The latest issue delves into the evolving landscape of cryptocurrency, artificial intelligence, and economic policies shaping the world today. From the Donald $TRUMP coin fueling political enthusiasm in the crypto space to Melania Trump’s foray into digital assets, the rise of politically themed meme coins signals a new trend in blockchain speculation. Meanwhile, the $DJT meme coin, tied to Barron Trump, continues to stir controversy with its market fluctuations and investor skepticism. Beyond the crypto boom, OpenAI’s Stargate Project marks a bold leap in AI infrastructure, with a $500 billion investment reshaping the future of artificial intelligence in the U.S. However, AI markets have faced turbulence, as seen in the DeepSeek AI-driven stock market crash, which wiped out $500 billion in value overnight. Additionally, trade policies under the Trump administration are shifting towards protectionism, with tariffs impacting key industries like AI, semiconductors, and agriculture. On a lighter note, the Steam Squad comic series emerges as a refreshing alternative for young readers in a screen-dominated world, bringing adventure and education together. Lastly, Greystone Tower stands as a beacon of luxury in Victoria Island, Lagos, offering a sophisticated, multiuse development designed for corporate excellence. This issue provides an in-depth exploration of these major trends, uncovering the intersections of finance, technology, policy, and culture in today’s fast-changing world.

Donald $TRUMP Coin

The world of cryptocurrency is no stranger to meme coins digital assets often driven by internet culture, humor, and social movements rather than traditional utility. The Donald $TRUMP coin, a politically themed meme token, emerged as a major player in this space. Launched by former U.S. President Donald J. Trump on the Solana blockchain, the $TRUMP coin gained immediate attention, fueled by political enthusiasm and a dedicated following

Melania Trump Crypto Coin

Following the success of the Donald $TRUMP meme coin, former First Lady Melania Trump entered the crypto space with her own digital asset. Launched on the Solana blockchain, this meme coin quickly gained traction, driven by the Trump brand’s influence and the growing appeal of politically themed cryptocurrencies. While initially seen as a lighthearted project, its launch disrupted the market, triggering volatile price swings and intense investor interest. The token's rapid rise and dramatic fluctuations highlight the speculative nature of meme coins and their dependence on social sentiment, media coverage, and political movements

$DJT Meme Coin

In the ever-evolving world of cryptocurrency, few tokens have generated as much controversy as the $DJT meme coin. Named after Barron Trump, the youngest son of former President Donald Trump, this meme coin made waves in the market amid rumors of its direct involvement with the Trump family. The speculation was fueled by high-profile claims and blockchain activity, creating a whirlwind of hype, price surges, and

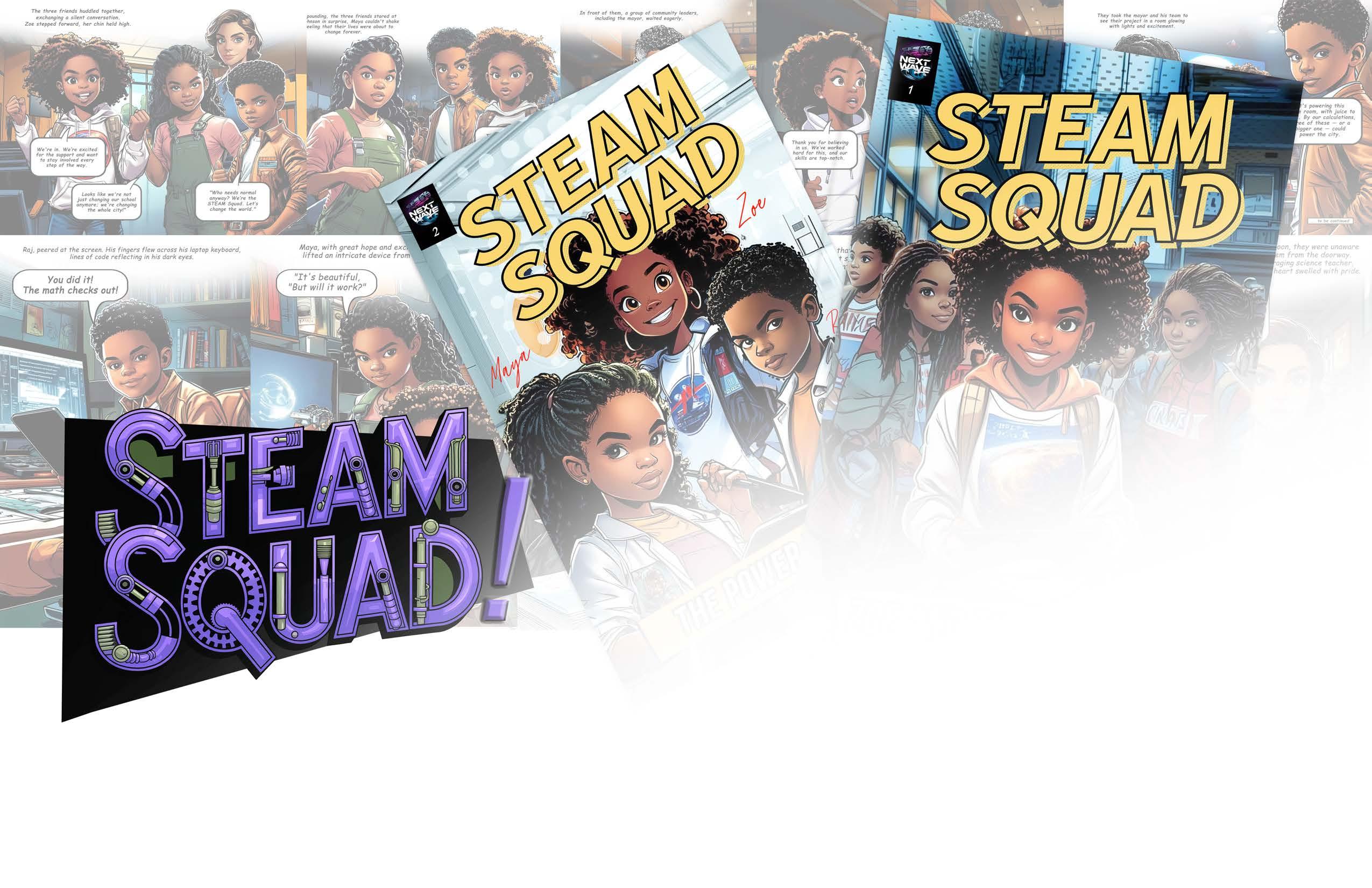

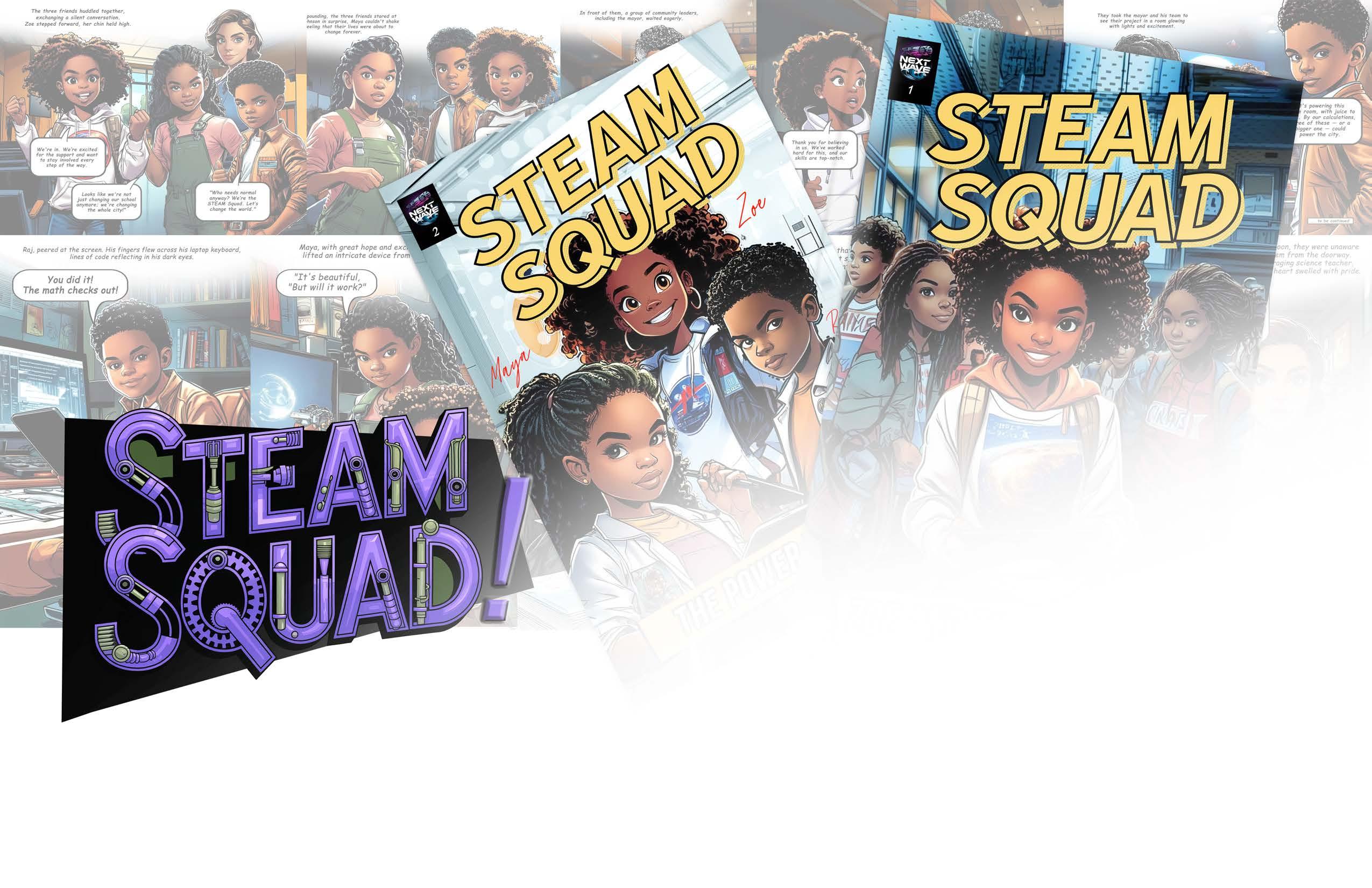

In an era where digital screens dominate children's entertainment, Steam Squad emerges as a breath of fresh air, bringing excitement, education, and empowerment to young readers. The first two issues of this thrilling comic series are now available at InfluentialMagazine.tech, and with a third issue on the horizon, there has never been a better time to dive into the world of Steam Squad.

Donald Trump’s nominee for Commerce Secretary, Howard Lutnick, recently emphasized the administration’s preference for across-the-board tariffs as a strategic tool to address various economic concerns. His statements, made during a Senate confirmation hearing, signal a shift toward broader protectionist trade policies, with significant implications for industries such as artificial intelligence (AI), semiconductors, and agriculture.

In a groundbreaking move that has sent shockwaves through the tech industry, OpenAI has announced an ambitious plan to develop an advanced AI infrastructure under the banner of the Stargate Project. This initiative, backed by SoftBank, Oracle, and MGX, will see a staggering $500 billion invested over the next four years.

The project's primary goal is to construct next-generation AI data centers across the United States, ensuring that the country remains a global leader in artificial intelligence. By leveraging the computational power of these centers, OpenAI hopes to accelerate progress in fields like healthcare, robotics, and even national security

In a historic market event, over $500 billion in value was wiped out in a single day—the largest sell-off in stock market history. The culprit? A Chinese AI startup named DeepSeek AI, whose unexpected technological leap sent shockwaves through Silicon Valley and Wall Street alike. The revelation of DeepSeek's groundbreaking AI model rattled the markets, spooking investors into a mass exodus from major AI and semiconductor stocks.

Welcome to Greystone Tower, a place where luxury meets excellence. This 19-floor mixed-use development is set to expand options for corporate tenants in Victoria Island, Lagos. With an exclusive, spacious smart lobby, guests are welcomed with elegance, creating an atmosphere of prestige and professionalism. The sleek design and ambiance leave an unforgettable impression on every visitor.

“Influential Magazines, driven by its unwavering aim and mission, strives to be a catalyst for global business transformation. Our commitment extends beyond the conventional, as we envision Unlocking vast business potential in emerging economies. This endeavor creates an unparalleled opportunity for worldwide expansion and knowledge exchange. The emerging nations, marked by dynamic markets and untapped resources, beckon entrepreneurs, investors, and enterprises globally to partake in mutually beneficial ventures. Influential Magazines serves as the conduit for this transformative journey, shedding light on the visionary growth strategies, infrastructure development, and burgeoning consumer bases within the emerging nations. As these economies evolve and innovate, our mission is to foster international collaboration, creating a vibrant space where industries thrive, and insights are shared. Embracing the business potential in these emerging economies not only unlocks doors for unprecedented growth but also nurtures a global dialogue, enriching our collective understanding of diverse business landscapes and strategies. The emerging nations, through Influential Magazines, transcend being mere destinations for business, they also become dynamic hubs for cross-cultural learning and collaboration."

$TRUMP Meme Coin:

The world of cryptocurrency is no stranger to meme coins— digital assets often driven by internet culture, humor, and social movements rather than traditional utility. The Donald $TRUMP coin, a politically themed meme token, emerged as a major player in this space. Launched by former U.S. President Donald J. Trump on the Solana blockchain, the $TRUMP coin gained immediate attention, fueled by political enthusiasm and a dedicated following.

While the $TRUMP coin started as a novelty, its rapid rise in market capitalization and trading volume demonstrated the growing intersection of politics, finance, and digital assets. However, like all cryptocurrencies— especially meme coins—it remains a highly volatile and speculative asset.

At its peak, the Donald $TRUMP coin reached a market capitalization of over $14 billion, making it one of the largest meme coins in circulation. However, its

valuation has fluctuated significantly, reflecting the speculative nature of meme coins and their dependence on social media hype and political events.

At the time of writing, the coin’s market cap sits at approximately $10.6 billion, ranking among the top meme-based cryptocurrencies. This fluctuation underscores both the opportunities and risks associated with investing in politically charged digital assets.

The $TRUMP coin’s tokenomics play a significant role in its market behavior. Here’s a breakdown of its structure:

• Total Supply: 1 billion tokens will be minted over the next three years.

• Initial Circulation: 200 million tokens were made available at launch, while the remaining 800 million are being held in reserve.

• Major Holders: A substantial 80% of the total supply is held by the Trump Organization and affiliated entities, including CIC Digital LLC and Fight Fight Fight

LLC.

• Unlock Schedule: The coins held by Trump-affiliated entities are subject to a threeyear unlocking schedule, meaning they cannot be immediately liquidated. This concentration of supply raises questions about centralization and control, as the Trump Organization’s dominance over the token could influence its price and market stability.

Potential Benefits and Risks

Benefits of Investing in $TRUMP Coin

1 Political and Social Influence Unlike other meme coins, $TRUMP benefits from its association with a major political figure. This connection gives it a dedicated community and the potential for longevity, as Trump supporters may continue to back the token through political cycles.

2 Exchange Listings and Liquidity Growth If the $TRUMP coin is listed

on major exchanges like Binance, Coinbase, or Kraken, it could significantly increase in liquidity and accessibility, leading to potential price surges.

3 Integration with Trump’s Ecosystem

The coin could be integrated into the Trump campaign, merchandise, or even events, creating real-world use cases that differentiate it from other speculative meme coins.

4 Bull Market Potential

If meme coins enter another bull cycle, $TRUMP could ride the wave, similar to how Dogecoin and Shiba Inu surged during previous market booms.

5 Policy-Driven Growth

Trump’s pro-crypto stance could lead to favorable regulatory policies, further fueling investor confidence and adoption.

Risks and Concerns

1 High Volatility

Like all meme coins, $TRUMP is prone to extreme price swings. Its value is largely driven by market sentiment rather than underlying fundamentals.

2 Centralized Holdings

With 80% of tokens held by Trump-affiliated entities, the risk of large sell-offs remains a significant concern. A sudden liquidation could lead to price crashes.

3 Regulatory Uncertainty Government regulations on political cryptocurrencies could impact the coin’s longterm viability. Ethical concerns surrounding a sitting

or former president profiting from a personal cryptocurrency may lead to scrutiny.

4 Speculative Nature

The $TRUMP coin lacks intrinsic value or technological innovation beyond its branding. Its success is tied to the Trump name rather than unique blockchain utility.

5 Competition from Other Meme Coins

The launch of additional Trump-themed tokens caused a temporary dip in $TRUMP’s value. This highlights the risk of dilution from similar tokens within the Trump ecosystem.

Investment Tips for $TRUMP Coin

Do Your Research

Before investing in $TRUMP or any meme coin, ensure you understand its market dynamics, tokenomics, and associated risks. Analyze blockchain data, trading volume, and wallet distributions to assess potential price movements.

Consider Short-Term Trading Strategies

Given its volatility, $TRUMP may be better suited for short-term trading rather than long-term holding. Monitoring social media trends and news related to Trump’s political activities can provide insights into potential price surges.

Watch for Exchange Listings

If major exchanges list $TRUMP, liquidity will improve, potentially leading to price spikes. Keep an eye on announcements from Binance, Coinbase, and Kraken.

While meme coins can offer high returns, they also come with significant risks. Ensure that your investment portfolio includes more stable assets like Bitcoin, Ethereum, or blue-chip stocks.

Stay Updated on Regulations

Meme coins tied to political figures may face legal and ethical challenges. Watch for any regulatory changes that could impact the coin’s future.

Be Wary of Market Manipulation

With a large percentage of $TRUMP tokens held by a few entities, price manipulation is a possibility. Be cautious of sudden price drops or pump-and-dump schemes.

Final Thoughts: Is $TRUMP a Good Investment?

The Donald $TRUMP meme coin is a unique asset in the crypto world, blending politics with digital finance. While it offers potential for short-term gains due to its strong community backing and media attention, it remains a highly speculative investment.

Investors should approach $TRUMP with caution, recognizing both its opportunities and risks. As with any cryptocurrency investment, conducting thorough research and exercising prudent risk management are essential.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.

Following the success of the Donald $TRUMP meme coin, former First Lady Melania Trump entered the crypto space with her own digital asset. Launched on the Solana blockchain, this meme coin quickly gained traction, driven by the Trump brand’s influence and the growing appeal of politically themed cryptocurrencies.

While initially seen as a lighthearted project, its launch disrupted the market, triggering volatile price swings and intense investor interest. The token's rapid rise and dramatic fluctuations highlight the speculative nature of meme coins and their dependence on social sentiment, media coverage, and political movements.

The coin debuted with significant hype, reaching a peak market capitalization of $2.15 billion, securing its place as one of the top meme coins in the space. Despite its early surge, the coin has experienced sharp volatility, similar to its counterpart, the Donald $TRUMP coin.

Notably, the launch of this new token caused a temporary 40% drop in $TRUMP’s value, as investors shifted their focus. However, both coins have since recovered, reinforcing the unpredictable nature of politically driven cryptocurrencies.

Understanding the tokenomics is crucial for evaluating its long-term viability. Here’s how its structure compares to other meme coins:

• Total Supply: 1 billion tokens were initially planned for distribution.

• Initial Circulation: A portion of the supply was immediately available for trading, with additional tokens to be released in phases.

• Major Holders: The majority of the supply is controlled by Trump-affiliated entities and private investors.

• Market Positioning: While designed as a meme coin, it is marketed as a digital collectible representing Melania Trump's brand and legacy.

Potential Benefits and Risks

Benefits of Investing

1 Trump Brand Power

As part of the Trump-backed crypto ecosystem, this token benefits from strong brand recognition and a dedicated following. Its connection to a former First Lady differentiates it from other meme coins.

2 Media and Political Influence

Political events and media coverage can significantly impact its price. If Melania Trump continues to promote the token or integrate it into future ventures, demand could rise.

3 Exchange Listings and Liquidity Growth

If major exchanges like Binance or Coinbase list this coin, its liquidity could increase, leading to greater accessibility and potential price surges.

4 Meme Coin Market Growth

If meme coins enter another bullish cycle, this token could

Due to its high volatility, this asset may be more suitable for short-term traders rather than long-term holders. Watching price movements and media trends can help identify potential buying or selling opportunities.

benefit from the broader market movement, similar to Dogecoin and Shiba Inu’s historic rallies.

5 Potential Utility and Use Cases

Future developments could include integration with exclusive Trump-related events, merchandise, or NFT marketplaces, giving the token additional value beyond speculation.

Risks and Concerns

1 Extreme Volatility

Like all meme coins, this one is highly volatile, with its value largely dictated by hype rather than underlying fundamentals.

2 Limited Utility

While marketed as a digital collectible, the token lacks clear use cases beyond speculation, making it more susceptible to short-term price swings.

3 Regulatory Scrutiny

Given its political affiliation, this asset could face increased regulatory scrutiny, especially if government agencies tighten cryptocurrency policies.

4 Competition with $TRUMP Coin

The simultaneous existence of

multiple Trump-themed tokens could dilute investor interest, leading to fluctuations in both coins’ values.

A significant portion of the supply is controlled by insiders, which raises concerns about potential price manipulation or large-scale sell-offs.

Since this token is tied to a well-known political figure, its value could be influenced by election cycles, political endorsements, or regulatory changes. Stay informed on relevant news.

A listing on major exchanges like Binance or Kraken could provide a significant boost to liquidity and price potential. Keep an eye on announcements from major platforms.

Due to its high volatility, this asset may be more suitable for short-term traders rather than long-term holders. Watching price movements and media trends can help identify potential buying or selling opportunities.

While meme coins can offer high returns, they are also risky. Consider diversifying your portfolio with more established assets like Bitcoin and Ethereum.

With a large percentage of supply held by a few entities, sudden price swings and liquidity traps are possible. Exercise caution when entering or exiting positions.

This meme coin represents a fascinating blend of politics, celebrity influence, and crypto speculation. While it has captured attention with its rapid rise in value and connection to a high-profile public figure, it remains a highly speculative asset with significant risks.

Investors should approach with caution, recognizing its potential for both quick gains and sharp losses. As with all crypto investments, conducting thorough research and understanding market dynamics is key.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.

In the ever-evolving world of cryptocurrency, few tokens have generated as much controversy as the $DJT meme coin. Named after Barron Trump, the youngest son of former President Donald Trump, this meme coin made waves in the market amid rumors of its direct involvement with the Trump family. The speculation was fueled by highprofile claims and blockchain activity, creating a whirlwind of hype, price surges, and skepticism.

Despite the uncertainty surrounding its origins, $DJT skyrocketed in value upon launch, riding the wave of Trumprelated cryptocurrency trends. However, like all politically themed meme coins, its rapid rise was followed by extreme volatility, raising questions about its legitimacy and longterm viability.

The launch of $DJT was met with intense speculation, leading to a meteoric rise in market capitalization. Within hours of its debut, the coin's value surged to a peak of $72 million, driven by rumors of Barron Trump's direct involvement. However, when the Trump family failed to officially acknowledge the token, skepticism set in, leading to a sharp decline.

At its lowest point, the market cap plummeted by more than

50%, dipping to around $33 million as investor confidence wavered. Despite this drop, trading volume remained high, suggesting that traders were still speculating on the token’s potential resurgence.

The $DJT coin's tokenomics reflect a typical meme coin structure, with high supply and rapid trading activity:

• Total Supply: 1 billion tokens were reportedly created at launch.

• Initial Circulation: A significant portion of tokens was released to the public, while insider wallets controlled a notable percentage of the supply.

• Major Holders: Reports indicate that a small group of insiders held large portions of the supply, leading to concerns over price manipulation.

• Liquidity and Trading: High trading volume on decentralized exchanges initially drove up demand, but the market soon experienced a sell-off as doubts over the token’s legitimacy grew.

The $DJT coin’s rise was largely fueled by rumors that Barron Trump was directly involved in its creation. The controversy intensified when Martin Shkreli, the infamous “Pharma Bro” and convicted securities fraudster, claimed that he co-founded the token with Barron.

Reports of insider trading and sudden sell-offs suggest that early adopters may have artificially inflated the price before exiting, leaving later investors at a loss.

Shkreli insisted that he had extensive evidence proving his collaboration with Barron Trump, but the Trump family remained silent on the matter. Unlike past instances where Melania Trump publicly denied false claims about Barron, no official statement was made to dismiss Shkreli’s allegations. This lack of response left the market divided— was Barron Trump truly involved, or was this just another case of opportunistic name-dropping to pump a coin’s value?

As speculation mounted, blockchain investigators uncovered evidence of insider trading, with early investors dumping massive amounts of $DJT for profit. This further fueled concerns that the token was a classic pump-and-dump scheme, where insiders inflate prices before cashing out, leaving retail investors at a loss.

Potential Benefits and Risks

Potential Benefits of Investing in $DJT

1 Hype-Driven Growth

If Barron Trump or another Trump family member acknowledges the token in any way, its value could surge again, making it a high-risk, high-reward investment.

2 Meme Coin Resilience

The meme coin market has shown that even controversial tokens can experience multiple waves of surges. If trading volume remains high, $DJT could see periodic rallies.

3 Trump-Themed Crypto Ecosystem

With multiple Trump-related cryptocurrencies gaining traction, $DJT could continue benefiting from association with the broader trend, even if it lacks an official endorsement.

4 Exchange Listings

If $DJT gets listed on major centralized exchanges, it could experience a significant liquidity boost, making it easier for investors to trade.

5 Speculative Trading Opportunities

Traders looking for short-term gains may find opportunities in $DJT’s price swings, as speculative hype often drives quick market movements.

Risks and Concerns

1 Unverified Trump Family Involvement

Unlike $TRUMP and $MELANIA, which have clear connections to the Trump family, $DJT’s legitimacy remains uncertain. The lack of confirmation or denial from Barron Trump leaves investors in a precarious position.

2 Pump-and-Dump Suspicions

Reports of insider trading and sudden sell-offs suggest that early adopters may have artificially inflated the price before exiting, leaving later investors at a loss.

3 Legal and Regulatory Risks

If authorities investigate $DJT’s origins and find fraudulent activity, the token could face regulatory action, leading to possible delistings or legal

For high-risk traders, $DJT may offer speculative opportunities. However, long-term investors should approach with extreme caution, as its legitimacy remains unverified and price movements unpredictable. As always, conduct thorough research, stay informed, and never invest more than you’re willing to lose.

consequences for its creators.

4 Extreme Volatility

$DJT has already demonstrated price swings of over 50%, meaning investors must be prepared for sudden crashes and unpredictable market movements.

5 Lack of Utility or Long-Term Vision

Unlike some meme coins that evolve into functional projects, $DJT currently lacks a roadmap, use case, or clear long-term goal, making its future uncertain.

Investment Tips for $DJT Coin

Stay Skeptical and Do Your Own Research

With conflicting reports on $DJT’s origins, it’s crucial to verify information from reliable sources before investing. Avoid making decisions based solely on social media hype.

Monitor Insider Activity

Blockchain explorers can reveal wallet movements. If large holders begin offloading tokens, it could indicate an impending price drop.

Consider Short-Term Trading Strategies

Given its volatility, $DJT may be more suitable for day traders rather than long-term holders. Watching trading volume and price trends can help identify profitable entry and exit points.

If Barron Trump, the Trump family, or a major political figure acknowledges the token, it could trigger another wave of investor interest. However, without verification, caution is advised.

Since $DJT is highly speculative, only invest funds you can afford to lose and consider balancing your portfolio with more stable assets like Bitcoin or Ethereum.

Final Thoughts: Is $DJT a Worthwhile Investment?

The Barron Trump-themed $DJT coin has undoubtedly shaken up the meme coin market, sparking debates about its legitimacy, insider manipulation, and future potential. While its $72 million peak market cap showed strong initial demand, its sharp decline highlights the risks associated with politically themed meme coins.

For high-risk traders, $DJT may offer speculative opportunities. However, long-term investors should approach with extreme caution, as its legitimacy remains unverified and price movements unpredictable. As always, conduct thorough research, stay informed, and never invest more than you’re willing to lose.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.

In an era where digital screens dominate children's entertainment, Steam Squad emerges as a breath of fresh air, bringing excitement, education, and empowerment to young readers. The first two issues of this thrilling comic series are now available at InfluentialMagazine.tech, and with a third issue on the horizon, there has never been a better time to dive into the world of Steam Squad

Steam Squad is a 24-page action-packed comic book series designed to captivate young readers while subtly instilling important values like teamwork, critical thinking, and perseverance. Priced at just $10 per issue, it offers an affordable yet enriching alternative to traditional entertainment.

This dynamic series follows a group of young, brilliant minds who come together to solve real-world problems using

science, technology, engineering, art, and mathematics (STEAM). With a diverse cast of characters, Steam Squad makes sure that every child sees themselves represented in a story that encourages curiosity, learning, and self-confidence.

Why Steam Squad is a Must-Read for

1. Encourages Problem-Solving and Critical Thinking

Each issue of Steam Squad presents the characters with a new challenge that requires logical thinking and teamwork to overcome. Rather than relying on brute force or luck, the squad uses their STEAM knowledge to analyze situations, experiment with solutions, and ultimately triumph. This storytelling approach encourages young readers to think critically and approach problems with a solution-oriented mindset.

2. Diverse and Relatable Characters

Representation matters, and Steam Squad excels in showcasing a diverse group of young heroes. These characters come from different backgrounds, each bringing their own strengths, perspectives, and problem-solving skills. This inclusivity ensures that children of all cultures and experiences feel seen and inspired.

3. Inspires a Love for STEAM Education

As the world advances technologically, STEAM skills are becoming increasingly vital. Steam Squad introduces these subjects in a fun and engaging way, making learning feel like an adventure rather than a chore. Kids who read this series might find themselves more interested in subjects like robotics, coding, or even space exploration.

4. Promotes Teamwork and Collaboration

The stories emphasize the power of working together. The Steam Squad characters each have unique talents, but it is only when they combine their skills that they succeed. This teaches children that collaboration and communication are just as valuable as individual knowledge.

5. A Fun and Action-Packed Read

While the educational aspects are seamlessly woven into the narrative, Steam Squad remains, at its core, an action-filled comic book. It features thrilling adventures, unexpected twists, and visually striking artwork that keep kids glued to the pages.

The First Two Issues: A Sneak Peek

• Issue #1: The squad faces their first major challenge, using science and ingenuity to thwart a crisis that could impact their entire community. This issue sets the stage for the characters' development, introducing

readers to their individual talents and the overarching mission of the team.

• Issue #2: With the stakes even higher, the Steam Squad encounters a new adversary who challenges their problem-solving skills in unexpected ways. The action escalates, and the team must dig deep to find innovative solutions.

The Third Issue is on the Way!

If you’ve already enjoyed the first two issues, get ready for even more adventure! The third installment is currently in development and promises to take Steam Squad to new heights with an even more exciting storyline, fresh challenges, and deeper character development.

Beyond being an engaging comic book, Steam Squad aligns with educational goals that many parents prioritize for their children. It provides a break from passive screen time while still offering an

entertaining experience that fuels a love for learning. Parents appreciate the blend of fun and meaningful content, knowing that their kids are reading something that stimulates their intellect and creativity.

Get Your Copies Today!

With its affordable pricing and high entertainment value, Steam Squad is an investment in a child’s imagination and future. Visit InfluentialMagazine.tech to purchase your copies today and join the growing community of Steam Squadfans.

Don’t miss out—issue #3 is coming soon! Stay tuned for updates and be ready to dive into the next chapter of this phenomenal series.

Final Thought: In a world filled with distractions, Steam Squad is a beacon of creativity, inspiration, and adventure. Give your child a story that not only entertains but also educates and empowers. This is more than just a comic—it’s a movement to inspire the next generation of thinkers, creators, and leaders.

Donald Trump’s nominee for Commerce Secretary, Howard Lutnick, recently emphasized the administration’s preference for acrossthe-board tariffs as a strategic tool to address various economic concerns. His statements, made during a Senate confirmation hearing, signal a shift toward broader protectionist trade policies, with significant implications for industries such as artificial intelligence (AI), semiconductors, and agriculture.

Lutnick’s remarks highlight a key debate in Trump’s economic policy: should tariffs be targeted or applied universally? By advocating for country-by-country tariffs, Lutnick underscores his belief that broad duties are necessary to counter economic threats from countries like China while ensuring domestic industries remain competitive. However, this approach raises critical concerns for investors navigating market volatility and potential global trade tensions.

Broad-Based Tariffs as a Trade Strategy

Lutnick’s stance on tariffs reflects Trump’s broader trade philosophy— leveraging duties as a means to enforce economic reciprocity. He criticized the Biden administration’s AI export controls, arguing that they function like a “whack-a-mole model” without the backing of tariffs. Instead, he sees broad-based tariffs as a more effective

mechanism for ensuring that foreign competitors, particularly China, do not benefit unfairly from American innovation.

Lutnick directly addressed concerns that China has systematically stolen intellectual property and undermined American companies, stating, “They stole things, they broke things, they have taken our IP. It’s got to end.” His strong rhetoric underscores the belief that tariffs can be an enforcement tool rather than just a fiscal measure.

However, such an aggressive stance could trigger retaliatory measures from affected nations, potentially escalating trade disputes. China and other trade partners may impose their own duties on American exports, increasing costs for businesses reliant on global supply chains. For investors, this uncertainty could introduce market volatility, particularly for companies with international exposure.

The AI industry has become a central focus of economic and national security discussions. Lutnick’s comments suggest that Trump’s administration sees AI as a key battleground in global economic competition. Some experts argue that export controls implemented under Biden have not been enough to prevent foreign competitors from making rapid advancements. The recent case of Chinese AI startup DeepSeek, which

reportedly developed a powerful AI model by potentially querying OpenAI’s systems, exemplifies these concerns.

From an investment perspective, broad-based tariffs targeting AI-related imports could create both opportunities and challenges. On one hand, increased tariffs may incentivize domestic production and investment in U.S.based AI firms, leading to growth in local tech industries. On the other hand, companies reliant on international collaboration could face higher operational costs and supply chain disruptions. Investors should monitor how these policies affect the valuations and profitability of AI firms, particularly those with significant dependencies on foreign markets.

Lutnick’s confirmation hearing also addressed semiconductor manufacturing, another critical industry impacted by tariffs. While Trump has criticized Biden’s CHIPS and Science Act, which funds domestic semiconductor production, Lutnick described it as an “excellent down payment” for rebuilding the sector in the U.S. This divergence suggests that, despite Trump’s skepticism, his administration may continue providing incentives for chipmakers to establish manufacturing plants domestically.

Investors should consider how tariffs

on semiconductor imports might affect major players like Intel, Nvidia, and Taiwan Semiconductor Manufacturing Company (TSMC). Higher duties on imported chips could drive demand for U.S.-based manufacturing, benefiting companies investing in domestic production. However, retaliatory tariffs from other nations, particularly China, could create headwinds for U.S. semiconductor firms with significant international revenue streams.

Potential Market Volatility and Investor Sentiment

The looming February 1 deadline for Trump’s first wave of tariffs has created uncertainty in financial markets. Trump has proposed 25% tariffs on Canada and Mexico and 10% duties on China, citing issues such as migration and illegal drug trafficking. Investors are closely watching how these measures will be implemented and whether they will spark retaliatory action from affected nations.

Mexican President Claudia Sheinbaum recently dismissed concerns over the proposed tariffs, stating, “We don’t expect it will happen. But if it does, we have our plan.” While the specifics of Mexico’s response remain unclear, such uncertainty can impact investor sentiment and lead to short-term market fluctuations.

Broad-based tariffs can also lead to increased inflationary pressures, a topic Lutnick briefly addressed. He dismissed concerns that tariffs drive inflation, calling such claims “nonsense.” However, economic analysts argue that higher import duties often result in increased consumer prices, particularly for goods with limited domestic alternatives. For investors, this means that sectors sensitive to input costs—such as retail, consumer goods, and automotive—

could experience margin compression, impacting stock performance.

Agriculture and Trade Policy: Winners and Losers

Historically, tariffs have had mixed effects on the agricultural sector. While Lutnick argued that tariffs could ultimately benefit farmers, past trade disputes suggest that retaliatory measures often target U.S. agricultural exports. For example, during Trump’s previous tariff battles, China imposed duties on American soybeans, prompting economic distress among U.S. farmers.

If Trump’s new tariff measures lead to similar retaliation, agricultural commodity prices could be affected, impacting investors in agribusiness stocks and futures markets. Companies such as John Deere, Archer Daniels Midland, and Cargill may see increased volatility depending on how trade relations evolve.

For investors, navigating a protectionist trade environment requires a strategic approach. Here are a few key considerations:

1 Focus on Domestic-Oriented Companies – Companies with strong domestic supply chains and minimal reliance on imports may be better positioned to weather tariffrelated disruptions. Sectors like defense, energy, and domestically focused tech firms could offer more stability.

2 Monitor Tariff-Related Sectors – AI, semiconductors, and agriculture are among the

industries most directly affected by Trump’s tariff strategy. Investors should stay informed about policy developments and company earnings reports to assess potential risks and opportunities.

Given the uncertainty surrounding global trade relations, diversifying across sectors and geographies can help mitigate risks associated with sudden policy changes.

4 Stay Alert for Retaliatory Actions – If key trade partners impose countermeasures, affected industries may experience revenue losses. Investors should monitor geopolitical developments and adjust their portfolios accordingly.

Lutnick’s Senate hearing provided crucial insight into the Trump administration’s trade priorities, emphasizing broad-based tariffs as a solution to economic and security concerns. While these measures aim to protect U.S. industries, they also introduce potential market volatility, affecting investor sentiment and sector performance.

For investors, the key takeaway is that while some industries may benefit from protectionist policies, others— particularly those reliant on international supply chains—could face challenges. By closely monitoring policy developments, assessing sectorspecific risks, and maintaining diversified investment strategies, investors can navigate the shifting landscape of U.S. trade policy in the years ahead.

In a groundbreaking move that has sent shockwaves through the tech industry, OpenAI has announced an ambitious plan to develop an advanced AI infrastructure under the banner of the Stargate Project. This initiative, backed by SoftBank, Oracle, and MGX, will see a staggering $500 billion invested over the next four years.

The project's primary goal is to construct next-generation AI data centers across the United States, ensuring that the country remains a global leader in artificial intelligence. By leveraging the computational power of these centers, OpenAI hopes to accelerate progress in fields like healthcare, robotics, and even national security.

Stargate was officially unveiled at the White House on January 21, 2025, where it received a strong endorsement from President Donald Trump. In his remarks, he hailed the project as a testament to American innovation, job creation, and economic strength. Given the sheer scale of the investment and the potential ramifications, it’s no surprise that this initiative is attracting attention from both supporters and skeptics alike.

At its core, the Stargate Project is designed to lay down the infrastructure necessary to support the next wave of AI advancements. OpenAI, along with its partners, envisions these state-of-

the-art data centers as the backbone of an AI-powered future.

Masayoshi Son, the billionaire founder of SoftBank and chairman of Stargate, has stated that the initiative is “a step toward creating the most powerful AI systems ever conceived.” He has emphasized that AI will be pivotal in solving some of humanity’s most pressing problems, from eradicating diseases to optimizing global supply chains.

Oracle’s Larry Ellison, another key player in the project, has highlighted its potential to revolutionize medicine. According to him, the AI-powered computational resources housed in these facilities will make it possible to develop mRNA vaccines against cancer in a matter of days rather than months or years. This could redefine the way we approach disease treatment and prevention.

With an initial investment of $100 billion, the first phase of the Stargate Project is set to break ground in Texas. Over time, additional sites will be established across the country, ensuring that OpenAI's infrastructure is both scalable and resilient. If successful, this initiative will not only solidify the United States’ dominance in AI but also reshape industries on a global scale.

Elon Musk: A Voice of Dissent

Not everyone is on board with the Stargate vision. One of the most vocal

critics is none other than Elon Musk, who has a long history with OpenAI. Musk was one of the original cofounders of the company before parting ways due to disagreements over its direction.

Taking to social media, Musk openly questioned whether SoftBank has the financial capacity to fund such an enormous project, stating bluntly that the company “doesn’t have the money.” His skepticism underscores broader concerns about the financial feasibility of the endeavor. While OpenAI and its investors have assured that the funds are secured, such a massive undertaking naturally raises questions about whether the economic returns will justify the astronomical costs.

Musk’s criticism also extends beyond finances. He has previously expressed concerns about OpenAI’s increasing corporate control and the risks of advanced AI development being monopolized by a handful of powerful entities. His own company, xAI, has been pursuing a different approach to AI, focused on decentralized and opensource development. The rivalry between Musk’s xAI and OpenAI only adds more intrigue to the ongoing AI arms race.

In response to Musk’s skepticism, Sam Altman, OpenAI’s CEO, invited him to visit the project’s first construction site in Texas. Altman has emphasized that Stargate is not just an idea but a tangible project that is already taking shape.

Whether Musk takes him up on the offer remains to be seen, but it’s clear that OpenAI’s aggressive expansion strategy is not without controversy.

Despite Musk’s concerns, the companies backing Stargate remain highly optimistic. Their confidence stems from the belief that advanced AI infrastructure will unlock unprecedented capabilities across multiple sectors.

Masayoshi Son has argued that AI will be the most transformative technology in human history, far surpassing the impact of the internet. He envisions a future where AI can predict and prevent pandemics, optimize food production, and even contribute to sustainable energy solutions. His belief in AI’s potential has been a driving force behind SoftBank’s willingness to invest heavily in the sector.

Similarly, Oracle sees Stargate as a strategic asset that will enhance its cloud computing dominance. By integrating AI into its services, Oracle aims to offer next-level data processing capabilities to enterprises worldwide. From financial modeling to cybersecurity, AI-powered solutions are expected to drive efficiency and profitability across industries.

While some analysts question whether a half-trillion-dollar investment in AI infrastructure is sustainable, the project’s backers believe that the long-term payoff will be well worth it. They argue that failing to invest at this scale would leave the U.S. vulnerable to competitors, particularly China, which has been aggressively expanding its AI capabilities.

The Stargate Project is not just about technological progress—it is also a geopolitical statement. The race for AI

supremacy is heating up, with China making significant strides in its own AI infrastructure. Chinese firms have been developing cost-effective methods for training AI models, challenging the notion that only vast amounts of money can lead to breakthroughs.

OpenAI’s move to build massive data centers is seen as a direct countermeasure to China’s advancements. By securing domestic AI capabilities, the U.S. hopes to maintain its strategic advantage and prevent reliance on foreign AI infrastructure.

With AI increasingly being integrated into military applications, economic systems, and critical infrastructure, the stakes have never been higher. Stargate is as much about national security as it is about innovation.

Despite its grand ambitions, Stargate

faces significant challenges. First and foremost is the financial burden. Even with a $500 billion budget, constructing and maintaining AI data centers at this scale is a massive undertaking. The cost of energy consumption alone will be astronomical, prompting concerns about sustainability.

Environmentalists have raised alarms over the carbon footprint associated with such large-scale computing power. While OpenAI and its partners claim to be exploring renewable energy solutions, the reality is that AI processing requires enormous amounts of electricity. Some critics argue that more attention should be given to developing energy-efficient AI models rather than simply building bigger infrastructure.

There are also ethical concerns. With AI capabilities increasing at an unprecedented rate, questions arise regarding data privacy, bias in AI decision-making, and the potential for

misuse. If AI systems become too powerful without proper oversight, they could be exploited in ways that threaten personal freedoms and even democracy itself.

The next few years will be crucial in determining whether the Stargate Project lives up to its promise. If successful, it could mark the dawn of a new era in AI, where human intelligence is augmented by super-powerful computational resources capable of solving some of our most intractable problems.

On the other hand, if the project fails to deliver tangible results, it could go down as one of the most expensive miscalculations in tech history. The sheer scale of the investment means that there is little room for failure.

As construction begins and AI systems evolve, the world will be watching. Will

Stargate become the gateway to a new technological frontier, or will it collapse under the weight of its own ambition? Only time will tell.

The Stargate Project represents a pivotal moment in AI development. With half a trillion dollars on the line, it embodies both the boundless potential of artificial intelligence and the risks that come with uncharted technological territory. While investors see a future filled with breakthroughs in medicine, energy, and national security, critics worry about financial feasibility, ethical concerns, and environmental impacts.

Elon Musk’s skepticism adds another layer of drama to the story, highlighting the ongoing battle over the future of AI. As OpenAI moves forward with its grand vision, one thing is certain: the world is on the cusp of a new era, and Stargate could be the key to unlocking it.

n a historic market event, over $500 billion in value was wiped out in a single day—the largest sell-off in stock market history. The culprit? A Chinese AI startup named DeepSeek AI, whose unexpected technological leap sent shockwaves through Silicon Valley and Wall Street alike. The revelation of DeepSeek's groundbreaking AI model rattled the markets, spooking investors into a mass exodus from major AI and semiconductor stocks.

Tech giants like Nvidia, OpenAI, AMD, Intel, and others saw their stocks tumble at record speeds, as the implications of DeepSeek’s efficiency breakthrough threatened the foundation of AI's trillion-dollar industry. Investors panicked as they realized that DeepSeek had trained an AI model rivaling OpenAI’s most advanced systems at a fraction of the cost.

What followed was a financial bloodbath. Nvidia’s stock cratered by nearly 17%, erasing $600 billion in market cap in just hours. OpenAI, Microsoft, and other Western tech firms struggled to reassure investors that their dominance in artificial intelligence would not be upended overnight.

What is DeepSeek AI and Why is it So Disruptive?

DeepSeek AI is a China-based artificial intelligence company that remained under the radar until its sudden and shocking announcement in early 2025. The company unveiled its latest language model, DeepSeek-R1, which could match or exceed the performance of OpenAI’s GPT-5 while being trained at a fraction of the cost

DeepSeek’s breakthrough came from its highly efficient AI training techniques. Instead of relying on tens of thousands of expensive GPUs, like OpenAI and Anthropic, DeepSeek trained its model using just 2,048 Nvidia H800 GPUs—a number so low that industry experts initially thought it was a joke.

By leveraging novel optimization strategies, reinforcement learning with self-improving models, and a highly compressed dataset that mimicked the performance of more computationally expensive AI models, DeepSeek slashed the costs of AI training by nearly 90%.

Piggybacking on OpenAI’s Research: The Real Game Changer

One of the most controversial aspects of DeepSeek’s success was its ability to leverage OpenAI’s research—essentially using breakthroughs made in the West to power China's AI revolution. Despite OpenAI's closed-source approach in recent years, DeepSeek found ways to replicate key components of OpenAI's advancements through publicly available research, indirect data training, and clever engineering.

By reverse-engineering methodologies, DeepSeek bypassed years of costly R&D, allowing them to achieve state-ofthe-art AI capabilities without the financial burden that companies like OpenAI and Google had to endure. This led to the terrifying realization among Western tech investors:

If China could train competitive AI models for 90% less, what does that mean for the future of U.S.-led AI?

The Immediate Market Reaction: A Nightmare for Investors

Once the news broke, panic spread across global stock exchanges Investors quickly dumped shares in companies reliant on AI hardware and software dominance, fearing that DeepSeek's efficiency would undercut their business models.

The biggest casualties of the sell-off included:

• Nvidia (-17%) lost over $600 billion in market cap.

• AMD & Intel (-14% each) saw tens of billions vanish overnight.

• Microsoft (-10%) suffered heavy losses due to its investment in OpenAI.

• Alphabet (Google) (-9%) faced fears that its AI business would be disrupted.

• OpenAI's partners, including Microsoft, saw billions wiped off their valuations.

Why Did the Market Get Spooked?

1 The AI Bubble Just Burst –Investors realized that AI model training was no longer a high-cost barrier to entry. This meant that smaller firms and even rogue states could develop powerful AI models without needing billions in computing resources.

2 Nvidia’s Business Model at Risk – Nvidia’s success had been fueled by the high demand for AI chips. But if AI models could be trained using far fewer GPUs, Nvidia’s trillion-dollar AI boom could be in jeopardy

3 Western AI Leadership Under Threat – The idea that a Chinese company could leapfrog OpenAI, Anthropic, and DeepMind with a drastically cheaper AI model raised geopolitical and economic fears about U.S. competitiveness.

What This Means for the Future of AI

DeepSeek’s achievement signals a fundamental shift in AI development. The old model—where only the richest tech firms could afford to train AI—is now obsolete. This could have profound consequences for:

• Big Tech Companies –Giants like Nvidia, Microsoft, OpenAI, and Google may need to rethink their AI strategies to avoid becoming obsolete.

• Startups & Small Players –AI is now far more accessible, allowing smaller companies to compete with tech behemoths.

• Geopolitics – The AI race between the U.S. and China has just dramatically

4 Fear of AI Democratization – OpenAI and Google had positioned themselves as the gatekeepers of AI. But if anyone could train a worldclass AI with minimal computing resources, what control would be left?

escalated, with China proving it can achieve AI dominance at a fraction of the cost.

• Stock Markets – The tech sector’s vulnerability to AI disruption has been exposed The sell-off may be a sign of continued market volatility in the months ahead.

Can the U.S. Respond?

With DeepSeek proving that AI can be trained cheaply and efficiently, the U.S. must act quickly if it wants to maintain its lead in artificial intelligence. Some potential responses include:

1 Government Investment in AI – The U.S. could increase federal funding to support domestic AI firms and limit China’s access to critical AI components.

2 Regulating AI Models – If powerful AI can be trained on the cheap, some experts worry that bad actors could develop AI for disinformation, cyber warfare, or worse.

3 Strengthening Chip Restrictions – The U.S. has already tried to limit China's access to Nvidia’s most advanced AI chips. This crisis could prompt even stricter export controls

Investor Takeaways: What to Watch Moving Forward

For investors, this event has profound implications for the AI sector and broader markets. Here are key lessons:

• The AI Boom is Not Guaranteed – Companies that once had a monopoly on AI infrastructure may see their profit margins shrink.

• Nvidia’s Future is Uncertain – If AI models require fewer GPUs, Nvidia’s market dominance could fade.

• Geopolitical Risks Are Real – China’s rise in AI cannot be ignored—it could reshape global power dynamics.

Conclusion: The Beginning of a New AI Era

DeepSeek AI has fundamentally changed the AI landscape. The notion that only trillion-dollar companies could develop advanced AI has been shattered. With China proving that AI can be trained efficiently and at a low cost, the global AI race has entered a dangerous and unpredictable new phase.

The historic $500 billion stock market meltdown is just the beginning. The question now is whether the West can adapt—or if China will dominate the future of artificial intelligence. Investors, governments, and tech firms alike must prepare for a world where AI breakthroughs no longer come at a trillion-dollar price tag—but at a fraction of the cost.

• AI is Moving Faster Than Expected – Investors should stay flexible as AI continues to evolve at a breakneck pace.

Aseismic shift is underway in the American energy landscape. The government’s latest push for domestic energy expansion— coined “Drill Baby Drill”—is poised to transform both national and global markets, creating an electrified atmosphere for investment. This initiative is not just about oil and gas; it’s a comprehensive strategy encompassing traditional fossil fuels, nuclear power, and groundbreaking projects like Stargate, which aims to redefine how energy is harnessed for Artificial Intelligence (AI) and other emerging technologies.

As energy infrastructure undergoes rapid transformation, the financial yield for the United States could be in the trillions, with industries like AI, data centers, and advanced manufacturing poised to benefit immensely. Investors are taking note, positioning themselves in what may be one of the greatest energy-driven market expansions in modern history.

A Surge in Domestic Energy: The Economic Impact

The “Drill Baby Drill” initiative is centered around increasing domestic energy production to not only reduce

reliance on foreign oil but also to power the rapidly growing demands of the AI revolution.

• The U.S. is expected to ramp up crude oil production to over 14 million barrels per day by 2027, making it the largest oil producer in the world.

• Natural gas production is also projected to increase, with liquefied natural gas (LNG) exports expected to surpass 15 billion cubic feet per day (bcf/d) by 2026, strengthening America’s role as a key energy supplier to Europe and Asia.

• These expansions could contribute an additional $1.5 to $2 trillion in GDP over the next decade.

While fossil fuels remain the backbone of this initiative, new energy sources are coming into play—especially nuclear power, which is experiencing a renaissance thanks to AI-driven demands.

AI development is placing unprecedented pressure on the energy grid. Data centers housing AI models like ChatGPT, Tesla's autonomous driving algorithms, and advanced cybersecurity AIs require enormous

amounts of power, often exceeding what the current grid can provide.

This energy demand has prompted figures like Bill Gates and Jeff Bezos to invest heavily in nuclear power projects, including the revitalization of old nuclear plants. Gates’ TerraPower, for instance, is working on an advanced nuclear reactor in Wyoming that will power AI infrastructure and industrial facilities.

One of the largest AI-driven power projects is happening on the East Coast, where an aging nuclear power plant is being repurposed to serve nextgeneration data centers. If these projects succeed, AI infrastructure alone could drive nuclear power back to the forefront of energy policy, creating new investment opportunities worth over $500 billion in the next decade.

A particularly intriguing aspect of the energy revolution is the Stargate Project, a classified but widely speculated initiative that aims to harness exotic energy sources. While details remain scarce, reports suggest that it involves quantum energy harvesting, potentially leading to breakthroughs in unlimited clean energy production.

• If successful, the Stargate Project could reduce U.S. reliance on fossil fuels by 40% over the next 30 years.

• Investment estimates indicate a potential $2 trillion valuation if commercialized.

This project, alongside nuclear advancements and AI-driven energy consumption, is creating an entirely new investment sector where visionary investors can establish an early foothold.

Industries Set to Benefit from the Energy Revolution

The impact of this energy initiative stretches far beyond oil and gas. Key industries poised to benefit include:

1. Artificial Intelligence (AI) & Data Centers

• The AI sector is projected to grow from $200 billion to over $1.5 trillion by 2030, requiring substantial energy inputs.

• Data centers, already consuming 3% of global electricity, are expected to use 8% by 2030, making energy security a top priority.

2. Nuclear Energy & Advanced Reactors

• The U.S. is actively investing in next-generation nuclear reactors that will power AI systems, industry, and urban centers.

• Companies like TerraPower, X-energy, and NuScale Power are leading the charge, with investment opportunities exceeding $400 billion

3. Renewable Energy & Storage Solutions

• As fossil fuels are ramped up, so is investment in renewable energy storage systems.

• The global energy storage market is expected to surpass $500 billion by 2035.

4. Oil & Gas Services & Infrastructure

• Energy expansion means increased investment in pipelines, LNG terminals, and drilling operations, with projects worth $700 billion expected to roll out over the next decade.

5. Defense & Space Industries

• The military’s role in securing energy supply chains is growing, with $150 billion in energy-related defense contracts expected in the coming years.

• Space-based energy projects, including orbital solar farms, are gaining traction, creating a new market worth an estimated $300 billion

Financial Gains for the U.S.: A Trillion-Dollar Opportunity

If this initiative succeeds, the financial gains for the U.S. economy could be staggering:

The “Drill Baby Drill” initiative is more than an energy strategy—it’s a multi-trillion-dollar economic catalyst reshaping industries across the board. With AI, nuclear power, and exotic energy breakthroughs driving demand, investors have a rare opportunity to enter a market that could define the next industrial revolution.

• Increased Energy Exports: By 2030, the U.S. could generate over $600 billion annually in fossil fuel and LNG exports.

• AI and Tech Growth: AI infrastructure development alone could contribute an additional $2 trillion to GDP over the next 20 years.

• Nuclear Renaissance: Revitalized nuclear energy projects may unlock $500 billion to $1 trillion in new market value.

• Job Creation: The energy sector will generate millions of new jobs, particularly in skilled labor, tech, and engineering. With these numbers in mind, investors are taking positions now before the full market impact is realized.

For investors looking to capitalize on this energy boom, here are key avenues to consider:

1. Energy Stocks & ETFs

• Nuclear investments via TerraPower, X-energy, or NuScale Power are promising.

• AI-focused energy ETFs, such as Invesco AI & Energy ETF (AIEN), offer diversified exposure.

2. Infrastructure & Real Estate Investments

• Pipeline construction, LNG terminals, and data center expansion are areas of massive capital influx.

• Real estate investments near new energy hubs—such as the revived nuclear plant on the East Coast—could yield strong returns.

3. Private Equity & Venture Capital

• Venture capitalists are pouring money into AI-driven energy solutions, nuclear startups, and quantum energy projects

• Companies like ExxonMobil (XOM), Chevron (CVX), and ConocoPhillips (COP) stand to gain from increased drilling and LNG exports.

• Investing in companies contributing to the Stargate

Project could provide an early entry into an emerging trilliondollar market.

4. Defense & Space Technology

• The intersection of energy security and national defense is creating lucrative contracts for companies like Lockheed Martin (LMT) and Raytheon (RTX)

The Time to Invest is Now

The “Drill Baby Drill” initiative is more than an energy strategy—it’s a multitrillion-dollar economic catalyst reshaping industries across the board. With AI, nuclear power, and exotic energy breakthroughs driving demand, investors have a rare opportunity to enter a market that could define the next industrial revolution.

As the world races to secure its energy future, the U.S. is positioning itself as the global leader in energy security, technological advancement, and economic growth. For investors, the writing is on the wall: now is the time to stake a claim in this transformative era.

Welcome to Greystone Tower, a place where luxury meets excellence. This 19-floor mixed-use development is set to expand options for corporate tenants in Victoria Island, Lagos. With an exclusive, spacious smart lobby, guests are welcomed with elegance, creating an atmosphere of prestige and professionalism. The sleek design and ambiance leave an unforgettable impression on every visitor.

• Prime Location: Situated in Victoria Island, Lagos, a highdemand business and residential area.

• Mixed-Use Functionality: Ideal for office spaces, foreign missions, and luxury residential use.

• Smart Lobby: A spacious and elegantly designed lobby with advanced security systems.

• Expansive Office Space: A total of 11,190m² of globalstandard office space, offering a well-lit, luxurious environment on every floor (1,121m² per floor).

• Six Smart Elevators: Equipped with a 1,600kg lift capacity, ensuring seamless access throughout the building.

• Luxurious Residential Units: Four fully furnished 3bedroom luxury apartments located on the 17th floor, each featuring private swimming pools, smart windows, and curtains, designed to accommodate CEOs, MDs, and board members.

• Skyline Lounge: The 19th floor boasts a sky lounge that offers breathtaking panoramic views of the city, setting a new standard for luxury and exclusivity.

• Smart Parking Bay: Floors 1-5 feature a 306-car parking capacity, with identification sensors ensuring top-tier security and convenience.

• State-of-the-Art Security: Equipped with 24/7 surveillance, biometric access, and high-tech security protocolsto ensure a safe and secure environment.

• Eco-Friendly Design: Incorporating energy-efficient lighting, water recycling systems, and sustainable building materials for longterm environmental benefits.

• Conference and Meeting Facilities: High-end boardrooms and conference halls tailored for corporate excellence.

• Recreational Amenities: A well-equipped fitness center, wellness spa, and green terraces that offer relaxation amidst business engagements.

• Exclusive Business Lounge: A private space for networking, negotiations, and high-profile meetings.

• Concierge Services: Offering 24/7 guest assistance, ensuring a world-class hospitality experience.

• Helipad Access: A premium feature allowing executives to fly in and out seamlessly.

This commercial tower offers a rare opportunity for investors to tap into one of Africa’s most dynamic real estate markets. Here’s why investing in Greystone Tower is a strategic decision:

Investing in commercial real estate guarantees a consistent stream of rental income. Lagos remains one of the most vibrant and high-demand markets in Africa, and Victoria Island is at its core. With companies, international organizations, and embassies constantly seeking premium office space, this tower provides a prime opportunity for steady cash flow. Investors can expect:

• Competitive rental rates due to the prime location.

• High occupancy rates driven by corporate and diplomatic tenants.

• A stable source of income, minimizing financial risks.

• Long-term leasing agreements ensuring financial stability.

• Opportunities for short-term luxury apartment leasing, providing higher returns.

2. High Property Value Appreciation

Real estate in Victoria Island continues to appreciate due to the increasing demand for luxury commercial and residential spaces. Key factors driving this growth include:

• Scarcity of prime real estate: As one of Lagos’ most sought-after locations, Victoria Island has limited space for new developments, making existing properties more valuable over time.

• Economic growth: Nigeria’s expanding economy fuels demand for high-end office spaces and residential properties, leading to consistent property value increases.

• Infrastructure development: Ongoing improvements in road networks, security, and urban planning further boost property values in the area.

• Foreign investment interest: With increasing international business expansion into Nigeria, the demand for premium commercial properties is projected to rise steadily.

• Innovative real estate trends: Smart-building integrations and sustainability measures enhance property desirability.

Investors in Greystone Tower stand to gain significantly as property values increase year after year.

3. Multi-Purpose Investment Potential

This development offers a mix of commercial and residential

opportunities, ensuring flexible usage. Investors can benefit from:

• Corporate leasing: Office spaces can be rented out to multinational corporations, banks, tech companies, and diplomatic missions.

• Luxury residential leasing: The high-end 3bedroom apartments provide lucrative rental income in the growing luxury housing market.

• Retail and hospitality: The café/restaurant, gym, and rooftop sky lounge enhance the building’s appeal, adding multiple revenue streams.

• Serviced office solutions: Offering short-term office rentals for growing businesses and startups.

• Luxury co-working spaces: Catering to freelancers and businesses looking for high-end shared office environments.

Such multi-purpose functionality ensures resilience against economic shifts and maximizes investment returns.

4.

Real estate is a powerful tool for

• Event and conference hosting: The sky lounge and high-end facilities can serve as premium event spaces.

portfolio diversification. Unlike stocks and bonds, real estate investments are relatively stable and less susceptible to market volatility. By adding Greystone Tower to your investment portfolio, you can:

• Hedge against inflation, as property values and rental income tend to increase over time.

• Enjoy the security of a tangible asset that provides consistent cash flow.

• Reduce investment risks by spreading capital across different revenuegenerating sectors.

• Balance your portfolio with a stable, income-generating asset.

• Secure an asset that appreciates independently of global stock market fluctuations.

5. Enhanced Smart Technology & Automation

• Smart security systems providing biometric and AIdriven surveillance

• High-speed internet connectivity and fiber-optic infrastructure.

• Smart climate control features optimizing energy efficiency.

• Automated maintenance monitoring for cost-effective operations.

•

booking systems for seamless business operations.

6. Luxury Lifestyle & Executive Living

Greystone Tower is not just a commercial space; it is a statement of sophistication and prestige. Executives, expatriates, and high-networth individuals will appreciate:

• Exclusive penthouse access.

• Personalized concierge services.

• Proximity to high-end shopping, fine dining, and entertainment hubs.

• A lifestyle of security, comfort, and distinction.

7. Sustainability & Green Building Standards

In alignment with global real estate trends, Greystone Tower implements:

• Solar panel integration to reduce energy consumption.

• Efficient water recycling and conservation systems.

• Environmentally friendly building materials and energy-efficient appliances.

• Indoor green spaces and rooftop gardens fostering a

sustainable ecosystem.

Victoria Island remains the heart of business, commerce, and international diplomacy in Lagos. The demand for premium office spaces and high-end residences continues to grow due to:

• The presence of multinational corporations, leading financial institutions, and top tech firms.

• An influx of expatriates, diplomats, and corporate executives seeking luxury housing.

• Nigeria’s expanding economy, driving more businesses and professionals into Victoria Island.

• Increasing governmentbacked infrastructure projects enhancing the business environment.

• The emergence of Lagos as a major financial hub in Africa, attracting new businesses globally.

Greystone Tower in Victoria Island, Lagos, is a once-in-a-lifetime investment opportunity. Whether you’re an individual investor, a

corporate entity, or a real estate developer, this mixed-use development offers a combination of:

High rental income potential

Long-term property value appreciation

Multiple revenue streams from offices, residences, and retail amenities

A prestigious location in the heart of Africa’s commercial capital World-class amenities, security, and eco-friendly designs Unparalleled lifestyle benefits for executives and business leaders

For more information, please contact Vanessa Enaharoo at Inflational International via email at info@influentialinternational.com

Don’t miss out on this exclusive opportunity to own a piece of Lagos.