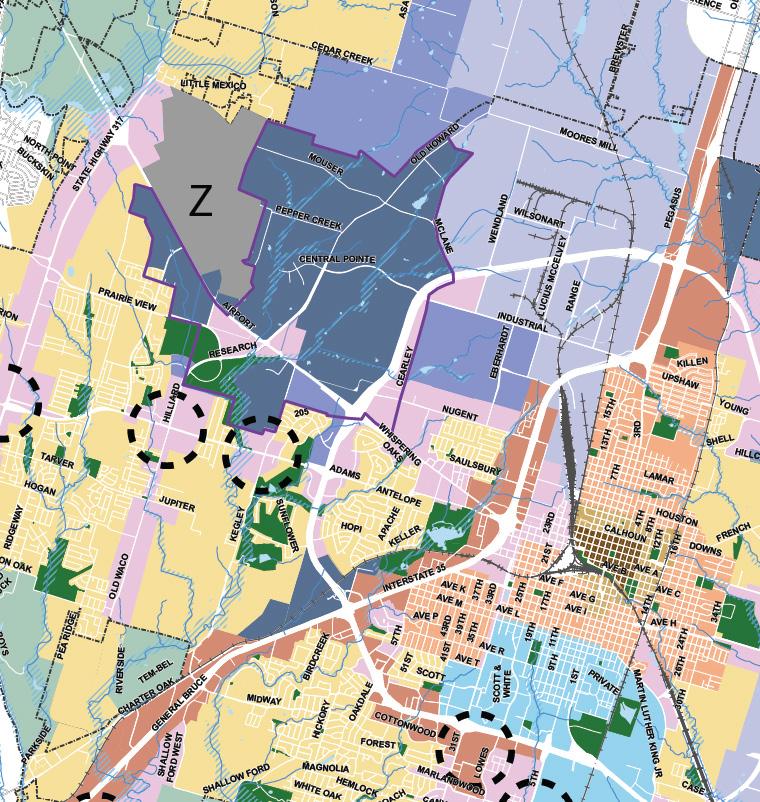

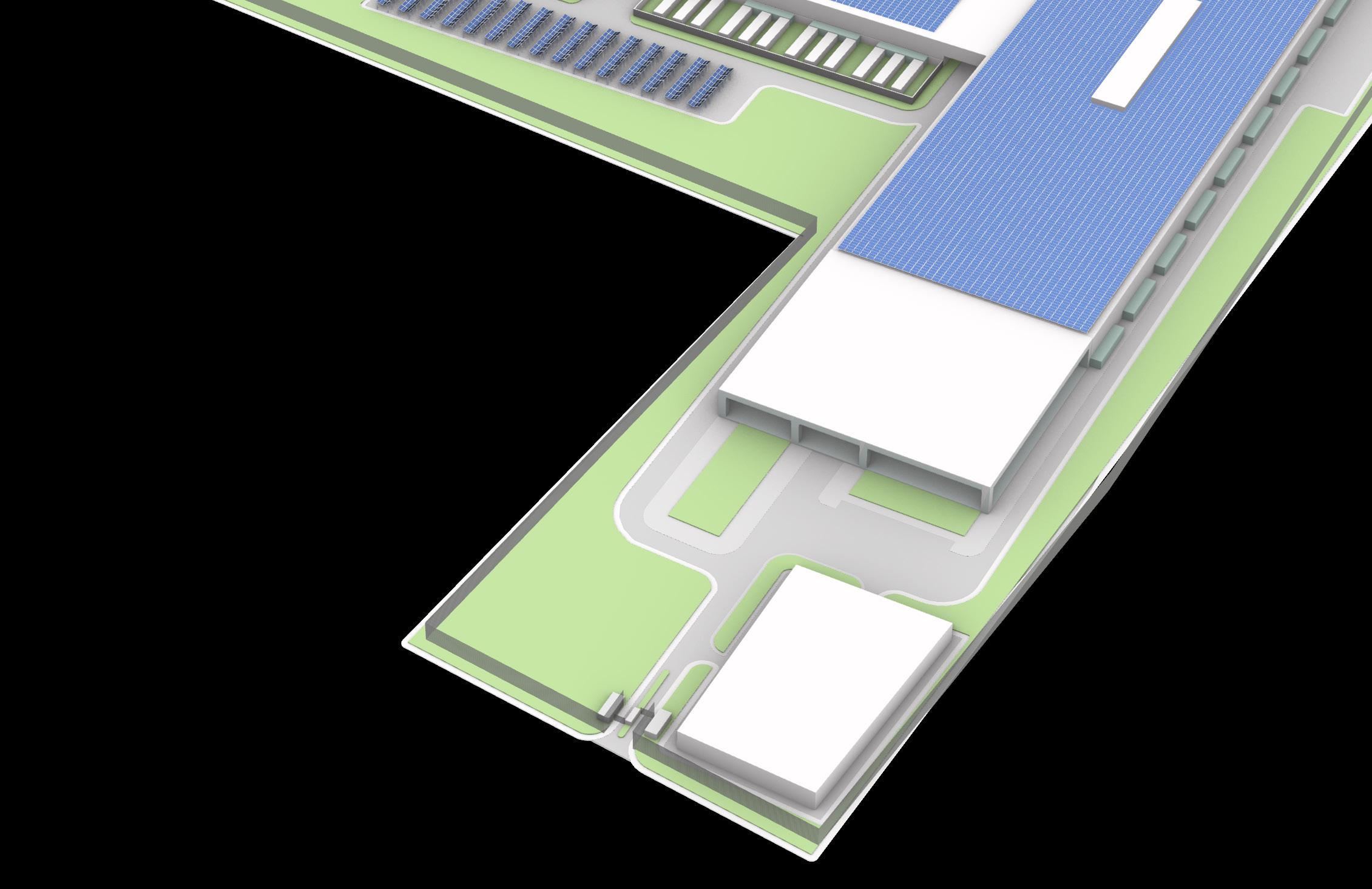

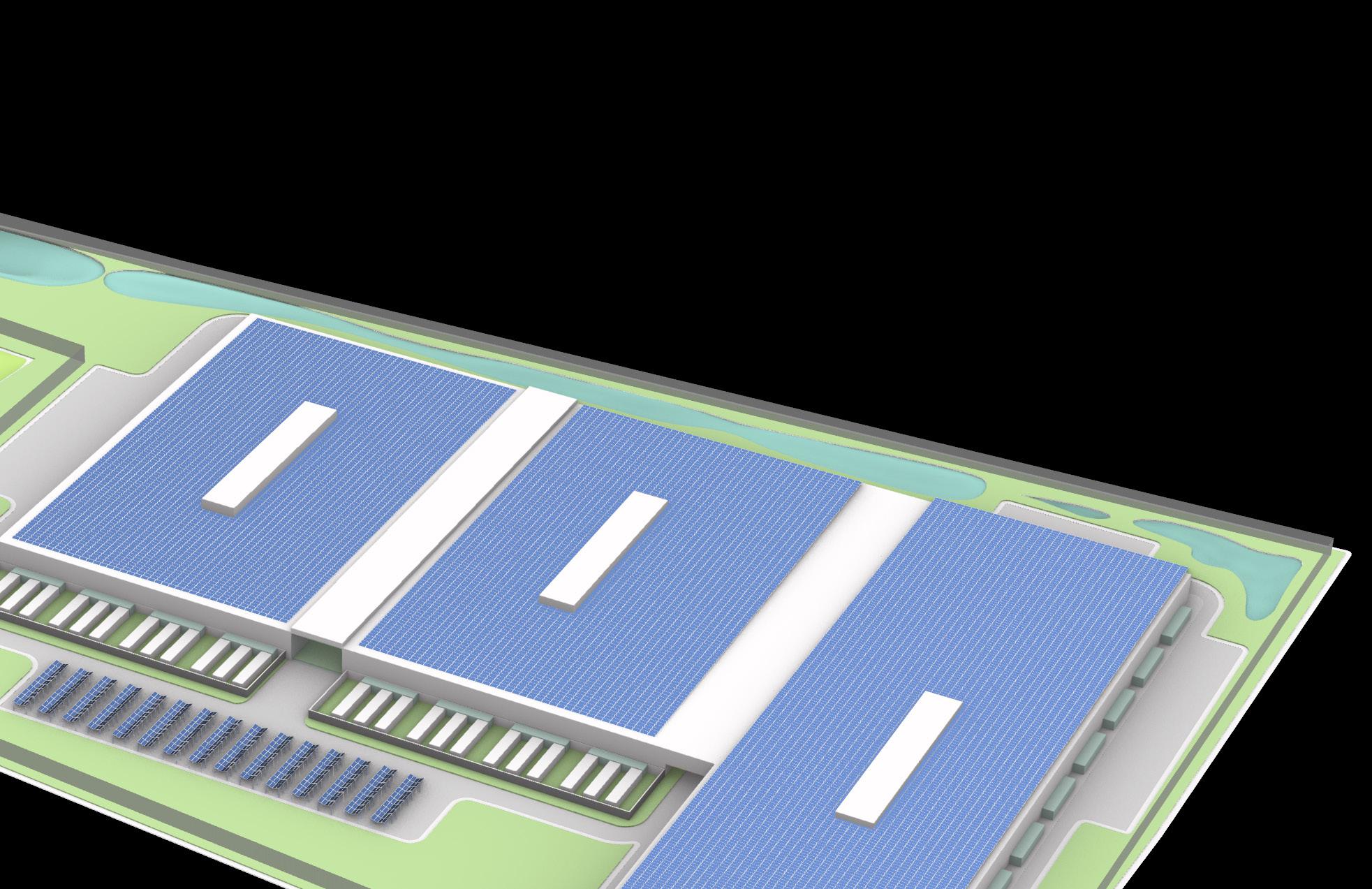

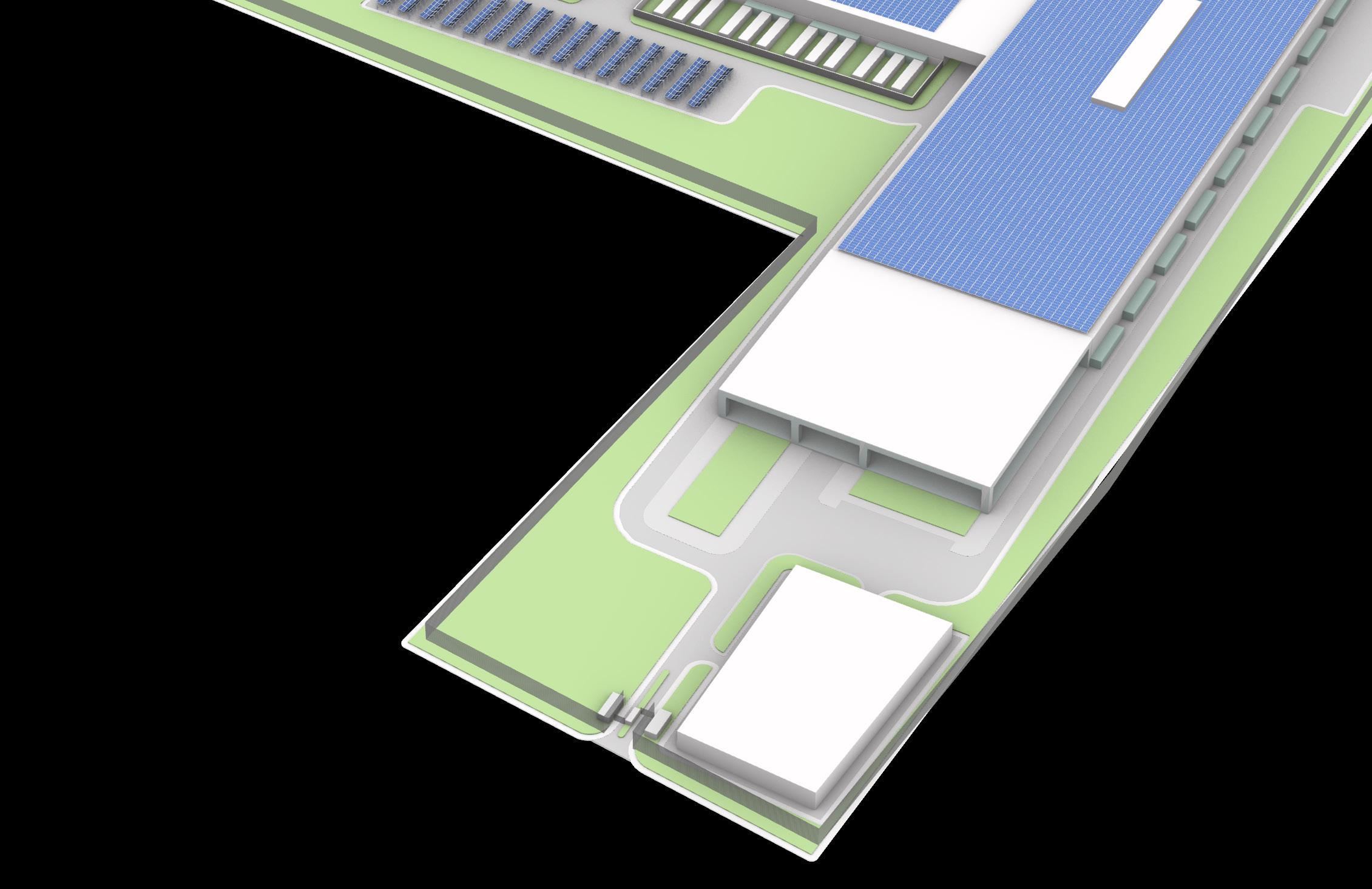

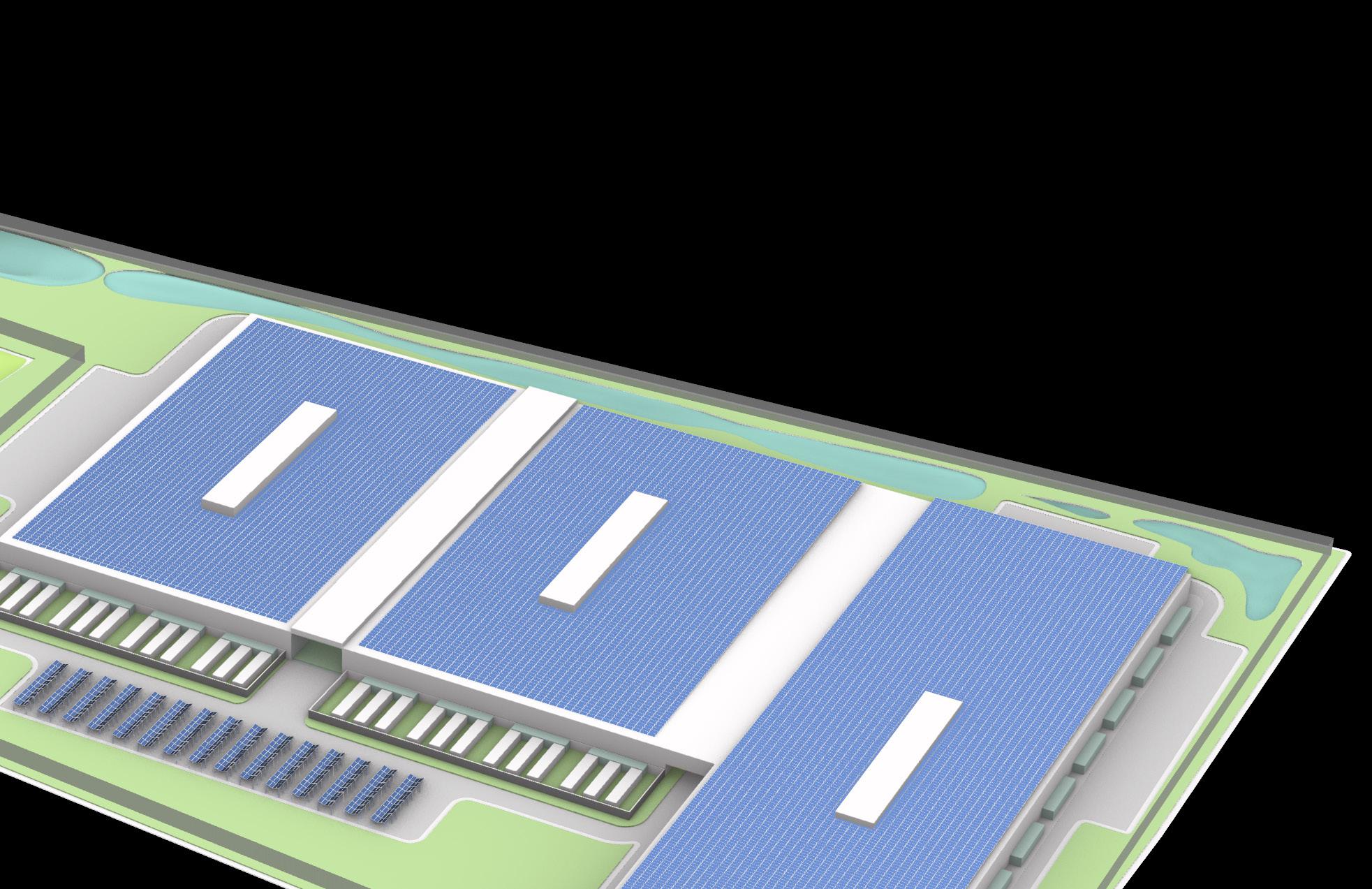

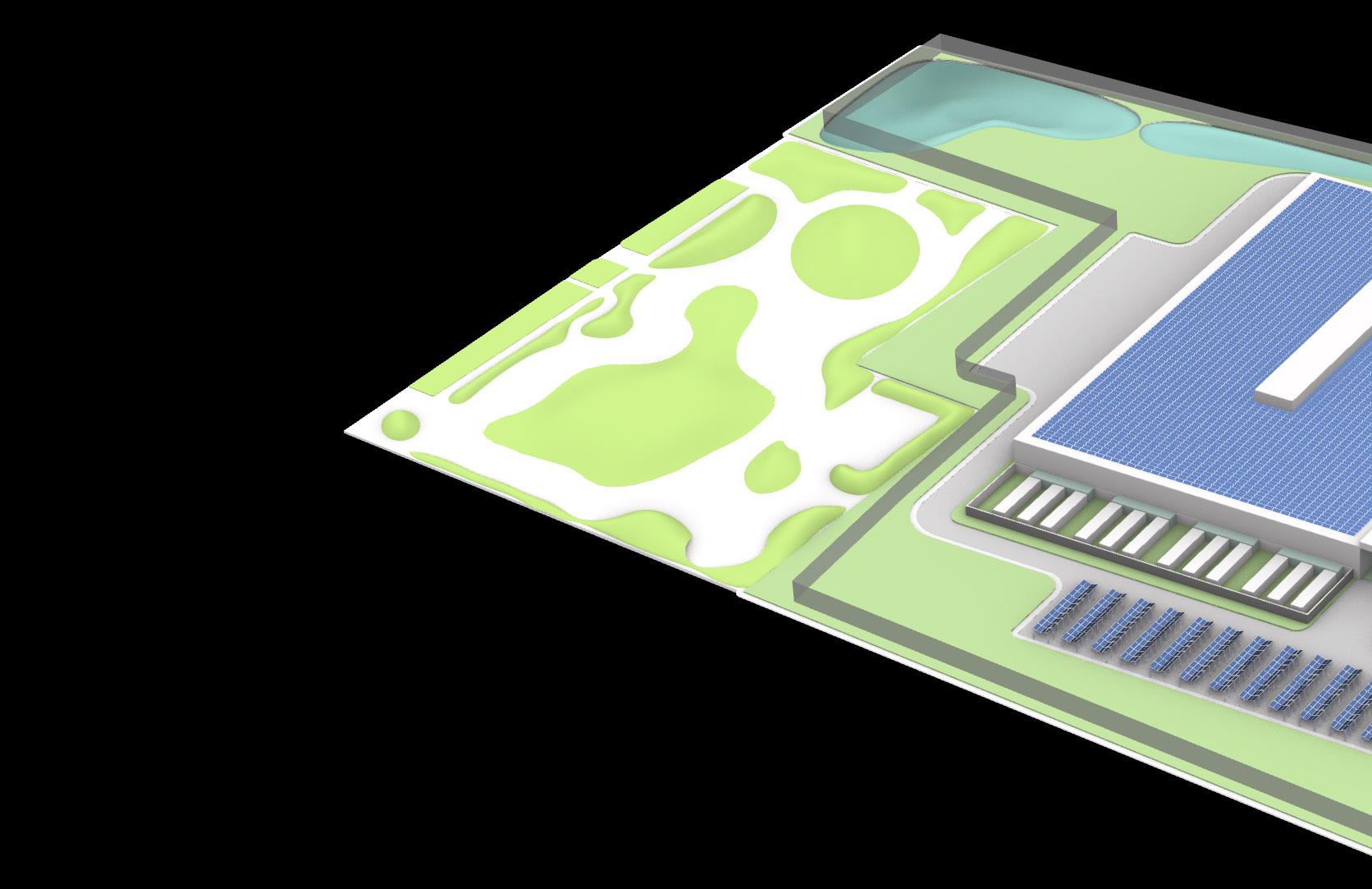

SITE MASTER PLAN

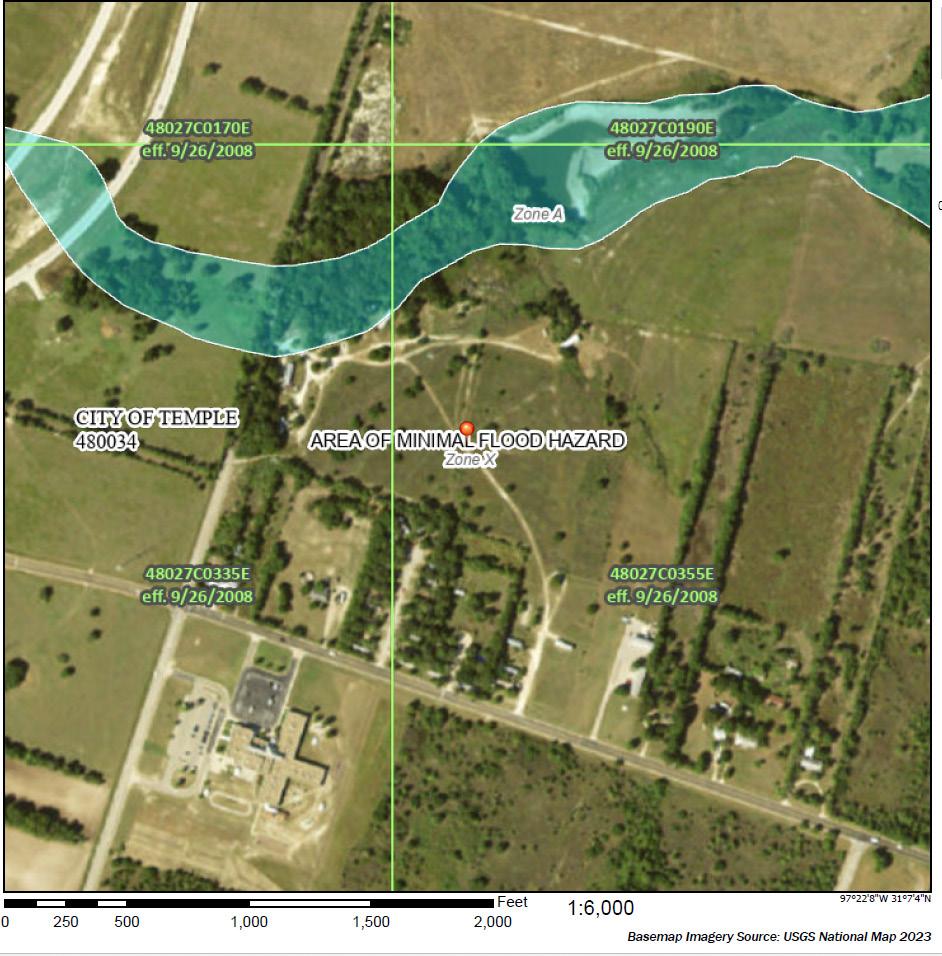

BIO SWALE/RETENTION POND

WETLAND PLANTING ZONE

PARKING

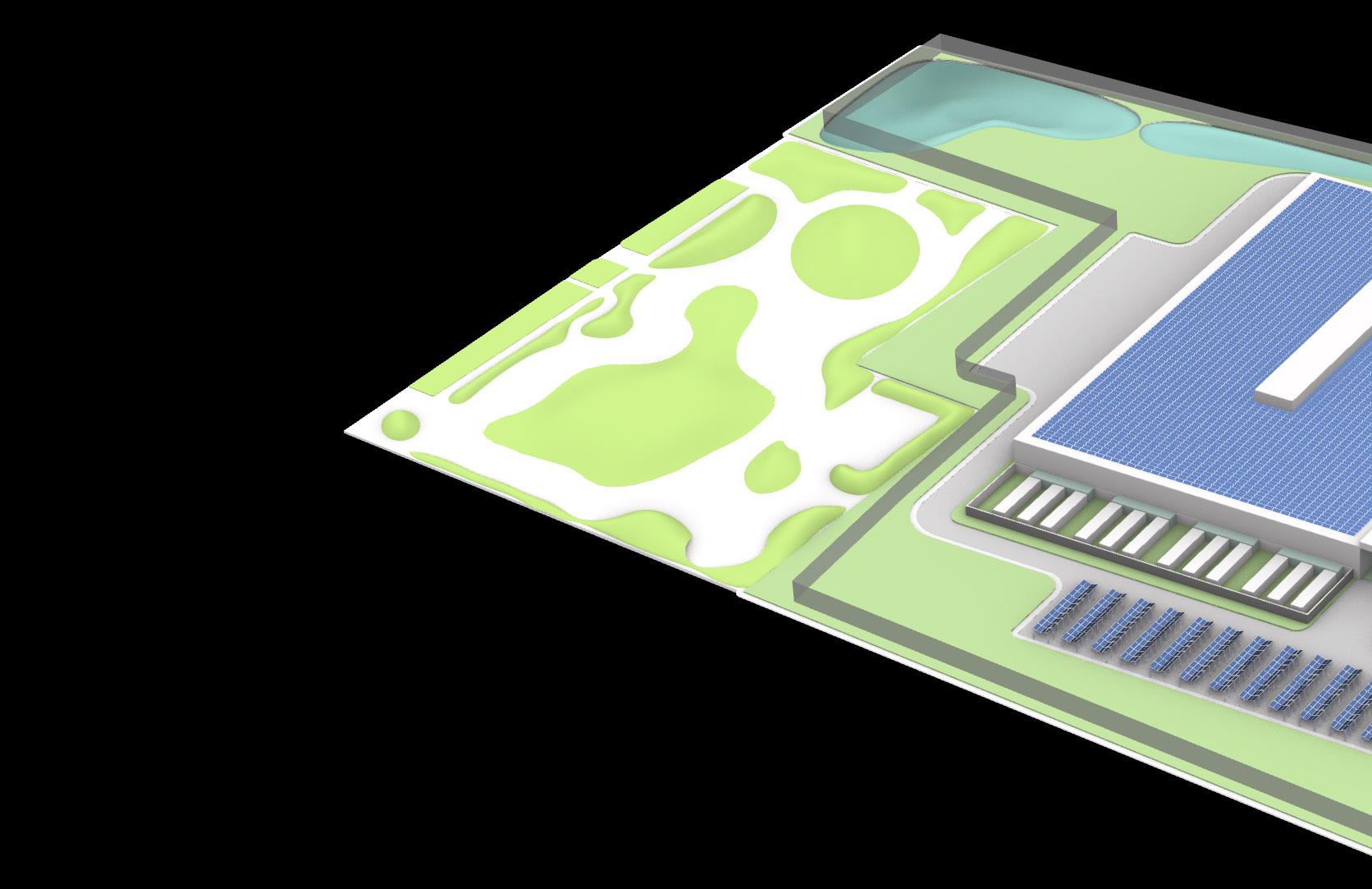

COMMUNITY PARK

PARK ENTRANCE

WHOLESALE UNIT ENTRANCE

SECURITY CHECKPOINT 2B

PARKING LOT WITH SOLAR SHADE +EV CHARGING

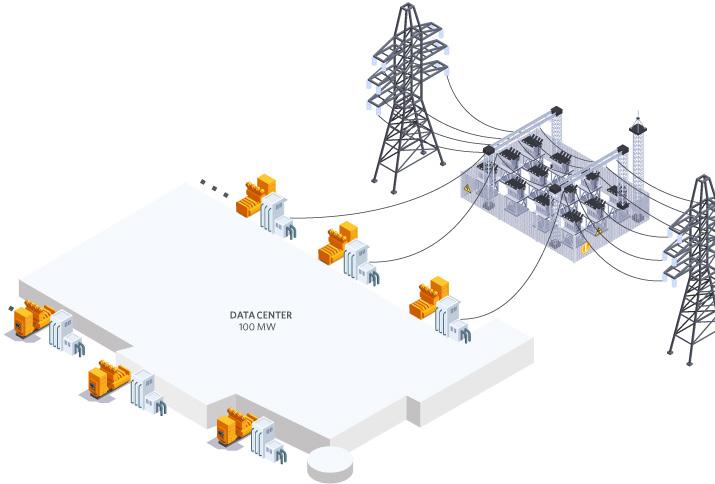

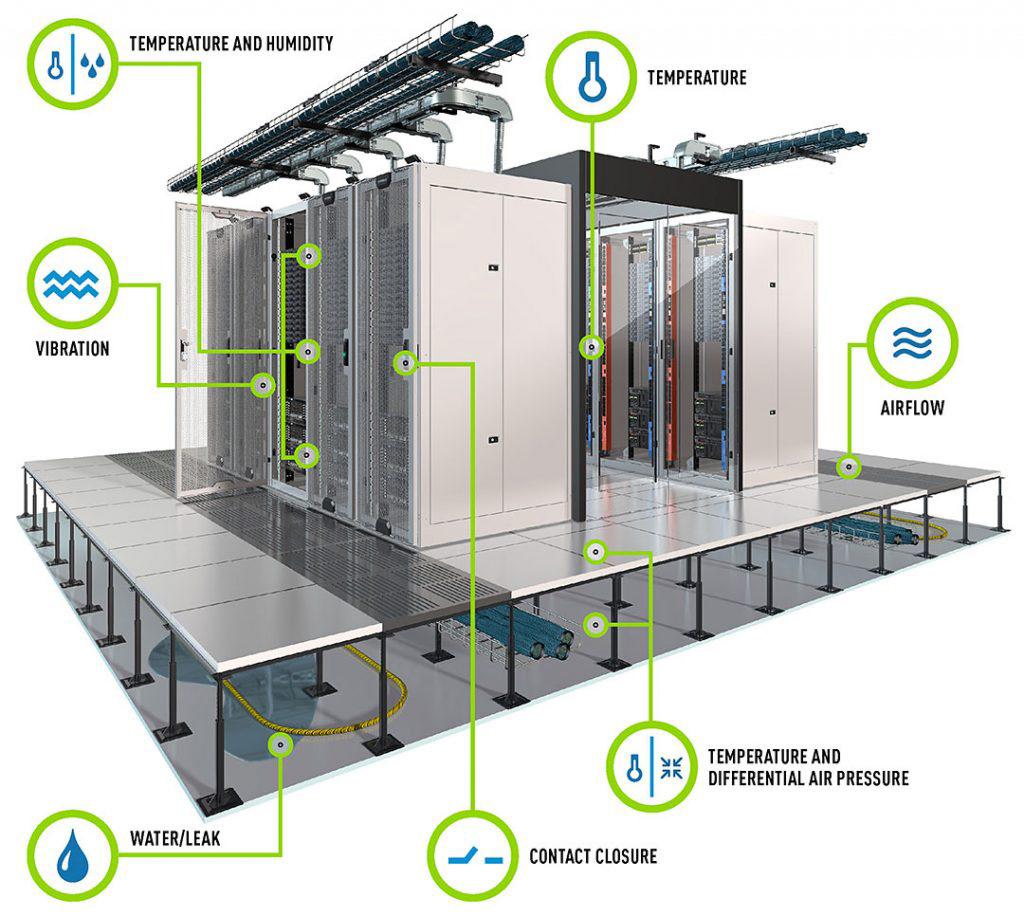

UPS

GENERATORS

RETAIL UNIT NETWORK ROOM

RETAIL UNIT DATA HALL SERVER

RETAIL UNIT OPERATION ROOM

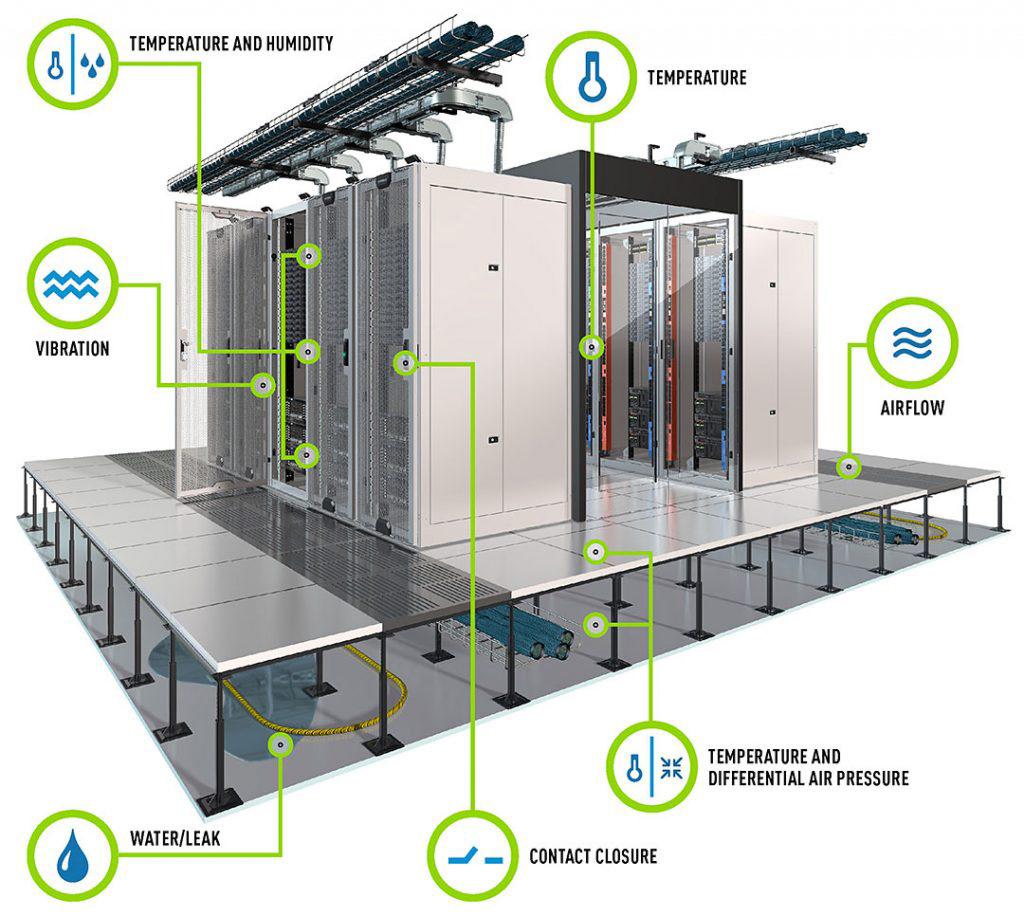

COOLING SYSTEM + RAINWATER COLLECTION SECURITY FENCE + CCTV

RETAIL UNIT NETWORK ROOM

PARKING

RETAIL UNIT DATA HALL SERVER

RETAIL UNIT OPERATION ROOM

RETAIL UNIT ENTRANCE SECURITY CHECKPOINT 2A

PARKING

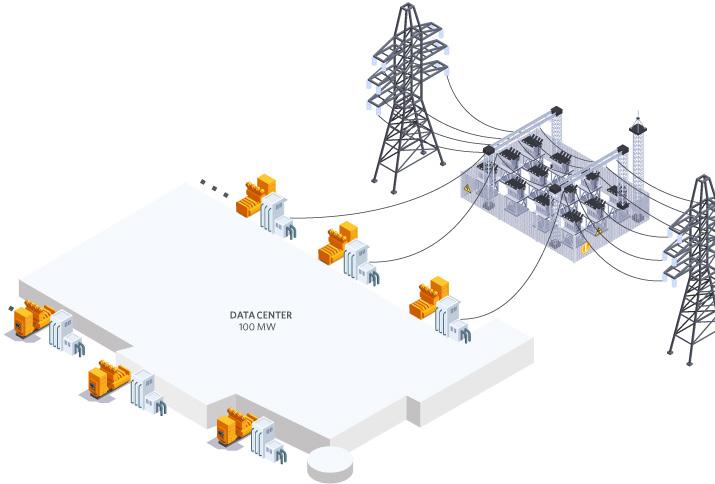

SUBSTATION

MAIN DATA

CENTER ENTRANCE

SECURITY CHECKPOINT 1

EcoLogic N

SOLAR -PRODUCTION (KWH MONTHLY) $2922895.36 E-PRODUCTION (KWH ANNUALLY) 35074744.32 TEMPLE SOLAR ENERGY PRICE $0.11 MONTHLY EST INCOME $321,518.49 ANNUALLY EST INCOME $3,858,221.88

GENERAL MARKETING STRATEGIES

Professional Website

Key for credibility and service details.

Showcase success stories and testimonials.

Foster direct relationships with visitors.

Billboards

Effective for capturing commuter attention. Strategically placed for maximum exposure. Highlight key selling points and include contact info.

Broker Partnerships

Utilize broker networks for market reach. Benefit from established relationships. Target Dallas market for expansion.

Google Ads

Capitalize on search engine visibility. Target keywords related to services. Drive targeted traffic and generate leads.

Influencer Sponsorship

Partner with industry influencers. Gain access to engaged audiences. Enhance brand credibility and visibility.

EcoLogic

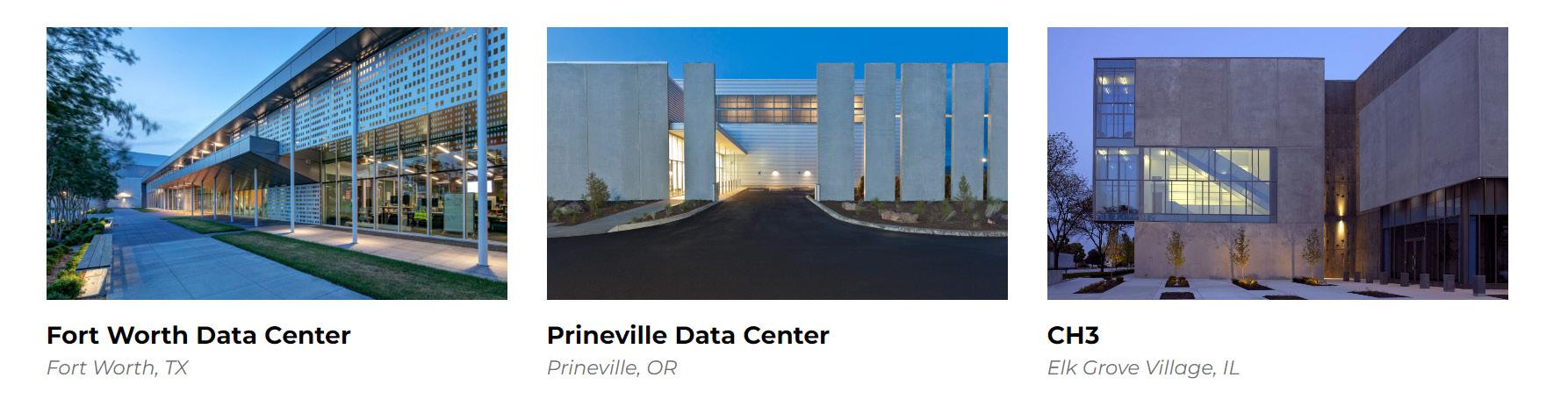

POTENTIAL WHOLESALE CLENTS

EcoLogic

192 AI START-UP IN AUSTIN 87 AI START-UP IN DALLAS

TEXAS COASTAL OFFICES OF THE NATIONAL WEATHER SERVICE

TEXAS COMMISSION ON ENVIRONMENTAL QUALITY

TEXAS DEPARTMENT OF TRANSPORTATION

EcoLogic

POTENTIAL RETAIL CLENTS

MARKET COMP

EcoLogic

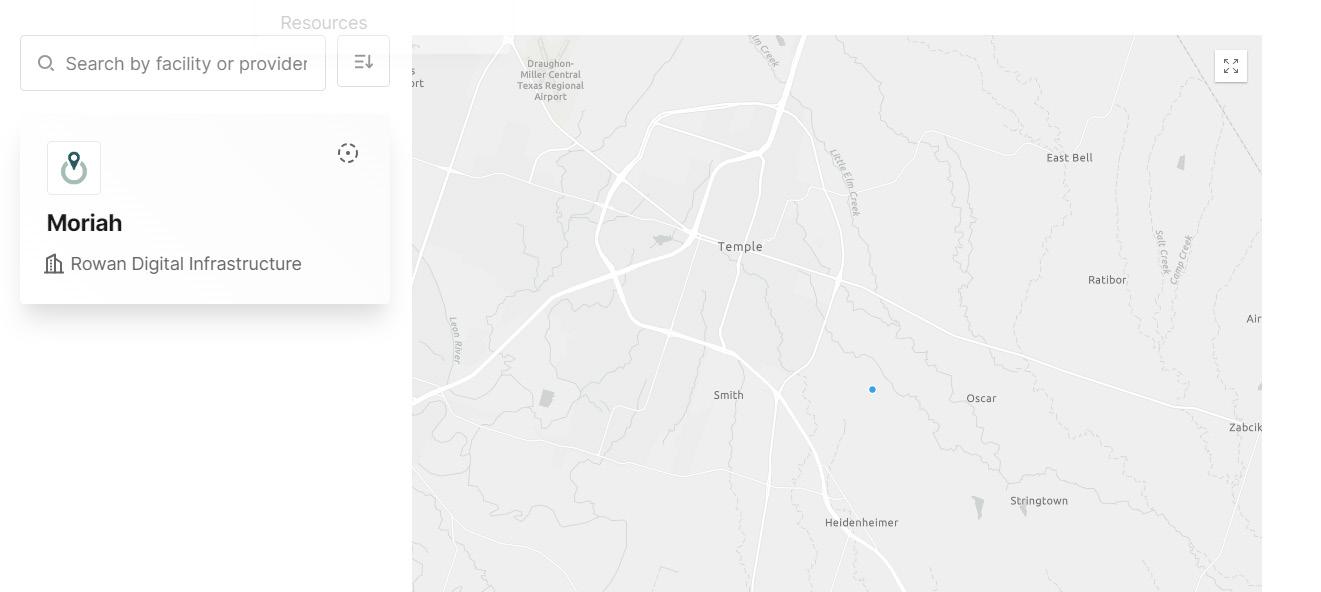

Site

EcoLogic Acquisition Cost PSF/% Total Cost Land Cost 3,523,394 $ Transfer Taxes 1% 35,233.94 $ Acquisition Fee 1% 35,233.94 $ Legal/Vehicle Expenses N/A 8,000 $ Other Acquisition Costs N/A - $ Total Acquisition Cost 3,601,862 $ Development Cost Hard Costs IT 496,402,021 $ Data Center Building 454,601,569 $ Onsite Energy Generation (Solar + Diesel ) 46,378,418 $ Site Work & Landscape 104,372,809 $ Hard Cost Contingency 7.5% 82,631,611 $ Total Hard Cost 1,184,386,428 $ Soft Cost Consultants (Arch+LA+EE) 12% 142,126,371 $ Construction Manager 15% 177,657,964 $ Feasibility studies and site Assessments/ Inspector 1% 11,843,864 $ Permits 1% 11,843,864 $ Insurance 5% 59,219,321 $ Green Building Certification Fee 1% 11,843,864 $ Financing Costs 7% 85,868,016 $ Legal Costs 5% 59,219,321 $ Miscellaneous Costs 3% 35,531,593 $ Soft Cost Contingency 5.0% 29,757,709 $ Total Soft Cost 624,911,889 $ Total Development + Acquisition Cost 1,812,900,179 $ Cost Reference Temple Commercial Factor 0.79 Data Center Unit Cost/SF Temple Price Architectural 237 187.23 $ Plumbing 12.95 10.23 $ Mechanical 33 26.07 $ Eletrical 31.5 24.89 $ Total 350 276.50 $ Event Beginning Duration Ending Year Closing 1/1/2024 0 Months 1/1/2024 0 Pre Constuction 1/1/2024 6 Months 7/31/2024 0 Construction 7/31/2024 16 Months 11/30/2025 1 Construction Misc (Certificate of 11/30/2025Occupancy) 2 Months 1/31/2026 2 Stablization 1/31/2026 24 Months 1/31/2028 4 Hold Period 1/31/2028 36 Months 1/31/2031 8 Exit 1/31/2031 0 Months 1/31/2031 8 Timing Assumptions

EcoLogic 0 1 2 3 4 5 6 7 8 2024 2025 2026 2027 2028 2029 2030 2031 2032 Investment Cash Flow TOTAL Land Acquisition Cost (3,601,861.88) $ (3,601,861.88) $ - $ Hard Cost (1,184,386,428.11) $ (197,397,738.02) $ (986,988,690.09) $ Soft Cost (624,911,889.13) $ (374,947,133.48) $ (249,964,755.65) $ Total Project Cost (1,812,900,179.12) $ (575,946,733.38) $ (1,236,953,445.74) $ Projected Revenue Wholesale Unit Rent - $ - $ 157,500,000.00 $ 162,225,000.00 $ 167,091,750.00 $ 172,104,502.50 $ 177,267,637.58 $ 182,585,666.70 $ 188,063,236.70 $ Retail Unit Rent - $ - $ 121,500,000.00 $ 125,145,000.00 $ 128,899,350.00 $ 132,766,330.50 $ 136,749,320.42 $ 140,851,800.03 $ 145,077,354.03 $ Solar Energy Reimbursement - $ - $ 35,074,744.32 $ 35,600,865.48 $ 36,134,878.47 $ 36,676,901.64 $ 37,227,055.17 $ 37,785,461.00 $ 38,352,242.91 $ Projected Gross Income(PGI) - $ - $ 314,074,744.32 $ 322,970,865.48 $ 332,125,978.47 $ 341,547,734.64 $ 351,244,013.16 $ 361,222,927.73 $ 371,492,833.64 $ Vacancy - $ - $ 4% 4% 4% 4% 4% 5% 5% Revenue loss - $ - $ (11,160,000.00) $ (11,494,800.00) $ (11,839,644.00) $ (12,194,833.32) $ (12,560,678.32) $ (16,171,873.34) $ (16,657,029.54) $ Total EGI - $ - $ 302,914,744.32 $ 311,476,065.48 $ 320,286,334.47 $ 329,352,901.32 $ 338,683,334.84 $ 345,051,054.39 $ 354,835,804.11 $ Projected Expense Management Expense - $ - $ (2,630,605.82) $ (2,656,911.88) $ (2,683,481.00) $ (2,710,315.81) $ (2,737,418.97) $ (2,764,793.16) $ (2,792,441.09) $ Ordinary Maintenance and Repairs - $ - $ (300,000.00) $ (303,000.00) $ (306,030.00) $ (309,090.30) $ (312,181.20) $ (315,303.02) $ (318,456.05) $ Common Area Maintenance - $ - $ (300,000.00) $ (303,000.00) $ (306,030.00) $ (309,090.30) $ (312,181.20) $ (315,303.02) $ (318,456.05) $ Common Area Util./Heat - $ - $ (670,000.00) $ (676,700.00) $ (683,467.00) $ (690,301.67) $ (697,204.69) $ (704,176.73) $ (711,218.50) $ Marketing & ADS - $ - $ (670,000.00) $ (676,700.00) $ (683,467.00) $ (690,301.67) $ (697,204.69) $ (704,176.73) $ (711,218.50) $ Misc/Legal - $ - $ (580,000.00) $ (585,800.00) $ (591,658.00) $ (597,574.58) $ (603,550.33) $ (609,585.83) $ (615,681.69) $ Insurance(Cyber) - $ - $ (860,000.00) $ (868,600.00) $ (877,286.00) $ (886,058.86) $ (894,919.45) $ (903,868.64) $ (912,907.33) $ Additional Real Estate Tax (Wholesale Tenant Pay 2/3) - $ - $ (300,000.00) $ (303,000.00) $ (306,030.00) $ (309,090.30) $ (312,181.20) $ (315,303.02) $ (318,456.05) $ Landscaping - $ - $ (528,469.92) $ (533,754.62) $ (539,092.17) $ (544,483.09) $ (549,927.92) $ (555,427.20) $ (560,981.47) $ Reserve - $ - $ (1,000,000.00) $ (1,010,000.00) $ (1,020,100.00) $ (1,030,301.00) $ (1,040,604.01) $ (1,051,010.05) $ (1,061,520.15) $ Projected Expenses - $ - $ (7,839,075.74) $ (7,917,466.50) $ (7,996,641.17) $ (8,076,607.58) $ (8,157,373.65) $ (8,238,947.39) $ (8,321,336.86) $ NOI (575,946,733.38) $ (1,236,953,445.74) $ 310,753,820.06 $ 319,393,531.99 $ 328,282,975.63 $ 337,429,508.90 $ 346,840,708.49 $ 353,290,001.78 $ 363,157,140.97 $ Capital Expenditures ITImprovement (49,640,202.11) $ (49,640,202.11) $ (49,640,202.11) $ Common Area Improvements (1,000,000.00) $ (1,000,000.00) $ Cash Flow before Debt Service - $ (575,946,733.38) $ (1,236,953,445.74) $ 310,753,820.06 $ 269,753,329.88 $ 327,282,975.63 $ 287,789,306.79 $ 346,840,708.49 $ 302,649,799.67 $ 363,157,140.97 $ Disposition - $ - $ - $ - $ - $ - $ - $ - $ 5,283,982,810.49 $ Cost of sale - $ - $ - $ - $ - $ - $ - $ - $ (369,878,796.73) $ Net Disposition - $ - $ - $ - $ - $ - $ - $ - $ 4,914,104,013.75 $ Unlevered Cash Flow (575,946,733.38) $ (1,236,953,445.74) $ 310,753,820.06 $ 269,753,329.88 $ 327,282,975.63 $ 287,789,306.79 $ 346,840,708.49 $ 302,649,799.67 $ 5,277,261,154.72 $ Unlevered IRR 25.57% EM 3.93 Levered Return Acquisition Cost (3,601,861.88) $ - $ - $ - $ - $ - $ - $ - $ - $ Development Costs (572,344,871.50) $ (1,236,953,445.74) $ - $ - $ - $ - $ - $ - $ - $ Financing Construction Loan Proceeds Drawn 522,316,233.93 $ 723,719,326.90 $ - $ - $ - $ - $ - $ - $ - $ Construction Loan Interest & Fees (31,286,742.41) $ (74,582,364.72) $ - $ - $ - $ - $ - $ - $ - $ Construction Loan Repayment - $ (1,350,983,710.09) $ - $ - $ - $ - $ - $ - $ Permanent Loan Proceeds Drawn - $ 3,955,048,619.00 $ - $ - $ - $ - $ - $ - $ - $ Permanent Loan Interest & Fees - $ - $ (156,934,237.47) $ (154,096,595.23) $ (151,143,343.07) $ (148,069,770.86) $ (144,870,976.58) $ (141,541,858.48) $ (138,077,106.98) $ Permanent Loan Principal - $ - $ (69,649,847.13) $ (72,487,489.37) $ (75,440,741.53) $ (78,514,313.74) $ (81,713,108.02) $ (85,042,226.12) $ (88,506,977.62) $ Permanent Loan Repayment - $ - $ - $ - $ - $ - $ - $ - $ (4,506,403,322.53) $ Total Financing (84,188,913.23) $ 2,099,374,260.77 $ (226,584,084.60) $ (226,584,084.60) $ (226,584,084.60) $ (226,584,084.60) $ (226,584,084.60) $ (226,584,084.60) $ (4,732,987,407.13) $ NOI (575,946,733.38) $ (1,236,953,445.74) $ 310,753,820.06 $ 319,393,531.99 $ 328,282,975.63 $ 337,429,508.90 $ 346,840,708.49 $ 353,290,001.78 $ 363,157,140.97 $ Net Exceed Proceeds - $ - $ - $ - $ - $ - $ - $ - $ 4,914,104,013.75 $ Levered cf (659,407,317.98) $ 863,994,881.04 $ 84,169,735.46 $ 92,809,447.38 $ 101,698,891.03 $ 110,845,424.30 $ 120,256,623.89 $ 126,705,917.18 $ 544,273,747.59 $ IRR 58.24% EM 3.14 Sources & Uses (Unlevered) Uses Amount $/SF Acquisition Cost 3,601,862 $ $3 Construction (Hard Costs) 1,184,386,428 $ 720.37 $ Soft Costs 624,911,889 $ 380.09 $ Total Uses (Total Development Costs) 1,812,900,179 $ 503.32 $ Sources % Equity 1,812,900,179 $ 100% Debt - $ 0% Total Sources 1,812,900,179 $ Sources & Uses (Levered) Uses Amount $/SF Acquisition Cost 3,601,862 $ 2.19 $ Construction Cost (Hard Costs) 1,184,386,428 $ 720.37 $ Soft Costs 624,911,889 $ 380.09 $ Debt Origination Fee 13,509,837 $ 8.22 $ Interest Reserves 105,869,107 $ 64.39 $ Total Uses 1,929,976,729 $ 1,173.86 $ Sources % Equity 578,993,018.61 $ 30% Debt 1,350,983,710.09 $ 70% Total Sources 1,929,976,728.71 $ 100% Unlevered Cash Flow Unlevered IRR 25.57% EM 3.93 Levered cf IRR 58.24% EM 3.14

THANK YOU

EcoLogic