8 minute read

Aircraft Buyer Questions, Part 1: Trip & Mission Profile

Aircraft Buyer Questions, Part 1:

Trip & Mission Profile

Advertisement

What key questions do buyers need to answer when determining which aircraft models best meet their travel needs and mission requirements? René Armas Maes explores.

Before buying a business aircraft, due diligence is key. While the required capital and direct operating cost expenditure are, of course, important, you need to ensure your aircraft provides a good return on investment. Here are some tips in that regard relating to the trip and mission profile of your future airplane.

Before evaluating the several possible aircraft options on the market and narrowing the choices down to the right one for your mission, there are a number of questions that need answering. What are the most popular or frequent city-pair destinations that you’ll fly?

It is essential to understand any requirements for your future aircraft with regard to the airports you will regularly use. This includes climb gradient, payload restrictions, noise abatement, hot and high performance, special steep approach requirements, and more.

By analyzing aircraft performance against specific airport performance requirements, the end goal is to narrow down the suitable aircraft that you know will

meet, or exceed, the mission requirements in terms of airport accessibility.

Where is the operating base going to be located?

For similar reasons, the home base for the aircraft is a key question, too. Aircraft performance limitations (runway length, airport altitude, glide slope requirements, hot and dry conditions, etc.) needs to be factored, and will narrow the available choices available to you.

As an example, not all airport runways are created equal, with some being longer, and some shorter, restricting the aircraft that can use them. You’ll need to match up these airport specifics to any aircraft type you consider buying. “Either buy with the need to trade, and upgrade the aircraft built into the plan accordingly, or consider an aircraft that allows for the anticipated change in mission requirement.”

What is the projected ‘average stage length’ in your mission profile?

Quite simply, the average stage length is defined as the length of the flight from take-off to landing, in nautical miles, aggregated over the course of a year, and divided by the number of departures.

The answer to this equation will provide you with the average mission (in nautical miles) that your future aircraft will be required to fly. Ultimately, the aircraft should meet 80% of those anticipated missions.

It is unrealistic to expect an aircraft to achieve 100% of the missions without buying too much aircraft for the majority of your mission requirements – which inevitably increases your cost of purchase and operating costs unnecessarily. For these trips, it is possible to charter a larger jet ad hoc, or buy block hours of charter if you anticipate more than 20 hours of longer-range flying is needed annually, or make fuel stops (see below).

How could your future mission requirements change?

Is your typical mission profile likely to change in the near future? As businesses enjoy success, their travel requirements may include traveling further afield, or visiting new locations with airports that have limiting factors that would prevent the existing aircraft from accessing it.

While an aircraft purchased to fulfil a 3,000 nautical mile trip profile may work in the short term, if mission requirements change in the nearterm (i.e. within two to three years), an aircraft upgrade will be needed. Either buy with the need to trade, and upgrade the aircraft built into the plan accordingly, or consider an aircraft that allows for the anticipated change in mission requirement.

If you would be happy to make a fuel stop en route in order to meet 20% of your typical missions that are otherwise beyond its range capability, then you can expect to pay a lower capital expenditure and lower operating costs. Let’s illustrate with the

FIGURE 1: Weighing the Value of Non-Stop Flying vs a Fuel Stop

example of a trip from Bogota, Colombia (SKBO) to London City Airport (EGLC) in the UK, highlighted in Figure 1 (above).

The estimated trip length is 5,500nm with IFR and fuel reserves but, in this case, let’s assume the owner has a private jet with a range of 4,100 nautical miles. In order to complete their required trip, the owner must fly to the US (Opa-Locka Executive Airport - KOPF, in this example), make a fuel stop, and then fly across to EGLC.

While an Ultra-Long-Range Jet could make the flight non-stop, does the larger jet always make financial sense? If our 4,200nm jet costs $32m brand-new, and a 5,500nm brand-new plane costs $42-50m, you’re looking at spending $10-15m more for the non-stop option (less, if you’re shopping the pre-owned market).

Remember, the final aircraft choice should cover 80% of your planned yearly flying, not the other 20%. For corporations requiring 5,000nm range for just 20% of the time, a quick turn and fuel stop makes far greater sense, compared to spending several million US$ more on a longer-range jet.

What is the average passenger load you will need to carry?

The number of passengers that will typically travel in the aircraft is a key question to consider to ascertain what the typical payload will be, the number of seats and special requirements.

When considering your average passenger load, you should factor the available payload when the aircraft is fully-fueled. This ensures that no compromises need to be made between passengers (and their luggage) and fuel. Are you considering the cabin size and seating configurations?

It is important to understand your cabin space requirements, along with any special seating arrangements (divans, club seating, conference table and enclosed (or not) areas for meetings, rest, and privacy. Doing so will, again, help reduce the viable options on the market for you, but ensure the aircraft you buy is fit for your purposes.

Will you primarily be transporting executives, technicians, family (including children) and friends? How is the cabin equipped to meet their needs? Will passengers need to sleep aboard the aircraft? If so, how many, and does the existing configuration facilitate this? (As an example, a typical Super Midsize Jet will usually allow four people to sleep in the cabin at one time.)

What will be the catering requirements, and does the galley allow for this? And is there a fully private lavatory installed?

Don’t overlook the door width and cabin height. The latter is sometimes considered a critical factor for taller passengers. Indeed, Very Light and Light Jets can become uncomfortable for larger-than-average people on trips lasting two or more hours.

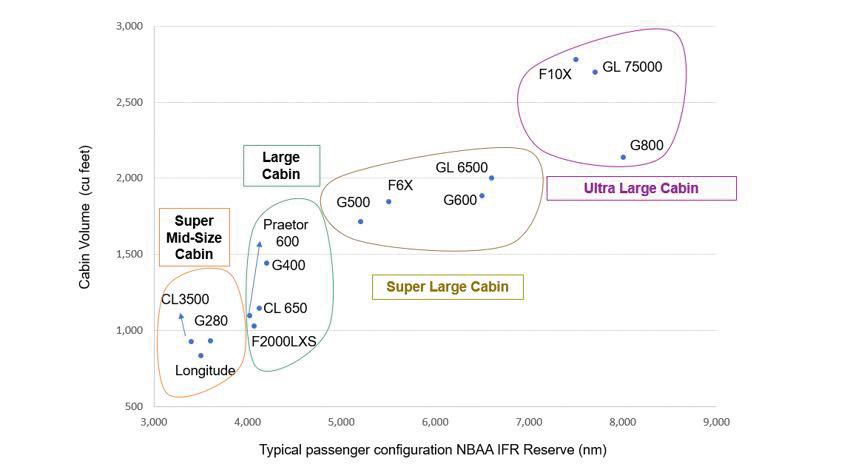

Consider, and measure, target aircraft cabin volumes (in cubic feet), as depicted in Figure 2 (overleaf) (which represents aircraft ranging between Super Mid-size to ‘Ultra-Large’ Jets within their groupings). This will help clarify which jets offer the best cabin volume in relation to range.

Nevertheless, you should keep in mind that the more space the aircraft offers, the higher its acquisition and operating cost will be, generally speaking.

Don’t forget any special luggage and cargo requirements

If you have any special, bulky cargo needs, they should be considered now, while you’re making your final shortlist of candidate aircraft to buy.

• Will passengers be carrying standard business luggage, or leisure (golf bags, skis, etc.)? • Will they be returning same-day, staying away for a couple of nights, or carrying luggage for a longer trip? • How might the luggage needs change over time?

Is accessibility to luggage from the main cabin during the flight a requirement? If not, passengers need to remember that any item not taken from the cargo compartment before departure can only be picked up upon landing, and adequate space to stow such items will be needed within the cabin.

A Few Other Key Questions

Is the ultimate purpose of travel going to be business, pleasure, or a mixture of both? Also, are you planning to offset some your fixed operating costs by placing your aircraft on an aircraft management company’s charter certificate? This has implications for the preferred colors and textures of the interior, as well as the configuration and desired equipage – potentially limiting the range of aircraft you will consider buying.

And last, but certainly not least, consider your target aircraft’s residual value. One of the largest hidden costs of operating a business jet can be its residual value. So this needs to be a key element in your buying decision.

In Summary

As demonstrated by this article, a customer trip and mission profile analysis is necessary, and explores a large number of areas, all of which will have a bearing on your aircraft selection. Your analysis is key to making the most of your final purchase decision, both from an investment and asset disposal perspective.

Indeed, having a clear idea of your mission and airport base requirements will help sharpen your focus and define your trip and mission profile. Consequently, it will allow you as an aircraft owner to make the correct operational and financial decisions.

Having explored the trip and mission profile here, in Part 2, we will continue our discussion with a focus on developing your budget in advance of buying your aircraft. Stay tuned! ❚

RENÉ ARMAS MAES

is vice president, Commercial at Jet Link International LLC and an international consultant with a broad experience in business aircraft sales. He has developed multiple analyses and studies for a number of US Fortune 500 companies and Venture Capital firms, and participated as keynote speaker at a number of business aircraft conferences.

MAKE MORE INFORMED BUYING & SELLING DECISIONS with AvBUYER.com