12 minute read

Business Section

Robin Brock, D.V.M.

THE GIFT THAT KEEPS ON COSTING

WRITER Robin Brock, D.V.M.

The holiday season is here. It is time to put on your thinking caps to come up with the perfect gifts for your loved ones. Often the idea comes up of giving pets for Christmas. Who wouldn’t want a loving and adorable puppy or kitten? All young animals are cute. Just remember that with this particular gift, you are giving a gift that will keep on costing.

When you give someone a gift that is alive, you give the responsibilities of feeding, training, grooming, and veterinary care just to name a few. All of these responsibilities will last long after Christmas is over. Before even considering a pet as a gift, you should consider whether or not the intended recipient is capable of meeting all of these responsibilities.

While the cost of pet food may seem inconsequential to many, to others it represents one more dollar that they simply don’t have to spend. If you are giving a pet to someone with a limited income, you may put an additional strain on their budget. If you really want this person to have a pet, then you may have to commit to providing pet food periodically. If this is not something you can realistically commit to, then perhaps a better gift would be periodic visits to this person with your own pet.

If the cost of food is not a problem for the recipient of your pet gift, then consider the other costs. There are many initial costs that are not recurring like food, but can still require a substantial commitment of funds. These costs include the initial vaccination series, spay/neuter and training costs. Some of these costs can be included in the gift, especially if several folks get together on the gift (i.e. one person provides the pet while others provide gift certificates for veterinary services, training or grooming).

Another way to combine some of the costs with the pet is to provide the gift recipient with a gift certificate to adopt a pet from a Humane organization. Many adoptions include at least one set of vaccinations and the animal’s spay/neuter. Be aware that some organizations will require that the potential adopter be approved prior to authorizing a gift certificate for them. Another advantage of a gift certificate for an adoption is that if the gift recipient decides that they really don’t want a pet, then they could choose not to adopt the pet and let the adoption fee simply become a donation for the organization. This is a much better situation than someone getting an animal and then having to take it to a shelter because they really don’t want it.

Some costs of pet ownership are ones we don’t like to think about. For instance, the cost of replacing, cleaning or purchasing slip covers for the living room sofa when the pet chews, scratches or soils it, is one example. There is also the wood chewing, shoe chewing, furniture scratching, curtain climbing, etc. etc. Most of us who love pets can overlook these little things as most of these annoying habits can either be trained out of the pet or outgrown as the pet ages. The question is will your pet gift recipient be willing to overlook these little things?

If you are giving a pet to someone who has never had a pet, my best advice to you would be “don’t”. My next best advice would be to urge you to include educational materials

Farmland Veterinary Clinic, P.A. Farm, Home and Office Calls

Call 336-492-7148 for an appointment 3793 Hwy. 64 West in Mocksville (located at the intersection of Hwy. 64 and Hwy. 901)

www.farmlandvet.com

about the pet with your gift. You might even want to give the book first and let your gift recipient read it before the pet arrives. Better yet, include the book with the Humane Society Adoption gift certificate and make sure the gift is given on a day when the Humane Society is closed. Having to wait to redeem the certificate will give your gift recipient time to read the book. Then he or she can decide whether or not to go and pick out a pet and what type of pet to get. This person might decide on a different type of pet or a different age of pet than what you would have chosen for him/her.

If you still want to provide a pet as a Christmas gift, just remember that you should think about what is best for the gift recipient and for the pet. This is not a toy to be played with until you are tired of it and then cast away. This is a living creature that has needs which must be met. The gift of a pet can be a wonderful gift. Don’t forget that it is also a gift that keeps on costing!

To find your FREE copy of the latest issue! Visit....

.com and click on the distribution page!

Remember you’ll find copies at the advertisers you see in each magazine plus your nearest Mock Beroth Tire.

canine café

Snowballs are coconut covered balls of goodness!

1 1/2 cups oat flour 1 1/2 cups brown rice flour 1 whole egg 1 teaspoon cinnamon 1 teaspoon vanilla extract 1/2 cup coconut milk Preheat oven to 375°F. Combine all ingredients (except coconut and coconut milk). Add coconut milk slowly. Mix until a dough forms you like (do not have to add all of milk). Line a cookie sheet with parchment paper. Spoon out mixture and roll into 1” balls. Roll in coconut. Place closely on cookie sheet.

1 cup shredded unsweetened coconut Bake 18 to 25 minutes, until a light brown. Cool completely on a wire rack.

What a perfect hostess gift for other dog lovers at Christmas time. A clear glass jar will allow the white dog treats to look just like snowballs. Adding some red ribbon locks in the mood for the season. Be sure to twist the top on tightly and store in the refrigerator.

The ZEN of the Lab

Nala

Our 6 month old kitten, Oliver

Thanks for sharing! We welcome your pet photos! Send your dog/cat/horse pet photo to: petpics@yadkinvalleymagazine.com

The Business Section Consider These Year-end Financial Moves

We’re nearing the end of 2020 – and for many of us, it will be a relief to turn the calendar page on this challenging year. However, we’ve still got a few weeks left, which means you have time to make some year-end financial moves that may work in your favor.

Here are a few suggestions: • Add to your IRA. For the 2020 tax year, you can put in up to $6,000 to your traditional or Roth IRA, or $7,000 if you’re 50 or older. If you haven’t reached this limit, consider adding some money. You actually have until April 15, 2021, to contribute to your IRA for 2020, but the sooner you put the money in, the quicker it can go to work for you. Plus, if you have to pay taxes in April, you’ll be less likely to contribute to your IRA then. • Make an extra 401(k) payment. If it’s allowed by your employer, put in a little extra to your 401(k) or similar retirement plan. And if your salary goes up next year, increase your regular contributions. • See your tax advisor. It’s possible that you could improve your tax situation by making some investment-related moves. For example, if you sold some investments whose value has increased, you could incur capital gains taxes. To offset these gains, you could sell other investments that have lost value, assuming these investments are no longer essential to your financial strategy. Your tax advisor can evaluate this type of move, along with others, to determine those that may be appropriate for your situation. • Review your investment mix. As you consider your portfolio, think about the events of these past 12 months and how you responded to them. When COVID19 hit early in the year, and the financial markets plunged, did you find yourself worrying constantly about the losses you were taking, even though they were just on “paper” at that point? Did you even sell investments to “cut your losses” without waiting for a market recovery? If so, you might want to consult with a financial professional to determine if your investment mix is still appropriate for your goals and risk tolerance, or if you need to make some changes. • Evaluate your need for retirement plan withdrawals. If you are 72 or older, you must start taking withdrawals – technically called required minimum distributions, or RMDs – from your traditional IRA and your 401(k) or similar retirement plan. Typically, you must take these RMDs by December 31 every year. However, the Coronavirus Aid, Relief, and Economic Stimulus (CARES) Act suspended, or waived, all RMDs due in 2020. If you’re in this age group, but you don’t need the money, you can let your retirement accounts continue growing on a tax-deferred basis. • Think about the future. Are you saving enough for your children’s college education? Are you still on track toward the retirement lifestyle you’ve envisioned? Or have your retirement plans changed as a result of the pandemic? All of these issues can affect your investment strategies, so you’ll want to think carefully about what decisions you may need to make.

Looking back – and ahead – can help you make the moves to end 2020 on a positive note and start 2021 on the right foot.

This article was written by Edward Jones for use by your local Edward Jones Financial Advisor. Edward Jones, Member SIPC Edward Jones, its employees and financial advisors are not estate planners and cannot provide tax or legal advice. You should consult your estate-planning attorney or qualified tax advisor regarding your situation.

Edward Jones, its employees and financial advisors are not estate planners and cannot provide tax or legal advice. You should consult your estateplanning attorney or qualified tax advisor regarding your situation. Frank H. Beals Financial Advisor 965 North Bridge Street, Elkin, NC 28621 3368354411 frank.beals@edwardjones.com

Paul J. Bunke, Sr., AAMS Financial Advisor 124 W. Kapp Street, Suite C, PO Box 407 Dobson, NC 27017 3363860846 paul.bunke@edwardjones.com

Audra Cox Financial Advisor 124 W. Kapp Street, Suite C Dobson, NC 27017 3363860846 audra.cox@edwardjones.com

Dale Draughn, AAMS Financial Advisor 140 Franklin Street Mount Airy, NC 27030 3367890136 dale.draughn@edwardjones.com Doug Draughn, AAMS, CFP Financial Advisor 496 N. Main Street Mount Airy, NC 27030 3367891707 doug.draughn@edwardjones.com Logan Draughn Financial Advisor 496 N. Main Street Mount Airy, NC 27030 3367891707 logan.draughn@edwardjones.com Kody Easter Financial Advisor 304 East Independence Blvd Mount Airy, NC 27030 3367892079 kody.easter@edwardjones.com

Christopher L. Funk Financial Advisor 128 South State Street PO Box 790 Yadkinville, NC 27055 3366792192 chris.funk@edwardjones.com Tammy H. Joyce, AAMS Financial Advisor 136 W. Lebanon Street Mount Airy, NC 27030 3367896238 tammy.joyce@edwardjones.com Tanner Joyce Financial Advisor 136 W. Lebanon Street Mount Airy, NC 27030 3367896238 tanner.joyce@edwardjones.com Aaron L. Misenheimer Financial Advisor 1530 NC Hwy 67, Suite A Jonesville, NC 28642 3362582821 aaron.misenheimer@edwardjones.com

Andi Schnuck Financial Advisor 496 N. Main Street Mount Airy, NC 27030 3367891707 andi.schnuck@edwardjones.com Barry Revis Financial Advisor 1810 North Bridge Street, Suite 101, Elkin, NC 28621 3368351124 barry.revis@edwardjones.com

in Pilot Mountain...

Mike Russell Financial Advisor 106B South Depot Street, Pilot Mountain, NC 27041 3363682575 mike.t.russell@edwardjones.com

From our family to yours.

Best Wishes Auto Glass Replacement Rear View Mirror Replacement for a very Merry Christmas Windshield Repair Power / Manual Window Repair Power/ Manual Door Lock Repair Side View Mirror Replacement Windshield Wiper Blade Replacement Commercial Fleet Service

(336) 759-9900

We’re an Official NC Inspection Station 8090 North Point Blvd. Winston-Salem Call Us First– We Can Handle Your Insurance Claim www.tarheelautoglass.com

PROFESSIONAL EXPERIENCED DETAIL CLEANING for your Car & Truck Collectible & Classic Cars

East Bend, NC (336) 961-2349 Over 25 years of car care experience

Norman’s CleanUp Shop

Creating Quality Custom Caps for your Business

COMMON CENTS

No charts, graphs or fancy words. Just common cents. WRITER David L. May Jr.

PRE-RETIREMENT TO DO LIST

Review key documents like your will, financial power of attorney, health care power and your living will. If you don’t have these documents already get these completed as soon as possible.

Make sure all the beneficiary designations on your retirement accounts, life insurance and even bank accounts are up to date.

Pay off your home mortgage, if it all possible before you retire from working. Eliminate other debts to maximize your positive cash flow in retirement.

Decide when you will turn on social security benefits, if you have not done so already. www.ssa.gov/retire/apply.html

Decide how to spend your time. What will you do? Have you really thought about it?

Sign up for Medicare on time. There are penalties if you don’t.

www.ssa.gov/medicare/apply.html

What’s your long-term care plan?

Develop a spending plan based on your retirement income. If you stop working the paychecks stop. What monies will fund your retirement needs and wants? Are there people and organizations you want to help support? Where will the monies come from?

Think about a contingent spending plan? What happens if one spouse passes away and one social security check is not part of the retirement income plan?

Maximize funding to your retirement accounts and savings while you are finishing up before you retire.

Congratulations on your upcoming retirement! Need help or direction in putting a plan together? Call my office for a no obligation appointment.

David L. May Jr. Agency, Agency Owner 336-983-4371 Fax:336-793-8424 145 Pineview Drive • King, NC 27021 SECURITIES OFFERED THROUGH LINCOLN DOUGLAS INVESTMENTS, LLC MEMBER FINRA & SPIC

Our next issue: JanuaryFebruary 2021 features.... Winter Comforts

Deadline for advertising in JanuaryFebruary Magazine is Friday, December 4

in stores beginning January 6

offering Regional Reach Local Impactwith

Your advertising message is included in 25,000 long shelf life print copies plus our digital edition

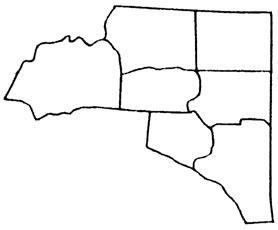

Distribution Counties near Yadkin River in Northwest North Carolina Western Forsyth • Davie • Surry Stokes • Northern Davidson Wilkes • Yadkin (core distribution highlighted)

If you’d like to learn more about advertising with us contact: John Norman 3366992446 john@yadkinvalleymagazine.com