11 minute read

High Noon Concerts

Need a doc? www.LubbockMedGuide.com

Lubbock & area physicians - by specialty & alphabetically + hospitals & related medical services TOVA Coffeehouse creates specialty drink for Covenant Children’s

Covenant Children’s has partnered with TOVA Coffeehouse for a good and tasty cause.

TOVA Coffeehouse’s Cause Drink for the months of May, June, and July is the Champions for Children Cream Soda.

The summer specialty drink was created specifically with kids in mind, and proceeds from the purchase of every cream soda will directly benefit Covenant Children’s.

Proceeds from the Champions for Children campaign go toward supporting upgrades and enhancements at Covenant Children’s pediatric emergency department inside the region’s only licensed free-standing children’s hospital.

TOVA Coffeehouse is located at 6023 82nd St.

High Noon Concerts every Wednesday

The High Noon Concert Series offers outdoor performances by local talent from noon to 1 p.m. every Wednesday through Aug. 11 at the Lubbock County Courthouse Gazebo, 904 Broadway.

Food trucks are onsite during the concerts.

Two $25 cash prize drawings are held during each concert.

Performances are July 7 – Robert Lopez July 14 – Gary Nix July 21 – Dustin Garrett July 28 – Sheena Fadeyi Aug. 4 – Blackwater Draw Aug. 11 – John Sprott

Old age is an excellent time for outrage. My goal is to say or do at least one outrageous thing every week. - Maggie Kuhn

Golden Gazette Crossword Puzzle

ACROSS

1. Breezy 6. Gemstone 10. 21st letter of the

Greek alphabet 13. Utterly stupid person 14. Prison 15. Stepped 16. Reiteration 18. Spool 19. Printer’s measures 20. Highway 21. Resembling glass 23. Discover 24. Impassive 25. Half the diameter 28. Native of Tahiti 31. At right angles to a ship’s length 32. Communion plate 33. Self-esteem 34. Sheet of matted cotton 35. Compare 36. Single entity 37. Very skilled person 38. Brilliant 39. Aunt’s husband 40. Seasoning plant 42. In fact 43. Intended 44. Mackerel shark 45. To act frivolously 47. Booth 48. First man’s mate 51. To sharpen 52. Moving the eyeball 55. River in central Europe 56. Exhort 57. Photograph, for short 58. A primary color 59. Takes to court 60. Shades

DOWN

1. Metal filament 2. As previously given 3. Bites 4. Female deer 5. Rare metallic element 6. Group of eight 7. Discharged a debt 8. Gone by 9. Grow longer 10. Foreknowledge 11. Garden tools 12. Indolently 15. Distinguishing characteristic 17. Charged particles 22. Cut of meat 23. Decree 24. Satisfied 25. Capital of Morocco 26. Manila hemp plant 27. Resolute 28. Massive, goatlike bovid 29. Nimble 30. Well-known 32. Hinge 35. Woody 36. Untie 38. South African river 39. Disheveled 41. To send for treatment 42. The villain in Othello 44. Burrowing animals 45. Norse god of thunder 46. Part of the verb “to ride” 47. Sled 48. English public school 49. Choose from a ballot 50. Greek god of love 53. French vineyard 54. Exclamation of surprise

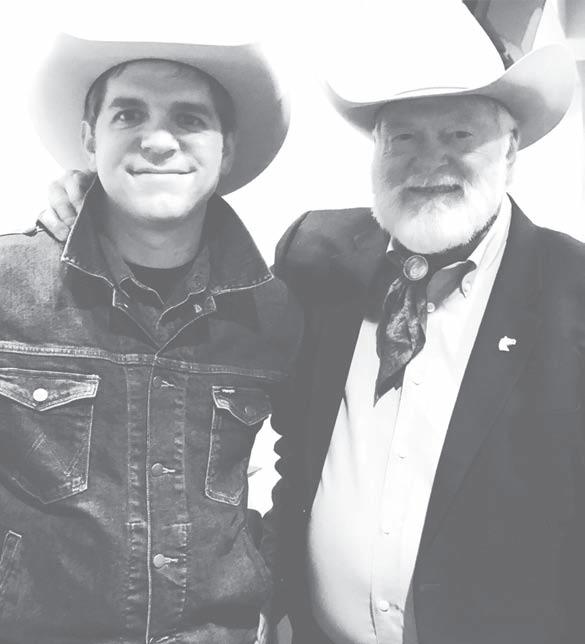

Andy Hedges and his Cowboy Crossroads podcast will partner with the National Ranching Heritage Center to record a new series of podcasts featuring past recipients of the National Golden Spur Award. Hedges’ interview with Western entertainer Red Steagall (right) launched June 29 and will be available indefinitely at https://andyhedges.com/ cowboy-crossroads.

A partnership with local cowboy songster Andy Hedges and the National Ranching Heritage Center launched a new podcast series on June 29 featuring Western entertainer Red Steagall as the first of numerous Cowboy Crossroads podcasts spotlighting past recipients of the National Golden Spur Award.

The award is the most prestigious honor given to a single individual in recognition of accomplishments in the ranching and livestock industries. Steagall is one of numerous past award recipients Hedges will feature as part of his monthly Cowboy Crossroads podcasts. The podcasts provide in-depth interviews with fellow musicians, poets, working cowboys and ranchers.

“Red Steagall will be my 70th monthly podcast but my first podcast sponsored by the National Ranching Heritage Center and featuring a Golden Spur recipient,” Hedges said. The podcast can be accessed at https:// andyhedges.com/cowboycrossroads as well as on other podcast hosting services.

“Podcasts are essentially radio shows that can be accessed on the internet,” Hedges said. He interviews a different guest on each podcast episode and asks them to share stories and discuss music, poetry, culture and the working cowboy.

The son of a schoolteacher and a rodeo cowboy turned preacher, Hedges grew up in the small community of Tokio, Texas, and now lives and performs in Lubbock. He fell in love with traditional Western music by listening to his father’s cassettes of cowboy songs.

He is a songster who performs works from the folk tradition with a varied repertoire that includes classic cowboy recitations, old cowboy songs, dust bowl ballads and blues.

Your elected officials

Contact your elected officials. Keep in touch during good times, offer solutions in not-so-good times.

President Joe Biden

202-456-1414, or comments line 202-456-1111

The White House, 1600 Pennsylvania Ave NW whitehouse.gov

U.S. Senator John Cornyn

U.S. Senator Ted Cruz

U.S. Representative Jodey Arrington

806-763-1611 or 202-224-3121

U.S. House of Representatives, Washington, DC 20515

Arrington.house.gov Gov. Greg Abbott

512-463-1782

Office of the Governor, P.O. Box 12428,

Austin, Texas 78711-2428

Gov.texas.gov

Texas State Senator Charles Perry

806-783-9934, 512-463-0128

Texas State Representative John Frullo

806-763-2366, 512-463-0676

Texas State Representative Dustin Burrows

806-795-0635, 512-463-0542 P.O. Box 2910, Austin, Texas 78768 10507 Quaker Avenue, Suite 103, Lubbock, Texas 79424

Page 20 • July 2021 • Golden Gazette Investment Planning: The basics & getting started

Why do so many people never obtain the financial independence they desire? Often it’s because they don’t take the first step – getting started.

Besides procrastination, people believe investing is too risky, too complicated, too time consuming, and only for the rich.

The fact is, there’s nothing complicated about common investing techniques, and it usually doesn’t take much time to understand the basics.

One of the biggest risks you face is not educating yourself about which investments may be able to help you pursue your financial goals and how to approach the investing process.

Saving versus investing

Both saving and investing have a place in your finances, but don’t confuse the two.

Saving is the process of setting aside money to be used for a financial goal, whether that is done as part of a workplace retirement savings plan, and individual retirement account, a bank savings account, or some other savings vehicle.

Investing is the process of deciding what to do with those savings. Some investments are designed to help protect your principal – the initial amount you’ve set aside – but may provide relatively little or no return. Other investments can go up or down in value and may or may not pay interest or dividends.

Stocks, bonds, cash alternatives, precious metals, and real estate all represent investments; mutual funds are a way to purchase such investments and are also considered an investment.

Note: Before investing in a mutual fund, carefully consider its investment objectives, risks, charges and fees, which can be found in the prospectus available from the fund. Read the prospectus carefully before investing.

Why invest?

You invest for the future, and the future can be expensive. Because people are living longer, retirement costs are often higher than expected. All investing involves the possibility of loss, including the loss of principal, and there can be no guarantee that any investment strategy will be successful.

You have to take responsibility for your own finances, even if you need expert help to do so. Government programs such as Social Security will probably play a less significant role for you than they did for previous generations. Corporations are switching from guaranteed pensions to plans that require you to make contributions and choose investments. The more you manage your dollars, the more likely it is that you’ll have the money to make the future what you want it to be.

Because everyone has different goals and expectations, there are a number of different reasons for investing.

Understanding how to match those reasons with your investments is simply one aspect of managing your money to provide a comfortable life and financial security for you and your family.

What is the best way to invest?

• Get in the habit of saving. Set aside a portion of your income regularly. Automate the process if possible by having money automatically put into your investment account before you have a chance to spend it. • Invest so that your money at least keeps pace with inflation over time. • Don’t put all your eggs in one basket. Though asset allocation and diversification don’t guarantee a profit or ensure against the possibility of loss, having multiple types of investments may help reduce the impact of a loss on any single investment. • Focus on long-term potential rather than short-term price fluctuations.

• Ask questions and become educated before making any investment. • Invest with your head, not with your stomach or heart. Avoid the urge to act based on how you feel about an investment.

Before you start

• Organize your finances to help manage your money more efficiently. Investing is just one component of your overall financial plan. Get a clear picture of where you are today. • What’s your net worth? Compare your assets with all your liabilities. Look at your cash flow. Be clear on where your income is going each month. List your expenses.

You can typically identify enough expenses to account for at least 95 percent of your income. If not, go back and look again. You could use those lost dollars for investing.

Are you drowning in credit card debt? If so, pay it off as quickly as possible before you start investing. Every dollar you save in interest charges is one more dollar that you can invest for your future. • Establish a solid financial base. Make sure you have an adequate emergency fund, sufficient insurance coverage, and a realistic budget. Also, take full advantage of benefits and retirement plans that your employer offers.

• Want Ads • Want Ads • Want ads •

EyEglAss REpAiR & REplAcEmEnt

Frame repairs, new lenses, new frames and/or adjustments. Serving West Texas since 1977! midwest Optical, 253334th, 806-797-5534 1/21

pROfEssiOnAl iROning

Professional ironing, reasonable rates. Quick turnaround. Call 806-748-6266 and leave a message. 2/21 REsthAVEn lOt

Great location. Section AA, Lot 190. Space 3. Retails for $5,195. Our offer $3,500. We pay transfer fee. Call 806-5005281.

7/20

cAn’t REAch yOuR tOEs? ... i cAn!

Professional manicures & pedicures. Top quality products & services. Promoting healthy nails. 20 years experience. Call Alicia at 806-317-5226. 2/17 sEniOR VisiOn cARE

Dr. Michael J. Dunn in Lubbock - 38 years of quality vision care. Call 745-2222.

lOt At REsthAVEn

Lot at Resthaven near mausoleum. $5,195 value. Make me a reasonable offer. Call 806407-5493.

11/20

cEmEtERy plOts

3 cemetery plots for sale in Seminole. $300 each. Call 432788-7322.

6/21

Investment Planning

(Continued from Page 20) help in creating a financial

Understand the impact of time

• Take advantage of the power of compounding. Compounding is the earning of interest on interest, or the reinvestment of income. • Use the Rule of 72 to judge an investment’s potential. Divide the projected return into 72. The answer is the number of years it will take for the investment to double in value. For example, an investment that earns 8% per year will double in 9 years.

Consider whether you need expert help

If you have the time and energy to educate yourself about investing, you may not feel you need assistance.

However, for many people – especially those with substantial assets and multiple investment accounts – it may be worth getting expert plan that integrates longterm financial goals such as retirement with other, more short-term needs.

Be aware that all investments involve risk, including the potential loss of principal, and there can be no guarantee that any investment strategy will be successful.

Review your progress

Financial management is an ongoing process. Keep good records and recalculate your net worth annually. This will help you for tax purposes, and show you how your investments are doing over time.

Once you take that first step of getting started, you will be better able to manage your money to pay for today’s needs and pursue tomorrow’s goals.

Zach Holtzman

Holtzman Wealth Strategies

Medicaid fraud drives up the cost of health care for everyone.

It’s everyones responsibility to report fraud & abuse.

Medicaid Fraud Control Unit 765-6367

mfcu@oag.texas.gov

Subscribe to the

News and features mailed to you at the first of each month. Subscribe to Lubbock’s Senior Newspaper. Clip and mail the attached form along with your subscription check.

Mail to: Golden Gazette

1310 Avenue Q Lubbock, TX 79401 Subscription Form

Please enter my subscription to the Gazette:

One Year Subscription for $24 Two Year Subscription for $48

Mail my copy of the Golden Gazette to:

Name ___________________________________

Address _________________________________

City _____________________________________ State ____________________________________

Zip______________________________________