Our exceptional line of stand-up bags make it more convenient to prepare desserts and beverages with premium Ghirardelli Chocolate.

CONVENIENT Smaller bags are easy to pour and store.

ACCESSIBLE Flexible offerings let you mix and match different chocolate varieties.

VERSATILE Couverture chocolate formats are perfect for flavoring, coating, melting, and glazing. Non-couverture chips hold up well when baked.

Explore the new line and request your samples today.*

Our seventh edition of The 40/40 List once again recognizes 40 fast casuals with fewer than 40 locations that we believe are on the verge of something big. The theme this year? Not just resilience, but reinvigoration as well.

BY CALLIE EVERGREENThe pandemic inspired fast casuals to adopt drive-thrus and delivery, marking the beginning of a new innovation era that has led to new restaurant designs and technological solutions to supply chain and labor shortage challenges.

FRANCHISE FORWARD

How one franchise group laid a blueprint for 1,000 locations. BY BEN COLEY

50 INNOVATION

The Wonders of Web3

The always-innovative Wow Bao has another customer engagement tool on deck.

BY ISABELLA SHERKI

FRESH IDEAS

One of the industry’s most nostalgic categories is riding a wave of comfort-food preference. BY ISABELLA SHERK

52

OUTSIDE INSIGHTS

Perhaps the evolution of the restaurant labor market needs to start from within. BY RAHKEEM MORRIS

56

START TO FINISH

The CEO of Eatzi’s Market & Bakery came into the industry by accident. But h e’s more than made up for lost time since.

Daddy’s Chicken Shack has developed a massive growth pipeline in a short period of time.

PHOTOGRAPHY: DADDY’S CHICKEN SHACK / SHANNON O’HARA

57 QSR’s RESTAURANT FRANCHISING / FEBRUARY 2023

MANAGING EDITOR Nicole Duncan nduncan@wtwhmedia.com

SENIOR EDITOR Ben Coley bcoley@wtwhmedia.com

C U S T O M M E D I A S T U D I O

DIRECTOR OF CUSTOM CONTENT Peggy Carouthers pcarouthers@wtwhmedia.com

ASSOCIATE EDITOR, CUSTOM CONTENT Charlie Pogacar cpogacar@wtwhmedia.com

58

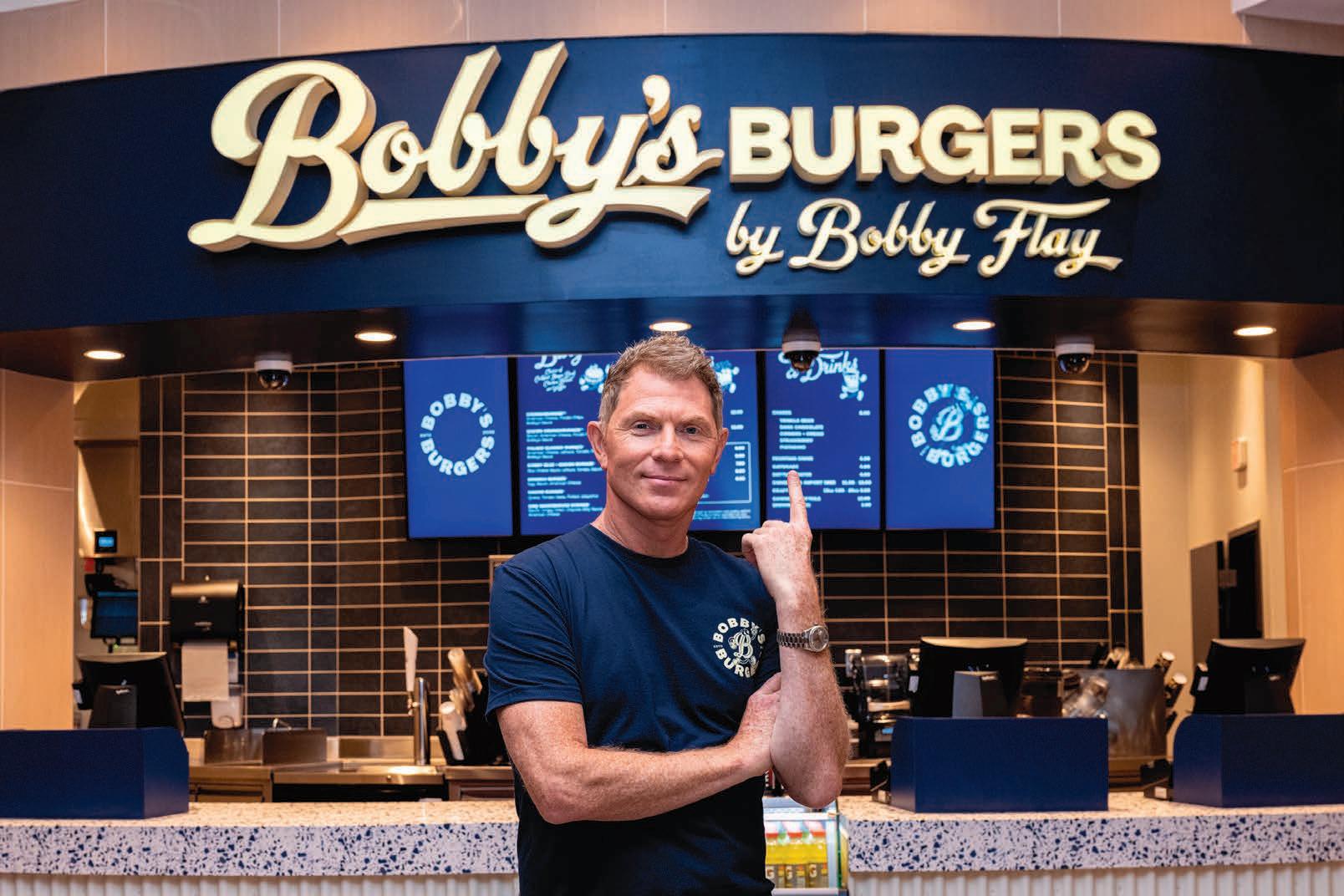

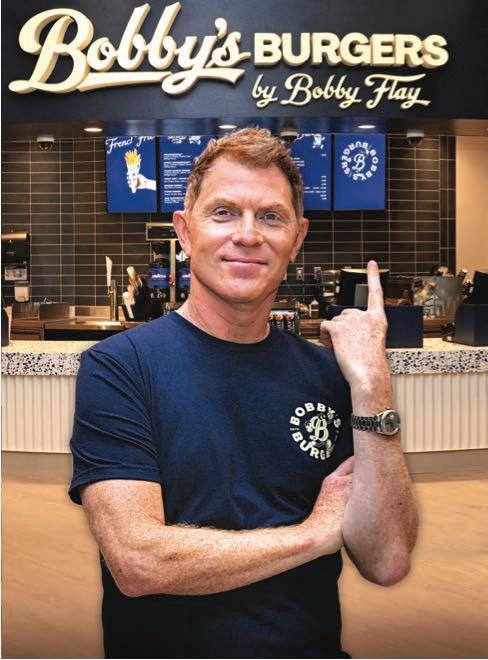

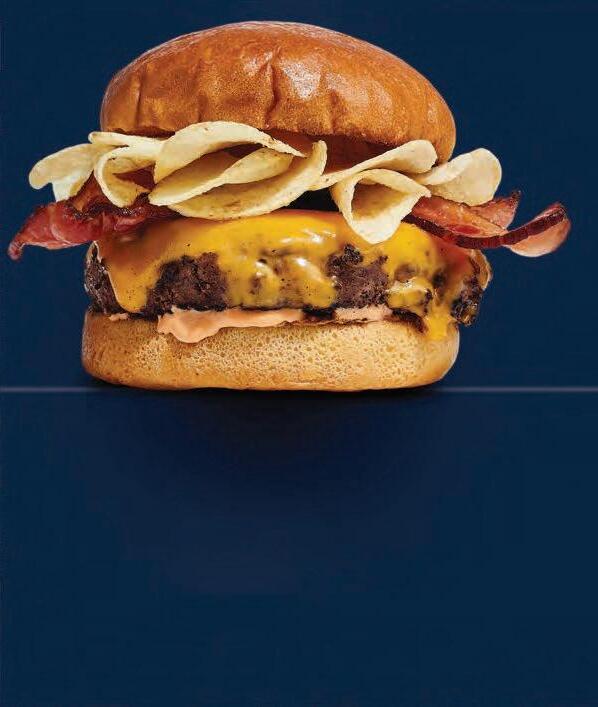

Bobby’s Burgers by Bobby Flay a Top Franchise Brand to Watch in 2023

64

Pizza Factory Hits a Homerun in Hometowns

Nationwide

Iconic West Coast brand enhances operations with innovative tech-stack, driving sales and expansion.

SPONSORED BY PIZZA FACTORY

66

Slim Chickens Hit Major Milestones in 2022

World-class leadership team invites operators to franchise with renowned chef.

SPONSORED BY BOBBY’S BURGERS

BY BOBBY FLAY

60 Bonchon Celebrated its Twentieth Anniversary and Drove Growth in 2022 The Korean fried chicken concept continues to strategically push growth and increase sales.

SPONSORED BY BONCHON

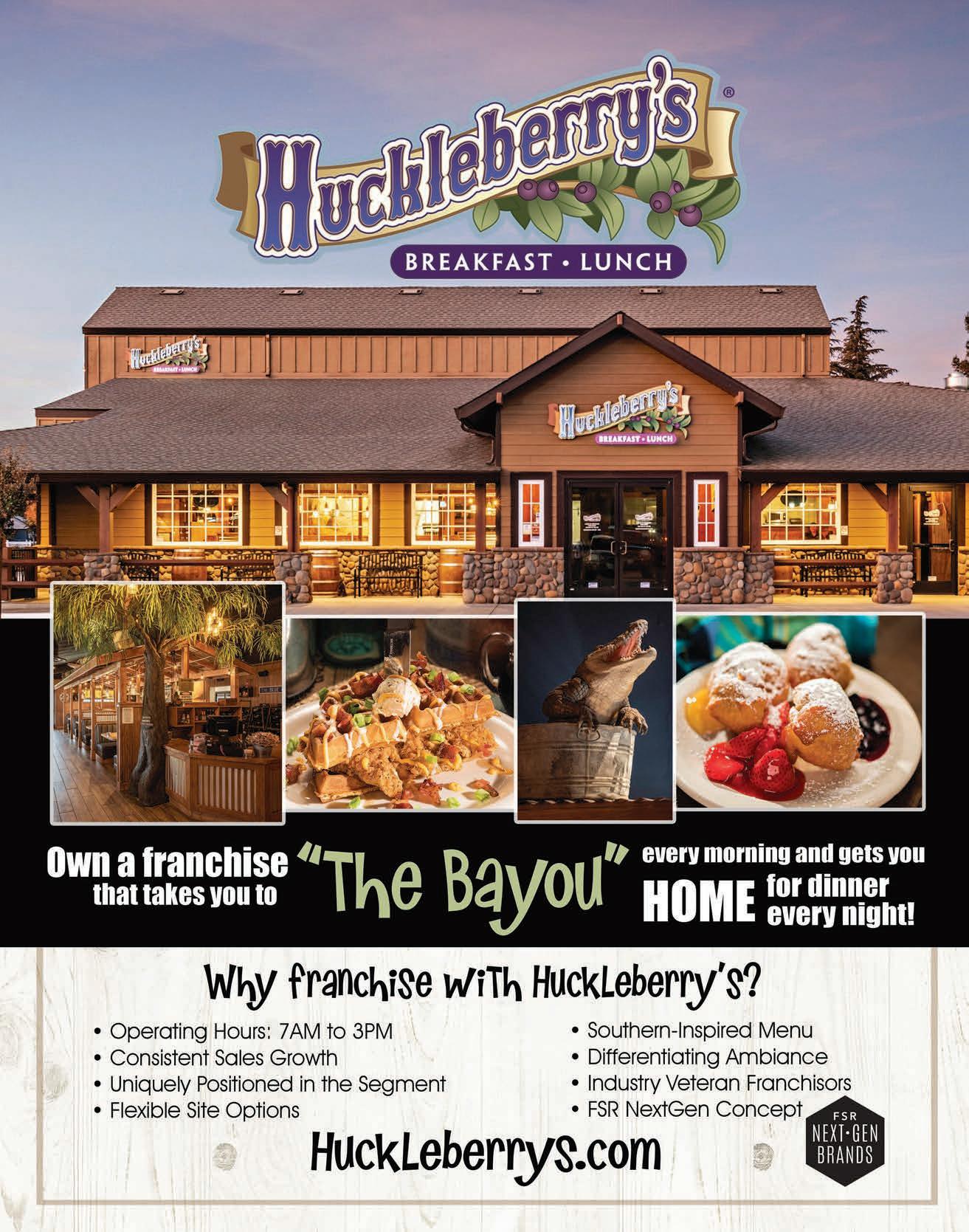

62 Huckleberry’s Breakfast and Lunch Positioned for National Expansion

Strong unit economics and 7 A M –3 P M operating hours set this brand apart.

SPONSORED BY HUCKLEBERRY’S

The breakthrough chicken brand wrapped up 2022 on a high note.

SPONSORED BY SLIM CHICKENS

68

The Human Bean’s Personal Touch

72 Bring the Taste of Harlem Home with Harlem Shake

A R T & P R O D U C T I O N

ART

GRAPHIC DESIGNER Erica Naftolowitz enaftolowitz@wtwhmedia.com

This unforgettable, retro-dining experience is on the franchising fast track.

SPONSORED BY HARLEM SHAKE

74 Abbott’s Frozen Custard Is Heating Up

The 120-year-old brand recently inked a 100+ unit franchise agreement.

SPONSORED BY ABBOTT’S FROZEN CUSTARD

76

Fast-Growing Chains Seek Franchisees

S A L E S & B U S I N E S S D E V E L O P M E N T GROUP

PUBLISHER Greg Sanders gsanders@wtwhmedia.com

NATIONAL SALES DIRECTOR Eugene Drezner edrezner@wtwhmedia.com 919-945-0705

NATIONAL SALES MANAGER Edward Richards erichards@wtwhmedia.com 919-945-0714

NATIONAL SALES MANAGER Amber Dobsovic adobsovic@wtwhmedia.com 919-945-0712

NATIONAL SALES MANAGER John Krueger jkrueger@wtwhmedia.com 919-945-0728

SALES SUPPORT AND DIRECTORY SALES Tracy Doubts tdoubts@wtwhmedia.com 919-945-0704

F O U N D E R Webb C. Howell

A D M I N I S T R AT I O N 919-945-0704 / www.qsrmagazine.com/subscribe

QSR is provided without charge upon request to individuals residing in the U.S. who meet subscription criteria as set forth by the publisher.

Pairing cups of kindness with a top-ranked drive-thru coffee brand.

SPONSORED BY THE HUMAN BEAN

70

Power in Numbers Focus Brands leverages its size to reap benefits for franchisees.

SPONSORED BY FOCUS BRANDS

78

This 56-Unit Premium Sandwich Concept Has a Unique Recipe for Growth The crowd favorite in northern California since 1995, Mr. Pickle’s Sandwich Shop is ready to franchise nationwide. SPONSORED BY MR. PICKLE’S SANDWICH SHOP

R E P R I N T S The YGS Group 800-290-5460 FAX: 717-825-2150 qsrmagazine@theygsgroup.com www.qsrmagazine.com/reprints

Sponsored content in this magazine is provided to the represented company for a fee. Such content is written to be informational and non-promotional. Comments welcomed at sponsoredcontent@qsrmagazine.com.

WTWH MEDIA LLC RETAIL, HOSPITALITY, AND FOOD GROUP

I’m not an economist. I can’t count the number of quarters in my daughter’s piggy bank before getting a headache. As I type this in early January, I’ve browsed a lot of articles concerning a potential recession, with some claiming there’s a current one, and what it all means or could mean or where it heads next. I can’t speak to the curve or the recovery line, but I do want to highlight something I came across recently that speaks to a broader theme. Generally (and why COVID was nothing like 2008–2010), foodservice, especially fast food, weathers economic downturns better than most. It’s a reflection of the so-called “Lipstick Effect,” where consumers are willing to buy lower-priced luxury goods when wallets tighten. Say, instead of a fur coat, you get expensive lipstick. In the case of restaurants, think of families replacing vacations or other excursions with a night out at their favorite eatery, or a bag of takeout.

But how does this carry forward into today’s landscape? Something I’ve heard from a lot of operators is that consumers have begun to self-segment their behavior to fit the climate. Some are eating out less frequently, yet doing so more indulgently. Starbucks, for one, speaking nothing of its traffic, has seen beverage modifiers balloon into a $1 billion business. Younger consumers in particular are taking advantage of a cold customized beverage program t hat’s replaced revolving LTOs. What it suggests is core and loyal customers are amping up “affordable luxuries” when they feel the experience is worth the price. The real friction that’s popped during this inflationary era is when brands ask customers to pay more for

something they’ve historically paid less for. Or, even more so, try to justify the tag of “shrinkflation” in a universe that built its base on value and abundance. However, guests don’t appear to be pushing back nearly as much for things they choose. One example: delivery. As you can see on page 8 , price is hardly a consideration for that cohort.

Getting back to the data I teased earlier, the Loyalty Report 2022 from Paytronix showed 55 percent of restaurant loyalty customers increased their average check size by more than the cost of menu items, indicating inflation increased loyalty member visits. Simply, loyalty has become a tool for mitigating difficult economic conditions. As the company pointed out, while the exact relationship between loyalty check size and prices can be difficult to determine, the trend is clear—loyalty members continued to spend despite inflation. Starting around March 2022, loyalty member checks lifted in lockstep with prices. In my view, core users are going to stick as long as brands give them the means and support to do so. Along the way, loyalty also empowers restaurants to present a new face of value that goes beyond the deep discount—one that’s personalized and catered to what a guest actually wants. In the end, it’s something worth paying for.

Danny Klein, Editorial Director

The quick-service consumer has already begun to vote with their wallets.

& consistently delight your customers, with

DISCOVER MORE!

VISIT US AT BOOTH #1035#

DISPENSING, REINVENTED!

Subway sells more freshly baked cookies than any other restaurant company in the U.S.

Two of the brand’s most iconic items melded together for a cause.

TO CELEBRATE NATIONAL COOKIE DAY on December 4, Subway unleashed a foot of “cookie goodness,” piled high with toppings. Inspired by the company’s new Subway Series signature lineup, cookie lovers could sink their teeth into four limited-edition footlong flavors exclusively at Cookieway, Subway’s pop-up restaurant that only serves its cookies.

One example: The Subway Cookie Club, which mirrored Subway’s No. 11. It stacked cookies on cookies with a Double Chocolate cookie base and vanilla frosting, then topped with Chocolate Chip, White Chocolate Macadamia and Raspberry Cheesecake cookie chunks, rainbow sprinkles, and chocolate and raspberry sauce. Other options included: The Mexi-Cali; The Monster; and The Great Pickle:

The “subs” were available on a first-come, first-serve basis in exchange for a donation to the Subway Cares Foundation, a 501c3 non-profit organization that provides grants to organizations around the world.

By now, it’s no mystery prices have climbed industry-wide. Customers are paying more for many of the quick-service meals they’ve ordered for years. And there’s not much to suggest that’s going to subside any time soon, even if it might have peaked during 2021. All said, though, how are consumers reacting?

Specifically, we’ll focus on one positive reflection from a study by global scale-up company Deliverect, which serves more than 27,000 locations across 40 markets. The company surveyed over 7,000 global consumers to identify preferences and changing habits when it comes to restaurant o erings. One point that emerged on the U.S. side—delivery consumers don’t consider price a key factor in their delivery purchasing behavior. Simply, they’re willing to foot the bill for convenience.

The baseline:

Guests, infl ation and all, are still ordering more delivery: 42 percent of people in the U.S. get up to three deliveries a week. That’s 2 percent above pre-infl ation habits.

42 %

of people in the U.S. get up to three deliveries a week

It’s not just a solo thing: Twenty percent of respondents in Deliverect’s study said they were ordering on a weekend evening with friends and family, which was 1.4X more than people ordering on a weekday with their crew.

The top five influencers:

30% Quickest delivery time

28% Convenient location

The classics:

25% Specific menu item availability

19% Appealing photos of the food

17% Saw on social media

Just as restaurants witnessed out of the COVID gates, pizza remains a cuisine delivery customers gravitate toward—whether the reason is price or comfort. Fortyseven percent of people said they’d order pizza any time, infl ation or not. “Good ol’ American food” was next at 40 percent

20% Ô 1.4

were ordering on a weekend evening with friends and family

47 %

of people said they’d order pizza any time, inflation or not

The not-so-good, or why people are frustrated with delivery:

31% Long delivery time

A whopping 90 percent said quality ingredients were more important now than before the rise of infl ation. Additionally, convenience was a major deciding factor for guests selecting a restaurant for takeout and delivery; 84 percent claimed how close a restaurant was and how fast their food could get to them was more important today than it’s ever been.

90% 84%

which was 1.4Xmore than people ordering on a weekday said quality ingredients were more important now than before the rise of inflation claimed how close a restaurant was and how fast their food could get to them was more important today than it’s ever been

30% Incorrect orders

26% Delivery charges

25% Incomplete orders (such as items missing)

23% Unexpected/ miscommunicated delays with order

To circle:

“overpriced” menu items didn’t appear in the list, “reinforcing that people are willing to pay more for high-quality food,” Deliverect said.

Wait? In terms of wait times, here were consumers’ expectations:

10–20 minutes

minutes

Inflation remains an ever-pressing concern.

Cost Effective, for both capital and operational expenses bring CFO's on board.

Clean, near zero GWP with no fossil fuels, more than satisfies regulators.

Reliable, on demand hot water with backup eases the minds of facility managers.

Easy, installation and remote monitoring make contractors big believers.

Safe, tankless heating defends users against Legionella.

Scalability and built-in redundancy fit the plans of engineers.

See how it works

SMOKEY MO’S IS A TEXAS BBQ JOINT RAISED RIGHT.

In just over 20 years, we’ve gone from a single Texas neighborhood BBQ place to QSR magazine’s list of America’s 40 hottest category startups!

As we continue to grow, we’re excited about where we’re headed, but we’ll never forget where we’re from.

That’s why we smoke all of our meats in-house for 10 – 14 hours every day at every single Smokey Mo’s location. Having Mo’ flavor and Mo’ passion is how we provide every customer with authentic Texas BBQ and genuine Texas hospitality.

For locations and franchise opportunity information, follow the smoke to smokeymosbbq.com.

Hot dogs are a classic and nostalgic food that generations of Americans have enjoyed. Memories of celebrating the Fourth of July, for example, are often associated with grilling the food by the pool or out on the deck. People crave hot dogs at the fair, the carnival, or the boardwalk. Hot dogs are hardly new to the consumer conscious, but industry professionals in the category are working to keep them relevant to modern diners.

During the pandemic, online ordering and third-party delivery boomed, and the trend has proved to have lasting power—something that translates well to hot dogs. Being stuck at home brought

a return to the comforting, nostalgic food people grew up with, now available through a few clicks on their mobile devices. One of those items was undoubtedly hot dogs. What normally is an occasion-based food shifted into an opportunity for convenience.

Jenn Johnston, president of the quick-service restaurant division at FAT Brands, where Hot Dog on a Stick is housed, says the pandemic surge continues to adjust dayparts. The snack brand’s year-to-date sales and transactions are each up 10 percent. “I think that is a testament to consumers really continuing to crave comfort foods post pandemic,” Johnston says.

One of the industry’s most nostalgic categories is riding a wave of comfort-food preference.

Hot Dog on a Stick has 50 units, with the majority located in shopping malls, and a smaller footprint on boardwalks and amusement parks. Before the pandemic, the brand mostly drove customers to stores by being located in foot traffic-heavy locations where they were out shopping or having fun, and wanted a quick bite to eat. After, like many other quick-service brands, Hot Dog on a Stick had to adjust. The chain had not majorly delved into the world of third-party delivery yet. “Our products are made fresh to order when people get to the counter, so we hadn’t really anticipated the demand for people ordering to go and enjoying them later in their home,” Johnston says. “With the pandemic we ended up putting all of our stores on third party delivery and online ordering.”

Johnston also notes that because hot dogs can be a snacking occasion or a meal for consumers, many will order multiple hot

dogs in each order. This leaves room for innovation in the category, especially at Hot Dog on a Stick—if a customer orders dinner and wants to try a new kind of hot dog, they might get one newer option alongside their classic favorites. One popular offering of late has been the Flaming Hot Cheetos hot dog, Johnston says. She also adds a large portion of transactions are ordered with a lemonade, another item the brand likes to focus on in terms of R&D. The brand offered a “Pineberry” flavor throughout the holiday season, for instance.

Wienerschnitzel, which claims to be the nation’s largest hot dog chain, also focuses on innovation to inspire trial and encourage repeat visits from loyal users, chief marketing officer Doug Koegeboehn says. The brand has rolled out pretzel buns and different toppings for fresh kinds of hot dogs. Koegeboehn says he believes toppings are where innovation thrives in the hot dog business. One of Wienerschnitzel’s popular creations is called a “junkyard dog,” which has chili cheese fries on top. However, the brand finds

sticking to its classic menu items generally serves it well. “People typically go back to what they actually love,” he says. “Our No. 1 sellers are chili cheese and chili dogs.”

Similarly, Johnston says Hot Dog on a Stick also likes to prioritize its core. “We really try to stay true to our iconic menu first and foremost,” she says. “It gives us a lot of credibility—we do a few things and we do them really well. We spend a lot of time in research and development with numerous items, and only a small amount of them actually make it to market because we want to make sure that if we do innovate, it’s a wow factor.”

In terms of playing into the nostalgia of the food group, Koegeboehn says it has its place, but is not the only thing that is important to talk about. You also have to continue promoting their relevance today, he says. “I truly believe the best way to promote any product is showing how it’s relevant in today’s society,” Koegeboehn says. “Nowadays you should be talking about the qualities of the product.”

Leaning into relevance is important, Koegeboehn adds, because of the preconceived notions people may have surrounding the food. Many Americans are still afraid of what is in hot dogs, even if they may love the taste, he says. That’s why Koegeboehn thinks keeping the modernity element in marketing and social media is important. Spreading the word about Wienerschnitzel on social media along with fans of the brand online have made it a viable option for many franchise opportunities to come to fruition. Koegeboehn says area deals have been sold to new franchisees moving across the Midwest, and the brand’s first international deal was signed because of Wienerschitzel’s longevity as a brand.

That nostalgia factor when it comes to hot dogs remains vital, however. It is a driving force behind people’s hot dog cravings and the food’s classification as a comfort category in general. This balance between nostalgia and innovation can perhaps best be seen in Hot Dog on a Stick’s original location that had been open for 75 years on Muscle Beach in Los Angeles. Recently, it underwent a makeover. “It’s still very nostalgic and true to the roots of the original location,” Johnston says. “But it’s been optimized in a lot of ways with modern amenities like air conditioning being added.”

Where else are you given that opportunity in life?”

In pursuit of this dream, Rodriguez partnered with private equity firm Triton Pacific Capital to form franchising company, Tasty Restaurant Group. From the start, the goal was to enter agreements in quick service because of its recession-proof nature and ability to withstand different pressures, like a global pandemic. Rodriguez sought the best of fast food so he could worry less about brand management and leadership and more about developing people and fine-tuning operations.

Robert Rodriguez came to the U.S. without knowing English, and like many other immigrants, found his voice through restaurants.

His resume now features 50 years’ worth of industry experience—on the franchising and corporate side—including notable executive stops at McDonald’s, Taco Bell, and Denny’s. As he aged, Rodriguez became increasingly interested in running an organization that gives back to the community and creates a clear-cut career ladder for employees.

“How do I lead and how do I show people that this is an industry and this is a profession and it’s not a job and how do I give back?” Rodriguez says. “So I can give you example after example of going into restaurants and we see people who are struggling, don’t know what they want to do with their careers and businesses.”

“This is a great career,” he adds. “It’s really a great career, and it’s not just because you make money. It’s because I’m going teach you about a profit and loss statement, I’m going to teach you how to manage people, I’m going to teach you how to lead individuals, I’m going to teach you how to run a multimillion-dollar business.

The first acquisition was Burger King in June 2018. Tasty Restaurant Group also considered Wendy’s, but Rodriguez previously worked at Burger King and served as a franchisee; he also grew up in Miami, where the chain is headquartered. A year and a half later, Rodriguez leveraged his years of experience with PepsiCo—the parent of Yum! Brands— to buy into Pizza Hut. Then, after serving as Dunkin’ president from 2006–2008, the industry veteran became a franchisee for the doughnut chain and sister concept Baskin-Robbins. Rodriguez rounded out Tasty Restaurant Group with KFC and Taco Bell in December 2021.

The franchise company now operates roughly 400 restaurants in the Midwest, Mid-Atlantic, and Northeast. Tasty Restaurant Group is most heavily invested in Pizza Hut (221 stores ), followed by KFC (90), Burger King (68 ), Dunkin’ (20), and Baskin-Robbins ( six )

“Our mission continues to be the same,” Rodriguez says. “We’ve got to take care of our people first and foremost. We want to be a leading brand running great restaurants. But more importantly for me, it’s taking care of the people who will do that. Because I keep reminding everyone that at the end of the day, there are only cash registers in the restaurants. They’re not anywhere else. So the rest of us are just G&A and support staff.”

Of these brands, Dunkin’ is heading toward the biggest growth spurt. Tasty Restaurant Group recently signed a 45-unit deal to bring new locations to New Orleans, Baton Rouge, and surrounding markets over the next several years. There are only 15 Dunkin’ stores in Louisiana, but Rodriguez says those select few are “performing extremely well.” As an executive that spent years trying to build out the fast-food chain west of the Missis-

fast casuals with fewer than 4O locations

/ BY QSR STAFFInnovation, opportunity, and hardships spur entrepreneurship. And that’s always been the case for quickservice’s most inventive corner, fast casual. While COVID-19’s grip has lightened, there remain roadblocks, from rising costs to labor to a consumer grappling with uncertain economic conditions. But this hasn’t curbed the growth and inspiration of a new generation of brands. ¶ Our seventh edition of the 40/40 List once again recognizes 40 fast casuals with fewer than 40 locations that we believe are on the verge of something big. Whether just getting started or prepping for major expansion, this list of restaurants has designs to catapult out of the pandemic’s depths and into a future rife with potential.

T h E F o R t Y f O r T y L I S t

This wave of battle-tested fast casuals is ready to emerge into a new era of restaurant growth.

UNITS: 1

A word Pace Webb keeps returning to is “chemistry.” Daddy’s Chicken Shack tells a startup story that’s not unfamiliar. The brand had a product guests craved and then fit the dream into an improbable box. In this case, a 700-square-foot space in Pasadena, California, Webb and her husband and business partner, Chris Georgalas, discovered on Craigslist. There was no bathroom, foot traffic, seating, and a red curb fronting the store (so no parking). Webb says Daddy’s could count the number of customers “on our hands and feet in a day.”

This was November 2018. Four years later to the month, Daddy’s signed its seventh regional development deal and second in Texas. Not in the brand’s history, but in just 2022 alone. Along with the inking of eight franchise agreements across California, Oregon, Texas, Colorado, Arizona, Georgia, and Florida, the brand today boasts a total of 120 units in development.

There’s one location open and running—a 2,400-square-foot Houston model that portends future development. But two, in Scottsdale and Denver, are slated to land in Q1. The Pasadena test kitchen is no longer open to the public.

While there’s a lengthy road ahead, Daddy’s is off to a rare spurt. “It just all feels right,” Webb says. “And it doesn’t mean the path to success is at all linear, but we’re definitely in a very good place, and with great chemistry.”

What Webb is referencing is that intangible piece that often splits upstarts from those that make it. For Daddy’s, it clicked through the center of COVID-19. Webb maintained a fine-dining catering business in Daddy’s early days. When the pandemic hit, though, one company moved downward and the other rocketed: Daddy’s watched sales leap 200 percent.

Georgalas says COVID forced Daddy’s, like hosts of brands nationwide, to make serious adjustments and gather intel as it tried to figure out how to reach people. There came a point where drivers pulled up and got in line, and guests piled up outside.

Georgalas had never worked in a restaurant, so he went to the front of house and tried to meet every customer who walked in. Naturally, Daddy’s didn’t staff for a 200 percent increase, which kept him busy.

Georgalas handed water bottles and cookies to drivers and diners.

As regulations relaxed, Daddy’s figured out how to schedule shifts and leverage tech, which was an area the brand got ahead of from the outset; it had to, given the lack of foot traffic and parking. Daddy’s became one of the early customers of Ordermark (now Nextbite)—an online ordering solution that offers integration of third-party delivery providers—and dipped into facial recognition kiosks and autonomous delivery. By the end of 2018, Daddy’s was on 11 delivery apps and offered native online ordering.

Essentially, the fast casual navigated COVID with an omnichannel system before the couple (or many other people, for that matter) were even sure what that term defined.

“We were able to take a look at our data and look at our numbers and say, this is what we need here and adjust and once that dust settled, that’s when we realized,” Georgalas says. “We came up for air and we’re like, oh, I think we have something here.”

Georgalas reached out to old contacts and a close friend. Eventually, Daddy’s crossed paths with Dr. Ben Litalien, founder of FranchiseWell, an agency that consults with mega groups like UPS and IKEA. The partnership evolved into an investment from Dave Liniger, the co-founder of global real estate franchise RE/MAX. He chose Daddy’s from 200 potential candidates. “Hearing the success stories, hearing the challenges, [Dave] telling us that he’s made every mistake in the book in the last 50 years, but hearing what that’s yielded as far as the success that people were set up for from inside the business and outside, is really what was attractive to us,” Georgalas says.

Daddy’s then set out to design its Houston flagship, a standalone the company says shows potential franchisees an example of the

“biggest, baddest thing you could have.” Daddy’s expects to spread mainly as inline or endcap locations, with about 25 percent or so as standalones. “When I’m in the space, it has the gravitas of a legacy brand,” Webb says.

What can’t be lost, however, is why Georgalas pushed his chips in on day one. Webb’s Los Angeles-based catering shop, Taste of Pace, was asked to make sliders and tacos at an event back in 2013 (they weren’t on the menu). She developed a fried chicken sandwich with sriracha mayo, Thai-style slaw, buttermilk fried chicken, and a brioche bun. The food drew a crowd and even the praise of actress and singer Mandy Moore. The following day, Webb called her dad and flippantly mentioned she had a retirement plan. He’d be able to hang in the Venice Pier, wear Hawaiian shirts, and fry chicken. That’s where the name, “Daddy’s,” was born.

Webb’s father, an artist and graphic designer, would actually, in time, craft the Houston store’s interior alongside Harrison, a global consultancy company that’s assisted with development of several familiar restaurant aesthetics, including Fogo de Chão and Maggiano’s.

It’s an authentic-looking shack that mismatches elements of a house, like windows of random sizes, and a door hanging from the dining room ceiling. Think of it as American South with Japanese minimalism as a backbone.

Returning to the food (and Georgalas’ initial inspiration), Webb fine-tuned her sandwich over the years before Georgalas tried it in 2015. He believed Webb found her Shake Shack.

“I told her you should do something with this and she looked at me like I had five heads and she said, ‘well, you should do this with me,’” he says.

At the start of 2018, Webb and Georgalas opened Daddy’s at Smorgasburg food market. The weekly event attracted 4,000 customers when the restaurant joined, but saw upward of 13,000 at some points. Hundreds of sandwiches were sold each day and later that year, Georgalas tracked down the Pasadena space. They signed a lease and moved in 18 days later.

Webb notes, although she didn’t recognize it then, she had been training to be a CEO for years. “A chef’s career is very similar in a lot of ways,” she says. “You’re type A, a little high strung, have to be a great leader, have a product to get out on time, on budget, at a certain temperature. There were so many similarities that I didn’t even know I had been cultivating.”

But importantly, in addition to the sandwich, Georgalas believed in Webb. His first role, he says, was to support her and find ways to get the message out. He was an institution position trader at Deutsche Bank and the hospitality sector before they met, with no inkling to get in the restaurant game. “It was about supporting her, supporting a woman as a founder of a business called Daddy’s, which is really cool. And the magic is really starting to happen,” he says.

Why the franchising route came down to Liniger. They jumped

in together. Liniger joined as an investor and later sought out his own regional development agreement. He was the first to ignite a chain of regional development deals, securing 20 units split evenly between Arizona and Colorado. A year after starting its franchising journey, Daddy’s hosted a regional developer conference in Las Vegas.

The small menu helped streamline operations and Daddy’s tech chops created a system where the brand could track and monitor performance. Daddy’s selection of chicken sandwiches is best described as a confluence of Southeast Asian, American South, and Japanese culture, partly an ode to Georgalas, who is half-Japanese. For instance, the Big Daddy sandwich comprises napa slaw and sriracha mayo, while the Spicy Daddy features sambal, cilantro, and ginger mayo. For dessert, the restaurant offers salted miso chocolate chip cookies, baked fresh each day.

The regional developer approach is a hybrid of sorts; a “train the trainer” system that enables quick growth if executed correctly. Regional developers buy the rights to a territory of a million people that matches the demographic of a Daddy’s customer. They’re then required to open a store (or more). After, they sub-franchise the other nine units, almost like a mini franchisor. The idea being they get a flagship location certified as a training store and lay the blueprint for regional operators. This way, training is hyper local and franchisees aren’t reliant on corporate for every level of support.

Getting these developing units open is on the horizon for Daddy’s, which has forced Georgalas and Webb to undergo a crash course on franchising and expansion: to make sure real estate selection, tech, marketing, and using data to attract and reengage guests is tight and ready to replicate. “And then culture. I think the harder part of franchising—yes, very systems and process focused. But how do you scale a culture?” Webb says. “Because one place can have a delicious chicken sandwich, but if they don’t have a good hospitality experience that’s just really going to hurt, especially for an emerging brand.”

Georgalas calls this, “scaling a feeling.” One element Daddy’s has going in its favor is how the chain took root. The ability to deliver digital hospitality—a target brands across the lexicon are working back against these days—was something Daddy’s developed from the ground floor. It started with a blank canvass in one of the biggest paradigm shifts in sector history.

“It’s exciting and we’re up for it,” Georgalas says. “And again, we have a responsibility and we’re going to give every ounce of effort we have to set people up for success, both internally and our team. Franchisees and developers, just across the board.”

Daddy’s will focus on regional growth so it can quality control and wield purchasing power. Once it establishes an area, the brand will refocus before heading elsewhere. “I like to see other people win,” Webb says. “I know I can make an awesome piece of food. I know I can make a great fried chicken sandwich. I know I can run a restaurant if I’m there five, six days a week. I know all that. I don’t need to prove that anymore. I want to make opportunities for other people—that’s

Speaking of chemistry, being married and also being business partners isn’t for everybody, Webb laughs. “I’ll say that off the bat,” she says. “But it’s definitely for us.”

Before they started Daddy’s, Webb says she was given a piece of advice—stay in your respective lanes, define roles and responsibilities, and make sure one person doesn’t feel like the boss of the other. Technically, Webb is the CEO and Georgalas president. “It just really works. We’ve also got a very different skillset and the way we approach problem solving, thinking, is also very different and so it’s very complementary,” she says. Webb focuses on ops and culinary, while Georgalas oversees marketing and tech. He’s more of a macro thinker whereas Pace dives in.

Again, however, the nuances aren’t as vital as the high-level picture, which is something Daddy’s continues to keep in sight. “You just go through incredible highs and experiences and then you have incredible challenges at times,” Georgalas says. “But we find that we’re saying during both of those scenarios that we get to do this together, and it doesn’t matter.”

Webb was pregnant when Daddy’s debuted. They now have two daughters and Georgalas jokes Webb runs the household like she does the restaurant. “Parts to reorder, a toy list,” Webb quips.

But throughout it all, Georgalas says, Daddy’s chemistry has held because the goal has stayed unshakable—develop a restaurant that empowers others to excel. “That’s what makes us feel really good about what we’re doing,” Georgalas says. ➺

Texas Pete ® is taking its flavor on the road with convenient, easyto-enjoy portion control packets! Whether it’s a Texas Pete ® dip cup or sauce packet, your customers will be able to enjoy bold flavor for a better on-the-go dining experience—anywhere, at any time. Ask your broker for the #1 portion control hot sauce and request a free sample today!

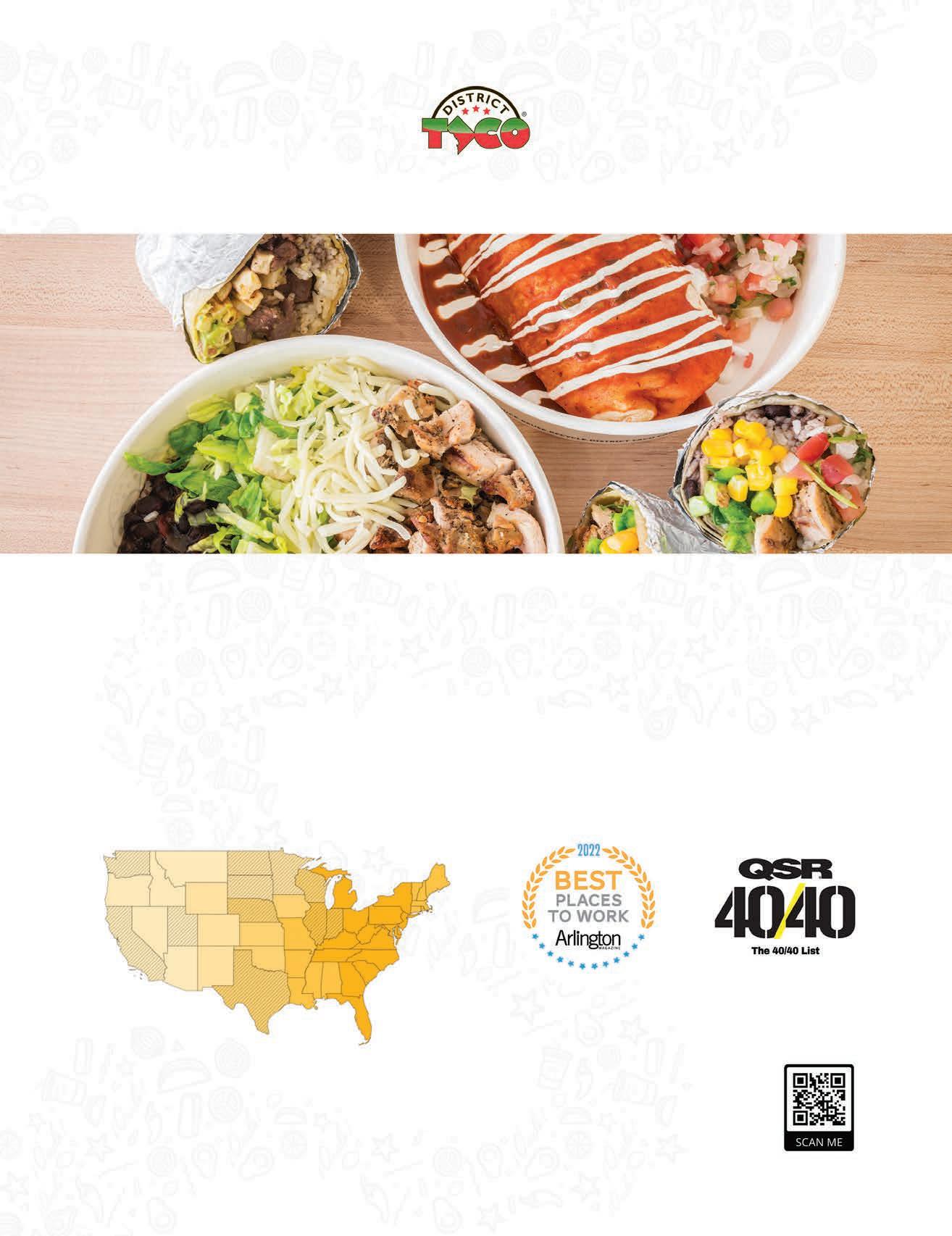

District Taco is the restaurant rags-to-riches story at its finest. After leaving his home in Yucatán, Mexico, hoping to make it in the U.S., Osiris Hoil hit a setback. In 2007, as the economic crisis took root, he was laid-off and forced to start from scratch in a new country. He took his mother’s recipes, passion for combining Mexican cooking with a new American lifestyle, and began to chart a business. Hoil and his neighbor, Marc Wallace, got together in 2019 over homemade chips, salsa, and guacamole and decided to launch the District Taco food cart in Rosslyn. The brand has since grown to 15 stores across the DMV. “Beyond creating fresh, healthy, a nd unique recipes, we are also committed to strengthening the well-being of our growing community and the members within them,” says the company, which was named one of QSR ’s Best Brands to Work For this past year, earning recognition for its PTO for all employees and a Pioneer Program of peer-nominated rewards.

DISTRICT TACO (3), STAFF: MATT MENDELSOHN PHOTOGRAPHY

Prior to 2020, District Taco had started to make technological advances within its restaurants. When health concerns arose, customers moved from dining in-store to ordering pickup and online deliveries. District Taco just announced plans to expand via franchising. The brand aims to add an average of 15–20 franchises per year for the next five with initial growth primarily focused on the Eastern Seaboard and the M idwest.

“District Taco has come a long way from the original taco cart in 2009, where we began delivering a unique dining experience by providing fresh, healthy, authentic Yucatáninspired food to a loyal customer base,” Hoil says. “I am so proud of the journey we have undertaken so far, and excited for the road ahead as we continue to expand and franchise across the country. We hope our story continues to inspire others to follow their own American dream.”

22 FEBRUARY 2023 | QSR | www.qsrmagazine.com

UNITS: 8 GUISADOS (3)

Since its December 2010 founding, Guisados’ vision has remained intact, and it begins with the style of cooking itself. Guisados’ food takes a different approach to the mainstream “taco.”

“Growing up, mom wasn’t on the grill making carne asada or nachos; these stews were/are not only a portrayal of how we as Mexican Americans eat, but how many other cultures cook for their families,” says owner and operator Armando De La Torre. “We take pride in our food and realize that our menu is an accurate portrayal of the foods we really ate growing up.” Guisados’ goal was to serve homestyle braises on handmade corn tortillas—the latter of which are made to order from fresh ground masa. “Over the years our growth not only fuels foodies and visitors of our city, but brings so many back to the memories of

their mothers kitchen,” De La Torre says. "Guisados' menu is a memory, a recreation of our childhood, and it is truly something special to be able to share that with our city and all those who pass through our doors,” he adds. “We take deep pride and responsibility in its continued growth and enjoy the challenge of bringing that identity to life with each new location.”

The family run operation is an ode to how mom spent her afternoons: stirring, dancing to Mexican singer and actor Javier Solis, and adding each ingredient as she prepared family dinners. Since Day 1, Armando Sr. has been in charge of food, consistency and development, while De La Torre (Armando Jr.) handles daily operations, designs the menus, brand identity, marketing materials, collaborations, and all creative aspects of the restaurant. Natalie, who is Armando Sr.'s daughter, serves as GM and continues to manage and operate multiple locations and day-to-day tasks. “All with a belief that the most essential type of leadership is presence, and that our presence continues to have an impact on our company’s culture and growth,” De La Torre says.

The nostalgia has carried to units in Echo Park, Downtown L.A., West Hollywood, Burbank, Beverly Hills, Pasadena, and soon, Hermosa Beach. Guisados’ stews and masa are still made at the original Boyle Heights kitchen multiple times a day and delivered to restaurants. Along the growth trail, the company has cultivated a community of artists through its Featured Artist Program—a revolving display of local art and murals—and introduced a breakfast taco menu.

When COVID hit, Guisados closed all locations. Three weeks later, Armando Sr., Jr., and Natalie rolled up their sleeves and opened one branch, slowly inviting a couple of long-time employees to help out. “We focused on delivery, takeout, and always offered to put the food in your trunk if you requested,” De La Torre says. “Our business actually became a bit more efficient as we learned some new ways to cut overhead and streamline our operation. Fortunately, being that we are already a [quick-service operation], our menu and packaging essentially remained the same.”

The brand introduced taco kit style options to feed a family of four to six. They came fully dressed and ready to eat, or in a “survival pack,” where the items arrived separate in deli containers so guests could make their own and store for later.

Today, Guisados operates with a spoke-and-wheel system where everything is cooked and sourced from a central commissary where it braises stews and grinds corn, and delivers to units, as mentioned before. The approach, the company says, gives it confidence to open another seven to 10 locations. This commissary/co-packing method is key to future consistency. “Our goal is to grow even further than that; we are ready for the next step in our journey,” De La Torre says.

“Restaurants are a labor of love, and though the everchanging landscape of the labor force and supply chains may feel tedious day to day, we are grateful that we are continuing to manifest the dream we once had when we first opened our doors,” he adds. “To be able to provide more jobs for our community and more opportunities for our staff is one of the most rewarding feelings of seeing this restaurant grow. We've seen employees become mothers, fathers and friends, we've seen fathers become grandpas and so many stories begin within our walls."

Over the past 17 years, Sprinkles has expanded from its trailblazing roots in Beverly Hills, California, to a national presence with

consumers around the world.”

bakeries that serve hand-crafted cupcakes, each frosted in its signature swirl alongside layer cakes, cookies, brownies, and even “pupcakes.” The company also recently launched a line of Belgian chocolates and popcorn inspired by its top-selling cupcake flavors. But Sprinkles might just be best known for its cupcake ATM, which it claims is the first on the market. Today, they can also be found in non-traditional spots like airports and college campuses. Going into the future, the classic brand is ready to ramp up growth via franchising. Sprinkles’ first domestic franchise opened in Salt Lake City and international expansion will follow, starting in Asia.

“As a brand, we are so fortunate in the way Sprinkles lives in the hearts and minds of our guests. We’re connected to celebrations, sharing joy and everyone’s favorite ‘treat yourself’ moment,” says Dan Mesches, Sprinkles CEO. “Innovating new products and flavors, franchising domestically and internationally, and growing our DTC channel are not only integral to our growth strategy but allows us to connect meaningfully with more

It’s a path that’s been building from an infrastructure standpoint. Just before the pandemic, Sprinkles rolled out an e-commerce platform and began offering nationwide shipping. Amid COVID, the chain expanded offerings (t he aforementioned chocolate and popcorn), and in addition, Sprinkles implemented creative partnerships with brands like Golde, Kosterina, and Sanctuary, as well as award-winning chefs like Brooke Williamson and Claudette Zepeda, to create limited-edition cupcakes. Across the pandemic, Sprinkles grew its directto-consumer channel and tacked on CPG products like cake and cupcake mix. It created efficient ways for guests to order, either through its custom-built online ordering platform or at kiosks in-store. Digital menuboards are also a staple feature.

The female-founded brand, by Candace Nelson, says 76 percent of its bakery GMs are female.

“We are constantly innovating and will be launching a new product format in the new year,” the company says. “Sprinkles will continue to partner with brands across all lifestyle verticals including, food, beauty, fashion, and entertainment in addition to the celebrity and chef collaborations also slated for 2023 and beyond.”

HEADQUARTERS: WARREN, MICHIGAN

UNITS: 35

Just under five years ago, Wing Snob started up in Michigan. The brand has since reached 35 locations and is actively expanding in seven states and Canada. The brand says it noticed the influx of delivery coming in during the pandemic, so it worked to lean into relationships with third-party delivery companies. Since, it has also

revamped its rewards offering— called Snob Perks—to coincide with a mobile app. Wing Snob says it is growing in many markets across different states, and hopes to hit 100 locations by 2025.

HEADQUARTERS: ATLANTA,

The inception of Knuckies stems from award-winning, Boston-based pizza concept, Crazy Dough’s Artisan Slice Bar, which was acquired in 2017 by Georgia Franchise Group. Known for its award-winning dough produced by Atlanta-based H&F Bread Company ( eventually bought by Engelman’s Bakery), Crazy Dough’s won the World Champion Title for “Best of the Best” at the International Pizza Expo in 2014. What ended up being the long-term value play, though, was the dough itself—now central to Knuckies’ hoagie rolls. The brand was created by two restaurant operators who recognized the opportunity. They believed so much they closed two other concepts and converted them

to Knuckies, pouring their life savings in before raising additional growth capital to expand. Today, the hoagie role is the No. 1 compliment from consumers.

COVID hit Knuckies hard considering it had opened the first in late 2019. The following year, the company did under $200,000 but worked to stay afloat. That figure more than doubled to $460,000 in 2021 and that same store, as of November 2022, was up to $600,000 in sales that calendar alone. There are now four corporate units, a franchise, and another franchise on deck for Q1. Through launching online ordering and third-party platforms, Knuckies’ model has shifted from 70 percent dine-in to 87 percent takeout, and the brand’s operational design has adjusted in response. The chain plans to continue franchise and corporate growth going forward, while investing in a custom mobile app, new website, and further sales-driving tech platforms.

HEADQUARTERS: OLD GREENWICH, CONNECTICUT

UNITS: 8

In a chicken category dominated by tender and wing brands, Garden Catering has stayed true to the nugget for more than three decades. Debuted by Lou Iandoli as Garden Poultry in 1978 in Greenwich, Connecticut, Garden Catering starts with all-white breast meat sourced from family farms that is humanely raised with no antibiotics ever. They’re then hand-cut and cooked in small batches each day. The process and product have earned cult raves, including TikTok stars Charli and Dixie D’Amelio.

Garden Catering was purchased by Frank Carpenteri Sr. in 1989 following Iandoli’s passing. Today, it’s run by Carpenteri Sr.’s son and

New York Citybased INDAY is taking Indian food and bringing it to a fast-casual format. With five restaurants in office buildings at the time, INDAY was significantly affected by the COVID pandemic. To lessen the impact, it streamlined its menu and prioritized popular dishes like chicken tikka masala and garlic naan. INDAY has different iterations of its restaurant working for various customer bases; an “Express” concept that operates in commercial or transit areas and “INDAY All Day,” a neighborhood-focused concept that features breakfast, lunch, and dinner offerings where customers “live, work, and play.” The brand has its eyes set on expansion, with plans to grow to 18 restaurants by the end of 2024.

daughter across the eight Connecticut and New York locations. The prominence of the nugget hasn’t wavered, of course—guests still flock to Garden Catering to buy them by the pound ( The Boss is a pound, extra fries, and two drinks for about $20) Another menu staple includes The Hotsy Sandwich, a breakfast offering that’s earned national acclaim. It includes bacon, egg, and cheese, and is topped with Garden Catering’s famed potato cones and Hotsy’s chili.

Throughout COVID, Garden Catering built a new tech stack, upgraded employee compensation, and secured new marketing leadership. It plans to expand into retail with a line of sauces and seasoning and open new stores with a redesigned prototype.

HEADQUARTERS:

BAY SHORE, NEW YORK

UNITS: 7

Bango Bowls offers menu items like salads, poke, acai, flatbread paninis, and smoothies. The brand has simplified the processes to execute its menu to fit in its 1,000 squarefoot stores. Bango Bowls says the onset of COVID accelerated its growth because of this smaller store strategy. Maximizing output and dialing in on a small footprint were key steps. The brand also has a digital ordering platform where about 90 percent of its business is takeout.

Bango Bowls is in the process of franchising the concept and plans on beginning to sell franchises at

UNITS: 7 INDAY 24 FEBRUARY 2023 | QSR | www.qsrmagazine.com

The #1 fastest growing snack is now available for your menu! ¡Hola! Churros™ are a delicious, easy-to-prep choice that adds creativity to your menu with all the versatility and customization you look for in delectable desserts. Wondering what you could create with ¡Hola! Churros?

Scan the QR code or visit our website at Churros.com/ideas-guide to find out!

the start of Q2. Long term, the brand has set its sights on 100 units in three years.

HEADQUARTERS: RIVERSIDE, CALIFORNIA

UNITS: 30

A sense of playfulness pervades Cookie Plug, from its graffiti-covered walls to its colorful selection of cookies, with names like the O.G., Purple Haze, and Pixie Junkie, as well as monthly specials. Since the first store debuted

THE KEBAB SHOP

UNITS: 33

in 2019, the brand has swelled to 30 locations across California and Nevada. And despite the pandemic, it managed to open 23 units in the first two years of operation.

Cookie Plug kicked off franchising last March, and now has some 130 units under development through a combination of corporate and franchise-owned deals, with forthcoming locations as far afield as Puerto Rico. And that’s the tip of the iceberg. The company is aiming for 500 open locations and 1,000 more in the pipeline by the end of 2025.

Hot Chikn Kitchn took a signature route to a sizzling category by building around four premium sauces: Base, Medic, After Burner, and Angry Hot. It then couples these flavors with high-quality chicken that’s certified halal. Operationally, a small menu ( there are seven mains and every one includes chicken ), allows the brand to be efficient with limited prep time. The company says employees could show up at 10:30 to open at 11. But there’s also plenty of mission behind the product. Mike Sarago and his son, Anthony Sarago, along with partner Chef Frederic Gilmore, created Hot Chikn Kitchn to “harness the power of food to bring people together.” It started during COVID as a spot to connect community, and has thrived since.

Since originating in San Diego’s East Village in 2007, Kebab Shop has scaled to 33 units, with momentum picking up. The brand faced its share of hardships during COVID, but had infrastructure—digital capabilities for online ordering, pickup, and delivery, and cloud-based operations to help communicate changes to staff—in place to weather the worst of it. In fact, it opened 12 units during the pandemic window and has doubled its store count since 2020. “The Kebab Shop’s experience during COVID-19 motivated us, even more so, to accelerate our growth across

our existing markets and into new ones, including South Florida,” CMO Wally Sadat says.

The Kebab Shop now plans to expand by 10–15 stores per year over the next few, which includes openings in existing markets like California, Texas, and Florida. The ultimate aim: bring the concept to every major city in America.

“Our mission is to ‘Change The Kebab Game’ by making kebabs as approachable here in the U.S. as it is in Europe. We give people a unique Mediterranean experience by using familiar ingredients in surprising ways. From our loaded San Diego Wrap to our award-winning fries, and specialty sauces made in-house, we hope to appeal to everyone,” Sadat says

The Kebab Shop’s popularity grew from an innovative menu and accessible environment. The food focuses on European-Style Kebabs (carved off vertical rotisseries or chargrilled) served in wraps, boxes, or plates that can be customized based on the guests’ preferences, with the brand’s fries and house-made sauces. “The past five years have been crazy; we launched 16 restaurants in five different markets more than doubling our store count since the start of COVID,” Sadat says. “This experience has made our concept stronger, and we are ready to accelerate our growth even further.”

“The brand’s mission of unity through food has been the driving force behind its success. We believe that food is what unites us all and lifts people up,” the company says. Hot Chikn Kitchn hosts “Unity Days” where nonprofits can raise money in-store. They typically run from open to close on Tuesdays and the chain donates 25 percent of guests’ pre-tax sales back to their chosen organization. Recently, Hot Chikn Kitchn went from two to four locations in a single month and isn’t holding back on future goals—it plans to roll more than 200 locations within the next three years.

“HCK is the result of a lot of hard work and determination by our team,” Mike Sarago says. “The brand has a delicious menu that is easy to execute and ready to scale. We cannot wait to bring our Nashville Style Hot Chicken to the whole country.”

Cash handling can be a huge time and labor commitment – something restaurant operators don’t have enough of. SafePoint is comprised of smart safe technology, change order management, armored transportation, and our customer reporting platform, and is designed to make your in-store cash handling quick and easy. Leave it to the pros!

download the Ultimate guide for restaurant Cash Handling

Everything you need to know to increase efficiency, mitigate risk, and reduce costs associated with in-store cash handling.

Folsom, California. In 2023, the company plans to double in size, opening 10 corporate stores and 20 licensed partner outlets.

goal is to give back to the community through serving great hospitality, quality food and to open opportunities to inspire and nurture more potential leaders and chefs to grow and live their passion and purpose with us,” Chef Margaux says.

The Melt bases all of its core decisions on providing customers an “I Love It Here” experience, including reinvention of common comfort foods, like the MeltBurger, which includes Angus and Wagyu beef that’s chopped, grilled, and filled with melted cheddar cheese, jalapeños, pickles, and Melt sauce on a toasted bun.

CEO Ralph Bower credits much of the brand’s success to carefully listening to guests’ changing needs, particularly during COVID. At the onset of the pandemic, sales dropped 80 percent overnight. Bower addressed fears by keeping all restaurants open despite historically low revenue and guaranteeing paychecks for more than 140 employees at the seven Bay Area and Southern California locations. Delivery volume grew from 10 percent pre-pandemic to more than 80 percent within the first month of the shutdown. Nearly three years later, the channel still mixes around 40 percent companywide.

As of November, The Melt’s 2022 revenues were outpacing 2021 by nearly 60 percent, and AUV was more than doubled preCOVID levels. It finished 2022 with 12 company-owned and 13 licensed partner locations, with the recent addition of three restaurants in West Hollywood, Danville, and

Chef J. Margaux started i.8sushi in the heart of 2020’s quarantine. It began in a home garage kitchen in L.A. as a way to prank family and friends during trying times, she says. Or, to show them “great things can come in different and unexpected packages.” That happened to be delivery sushi in a pizza box. As it turned out, Chef Margaux’s Filipino- and tropical-flavor-inspired creations spawned a fast following. The ecofriendly and offbeat experience erupted on Instagram. Looking to meet demand and unable to do so from the garage, Chef Margaux, a 23-year-old immigrant from the Philippines, took the brand to a commercial ghost kitchen in the San Fernando Valley before eventually opening a storefront on Sunset Drive. Chef Margaux got her brand off the ground—and scaling—in two years with Univer. se, an app that helps upstarts like i.8sushi build a website, open shops, and take payments from their phone.

Her plan now is to expand as a takeout favorite across L.A. before, hopefully, thinking national. “Our

“The pandemic was an incredibly challenging time to start a new food venture, but we feel so grateful to have grown so rapidly in just two years—from our garage to two locations in Los Angeles,” she adds. “The support of our community and tools like Univer.se helped us get up and running quickly and expand our footprint to share our passion with more people. We are looking forward to expanding to more storefronts in the L.A. area so we can share our enthusiasm for our sushi made with love.”

HEADQUARTERS: VENTURA, CALIFORNIA

UNITS: 25

Urbane Cafe began in 2003 when owner Tom Holt felt there was a glaring gap in Ventura’s sandwich and salad scene. The concept is known for its fire-baked Focaccia bread, which has been around since the ancient Romans, according to the restaurant. Fresh cuts of all-natural, hormone-free meat are prepared each day for grilling, baking, and roasting, and the brand makes it a point to partner with local growers and food suppliers whenever possible.

During the thick of COVID, Urbane Cafe quickly pivoted by elevating its loyalty app and online

recalls he and business partner Teddy Gailas searching for a capital raise to expand the business. However, the duo left meetings disenchanted with many of the venture capitalist groups. They didn’t have the same belief in culture; talks seemed to focus solely on numbers.

After several backand-forth exchanges with different entities, Phillips was eventually introduced to Mark Leavitt, one of three managing partners at Enlightened Hospitality Investments, a fund connected to well-known restaurateur Danny Meyer. When Leavitt and Phillips sat down for a conversation, there was agreement on values, trajectory, and capabilities—everything Phillips and Gailas sought after previously. After completing due diligence and meeting Meyer and Pete Mavrovitis, the third managing partner, Phillips was convinced that Enlightened Hospitality would be the best partner for growth.

In October, Chip City announced that it received a $10 million capital injection from the fund, which will help the company grow outside of New York City, in markets like New Jersey, Boston, the DMV, Connecticut, and Florida. Phillips says the brand expects to reach 40 locations by the end of 2023. In addition to retail stores, the company partnered with Uber Eats on its nationwide shipping program, allowing the chain to send six packs of cookies anywhere in the country.

Chip City is part of a surge in the cookie segment, along with brands like Crumbl, which sur-

ordering platform. Restaurants introduced takeout racks for to-go customers, launched curbside pickup, and leveraged third-party delivery services to reach homebound guests.

In nearly 20 years of business, Urbane has grown to $54 million in annual sales. The company is primarily based in Southern California, but in 2023, the chain plans to expand by 10 restaurants and introduce its first out-ofstate location in Las Vegas.

HEADQUARTERS:

FAYETTEVILLE, ARKANSAS

UNITS: 3

HEADQUARTERS:

NEW YORK CITY, NEW YORK

UNITS: 14

space. And I think the fact that so many of these concepts have had such great success has added fuel to the fire. Imitation is the greatest form of flattery as they say. So I think people seeing over the last five years how well these types of cookie brands have performed have caused more growth in the space and the segment.”

Omar Kasim could see that quesadillas were the top-selling item at one of his taco shops. Additionally, he learned in a webinar that it was the No. 1 requested item at Chipotle. These discoveries pushed Kasim to create a concept centered around the Mexican favorite. Since opening, Plomo Quesadillas has become a go-to spot around the University of

passed 500 locations, and Cookie Plug, which announced a franchising program. Phillips attributes the rise to the nostalgia of cookies. It makes the dessert relatable. He also points out how cookies are made for social media and visible content.

“The cookie break, the way that translates to a photo, it’s just very Instagrammable, very popular on TikTok,” Phillips says. “And I think anything that trends on social media nowadays creates a big driver of momentum in the

Being part of an increasingly competitive space, Chip City looks to separate itself with quality and the customer experience, Phillips says. The company completes its own production. Chip City owns an 18,000-square-foot commissary in College Point, Queens, where it makes all cookies from scratch. Phillips says the brand has opted to not use a copacker so that it can remain on the cutting edge. Chip City has more than 40 flavors in rotation, and the chain is continuing to innovate.

The brand is registered to sell franchises, but any approach it takes will be measured.

“If we found a partner that we feel like will maintain the Chip City experience the way that we do it at our corporate locations, it will be something that we entertain,” Phillips says. “But we’re just going very slowly with it because again we’re just very committed to the integrity of the product and consistency of the product.”

Arkansas, especially after 2 a m on weekends. The brand only serves quesadillas and certain sides, and each one is named after notorious individuals in history, like The Escobar and The Jesse James. Customers are able to “Make it Dirty,” by having their quesadilla crusted with an additional layer of cheese on the outside.

“Everyone has this notorious alternative side of them, and we lean into that. During the day, you can be good and have a salad. When you’re out on a Friday night, however, that is the time to indulge and Make it Dirty,” Kasim says.

Currently the brand touts two brick-and-mortar locations and a food truck named the “Plomobile.” The brand is scheduled to open its first out-of-state location in Dallas this summer.

HEADQUARTERS: PASADENA, CALIFORNIA

UNITS: 4

unforgettable experience for all,” says Michelle Chino, head of corporate marketing at Sip Fresh. “Our stores offer a fun, interactive experience which the whole family can enjoy. Sip Fresh creations were made for a new era in the beverage industry and are social media, Instagram-worthy favorites. We pride ourselves in the quality products we craft and the fun we serve up at each of our locations.”

Eye-catching storefronts and displayed juice barrels draw guests to a menu that’s anchored by Fresh Sips ( the juices ) and rounded out by Tropical Sips, Cha Cha Chamoys, Smoothie Sips, and Shakin’ Tea Sips. “Sip Fresh creations were made for a new era in the beverage industry and are social media, I nstagram-worthy favorites,” the company adds. “We pride ourselves in the quality products we craft and the fun we serve up at each of our locations.”

HEADQUARTERS: WASHINGTON, D.C.

UNITS: 7

Call Your Mother Deli describes itself as a destination for playful and nostalgic comfort food, including its signature bagels, sandwiches, and baked goods. All stores combined, the brand makes 45,000 bagels each week. The company says its bagels are a mixture of the classic New York-style and the sweeter Montreal-style. Cofounder

Andrew Dana is Jewish and draws on the eclectic food from his childhood memories to inspire the menu. Meanwhile, cofounder Daniela Moreira has worked in several

The inspiration for Sip Fresh began, as the company likes to say, on a balmy evening at a local bar. Could a juice chain mirror the mixology trend that had taken over the beverage scene? Sip Fresh carried this mantra throughout growth and development. The chain crafts recipes in-house with “Sipologists” during the day in small batches. “Sipistas” greet customers with fresh samples of juices to narrow their choices akin to an ice cream shop. The fresh and interactive experience has set the chain apart in what’s become a $146 billion industry, the company says.

“The idea behind Sip Fresh is simple: create fresh, eye-stopping, delicious drinks that provide an

Sip Fresh, like many, had to close during 2020 lockdowns. It took the time to integrate new tech, optimize the menu, and enable online ordering as stores got back on line. These changes, it says, helped the business and provided a better platform to scale. Sip Fresh initially plans to pursue growth in the Western and Southwestern portions of the country.

“As a multi-unit franchisee for decades, my focus at Sip Fresh is to incorporate the key elements needed to run a successful business from the franchisee’s standpoint,” says Sharon A rthofer, Sip Fresh CEO and founder, and 27-year franchise industry veteran. “We have designed a business model that provides strong consumer traffic with manageable labor, highly streamlined operations to maximize profitability. Our goal is for our franchisees to succeed in this new space; prioritizing seamless processes in order to service more guests and establish a loyal following in their community.”

HEADQUARTERS: NEW YORK CITY, NEW YORK

UNITS: 6

The start of COVID was particularly difficult for Chinah, which had two stores at the time located in the ground floor of office mid-rises. With the switch to work from home, sales predictably fell, dropping as much as 95 percent during Omicron. Realizing that office occupancy may never return to pre-pandemic levels, the fast casual is now pivoting to locations that offer sidewalk access in high foot traffic areas. Ghost kitchens are coming into the fold as well.

The company said it’s equipped with a low-cost operating model that will allow it to reach dozens of locations in the next two years and hundreds of stores by the end of the decade.

Chinah’s proteins—including tangy braised pork shoulder, crispy air-fried sesame and kung pao chicken, and spicy mapo tofu—are sourced from a commissary and finished onsite in combi-ovens, which don’t require any venting. Because of this, the chain can open new restaurants for as little as $50,000 in equipment, labor, and buildout costs. Chinah is planning to reach Washington, D.C. in 2023, while also growing in New York City. In 2024 and beyond, it will expand to other East Coast cities and ultimately, nationwide.

Twisted Kitchen is a great choice for franchising - offering fresh food, fast. Our guests can create-your-own meals or select one of our delicious choices prepared with high quality ingredients. Stay and enjoy your meal in our friendly inviting dining room or order to go. Our brand fits today’s lifestyle of “On-the-go”, health conscious and customized by the consumer.

Our staff enjoys the easy processes developed to deliver a seamless ordering experience for our guests. The employee training system makes it easy to get your new team member started.

• Founded in 2009

• Menu offerings of build your own pasta, wraps and salads appeals to all age groups

• Exciting design and multiple development opportunities

• Experienced support team

restaurants and grew up cooking campsite meals with family in Argentina. Almost everything at Call Your Mother is made in-house. If it isn’t, it’s sourced from a trusted partner, like Z&Z, Logan’s Sausage, and Liberty Delights.

During the height of COVID, Dana and Moreira grew their team to 200 workers and expanded benefits to feature language classes, practical skills workshops, and parental leave. Call Your Mother supports the local D.C. community through partnerships with Urban Alliance, AYUDA, Food Rescue, and Martha’s Table.

In 2023, Call Your Mother will expand beyond Washington, D.C., for the first time, opening three new stores in Denver.

HEADQUARTERS: HARLEM, NEW YORK

UNITS: 2

HEADQUARTERS: CENTENNIAL, COLORADO

UNITS: 28

Coffee of Hawaii will naturally garner some attention, but the Colorado-based coffee and cafe brand has the beans to back it up.

After relaunching under new ownership and leadership in 2018, Bad Ass Coffee of Hawaii is making a name for itself as a rejuvenated 33-year-old franchise brand. Led by CEO Scott Snyder, the coffee company recently signed its largest deal in brand history to open 20 locations in Florida. With about 80 additional units sold and in various stages of development, the concept is well on the way to its goal of opening 150 new locations over the next five years.

“I saw its potential and knew what was missing to transform Bad Ass Coffee of Hawaii to new levels of success,” Snyder told QSR in August 2022. “We knew

eight draught beers.

from the start that there would be a lot of change to manage in the organization, so leadership alignment around one common vision would be critical. Even after the pandemic started, we maintained our focus on the vision but were still able to execute efficiently and pivot as a team when met with challenges.”

In addition to aggressive franchise sales and development, Bad Ass Coffee also experienced a 66 percent increase in average unit volume in 2021 to $720,000, which is up 76 percent from 2019. The brand debuted new store prototypes in 2022 designed to ignite rapid growth, plus rolled out a new point-ofsale system that integrates online ordering and loyalty on one platform. And a significant menu innovation project with Denver-based Food & Drink Resources provided a road map for the brand’s future food and beverage options, which will be ontrend and inspired by its Hawaiian heritage.

“Bad Ass Coffee’s dedication to sharing Hawaiian coffee starts with its longstanding partnerships with multi-generational Hawaiian coffee farmers, including Greenwell Farms in Kona—the oldest coffee farm on the Hawaiian Islands and one Bad Ass Coffee of Hawaii is proud to call a partner for the past 33 years,” says Chris Ruszkowski, senior vice president of marketing for the brand. “Through these partnerships, the brand embraces its unique practice of harvesting some of the highest-quality coffee beans in the world.”

Harlem Shake serves up burgers, shakes, “and good times” amid a backdrop of vintage diner decor and more than 200 autographed celebrity headshots, from Maya Angelou to P.Diddy and Asap Rocky. In addition to burgers made with custom blend Pat LaFrieda patties, Harlem Shake offers other made-to-order fare including allbeef hot dogs, chicken sandwiches, Jerk Fries, grilled cheese melts, entree-size salads, and an extensive beer and wine selection including

The retro burger joint was founded in 2012 by Jelena Pasic, who fell in love with Harlem’s warmth, charm, history and spirit of the Harlem Renaissance. Her own small-town Croatian roots instilled a strong sense of local community pride and passion for tradition in Pasic, so she ensured the dining experience would pay homage to Harlem’s history through careful design and an ongoing relationship with community members, which includes predominantly hiring folks living in the Harlem neighborhood. For example,

Dardra Coaxum is a Harlem native who manages the brand’s social media and community relations for the restaurant’s second location in Brooklyn, which opened in October 2021 despite pandemic-related challenges.

With a goal to expand the retro, fast-casual concept into more beloved neighborhoods, Harlem Shake is working on refining its franchise program and developing a sales team, though it will continue opening corporate-owned locations to grow its footprint. The brand has registered to sell franchises in 31 states.

HEADQUARTERS: CEDAR PARK, TEXAS

UNITS: 17

Smokey Mo’s BBQ offers its Texas style throughout the central part of the state, including low and slow-

With custom programming, one-touch operation and precision performance, Vitamix® machines empower employees to achieve perfectly consistent results every time – even the first time.

It’s just one reason we’re the industry’s most trusted blending partner.

See what else sets us apart at VITAMIX.COM/OURDIFFERENCE

cooked brisket, which is smoked in-house for 10-14 hours each day at every location. A notable differentiation is that all stores have a trained pitmaster who’s an expert in the art of smoking, slicing, and serving meat, giving each restaurant a particular taste.

At the start of COVID, when everything was shut down, Smokey Mo’s was forced to lay off 40 percent of its staff. However, the fast casual was able to bring these jobs back within weeks. In fact, throughout the pandemic, the brand maintained nearly full staffing and amplified its catering, third-party delivery, and takeout channels to meet the needs of customers.

In January, the Texas chain announced it was purchased by private equity firm Switchback Capital. The company intends to help the restaurant debut 32 locations in the next three years and unveil a new brand look. CEO Craig Haley said the updated design streamlines operations, provides an open view of smokers, and develops clearer pathways for preparing and delivering food to guests during peak hours.

HEADQUARTERS:

As the self-proclaimed world’s most innovative donut and ice cream concept, Yonutz is on a mission to “smash the ordinary” by smashing donuts and ice cream together in a concoction perfectly designed for Instagram and Tik Tok. The sweet treat brand aims to transport guests “into a whimsical dessert wonderland,” where customers create one-of-a-kind Smash Donuts from an array of gourmet donuts, ice cream, and topping choices. A photo wall allows guests to capture the perfect pic for their social feed—providing free advertising for Yonutz, as a bonus.

Yonutz’s partnership with Kevin Harrington, original “Shark” on the Emmy-winning TV show, “Shark Tank,” plus being awarded “Best Dessert Shop in South Florida” by CNN has helped Yonutz quickly rise to fame, collecting loyal fans along the way. Winning Dessert Wars in 2019 and 2020 also aided in building brand name recognition.

After completing a company rebrand and renovation of its flagship location in South Florida during the pandemic, Yonutz began offering franchises and opened seven locations in 2022 that feature neon signs, colorful countertops, and revamped bar areas with additional seating. The brand has about 20 more new shops in the pipeline, with more promised to follow.

HEADQUARTERS:

CONWAY, ARKANSAS

UNITS: 25

TACOS 4 Life was founded with the mission to end world hunger. In 2009, cofounders Austin and Ash-

ton Samuelson learned that more than 18,000 children die each day due to hunger-related causes. Five years later, the duo created Tacos 4 Life, which donates a meal for every taco, salad, quesadilla, rice bowl, or nachos sold via nonprofit partner Feed My Starving Children. Unlike other concepts, the donation isn’t a limited-time offer or promotion. It’s a continuous program that’s resulted in 26.5 million meals sent to children. Even during the pandemic-ridden 2020, the fast casual was able to raise 4.3 million meals.

In 2022 alone, Tacos 4 life

projects hitting 5.5 million meals. With all the restaurants either open, under construction, and in development, the brand believes it will reach 10 million meals per year in the future.

Tacos 4 Life is known for its Korean BBQ Steak, Hawaiian Shrimp Taco, Chicken Bacon Ranch Taco, Firecracker Shrimp, and Sweet & Spicy BBQ Pork Taco. The company adjusted to COVID by growing its off-premises offerings, including a new mobile order system through its app and the addition of curbside pickup.

HEADQUARTERS: MINNEAPOLIS, MINNESOTA

UNITS: 8

My Burger, founded in 2004 by Larry Abdo, is a family affair. All eight stores are owned and operated by multiple generations, and thoughtful growth has been focused on the Twin Cities area. As the company expands, it’s dedicated to keeping the brand local and family-owned.

Restaurants blend old-school mentality with modern design; never-frozen burger patties are hand-pressed and hand-sliced, and vintage milkshake machines line walls that are covered with bold graphics and clever phrases. The decor is specific to each store to create a local feel.

Passion for the brand starts at the stop. CEO John Abdo and other executives regularly work in stores, whether it’s on the line, cleaning, or expediting. The corporate team passes that excitement to staff; several managers and cooks have been with the brand since the beginning or for more than 10 years.

For My Burger, takeout has always been a big business. The fast casual uses a special burger box with punch-out holes that was rigorously tested to ensure food would hold up for walks back to Minneapolis offices. Also, during COVID, the company pivoted to Toast’s POS system to align operations and track guest behavior.

HEADQUARTERS: SALT LAKE CITY, UTAH

UNITS: 11

Chip Cookies was born in 2016 out of a rented kitchen in Provo, Utah, by husband and wife cofounder duo Sarah and Sean Wilson. Sarah’s late-night pregnancy cravings for warm chocolate chip cookies led to “a new category of cookies,” and the brand now touts itself as the original gourmet cookie delivery company with 11 locations in Utah and Idaho and $6 million in systemwide annual sales.

From the OG Chocolate Chip Cookie and Biscoff Chip to a Sugar Chip cookie with homemade cream cheese frosting, Chip’s cookies are all freshly baked and delivered locally as well as shipped nationwide. A focus on sourcing high-quality ingredients and mantra of providing “quality over quantity” helps differentiate Chip Cookies from competitors in the treat segment.

The delivery concept was in a favorable position when the pandemic hit, and managed to open a new store and convert some locations to temporary drive-thrus.