7 minute read

The Joy of Writing and Cooking

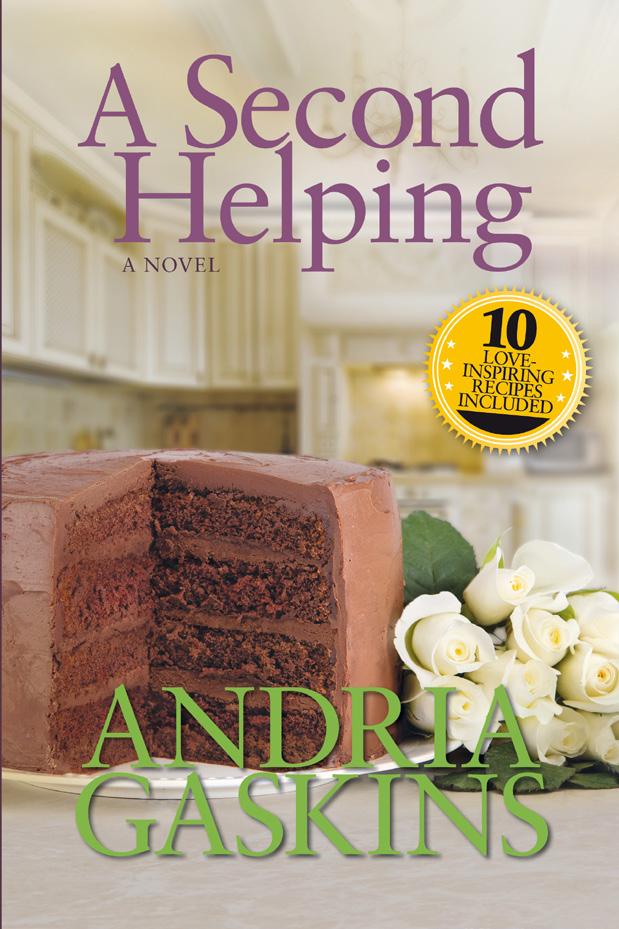

A Second Helping

Andria Gaskins is a romance novelist and great cook

By Lelita Cannon

Andria Gaskins holds many titles — doctor, wife, mother, novelist and culinary artist extraordinaire — to name a few.

A graduate of Wake Forest University, Gaskins was proprietor and head physician at Gaskins Chiropractic until 2003 when her first son was born. During that time, she felt a professional transition would best serve her family. She still wanted to work but remain close to home. After visiting Charlotte Regional Farmer’s Market, her husband suggested she sell baked goods there. Initially, she resisted. The idea didn’t appeal to her as a particularly successful or glamourous shift from her career as a chiropractor. “Leaving my practice to make cakes and pies sounded a bit cuckoo,” she said.

Gaskins experienced a less than delightful run-in with a more seasoned vendor she approached for advice while researching the venture. It was then that she decided to open her own stand. And her fellow baker’s customers followed her. Patrons flocked to her shop, and in 2004, Queen City Kitchen was born. Here, she also offered private in-house catering for market clientele.

In 2005, Gaskins birthed her second son, but continued to serve customers via her home baking business through 2010. She began cooking competitively in 2008 and participated in contests around the country for five years. She has won multiple awards for her cornbread—a tried and true traditional Southern favorite. She launched the website QueenCityKitchen.com in 2009 and has appeared as a regular guest chef featured on “Charlotte Today” and “Good Day Charlotte.”

Gaskins cultivates her own recipes and develops additional concepts to improve upon those that are not her original creations. She plucks motivation from myriad resources. “I get inspired by different things and experiences. I can’t put my finger on just one thing. If I write a recipe for my website, I’m inspired by childhood memories, experiences with my husband or past cooking competitions. If I write a recipe for TV or a contest, I pay close attention to current food trends and try to incorporate them into recipes that spark nostalgic

Novelist and cookbook author, Andria Gaskins and her book, A Second Helping.

Photo courtesy of Andria Gaskins

memories for the viewers or judges. My inspiration comes when the situation comes.”

In 2015, Gaskins’ book, “A Second Helping” was published. Marrying her enthusiasm for love and cuisine led her to construct the consummate romantic comedy. She never set out to write a novel, but instead, dreamed of publishing a cookbook; however, agents and publishers were more interested in celebrity cookbooks. Nonetheless, Gaskins found the silver lining. Deeply in love and living her own fairytale with her husband of 22 years — her college sweetheart — and father of their two teenage sons, she wanted to share what that looked and felt like. “I don’t really like romance novels, but I’m a corny sap who’s really good at writing love stories,” she said. “I love love.”

“My husband was a published short story writer, and I am too competitive for my own good. I figured if he could write short stories and get them published, then I’m going to write a long story and get it published.”

Gaskins has authored a cookbook inspired by what her characters in “A Second Helping” ate. She’s currently testing recipes with plans to debut for the 2022 holiday season. She is also currently working on her second novel. Though it has been challenging, completing both a novel and cookbook while growing Queen City Kitchen, her goal is to release the untitled book in 2023.

Gaskins is a Matthews Community Farmers Market vendor and board member. Her Queen City Kitchen select baked goods are also available at Coffee Central on the campus of Central Church.

Follow Andria on Instagram @queen.city.kitchen. P

Female Homeownership Is on the Rise:

Here’s How to Get Started on Your Home Buying Journey.

By AJ Barkley, Neighborhood and Community Lending Executive, Bank of America

According to the U.S. Census*, the homeownership rate among women increased from 51% to 61% over the past 30 years, while the homeownership rate among men dropped slightly from 71% percent to 67% percent. As women reach higher education and income levels, they’re making homeownership a priority. like embarking on a new adventure.

Single women are an especially powerful force, making up the secondlargest demographic of U.S. homebuyers – second only to married couples (National Association of Realtors®). Across the country, single women are forgoing the traditional path of getting married, then buying a home and having children. It’s clear they’re fiscally educated, want to gain control of their financial futures and see homeownership as a way to build equity.

Whether you’re a single woman or not, you may be assessing whether homeownership is right for you and where to start, so we’re breaking it down:

To Buy or Not to Buy

It’s no secret that buying a home is one of the biggest financial decisions you’ll make, so how do you know when you’re ready to graduate from renter to homeowner? It’s important to understand each options advantages and drawbacks, and asses your personal and financial circumstances. • Consider Upfront Costs: In addition to a down payment, you should budget an additional 3%-6% for the upfront fees/costs to buy a home.

Keep in mind, there are solutions that can significantly reduce the amount of money you need to buy a home. In fact, Bank of America offers one of the most generous programs in the industry with up to $17,500 in combined down payment and closing costs grants (no repayment required).

Visit bankofamerica.com/homeowner to learn more.

• Balance Self-Expression and

Responsibility: Renting typically limits the freedom you have to make the space your own, but the landlord is financially responsible for repairs and maintenance. On the other hand, as a homeowner, you have the freedom to customize your home to fit your lifestyle and needs.

• Potential to Build Long-Term

Generational Wealth: As a renter, you face unpredictable rent increases each time your lease is up for renewal.

As a homeowner, a fixed-rate mortgage means steady principal and interest payments. Moreover, homeownership remains one of the most common methods for families to build generational wealth, as homes may appreciate over time. Your Financial Journey from Savings to Sold

If by now you’ve decided homeownership is right for you, you may be wondering where to begin. No matter where you are on the financial journey, Bank of America is committed to helping hopeful homebuyers get on the right path with a range of solutions – starting with tools that help manage spending and saving patterns while practicing responsible credit behavior. • Plan, Budget, Save: Define, prioritize and make progress toward your financial goals with Life Plan®, a

digital experience that helps you set and track near- and long-term goals based on your life priorities, and better understand and act on steps toward achieving them. Get started at bankofamerica.com/lifeplan.

• Prioritize Paying Down Debt:

Reducing your debt-to-income ratio makes you a more attractive borrower.

Bank of America’s Better Money

Habits videos and checklists can help you build financial acumen so you can manage more complex financial needs over time. Visit bettermoneyhabits. bankofamerica.com to get the financial know-how you need to move forward.

• Run the Down Payment Numbers:

Calculate your down payment with our Mortgage calculator. The down payment you make on your home not only affects how much you’ll need to borrow, but it can also influence your interest rate and whether your lender will require you to pay for private mortgage insurance. If you put less money down on a home at closing, you’ll pay more in fees and interest over the loan’s lifetime (and vice versa). Run the numbers at bankofamerica.com/mortgage/ mortgage-calculator.

Whether homeownership feels a few months or a few years away, it’s never too early to start thinking about your next savings goal. As you look ahead, connect with a local Bank of America lending specialist to discuss your situation and available options. P

* The 30 year range is from the 1990 Decennial Census to the 2019 American Community, and was cited in a report from the Urban Institute – A Three-Decade Decline in the Homeownership Gender Gap.

Bank of America, N.A., Member FDIC Equal Housing Lender ©2022 Bank of America Corporation