Latin America is witnessing substantial economic growth and diversification through strategic investments across various sectors. From eco-tourism to renewable energy projects, the region offers a wealth of opportunities for investors. Countries like Costa Rica, Colombia, Chile, and Jamaica are leading the charge, creating compelling investment prospects. Here’s an in-depth look at some of the major developments in Latin America that present significant investment opportunities.

Eco-Tourism Ventures in Costa Rica

Selina

A global hospitality brand started in Central America, known for its focus on eco-friendly accommodations. Selina offers sustainable lodging options that cater to eco-conscious travelers, emphasizing community engagement and environmental responsibility.

Kasiiya Papagayo

An eco-luxury resort in Costa Rica that emphasizes sustainable tourism practices. Kasiiya Papagayo integrates luxury with sustainability, providing a model for eco-friendly tourism that preserves natural resources and supports local communities.

Ruta N

An innovation and business center in Medellín aimed at transforming the city into a tech hub. Ruta N fosters technological innovation and entrepreneurship, making Medellín a prominent center for tech startups and innovation in Latin America.

Medellín Innovation District

A district fostering innovation and technology. The Medellín Innovation District supports startups, technology firms, and educational institutions, creating a vibrant ecosystem for technological advancement.

Rappi

A Colombian on-demand delivery startup that has expanded across Latin America, attracting significant international investment. Rappi exemplifies the rapid growth and potential of tech startups in Colombia, driving innovation in the delivery and logistics sectors.

Renewable Energy Projects in the Dominican Republic

Parque Eólico Los Cocos

The largest wind farm in the Caribbean, contributing to the country's renewable energy capacity. Parque Eólico Los Cocos plays a crucial role in diversifying the Dominican Republic's energy sources and reducing reliance on fossil fuels.

Monte Plata Solar

One of the largest solar power plants in the Caribbean. Monte Plata Solar represents significant strides in renewable energy, helping to meet the Dominican Republic’s energy needs sustainably.

Agritech Innovations in Brazil

Solinftec

A Brazilian agritech company providing digital solutions for agriculture. Solinftec's technology enhances farming efficiency and productivity, making it a key player in the agritech sector.

Agrosmart

A startup offering precision agriculture tools to optimize farming practices. Agrosmart’s innovations help farmers make data-driven decisions, improving crop yields and resource management.

Hospitality Boom in Mexico’s Riviera Maya

Azulik

An eco-friendly luxury resort in Tulum known for its sustainable design. Azulik combines luxury with sustainability, offering unique experiences that prioritize environmental conservation.

Xcaret

A resort and eco-archaeological park emphasizing sustainable tourism and cultural preservation. Xcaret showcases the integration of tourism with environmental and cultural stewardship.

Artisanal Craft Enterprises in Peru

Artesanías de Chile

While based in Chile, it provides a model for supporting artisans through fair trade. Artesanías de Chile's approach can be replicated to empower Peruvian artisans and promote sustainable craft industries.

“Influential Magazines, driven by its unwavering aim and mission, strives to be a catalyst for global business transformation. Our commitment extends beyond the conventional, as we envision Unlocking vast business potential in emerging economies. This endeavor creates an unparalleled opportunity for worldwide expansion and knowledge exchange. The emerging nations, marked by dynamic markets and untapped resources, beckon entrepreneurs, investors, and enterprises globally to partake in mutually beneficial ventures. Influential Magazines serves as the conduit for this transformative journey, shedding light on the visionary growth strategies, infrastructure development, and burgeoning consumer bases within the emerging nations. As these economies evolve and innovate, our mission is to foster international collaboration, creating a vibrant space where industries thrive, and insights are shared. Embracing the business potential in these emerging economies not only unlocks doors for unprecedented growth but also nurtures a global dialogue, enriching our collective understanding of diverse business landscapes and strategies. The emerging nations, through Influential Magazines, transcend being mere destinations for business, they also become dynamic hubs for cross-cultural learning and collaboration."

Influential Magazine

3010 LBJ Freeway, Suite 1200 Dallas , TX , 75234-7770

Tel: 1 469 9667050

4 ECO-TOURISM venturesIN costa rica 8 tech hubs in colombia 12 renewable energy works of dom rep 16 agritech innovations in brazil 22 hospitality boom in mexico 28 artisanal craft enterprises in peru 34 health tech advancements in chile 38 educational technology in jamaica 42 sustainable fashion brands in guatemala 46 urban development projects in panama

Costa Rica has emerged as a global leader in eco-tourism, thanks to its rich biodiversity, commitment to sustainability, and innovative hospitality ventures. This article explores two prominent ecotourism ventures—Selina and Kasiiya Papagayo—that exemplify the country's sustainable tourism practices. It also provides investment tips for those interested in supporting and profiting from this growing sector.

### Selina: Redefining Eco-Friendly Accommodations

Selina is a global hospitality brand that started in Central America and has quickly expanded to over 20 countries. Known for its unique blend of coworking spaces, accommodations, and wellness facilities, Selina places a strong emphasis on eco-friendly practices.

Selina properties are designed with sustainability in mind, using locally sourced materials and incorporating elements of the natural environment. This approach not only reduces the carbon footprint but also supports local economies. Selina engages with local communities through various initiatives. They employ local staff, source food from local farmers, and support community projects. This integration helps create a positive impact on the

local economy and environment. Selina offers eco-friendly amenities such as organic toiletries, recycling programs, and water-saving technologies. Their properties also feature communal kitchens to reduce food waste and promote shared consumption.

### Investment Opportunities with Selina

Investing in Selina offers several opportunities for those interested in the eco-tourism sector. Investors can purchase shares in Selina through private equity deals or public offerings (if available). This allows investors to benefit from the company's growth and expansion. Investing in properties operated by Selina can be a lucrative option. These properties tend to appreciate in value due to their prime locations and sustainable practices. Investors can also partner with Selina to develop new properties or enhance existing ones. This can involve providing capital for renovations, expansions, or new builds in emerging eco-tourism destinations.

### Kasiiya Papagayo: A Paradigm of Eco-Luxury

Kasiiya Papagayo is an eco-luxury resort located on the Papagayo Peninsula in Costa Rica. This resort sets a high standard for sustainable tourism

practices while providing guests with a unique, luxurious experience.

Kasiiya Papagayo is built with minimal environmental impact. The resort uses sustainable construction methods and materials, ensuring that the natural landscape is preserved. The resort is powered by renewable energy sources, including solar panels and wind turbines. This commitment to clean energy reduces the resort's carbon footprint and reliance on non-renewable resources. Kasiiya Papagayo actively participates in biodiversity conservation efforts. The resort's grounds serve as a sanctuary for local wildlife, and guests are encouraged to engage in ecofriendly activities like guided nature walks and wildlife observation. The resort has a comprehensive waste management system that includes recycling, composting, and reducing single-use plastics. Guests are provided with reusable water bottles and bags to minimize waste.

### Investment Opportunities with Kasiiya Papagayo

Investing in Kasiiya Papagayo and similar eco-luxury resorts offers several avenues for potential investors. Investors can directly invest in Kasiiya Papagayo by purchasing equity or providing capital for expansion

Eco-conscious travelers are more likely to support businesses that demonstrate a genuine commitment to sustainability.

projects. This can yield significant returns as the resort grows and attracts more visitors. Purchasing or developing eco-luxury real estate near Kasiiya Papagayo can be a profitable venture. Properties in eco-tourism hotspots tend to appreciate in value, providing longterm investment potential. Investors can consider investing in sustainable tourism funds that focus on ecofriendly resorts and hotels. These funds typically invest in multiple properties, spreading the risk and increasing potential returns.

Costa Rica's commitment to sustainability has positioned it as a leading destination for eco-tourism. The country's diverse ecosystems, from rainforests to beaches, attract millions of tourists each year. This influx of eco-conscious travelers has spurred the growth of eco-friendly accommodations and sustainable tourism practices.

The Costa Rican government has implemented various policies and incentives to promote sustainable tourism. Certification for Sustainable Tourism (CST) certifies tourism businesses that meet strict environmental and social standards. Both Selina and Kasiiya Papagayo have achieved high CST ratings, further enhancing their appeal to eco-conscious travelers. The government offers tax incentives to businesses that invest in sustainable practices. This includes tax breaks for using renewable energy, water conservation measures, and waste management systems. Costa Rica has designated over 25% of its land as

protected areas, ensuring the preservation of its natural beauty and biodiversity. This commitment to conservation attracts tourists and investors alike.

Investing in eco-tourism in Costa Rica requires a strategic approach.

Thoroughly researching the ecotourism market in Costa Rica is essential. Understanding the demand, competition, and regulatory environment is crucial to making informed investment decisions. Collaborating with local experts and businesses can provide valuable insights into the market and help navigate the regulatory landscape. Local partnerships can also enhance the credibility and authenticity of your investment. Ensuring that your investment aligns with sustainable practices is important. Eco-conscious travelers are more likely to support businesses that demonstrate a genuine commitment to sustainability. Taking advantage of government incentives for sustainable tourism can reduce costs and improve the profitability of your investment. Diversifying your investment portfolio by investing in different aspects of eco-tourism, such as accommodations, renewable energy projects, and conservation initiatives, can also be beneficial.

The future of eco-tourism in Costa Rica looks promising. As more travelers seek sustainable and authentic experiences, the demand for ecofriendly accommodations is expected to grow. This presents a significant

opportunity for investors to support the development of sustainable tourism infrastructure. Technological innovations are playing a crucial role in the evolution of eco-tourism. From renewable energy solutions to smart waste management systems, technology is enhancing the sustainability and efficiency of ecotourism businesses. Investors should stay abreast of these innovations and consider integrating them into their investment strategies. Successful ecotourism ventures prioritize community engagement and social impact. By supporting local communities and preserving cultural heritage, these businesses create a positive and lasting impact. Investors should look for opportunities that emphasize community involvement and social responsibility.

Eco-tourism in Costa Rica offers a unique blend of sustainability and profitability. Ventures like Selina and Kasiiya Papagayo exemplify the potential for eco-friendly accommodations to attract travelers and generate significant returns. By investing in sustainable tourism practices and leveraging government incentives, investors can contribute to the preservation of Costa Rica's natural beauty while reaping the benefits of this growing sector. The key to successful investment in ecotourism lies in thorough research, strategic partnerships, and a genuine commitment to sustainability. As the demand for eco-friendly travel experiences continues to rise, Costa Rica remains a prime destination for eco-tourism investments that promise both financial and environmental rewards.

olombia has become a beacon for technological innovation in Latin America, with Medellín leading the charge as a burgeoning tech hub. Once known primarily for its troubled past, Medellín has undergone a remarkable transformation, earning recognition as a city of innovation. This article explores the key players in this tech revolution— Ruta N, the Medellín Innovation District, and the on-demand delivery startup Rappi. Additionally, it provides investment tips for those looking to capitalize on Colombia's growing tech scene.

Ruta N: Transforming Medellín into a Tech Hub

Ruta N, an innovation and business center in Medellín, is a pivotal force behind the city's transformation into a tech hub. Founded in 2009, Ruta N was established with the goal of fostering economic development through technology and innovation. The center offers a variety of services, including business incubation, acceleration programs, and access to venture capital. It also provides a collaborative space where startups, corporations, and research institutions can interact and innovate together.

Ruta N has been instrumental in attracting international tech companies

to Medellín. Firms such as HewlettPackard, IBM, and SAP have established operations in the city, drawn by the supportive environment and access to a talented workforce. The center also supports local startups, helping them scale and compete on a global stage. This has created a vibrant ecosystem where ideas can flourish and businesses can grow.

Medellín Innovation District: Fostering Innovation and Technology

The Medellín Innovation District, another cornerstone of the city's tech ecosystem, is a dedicated area designed to foster innovation and technology. The district is home to numerous tech companies, research institutions, and educational facilities, all working together to drive technological advancements. It offers state-of-the-art infrastructure, including high-speed internet, modern office spaces, and coworking areas, making it an attractive location for both startups and established tech firms.

The Medellín Innovation District aims to create a collaborative environment where knowledge can be shared and new ideas can be developed. This synergy is vital for the growth of the tech sector, as it encourages crosspollination of ideas and fosters an entrepreneurial spirit. The district also

hosts events, workshops, and conferences, providing opportunities for networking and professional development.

appi: A Colombian Tech Success Story

One of the standout success stories of Colombia's tech scene is Rappi, an ondemand delivery startup that has expanded across Latin America. Founded in Bogotá in 2015, Rappi has quickly grown to become a major player in the region's tech industry. The company offers a wide range of services, including grocery delivery, restaurant takeout, and even cash withdrawals.

Rappi's rapid growth has attracted significant international investment. In 2018, the company secured $200 million in funding from DST Global, a venture capital firm led by Russian billionaire Yuri Milner. This investment valued Rappi at over $1 billion, making it one of the few unicorns in Latin America. Subsequent funding rounds have further bolstered the company's valuation and growth prospects.

Rappi's success can be attributed to its innovative business model and ability to adapt to the needs of consumers in different markets. The company

One of the standout success stories of Colombia's tech scene is Rappi, an on-demand delivery startup that has expanded across Latin America. Founded in Bogotá in 2015, Rappi has quickly grown to become a major player in the region's tech industry. The company offers a wide range of services, including grocery delivery, restaurant takeout, and even cash withdrawals.

Supporting innovation hubs like Ruta N and the Medellín Innovation District can be a strategic move for investors. These centers provide a fertile ground for startups and offer resources that can enhance the growth and success of tech ventures. Investing in infrastructure, mentorship programs, and incubation services can yield long-term benefits for both investors and the broader tech community.

leverages technology to provide a seamless user experience, with features such as real-time tracking, personalized recommendations, and multiple payment options. This focus on customer satisfaction has helped Rappi build a loyal user base and expand its services rapidly.

Investing in Colombia's tech sector presents several opportunities. The country's growing economy, supportive government policies, and vibrant tech ecosystem make it an attractive destination for investors. However, it's important to approach investment with careful consideration and strategic planning.

Thorough research is crucial when investing in Colombia's tech sector. Understanding the local market, regulatory environment, and competitive landscape is essential. Investors should also be aware of the cultural nuances and business practices that can impact the success of their investments.

Partnering with local firms can provide valuable insights and help navigate the complexities of the Colombian market. Local partners can offer on-the-ground knowledge and connections that can be critical for success. They can also help bridge cultural gaps and ensure that investments are aligned with local needs and preferences.

Investors should consider diversifying their portfolios by investing in a mix of startups, established companies, and venture capital funds. This approach can help spread risk and increase the potential for returns. Investing in a variety of sectors, such as fintech, health tech, and agri-tech, can also provide exposure to different growth opportunities within the tech ecosystem.

Supporting innovation hubs like Ruta N and the Medellín Innovation District can be a strategic move for investors. These centers provide a fertile ground for startups and offer resources that can enhance the growth and success of tech ventures. Investing in infrastructure, mentorship programs, and incubation services can yield long-term benefits for both investors and the broader tech community.

Investing in companies like Rappi, which have demonstrated significant growth and scalability, can be a lucrative opportunity. However, it's important to conduct thorough due diligence to assess the company's financial health, market position, and growth prospects. Understanding the competitive landscape and potential risks is also crucial.

Staying informed about government policies and incentives can help investors take advantage of favorable conditions for tech investments. The Colombian government has

implemented various initiatives to support the tech sector, including tax incentives, grants, and funding programs. Keeping abreast of these opportunities can enhance the profitability of investments.

Investing in education and talent development can also yield significant returns. Colombia has a growing pool of tech talent, but there is still a need for skilled professionals in areas such as software development, data science, and cybersecurity. Supporting educational programs, coding bootcamps, and training initiatives can help address this gap and create a more robust tech ecosystem.

Investors should consider the long-term potential of their investments. The tech sector in Colombia is still evolving, and it may take time for investments to yield substantial returns. Patience and a long-term perspective are essential for navigating the ups and downs of the market and realizing the full potential of investments.

Medellín's transformation into a tech hub is a testament to the city's resilience and forward-thinking approach. Ruta N, the Medellín Innovation District, and Rappi exemplify the innovative spirit that is driving Colombia's tech revolution. By investing in these ventures and supporting the broader tech ecosystem, investors can contribute to the country's economic growth and development while reaping significant rewards.

Investing in Colombia's tech sector presents several opportunities. The country's growing economy, supportive government policies, and vibrant tech ecosystem make it an attractive destination for investors. However, it's important to approach investment with careful consideration and strategic planning.

The Dominican Republic has emerged as a leader in renewable energy in the Caribbean, harnessing wind and solar power to reduce its dependence on fossil fuels and promote sustainable development. This article explores two major renewable energy projects— Parque Eólico Los Cocos and Monte Plata Solar. It also provides investment tips for those interested in contributing to and benefiting from the growth of renewable energy in the Dominican Republic.

Parque Eólico Los Cocos: Pioneering Wind Energy in the Caribbean

Parque Eólico Los Cocos, located in the southwestern region of the Dominican Republic, is the largest wind farm in the Caribbean. The project, developed by the Empresa Generadora de Electricidad Haina (EGE Haina), began operations in 2011 and has since significantly contributed to the country’s renewable energy capacity.

Covering an area of approximately 15,000 hectares, Parque Eólico Los Cocos has an installed capacity of 215 MW, generated by 40 wind turbines. The farm's production capability plays a crucial role in reducing greenhouse gas emissions and decreasing the Dominican Republic's reliance on imported fossil fuels. The success of Los Cocos has also inspired other wind energy projects in the region, reinforcing the country’s commitment to renewable energy.

The implementation of Parque Eólico Los Cocos has had positive economic and environmental impacts. By providing a reliable source of clean energy, the wind farm helps stabilize energy prices and ensures a more sustainable energy supply. Additionally, the project has created jobs and stimulated economic growth in the surrounding communities.

Monte Plata Solar: A Beacon of Solar Power

Monte Plata Solar, located in the province of Monte Plata, is one of the largest solar power plants in the Caribbean. Developed by the multinational company Phanes Group in collaboration with the General Energy Solutions (GES) and Soventix, the project began operations in 2016. Monte Plata Solar boasts an installed capacity of 30 MW, generated by approximately 132,000 photovoltaic panels spread across 67 hectares. The solar power plant produces enough electricity to power around 25,000 homes and reduces carbon dioxide emissions by an estimated 35,000 tons annually. Monte Plata Solar is a key component of the Dominican Republic's strategy to diversify its energy mix and increase the share of renewable energy in its national grid.

The success of Monte Plata Solar demonstrates the potential of solar power in the Caribbean, where abundant sunshine provides an ideal environment for solar energy projects. The plant’s contribution to energy security, environmental sustainability, and economic development makes it a model for future renewable energy initiatives in the region.

Investment Opportunities in the Dominican Republic's Renewable Energy Sector

Investing in renewable energy projects in the Dominican Republic presents numerous opportunities for both local and international investors. The country’s favorable geographic conditions, supportive government policies, and growing demand for clean energy make it an attractive destination for renewable energy investments. However, successful investment requires careful consideration and strategic planning.

These initiatives showcase the potential of wind and solar power to drive sustainable development and energy security in the Caribbean. By investing in these projects and supporting the growth of the renewable energy sector, investors can contribute to the country's economic development and environmental sustainability.

Thorough research is essential when investing in the Dominican Republic's renewable energy sector. Investors should familiarize themselves with the local market dynamics, regulatory framework, and competitive landscape. Understanding the policies and incentives offered by the Dominican government can help investors take advantage of favorable conditions for renewable energy projects.

The Dominican Republic has implemented various policies to promote renewable energy, including tax incentives, grants, and feed-in tariffs. These measures aim to attract investment and encourage the development of clean energy projects. Staying informed about these incentives and regulatory changes can enhance the profitability of investments.

Collaborating with local firms and stakeholders can provide valuable insights and facilitate the investment process. Local partners can offer onthe-ground knowledge and connections that are critical for

navigating the complexities of the Dominican market. They can also help ensure that investments align with local needs and preferences.

Investing in renewable energy projects not only provides financial returns but also contributes to environmental sustainability and social development. Projects like Parque Eólico Los Cocos and Monte Plata Solar have positive impacts on reducing greenhouse gas emissions and promoting clean energy. Additionally, these projects create jobs, stimulate local economies, and improve energy access for communities.

Investors should consider the broader environmental and social impact of their investments and support projects that align with sustainable development goals. This approach not only enhances the long-term viability of investments but also contributes to positive outcomes for society and the environment.

Long-Term Investment Perspective

require significant upfront investment and may take time to generate substantial returns. Investors should adopt a long-term perspective and be prepared to navigate the ups and downs of the market. Patience and a commitment to sustainability are key to realizing the full potential of renewable energy investments.

The Dominican Republic's commitment to renewable energy is evident in the successful implementation of projects like Parque Eólico Los Cocos and Monte Plata Solar. These initiatives showcase the potential of wind and solar power to drive sustainable development and energy security in the Caribbean. By investing in these projects and supporting the growth of the renewable energy sector, investors can contribute to the country's economic development and environmental sustainability.

The Dominican Republic's strategic location, abundant natural resources, and supportive government policies create a favorable environment for renewable energy investments. As the country continues to prioritize clean energy, the opportunities for investors are expected to grow.

Brazil, one of the world's leading agricultural producers, is experiencing a wave of agritech innovations that are transforming the industry. These advancements are driving efficiency, sustainability, and productivity in farming practices. Among the notable players in this revolution are Solinftec and Agrosmart, two companies that are at the forefront of agritech development in Brazil. This article explores their contributions to the field and offers investment tips for those interested in Brazil's burgeoning agritech sector.

Solinftec: Revolutionizing Agriculture with Digital Solutions

Solinftec, a Brazilian agritech company, has emerged as a key player in the agricultural technology landscape.

Founded in 2007, Solinftec specializes in providing digital solutions designed to enhance agricultural productivity and sustainability. The company’s flagship product is its comprehensive digital platform, which integrates various technologies to offer real-time insights and data-driven recommendations for farmers.

The Solinftec platform uses advanced sensors, machine learning algorithms, and cloud computing to collect and analyze data from various sources, including weather conditions, soil moisture levels, and crop health. This data is then used to generate actionable insights that help farmers make informed decisions about their operations. By optimizing factors such as irrigation, fertilization, and pest control, Solinftec’s technology contributes to more efficient and sustainable farming practices.

One of Solinftec's key innovations is its use of precision agriculture techniques. These techniques involve applying inputs such as water, fertilizers, and pesticides with high precision, tailored to the specific needs of different areas within a

field. This approach not only improves crop yields but also reduces waste and minimizes environmental impact. Solinftec’s solutions have been adopted by numerous farms across Brazil and other countries, demonstrating their effectiveness in enhancing agricultural productivity.

The company’s focus on digital solutions aligns with the broader trend of digital transformation in agriculture. As farmers increasingly seek to leverage technology to improve their operations, Solinftec’s platform offers a valuable tool for achieving greater efficiency and sustainability.

Agrosmart: Precision Agriculture for Optimal Farming Practices

Agrosmart, a Brazilian agritech startup founded in 2014, is another notable player in the agritech space. The company specializes in precision agriculture, offering a range of tools designed to optimize farming practices and improve crop management. Agrosmart’s solutions are geared towards enhancing decisionmaking and increasing the efficiency of agricultural operations.

At the core of Agrosmart’s offerings is its precision agriculture platform, which integrates various technologies to provide farmers with real-time data and insights. The platform utilizes sensors, satellite imagery, and data analytics to monitor key factors such as soil conditions, weather patterns, and crop health. This information is used to generate recommendations for optimizing irrigation, fertilization, and pest management.

One of Agrosmart’s key innovations is its focus on data-driven decision-making. By providing farmers with accurate and timely information, the platform helps them make informed choices about their farming practices. This approach not only improves crop yields but also reduces input costs and minimizes environmental impact.

Agrosmart’s solutions are designed to be user-friendly and accessible, making it easier for farmers to integrate technology into their operations. The platform’s intuitive interface and actionable insights help farmers streamline their workflows and achieve better results.

The startup’s emphasis on precision agriculture aligns with the growing demand for technology-driven solutions in the agricultural sector. As farmers seek to enhance their productivity and sustainability, Agrosmart’s tools offer valuable support for achieving these goals.

Investing in agritech innovations in Brazil presents numerous opportunities for growth and impact. The country’s position as a major agricultural producer, coupled with its commitment to technological advancement, makes it an attractive destination for agritech investments. However, successful investment requires careful consideration and strategic planning.

Thorough research is essential when investing in Brazil’s agritech sector. Investors should familiarize themselves with the local market dynamics, regulatory environment, and competitive landscape. Understanding the needs and challenges faced by Brazilian farmers can also provide valuable insights for identifying promising investment opportunities.

Brazil’s agritech sector is characterized by a diverse range of technologies and solutions, including precision agriculture, digital platforms, and data analytics. Investors should explore the different segments within the sector and assess the

potential for growth and innovation.

When considering investments in agritech companies, it is important to evaluate the technology and innovation behind their solutions. Investors should assess the effectiveness, scalability, and competitive advantage of the technologies offered by companies like Solinftec and Agrosmart. Understanding the technical aspects of the solutions, including their data analytics capabilities and integration with existing farming practices, can help investors make informed decisions.

Market demand and adoption are critical factors to consider when investing in agritech. Investors should evaluate the level of interest and willingness among farmers to adopt new technologies. Analyzing trends in agricultural practices, such as the growing emphasis on sustainability and efficiency, can provide insights into the potential for agritech solutions to meet these needs.

Engaging with farmers, industry experts, and stakeholders can also provide valuable feedback on the relevance and effectiveness of agritech solutions. Understanding the pain points and challenges faced by farmers can help investors identify opportunities for innovation and

Collaborating with local entities can enhance the success of agritech investments. Local partners can offer valuable insights into the Brazilian agricultural market and help navigate regulatory and cultural considerations. They can also provide connections to farmers, industry associations, and government agencies that can support the growth and adoption of agritech solutions.

Investors should consider forming partnerships with local agritech companies, research institutions, and industry organizations. These collaborations can provide access to expertise, resources, and networks that can accelerate the development and commercialization of agritech solutions.

Diversification is a key strategy for managing risk and maximizing returns in the agritech sector. Investors should consider diversifying their portfolios by investing in a mix of agritech companies and technologies. This approach can help spread risk and increase exposure to different growth opportunities within the sector.

Investing in a range of agritech solutions, such as precision agriculture, digital platforms, and data analytics, can provide a balanced portfolio that benefits from various trends and innovations.

Diversification can also help investors capture opportunities across different segments of the agricultural value chain.

Investing in research and development (R&D) is crucial for driving innovation and growth in the agritech sector. Supporting R&D initiatives can help companies develop new technologies, improve existing solutions, and stay ahead of market trends. Investing in R&D can also enhance the competitiveness of agritech companies and contribute to their long-term success.

Investors should consider supporting R&D programs, innovation labs, and collaborative research initiatives. These investments can provide valuable insights, foster technological advancements, and create opportunities for growth and differentiation in the agritech market.

Agritech innovations have the potential to drive significant environmental and social impact. Technologies that improve farming practices, enhance sustainability, and reduce resource consumption contribute to broader goals of environmental conservation and social development.

Investors should consider the environmental and social impact of their investments and support agritech

solutions that align with sustainable development goals. By investing in technologies that promote efficiency, reduce waste, and support smallholder farmers, investors can contribute to positive outcomes for society and the environment.

Staying informed about market trends and regulatory changes is essential for successful investment in the agritech sector. The agricultural industry is influenced by various factors, including technological advancements, policy changes, and market dynamics. Monitoring these trends can help investors anticipate opportunities and challenges and make informed investment decisions.

Investors should keep abreast of developments in agritech regulations, government policies, and industry standards. Understanding the impact of these factors on the market and individual companies can provide valuable insights for managing investments and identifying growth opportunities.

The agritech sector in Brazil is poised for continued growth and innovation. Companies like Solinftec and Agrosmart are leading the way in developing technologies that enhance agricultural productivity, sustainability, and efficiency. Their contributions to precision agriculture and digital solutions are transforming

the industry and setting new standards for farming practices.

Investing in Brazil’s agritech sector offers significant opportunities for growth and impact. By conducting thorough research, evaluating technology and innovation, assessing market demand, partnering with local entities, diversifying portfolios, supporting R&D, and considering environmental and social impact, investors can contribute to the success of agritech ventures and benefit from the growth of this dynamic sector.

The future of agritech in Brazil is bright, with ongoing advancements and a growing focus on sustainability and efficiency. As the sector continues to evolve, investors have the chance to be part of this transformative journey and support the development of innovative solutions that drive progress in agriculture.

Additionally, the growing global focus on food security and sustainable agricultural practices is amplifying the importance of Brazil's agritech sector. As international markets recognize the potential of Brazilian innovations in agriculture, there is an expected increase in collaborative ventures and partnerships that will drive technological advancements further. This cross-border synergy fosters the growth of local agritech

startups and enhances Brazil’s reputation as a hub for agricultural innovation. The convergence of international expertise with Brazil's local knowledge and resources will likely lead to the development of cutting-edge technologies that can be scaled and adapted for use in diverse agricultural environments worldwide.

Furthermore, Brazil’s vast and varied landscapes provide an ideal testing ground for innovative agritech solutions, ranging from precision agriculture and digital farming platforms to advanced biotechnology. These innovations can be tailored to address the specific challenges faced by farmers in different regions, ensuring that the benefits of technological advancements are widely distributed across the agricultural sector. The success stories of companies like Solinftec and Agrosmart serve as testament to the transformative potential of agritech in Brazil, highlighting the ways in which technology can drive productivity, efficiency, and sustainability in farming practices.

Investors who strategically align with these trends stand to gain significantly, both in financial returns and in contributing to global food security and environmental sustainability. By supporting Brazil's agritech sector, investors not only capitalize on emerging market opportunities but also play a crucial role in promoting sustainable agriculture and addressing global

Mexico’s Riviera Maya, a stunning stretch of coastline along the Caribbean Sea, is experiencing a significant hospitality boom. This region, known for its pristine beaches, lush jungles, and rich cultural heritage, has become a hotspot for luxury and eco-friendly tourism. Among the key players in this growth are Azulik, an eco-luxury resort in Tulum, and Xcaret, a unique resort and ecoarchaeological park. This article explores these prominent establishments and offers insights for potential investors interested in the burgeoning hospitality sector in the Riviera Maya.

Azulik: Pioneering Eco-Luxury in Tulum

Azulik, located in the heart of Tulum, represents a pioneering effort in combining luxury with environmental sustainability. Established in 2003, Azulik is renowned for its commitment to eco-friendly practices and unique architectural design. The resort’s philosophy centers around harmonious integration with nature, offering guests an immersive experience that emphasizes environmental stewardship and cultural respect.

Azulik’s design is a testament to sustainable luxury. The resort features villas constructed from locally sourced materials, such as wood and thatch, blending seamlessly with the

surrounding natural environment. The use of renewable energy sources, including solar panels, and water conservation measures further enhance the resort’s commitment to sustainability. Additionally, Azulik’s construction minimizes its ecological footprint by avoiding the use of concrete and other materials that could disrupt the local ecosystem.

The resort offers a range of luxurious accommodations, including treehouse suites and beachfront villas, designed to provide guests with an unparalleled connection to nature. Azulik’s amenities include a world-class spa, gourmet dining options, and a private beach, all while maintaining a focus on environmental sustainability. The resort’s dedication to preserving the natural beauty of Tulum has earned it recognition as a leader in eco-luxury tourism.

Azulik’s success highlights a growing trend in the hospitality industry where travelers seek not only luxury but also an authentic connection to nature and sustainable practices. The resort’s innovative approach and commitment to environmental stewardship make it a prime example of how luxury and sustainability can coexist.

Xcaret, located near Playa del Carmen, is a prominent example of how

sustainable tourism and cultural preservation can be integrated. Opened in 1990, Xcaret is both a resort and an eco-archaeological park, offering visitors a diverse range of experiences that celebrate Mexico’s natural and cultural heritage.

The Xcaret Park encompasses a variety of attractions, including natural water pools, underground rivers, and lush gardens. It also features cultural exhibits, traditional Mexican performances, and historical reenactments that provide guests with a comprehensive understanding of the region’s heritage. The park’s design emphasizes environmental sustainability, with efforts to protect local wildlife, conserve water, and reduce energy consumption.

Xcaret’s commitment to sustainability extends to its hospitality operations. The resort offers a range of ecofriendly accommodations and dining options that prioritize local and organic ingredients. The integration of sustainable practices into the resort’s operations, along with its dedication to cultural preservation, has made Xcaret a model for responsible tourism in the region.

One of Xcaret’s key initiatives is its focus on environmental education and conservation. The park collaborates with various organizations to support wildlife protection programs and environmental research. This commitment to education and conservation not only enhances the

guest experience but also contributes to the broader goal of preserving Mexico’s natural and cultural resources.

Xcaret’s success underscores the importance of integrating sustainability and cultural preservation into tourism development. By offering a range of experiences that highlight both the natural beauty and cultural richness of the Riviera Maya, Xcaret sets a high standard for responsible tourism.

Riviera Maya presents significant investment opportunities, particularly for those interested in eco-friendly and culturally sustainable tourism. The region’s growing popularity as a tourist destination, combined with a strong emphasis on sustainability and luxury, creates a favorable environment for investment. However, successful investment requires careful consideration and strategic planning.

Investors should begin by analyzing market trends and understanding the demand for hospitality services in the

Riviera Maya. The region’s appeal to international tourists, driven by its natural beauty, cultural heritage, and luxury offerings, continues to grow. Additionally, there is an increasing demand for eco-friendly and sustainable tourism options, reflecting a broader global trend towards responsible travel.

Understanding the preferences and expectations of travelers can provide valuable insights for identifying investment opportunities. Investors should consider the types of accommodations and experiences that are most sought after, as well as the factors that drive visitor satisfaction.

Sustainability is a key consideration for investments in the Riviera Maya hospitality sector. Projects that incorporate eco-friendly practices, such as energy efficiency, water conservation, and waste reduction, are likely to attract environmentally conscious travelers and align with regulatory requirements.

Evaluating the environmental impact of potential investments and supporting projects that prioritize sustainability can enhance long-term success. Investments in green building technologies, renewable energy, and conservation initiatives can contribute to the overall sustainability of hospitality operations.

Assessing Cultural Integration and Community Engagement

Cultural integration and community engagement are important factors to consider when investing in the Riviera Maya. Projects that respect and celebrate local culture, support community development, and contribute to cultural preservation are likely to resonate with both tourists and local residents.

Investors should assess how potential projects integrate with the local community and contribute to cultural preservation. Supporting initiatives that promote local craftsmanship, traditional practices, and cultural heritage can enhance the authenticity and appeal of hospitality offerings.

Partnering with Local Experts and Stakeholders

Collaborating with local experts and stakeholders can provide valuable insights and support for successful investments. Local partners can offer

knowledge of market dynamics, regulatory requirements, and cultural considerations, helping investors navigate the complexities of the Riviera Maya hospitality sector.

Forming partnerships with local businesses, government agencies, and community organizations can enhance investment success and contribute to the overall development of the region. Engaging with local stakeholders can also help build relationships and establish a positive reputation within the community.

Diversification is a key strategy for managing risk and maximizing returns in the hospitality sector. Investors should consider diversifying their portfolios by investing in a mix of hospitality projects, including luxury resorts, eco-friendly accommodations, and cultural attractions.

By investing in a range of projects, investors can capture opportunities across different segments of the hospitality market and mitigate potential risks. Diversification can also provide exposure to various growth trends and market demands within the Riviera Maya.

Investing in innovation and technology can enhance the competitiveness and appeal of hospitality projects.

Incorporating advanced technologies, such as smart building systems, energy-efficient solutions, and digital guest experiences, can improve operational efficiency and guest satisfaction.

Supporting innovation in hospitality can also contribute to sustainability goals and enhance the overall guest experience. Investing in cutting-edge technologies and practices can set projects apart from competitors and attract discerning travelers.

Staying informed about regulatory and market developments is essential for successful investment in the Riviera Maya hospitality sector. Investors should monitor changes in regulations, government policies, and market trends that may impact hospitality operations and investment opportunities.

Understanding the regulatory landscape and staying abreast of market developments can help investors anticipate challenges and seize emerging opportunities.

Engaging with industry associations, government agencies, and market analysts can provide valuable insights and updates.

The hospitality sector in Mexico’s Riviera Maya is poised for continued growth, driven by a strong demand for luxury and eco-friendly tourism experiences. Key players like Azulik and Xcaret exemplify the successful integration of sustainability, luxury, and cultural preservation, setting high standards for the industry.

Investing in the Riviera Maya offers significant opportunities for growth and impact, particularly for those interested in eco-friendly and culturally sustainable tourism.

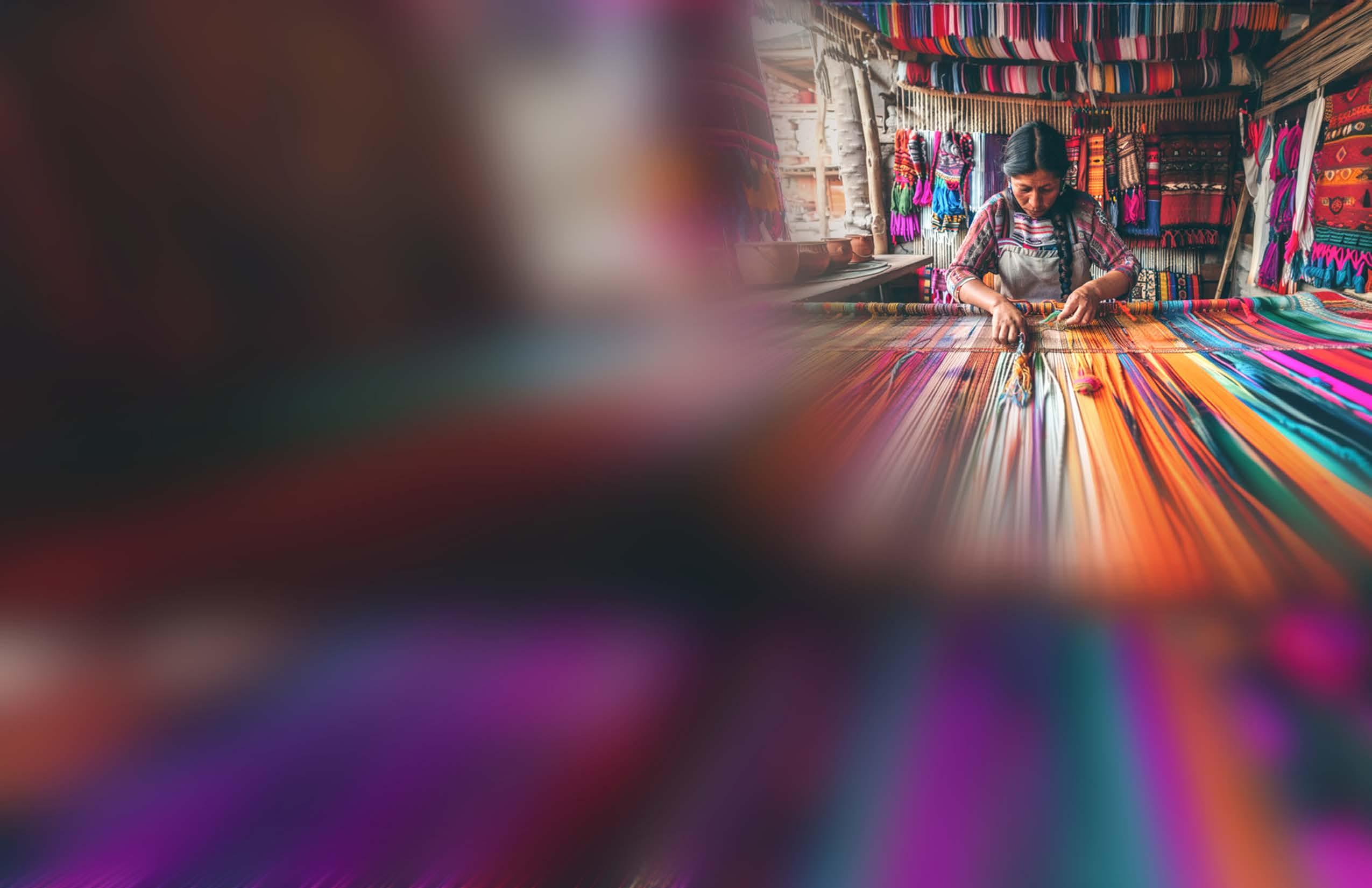

Peru, renowned for its rich cultural heritage and vibrant artisanal traditions, is home to a flourishing craft industry that plays a significant role in the country’s economy and cultural identity. Artisanal craft enterprises in Peru are gaining recognition not only for their exquisite products but also for their contributions to local communities and sustainable development. Two notable examples in this sector are Artesanías de Chile, which, despite being based in Chile, provides a model for supporting artisans through fair trade practices, and Allpa S.A., a Peruvian company dedicated to exporting artisanal crafts and supporting local communities. This article explores these enterprises and provides insights for potential investors interested in Peru’s artisanal craft sector.

Artesanías de Chile, although based in Chile, offers a valuable model for supporting artisanal enterprises in Latin America, including Peru. Founded in 1969, Artesanías de Chile is a pioneer in promoting and supporting traditional crafts through fair trade practices. The organization’s approach focuses on enhancing the livelihoods of artisans by providing them with access to global markets, fair pricing, and capacitybuilding opportunities.

The fair trade model employed by Artesanías de Chile emphasizes equitable relationships between artisans

and buyers, ensuring that artisans receive fair compensation for their work. This model helps artisans achieve economic stability and fosters sustainable development within their communities. By focusing on fair trade, Artesanías de Chile sets an example for similar organizations in Peru and other Latin American countries, demonstrating the positive impact of ethical business practices on artisanal craft enterprises.

Artesanías de Chile also invests in the preservation of traditional craftsmanship by supporting training programs and workshops for artisans. These initiatives help artisans refine their skills, adapt to changing market demands, and maintain the quality of their products. By promoting traditional techniques and encouraging innovation, Artesanías de Chile contributes to the ongoing vitality of the artisanal craft sector.

The success of Artesanías de Chile underscores the potential benefits of fair trade practices for artisanal enterprises. Investors interested in the Peruvian craft sector can draw valuable lessons from this model, particularly in terms of supporting artisans through ethical and sustainable business practices.

Allpa S.A., a leading Peruvian company, is a prominent example of how artisanal craft enterprises can

thrive through effective support and export strategies. Established in 1987, Allpa S.A. focuses on producing and exporting high-quality Peruvian crafts while providing vital support to local artisans and communities. The company’s mission is to promote Peruvian craftsmanship on the global stage, create economic opportunities for artisans, and support sustainable development.

Allpa S.A. works closely with a network of artisans across Peru, offering them a platform to showcase their products and reach international markets. The company provides artisans with training, resources, and technical support to enhance their production processes and product quality. By facilitating access to global markets, Allpa S.A. helps artisans achieve fair prices for their work and supports their economic empowerment.

One of the key strengths of Allpa S.A. is its commitment to sustainable practices. The company emphasizes the use of eco-friendly materials and techniques in its craft production, aligning with broader trends towards environmental responsibility. Additionally, Allpa S.A. supports community development initiatives, including education and healthcare programs, which contribute to the overall well-being of artisan communities.

The company’s focus on quality and sustainability has earned it a strong reputation in the international market. Allpa S.A. exports a diverse range of products, including textiles, ceramics, and jewelry, showcasing the rich

Artesanías de Chile also invests in the preservation of traditional craftsmanship by supporting training programs and workshops for artisans. These initiatives help artisans refine their skills, adapt to changing market demands, and maintain the quality of their products.

cultural heritage and craftsmanship of Peru. The success of Allpa S.A. highlights the potential for growth and impact in the Peruvian artisanal craft sector, particularly for companies that prioritize ethical practices and community support.

Investing in Peru’s artisanal craft sector presents a range of opportunities for growth and impact. The country’s rich cultural heritage, skilled artisans, and growing international interest in handmade crafts create a favorable environment for investment. However, successful investment requires careful consideration and strategic planning.

Understanding the Market and Demand

Investors should begin by analyzing the market and demand for artisanal crafts in Peru. The sector is characterized by a diverse range of products, including textiles, ceramics, and jewelry, each with its own market dynamics and consumer preferences. Understanding the trends in global demand for handmade crafts and the specific preferences of target markets can provide valuable insights for identifying investment opportunities.

Evaluating Artisan Support and Capacity Building

The increasing interest in sustainable and ethically produced goods offers additional potential for growth. Consumers are increasingly seeking products that reflect cultural authenticity and environmental responsibility. By aligning with these trends, investors can tap into a growing market segment and support artisanal enterprises that prioritize ethical and sustainable practices.

Investing in artisanal craft enterprises requires a focus on supporting artisans and enhancing their capacity. Successful investments should consider how companies, such as Allpa S.A., provide training, resources, and technical support to artisans. Supporting initiatives that improve production processes, product quality, and market access can contribute to the long-term success of artisanal enterprises.

Investors should evaluate the extent to which potential investment opportunities offer support to artisans and communities. Investing in companies that prioritize artisan empowerment, skill development, and fair trade practices can enhance the overall impact of investments and contribute to the sustainability of the craft sector.

Sustainability and ethical practices are key considerations for investments in the artisanal craft sector. Companies that emphasize eco-friendly materials, responsible production methods, and fair trade principles are likely to attract environmentally conscious consumers and align with global trends towards sustainability.

Investors should assess the sustainability practices of potential investments, including the use of renewable resources, waste reduction strategies, and community support initiatives. Supporting enterprises that prioritize ethical and sustainable practices can enhance the positive impact of investments and contribute to the broader goals of environmental and social responsibility.

Collaborating with local organizations and stakeholders can provide valuable insights and support for successful investments. Engaging with artisan cooperatives, industry associations, and community organizations can help investors navigate the complexities of the Peruvian craft sector and build strong relationships within the local community.

Partnerships with local entities can also offer access to valuable networks, market knowledge, and cultural insights. By working with local partners, investors can gain a deeper understanding of the artisanal craft sector and identify opportunities for collaboration and growth.

Diversification is a key strategy for managing risk and maximizing returns in the artisanal craft sector. Investors should consider diversifying their portfolios by investing in a range of craft products, companies, and market segments. Diversification can help spread risk and increase exposure to different growth opportunities within the sector.

Investing in a mix of products, such as textiles, ceramics, and jewelry, as well as companies with varying business models and market focuses, can provide a balanced portfolio that benefits from diverse trends and consumer preferences. Diversification can also help investors capture opportunities across different segments of the artisanal craft market.

Supporting Innovation and Market Expansion

Supporting innovation and market expansion can enhance the success of artisanal craft enterprises. Investments in product development, marketing strategies, and international expansion can help companies reach new markets and attract a broader customer base.

Investors should consider supporting initiatives that drive innovation in craft production, such as the integration of new technologies or the development of unique product designs. Additionally, investing in marketing and branding efforts can help companies increase their visibility and appeal in global markets.

Staying informed about market trends and regulatory changes is essential for

successful investment in the artisanal craft sector. Investors should monitor developments in consumer preferences, industry standards, and government policies that may impact the craft sector.

Understanding the regulatory landscape and staying abreast of market trends can help investors anticipate opportunities and challenges. Engaging with industry experts, market analysts, and regulatory agencies can provide valuable insights and updates.

The artisanal craft sector in Peru is poised for continued growth and innovation, driven by a rich cultural heritage, skilled artisans, and increasing global interest in handmade and sustainable products. Companies like Artesanías de Chile and Allpa S.A.

exemplify successful models for supporting artisans, promoting fair trade, and emphasizing sustainability.

Investing in Peru’s artisanal craft sector offers significant opportunities for growth and impact. By understanding market trends, evaluating artisan support, assessing sustainability practices, partnering with local stakeholders, diversifying portfolios, supporting innovation, and monitoring regulatory changes, investors can contribute to the success of artisanal enterprises and benefit from the sector’s evolving dynamics.

The future of artisanal craft enterprises in Peru is bright, with ongoing advancements and a growing emphasis on cultural preservation and sustainability. As the sector continues to thrive and attract global attention, investors have the chance to support and be part of this vibrant and transformative industry.

hile has emerged as a significant player in the health tech sector in Latin America, driven by innovative startups and biotechnology companies that are transforming healthcare management and diagnostics. The country's commitment to advancing technology in healthcare is exemplified by companies such as Pegasi and Miroculus. These firms are at the forefront of health tech innovations, offering digital solutions and pioneering diagnostic tools that are setting new standards in the industry. This article explores these key players and provides insights for potential investors interested in the burgeoning health tech sector in Chile.

Pegasi, a dynamic health tech startup based in Chile, is making notable strides in the field of healthcare management through its innovative digital solutions. Established with the mission of enhancing the efficiency and effectiveness of healthcare delivery, Pegasi offers a range of digital tools designed to streamline healthcare operations and improve patient outcomes.

At the core of Pegasi's offerings is a comprehensive digital platform that integrates various aspects of healthcare management. The platform includes features for electronic health records (EHR), patient scheduling, and telemedicine, providing healthcare providers with a unified

system to manage patient information and interactions. This integration helps reduce administrative burdens, minimize errors, and enhance the overall quality of care.

One of Pegasi's key innovations is its focus on data analytics and artificial intelligence (AI). The platform utilizes advanced algorithms to analyze patient data, identify trends, and provide actionable insights for healthcare providers. This data-driven approach enables more informed decision-making, personalized treatment plans, and proactive healthcare management.

Pegasi's solutions also extend to patient engagement, offering tools that allow patients to access their health information, schedule appointments, and communicate with their healthcare providers. By enhancing patient engagement, Pegasi aims to improve adherence to treatment plans, increase patient satisfaction, and ultimately achieve better health outcomes.

The success of Pegasi underscores the growing demand for digital solutions in healthcare. As healthcare systems worldwide continue to evolve and adapt to technological advancements, the need for innovative platforms that streamline operations and enhance patient care becomes increasingly critical. For investors, Pegasi represents a promising opportunity in the health tech sector, with its cuttingedge solutions and commitment to improving healthcare management.

Miroculus: Pioneering Diagnostic Tools with Biotechnology

Miroculus, a biotechnology company based in Chile, is at the forefront of developing innovative diagnostic tools that are revolutionizing the field of diagnostics. Founded with a vision to transform healthcare through advanced biotechnology, Miroculus focuses on creating solutions that enable early detection and accurate diagnosis of diseases.

One of Miroculus' flagship products is its proprietary diagnostic platform, which leverages microRNA technology to provide highly sensitive and specific diagnostic tests. MicroRNAs are small RNA molecules that play a crucial role in regulating gene expression and are often implicated in various diseases. Miroculus' technology allows for the detection of disease-specific microRNAs in biological samples, offering a powerful tool for early disease detection and monitoring.

The diagnostic platform developed by Miroculus is designed to be versatile and adaptable, capable of addressing a wide range of medical conditions, including cancer, cardiovascular diseases, and infectious diseases. The platform's ability to provide precise and reliable diagnostic information has the potential to significantly impact patient care by enabling earlier intervention and more personalized treatment approaches.

In addition to its diagnostic tools, Miroculus is also involved in research

and development to expand its product offerings and enhance its technology. The company's commitment to innovation and its focus on addressing unmet medical needs position it as a leader in the biotechnology sector.

For investors, Miroculus represents a compelling opportunity in the health tech space, particularly in the field of diagnostics. The company's advanced technology, strong research capabilities, and potential for impact in disease detection make it an attractive investment prospect.

Investing in Chile’s health tech sector offers significant opportunities for growth and impact. The country’s commitment to advancing healthcare through technology and innovation, combined with a supportive regulatory environment, creates a favorable landscape for investment. However, successful investment requires careful consideration and strategic planning.

Investors should start by analyzing market trends and understanding the demand for health tech solutions in Chile. The healthcare sector is undergoing rapid transformation, with increasing adoption of digital tools, AI, and biotechnology. Understanding the specific needs of the market, such as the demand for digital health management solutions and advanced diagnostic tools, can provide valuable insights for identifying investment opportunities.

The growing emphasis on personalized medicine, telehealth, and data-driven healthcare solutions reflects broader trends in the global health tech market. Investors should consider how these trends align with the offerings of companies like Pegasi and Miroculus and evaluate the potential for growth in these areas.

Investing in health tech requires a focus on technological innovation and scalability. Investors should assess the technological capabilities of potential investments, including the sophistication of digital platforms, the efficacy of diagnostic tools, and the potential for scalability. Companies that demonstrate cutting-edge technology and the ability to scale their solutions are likely to offer higher returns on investment.

Pegasi’s integration of AI and data analytics and Miroculus’ use of microRNA technology are examples of innovative approaches that enhance the value proposition of health tech companies. Evaluating the scalability of these technologies and their potential to address broader market needs is crucial for making informed investment decisions.

Regulatory compliance and market access are key factors to consider when investing in health tech. The healthcare industry is highly regulated, with strict requirements for product approval, safety, and efficacy. Investors should assess the regulatory landscape in Chile and ensure that potential investments comply with relevant regulations and standards.

Additionally, understanding market access and reimbursement pathways is important for evaluating the commercial viability of health tech solutions. Companies that have established pathways for market entry and reimbursement are better positioned to achieve financial success and attract investment.

Investing in companies that prioritize innovation and research can enhance

the impact and success of health tech ventures. Supporting research and development efforts, as well as investing in innovation-driven companies, can contribute to the advancement of technology and the development of new solutions.

Miroculus’ focus on expanding its diagnostic tools and Pegasi’s commitment to enhancing its digital platform are examples of how investment in innovation and research can drive growth and impact. Investors should consider opportunities to support companies that are actively engaged in research and development and are committed to advancing their technology.

Collaboration with local and international stakeholders can provide valuable support and insights for health tech investments. Engaging with healthcare providers, regulatory agencies, research institutions, and industry associations can offer valuable perspectives and facilitate successful investment.

Forming partnerships with local organizations and stakeholders can also help investors navigate the regulatory environment, access market insights, and build relationships within the health tech community. Collaborating with international partners can provide additional opportunities for market expansion and global reach.

Diversification is a key strategy for managing risk and maximizing returns in the health tech sector. Investors should consider diversifying their portfolios by investing in a range of health tech solutions, including digital health platforms, diagnostic tools, and biotechnology innovations.

By investing in a mix of technologies and market segments, investors can capture opportunities across different areas of the health tech market and mitigate potential risks. Diversification can also provide exposure to various growth trends and emerging technologies within the sector.

Staying informed about market and technological developments is essential for successful investment in health tech. Investors should monitor changes in healthcare trends, technological advancements, and regulatory updates that may impact the health tech sector.

Engaging with industry experts, attending conferences, and subscribing to industry publications can provide valuable insights and keep investors abreast of the latest developments. Understanding these trends can help investors anticipate opportunities and challenges and make informed investment decisions.

Chile’s health tech sector is poised for continued growth and innovation, driven by advancements in digital health solutions and biotechnology. Companies like Pegasi and Miroculus are leading the way in transforming healthcare management and diagnostics, setting high standards for the industry.

Investing in Chile’s health tech sector offers significant opportunities for growth and impact, with a focus on technological innovation, regulatory compliance, and market expansion. By understanding market trends, evaluating technological capabilities, supporting innovation, and collaborating with stakeholders, investors can contribute to the success of health tech ventures and benefit from the sector’s evolving dynamics.

The future of health tech in Chile is promising, with ongoing advancements and a growing emphasis on technology-driven healthcare solutions. As the sector continues to evolve and attract global attention, investors have the opportunity to support and be part of this transformative journey in health technology.

A crucial element for the sustained growth of Chile's health tech sector is the development of a robust and sustainable ecosystem. This involves fostering collaboration between the public and private sectors, enhancing funding mechanisms for startups, and creating an environment that supports innovation and entrepreneurship.

The Chilean government has been proactive in supporting the health tech sector through various initiatives and policies. Government grants, tax incentives, and funding programs aimed at encouraging research and development (R&D) are instrumental in nurturing innovation. These initiatives not only provide financial support but also help create a favorable regulatory environment for health tech companies to thrive.

Venture capital (VC) firms and private investors play a pivotal role in the growth of the health tech sector. By providing early-stage funding and strategic support, VCs help startups like Pegasi and Miroculus scale their operations and bring their innovative solutions to market. The influx of private investment also stimulates competition and drives further

advancements in technology and product development.

Collaboration with academic and research institutions is essential for fostering innovation in the health tech sector. Universities and research centers in Chile are actively involved in cutting-edge research and development, providing a steady pipeline of new ideas and technologies. Partnerships between health tech companies and academic institutions can facilitate the translation of research findings into practical applications, accelerating the development of new solutions.

International collaboration is another key factor in the growth of Chile's health tech sector. By forming strategic partnerships with global health tech companies and research institutions, Chilean startups can access new markets, share knowledge, and leverage advanced technologies. These collaborations also help Chilean companies navigate international regulatory landscapes and expand their reach beyond Latin America.

Building a skilled workforce is crucial for the sustainability of the health tech sector. Initiatives aimed at enhancing education and training in fields such as biotechnology, data science, and healthcare management are vital. By investing in workforce development, Chile can ensure a steady supply of qualified professionals to support the growth of the health tech industry.

amaica is rapidly emerging as a hub for educational technology (edtech) in the Caribbean, driven by innovative companies that are transforming the way students and educators interact with learning resources. The country's commitment to advancing education through technology is exemplified by two notable firms: EduFocal and One-onOne Educational Services. These companies are at the forefront of leveraging technology to enhance learning experiences and address educational challenges. This article explores the contributions of these key players and provides valuable insights for potential investors interested in Jamaica's burgeoning edtech sector.

EduFocal: Transforming Education with Online Learning Solutions

EduFocal, a Jamaican edtech company, is making significant strides in the field of online learning by offering comprehensive digital solutions that cater to various educational needs. Established with the goal of improving access to quality education, EduFocal provides a range of online tools designed to support students, teachers, and educational institutions.

At the core of EduFocal’s offerings is its digital learning platform, which includes interactive educational content, practice exams, and personalized learning pathways. The platform is designed to enhance the learning experience by providing students with access to a wide range of resources and tools that are tailored to

their individual needs. This approach helps students to better understand and retain information, improve their academic performance, and achieve their educational goals.

One of EduFocal’s key features is its emphasis on adaptive learning. The platform utilizes data-driven algorithms to analyze students' performance and provide personalized recommendations based on their strengths and areas for improvement. This personalized approach helps students to focus on specific areas of need, improving their overall learning outcomes.

In addition to its student-focused tools, EduFocal also offers resources for educators and schools. The platform provides teachers with access to a variety of instructional materials, including lesson plans, assessments, and progress tracking tools. These resources help educators to better support their students and enhance their teaching practices.

EduFocal's impact on the Jamaican education system is significant, addressing challenges such as limited access to quality educational resources and the need for personalized learning solutions. The company’s innovative approach to online education aligns with global trends towards digital learning and offers valuable opportunities for investors interested in the edtech sector.

One-on-One Educational Services: Personalized Learning Experiences

One-on-One Educational Services is another prominent player in Jamaica's edtech landscape, specializing in providing personalized learning experiences through its innovative digital solutions. Founded with the mission of enhancing educational outcomes through tailored instruction, One-on-One offers a range of services designed to meet the unique needs of individual learners.

Central to One-on-One’s approach is its focus on personalized tutoring and academic support. The company provides students with access to oneon-one tutoring sessions, where they can receive individualized attention and instruction from experienced educators. This personalized approach helps students to address specific learning challenges, improve their academic performance, and build confidence in their abilities.

One-on-One also offers a variety of digital learning tools and resources to support its tutoring services. These include online practice exercises, interactive educational content, and progress tracking features. By combining personalized tutoring with digital resources, One-on-One creates a comprehensive learning experience that addresses the diverse needs of students.

In addition to its focus on individual learners, One-on-One Educational Services also collaborates with schools and educational institutions to provide customized solutions for their students.

These include online practice exercises, interactive educational content, and progress tracking features. By combining personalized tutoring with digital resources, One-on-One creates a comprehensive learning experience that addresses the diverse needs of students.

This includes developing tailored educational programs, providing teacher training, and offering support for implementing technology in the classroom.

The company’s commitment to personalized learning and its innovative use of technology position it as a leader in the Jamaican edtech sector. For investors, One-on-One represents a promising opportunity in the field of educational technology, with its focus on enhancing learning outcomes through tailored instruction and digital resources.