WHITE COLLAR | ISSUE 003

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR

1

WHITE COLLAR ISSUE 003

EDITOR'S NOTE 03

THE THREAT OF ECONOMIC COLONIZATION 04

KENYA'S BANKING ROCKSTAR 07

IS ADVERTISING THE SOLUTION TO YOUR BUSINESS PROBLEMS? 10

Contents HOW TO ATTAIN YOUR WEALTH GOALS 18

THE POWER SUIT VS A GENTLEMAN’S BLAZER 22

2

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR

WHITE COLLAR | ISSUE 003

Editor’s Note Hello & Welcome to White Collar! We’re glad to have you with us for this issue. A famous banker once asked “If you had a sum of money and someone who you didn’t know so well wanted to borrow a bit of it, how much interest would you charge on your money?” The crowd responded with one answer after the other, but the aggregate of their answers was at about 20 percent interest. “Well that’s the position that banks are always in,” he responded “and we charge much less to encourage lending and spur economic growth.” The baking institution is a pillar of modern day society and it’s only right that we discussed it. It has played a central role in the advancement of mankind. In its earliest form, it was a means of keeping track of a surplus harvest or excess commodities acquired in trade. Traces of it have been seen in great civilizations across history, from the Egyptians to the Assyrians, the Greek and the Ancient Chinese empires. In today’s Issue we take the perspective of a few tried and tested bankers in an effort to understand their world a bit better. We love hearing back from our readers. Keep reaching out to

Contributors:

Michael Kiruthi, Esq Joseph Kiswili Emmanuel Kyama

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR

us across our social platforms. We hope you enjoy it!

Kyama Kivuva

ManuKyama

3

WHITE COLLAR ISSUE 002

The Threat of Economic Colonization. HOW KENYAN SOCIAL MEDIA HAS POINTED OUT TO THE BIGGER PROBLEM The game of Monopoly is an interesting pass time. It also offers a lot of life lessons. The game is marked with euphoric victories and crushing spirals into defeat. The game is played as a combination of luck (rolling the dice) and strategy. Each player does their best to gather territories, build on them to raise their value and charge rent to the other passing players. When the rent becomes too steep for a passing player to pay, he then has to bow out of the game and surrender all his remaining properties to his creditor. In an attempt to explain capitalism and danger of monopolistic entities, the comedian Louise C.K describes playing a game of monopoly with his daughter. He casts the audience in her place and speaks to them as though they were her. And slowly and masterfully highlights the reality of property loss to large monopolistic institutions.

4

He does this through a comedic lens, to indirectly point at the harsh truth. The strategies outlined in these juvenile board games may seem direct and easily noticeable; however it is astonishing to see them applied in real life. The Country of China is an economic power-house! The Chinese companies price their goods and services at aggressively low prices in order to get a larger market share. They have slowly established themselves as the world’s manufacturing hub with companies as large as Apple having their factories there. The low prices allow for companies to provide products at competitive prices while still making a profit.

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR

WHITE COLLAR | ISSUE 002

the idea that the raised funds would go towards pursuing infrastructure development. Despite some of their best efforts, they don’t raise enough. They then go out in search of a lender who would help them surmount the problem they’re facing. And sometimes, on the other side of this negotiation table they meet Chinese companies who offer not only the finances but also the expertise needed to execute these extensive infrastructure projects. The deal in itself might be the best option for most developing countries sitting across the table and so, some of them take the deal.

A F R I EN D I N D EED?

$8 Billion Sri Lanka's debt to state controlled Chinese firms

A FR I EN D I N N EED ! Developing nations across the world are in the middle of an infrastructure boom. They need to develop working spaces, Transportation systems, Education and Health Centres in order to keep up with the internal growth and catch up with the rest of the world. These countries are aspiring to accomplish a lot but lack the funds, expertise and equipment needed to properly execute the stated projects. Some of these countries have tried various methods to raise capital, with

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR

In banking, debt is viewed as an asset class in its own right. It is considered a relatively less risky asset class than the rest and returns are generally in form of interest payments and/or capital gains due to impact of interest rates changes over time. That kind of logic can be applied here in a way. Using debt, these state owned Chinese companies can press their advantage when asking to be paid back and negotiate for whatever the state of China wants, much to the disadvantage of the developing countries. These kinds of deals have been taking place for a long time now, so why the sudden alarm. Well, in the past these deals did not threaten the sovereignty

5

WHITE COLLAR ISSUE 003

of the developing nations. China has gone unchecked for a while and has kept pressing for more and more in form of repayment. Quite recently, in a move that woke the whole world right up, the nation of Sri Lanka handed over the strategic port of Hambantota to China on a 99-year lease. This move raised red flags and highlighted the intention behind the deals that China was making. Sri Lanka owes more than $8 billion to state-controlled Chinese firms, officials say. Sri Lankan politicians said the Hambantota deal, valued at $1.1 billion, was necessary to chip away at the debt, but analysts warned of the consequences of signing away too much control to China. The ‘monopoly’ like deal has been said to threaten the sovereignty of the state of Sri Lanka. Former Secretary of State, Rex Tillerson, (while in Kenya) spoke out against the economic relationship between China and Africa saying that it encouraged dependency. This comes hot on the heels of the Sri Lankan port lease to China towards the end of 2017.

backyard,” said Constantino Xavier, a fellow at Carnegie India in New Delhi, to the Times. Something clearly needs to be done to curb the influence of growing superpowers. Especially if they seem to be beyond reproach. In the mean-time there have been reports of push-back to Chinese investment in South-east Asia. This includes the recent side-lining of hydro-power projects in Nepal, Pakistan and Myanmar. Africa needs to watch closely and follow suit! Kenya has issued new 80% of the used to pay These be Africa. There kind

Euro-bonds and about money raised may be the country’s debts. kinds of moves should replicated throughout

is need for some of inter country arbitration both during and after deal-making.

Organizations like the United Nations and IMF also need to step in. We hope that the port exchange will be the last of its case and that countries will adopt caution when pursuing such deals by always having a plan in place for debt repayment. ◊ ◊ ◊ ◊ ◊

The move has shocked many states including India. “India has been overwhelmed by China’s offensive in its strategic

6

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR

WHITE COLLAR | ISSUE 003

KENYA’S BANKING ROCK-STAR!

Central Bank Governor Patrick Njoroge is a man who doesn’t need much of an introduction. His name echoes in the banking hall of fame. Today, White Collar puts him under microscope and tries to distill some lessons from him.

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR

7

WHITE COLLAR ISSUE 003

Who is Dr. Patrick Ngugi Njoroge? Patrick Ngugi Njoroge is Kenya’s 9th Central Bank Governor. He is an avid member of Opus Dei (one of the institutions of the Roman Catholic Church, which teaches that everyone is called to holiness and that ordinary life is a path to sanctity). Given his faith He has shocked many by being the first in such a position of power to turn down perks from the said position. He refused the Mansion in Nairobi’s Muthaiga where he would have been a neighbor to the Former-President Mwai Kibaki, the Former Attorney General Charles Njojo and other elite individuals. He also turned down the luxury fleet of cars and the guarded escort. That in itself is extraordinary in Africa. In many ways he is the hope of an evolved mind-set in the modern African leader. Before we proceed, the answer is yes! We do appreciate the irony in calling a man of faith, a ‘Rock-star’. Early Life & Education He was born in Kenya around the year 1961, and not much is known from his early childhood. He joined the prestigious Mang’u High School (between the years 1973-1976) for his O-level education, after which he attended Strathmore College for his A-level studies. In 1979 he was accepted at the University of Nairobi, and he graduated with a bachelor of arts in Economics in 1983. He continued his studies there and in 1985 he graduated with a Masters in Economics from the University of Nairobi. He didn’t stop there though; he went to Yale University where he graduated with a Doctor in Philosophy in Economics. Career He started out as a planning officer with the Kenyan Ministry of Planning in 1985. He later decided to put his talents to good use and in 1993 he shifted to the Kenyan Ministry of Finance as an economist, but this only lasted a little

more than a year. He was scooped up by the International Monetary Fund (IMF) mid 1995. He seemed to enjoy working, learning and growing there because he stuck around until 2015. He first moved from the position of economist to senior economist. He made his way up the ranks until he became the Advisor to the deputy Director of the IMF in 2012. He held this position until June 2015 when he was nominated by President Uhuru Kenyatta to take up the role of Governor of the Central Bank of Kenya. Still awake?! …Good! Jokes aside though, he’s had a tremendous career so far. Why Dr. Patrick Njoroge deserves this ‘Rock-Star’ status. October 2015, just a few months after he took office, The Central bank of Kenya placed the Imperial bank under receivership. Then again in April 2016, Chase bank was put under receivership. (Receivership is a situation in which an institution or enterprise is held by a receiver—a person "placed in the custodial responsibility for the property of others, including tangible and intangible assets and rights"— especially in cases where a company cannot meet financial obligations or enters bankruptcy.) This was a very clear statement from the new Central bank Governor, and the message was ‘There’s a new Sheriff in Town!’ “Totally devoid of ego and instinctively averse to selfadvertisement” is how a senior Treasury official and longserving central banker described him but his gentle demeanor and humility are never to be mistaken for weakness. Just ask the of currency trader that drew the short stick and had to sit across from him and explain the reason behind his speculations. Governor Dr. Njoroge has always believed in data that drives decisions. And when no data could be

Totally devoid of ego and instinctively averse to self-advertisement

8

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR

WHITE COLLAR | ISSUE 003

DR. PATRICK N. NJOROGE

up banking in Kenya have stood out like a light on a hill and the whole world recognized his efforts. In May 2016, he was recognized as the Central Bank Governor of the year at the African Banker Award held during the African Development Bank (AfDB) annual meeting in Lusaka, Zambia.

presented to support the trader’s speculations, the governor held the trader’s hands to the fire. He berated the ‘poor’ trader and told him to keep his speculations to himself. Under his governorship it isn’t advisable to loosely speculate about anything when it comes to the markets. Worse still, do not unfoundedly speculate about the Kenyan Shilling. He has always been patriotic that way. He’s always done whatever it takes to protect the Kenyan Shilling. This involves making sure that the Kenyan shilling is within the inflation targets of the Central bank. He has also protected against a strong dollar. Many people in the country complain about the dollar exchange rate being over 100 shillings, but to put this to perspective you have to compare how the Kenyan shilling is performing compared to other world currencies with respect to the dollar. Some

Later in 2016, he received the Global Markets Central Banker Governor of the Year award for sub-Saharan Africa Currencies were inflated by over 400%. We should however pause for a minute, and ask ourselves who’s really to blame here. Is the Shilling getting weaker or is the dollar getting stronger? The behavior of the dollar has been called to question by many central banks around the world. The European Central bank has begun to replace the unstable dollar with the more stable Chinese Yuan. This move speaks volumes about how the rest of the world feels about the dollar. Whether or not Kenya does the same is down to Governor Dr. Njoroge. Kenya is in safe hands. Dr. Njoroge has always had Kenya’s best banking interests at heart. Yes that was a pun, but there’s some truth to it; He spoke out against the capping of interest rates saying that they’d discourage banks from lending.

during the IMF/World Bank meetings in Washington, DC. A UK publication exclusively for bankers has named him as the 2018 Central Banker of the Year, in Africa. “Since being appointed as central bank governor in July 2015, he has acted swiftly to clean up the country’s banking sector, improve supervision and guidance measures, and spearhead efforts to position Kenya as a hub for green finance,” said the magazine. We appreciate his revolutionary approach to Central Banking. He has always been an independent thinker and his ability to not be swayed is to be admired. In This way he rebelled against the norm and that’s why we chose to name him ‘Kenya’s Banking Rock-Star’.◊ ◊ ◊ ◊ ◊ ◊ ◊ ◊ ◊ ◊ ◊ ◊ ◊ ◊

The great governor’s action’s to clean

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR

9

WHITE COLLAR ISSUE 001 3

WHITE COLLAR | ISSUE 002

IS ADVERTISING THE SOLUTION TO YOUR BUSINESS PROBLEMS? Which brings me to the questions, does Marketing (Advertising) solve all business problems? Depending who you ask, the answer can easily vary from person to person. Every business needs an element of marketing, not necessarily advertising. If anything with good / right application of the marketing principles, one really doesn’t need advertising. Back to Basics (that we often forget) My definition of marketing is understanding the market, knowing the customers, producing (offering) them something they want / need. This has to be at the right price (where they feel they get value) delivered by the right people (the team) at the right time and place.

Sales are low – we need a advertising. Profits are low – we need advertising. Customers don’t like our products advertising. These are some of the statements people in management and business owners say. Not all, but a good number.

10

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR

Now, with that basic understanding of marketing, as a business owner / manager, will advertising still solve all your problems? You as a manager are better off ticking off all other boxes before advertising. Yes, there is a place for advertising. Yes, it can bring in new customers. Yes it can increase your turnover. No, it won’t be sustainable unless all other factors are catered for.

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR

10

WHITE COLLAR | ISSUE 003

Other Factors I believe that understanding the market and all its players is paramount. If you really want to kick ass in the game, you have to know the game and all its players. This ranges from the industry, to your competitors, market leads, and why they are leaders, failures – and why they failed and most importantly – the customer. If you begin with the customer and truly understand what it is they want / need, you can then produce the same at the most efficient and effective manner. But for you to do that, you need to know what others are offering and how they are doing it. Understanding the customer is the utmost important thing. After all, they will be your source of income. Understanding the product is equally crucial. This will come as a byproduct by fully understanding both the industry and the customer. The importance is understanding the two variables is cause many a times, businesses have one of the two variables correct – but not both. This means you can have the right customer, but the wrong product. Or, you can have the right product – selling it to the wrong customer. The other day I was consulting for a restaurant and they were facing a similar challenge. They had a great target audience, business good – they had found their sweet spot. However – business being business, they wanted to grow their business.

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR

One item they didn’t have on their menu were pastries. Therefore, they outsourced the production of pastries to a fancy chef – who of course makes fancy pastries. For weeks, they stuffed their fancy displays with these fancy pastries. However – the uptake of the same were dismal. Most of the times, the members of staff ate over 80% of the stock – just so they didn’t go bad. From the above situation – they had a good pool of customer, and a desired product. The customers always come saw these pastries – and didn’t but. After some research, it was evident the price point wasn’t good – and customer didn’t get the feeling of “value for money”. The customers weren’t interested in the fancy pastries, but wanted something more practical and of course- more affordable. After the survey, my advice to them was to get a supplier who can produce what the customers actually want. In such a situation, there would be no way one would have achieved sustained growth and revenue with the above business model – even with marketing and advertising.

11

WHITE COLLAR | ISSUE 002

12

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR

WHITE COLLAR | ISSUE 001

A

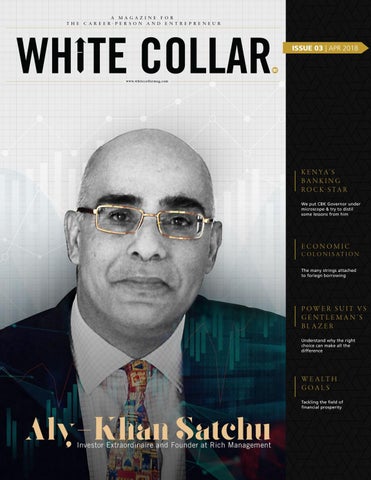

ly-Khan Satchu is an active investor in the Nairobi Securities Exchange (NSE), the USE and various other African stock markets. He invests both his personal finances and those from other parties. He is a point of reference when it comes to trading and a regular feature on Aljazeera and CNBC. His wealth of experience guarantees that he understands how to navigate the choppy waters of the African markets. He is also a distinguished author, having written the book ‘Anyone Can Be Rich’ which discusses the NSE and the Kenyan economy. He was born in the year 1966 in Mombasa, Kenya. His parents did their best to expose Aly-khan to the world from an early age and sent him to boarding school in London at the age of 13. Studying abroad had been part of the family tradition passed from father to son and It was rooted in the belief that the center of the then British empire was the best place for a decent education. Aly-Khan’s father knew his temperament and told him not to study law, but against his father’s wishes he proceeded to study law at the University of Durham, in North-east England (this must’ve been Aly-Khan’s youthful rebellion). When he was done with school, he moved to the city of London where he got work at one of the lowest positions at Credit Suisse. The moment he got to the trading floor it was as if something finally locked into place. He always had a passion for numbers and thought that he would enjoy the challenge of the market against his intellect. Every day spent working at the printer on the trading floor affirmed his interests. After long months spent learning how everything worked, he got the opportunity to deliver a document to the bank’s Vice Chairman. He pleaded his case and got the opportunity that launched him onto his career. In his first year, they had set a million dollar target for him and he broke past and made a whopping 15 million dollars! And just like that, he secured his fate. In an exclusive interview with White Collar, He reveals a few tricks to his trade, the secret to his drive and we get to find out what makes him such a terrific trader.

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR

13

WHITE COLLAR ISSUE 003

I walked into the open plan office, and Mr. Satchu was seated at the far right, hunched and facing his computer. He seemed occupied and focused but as soon as my arrival was announced to him, his entire demeanor changed. He calmly invited me over and sat me sit opposite him. A bit of introductory small talk ensued and we eventually settled down and were ready to get into the nitty-gritty of what makes up such an illustrious career.

Who is Aly-Khan? That’s the most difficult question to answer, hehe. I think discovering one’s self is a journey. Even as an older person you still discover new parts of yourself. And I’ll leave you with the words from a famous thinker San Tzu who said ‘Understand yourself before you understand your enemy’

Who is the enemy in your analogy? The enemy here isn’t a physical enemy per se. The enemy is anything that moves you from your path. And if you’re on the journey of self-discovery every day it gets easier to identify the things that derail you.

What was your childhood like? I was brought up in Mombasa as a young boy, and I appreciate the upbringing. That was about 45 years ago and a lot of things have changed. Mombasa used to be a small town where everyone knew everyone else. It was also quite cosmopolitan; there were all kinds of people represented there. I still love to visit the place and have some ‘madafu’ or even enjoy some ‘mhogo'

14

Were there any personality traits that signaled a career in investments? I always liked numbers. As a young boy I remember I’d drive my father mad because I kept trying to calculate the cost of re-developing the Mombasa Gold Club. Hehe.

Who were your role models of your youth?

I would describe myself as someone who likes to ‘understand’ as much as possible. The more information I can absorb the more of an advantage it gives me.

Being brought up in Kenya I would always admire people from Africa who would go abroad and create a name for themselves. That kind of person inspired me. From a markets point of view someone like George Soros, and I know it’s a dirty name now. But in those days he was a fantastic trader. Later on when I started working, I saw him in action. It was when the pound collapsed, and Soros made a billion pounds. It all unfolded in front of me and I was in the middle of it. I admired his instincts to identify an opportunity in the markets and the instinct to capture those opportunities. It’s a difficult task because quite often we are able to identify an opportunity but not capture it. He made both things happen. Other heroes of mine were people like Nelson Mandela. He was a leader of my generation and I found him to be someone I could identify with. I liked his moral compass and I don’t think there was anything he said that I could disagree with.

What was the most challenging phase of your life? I think the most challenging time of my career was when I was about 28, and I had just been made a Managing Director and I had the responsibility of a lot of people. It suddenly woke me up to the fact that I wasn’t just a striker but I was now part of a team. That was quite a dramatic moment for me.

Of all the places you’ve worked, which place stood out and why? That has to be Credit Suisse First Boston, which is now Credit Suisse. In fact they appointed their first black CEO, Tidjane Thiam. I would describe that as the most interesting place I’ve worked for. The reason I’d say that is because they have so many, very brilliant people in one area. It was quite challenging and the people would always push back but at the same time I have never

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR

WHITE COLLAR | ISSUE 003

seen that density of very smart people in one organization. Today it’s a bit different, but in those days… their ability to react to react to events and speed with which they reached a decision was amazing. I have not seen that replicated elsewhere. These guys were squash-buckling capitalists who moved enormous amounts of money around the world quite quickly and were able to make profits from that, while also supporting their customers.

How does one know it’s the right time to change employment or like in your case begin to trade your personal funds? The society today is not like it was back in my day. Case in point, I have a friend with a big IT business somewhere in Eastern Europe and all of a sudden these employees would resign and when asked why they’d say ‘we’re just bored and want something different!’ Today the society is more of a gig economy and the decisions that govern career change are up to the individuals. Today it’s a bit more flexible and daring. Today

One thing that people underestimate about Kenya, especially Kenyans like ourselves, is that we have a free market economy up to a degree. We can freely move money and invest it. We cannot take that for granted.

What’s your outlook on the derivatives market in Africa? I traded derivatives for a while. I think when it comes to derivatives markets this is where we are really... (pauses to suggest thinking deeply) this is where we have no sovereignty. If you want to talk about sovereignty talk about derivatives markets; let me give you an example, One time the oil price was over $ 100 a barrel. African governments that were oil producers could have locked in, for say 5 years, an average price of $90 a barrel. Not one did! They risked their people’s well-being because they did not understand there was an opportunity here to reduce risk for themselves. Africa needs to take more control of its natural resources

the society is more of a gig economy and the decisions that govern career change are up to the individuals. Today it’s a bit more flexible and daring

In my situation, I was working in the City and I had just turned 40 and I needed a change. But mostly I wanted to be back home because I knew that Africa was about to take off and the last thing I wanted to do was be in London while Africa took off.

What would you say the investment Climate is like in Kenya? Interesting question. Well, we’ve got to put it in the context where we came off an election and the economy was at stand still but we’re seeing things slowly pick up momentum. Typically the year after an election should be a good year. We saw the two principles shake hands which was symbolic but also sent a very strong message.

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR

and one way to do so is through taking control of derivatives. It’s a classic problem, I mean, there is no value addition if we’re selling resources at the spot price offered at the markets. Countries can also protect themselves against these big surges, example the last time the shilling fell out of bed was when the oil price went up.

Why aren’t we competing with the rest of the world here? Because those are highly paid and highly specialised jobs! Historically the best of banks were in the western world

15

WHITE COLLAR ISSUE 003

and they managed to concentrate expertise and strength in those capital cities. They paid the high salaries and sucked in the talent. Given that, Africa just hasn’t been able to compete so far. But I have confidence that we are going to begin to compete. We’re looking to set up institutions that function at that level for example Nairobi is starting to create a financial center.

Do you have any inclinations to begin a center that trades derivatives? Yes, in fact within the next 12 months we should have something going.

We have seen Countries use debt to take advantage of unsuspecting countries, how do we make sure Kenya doesn’t end up in a situation like this? This criticism is pointing at China; in the case of the port of Hambantota that China constructed for Sri Lanka. Sri Lanka could not make the interest payments of the port and the Chinese took the port on a 99 year lease. I think we should be careful. African countries look at debt as something that can be taken without much thought of repayment. Debt should be invested sensibly. You should get a better return for your investment than the interest you’re paying. We’ve got to scrutinize what our governments are doing and think about our national interests over our personal interests.

Are Cryptocurrencies the future of money? I think there’s room for alternative non-fiat currencies, and that’s the void that cryptocurrencies are trying to fill. I was very bullish about Cryptocurrencies in early 2017. I saw it as an asset class that was going to grow and it grew exponentially. However in 2018 an investor should be a lot more careful. There are more than 1500 cryptocurrencies and not all of them will succeed, so the investor has to turn into a bit of a stock-picker. The rising tide that floats all Cryptocurrencies is gone, so it’s now a bit more complex. The main issue though, is around the parallel economy;

16

governments will not allow these currencies to go on unregulated.

Traders are familiar with making the occasional loss. Give us an example when you did and tell us of any possible lessons you learnt. Losses are the most difficult thing for any trader. It’s like a punch in the solar plexus. This however is a continuous learning exercise and it’s all about risk management. The best traders are the best risk managers. The memory that stands out most all was around 1995, I was moving to Sumitomo bank with my team. I had a very strong conviction about Europe, that time Europe was in a recession. The European economy was dead and in that kind of environment central banks cut interest rates in order to stimulate the economy. I had taken a pretty big positions in the T-bill (treasury bill) market in France. At first we were up $ 5 million which was incredible. Then two things happened. Jack Chirac, the then president of France, set off an underwater nuclear explosion. And at the then someone poisoned Perrier water bottles. These two events created a lot of pressure on the French currency. Our position which was +5 moved to -10. I learnt how to deal with that. More clearly I learnt that was too big a bet. You can have a conviction of 110 percent but you still have to manage your risk. Anything can happen. I also learnt to appreciate that I was with a group of people and it wasn’t just about me.

Are there any missed opportunities that you wish you leveraged? Oh yea! There’s so many. In the Markets you spot numerous opportunities. My problem however is spotting it, but then not holding on to it. There’s a book I like, ‘Reminiscence of a Stock market operator’ and in it the author says ‘You have to run your

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR

WHITE COLLAR | ISSUE 003

winners.’ There’s times when I didn’t run my winners. An example is Netflix, It’s grown more than a hundred times since I spotted it. People thought it was just an American business, but I put two and two together and saw that it was going to be a global business

Have you invested in any start-ups? Yes!

Examples? I won’t give you the names, Hehe. But I have. I’ve invested in some think-tanks and some financial services startups. And still, I’m looking closely at a few start-ups at Nairobi garage; there’s new things popping up there all the time. I’m also considering going more aggressively into agriculture because of the potential it has in Kenya. So yea, ICT and agriculture

You’ve been in close proximity to heads of state. Have you used these opportunities to affect change? I’ve been very fortunate with that. Sometimes I’d even position myself for a ‘chance encounter’. The chance meeting isn’t really a chance meeting. Hehe.

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR

In moments I’ve met the British Prime Minister, The Japanese Prime Minister, The head of the IMF and African heads of state. I like to think that it’s in moments like that I really shine and lobby. But the tragedy is that you can push a beneficial agenda but the road to policy is very tricky and not many ideas live to be policy.

What trends in business and policy would you encourage in Africa? I think for Africans, if we can trade across our borders without impediment, it would create a huge and dynamic momentum for us. Also the sheer number of people we have to find employment for is unprecedented in History. We need to figure out how to create more employment and improving education. We also have to figure out how to reduce the cost of living. It’s surprising that the cost of living in Kenya is higher than that of Poland. Also a friend of mine recently informed me that in Vietnam; you can eat and access the internet 5G, daily for less than a dollar a Day.◊ ◊ ◊ ◊ ◊ ◊ ◊ ◊ ◊ ◊ ◊ ◊◊◊◊◊◊◊◊

17

WHITE COLLAR ISSUE 001

How to Attain Your

Wealth Goals I f you’re reading this, chances are, the story below in a way describes your journey as well.

You went to school all bright eyed. At first you didn’t understand the purpose of school and quietly thought it was a ploy by your parents to get rid of you for most of the day. As time went on, you began to make sense of the ties between a good performance and the ability to land a good job (or a career if you’re lucky). That was the ‘golden-ticket’ as far as you were concerned. You buckled up and studied hard with the brightest vision of the possible future that good grades could create. However with each stage of schooling, your vision/dream was re-adjusted to suit a given reality of circumstance. You made the transition to intern and you learnt afresh what the job market really requires.

18

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR

WHITE COLLAR | ISSUE 001

W O R K I N G SM AR T Working smart is mostly vague but we’ll define it as ‘adding a bit of strategy to hard work’. It didn’t take long to discern the fact that most jobs keep people barely afloat. So how does one generate wealth under such circumstances?

W ORKING HAR D Don’t roll your eyes just yet. Stick around. There really is no substitute for hard work. Hard work is a means to an end and not the end in itself. Hard work serves to equip you with everything you need to know in order to perform at industry standards (or at world class standards if you push yourself). The late nights spent perfecting and perusing the myriad of specialised blogs or videos on your particular field are both valuable pieces of informal education. This is what gives you an edge over the rest and allows you to stand out. This makes you an easy candidate for promotion. And now, thanks to the promotion, you’re making a bit more money. But it’s still somehow not enough because life’s responsibilities keep catching up to you. The point of working so hard is to slowly save and accumulate as much as possible. The economists say ‘save 30-40%’ of your income. If by some miracle this is possible, then you seriously have to consider what you’re saving for. Hence the next step.

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR

Once you’re stable at your place of work, and the enormous responsibilities now seem manageable, then you begin to think of a side project. This project is a combination of a passion and a skill that you’ve nurtured or harboured for a while but never really got the opportunity to pursue. At this stage in a way the journey starts all over again, with the late night or early morning practice and learning sessions. By this point weekends barely exist for you. The only excuse for social functions is networking. You look for the right partners and given the vast number of industry contacts and experience you all bring to the table you see it fit to formalise and start a business. A joint venture allows the parties involved to pool resources and share expenses. A combination of hard work, good coordination and luck might result in you seeing your investment returned. And soon after breaking even you start to make a bit of money aside from what you make at your formal employment. You try your best to save the said ’30-40%’ of your total income. But what are you really saving for this time? The norm is most people live off of what is achieved at this stage and accumulate funds as much as possible. Of course there’s an investment every once in a while but that’s never really the point of it. Most people will settle for having the bank interest rate make money for them. However is this really sustainable as a means of generating wealth? Let’s have a look at some of the countries with the highest interest rates on their savings accounts. They are:

19

WHITE COLLAR ISSUE 003

The mentioned countries may seem to have relatively high interest rates. So why don’t the multitudes rush to invest there? Well, interest rates on savings accounts have some correlation to the current rate of inflation. Notice on the chart that the highest rates of inflation are accompanied with the highest savings rates. That means, the quantity of funds invested will increase however the value of the said funds will not make a significant increase. A good example is the Zimbabwe’s dollars you could have a million off them but with that million only afford to buy a shirt. Despite this, the local savings account, with a minimal returns, works perfectly well for certain people. Especially those who are looking just to conserve their wealth. For the rest who always want to see some sort of growth, ( or people who invest for the sport of it) there might be another solution: Based on your level of expertise, one could either approach an investment firm (low cost exchange-traded funds or mutual funds) or privately invest the said funds in fields that you are familiar with.

target growth of between 6%-9% and which is what most investment firms offer. They will help you build a relatively safe portfolio consisting of a diversified mix of investments. It always helps if you pick something that you understand. This kind of investment is not a ‘sprint’ and neither is it a straight line. The best results are seen when longevity is factored in. There is a risk of loss and you have to be prepared to face it. Do not invest what you are not willing to lose. It’s also advisable to set standards for yourself, for example if 15% of your investment is lost then you get all your money back or again if you investment surpasses a given target then withdraw the principal sum/profit and let the rest keep making money. With the few principles discussed here and a host of others that you could research and add onto these, you stand a better chance of attaining your wealth goals. ◊ ◊ ◊ ◊ ◊ ◊ ◊

The trick here is to get the money growing at a rate of return where compound growth works. That means you need to

20

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR

WHITE COLLAR | ISSUE 003

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR

21

WHITE COLLAR ISSUE 003

The Power Suit Vs A Gentleman’s Blazer BRIEF HISTORY: SUIT A n important part of networking is looking the part. Be it a business meeting or semi-casual networking event one needs to dress in an appropriate manner. Attention to detail is key because it reflects on an individual’s attitude towards the quality of their work. However in order to understand 21st Century Business Synergy better, we have to know the steps that came before:

22

The man's suit of clothes, in the sense of a lounge or business suit, is a set of garments which are crafted from the same cloth. This article discusses the history of the lounge suit, often called a business suit when made in dark colours and of conservative cut. The present styles of suits were first realised in the late 19th Century. However the modern suit can be traced back to much simpler origins in the 17th Century when

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR

WHITE COLLAR | ISSUE 003

the restored monarch, Charles II, decreed that the men of court would be dressed in a fashion that reflects the modern suit. This mode of dressing spread out across Europe and the rest of the world, in the 18th to 20th Century, as the accepted way for a gentleman/ businessman to dress. Towards the end 20th Century we have seen the suit become adopted even by women. At first in the 1980’s in form of the skirt suit. In the following centuries designers branched out and crafted different style suits for every occasion. The evening was accompanied by the dinner jacket, sometimes with coat-tails or a tuxedo for special occasions, for example weddings or coronations.

BRIEF HISTORY: BLAZER

The Blazer was tailored in the image of the suit jacket but was made to look a bit more casual. It was also tailored from a tougher material and was made in the brightest colours. In fact the term blazer was used to describe the bright red colour of the jackets worn by a various boat clubs in the early 1800’s. And that attribute of bright colour has continued to be part and parcel of the blazer brand. This article of clothing was popularised when the oxford and Cambridge rowers started to wear them on dry land in the 1950’s. More and more sportsmen too to it and it became a way to announce different teams because of

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR

the obvious bright colours and school emblems. The Blazer was quickly adopted by the royalty, aristocrats and the newly wealthy to reflect a sense of family by displaying their family colour and crest. However as time went on and the middle-class expanded the blazer was further adopted and a form of semi-casual wear for weekend occasions or informal gathering.

HOW TO STYLE:

From the stated histories some Facts stand out right away:

The suit is a two or three piece garment. It has a darker range of colours and a soft, light fabric. It’s sharp finish and sleek lines are a more refined look and thus the suit is perfect for a business setting or official function. The darker colours set a less playful tone and reduce the chances of distraction. This also serves to make the wearer of the suit seem more powerful hence the phrase ‘Power-suit’. The power-suit is mostly a bespoke (made to measure) suit with dark colours. It creates an air of sophistication and attention to detail. For hint of personality one could complement the suit with matching happy socks. To cultivate a more sophisticated image one could add a range of accessories for example a gold plated tie-clip or cuff-links. The Blazer on the other hand is a single piece garment. It has a bright range of colours, or stripes and is made from a heavy and tough fabric. Its rugged finish is compatible with collared polo shirts or informal dressshirts. This article of clothing is often worn as the brightest part of the outfit and thus most of the other colours worn should be darker or should contrast the colours worn. The Blazer is perfect for high end, outdoor sporting events for example Polo tournaments. It was first intended to be worn on boats and would work well with a nautical theme, for example khakis and boatshoes.

23

WHITE COLLAR ISSUE 003

Ad space

24

A MAGAZINE FOR THE CAREER-PERSON AND ENTREPRENEUR