3 minute read

How to make and save money documenting a

How to make and save money documenting a related party loan

Documenting a loan to a related party is crucial – so why is it so rarely done?

It’s the nature of the relationship

between the parties to the loan that puts this important piece of administration onto the “do it tomorrow“ list. Organising documentation with a friend or business partner changes the relationship dynamic from a personal relationship to a business relationship. Then there is the prospect of seeking formal advice and negotiation which could result in disagreements and friction. It all sounds too hard; ‘we’ll be alright...right?’

Relationship loans are a huge part of the Small to Medium Enterprise (SME) landscape. Businesses borrow billions of pounds from related parties to support their ambitions, yet fail to recognise the material risk to the transaction when they remain undocumented, leaving the ambiguity of a long forgotten conversation to raise its ugly head down the track. The relationship that underpinned the loan is then threatened, and may even break.

The old adage “Never lend money to friends and family!“ belies the facts. Over 40% of startups in the US get their funding from friends and family. The ‘bank of Mum and institutions, and over the next three decades, trillions of pounds will flow from baby boomers to the next generations through loans, gifts, asset transfers – in life, preinheritance.

Credi was built to solve this problem, delivering a cloud based solution that in a few months has thousands of users and approaching $100 million of loans on its platform. It enables borrowers and lenders to establish, negotiate, document and manage their agreements; whether between individual or business entities. Loans can be set up by borrower or lender. It’s easy to change the terms before agreement, to accept or decline, and has full tracking, communications and control.

Credi’s Partner program now delivers the platform to accountants, bookkeepers or financial planners, so they can support their clients relationship lending. Credi partners can either administer the process, with their clients approving any transactions, or the clients can follow a DIY approach.

How Credi will save money is plain to see. A loan gone bad, the cost of recovery, the professional fees involved - the possible downside is easy to quantify. A more pernicious cost is the emotional toll on relationships. Arguments over money are often cited as contributing to the breakup of financial partnerships, marriages, friendships - often over what were simple misunderstandings about financial dealings. Dad’ is considered one of the top UK financial

These unfortunate and costly outcomes can be prevented through having clear agreement established at the outset. The financial and emotional benefits are obvious.

Making money with Credi is also straightforward. Partners can enhance their existing service by replacing non-recoverable wasted time with a value adding service for their client. The value of goodwill cultivated through mitigating risks a client might not have considered is immeasurable. Deliver your clients a tool that encourages planning and good financial management. In the long term the insights gleaned from these relationships can connect the partner to both the borrower and lender and help, straddling generations.

@crediplatform

Tim Dean, CEO, Credi.com

25 years in accounting software and financial technology firms. My main focus has been running international FinTech operations and growing major on-line services businesses in the UK and Australia servicing hundreds of thousands of consumers. With a huge amount of hindsight and experience I begun to look to opportunities in the market to create a lending platform that would revolutionise the way people and business entities access and manage loans between themselves.

In 2014 I bought Australia’s first P2P platform, and having spent the last three years looking at the opportunities for this business. I decided a better solution lay at the heart of personal finance. My experience and leadership in business development, financial accounting technology and at a personal level raising 4 children, operating as my own personal Bank of Mum and Dad, gave me an insight into the market of relationship lending.

Since then I have established a team to deliver a global social lending platform Credi.com which has thousands of users across the globe, with upwards of $100 million of loans on the platform since launch 9 months ago.

FIND OUT MORE...

Credi.com is available in 51 countries, including the UK. Credi’s partner platform will be available from April 2018.

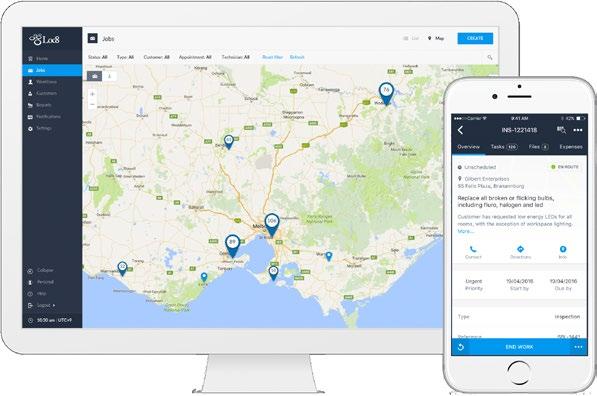

Field Service

Loc8 Lite - the free jobs app for small businesses