach D.C.’s Department of Employment Services, to no avail. “My savings are drying up a bit and I’m just getting a little nervous,” one user says. “This is the crisis of a lifetime for all of us, and we're all just trying to get by,” adds another. The number of people in D.C. who say that the unemployment office has not responded to their claims continues to mount.

In Ward 7, where Maxwell and her Park 7 neighbors live, nearly 17 percent of people are unemployed, data from DOES shows. At least 89 residents of the ward have died from COVID-19. This misery, and the weight of this knowing, is the drumbeat of daily life.

“We are not going to continue to allow your reign of terror,” Maxwell continues.

Through the living room windows of the house, a man’s silhouette is visible. He peers out the window sporadically, surveying the crowd that crossed a city in the middle of a global pandemic to make their points heard.

They don’t want platitudes. They don’t want pity. And they certainly do not want Chris Donatelli’s thoughts and prayers.