EVOLVING QUICK SERVICE FOR THE FUTURE CAVA CEO BRETT SCHULMAN THE GUIDE TO LANDING AN INVESTMENT Industry leaders give advice on what makes a brand fi nancially attractive. | P. 32 | AND FEATURING: Restaurant Equipment & Technology | P. 47 | ON ITS RISE TO THE TOP OF THE MEDITERRANEAN SEGMENT, CAVA KEEPS BEATING EXPECTATIONS AND WINNING OVER NEW GUESTS. | P. 18 | CAVA Chases Stardom

DANNY KLEIN

DANNY KLEIN

16 WOMEN IN LEADERSHIP Broadway Comes to San Diego

A new operator is bringing Schmackary’s, the ‘official cookie of Broadway,’ to the West Coast.

42 FRANCHISE FORWARD Tackling Franchisee Bankruptcy

Some operators are facing tough times during a strenuous macroeconomic environment that won’t let up. BY SAM DANLEY

9 FRESH IDEAS Twisting the Pretzel Segment

The popular snack has become more than just a mall-based treat. BY SAM DANLEY

14 ONES TO WATCH Old School Bagel Cafe

Learn how the rising concept is bringing a taste of New York to Middle America. BY SATYNE DONER 46 START TO FINISH Geoff Henry

The Gong cha Americas leader discusses the chain’s rapid rise in the beverage segment.

More than a decade of

CAVA CEO Brett Schulman leads a team that’s relentless in its pursuit of innovation and growth.

PHOTOGRAPHY: CAVA / JARED SOARES

ON THE COVER

NEWS

DONER

BY SATYNE

INSIGHT

DEPARTMENTS QSR / LIMITED-SERVICE, UNLIMITED POSSIBILITIES TABLE OF CONTENTS JULY 2024 #317 FEATURES CAVA FRED + ELLIOTT 18 The Evolution of a Category Leader BY SAM DANLEY

public debut, and there’s plenty more to come. 26 The Power of Scale BY BEN COLEY Restaurant group leaders share best practices and advice on how to run a company covering several food concepts and personalities. 32 Invest and be Invested in BY

restaurant market has been volatile, quiet, and complex—somehow all at once—over the past year or so in COVID’s wake. Is stability ahead or more chaos? QSR is a registered trademark of WTWH Media, LLC. QSR is copyright © 2024 WTWH Media, LLC. All rights reserved. The opinions of columnists are their own. Publication of their writing does not imply endorsement by WTWH Media, LLC. Subscriptions (919) 945-0704. www.qsrmagazine.com/subscribe. QSR is provided without charge upon request to individuals residing in the U.S. meeting subscription criteria as set forth by the publisher. AAM member. All rights reserved. No part of this magazine may be reproduced in any fashion without the express written consent of WTWH Media, LLC. QSR (ISSN 1093-7994) is published monthly by WTWH Media, LLC, 1111 Superior Avenue Suite 2600, Cleveland, OH 44114. Periodicals postage paid at Cleveland, OH and at additional mailing offices. 18/ CAVA IS NOW OVER 300 UNITS NATIONWIDE AS ITS POPULARITY CONTINUES TO SOAR. July Restaurant Equipment & Technology P.47 2 BRANDED CONTENT 4 EDITOR’S LETTER 7 SHORT ORDER 64 ADVERTISER INDEX www.qsrmagazine.com | QSR | JULY 2024 1

growth set the stage for CAVA’s spectactular

The

BRAND STORIES FROM QSR

EDITORIAL

EDITORIAL DIRECTOR

Danny Klein dklein@wtwhmedia.com

QSR EDITOR Ben Coley bcoley@wtwhmedia.com

FSR EDITOR Callie Evergreen cevergreen@wtwhmedia.com

ASSOCIATE EDITOR Sam Danley sdanley@wtwhmedia.com

VICE PRESIDENT EDITORIALFOOD, RETAIL, & HOSPITALITY Greg Sanders gsanders@wtwhmedia.com

CONTENT STUDIO

VICE PRESIDENT, CONTENT STUDIO Peggy Carouthers pcarouthers@wtwhmedia.com

WRITER, CONTENT STUDIO Ya’el McLoud ymcloud@wtwhmedia.com

WRITER, CONTENT STUDIO Olivia Schuster oschuster@wtwhmedia.com

ART & PRODUCTION

SENIOR ART DIRECTOR Tory Bartelt tbartelt@wtwhmedia.com

FSR ART DIRECTOR Erica Naftolowitz enaftolowitz@wtwhmedia.com

SALES & BUSINESS DEVELOPMENT

VICE PRESIDENT SALESFOOD, RETAIL, & HOSPITALITY Lindsay Buck lbuck@wtwhmedia.com

VICE PRESIDENT, BUSINESS DEVELOPMENT Eugene Drezner edrezner@wtwhmedia.com 919-945-0705

NATIONAL SALES DIRECTOR Edward Richards erichards@wtwhmedia.com 216-956-6636

NATIONAL SALES DIRECTOR Amber Dobsovic adobsovic@wtwhmedia.com 757-637-8673

NATIONAL SALES MANAGER Mike Weinreich mweinreich@wtwhmedia.com 561-398-2686

CUSTOMER SERVICE REPRESENTATIVE Tracy Doubts tdoubts@wtwhmedia.com 919-945-0704

CUSTOMER SERVICE REPRESENTATIVE Brandy Pinion bpinion@wtwhmedia.com 662-234-5481, EXT 127 FOUNDER Webb C. Howell

ADMINISTRATION

919-945-0704 / www.qsrmagazine.com/subscribe

QSR is provided without charge upon request to

IN THIS ISSUE

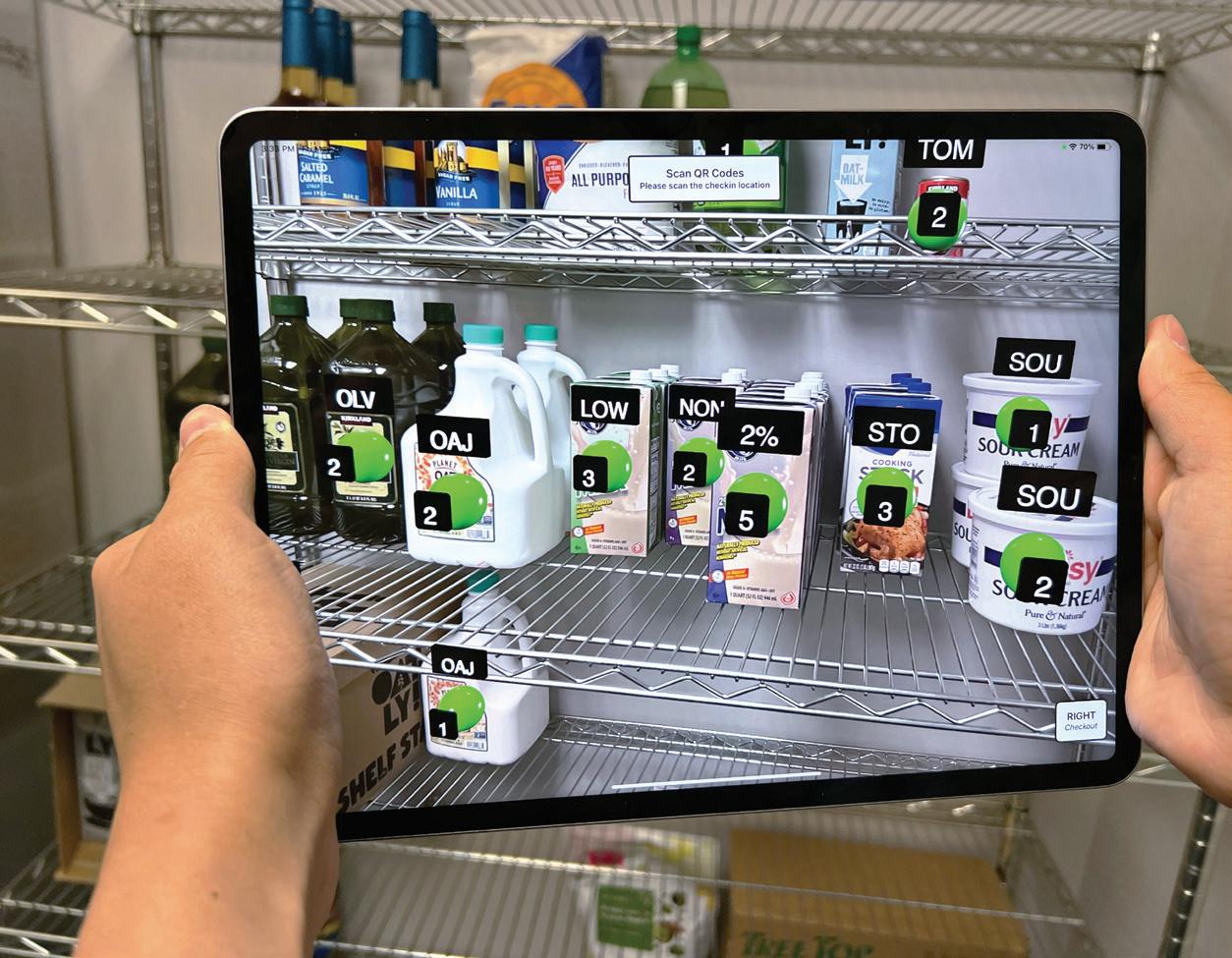

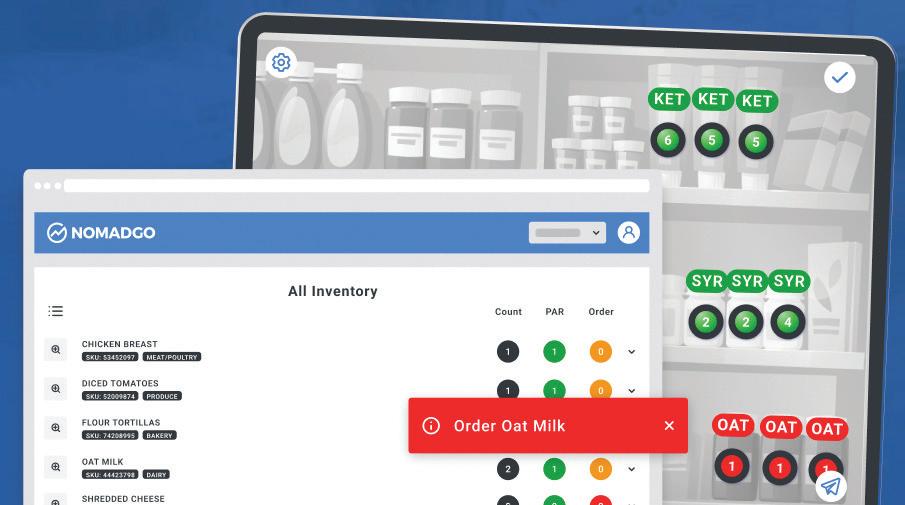

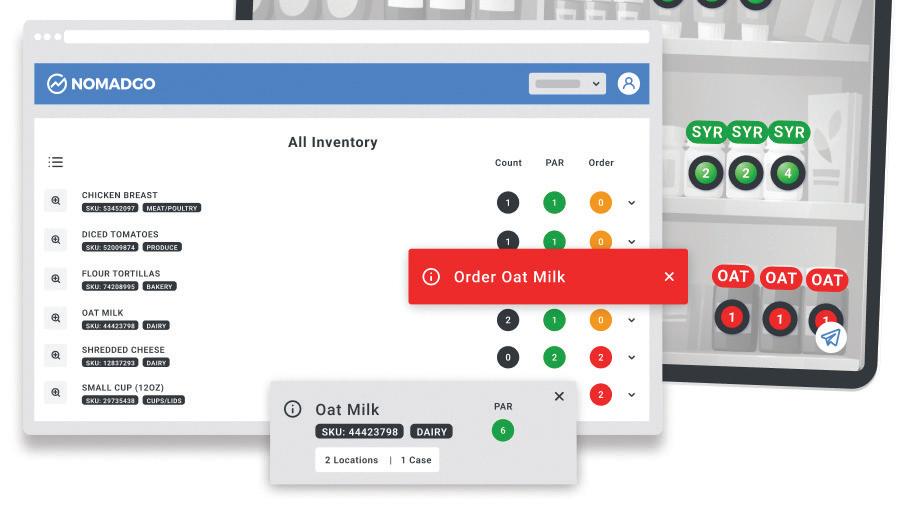

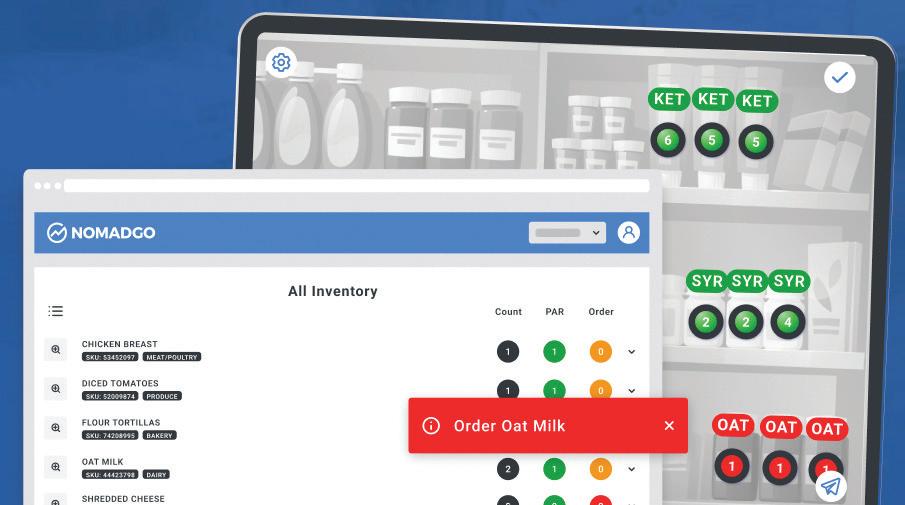

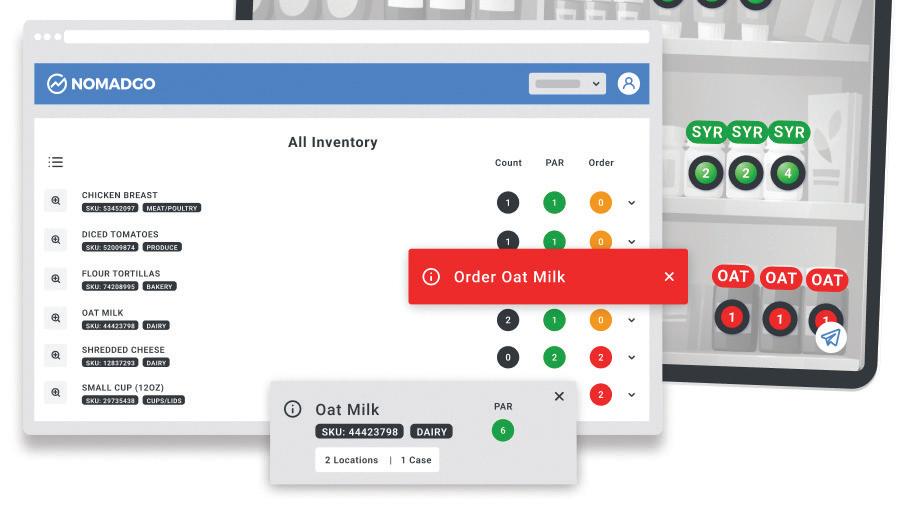

BRANDED CONTENT

individuals residing in the U.S. who meet subscription criteria as set forth by the publisher. REPRINTS The YGS Group 800-290-5460 FAX : 717-825-2150 qsrmagazine@theygsgroup.com WTWH MEDIA LLC RETAIL, HOSPITALITY, AND FOOD GROUP 12 Why Franchisees Struggle with Their Media Presence

solution to inconsistencies in restaurant marketing. SPONSORED BY ANSIRA ANSIRA 48 The Future of Drive-Thru Signage Technology and How It Affects Revenue

fast-casual dining

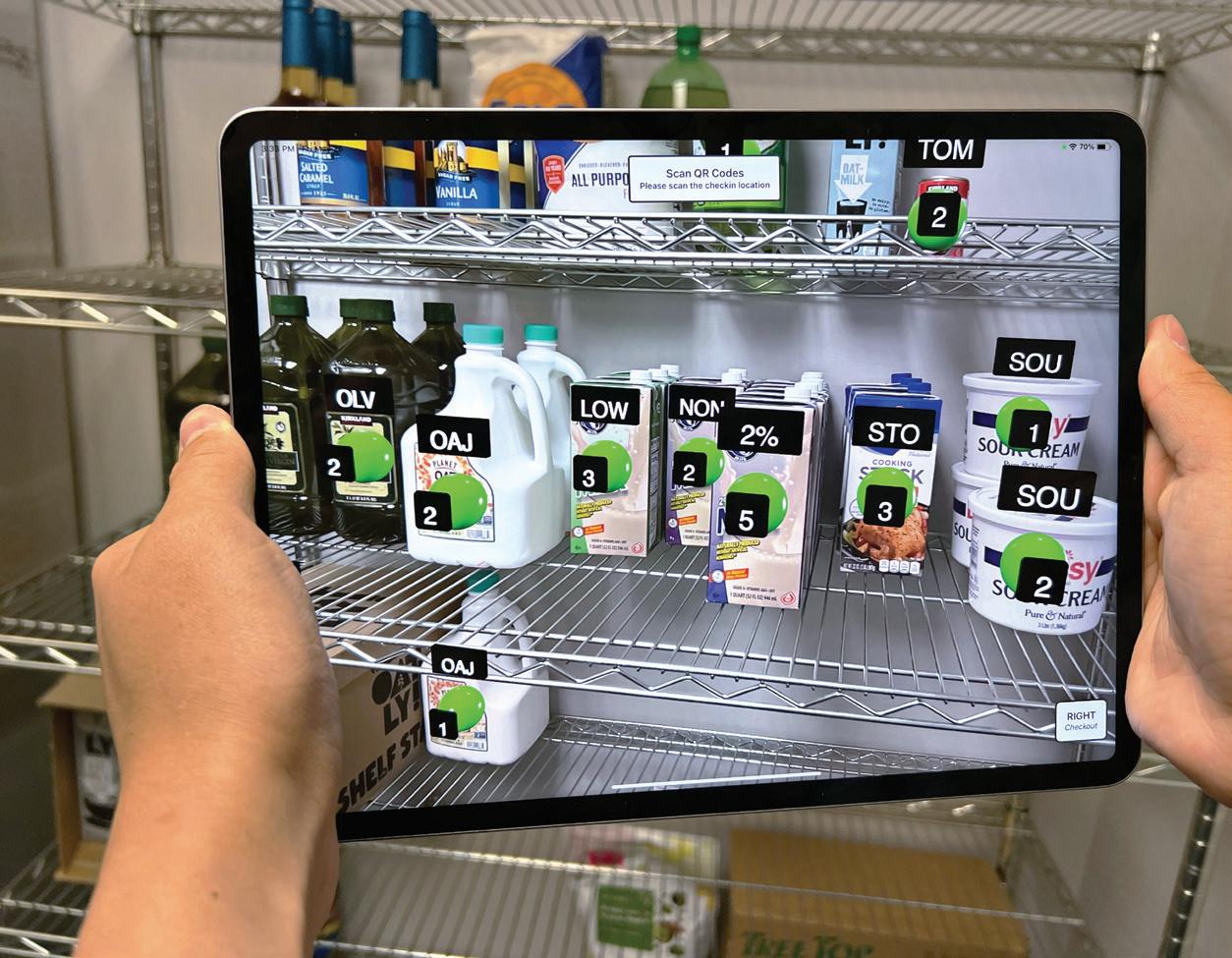

continuing to think of ways to improve efficiency. SPONSORED BY DSA SIGNAGE 50 How the Biggest Fast Food Empires Handle Their Cash The simple strategy big brands are using to save hours of payroll every week. SPONSORED BY LOOMIS 52 Why Manual Inventory Counts Are a Thing of the Past Fast and accurate mobile AI computer vision counts improve efficiency while unlocking supply chain automation. SPONSORED BY NOMAD GO 54 Restaurant Tech: Why Operators Need a Full-Service Technology Partner The right partner keeps the focus on the customer experience, not technical difficulties. SPONSORED BY R.F. TECHNOLOGIES, INC. 56 Restaurant Technologies Helps Customers “Control the Kitchen Chaos” Automated kitchen solutions can help drive efficiency and cost savings. SPONSORED BY RTI 58 Ensuring Operational Excellence The key to minimizing downtime and maximizing profits. SPONSORED BY TAYLOR COMPANY 60 Transforming QuickService Restaurants with UPM Raflatac OptiCut Linerless Labels Unveiling OptiCut technology: performance and sustainability. SPONSORED BY UPM RAFLATAC 62 Advancing Signage: The Crucial Role of Digital Reader Boards in Quick-Service Restaurants Transitioning from manual to digital signage offers major advantages. SPONSORED BY WATCHFIRE SIGNS 47 Restaurant Equipment & Technology / July 2024 As restaurants continue to combat new challenges, here are some of the companies and vendors offering solutions. 48 DSA SIGNAGE 50 LOOMIS Old wisdom has noted that the restaurant industry was slow to adapt to certain technologies. The digitization of, well, everything was a slow and steady process playing out during the 2000s and 2010s. New equipment, technology, and digital solutions were rolled out fast and furious, all with the aim of helping restaurants become more efficient. Restaurant Equipment & Technology JULY / 2024 52 NOMAD GO 54 R.F. TECHNOLOGIES, INC. 56 RESTAURANT TECHNOLOGIES 58 TAYLOR COMPANY 60 UPM RAFLATAC 62 WATCHFIRE LOOMIS ISTOCK.COM RESTAURANT TECHNOLOGIES UPM RAFLATAC WATCHFIRE 2 JULY 2024 | QSR | www.qsrmagazine.com

A

How

is

Value Hunting is Much Harder These Days

Quick-service chains keep raising menu prices, and guests are reacting negatively.

With consumers facing inflation everywhere they turn, restaurants are being cut from people’s list of purchases at a growing rate.

In May, Popmenu released a nationwide survey of 1,000 U.S. consumers that found 30 percent of their individual or family food budget was spent on restaurants each month, down from 40 percent in May 2022. About 38 percent said they are spending the same or more on restaurant meals compared to last year, but are tipping less. But it’s not as if customers are doing this because they want to. In the same study, 64 percent said they would order at a restaurant every day if they could manage it, but inflation makes that an impossible task for many.

And the mom-and-pop dining concepts aren’t the only ones feeling this pullback. The likes of McDonald’s, Wendy’s, and others have shared how they’re seeing sluggish traffic from lower-income consumers. It’s quite remarkable how fastfood prices have changed compared to a decade ago.

You can’t blame customers for having second thoughts about spending their dollars at a fast-food restaurant. These concepts are highly associated with value, and if that’s not part of the deal anymore, then what’s really the point?

Fast-food chains have sensed this boiling point from consumers and are trying to respond accordingly. Domino’s has its Emergency Pizza deal, which is essentially a repackaged BOGO offer. Wendy’s has its $5 Biggie Bag and its 2 for $3 Biggie Bundles for breakfast. And McDonald’s, the largest player in the U.S. quick-service space in terms of systemwide sales, is attempting to rope customers back in with a $5 value platform

available nationwide. Customers will get either a McChicken, McDouble, or fourpiece chicken nuggets, along with fries and a drink. Shortly after McDonald’s unveiled its value news, Burger King responded with a $5 package of its own; guests will have a choice of one of three sandwiches with nuggets, fries, and a drink. The fast-food giant also said it was testing two other value deals that could come in the latter half of 2024. This is the new reality for the fast-food segment.

In other cases, brands are attempting to showcase their value in ways other than price point, like higher-quality service, efficient operations, and distinct menu innovation. This is especially true of fast casuals that can’t really compete with fastfood chains on these lower-priced value offers ( i.e. Portillo’s, Shake Shack ).

Quick-service operators will have to tread carefully because if this inflation issue persists, they’ll not only lose share to at-home occasions, but also to the casual-dining industry. Yes, the full-service segment, which is typically known for higher prices in exchange for more in-depth service. But not anymore. Chili’s 3 for Me national value platform starts at $10.99 and includes an appetizer, entrée, and drink for $10.99. Not many chains can compete with that. And Chili’s knows this; that’s why it released a new Big Smasher burger that resembles the Big Mac. The chain is not afraid to take shots because it knows quick-service is vulnerable.

Here’s hoping our wallets will eventually get a break.

Ben Coley, Editor

BCOLEY@WTWHMEDIA.COM QSR MAGAZINE

4 JULY 2024 | QSR | www.qsrmagazine.com EDITOR’S LETTER

Reduce overall operational expenses without sacrificing quality! Our two-in-one drivethru headset system comes complete with drive-thru SOS timing metrics

drive-thru timing measurements directly from the base station or stream the data to any monitor

DESIGNED FOR COST SAVINGS Innovative timer-integrated drive-thru system eliminates the need for a separate timer purchase The all-new APEX Plus drive-thru headset system integrates speed-of-service timing metrics, providing you real-time drive-thru performance data at your fingertips! MAXIMIZE YOUR DRIVE-THRU TODAY WITH INTEGRATED TIMING Call or Email Us to Learn More! We Are Taking Pre-Orders Now! Restaurant Technology Solutions EST. 1989 TECHNOLOGIES ®RF TWO-IN-ONE DRIVE-THRU SYSTEM & SPEED-OF-SERVICE (SOS) TIMER OFFICES IN: CHICAGO • DALLAS • LOS ANGELES • NEW ENGLAND • ST. LOUIS rfdrivethru.com I (800) 598-2370 I sales@rftechno.com © 2024 R.F. Technologies, Inc. All rights reserved.

Raising New Leaders

Raising Cane’s holds a big conference to support its up-and-coming operators.

RAISING CANE’S HELD A FOCUSED CONFERENCE for over 1,300 assistant restaurant leaders and business unit teams at Dallas’ Hilton Anatole to provide training, tools, and support for their career advancement.

Throughout the conference, co-CEO and COO AJ Kumaran emphasized Cane’s commitment to sharing its success with crew members and building their careers. He highlighted the significant role of assistant restaurant leaders in the company’s future, noting that over half of the current restaurant leaders and 45 percent of current restaurant partners were promoted from the assistant restaurant leader level.

The conference underscored Raising Cane’s investment in its assistant restaurant leaders, who have seen a 25 percent compensation increase in the past year. Kumaran stressed the importance of this position in achieving the brand’s vision of becoming a top 10 U.S. restaurant company and the chain’s committment to continued investment in their growth.

RAISING CANE’S

www.qsrmagazine.com | QSR | JULY 2024 7 SHORT

Raising Cane’s recent conference hosted more than 1,300 people.

ORDER

Xenial, a subsidiary of tech company Global Payments, released a survey in April examining consumers’ quick-service ordering preferences

The study was conducted by The Harris Poll and reached nearly 2,000 U.S. adults who visit fast-food locations. It’s meant to provide a detailed look at how diners are engaging in a post-pandemic environment with several channels now available to them.

Top Ordering and Payment Preferences

Respondents were asked to rank how they like to order and pay at quick-service restaurants, from most to least preferred.

• Twenty-three percent selected drive-thru with a traditional speaker as their top choice.

• That’s followed by 21 percent preferring to order and pay ahead with a mobile device, 21 percent preferring to order inside with a real person, 12 percent preferring to order and pay in the drive-thru with a line buster (i.e. employee taking orders on a tablet), and 7 percent preferring an automated experience at the drive-thru or inside via kiosk.

• According to Xenial, the closeness in percentages showcases the importance of restaurants providing diverse options to match the transaction habits of consumers.

• “We’re seeing a splintering of [quick-service] consumer preferences among all the different channels that enable them to order and pay for food,” Siefken said. “It has never been more important for [quick-service] restaurants to offer a cohesive, holistic experience to serve the wide-ranging preferences of today’s consumers,” Chris Siefken, Xenial’s head of technology, said in a statement.

23% selected drive-thru with a traditional speaker as their top choice

83 % said they arrive knowing what they want

Diners Changing Their Minds

21% preferring to order and pay ahead with a mobile device

10 % don’t know what they want and use the menu or advertisements to decide

Respondents were asked how menus and advertisements impact their order.

• Eighty-three percent said they arrive knowing what they want, but 27 percent often change their order after looking at the menu or in-restaurant advertisements.

• Ten percent don’t know what they want and use the menu or advertisements to decide.

• “Technology can help alleviate many of the pain points identified by this survey,” Siefken concluded. “From providing a unified platform that unites the front and back of the restaurant to helping speed people through the drive-thru and investing in digital menu boards with the flexibility to present more offers to diners, the right technologies are important differentiators as restaurants compete for customers and workers.”

Consumer Patience

Respondents were asked how many cars lined up in the drive-thru would cause them to skip or leave the line to find another restaurant.

• Sixty-one percent said they would skip or leave if there were five or more cars. If there were fewer than five cars, only 29 percent would skip or leave.

• However, 91 percent of diners who said they would skip or leave if there were too many cars also said they would be more likely to stay if they previously had a speedy experience at the same store.

61%

said they would skip or leave if there were five or more cars

CHOSING FOOD: ADOBE STOCK SIBERIAN ART, DRIVE THRU: ADOBE STOCK / MARIIA

8 JULY 2024 | QSR | www.qsrmagazine.com SHORT ORDER

fresh ideas

|CATEGORY INNOVATION|

Twisting the Pretzel Segment

These brands are expanding their reach beyond the confines of shopping centers.

BY SAM DANLEY

While pretzel chains have long been synonymous with mall culture, shifting consumer habits, particularly among Gen Z and millennials, have sparked a seismic change in the snack food landscape. With a growing preference for smaller, more frequent eating occasions, snacks are now vying for a larger slice of the consumer pie.

Recognizing this evolving trend, pretzel brands are rethinking their approach, seeking to expand their reach beyond the confines of shopping centers.

“I think sometimes certain categories get put in little boxes, but we feel like people want pretzels on more occasions than just a visit to the mall,” says Hillary Frei, head of marketing for Wetzel’s Pretzels. “That’s why we’re trying to expand the format as much as possible.”

Wetzel’s quest to “bring pretzels to the people” is unfolding in

a few ways. The brand is targeting other types of nontraditional venues, like airports and amusement parks. A fleet of food trucks continues to expand alongside units in convenience stores. It even scaled down to fit inside Macy’s and Walmart locations. But the biggest twist came last year when it scaled up and debuted its first storefront model.

The brand opened the doors to its first Twisted by Wetzel’s store in La Habra, California, in May 2023. Frei says it goes beyond the chain’s grab-and-go DNA with a “360-degree experience.”

The 1,200-square-foot design is nearly twice the size of a typical mall location, and in a first for Wetzel’s, it includes in-store seating. An open kitchen showcasing the pretzel-making process and an Insta-friendly wall add an experiential element.

The streetside format serves as an innovation lab with new products that are stuffed, topped, and drizzled, plus a fresh lineup

WETZEL’S PRETZELS

www.qsrmagazine.com | QSR | JULY 2024 9

Wetzel’s Pretzels is targeting multiple nontraditional venues for expansion .

of house-made beverages. Some of those offerings will remain exclusive to the Twisted concept. Some will make their way onto menus across the system.

“We think about Twisted as a product innovation lab,” Frei says. “We can have a lot of fun, push boundaries, push formats, and really figure out where consumer appetites are.”

A second corporate location opened in Surprise, Arizona, last year, followed by a franchised unit in the Los Angeles area in early 2024. No definitive growth targets have been set yet. Frei says Wetzel’s is “still using it more for innovation than for growth.” But she’s bullish on the potential. That’s because the model unlocks additional pathways for growth to allow franchisees the ability to scale faster. And it opens up plenty of new territory, given the company hasn’t gone to the street before.

fresh ideas

beverage platforms like smoothies and lemonades— lends itself to the drive-thru. Strong results at the first two stores in Iowa sparked a wave of interest from franchisees. Now, Pretzelmaker is working on a new double-drive thru prototype that maximizes its digital capabilities. The first two in development are expected to open in the back half of 2024.

“We’re looking at how to continue improving the consumer experience, whether it’s in the store or in the drive-thru line,” Lauenstein says. “We’re making sure that we’re constantly evaluating the order time and queuing, that the consumer is served quickly, and the orders are correct. We’re playing around with our app, making sure people know they can order ahead. And we’re going to be testing in-store kiosks for the people that want to get out of their car and come inside.”

“Wetzel’s on the street is definitely part of our growth mode, but what it looks like, well, that’s the whole point of Twisted,” she says. “It’s really helping us understand what will work on the street and what we can do in this setting.”

Wetzel’s isn’t the only pretzel brand twisting into new shapes as it pushes beyond nontraditional locations. Take Pretzelmaker as an example. The snack food chain started rolling out its Fresh Twist branding four years ago to fulfill demand for morning and late-night options and increase the portability of the menu for expansion into travel centers, universities, and airports. The menu grew to include breakfast sandwiches and flatbread pizzas made with fresh pretzel dough.

Fresh Twist was designed to cater to smaller footprints and on-the-go customers, creating an opening to jump-start expansion into the drive-thru arena. Pretzelmaker made its first foray into the channel last year with a couple of single-lane sites in Iowa.

“This is a great approach for us to get the consumer to use our brand more often,” says Pretzelmaker president Allison Lauenstein. “It allows them the convenience that they want without having to park their car and go inside to grab their pretzel bites and their lemonade.”

Venturing into the drive-thru changes the dynamic when it comes to driving traffic. Historically, Pretzelmaker has relied on impulse occasions, engaging the senses of a captive audience to spark cravings. Now, it has to become more of a destination.

That’s where menu diversity comes into play. Lauenstein says the brand’s broad menu—encompassing everything from sweet and savory snacks to more substantial mealtime offerings, plus

Additionally, she sees an opportunity to pair Pretzelmaker with other FAT Brands concepts like Great American Cookies or Marble Slab Creamery in a drive-thru setting down the road. But no plans have been solidified yet.

“Pretzelmaker is not only a profitable business, but it is easier to execute than some of the other brands out there,” Lauenstein says. “We’re starting to look across the entire portfolio and see where it might make sense to help drive some incremental traffic and sales for our sister brands.”

Fellow pretzel chain Auntie Anne’s made headlines in 2021 when it opened its first drive-thru alongside sister concept Jamba in Wiley, Texas. It already had plenty of cobranded locations with fellow GoTo Foods concepts Cinnabon and Carvel, but that store marked a major milestone in its journey outside of the food courts it has historically occupied. Three years after the Wiley store went online, GoTo Foods has opened over 20 co-branded Auntie Anne’s and Jamba locations, roughly half of which feature a drive-thru.

“We’ve been working to be more accessible by going streetside,” says chief brand officer Julie Younglove-Webb. “The big thing that really affords us is convenience, which just allows for greater frequency.”

The brand is looking to continue strengthening that convenience piece by growing its loyalty membership base. It’s leaning into technology and using machine learning to generate personalized offers based on customer behavior.

The partnership with Jamba is particularly complementary because Auntie Anne’s caters to dayparts from noon on, while Jamba specializes more in the morning crowd, she adds. For franchisees, that offers a labor-efficient means of attracting a larger customer base with a broader menu.

Sam

the associate editor of QSR. He can be reached at sdanley@wthwmedia.com WETZEL’S PRETZELS, PRETZELMAKER, AUNTIE ANNE’S |CATEGORY INNOVATION|

Danley is

10 JULY 2024 | QSR | www.qsrmagazine.com

PRETZEL CHAINS ARE WORKING TO BECOME MORE ACCESSIBLE TO GUESTS, WHETHER THAT’S FOOD TRUCKS OR DRIVE-THRU.

REPAIRS RAPID REPAIRS RAPID DRIVE-THRU HEADSET COMPLETE SOLUTIONS PROVIDER TO THE RESTAURANT INDUSTRY Our Professional Technicians Service All Major Brands FREE INBOUND SHIPPING 24 HR REPAIR GUARANTEE CUSTOM REPAIR PROGRAMS TEXT “REPAIR” TO 847-495-7400 FOR YOUR FREE SHIPPING LABEL OFFICES IN: CHICAGO • DALLAS • LOS ANGELES • NEW ENGLAND • ST. LOUIS rfdrivethru.com I 800-598-2370 I sales@rftechno.com WE OFFER Nationwide On-Site Repair & Installation Services Extensive Inventory of Parts & Accessories Restaurant Technology Solutions EST. 1989 TECHNOLOGIES ®RF

Why Franchisees Struggle with Their Media Presence

A SOLUTION TO INCONSISTENCIES IN RESTAURANT MARKETING.

Many franchisees struggle to establish an e ective online presence while keeping their digital content relevant and consistent while optimizing their advertising strategies. It’s a delicate balance that requires adherence to brand guidelines while maintaining a savvy digital strategy to attract and retain customers.

It is important to align the enterprise brand message with local franchise locations. If advertisements don’t tie the brand message to the individual franchise location message, the information becomes weak and unclear. “It’s all about maintaining consistency with advertising messages for both the brand and the local franchisee at the same time,” says Angie Cordova, vice president of product management at Ansira. “If the consumer sees one thing in the ad and something di erent on the website or app it creates a broken experience we want to avoid.”

tions including SEO optimization and paid media strategies while keeping websites updated. By leveraging these digital strategies, franchisees can boost their websites for search engines and create compelling, localized content that drives paid and organic tra c along with consumer engagement.

Brand inconsistencies can be as simple as varying color schemes, contradicting operation hours, and outdated menus across di erent platforms. “If the media advertisements and franchisee location information are conflicting or outdated, a consumer prospect could become easily distracted, which may ultimately influence them to go somewhere else,” Cordova says.

Empowering franchisees to overcome these challenges, Ansira o ers tailored marketing solutions. Ansira connects the enterprise brand with franchisees while maintaining brand equity and enabling local creativity and di erentiation.

“How do you ensure consumers will go to your location instead of someone else’s?” Cordova asks. “I encourage finding subtle and creative ways to be di erent, especially if you’re a local restaurant operator in a sea of other local restaurants under the same brand. Standing apart goes a long way in developing loyalty with consumers in your local area.” Whether sponsoring local events, charities, or promotions, Ansira helps franchisees connect with their community in meaningful ways.

Ansira empowers franchisees with powerful media mix solu-

Ansira’s use of artificial intelligence is a game-changer in digital advertising. Ansira’s AI manages media budgeting and bidding in real-time, optimizing the allocation of resources to maximize return on investment. This means franchisees can achieve more with their marketing budgets, reaching a broader audience more e ciently. “It’s making the media dollars stretch farther,” Cordova says. “You’re getting more consumer eyeballs and brand awareness in the media mix, but for the same amount of dollars because the AI is moving the media dollars to the best-performing publishers, channels, and ad types.”

Ansira emphasizes the importance of data-driven decisions. “It’s tempting for most people to say, “I like how this looks,” or “Let me insert this here,” based on a feeling or emotion. But looking at the actual data is important,” Cordova says. Regularly analyzing data helps franchisees adjust their strategies based on consumer behavior, seasonality, and market trends, ensuring their digital marketing e orts are always relevant and compliant.

Ansira provides restaurant leaders and franchisees with the tools, strategies, and insights needed to maintain brand consistency, optimize digital presence, and engage local consumers. Utilizing Ansira’s expertise, franchisees can master advertising challenges and grow restaurants to new levels. –By Olivia Schuster ◗

ANSIRA

To discover more about boosting your online presence, visit Ansira.com SPONSORED BY ANSIRA 12 JULY 2024 | QSR | www.qsrmagazine.com

HYPER-LOCAL MARKETING: SHOW ME YOU KNOW ME

Enhance your cross-channel communication efforts with Ansira. Create a digital strategy with a data-driven approach to deliver a consistent customer experience across all touchpoints. Stay compliant and relevant while delivering your hyper-local message to attract and retain your customers.

READY TO TALK ABOUT YOUR DIGITAL STRATEGY? Lorem ipsum

ansira.com

Old School Bagel Cafe

For 17 years, the concept has built a cult-like following in Oklahoma. Now, it’s ready to amp up growth through franchising.

BY SATYNE DONER

FOUNDERS: Danny Cowan & Wayne Hansen

HEADQUARTERS: Oklahoma City, OK

YEAR STARTED: 2007

ANNUAL SALES: $8.86 million (2023)

System sales projected at $9.86M (2024)

TOTAL UNITS: 15

FRANCHISED UNITS: 1

DANNY COWAN SPENT 20 YEARS WORKING AT THE once-popular New York Bagel, franchising two locations in Denver. He perfected the New York–style of boiling bagels in water for 60 seconds before baking, creating a crisp outer layer and soft center. Outside of New York Bagel, this method wasn’t commonly used in Middle America at the time.

When the chain filed for bankruptcy protection and sold in 2000, the brand changed hands multiple times and left customers missing an authentic bagel chain. Cowan viewed Middle America as an abandoned market, with nothing stopping him from bringing New York–style bagel sandwiches to Oklahoma City. He quit his job as a sales representative and realtor, partnered with his childhood friend Wayne Hansen, and invested in a new concept: Old School Bagel Cafe. Another friend, Kyle Tapp, joined the team a few years later.

“When [the founders] came back home to Oklahoma, there weren’t any New York–style bagel shops in the region, and the community kept asking for one,” says Joey Conerly, VP of corporate strategy for Old School Bagel. “They decided they would

take a stab at their own concept and put a spin on it in terms of culture and atmosphere.”

After launching in 2007, the bagel chain quickly became known as the “Cheers” of the area, growing a cult-like following through its commitment to guest relationships. The founders created a culture where operators know their customers’ names and bagel orders, delivery drivers are offered free drinks, and tables are pre-bussed.

It also sets itself apart by capturing both breakfast and lunch dayparts. So much so that Conerly says half of Old School Bagel’s sales come from the afternoon crowd and that the lunch menu surpasses breakfast.

Morning traffic is driven by traditional breakfast sandwiches and specialized coffees, whereas lunch consumers are drawn by unique offerings including the Old Smokey, Cuban, or Turkey Avocado. Guests can even build their own bagel sandwiches with a choice of meat, cheese, and veggies, served hot or cold.

“Everyone thinks of bagels and cream cheese, but when we throw pulled pork and Swiss on a bagel, it throws everybody for a loop. This variety of sandwiches hits on different cravings, and our customers can get something different every day,” Conerly adds. “We have people in the drive-thru ordering their breakfast and lunch for the day at the same time.”

Old School Bagel grew conservatively for 17 years, slowly ramping up its delivery, in-app, and catering channels. Last year was the biggest moment for the brand, with corporate growth doubling in unit size from seven to 15, and same-store sales growing 39 percent since 2019.

With the help of a new loyalty program, which tracks the customer’s journey with Old School Bagel, over 50,000 accounts have been registered since November 2023. The bagel shop has

OLD SCHOOL BAGEL CAFE (3)

DEPARTMENT ONES TO WATCH

[CONTINUED ON PAGE 45] 14 JULY 2024 | QSR | www.qsrmagazine.com

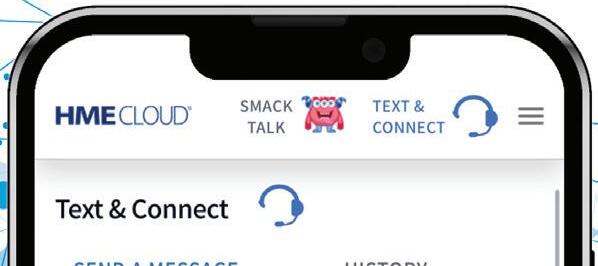

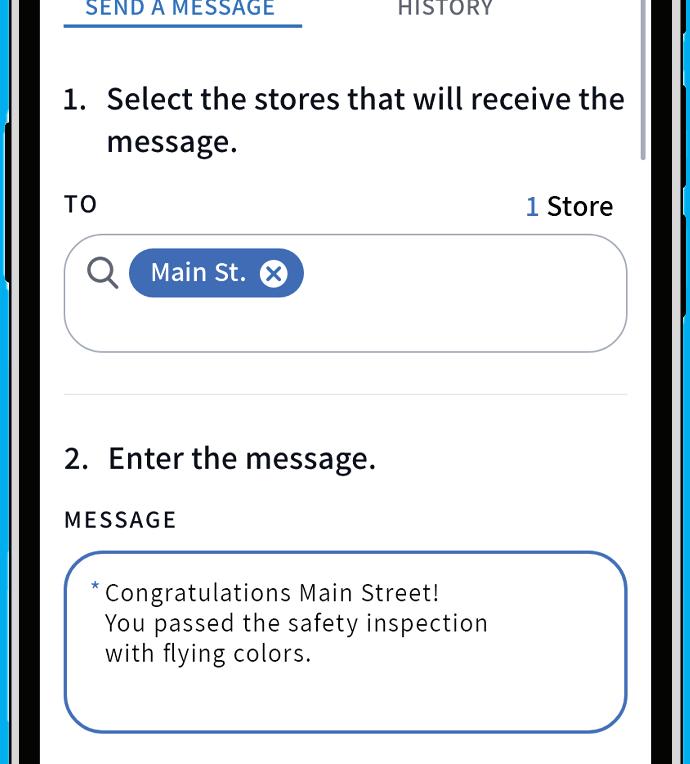

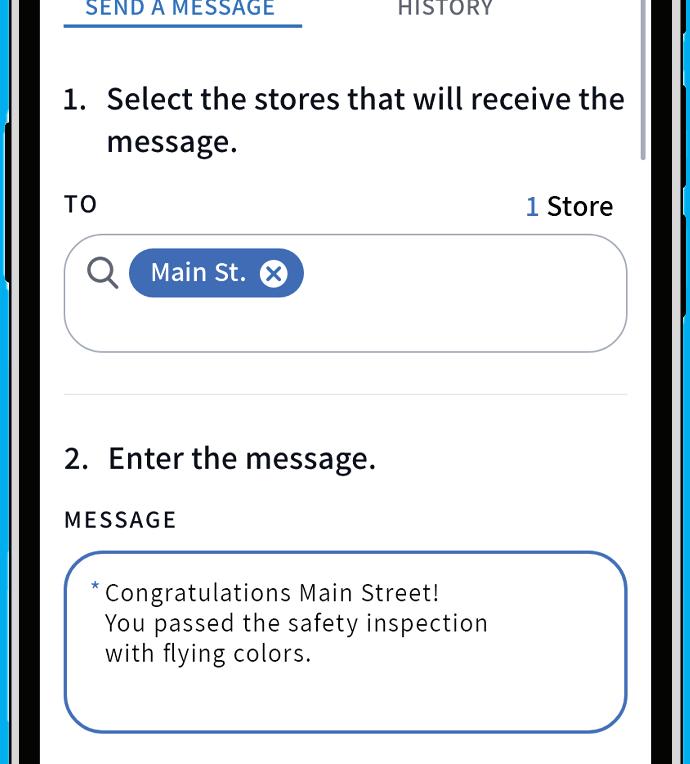

Key Information Delivered When it Matters Most

Stay Connected Like Never Before

Whether you’re congratulating a store for a job well done or alerting managers about a change in a process, the NEXEO | HDX™ communication platform delivers your messages in real time. Send your kudos or updates with Text & Connect in HME CLOUD® and broadcast them to select headsets in the store, without interrupting the drive-thru and enabling managers, supervisors, and owners to stay in contact with their teams at any time and from anywhere.

Go Beyond the Drive-Thru. Maximize Efficiency at Every Touchpoint. 866.577.6721 | www.hme.com/nexeo Select the specific groups or stores you want to reach. 1 Enter an encouraging message or reminder. 2 Tap to send your message, which is then converted to audio and played in real time to your recipients in their NEXEO headset. 3 ©2024 HM Electronics, Inc. The HME logo and product names are trademarks or registered trademarks of HM Electronics, Inc. All rights reserved. PA24-01.

DEPARTMENT

WOMEN IN LEADERSHIP

Broadway Comes to San Diego

First-time franchisee Sharian Lott steps into the spotlight with her own Schmackary’s cookie store.

BY SATYNE DONER

Sharian Lott, in her own words, is “sandwiched between a mother who’s a great singer, a soloist, and a daughter who we knew was going to be some kind of a performer by 3 years old.” The spirit of Broadway is deeply ingrained in her DNA—her mother Dorothy Smith was the first Black woman elected to office in San Diego and purveyor of the longest-running Black theater in the country. Lott’s daughter, Loren, went from performing for her teddy bears to large Broadway audiences and even TV shows, including “The Porter” and “The Young & The Restless.”

Growing up, Lott gained a deep appreciation for her mother’s strength and resolve. Smith was born in 1939, went to college on a boy’s scholarship, and powered through relentless adversity as she tried to make it in the entertainment industry. “She was always so happy … It was never about accolades or money. In the late 1950s, you don’t tell a young Black woman that she’s going to be an entertainer. You tell her to get a good job as a teacher, secretary, or wife. But everywhere she went, she was excellent,” Lott shares. “[Smith] prepared my daughter to be in the industry and gave her the moral and ethical foundation she’d

need to not be tainted by it.”

Surrounded by stars, Lott took a different path: She spent her early years teaching management and artificial intelligence at IBM and moved on to teach as a college professor in the San Diego Community College District for nearly three decades. She was looking forward to retiring, collecting her pension, and relaxing after a fulfilling career. Until her daughter gave her a cookie.

“As a child, I’d give her a cookie and then find it under the couch because she hated sweets,” Lott says. “One day, she was backstage at a Broadway show and told me, ‘Mommy, I’m obsessed with this cookie,’ and I flew to New York to see what it was all about.”

She arrived in New York and was introduced to Schmackary’s, otherwise known as “The Official Cookie of Broadway.” The award-winning brand has a reputation for appearing on Hulu’s “Only Murders in The Building,” feeding Broadway actors like Loren backstage, and partnering with local communities to raise money for charity.

As “Generation Y’s answer to the Old American Bake Shop,” the brand fuses newage comfort food with reinvented classics. It launched a franchise program in May 2023 with Fransmart, growing its national footprint by 100 percent with two franchise deals signed in Q1.

One of those multi-unit deals was inked by Lott, who intends to bring the cookie chain to California for the first time. It was an organic synergy between the two, with Lott’s family deeply embedded in the San Diego community and embodying the spirit of Broadway on the West Coast. After the brand won over her daughter, Lott became what she calls a “connected customer” and jumped headlong into the franchisee application process. It was enough to pull her out of retirement.

“Schmackary’s is my home. I gave [founder Zachary Schmahl and COO Jonny Polizzi] a picture of my mother’s kitchen because we still have the family home, and it looks exactly like their stores,” Lott says. “They did such a great job with the design. In fact, in my first store, I’m going to dismantle my mom’s kitchen and put her stuff in it.”

Lott says the franchisee experience is different from anything she’s done before. The two-month-long applica-

SCHMACKARY’S SHARIAN LOTT

Sharian Lott’s family is deeply rooted in the San Diego community.

[CONTINUED ON PAGE 45] 16 JULY 2024 | QSR | www.qsrmagazine.com

Ditch the Stick! Collaborate with our industry experts to find custom solutions for any operations large or small.

Better Performance Made Possible Serve up the perfect slice all day, every day with our Release Agents and Equipment solutions. To learn more, contact us at: info.food@vantagegrp.com •Improve product consistency

waste and cleaning frequency •Extend the life of your pans

www.vantagegrp.com

•Decrease

The Evolution of a LeaderCategory

/ BY SAM DANLEY

More than a decade of growth set the stage for CAVA’s spectacular public debut, and there’s plenty more innovation to come.

• CAVA HAS MADE ITS MARK IN THE MEDITERRANEAN FOOD SEGMENT OVER THE PAST DECADE-PLUS. CAVA 18 JULY 2024 | QSR | www.qsrmagazine.com GROWTH AND DEVELOPMENT

CAVA CEO Brett Schulman isn’t always one to stop and smell the roses. His eyes are typically focused on the road ahead. But he certainly paused to savor the moment before ringing the opening bell on the New York Stock Exchange on July 15, 2023.

Thirteen years earlier, he was pitching the concept to family and friends, hoping to raise enough funds to build a few units and prove there was demand for Mediterranean fare served in a fast-casual format. A broader vision to define a category blossomed as CAVA climbed its way to national prominence. Now, the fast-growing company was notching a major milestone with its public market debut.

“You only get a handful of moments in life that are so memorable,” Schulman says. “But as I said to the team the night before the IPO, that wasn’t the destination. It was the beginning of the next chapter of our journey.”

That chapter started with a sizzle that was only getting hotter. CAVA’s stock price nearly doubled after Schulman rang the opening bell, pushing its valuation to $5 billion and giving it one of the strongest first-day gains in recent memory.

Trading on the stock market is a different animal that comes with high-stakes expectations from investors. It’s not unusual for Wall Street

www.qsrmagazine.com | QSR | JULY 2024 19 GROWTH AND DEVELOPMENT

to push so hard for growth that companies lose sight of the fundamentals. CAVA isn’t concerned with day-to-day moves in its stock price, though, and it isn’t letting its status as a public company push it into short-term thinking.

“People can get distracted by changes and fluctuations in the market, but we’re staying focused on what’s right for the business over the long term,” says CFO Tricia Tolivar. “We’ve always thought ahead and tried to understand what we need to be doing now to bring things to life in the future.”

Case in point: After restaurant margins blew past expectations last year, the company turned around and made a multi-million dollar incremental investment in wages and benefits. Executives told investors the move would have a 100-120-basispoint impact on store-level profitability going forward. That hit was well worth the gain for a chain plotting aggressive expansion in a competitive labor market.

“We said, ‘Listen, don’t take this as the new normal. We’re going to create shareholder value, yes, but we’re going to reinvest in our team and reinvest in our guests,’” Schulman says. “We’re setting the precedent with our public stakeholders that we’re building something not for the next ten weeks or the next ten months, but for the next ten years.”

The chain’s rapid ascension owes to that longterm view. It invested in a vertically integrated production model long before it was primed to grow. It introduced pickup windows and secondary makelines well ahead of the pandemic’s digital tidal wave. And it’s continually upped the game on the employee experience—a key ingredient that goes hand-in-hand with the heightened hospitality that’s as much a part of its DNA as its health-forward fare.

More than a decade of continuous transformation propelled the fast casual to its next chapter. There’s plenty more evolution to come. Beneath it all is the enduring idea of “bringing heart, health, and humanity to food.” It’s a premise that hatched nearly 20 years ago with a menu of small plates served tableside in a quiet East Coast shopping center.

Full Service to Fast Casual

CAVA’s story starts in 2006, when founders Ted Xenohristos, Ike Grigoropoulos, and Dimitri Moshovitis opened a full-service concept called Cava Mezze in Rockville, Maryland. It paid homage to their parents, who were first-generation Greek immigrants and lifelong service industry workers, in a few ways. First was a menu inspired by recipes from their childhood. Second was an internal culture that wasn’t predicated on churn and burn, which in turn fostered a warm and welcoming atmosphere.

They started selling dips and spreads in local grocery stores a few years later. That’s where Schulman enters the picture. He got involved as a consultant for the CPG side of the business in 2009, lending his experience running a snack brand to help the group navigate the retail landscape.

An offer to join as the fourth partner came a year later. It only took a single meal at the restaurant to seal his decision.

“I didn’t tell the guys I was going to dinner there because I wanted to see how they ran their business,” Schulman says. “I was struck by how happy the team was, how broad the appeal

CFO

TRICIA TOLIVAR

CEO BRETT SCHULMAN

• CAVA’S FAST-CASUAL JOURNEY BEGAN IN 2011.

20 JULY 2024 | QSR | www.qsrmagazine.com GROWTH AND DEVELOPMENT

CAVA (2)

of the menu was, and how good I felt after eating the food. So, I went to them the next day and said, ‘I’m in, but have you ever thought about taking what you do in full-service and putting it in a fast format?’”

Riding the crest of fast casual’s exploding popularity, the team saw an opportunity to bring their Mediterranean cuisine to a broader audience. It took some time to figure out how the food would translate from a made-toorder format in a full-service setting to a more convenient quick-service environment. They landed on a walk-the-line model for a few key reasons.

“I’m kind of impatient, so I loved the idea that you have your food when you get to the register no matter how long the line is,” Schulman says.

More importantly, customization was starting to take hold throughout the industry, and this was the perfect format with the perfect pantry for guests to tailor their meals to their preferences.

of wanting to eat better without necessarily making a bunch of sacrifices. That’s where our food comes in with legumes, Greek yogurt, olive oil, chickpeas, and all of these things that are satisfying and healthy at the same time.”

Armed with $2 million in investments from friends and family, the group set out to open three locations in different types of trade areas throughout the Washington, D.C. metro area. Store number one came online in early 2011. Two and three followed a year later. There were some lessons around sourcing and kitchen processes that helped improve consistency. CAVA introduced Community Days that offer free meals and match donations for local charities to address tepid traffic at one of those initial stores. The tradition has been upheld with each new restaurant since then.

The partners personally guaranteed a loan for the next few units after working through those early kinks. The goal was to get to five units, gain a deeper understanding of what was and wasn’t working, and “really own the model” to potentially scale further.

“I think we realized we had something that could become much bigger when we opened our fifth restaurant,” Schulman says. “Our Community Day had long lines. The other restaurants were really accelerating their growth. We could see it all start to come together and clearly resonate with consumers.”

By 2015, CAVA had eight stores and another three on the way in its home market, plus $16 million in fresh funding to fuel its expansion on the West Coast. It marked the beginning of a “Coastal Smile” strategy aimed at following population migration trends toward the Sunbelt and the suburbs.

Things kicked into hyperdrive a few years later when the company acquired Zoës Kitchen for $300 million. The purchase was financed through a significant equity investment in CAVA led by Act III Holdings, the investment vehicle created by Ron Shaich, founder and former CEO of Panera Bread.

Plus, it supports high volumes with a labor-efficient production format.

“That allows you to take some of that efficiency and invest in higher-quality ingredients, which we could already tell people were gravitating to,” Schulman says. “There’s that struggle

At 261 units, the competing Mediterranean fast casual was much larger than CAVA, with high-quality sites that Schulman says were “way underperforming their potential.” The main thesis was that this real estate could rapidly accelerate CAVAs expansion under its new growth framework.

CAVA (4) www.qsrmagazine.com | QSR | JULY 2024 21 GROWTH AND DEVELOPMENT

“We also thought that scale was going to matter more than ever, and that technology was a big driver of that bifurcation into the haves and the have-nots—those that have the necessary resources to invest in delivering relevant, differentiated guest experiences and have the business insights to compete in a modern world, let alone have the resiliency in their business model to withstand COGS and labor inflationary pressures,” he says.

Zoës was a “melting ice cube” with slumping sales and stagnating traffic when the deal closed in November 2018, Schulman adds. His team just needed to make sure it didn’t turn into a puddle before they flipped all of its units into more productive CAVA locations. The scope of that challenge came into full view within a week of operating as a combined entity. Same-store sales at Zoës, which were declining in the low-single-digits during negotiations, suddenly tanked nearly 12 percent.

The team was already formulating how to shore up the business, but it wasn’t anticipating that level of comp deceleration, so its attention immediately turned toward triaging the newly acquired brand.

“We were just holding the line and trying to keep our head above water,” Schulman says. It was a classic case of menu creep breaking operations. The newly acquired brand had 276 ingredients in its pantry, a third of which weren’t cross-utilized. CAVA spent the better part of a year eliminating some of the complexity and stabilizing Zoës before executing any conversions.

The first test came in late 2019. It cost $60,000 to repurpose the store versus the $1.2 million CAVA was spending on new builds. The result? Weekly sales doubled from $25,000 to $50,000.

Emboldened by the post-conversion performance lift, the company started pushing harder and faster on the project, even amid the pandemic. It flipped eight restaurants into the primary brand in 2020. Another 117 were completed over the next two years.

Going Public

CAVA announced its plan to go public last spring after confidentially filing to do so earlier that year. The idea started percolating during the 2021 IPO boom. Krispy Kreme, Dutch Bros, Portillo’s, First Watch, and sweetgreen all went public that year.

Naturally, CAVA’s board asked Schulman and Tolivar if they thought the company was ready to take the plunge.

“Operationally and organizationally, it just didn’t feel like we were as fine-tuned of a machine as we needed to be,” Schulman says. “The board didn’t put any pressure on us. They just said,

‘OK, got it. But if we were going to operate as a public company, whether we ever go or not, what would you need that you don’t have?’”

Tolivar said she’d upgrade the controller to a chief accounting officer, bring in a financial planning and analysis leader with investor relations experience, and review all of the internal controls. Schulman wanted a line of sight into the end of the Zoës conversions and a clear sense of when the company would get back to a single-brand state. He also wanted to see less variability on the scatterplot tracking store-level performance metrics.

“You’d have restaurants in the same area ordering at the same prices with similar rent and revenue, but there’d be a 400-basis-point delta in performance,” he says. “We needed to be more consistent.”

The question of going public resurfaced at a board meeting in January 2022. That scatter plot was tighter, but the answer was the same—“We’re not quite there yet.”

The company embarked on a non-deal roadshow that summer. Executives met with dozens of public participants to socialize the story around the conversions and gain feedback on the business to help shape the strategy going forward. Those conversations, coupled with ongoing improvements across the

22 JULY 2024 | QSR | www.qsrmagazine.com GROWTH AND DEVELOPMENT

• CUSTOMERS GRAVITATE TOWARD CAVA’S OFFERING OF FRESH FLAVORS AND CUSTOMIZATION.

business, sparked a change of tune when the question came up again at a board meeting in August.

“Tricia and I looked at each other and said, ‘Actually, we feel really good about it,’” Schulman says. “We felt like we were hitting our stride. We’d achieved that operating consistency we were striving for. We had that line of sight into the last conversion in 2023.”

They mapped out a timeline, looking six to nine months ahead toward the end of a rate hike cycle, and began conducting audits, filling out the finance team, and drafting mock earnings releases and public filings. CAVA even staged a few practice earnings calls to give everyone a sense of what it’s like fielding questions from investors.

“We leveraged our board and other team members to get feedback on how we were distilling information and articulating our strategy,” Tolivar says. “For us, the most important thing was working as a team to communicate the power of the brand and what we have to offer so that when we were doing it for the first time live, it wasn’t nearly as daunting as it might have been otherwise.”

CAVA could’ve achieved its five-year plan without accessing additional funding beyond the credit facility it had in place, but there were a few things that made it worthwhile to go public.

“We thought it would bring tremendous awareness to what we’re doing and the food we’re serving,” Schulman says. “It

would really fortress our balance sheet so that if there were any economic challenges on the horizon, we could be steadfast in our strategy of defining the category and building out this national brand, and we could do it the way we wanted to do it.”

The Road Ahead

CAVA netted 153 restaurants from the conversion journey, which came to an end last fall when the last of the remaining 28 Zoës locations reopened under a new banner. It opened 72 stores in 2023, including 28 conversions, and exited its first year as a public company with 309 units in 24 states and Washington, D.C.

CapEx requirements for new builds are now substantially higher for the solo-minded growth brand as it searches for its own properties. But it has an expanded capital base to fund its expansion and a goal of putting 20 percent of its pipeline each year in greenfield markets. There’s plenty of whitespace to plant flags in new territories, including the Midwest. Growth in that region commenced this spring with the first of many planned restaurants for the Chicago market.

A few infrastructure points are working behind the expansion curtain. There’s a new dips and spreads manufacturing facility in Virginia that came online earlier this year. Tolivar says the site, combined with an existing facility in Maryland, will support 750 restaurants alongside the brand‘s CPG arm.

Most importantly, from her perspective, CAVA is cultivating an internal pipeline of leaders it can deploy across new openings. The idea is to sprinkle “cream of the crop” GMs across the country—one per each cluster of eight restaurants—who train and develop new GMs.

“This program is critical to the future success and growth of the company overall,” Tolivar says. “You have to find the right real estate, but if you don’t have the right GM, it doesn’t matter. We anticipate growing at least 15 percent per year, and we want to make sure we’ve got that pipeline of new GMs so that we’re ready to grow and open those restaurants in a very powerful and meaningful way.”

CAVA is targeting 15 percent annual growth as part of a broader goal to reach the 1,000-unit threshold by 2032. Much like the endless customizations presented in the walk-the-line model, it’s going to get there with diversified formats and a playbook written on the customer’s terms.

Prototype innovation in the fast-casual segment has leaned heavily toward shrinking footprints and fewer, if any, seats for in-store dining as more resources shift toward growing off-premises sales. In-store dining still accounts for roughly two-thirds of CAVA’s sales, though, and Schulman sees a chance to win over guests seeking alternatives to pricier casual-dining experiences in a post-pandemic, post-inflationary environment.

“The traditional full-service chain model is challenged to deliver a relevant value proposition to modern consumers, and quick-service is moving away from dining rooms,” he says. “I think that’s creating an opportunity and space in between.”

CAVA is reimagining how it shows up in the dining room with its new 3.0 store design. The latest prototype features softer

CAVA (4) www.qsrmagazine.com | QSR | JULY 2024 23 GROWTH AND DEVELOPMENT

seating, a fresh color palette, and other visual updates aimed at driving greater on-premises traffic.

“In a world that’s increasingly permeated with technology, people still crave that human connection,” Schulman says. “So, we think there’s a real opportunity to enhance our physical experience and grab even more of those full-service occasions in our multi-channel format.”

Ultimately, the goal is to increase access to the brand and improve its adaptability across trade areas. That means offering comfortable channels for customers to get their bowls and pita wraps however they choose. So, while it’s tinkering with the ambiance to drive in-restaurant occasions, it’s also continuing to invest in store models that cater to dig-

ital channels and off-premises occasions.

About 10 percent of CAVA’s footprint featured digital-order drive-thru lanes heading into 2024. They boast higher AUVs and stronger restaurantlevel margins. The company wants to see them make up a larger portion of the portfolio going forward. Since those sites typically come with higher real estate and construction costs, the priority is achieving cash-on-cash returns exceeding 35 percent, instead of chasing a specific quantity.

Group settings offer another opportunity to meet guests on their terms, and new formats geared toward launching a full-scale catering program are entering the fray. There’s a digital kitchen prototype that doesn’t have an in-restaurant serving line. It’s strictly for digital order pickup and delivery courier pickup, plus catering hub production. There’s also a hybrid kitchen model with a serving line, a digital makeline, and a 300-square-foot kitchen to support centralized catering production.

These new formats are just the latest example of CAVA’s constant recalibration amid shifting consumer tides. It recognized the growing adoption of digital tools early on and adapted accordingly, introducing a mobile payment and loyalty app in 2013, followed by dedicated digital order makelines

in 2015. By 2017, an in-house digital platform was established, paving the way for those pickup lanes a year later. In 2021, digital menu boards were implemented, and in 2022, CAVA revamped its digital order platform with a scalable microservices architecture.

This 10-year transformation led to 34 percent channel revenue. Building on that foundation, CAVA is now on the precipice of what Schulman believes will be another decade-long transformation. This time, it’s centered around data. And it’s coming into focus on several fronts.

Enhanced operational data and AI insights are rolling out alongside a “restaurant health system” that gathers real-time guest feedback at the store level. Those tools come on the heels of a new real estate platform with deeper analytics and anonymized mobile data for quicker site analysis.

CAVA is in the early innings of its Connected Kitchen initiative, a multi-year project geared toward making restaurants easier to run. It will focus on exploring and implementing data-driven and generative AI technologies to automate inventory, manage scheduling, and provide guidance on how much food should be prepared or cooked by the day or even by the hour.

The company also is looking to grow its audience of first-party data. Schulman says that’s imperative given the advent of thirdparty privacy regulations. It sees a significant opportunity to use that data to build one-toone lines of communication and foster deeper, more personal relationships with guests as it scales. To that end, it is reimagining its loyalty program with new types of rewards that it hopes will drive frequency, mix, and check. Tests are underway in a handful of markets and will roll out nationwide by the end of the year.

At first glance, this data-centric push toward automation and AI might seem at odds with the original vision of combining heart and hospitality with healthy food that catalyzed CAVA’s success. Technology has a way of making consumer touchpoints increasingly transactional. But Schulman says it all depends on how you use it.

“Using data to empower our team to deliver that hospitality and personalize the relationship with you—I think there’s tremendous opportunity there,” he says. “It’s about leveraging technology to enhance, not replace, the human experience.” Sam Danley is the associate editor of QSR. He can be reached at

CAVA (5)

sdanley@wthwmedia.com

24 JULY 2024 | QSR | www.qsrmagazine.com GROWTH AND DEVELOPMENT

• CAVA IS BUILDING MORE DRIVE-THRUS FOR DIGITAL CUSTOMERS.

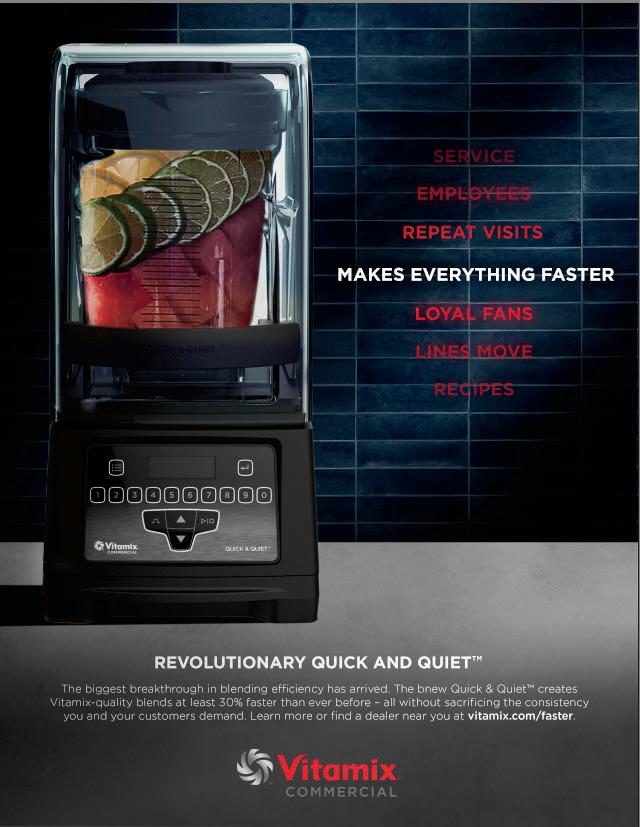

THE REVOLUTIONARY QUICK & QUIET™

The biggest breakthrough in blending efficiency has arrived. The new Quick & Quiet™ creates Vitamix-quality blends at least 30% faster than ever before – all without sacrificing the consistency you and your customers demand. Learn more, or find a dealer near you at vitamix.com/faster.

MAKES EVERYTHING FASTER

THEPOWEROFSCALE

/ BY BEN COLEY

HELMING A RESTAURANT GROUP PROVIDES A WIDER PERSPECTIVE OF WHAT’S IMPACTING THE INDUSTRY. BRIX HOLDINGS (5) CARLOS VAZ

26 JULY 2024 | QSR | www.qsrmagazine.com BUSINESS ADVICE

SCALE

Restaurant group leaders share best practices and advice on how to run a company covering several food concepts and personalities.

HAIGWOOD STUDIOS PHOTOGRAPHY ADOBE STOCK DARRYL BROOKS

www.qsrmagazine.com | QSR | JULY 2024 27 BUSINESS ADVICE

Brix Holdings CEO Sherif Mityas likes to compare running a restaurant group to skin.

Above the outer layer are the characteristics that make a restaurant unique: menu, food offerings, restaurant design, colors, service model, and taglines. And Brix differentiates by having brand-specific employees responsible for those departments.

Below the skin, the part that guests don’t see, components are a lot more similar across the board. Like a singular technology and finance team that can support all brands in the portfolio. Chains need POS, back-office systems, and loyalty programs, but those can be shared. That’s where the cost savings and synergies come into play.

“That’s the scale benefit we get by being able to supply those things across all the brands with centralized shared services,” Mityas says. “But the things that touch the guests that are visible, you have to make sure that they stay unique, that they’re specific, and differentiated by brand. And we have people that are dedicated to those brands for those types of activities.”

Brix comprises Friendly’s, Orange Leaf, Red Mango, Smoothie Factory + Kitchen, Humble Donut Co., Pizza Jukebox, and Clean Juice. The company is one of many concepts consolidating in the restaurant industry to unlock greater power, scale, and resources compared to one concept going at it alone.

Behind the scenes, FAT Brands is organized into separate verticals (quick service, fast casual, casual dining, polished dining, and a manufacturing business) to create savings by buying in bulk and leveraging purchasing power.

Wiederhorn adds that best practices, like cleanliness, food safety, and recipes, are universal across multiple concepts. When it comes to the brand level, the company relies on its presidents to work with the marketing team to develop specific initiatives.

“While there’s obstacles and challenges, there’s also these opportunities to leverage the strength of the portfolio and increase the opportunity for all the brands to get better, to perform better, and to grow because of the strength of the portfolio.”

The obstacles faced by restaurant groups aren’t too different from any single chain, says Mityas. It often goes back to, “How do you create unique experiences for your guests?” And in today’s time, when prices are up, it’s tough for guests to go out versus eating at home. Brands need the complete package to earn a customer’s dollar. From a portfolio perspective, Brix has to worry about that seven times over, considering the varying consumers, targets, dayparts, and occasions for each of its restaurants. Mityas says “It becomes a little bit of a Rubik’s Cube because you’re working with different dimensions of guests.”

“While there’s obstacles and challenges, there’s also these opportunities to leverage the strength of the portfolio and increase the opportunity for all the brands to get better, to perform better, and to grow because of the strength of the portfolio,” Mityas says.

FAT Brands chairman Andy Wiederhorn, who oversees nearly 20 chains across 47 states, 40 countries, 2,380-plus locations, and 760-plus franchisees, agrees with Mityas that customer-facing attributes are crucial in operating a restaurant group effectively. To him, each restaurant must understand what it’s known for and lean into it, whether that’s the best wings, burgers, or buffet. For Great American Cookies, it’s the cookie cakes that many order for their graduation, proms, birthdays, and other special occasions. For Twin Peaks, it’s the 29-degree beer.

“We’re bringing everybody together so they realize that they’re part of a much bigger system and that they can understand the purchasing power and the shared services and things that they can take advantage of,” Wiederhorn says. “So we’ll have supply chain meetings where there’s attendees from all brands and they can all talk about what they need in their brand and what we have going on as initiatives and best practices. But in terms of communicating, it’s usually either the marketing teams or the brand presidents communicating to their brands, whatever messaging is applicable at the brand level.

“We might send out messages about same-store sales or ‘Here’s what we’re seeing in terms of traffic or cost across categories or across the system,’ but not that often,” he adds. “ It’s really more at the brand category level.”

Jay Fiske, president of Powerhouse Dynamics, is familiar with building the behind-the-scenes structure that Wiederhorn and Mityas refer to. He helps run an IoT company that connects devices—oven, shake machines, thermostat, etc.— directly to the internet so that operations managers can easily access the latest information on their equipment.

For more than a decade, Powerhouse Dynamics has worked with Inspire Brands, one of the largest restaurant groups in America. The technology is based in close to 4,000 locations across Arby’s, Buffalo Wild Wings, and Dunkin’. The company started at Arby’s with internet-connected thermostats, which involved installing energy sensors to track HVAC equipment and performance. Powerhouse Dynamics began by rolling out the technology to corporate stores and then expanded it to franchisees. Inspire then approached the company about using the same innovation for its ovens.

Powerhouse Dynamics’ system automatically tracks oven temperatures from the moment food is placed inside until it’s cooked, eliminating the need for manual temperature checks and record-keeping. Previously, kitchen staff would manually monitor and record temperatures, a time-consuming task prone to errors. With Powerhouse Dynamics’ IoT solution, oven data is seamlessly transmitted to the cloud, where it is analyzed and compiled into comprehensive reports. Fiske estimates that his company’s system saves approximately an hour per store per day in administrative work.

BRIX HOLDINGS

28 JULY 2024 | QSR | www.qsrmagazine.com BUSINESS ADVICE

SHERIF MITYAS

PARTNER? STANTIAL GROWTH! Sub#1 Fast Casual and Sandwich Categories Nation’s Restaurant News America’s Favorite Chains list #1 Fastest Growing Sandwich Franchise Nation’s Restaurant News 11 Years in a row! #1 Most Respected Fast-Casual Brand QSR Magazine Readers Choice #1 Fast-Casual Restaurant Chain Newsweek’s America’s Best Customer Service 2024 Ranking call 732-292-8272 email: franchise @ jerseymikes.com scan: QR code with your cell For franchise information: #2 on Franchise 500 Best Franchises Entrepreneur Magazine 2024 OVER 3,500 & IN DEVELOPMENT STORES OPEN WORLDWIDE! jerseymikes.com FRANCHISE Are you our next a #1 Fastest Growing Restaurant Chain QSR Magazine 2022

Inspire found the technology so useful that it awarded Powerhouse Dynamics with its Maverick Award for Innovation in 2022.

“Margins are thin and there’s a lot of complexity,” Fiske says. “You’ve got high staff turnover. So how can you apply technology to manage this infrastructure in such a way that you let people focus on what people are good at and let technology help take a lot of the burden off of the shoulders of running a restaurant, especially for the multi-site?”

When these types of technologies can be spread throughout multiple concepts at the same time, restaurant groups find it easier to fold acquired chains into the portfolio. The transaction essentially turns into a “plug and play” situation.

Wiederhorn has been involved in several purchases over the years.

FAT Brands began its journey in 2003 with the acquisition of Fatburger. Over the years, the company expanded its portfolio, adding Buffalo’s Café and subsequently launching Buffalo’s Express. In October 2017, Ponderosa Steakhouse and Bonanza Steakhouse were acquired for $10.5 million. This was followed by the acquisition of Hurricane Grill & Wings for $12.5 million in July 2018, and Yalla Mediterranean in August 2018. In June 2019, Elevation Burger was purchased for $10 million.

Amid the challenges of the pandemic, FAT Brands continued its expansion efforts. In September 2020, the company acquired Johnny Rockets for $25 million. The following year saw significant acquisitions, including Global Franchise Group (comprising Round Table Pizza, Great American Cookies, Marble Slab Creamery, Hot Dog on a Stick, and Pretzelmaker) for approximately $445 million, Twin Peaks for $300 million, Fazoli’s for $130 million, and Native Grill & Wings for $20 million. Additionally, Nestlé Toll House Café was acquired in late 2022, followed by Smokey Bones in 2023.

Wiederhorn stresses the importance of selecting proven brands with a track record of success across numerous markets and units. He also notes that FAT Brands typically targets franchise brands for acquisition, citing their scalability and ability to stand independently. However, he mentioned that the acquisition of Smokey Bones was somewhat unique, as the company plans to convert some stores to Twin Peaks and potentially refranchise others. This decision, he explains, was driven partly by the desire to diversify the company’s portfolio with a barbecue brand.

“I made mistakes before where I bought brands that were too small and it’s one mistake or problem along the way,” Wiederhorn says. “Soaks up all the cash flow from that brand. And it’s a bad lease or something else. So that’s something that we always work for today is, if we’re going to make an acquisition, does it have enough scale to make sense for us? Today we’re fortunate that we have so many stores and then we’re looking for, in our case, has it been proven in a franchise model because we’re really a global franchising company.”

Brix Holdings has shown interest in M&A activity too. In April, the group revealed that it reached a deal to acquire Clean Juice, a better-for-you fast casual with 75-plus units and a dozen more in development. That brought Brix’s portfolio to more than 300 locations. However, the restaurant group will have

some work to do as Clean Juice has shuttered a net of roughly 60 stores since the end of 2022.

At the time of the acquisition, Mityas said each of Brix’s brands has a “unique and differentiated position” in their respective sectors, and that Clean Juice is in the same class. The restaurant group plans to support a “renewed period of growth and success” for the fast casual.

Wiederhorn, offering advice to restaurant operators aspiring to manage successful restaurant groups, emphasizes the importance of financial awareness and operational efficiency. He says operators need to have a firm grasp on their financial metrics daily, including revenue, labor costs, and food costs. Waiting until weeks after the end of the month to assess financial performance could result in missed opportunities to address issues promptly.

In addition to financial vigilance, Wiederhorn highlights the significance of analyzing product mix to ensure menu items align with customer preferences and profitability. He also mentions the necessity of investing in personnel, recognizing the critical role employees play in delivering service and maintaining operations.

“You really have to be sensitive to having a relationship and reducing your turnover,” Wiederhorn says. “You need to care about your people. You need to know what’s going on in their lives so that they can feel connected to you and therefore they’re more loyal than just hopping jobs for the next incremental 50 cents or a dollar they get per hour in their wage. So I think knowing your numbers and knowing your people, investing in your people, are your critical steps.”

Mityas knows it’s cliche, but he believes restaurant group leaders must understand the role of assembling a competent and cohesive team capable of navigating the complexities of managing several brands. He notes that companies shouldn’t view acquisitions as mere add-ons, and urges operators to prioritize seamless integration into the existing portfolio.

It helps that Brix plays in both the quick-service and casualdining spaces.

“Because we play across all the segments, we actually believe we have a better understanding of the total consumer of their different occasions, their different daypart needs,” Mityas says. “Basically the reasons why they go out to a restaurant, when they just need to stop in quickly for something, when they’re ready to spend an hour sitting down and having something. And so that knowledge we believe gives us a more complete view of the guests so that we can better personalize the experience across our brands. We can better create menu innovation because we understand something from one concept is probably applicable to that guest in a different concept. And so by giving us basically just more knowledge of the totality of the guests’ needs and their preferences, we’re in a better position to tailor and create unique and personalized experiences for the total guests, not just when they’re ready for a quick-service experience or not just when they’re ready to come and sit down with their family at our Friendly’s.”

30 JULY 2024 | QSR | www.qsrmagazine.com BUSINESS ADVICE

Ben Coley is the editor of QSR. He can be reached at bcoley@wtwhmedia.com

SAY HELLO TO YOUR OIL'S NEW BEST FRIEND FILTER AND SAVE UP TO 50% IN OIL COSTS STREAMLINE LABOR AROUND THE FRYER REDUCE RISK IN THE KITCHEN HANDLE LESS HOT OIL IMPROVE THE QUALITY OF FRIED FOODS VITO FRY FILTER SHOP.VITOFRYFILTER.COM INFO@VITOFRYFILTER.COM +18478590398

/ BY DANNY KLEIN

/ BY DANNY KLEIN

Invest Invested In AND BE

The restaurant market has been volatile, quiet, and complex—somehow all at once— over the past year or so in COVID’s wake. Is stability ahead, or more chaos?

ADOBE STOCK AMENIC181 32 JULY 2024 | QSR | www.qsrmagazine.com FINANCE

PwC said in early January the starting bell was beginning to sound for M&A. It also acknowledged the country was slogging through “one of the worst bear markets for M&A in a decade.” The puzzle was a convoluted one, mainly drawn by inflation, interest rates, and difficulty accessing capital to fund growth. The climate, broadly, made it challenging for many brands to generate profitability through high-cost measures, like commodities and building materials. In all, it depressed valuations, which made it appear wiser to wait things out.

PwC’s thought, however, was decelerating inflation and expected reductions in interest rates, along with pent-up demand for (and supply of ) deals could tip the scales later this year.

In this special report, we’ll touch base with some of the restaurant industry’s top thought leaders in the investing arena to take their pulse on the current state as well as what could be coming next. Additionally, we’ll explore how brands can position themselves to partner with investors and what they need to check off before taking that leap.

THE STATE AND SETBACKS

There are a few converging factors mudding the growth proposition, says Lauren Fernandez, CEO and founder of Full Course, a restaurant industry incubator and accelerator of early stage brands. You could start with the high interest rates tied to construction lending. It’s also true for general business lines of credit. These rapid rate hikes, she says, did nothing to support banks wanting to lend because they weren’t sure when things would level out. “So like many investors in this space,” Fernandez says, “they were just waiting to see what’s going to happen.”

That lack of lending action showed up in different places for restaurants in 2023. Big deals slowed since private equity firms didn’t want to buy and sell without leverage. Large bank offers were hit by unfavorable interest rates. And, in turn, activity grinded to a halt.

Andrew Smith, cofounder and manager partner of Savory Fund, a group that oversees 11 brands, says 2023 was the toughest year over the last 15, even more so than 2020 or 2021. “I think a lot of people kind of felt like, gosh, what is this next phase in the F&B industry? And all I would say is from a Savory standpoint, our team, our leadership, will be the first to say that we are extremely excited and bullish about the future. We feel like the future is going to be better than the past.”

www.qsrmagazine.com | QSR | JULY 2024 33 FINANCE

Fernandez agrees with PwC on the point of there being a backfill of demand and people sitting on the sidelines ready to go when money starts moving.

So does Pete DiFilippo, principal at C Squared Advisors. “The state of financing for restaurants is varied,” he says. “National tier 1 brands with solid operations should not have trouble finding a finance partner. Lenders and nontraditional capital sources are hungry for deals after a particularly slow 2023. Those operators in regional or less established brands continue to face more challenges when seeking financing as capital providers are being more cautious with structure and terms.”

Erik Herrmann, partner and head of investment group at CapitalSpring, thinks the current landscape has to be viewed through the tumult of the past few years. In some ways, as tepid as it was, 2023 was the first glimpse of a “new normal” since 2019. This coming year is similar minus one caveat—the commodity and labor environment (outside of California) is relatively stable. However, the consumer outlook is weaker than it’s been thanks to inflation and challenges with discretionary spend. “I think a lot of the concepts that we invest in are differentiated—they’re going to market based on value and convenience,” he says. “They’re decently well insulated but not immune from that consumer dynamic. So I think it’s probably a year of net headwinds for the industry after a year of normalization in 2023.”

“ In many ways, you need to be thinking about 2025 as the next buying year for banks. I think there’s been a massive repricing of risk.”

-ERIK HERRMANN PARTNER & HEAD OF INVESTMENT GROUP CAPITALSPRING

“I think it just makes your work harder to grow or to refine your model,” Herrmann adds. “To find ways, whether it’s making it more efficient, or reduce the development costs so the units can still generate attractive returns. It’s just tougher today. But it really hits you from all sides.”

Chris Elliott, CEO of FSC Franchise Co., owner of Beef ‘O’ Brady’s, The Brass Tap, and most recently, Newk’s Eatery, says, by and large, M&A has lagged along since COVID. He believes it will gain momentum in 2024.

“From a private equity standpoint, there’s a lot of dry powder, meaning, there’s a lot of people that are looking and have money to spend,” he says. “Sellers are getting better valuations and are looking to make a deal. If we get some favorable news from the Fed on interest rates, that will be a positive indicator to the market that now is a time to consider M&A. The biggest obstacle to deals in 2024, will be agreement between seller and buyer on valuation.”

“ From a private equity standpoint, there’s a lot of dry powder, meaning, there’s a lot of people that are looking and have money to spend”

-CHRIS ELLIOTT CEO FSC FRANCHISE CO.