4 minute read

Jada Grandy-Mock Is Preparing New Paths for Herself, Family and Community

By Angela Lindsay

Fifth Third Bank executive Jada Grandy-Mock has accomplished a series of impressive firsts throughout her life. She was the first in her family to go to college; the first to earn a master’s degree; the first to own a home; the first to get married; and will likely be the first to leave an inheritance. However, when asked what makes her most proud, her answers reflect her delight in the advancement of others.

Grandy-Mock is chief corporate community economic development officer at Fifth Third Bank. She and her brother were raised by a single mother in a neighborhood in Pittsburgh where teenage pregnancies were common, she said. She also recalls her brother dodging bullets in their public housing community. While her mother worked hard, Mock was responsible for her brother along with completing household chores. Despite the hardships, Grandy-Mock stayed the course and brought her brother and others right along with her.

“I’m most proud of my brother graduating from college and the father and husband he has become,” she said. “I supported my brother’s education financially, and it has really paid off.”

The beauty of her experience is that her cousins attended school as well and “the generational poverty gap is gone,” GrandyMock said. None of her family members currently live in public housing. GrandyMock considers lifting up others to be one of her most important assignments in life and her work as a founding board member of the Renaissance West Community Initiative reflects her dedication to that cause. “Seeing that community thriving and being a haven of hope and economic opportunity for its residents” is extremely important to her, she said.

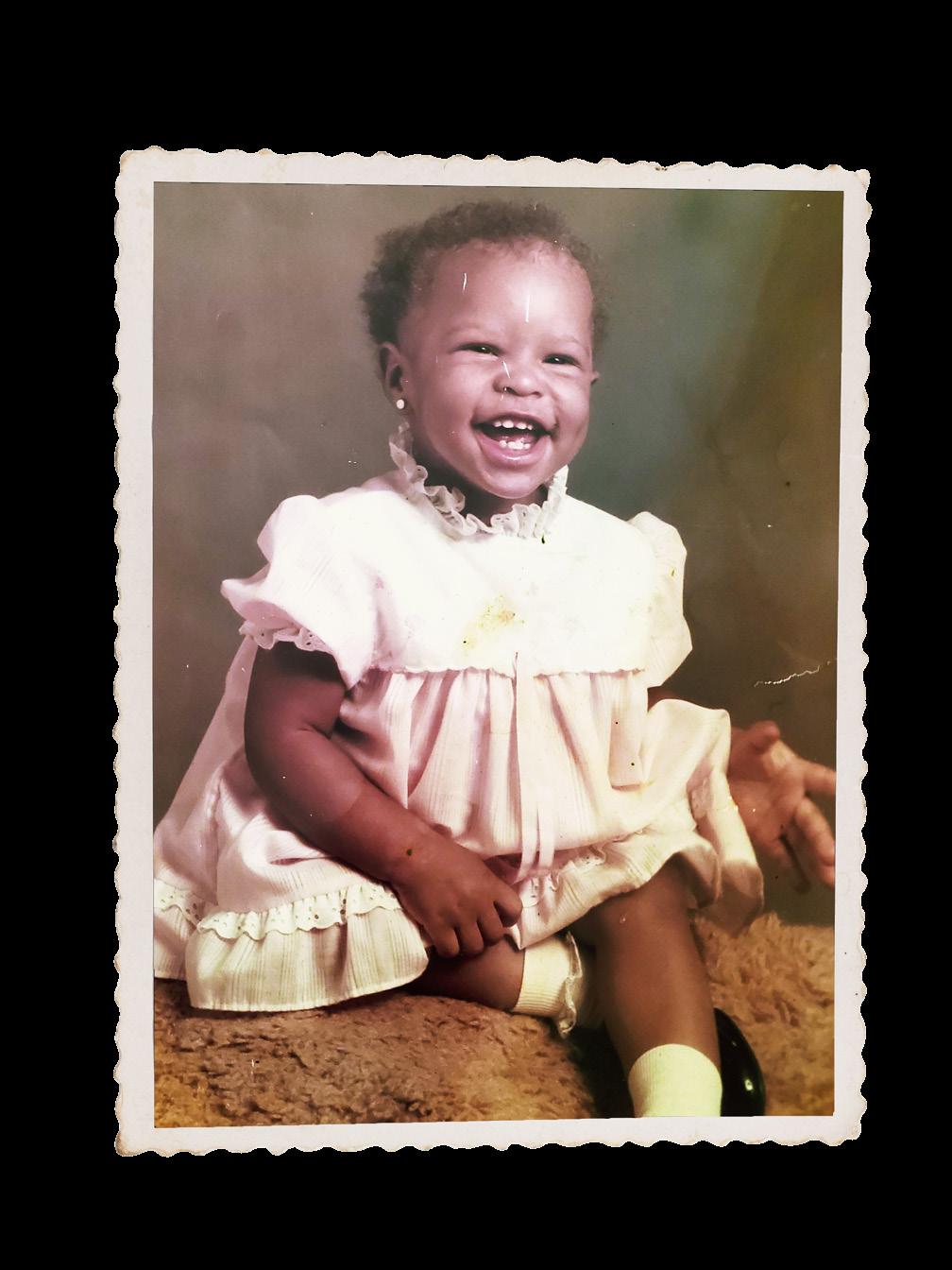

Left: Jada GrandyMock (center) attends an Annual MLK Holiday Breakfast in Charlotte. Below: Jada GrandyMock grew up in Pittsburgh. Here she is as a toddler.

During her childhood, Grandy-Mock, who began working when she was 14, saw families in her own neighborhood struggle financially due to a lack of resources and opportunities.

“I remember people passing away and families going around with cups or envelopes asking individuals to contribute to be able to help lay loved ones to rest,” she said.

This reality made her want something different for her family and inspired her to pursue a career in banking to create economic opportunities for people so that they could, in turn, help others. Although she was an honor roll student, she admittedly was “not the best behaved” child and frequently found herself in trouble. But instead of detention, teachers gave her more schoolwork. Plus, she had people around her who cared — starting with her mother.

“While we didn’t have a lot of money, my mom always taught us the importance of hard work and getting an education,” she said. “She also taught us a lot of things about what money couldn’t buy like having a strong work ethic, believing in something bigger than ourselves, and having respect for adults and authority.”

In addition, Grandy-Mock benefitted from mentors who encouraged her to excel in school, who didn’t underestimate her potential and exposed her to a world outside of the one she knew. Armed with this encouragement and an innate determination, she went on to earn both a bachelor’s degree in business administration/finance and an MBA in management from Robert Morris University. She later earned a diploma from the American Bankers Association (ABA) Stonier Graduate School of Banking and a Wharton School of Business Leadership and Management Certificate.

Now, Grandy-Mock leads Fifth Third Bank’s community development, corporate responsibility and Community Reinvestment Act (CRA) compliance strategic initiatives. She supervises a team of 16 community and economic development managers. Her focus includes overseeing strategic community development banking partnerships, establishing philanthropic strategies, coaching and developing employees, and driving the bank’s CRA business and diverse market segment results to create financially inclusive and economically viable communities. Her rise, however, has not been without its challenges.

Grandy-Mock admits to missteps early on. She said she wasn’t always “the most tactful person” and that caused some angst in her relationships. This personality trait caused people to see her “as a threat versus a partner” so she had to “soften up a little bit,” she said. Since then, Grandy-Mock has learned to manage other people’s perceptions, walk with confidence, believe in her own capabilities and accept feedback from others.

She cherishes her ability to lead and inspire her team to “march together toward a shared vision to be the one bank people most value and trust,” she said. She and her team are dedicated to building “stronger communities and providing people with financial solutions that will improve their lives and well-being.”

Grandy-Mock’s goal at Fifth Third Bank is to build on the success of the bank’s five-year $32 billion commitment to partner with community organizations that support small businesses, affordable housing, economic and workforce development to create financially inclusive and economically viable communities. Another of her goals is to provide philanthropic investments to support comprehensive community development and neighborhood revitalization.

As an optimist and a woman of faith and integrity, Grandy-Mock said she appreciates the importance of relationships and hard work and gives this advice to young women: “Be your authentic self. Be humble and be open and willing to learn. You’re better than you think. You’ve got this!” P