Strides for Peace is putting on its 2nd annual event at the University of Illinois Chicago’s Dorin Forum

By JESSICA MORDACQ Staff Reporter

While Strides for Peace’s annual Race Against Gun Violence is a way for grassroots gun violence prevention organizations to raise money, its second annual gun violence prevention expo allows these organizations to connect with each other — and with young people At the University of Illinois Chicago’s Dorin Forum on Nov. 21, the expo’s theme will be “Le gacy of Leadership: Inspiring the Next Generation to Rise.” A large portion of the event aims to connect high school students

The Foundation was created by the community, for the community. Join us to build a racially just society in which all members of our community thrive and prosper. Together we can invest in real change.

Please give to our annual fund today.

By SAM TUCKER Contributing Reporter

Four arts and design businesses have moved into a newly rehabilitated building in East Garfield Park, opening in a corner location in the neighborhood after a ribbon-cutting ceremony.

Business owners Micah Taylor and Tom Livings acquired the building that had been used as a gear factory, and it has been under renovation for over a year. Now, they have opened their four businesses in the 100-year-old building at 2811 W. Fulton St.

T he four businesses include Chicag P rintworks, a print shop, and Direction Tour Marketing, an arts marketing agency. Taylor is the president of b oth. Livings is the co-owner of S tudio i nHaus, an architectural rendering firm and a partner in Fl ightFX, an aircraft simulator design fir m.

From le to right, Laarni Livings, co-founder of Studio inHaus, Micah Taylor, 27th Ward Ald. Walter Burnett, Tom Livings and Mike omas, the executive director of the Gar eld Park Community Council, take part in the ribbon cutting on Oct. 24.

Editor Erika Hobbs

Sta Repor ter Jessica Mordacq

Special projects reporter Delaney Nelson

Contributing Editor Donna Greene

Digital Manager Stacy Coleman

Digital Media Coordinator Brooke Duncan

Reporting Partners Block Club, Austin Talks

Columnists Arlene Jones, Aisha Oliver

Design/Production Manager Andrew Mead

Editorial Design Manager Javier Govea

Designers Susan McKelvey, Vanessa Garza

Marketing & Adver tising Associate Ben Stumpe

Senior Media Strategist Lourdes Nicholls

Business & Development Manager Mary Ellen Nelligan

Circulation Manager Jill Wagner

Publisher Dan Haley

Special Projects Manager Susan Walker

BOARD OF DIRECTORS

Taylor said they bought the 5,700-squarefoot building from Overton Chicago Gear, a gear manufacturer, and started renovations in 2023. It took $2 million worth of investments to turn the manufacturing building into the current business space.

“Already, we feel like we’re becoming part of the community as a whole,” Taylor said. “Now, realizing that we’re here, we want to see what’s needed and what we can provide. We’re really looking forward to working with community members to better understand that … our number one priority is to simply be a good neighbor.”

The 2023 Chicago Equitable TransitOriented Development grant from the city made up $250,000 of the building’s investment. Access to transit was a big part of the owners’ move into Garfield Park. The grant gives funds for development near transit that is community-led and equitable. The building is a few blocks from the California Green Line stop and the 94 California Avenue bus line.

Chicago Printworks, owned by Taylor, is a digital print shop that offers printing for banners, posters, signs and flyers. Taylor said Chicago Printworks is a small print shop that offers a human interaction and personal tailoring that is hard to come by in the digital world of online print shops.

T he shop creates printworks from small-batch business cards, to major projects for large companies. Appointments can be made online to come into the shop to work on projects face-to-face with their printing team.

“A lot of shops don’t want to turn on the machines for, you know, a small run of 100 programs for a local theater, or 50 posters for an art opening. We’ve really found our place to shine in small-run projects,” Taylor said.

Taylor’s other business, Direction Tour Marketing, is an arts marketing agency

that specializes in promotion in the “real world.” They create marketing campaigns for businesses, events and organizations. Taylor said they help clients connect to unique and niche customers through marketing at places that are out in the neighborhoods where events are taking place.

Studio inHaus creates architectural rendering and visualizations, such as building plans or interior designs for new developments

“When you see a picture of a building outside of a building site showing you what it’s going to be, that’s kind of the most obvious example of what we do,” Livings said.

Livings co-owns the business with his wife, Laarni Livings, and said Studio inHaus performs much of their work for hotels, local and national, when they are in the process of redesigning hotel rooms and

Chair Eric Weinheimer

Treasurer Nile Wendorf

Deb Abrahamson, Gary Collins, Steve Edwards, Judy Gre n, Horacio Mendez, Charles Meyerson

Darnell Shields, Sheila Solomon, Audra Wilson

60302

708-467-9066

CIRCULATION Jill@oakpark.com

www.AustinWeeklyNews.com

by Juan Torres

Sunday, Nov. 17, from 6 to 8 p.m., BUILD Headquarters

Attend an art reception at the Broader Urban Involvement and Leadership Development, or BUILD, this month. The reception is for artist Juan Torres’ “MemoRíes,” a series of works that shares stories to connec t across communities and cultures. The work explores, “images that evoke the power of memory and nostalgia.” The work will be shown in BUILD’s gallery throughout November. The event is free to attend. Find more information on BUILD ’s website: https://ow.ly/S6os50U4oa1. 5100 W. Harrison St.

Dec. 6 from 9 a.m. to 7 p.m., and Dec. 7 from 11 a.m. to 3 p.m.

BUILD Headquarters

The Broader Urban Involvement and Leadership Development, or BUILD, will be sponsoring The Austin Holiday Market in early December The market celebrates local, small Black- and Brown-owned businesses, as well local nonpro ts. The market will have a range of products from about 30 vendors Sweet treats, handmade goods, vegan food and more will be o ered at this holiday market. Find more information about the market and the full list of vendors: https:// www.buildchicago.org/event/2024_ austinholidaymarket/. 5100 W. Harrison St

Wednesday, Nov. 13, 6 to 7 p.m., Gar eld Park Conser vatory

The Gar eld Park Conser vator y is hosting an in-person yoga session this month. Every month an in-person class is hosted at the conservator y, as well as bi-weekly virtual classes. The classes are taught by experienced yoga instructors and are hosted in the Horticulture Hall in the conser vator y. Tickets are $5 to attend the class. Register and nd more information about the event at: https:// ow.ly/Oz6v50U4o5S

Accepting donations through Dec. 1 Austin Coming Together is accepting donations for their holiday Toy Drive through Dec. 1. People can donate toys for children and young adults, ages 1 to 18. The donations will go to local children and families in the Austin community. The donation drive is accepting toys, coats and games. Items can be dropped o at the Austin Coming Together o ce, located at 5049 W. Harrison St., or items can be bought on the drive’s Amazon wishlist. Donate to the Amazon wishlist at https:// ow.ly/OSVT50U4ojy. Contact hub@austincomingtogether.org for more information. 5049 W. Harrison St.

Every Tuesday, from 10 to 10:30 a.m., and Thursdays 2 to 4 p.m.

West Side Forward hosts weekly info-sessions on their job opportunities, programs and resources. D uring the meeting, participants can learn about di erent resources and training programs in the carpentry, electrical and 3D printing trades. West Side Forward’s 10-week training programs equip graduates with both career entry skills and entrepreneurial skills. These training programs are only eligible for adults, age 24 and above, who have been formerly incarcerated or charged or convicted of a crime. To register for the info-session, call 267-807-9605 and use the access code: 346217. Learn more about the training program eligibility and its o erings on their website here. Contac t ji2@ westsideforward.org, or call 773-694-3045 to nd out more information. 4100 W. Ferdinand St

Compiled by S am Tucker

Zabicki’s work takes inspiration from chocolate-covered snacks and other ‘fanciful and decadent’ things

By LEEN YASSINE Block Club Chicago

About 15 years ago, Chicago artist Gwendolyn Zabicki started noticing the word “enrobed” everywhere.

“I would say it started with these cookies,” Zabicki, 41, said. “Everything was enrobed in chocolate. Like, we weren’ t

dipping things or dunking things or covering things in chocolate. They were now enrobed. And it was this beautiful, fanciful word. It was so extravagant for cookies or pretzels … and that word just stuck with me.”

Zabicki, 41, started noticing other enrobed things — or “things covered in other things” — like an upholstered couch she saw left outside in Logan Square. As the seasons passed and the furniture sat in a neighbor’s backyard, it became enveloped in a “perfect and smooth” layer of snow, she said.

Zabicki tried painting the couch more than a decade ago and returned to it in 2023, which inspired the work in her upcoming exhibit, “Enrobed”: a melted popsicle covering a sidewalk, a phone light shining

over a paletas cart menu, concentric halos of light seen around wet tree branches if it’s particularly humid.

The exhibit at Goldfinch Gallery, 319 N. Albany Ave., has been about a year in the making.

“As a painter, you watch like, your skills keep growing, and you keep becoming better and better,” Zabicki said. “So I started

page 1

with young adult leaders who funnel their passion for gun violence prevention into their communities.

About 200 Chicago public school students — including those from Austin Career and Colle ge Academy High School, Michele Clark Academic Prep Magnet High School, John Marshall Metropolitan High School in East Garfield Park, and North Lawndale High School — will attend the first half of the expo, featuring a panel discussion with friends of Blair Holt, a 16-year-old who was shot on a CTA bus in 2007, and Hadiya Pendleton, a 15-year-old shot in 2013.

The panel discussion speakers are leaders in their communities, and in their 20s or 30s, according to Joel Hamer nick, Strides for Peace’s executive director.

“When they were in high-school, [they] were impacted the way that many of the students in the room are currently experiencing,” Hamernick said. “But these young adult leaders went and did something, something responsive, something to create safety, to be healthy, something positive.”

Then, students will go into breakout sessions. These will include the likes of a hands-on “Stop the Bleed” training and youth-led peace circles

Students will also participate in a community showcase, where mentors lead groups in discussing ideas around school

safety and public health.

After students leave, the second half of the event looks like a typical expo. There will be a resource fair of about 50 tables of gun violence prevention foundations, organizations offering relevant support and training, and career development groups.

This year’s expo participants include West Side organizations such as BUILD, Breakthrough, YMEN, and New Life Centers.

These organizations will get to network with each other and expo attendees.

“Having done this work for more than 20 years myself, you end up being very noseto-the-sidewalk. You’re very focused on what you’re doing in your neighborhood,” Hamernick said. “These organizations often operate kind of in silos.”

An expo like this helps inform organizations of the breadth of work going on in their communities, and helps to lift spirits, too.

“The violence itself becomes so all-encompassing as the story that it’s easy to miss all of this other work that’s going on around the community,” Hamer nick previously told Austin Weekly News.

“There’s also a psychological benefit to it,” Hamernick said of the expo. “It’s just fundamentally encouraging to know that there are a lot of other people in this work that care about these things.”

The expo is free to attend. Booth re gistration is $500 and can be purchased at https://lu.ma/03z9kmgu.

Strides for Peace’s Gun Violence Prev ention Expo is at UIC’s Dorin Forum, 725 W. Roosev elt Road., on No v. 21 from 10 a.m. to 5 p.m.

in East Gar eld Park

from page 3

undergoing new construction.

we get to fly the plane,” Livings said. Ald. Walter Burnett Jr. of the 27th Ward, said the addition of the new busi ness brings a new energy to a “dead” corner of East Garfield Park. He said these businesses can give local youth an idea on the kinds of careers that are possible, and provide a “domino effect” for businesses

Democracy, Accountability, Equity, Connection, Civility

Election Day and the launch of Growing Community Media’s largest ever fundraiser do not intersect by accident.

Democracy is on the line this minute and it has never been clearer that local news is essential to salvaging and strengthening our democracy – whether that is across this great country or in the villages and neighborhoods we have covered for decades.

That’s why in our reader supported newsroom we focus on the Essential Civics and why democracy is at the top of our list of five virtues for local news. Democracy. Accountability. Equity. Connection. Civility. That’s the list.

Between now and Dec. 31 we aim to raise better than $300,000 from readers in our communities. We have a good head start toward that hefty goal thanks to the dozens of MatchMakers who have already offered their financial support.

In the coming weeks, we’ll use those funds to double your investment in the newsrooms which publish Wednesday Journal of Oak Park & River Forest, Austin Weekly News, Forest Park Review and Riverside-Brookfield Landmark.

If you believe that our reporters nurture democracy with every local municipal meeting we cover, every school budget we explore, each candidate we profile, then we ask you to invest in those reporters by becoming part of our newsroom.

We need hundreds of supporters who either renew their investment or decide for the first time that genuine, independent local news coverage deserves their support right now.

Making a donation to GCM is simple. So please consider signing on as a $10 recurring monthly donor, make a single annual donation at a level that works for you or let’s sit down and talk about your more substantial investment in this newsroom.

With your support we’ll be here, we’ll grow and we’ll deepen our coverage of every town we are honored to serve.

Democracy needs news. And news needs you.

With gratitude in advance.

Dan Haley Publisher Growing Community Media

Gwendoly n Zabicki’s paintings are o en inspired by leisure and where minds go when they have a moment of free time

of free time,” she said.

from page 5

with this painting, and I did it in 2023 with this couch covered in the blanket of snow.

“And then I was looking around for more things, and I’m like, ‘OK, things covered by things.’ And I just started seeing it everywhere and noticing it, and it became the theme for my show.”

While it took some time for Zabicki to hone in on her vision, much of the exhibit has ended up focusing on pleasure, she said. That’s what the word “enrobed” is all about to Zabicki — something “fanciful and decadent,” she said.

“The first couple ideas you have up for an idea, they’ re not that good. But then the longer you stay with it, the weirder, more interesting variations come forward,” Zabicki said. “It’s something that’s kind of percolating in the back of your mind, and then you start to see it. … Taken as a whole, when you look at the show, the paintings are very much about pleasure. There’s a painting of a cake, there’s a person in a hammock, there’s people at the lake, there’s a popsicle.”

Gwendolyn Zabicki’s paintings are often inspired by leisure and where minds go when they have a moment of free time.

That’s a running theme in Zabicki’s body of work, which is largely inspired by “where your thoughts go when you’re not paying attention, when you have a moment

“Every now and then, I’m living my l and parts of these little songs trickle back into my mind,” Zabicki said. “They’re aw songs, but they’re stuff that my kindergarten teacher taught me how to do, or a shoppin list, or your thoughts just bounce around. But that is a very large part of who we are and what it is to be alive, but that we don’t always share. We don’t have a chance to share it, and I’m interested in working at those things.”

Another of Zabicki’s “Enrobed” paintings is inspired by a group of young boys she passed while riding her bike.

“I saw some group of boys smoking a joint, and they were huddled in this circle,” Zabicki said. “It was obvious what they were doing there, because we’ve all done it, we’ve all been there, and it was very sweet. … I pedaled back, and I went up to them and asked them if I could make a painting of them. And they were all high at this point, but they were really open to the idea. … There’s one boy who’s like, slightly turned to the side, and he has a look on his face like, ‘Oh, please don’t bust us. Please don’t, oh middle-aged lady.’”

An important part of art making is “taking an absurd idea and just going as far as you can with it,” Zabicki said.

“People are open to it and rece ptive and they say, ‘Yes, yes. I want to go there with you,’” she said.

“Enrobed” is in Gallery I of the Goldfinch Gallery, 319 N. Albany Ave., and runs through Dec. 21. More information is available on the

website.

By EMELINE POSNER

Contributing Reporter

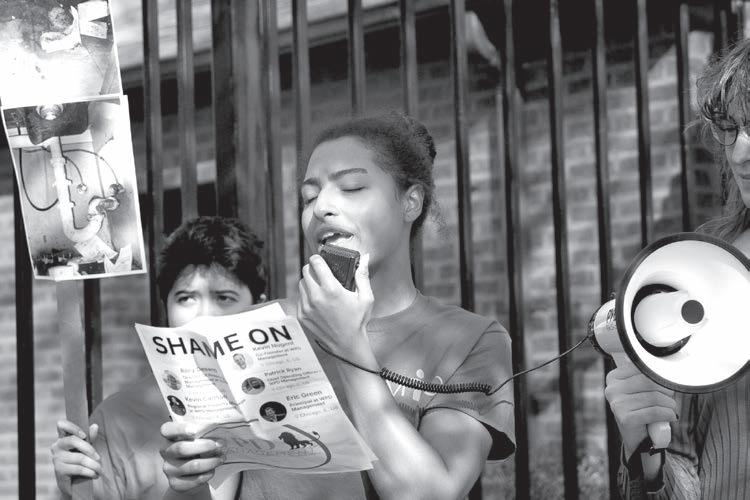

Tenants of a South Austin rental building say their new landlord has raised rents by hundreds of dollars but is not addressing hazardous conditions

Last Thursday, renters rallied outside the three-story, block-long apartment complex at 5334-5362 W. Madison St., calling on manager WPD Management to halt rent increases and eviction filings and to make necessary repairs to their apartments.

The company has notified tenants or rent increases between $300 and $800 for some apar tments, tenants said. The company has also filed a dozen eviction cases against renters, according to the Metropolitan Tenants Organization.

A couple of months after WPD Management took over the building in late May, the company raised Hector Rivera was notified that the company would raise his rent by $400. The tattoo artist, who has lived in the building for four years, took on extra work hours to save up for the increase.

But during the past six months, the management hasn’t responded to complaints about a severe roach infestation that affects his unit, he said. He shared videos with reporters showing dozens of roaches visible across his kitchen. He sets out roach traps daily, but they fill quickly, he said.

The infestation has drastically affected his quality of life. Rivera said he’s frustrated with WPD’s response

“You want my rent, but you can’t make repairs?” he asked. “I can’t cook on my stove I can’t store food in my broken cabinets, that are infested by roaches, I can’t store food in my refrigerator … I don’t want to eat in my own house.”

Other tenants have been unable to get the company to remediate mold, or make repairs to serious conditions issues such as lack of heat, leaks and holes in walls and floors, according to the Metropolitan Tenants Organization.

“No one should ever be forced to exist in dangerous and unlivable conditions,” said Ald. Emma Mitts of the 37th Ward, whose ward encompasses the building and who was present at the press conference.

Mitts called the current ownership “unresponsive” and “neglectful” and said that she had asked the city’s Department of Buildings to expedite inspections of the property out of concern for tenants’ safety.

City inspectors have failed the 5334-5362 W. Madison St. building complex at least 18 times over the past 10 years.

The previous owners received building code violations over washed-out mortar on the exterior walls, buckling walkways and

At a press conference on Oct. 31, tenants of 5362 W. Madison St. rallied against new property manager, WPD Management. Since the company took over the complex in late May, tenants said they’ve experienced infestations, leaks and no heat, as well as exorbitant rent increases and ev iction notices

“dangerous and hazardous” rear porches on the complex, which stretches a full block between North Lorel and Long Avenues. In most inspection records available online, inspectors wrote that they could not gain access to apartments.

All failed inspections appear to have occurred under previous ownership.

A holding company that shares a business address with WPD Management bought the building on May 31, 2024 for $3.7 million, according to public records.

That purchase was part of a bundled sale of five multifamily rental buildings in Austin and Garfield, public records show. The buildings sold for $12.7 million altogether.

The New York-based company that previously owned these properties was in financial distress, records suggest. That company’s holding companies were delinquent in property tax payments and earlier this year went into default on a $14.7 million multifamily loan taken out against the five properties.

That owner listed its headquarters as a small storefront in Munsey, NY, the listed offices of real estate investment firm Rhodium Capital Advisors.

Earlier this year, managing members of that company pleaded guilty to federal charges of mortgage fraud involving multifamily buildings in other states

The WPD-affiliated holding companies agreed to take over the mortgage from the troubled seller and get current on delinquent taxes on all five buildings.

Reached by phone, WPD cofounder Kevin Nugent declined to comment.

Tenants acknowledged that the building has had conditions problems for years. However, they said that responsiveness from management declined significantly after WPD took over.

“We have to be out here like this trying to gather and find out how we’re going to get some help,” said Cheryl Brown, a tenant who has lived in the building for three years and who said she has been unable to get a response from WPD about holes that have developed under the carpet in the floors of her apar tment.

WPD, a Chicago-based company, has expanded its presence from the South Side to the West Side in recent years. “Our hands-on, comprehensive approach to property management sets us apart,” Director of Business Development Dan Nagle told Multifamily Press in 2021, after the company added 200 West Side units to its management portfolio.

“We are excited to deepen our relationship with west side communities and provide support to residents and owners in this area of the city.”

One of the group’s demands is for WPD to sit down with tenants to discuss necessary repairs across the building.

Rivera and others said they don’t want to move from the building if they can help it.

“When you get decent people around, you want to hang onto that,” Rivera said of his neighbors. “How beautiful is that?”

HELP WANTED

Desktop Engineer (Original)

Administrative Specialist (Original)

The Metropolitan Water Reclamation District of Greater Chicago will be accepting applications for the following classification(s):

Desktop Engineer (Original)

Administrative Specialist (Original)

Additional information regarding salary, job description, requirements, etc. can be found on the District’s website at www.districtjobs.org or call 312-751-5100.

An Equal Opportunity Employer - M/F/D

Published in Austin Weekly News November 13, 2024

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENTCHANCERY DIVISION

CITIMORTGAGE, INC.

Plaintiff,

-v.-

JESSE J. ARRIAGA AKA

JESSE ARRIAGA, MARTHA K. ARRIAGA, UNIVERSITY VILLAGE HOMEOWNER’S ASSOCIATION

Defendants 22 CH 06584 814 W 15TH PL CHICAGO, IL 60608

NOTICE OF SALE PUBLIC NOTICE IS HEREBY GIVEN that pursuant to a Judgment of Foreclosure and Sale entered in the above cause on August 30, 2024, an agent for The Judicial Sales Corporation, will at 10:30 AM on December 2, 2024, at The Judicial Sales Corporation, One South Wacker, 1st Floor Suite 35R, Chicago, IL, 60606, sell at a public sale to the highest bidder, as set forth below, the following described real estate: Commonly known as 814 W 15TH PL, CHICAGO, IL 60608 Property Index No. 17-20-233-0370000 The real estate is improved with a townhome. The judgment amount was $403,127.93.

Sale terms: 25% down of the highest bid by certified funds at the close of the sale payable to The Judicial Sales Corporation. No third party checks will be accepted. The balance, in certified funds/or wire transfer, is due within twenty-four (24) hours. The subject property is subject to general real estate taxes, special assessments, or special taxes levied against said real estate and is offered for sale without any representation as to quality or quantity of title and without recourse to Plaintiff and in “AS IS” condition. The sale is further subject to confirmation by the court.

Upon payment in full of the amount bid, the purchaser will receive a Certificate of Sale that will entitle the purchaser to a deed to the real estate after confirmation of the sale. The property will NOT be open for

inspection and plaintiff makes no representation as to the condition of the property. Prospective bidders are admonished to check the court file to verify all information.

If this property is a condominium unit, the purchaser of the unit at the foreclosure sale, other than a mortgagee, shall pay the assessments and the legal fees required by The Condominium Property Act, 765 ILCS 605/9(g)(1) and (g)(4).

If this property is a condominium unit which is part of a common interest community, the purchaser of the unit at the foreclosure sale other than a mortgagee shall pay the assessments required by The Condominium Property Act, 765 ILCS 605/18.5(g-1).

IF YOU ARE THE MORTGAGOR (HOMEOWNER), YOU HAVE THE RIGHT TO REMAIN IN POSSESSION FOR 30 DAYS AFTER ENTRY OF AN ORDER OF POSSESSION, IN ACCORDANCE WITH SECTION 15-1701(C) OF THE ILLINOIS MORTGAGE FORECLOSURE LAW.

You will need a photo identification issued by a government agency (driver’s license, passport, etc.) in order to gain entry into our building and the foreclosure sale room in Cook County and the same identification for sales held at other county venues where The Judicial Sales Corporation conducts foreclosure sales.

For information, contact HEAVNER, BEYERS & MIHLAR, LLC Plaintiff’s Attorneys, 601 E. William St., DECATUR, IL, 62523 (217) 4221719. Please refer to file number 1653925. THE JUDICIAL SALES CORPORATION

One South Wacker Drive, 24th Floor, Chicago, IL 60606-4650 (312) 236-SALE

You can also visit The Judicial Sales Corporation at www.tjsc.com for a 7 day status report of pending sales. HEAVNER, BEYERS & MIHLAR, LLC

601 E. William St. DECATUR IL, 62523 217-422-1719

Fax #: 217-422-1754

E-Mail: CookPleadings@hsbattys. com

Attorney File No. 1653925

Attorney Code. 40387

Case Number: 22 CH 06584

TJSC#: 44-2383

NOTE: Pursuant to the Fair Debt Collection Practices Act, you are advised that Plaintiff’s attorney is deemed to be a debt collector attempting to collect a debt and any information obtained will be used for that purpose.

Case # 22 CH 06584 I3254639

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENTCHANCERY DIVISION CARRINGTON MORTGAGE SERVICES LLC

Plaintiff,

-v.VANESSA SANTOS, UNITED STATES OF AMERICASECRETARY OF HOUSING AND URBAN DEVELOPMENT, UNKNOWN HEIRS AND LEGATEES OF ANDRES SANTOS, DANNY SANTOS, UNKNOWN OWNERS AND NONRECORD

CLAIMANTS, AWILDA SANTOS, AS ADMINISTRATOR, AWILDA SANTOS, MANUEL SANTOS

Defendants

2022 CH 04038

857 N PARKSIDE AVENUE

CHICAGO, IL 60651

NOTICE OF SALE

PUBLIC NOTICE IS HEREBY

GIVEN that pursuant to a Judgment of Foreclosure and Sale entered in the above cause on June 27, 2024, an agent for The Judicial Sales Corporation, will at 10:30 AM on November 26, 2024, at The Judicial Sales Corporation, One South Wacker, 1st Floor Suite 35R, Chicago, IL, 60606, sell at a public sale to the highest bidder, as set forth below, the following described real estate:

Commonly known as 857 N PARKSIDE AVENUE, CHICAGO, IL 60651

Property Index No. 16-05-431-0010000

The real estate is improved with a residence.

Sale terms: 25% down of the highest bid by certified funds at the close of the sale payable to The Judicial Sales Corporation. No third party checks will be accepted. The balance, in certified funds/or wire transfer, is due within twenty-four (24) hours. The subject property is subject to general real estate taxes, special assessments, or special taxes levied against said real estate and is offered for sale without any representation as to quality or quantity of title and without recourse to Plaintiff and in “AS IS” condition.

The sale is further subject to confirmation by the court.

Upon payment in full of the amount bid, the purchaser will receive a Certificate of Sale that will entitle the purchaser to a deed to the real estate after confirmation of the sale.

Where a sale of real estate is made to satisfy a lien prior to that of the United States, the United States shall have one year from the date of sale within which to redeem, except that with respect to a lien arising under the internal revenue laws the period shall be 120 days or the period allowable for redemption under State law, whichever is longer, and in any case in which, under the provisions of section 505 of the Housing Act of 1950, as amended (12 U.S.C. 1701k), and subsection (d) of section 3720 of title 38 of the United States Code, the right to redeem does not arise, there shall be no right of redemption.

The property will NOT be open for inspection and plaintiff makes no representation as to the condition of the property. Prospective bidders are admonished to check the court file to verify all information.

If this property is a condominium unit, the purchaser of the unit at the foreclosure sale, other than a mortgagee, shall pay the assessments and the legal fees required by The Condominium Property Act, 765 ILCS 605/9(g)(1) and (g)(4).

If this property is a condominium unit which is part of a common interest community, the purchaser of the unit at the foreclosure sale other than a mortgagee shall pay the assessments required by The Condominium Property Act, 765 ILCS 605/18.5(g-1).

IF YOU ARE THE MORTGAGOR (HOMEOWNER), YOU HAVE THE RIGHT TO REMAIN IN

POSSESSION FOR 30 DAYS AFTER ENTRY OF AN ORDER OF POSSESSION, IN ACCORDANCE WITH SECTION 15-1701(C) OF THE ILLINOIS MORTGAGE FORECLOSURE LAW.

You will need a photo identification issued by a government agency (driver’s license, passport, etc.) in order to gain entry into our building and the foreclosure sale room in Cook County and the same identification for sales held at other county venues where The Judicial Sales Corporation conducts foreclosure sales.

For information, examine the court file, CODILIS & ASSOCIATES, P.C. Plaintiff’s Attorneys, 15W030 NORTH FRONTAGE ROAD, SUITE 100, BURR RIDGE, IL, 60527 (630) 794-9876

THE JUDICIAL SALES CORPORATION

One South Wacker Drive, 24th Floor, Chicago, IL 60606-4650 (312) 236-SALE

You can also visit The Judicial Sales Corporation at www.tjsc.com for a 7 day status report of pending sales.

CODILIS & ASSOCIATES, P.C. 15W030 NORTH FRONTAGE ROAD, SUITE 100 BURR RIDGE IL, 60527

630-794-5300

E-Mail: pleadings@il.cslegal.com

Attorney File No. 14-22-03111

Attorney ARDC No. 00468002 Attorney Code. 21762

Case Number: 2022 CH 04038 TJSC#: 44-2820

NOTE: Pursuant to the Fair Debt Collection Practices Act, you are advised that Plaintiff’s attorney is deemed to be a debt collector attempting to collect a debt and any information obtained will be used for that purpose.

Case # 2022 CH 04038 I3254427

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENTCHANCERY DIVISION SERVBANK, SB Plaintiff, -v.-

TASHIA GAINES, SEDRIC B. SMITH, JR. A/K/A SEDRIC B. SMITH, UNKNOWN OWNERS AND NON-RECORD CLAIMANTS

Defendants 23 CH 06914 4203 WEST HARRISON STREET CHICAGO, IL 60624

NOTICE OF SALE

PUBLIC NOTICE IS HEREBY

GIVEN that pursuant to a Judgment of Foreclosure and Sale entered in the above cause on September 9, 2024, an agent for The Judicial Sales Corporation, will at 10:30 A.M. on December 10, 2024, at The Judicial Sales Corporation, One South Wacker, 1st Floor Suite 35R, Chicago, IL, 60606, sell at a public sale to the highest bidder, as set forth below, the following described real estate:

LOT 2 IN BLOCK 1 IN WILLIAM HALE THOMPSON’S SUBDIVISION OF THAT PART OF THE EAST 1/2 OF THE NORTHWEST 1/4 OF THE SOUTHEAST 1/4 OF SECTION 15, TOWNSHIP 39 NORTH, RANGE 13, EAST OF THE THIRD PRINCIPAL MERIDIAN IN COOK COUNTY, ILLINOIS. Commonly known as 4203 WEST HARRISON STREET, CHICAGO,

IL 60624

Property Index No. 16-15-404-0460000

The real estate is improved with a single family residence.

Sale terms: 25% down of the highest bid by certified funds at the close of the sale payable to The Judicial Sales Corporation. No third party checks will be accepted. The balance, in certified funds/or wire transfer, is due within twenty-four (24) hours. The subject property is subject to general real estate taxes, special assessments, or special taxes levied against said real estate and is offered for sale without any representation as to quality or quantity of title and without recourse to Plaintiff and in “AS IS” condition. The sale is further subject to confirmation by the court. Upon payment in full of the amount bid, the purchaser will receive a Certificate of Sale that will entitle the purchaser to a deed to the real estate after confirmation of the sale. The property will NOT be open for inspection and plaintiff makes no representation as to the condition of the property. Prospective bidders are admonished to check the court file to verify all information.

If this property is a condominium unit, the purchaser of the unit at the foreclosure sale, other than a mortgagee, shall pay the assessments and the legal fees required by The Condominium Property Act, 765 ILCS 605/9(g)(1) and (g)(4).

If this property is a condominium unit which is part of a common interest community, the purchaser of the unit at the foreclosure sale other than a mortgagee shall pay the assessments required by The Condominium Property Act, 765 ILCS 605/18.5(g-1).

IF YOU ARE THE MORTGAGOR (HOMEOWNER), YOU HAVE THE RIGHT TO REMAIN IN POSSESSION FOR 30 DAYS AFTER ENTRY OF AN ORDER OF POSSESSION, IN ACCORDANCE WITH SECTION 15-1701(C) OF THE ILLINOIS MORTGAGE FORECLOSURE LAW. You will need a photo identification issued by a government agency (driver’s license, passport, etc.) in order to gain entry into our building and the foreclosure sale room in Cook County and the same identification for sales held at other county venues where The Judicial Sales Corporation conducts foreclosure sales.

MCCALLA RAYMER LEIBERT PIERCE, LLC Plaintiff’s Attorneys, One North Dearborn Street, Suite 1200, Chicago, IL, 60602. Tel No. (312) 346-9088. THE JUDICIAL SALES CORPORATION

One South Wacker Drive, 24th Floor, Chicago, IL 60606-4650 (312) 236-SALE

You can also visit The Judicial Sales Corporation at www.tjsc.com for a 7 day status report of pending sales.

MCCALLA RAYMER LEIBERT PIERCE, LLC

One North Dearborn Street, Suite 1200 Chicago IL, 60602 312-346-9088

E-Mail: pleadings@mccalla.com

Attorney File No. 22-09336IL_956098

Attorney Code. 61256

Case Number: 23 CH 06914 TJSC#: 44-2536

NOTE: Pursuant to the Fair Debt Collection Practices Act, you are advised that Plaintiff’s attorney is deemed to be a debt collector attempting to collect a debt and any information obtained will be used for that purpose.

Case # 23 CH 06914 I3254651

IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENTCHANCERY DIVISION LOANDEPOT.COM, LLC

Plaintiff vs. DELLA G. GRADY; U.S. DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT; CITY OF CHICAGO; THE UNITED STATES OF AMERICA, DEPARTMENT OF TREASURY; UNKNOWN OWNERS AND NON-RECORD CLAIMANTS

Defendant 23 CH 1602

CALENDAR 57

NOTICE OF SALE

PUBLIC NOTICE is hereby given that pursuant to a Judgment of Foreclosure entered in the above entitled cause Intercounty Judicial Sales Corporation will on December 17, 2024, at the hour 11:00 a.m., Intercounty’s office, 120 West Madison Street, Suite 718A, Chicago, IL 60602, sell to the highest bidder for cash, the following described mortgaged real estate: P.I.N. 16-08-412-017-0000. Commonly known as 140 North Mason Avenue, Chicago, IL 60644. The real estate is: single family residence. THE SALE SHALL BE SUBJECT TO A PRIOR RECORDED FIRST MORTGAGE.. Sale terms: At sale, the bidder must have 10% down by certified funds, balance within 24 hours, by certified funds. No refunds. The property will NOT be open for inspection. Prospective bidders are admonished to check the court file to verify all information. For information call Sales Department at Plaintiff’s Attorney, Diaz Anselmo & Associates P.A., 1771 West Diehl Road, Suite 120, Naperville, IL 60563. (630) 4536960. 7034-190874

INTERCOUNTY JUDICIAL SALES CORPORATION intercountyjudicialsales.com I3255119

All real estate advertising in this newspaper is subject to the Fair Housing Act, which makes it illegal to advertise any preference, limitation or discrimination based on age, race, color, religion, sex, handicap, familial status or national origin, or intention to make any such preferences, limitations or discrimination.

The Illinois Human Rights Act prohibits discrimination in the sale, rental or advertising of real estate based on factors in addition to those protected under federal law.

This newspaper will not knowingly accept any advertising for real estate which is in violation of the law. All persons are hereby informed that all dwellings advertised are available on an equal opportunity basis.

Restrictions or prohibitions of pets do not apply to service animals. To complain of discrimination, call HUD toll free at: 1-800-669-9777.

GROWING COMMUNITY MEDIA

By DELANEY NELSON | Special Projects Reporter

In the first third of the 20th century, Chicago’s population more than doubled—and with it, the city’s architecture and housing stock transformed. Developers erected high-rise luxury apartment buildings for the city’s wealthier residents while immigrants and poorer Chicagoans were crowded into blocks of packed tenements. In the middle of the spectrum emerged the bungalow

Between 1910 and 1930, Chicago developers built tens of thousands of bungalows — one-and-a-half story buildings characterized by low-pitched overhanging roofs, a narrow rectangular shape, expansive front windows, front porches, and limestone detailing.

“You had a lot of immigrants and a lot of people crammed into homes that didn’t have ample light or air circulation, bathrooms,

electricity, any of it,” said Carla Bruni, the preservation and resiliency specialist at the Chicago Bungalow Association.

“Bungalows were built in a very affordable way, even though they’re really well-built by today’s standards. You would never build these anymore. They would be so cost prohibitive.”

In their heyday, bungalows were known for being sturdy and efficient to build. Plus, unlike some tenements, they were outfitted with electricity and plumbing. The brick buildings popped up in neighborhoods along the western edge of the city, including parts of what are now Austin and North Lawndale, creating the “Bungalow Belt.” A Chicago bungalow typically has bedrooms on the first floor and an unfinished attic space that could be expanded down the line, once the homeowners had enough cash.

Bungalows, which required a relatively small down payment and low monthly payments, helped foster homeownership

among the city’s middle and lower-middle class. While bungalows “provided Chicago homebuyers of moderate means with extraordinary levels of domestic comfort,” according to the National Register of Historic Places property documentation, Black people were mostly excluded from owning them until the 1950s.

“You’d have every sort of socioeconomic background. You’d have somebody who worked in the meatpacking plants, and maybe his wife would be doing clerical work somewhere, and then they maybe had five kids. And then you’d have a doctor and his wife only living right next to them on a corner lot, because those tended to be bigger bungalows,” Bruni said. “It was really a socioeconomic mix, excluding African American families.”

While the Great Depression severely curtailed bungalow See BUNGALOWS on page B3

By DELANEY NELSON Special Projects Reporter

Homeownership offers many benefits to individuals, families and the wider community. Owning a home is one way to create generational wealth and invest in your neighborhood. It can create housing stability in a tumultuous rental market and stave off the displacement effects of gentrification.

On the other hand, homeownership is an investment – which means it costs money, whether that money comes from savings, loans, grants or other forms. The good news? There are countless programs on the neighborhood, city, county, state and national level that can help you buy a house and invest in your community

To get you started, we’ve gathered a nonexhaustive list of those programs and the organizations that offer them.

Home Ownership Made Easy

• Choose to Own allows qualified Housing Choice Voucher and Public Housing families to use its housing subsidy to buy a home and make mortgage payments.

• Down Payment Assistance Program assists first-time home buyers with grants of up to $20,000 to help cover down payments and closing costs.

• The CHA also offers virtual and in-person workshops for prospective homebuyers, Realtors and lenders.

ChiBlockBuilder

• To encourage the purchase and redevelopment of city-owned vacant lots, Chicago has an application portal for selling land with preferred use based on zoning and community plans

• The latest round of land sales opened in October and targets North Lawndale. Lots zoned for affordable housing construction or urban agriculture projects are priced at $1 per lot.

The Building Neighborhoods and Affordable Homes Program

• BNAH provides eligible buyers with grants to help them purchase a newly constructed singlefamily residential building.

Repair programs

• Home Repair Program gives funding to low-income Chicago homeowners to make necessary repairs (previously called the Roof and Porch Repair Program)

• As of Nov. 1, the Emergency Heating Repair program is open to owner-occupants of oneto-four-unit properties earning less than 80% of the median area income. It offers grants to replace or repair heating systems.

The DOH has a longer list of programs available to homeowners on its website.

Homebuyer Education Course

• NHS offers virtual and in-person homebuyer education courses led by HUD-certified housing counselors.

• The course covers the basics of budgeting, credit, shopping for a home, closing on a home and more.

Neighborhood Lending Services

• NLS is the largest non-profit licensed mortgage lender in Illinois.

• The lender offers purchase and purchase with rehab loans, including up to 100% financing for qualified borrowers. Qualification is not based solely on credit score.

• NLS also offers refinancing and home improvement loans, as well as down payment assistance.

NHS also provides real estate services to help you search for and buy a home.

Down Payment Assistance Program

• Earlier this year, the county opened a $3 million down payment assistance pilot program for applications.

• As of Oct. 29, the initial investment for the program was fully allocated, but the county is seeking additional funding.

Homeownership Program

• The homeownership program helps eligible first-time homebuyers afford a mortgage by providing vouchers that cover a portion of monthly mortgage payments.

Home Repair and Community Revitalization Programs

• The Home Repair and Accessibility Program helps low- and very low-income homeowners pay for repairs related to safety, health and accessibility in their homes. Eligible homeowners (total household income must be at or below 80% of the area median income) may receive up to $45,000 in the form of a five- or three-year forgivable loan to fund repairs. Grants are administered by city/ town-level grantees.

Homeownership Counseling and Mortgages

• The IHDA funds a network of housing counselors across the state.

• The agency also offers affordable mortgages that require borrowers to take a homeownership course, as well as grants and loans for home down payments.

• You can learn more at ihdamortgage.org/ homebuyers.

Follow us each month in print and at https://www.austinweeklynews.com/ at-home/, where you’ll find additional resources and useful information.

Continued from page B1

construction, more than 80,000 remain standing in Chicago, accounting for one-third of the city’s single-family housing stock.

The Chicago Bungalow Association was established in 2000 by Mayor Richard M. Daley to preserve the existing bungalow housing stock and prevent further demolition. The goal, Bruni said, was to save this relatively affordable housing type. Tearing down a durable structure like a bungalow is not only an affront to Chicago’s iconic architecture, but also contributes to landfill waste — and whatever a developer builds in its place would be more expensive.

The organization now serves all owners of homes older than 50 years and connects homeowners with resources to maintain their home, including webinars, a community social media forum and a database of referrals for contractors that can help with roofing, insulation, water systems, exteriors and more. About 1,000 members of the CBA live in Austin, Bruni said.

“A lot of people have fought really, really hard over decades to stay in their homes,” Bruni said. “With taxes going up, with insurance, utilities going up with repairs that get out of control, because it’s so hard to find the money to maintain your home, a lot of people are in very precarious situations. So we try to figure out ways through helping people understand how to repair things, what you might be able to do yourself.”

Owners of bungalows and other older homes

often have high electric, gas and water bills — a challenge CBA is addressing through its Home Energy Savings Program. In partnership with ComEd, Nicor Gas, Peoples Gas and North Shore Gas, CBA provides free home energy services and improvements, including a free assessment to identify energy use. The goal is to help homeowners seal and weatherize their homes, which makes the structure more energy efficient and helps to lower energy bills. The organization has conducted thousands of full air sealing insulations, with a typical error 40% to 50%, meaning more of the cooled air is circulated.

Barbara Seales, who moved into her Austin/West Humboldt Park-area bungalow mor than two decades ago, participated in the energy savings program. Contractors installed insulation under her porch and in her walls and attic, and installed an eco-friendly thermostat. Seales said she was pleased with the insulation process and has seen cost savings.

“Once I heard about this opportunity from a friend to get the insulation done, I followed up on it right away. Over time the house gets kind of airy—you get cracks and it settles and

An estimated 80,000 bungalows make up “The Bungalow Belt,” stretching along the outskirts of Chicago in a crescent shape between the suburbs and what used to be the industrial neighborhoods outside the Loop.

everything. So it was kind of airy, and I wanted it to be warmer. I’m one of the fortunate ones.

My enclosed back porch is heated, but it was still very airy in the winter time,” Seales said. “I love my enclosed back porch now, because I can go out there and enjoy it in the winter. It’s not just a seasonal part of the house.”

While energy efficiency upgrades can be helpful to owners of old homes, these improvements are not accessible if a home needs structural repairs like fixing a leaky roof. CBA has teamed up with social justice artist Tonika Lewis Johnson on unBlocked Englewood, an arts-driven community redevelopment project providing Englewood residents with funds to repair and beautify their homes.

One of the goals, Johnson said, is to use investment to address and counteract the historic disinvestment in Black neighborhoods that has made it difficult for residents to afford repairs for their homes. Of the 24 homes on the block that

the project is targeting, half have successfully undergone repairs, including addressing roofing, plumbing, and electrical problems.

unBlocked Inglewood isn’t just about repairing homes, Johnson said. It also encourages community engagement. She added that she hopes the project inspires city planners, policymakers and local government officials to address historic harms more directly and creatively

“If it were not for those homeowners, our neighborhood would be suffering even more. It is because of those owner occupied homeowners [that] we actually have a foundation to even consider building from,” Johnson said. “We have to address helping existing homeowners in Black neighborhoods because we want them to remain homeowners and pay property taxes and help support the public amenities in the neighborhood, and that can only happen if people can afford to live in the homes that they have, and they can do so safely.”

Here’s what we learned

By DELANEY NELSON Special Projects Reporter

Last November, Austin Weekly News launched a new project called “At Home on the Greater West Side.” Our goal was to demystify the homebuying process, specifically for residents of Austin, West Garfield Park and North Lawndale and the surrounding suburbs.

Now, a year later, we’re wrapping up the series. In many ways, AWN learned along with its readers, and if we’ve learned anything, it’s that the journey to homeownership isn’t exactly easy But that doesn’t mean you — yes you! — can’t achieve it.

1. Get realistic and take a class

Realtor Camella Sutton tells her clients to be realistic about what they can afford, and to save up for the “what-ifs”: “Knowing what’s out there is big, and [so is] knowing what you can and can’t afford,” she said. “What are you willing to cut back on? What sacrifices are you willing to make to get to the point of homeownership?”

It might seem obvious, but you need a combination of loans and savings to buy a home. Experts suggest building up your credit score as much as possible and being realistic about how much you need to save for a downpayment on your ideal home. Real estate agents, lenders and community organizations can all help you with this early planning stage.

Many experts recommend HUD-certified homeownership courses to first-time buyers. We spoke with the folks at Neighborhood Housing Services of Chicago about their class, but there are tons of other options. HUD also has an online tool to search for housing counselors or courses based on your location and needs.

Two primary people who will help make buying a home possible: A real estate agent and a lender. Real estate agents help buyers look at homes, make an offer and close on a home. Lenders deal with the financial side of things, pre-approving and approving buyers for a mortgage to buy property.

Before looking at properties, you’ll want to be preapproved for a mortgage. For this reason, many prospective buyers look for a lender first, work with them for their preapproval, and then find an agent, but you can pick an agent first. Lenders look at factors including income, savings and credit history to decide how much they would let you borrow to buy a home. You may want to shop around and get the opinion — and preapproval — of several lenders. Knowing how big of a mortgage you can get will help narrow your home search.

(Want to know more about lending and how to get a mortgage? Check out our guide at: https://ow.ly/Py6T50U2nvF Want to know more about finding the right agent and what their job entails? Read our Q&A with three Chicago-area real estate agents at https://ow.ly/6AGu50U2nxT.)

3. Look at homes, make an offer and close

This is the part of the process that likely comes to mind when you think about buying a house. With help from a real estate agent, prospective buyers tour properties, make offers and go through closing procedures that include getting a home inspection and meeting with a lawyer to finalize the terms of the sale.

Prospective buyers should make sure they budget for extra costs outside of a mortgage and downpayment. That includes closing costs, property taxes, home insurance and mortgage insurance, HOA fees, repairs, maintenance, renovations and more.

resource for West Siders who are interested in homeownership. But if the whole thing still sounds intimidating and impossibly out of reach, the good news is that there are countless community, city, county, state and national resources to help people like you become homeowners.

AWN is even hosting its own series of educational homeownership events. The final event “Before you buy, do these things,” will be Sunday, Nov. 24 at 2 p.m. at 1359 S. Kildare Ave., Chicago.

For more opportunities for first-time homeowners and home buyer education, check out the:

- Neighborhood Housing Service

- Neighborhood Assistance Corporation of America

- Cook County Land Bank Authority’s Homebuyer Direct program

4. Complete renovations and repairs, and move in

Not all homes are move-in ready. A thorough home inspection before closing on the property can help buyers assess what work needs to be done on a property

After moving in, homeownership costs don’t end at mortgage and insurance payments. Treat your home like the major investment it is: experts say it is a good plan to keep

- Chicago’s Building Neighborhoods and Affordable Homes project

In 12 months and over 30 stories, AWN spoke with countless real estate agents, local homeowners and housing experts about issues like saving for a mortgage, strengthening your credit, first time homebuyer programs and resources and the benefits of homeownership.

It was our goal to make this project accessible to as many people as possible. So in addition to traditionally reported pieces and features of community members, we also created graphics, explainers, glossaries and resource lists. We hope that even a small piece of this project has helped homeowners or prospective buyers on the West Side make a commitment to investing in themselves and their community through buying a home.

1%-4% of the home’s total cost in reserve in case of an unexpected emergency. Regular maintenance of gutters, roof, appliances, plumbing and HVAC systems will also keep your property value up and ensure you get the most out of your investment.

For more about what to do once you become a homeowner, read our guide on what’s next. We have also written a need-to-know guide on Illinois and Cook County property taxes.