A fresh look at premarital agreements

DUBLIN SOLICITORS BAR ASSOCIATION MAGAZINE | SPRING 2024 | ISSUE 99 DSBA.IE

PRESIDENT MATTHEW KENNY INTERVIEWED

DEVELOPMENTS

Parchmentthe

IRISH PRE-NUPS DSBA

RECENT

IN EMPLOYMENT LAW

Everything you need to run a law firm. PracticeManagement L

LEAP occupies a unique position in the legal software market as it includes traditional practice management and legal accounting attributes, document assembly and management, as well as many of the traditional legal publishing assets all in one solution.

leapsoftware.ie

e gal

n g

Publishing DocumentAssembly & Management LegalAccounti

The Legal Practice Productivity Solution

Welcome to the spring edition of the Parchment. Practice at the moment is a bit like a curate’s egg – it is good in parts.

News of the Supreme Court decision in the Delaney case casts a long shadow on personal injury practitioners who felt that there would be a reprieve to the swinging cuts to awards that have left genuine plaintiffs far worse off than before.

The announcement that the highly awaited Dublin Family Courts complex is to proceed following the recent granting of planning permission is a watershed moment for family law colleagues and all court users. Whilst it will likely be a further number of years before the complex is constructed and opened at Hammond Lane, this progress is warmly greeted by all.

The DSBA and in particular Keith Walsh SC have laboured over many years in a campaign to have the proposed Hammond Lane Court complex become a reality. Keith launched his co-authored excellent new book Domestic Violence – Law and Practice in Ireland

The DSBA has moved….

recently and we feature its launch on pages 8-11.

Colleagues, clients and the general public continue to struggle with the new Enduring Power of Attorney regime via the Decision Support Service. It is hoped that the system can be made more user friendly and fit for purpose in the not-too-distant future.

DSBA President Matthew Kenny is interviewed in this edition and there is a wide variety of articles from different areas of practice. The Parchment is looking for colleagues (both solicitors and barristers) who are interested in writing an article or contribution as a one-off or on a regular basis. Please get in touch if this might be you!

John Geary jvgeary@gmail.com

John Geary jvgeary@gmail.com

From the Editor WHEN YOU HAVE FINISHED WITH THIS MAGAZINE PLEASE RECYCLE IT. Spring 2024 dsba.ie the Parchment 1 DSBA COUNCIL 2023/2024 EDITOR John Geary PARCHMENT COMMITTEE Gerard O’Connell (Chair) Keith Walsh SC Áine Hynes SC Julie Doyle Kevin O’Higgins Stuart Gilhooly SC Joe O’Malley Killian Morris COPYRIGHT The Dublin Solicitors Bar Association PUBLISHED BY The Dublin Solicitors Bar Association, Unit 206, The Capel Building, Mary’s Abbey, Dublin 7 DSBA OFFICE, T: 01 670 6089 F: 01 670 6090 E: maura@dsba.ie DX 200206 Capel Building W: www.dsba.ie ADVERTISING ENQUIRIES Sharon Hughes T: 086 871 9600 The DSBA, its contributors and publisher do not accept any responsibility for loss or damage suffered as a result of the material contained in the Parchment. DISCLAIMER Advertisements are accepted at the discretion of the magazine which reserves the right to alter or refuse to publish any item submitted. Publication of an advertisement in the Parchment does not necessarily signify of cial approval by the DSBA, and although every effort is made to ensure the correctness of advertisements, readers are advised that the association cannot be held responsible for the accuracy of statements made or the quality of the goods, services and courses advertised. All prices are correct at time of going to press. Views expressed are not necessarily those of the DSBA or the publisher. No part of this publication may be reproduced in any form without prior written permission from the publishers.

Please note our new address and DX below:

After several years on Dawson Street, the Of ce of the DSBA has moved to the Capel Building, Dublin 7.

PATRICK LONGWORTH Chair of the Younger Members Committee

EIMEAR O’DOHERTY Chair of Inhouse Solicitors Committee

CIARA HALLINAN Chair of Criminal Law

ZOE HUGHES Chair of Probate Committee

MATTHEW KENNY DSBA President

NIALL CAWLEY DSBA Vice President

PAUL RYAN CPD Director Commercial Committee

JOAN DORAN Honorary Treasurer

CIARA O’KENNEDY Honorary Secretary

STEFAN O’CONNOR ÁINE GLEESON Chair of Property Law Committee

MARCUS HANAHOE Chair of Chair Litigation Committee

CLIONA COSTELLO Chair of Family Law Committee

JESSICA HICKEY Chair of Commercial Law Committee

AVRIL MANGAN Chair of Practice Management Committee

DSBA Book Awards Shortlist

We announce the shortlisted nominees for the annual prestigious DSBA Book Awards

Domestic Violence Legal Book Launched

Keith Walsh SC and Sonya Dixon BL’s impressive new book launched at prestigious gathering

Last Line of Defence

Killian Morris cross-examines

DSBA President Matthew Kenny about law and life

Probate Tips

Padraic Grennan gives practical tips for probate applications and how best to ensure they get finalised quickly

Recent Developments in Employment Law

Ciara O’Kennedy gives an overview on recent employment law developments

Irish Pre-Nups

Pre-nuptial agreements are becoming more commonplace.

Avril Mangan assesses the position

When is the use of Handcuffs Lawful?

Darren Gray assesses the decision in DPP -v- Pires , Corrigan & Gannon

The Money Man

The Parchment caught up with Currencies Direct Head of Ireland Alex Wilson

There is no question of the politicians voting for a public defender system. They have done the sums, and the private provision of legal aid is far more cost-effective

LAST LINE OF DEFENCE... MATTHEW KENNY

2 the Parchment Spring 2024

Contents 6

page

12

Unit 206,The Capel Building, Mary’s Abbey, Dublin 7, Ireland T: 01 670 6089 E: info@dsba.ie W: www.dsba.ie

12

Dublin Solicitors Bar Association

8 12 20 26

36 38 32

New Sustainability Laws – What you Need to Know

Ian Long opines that solicitors need to become familiar with the new sustainability laws and what they mean for our clients (and prospective clients)

Power Up Your Practice

Paula McNicholas compares legal practice and Formula One strategies. Both are highpressured, demand precision, and trust in the team is paramount

Solicitors’ Hubs

Niall Cawley assesses the practising environment for Solicitors particularly for small practices and concludes that it continues to remain challenging

Non-Marital Tax Treatment of Property

Susan Martin examines the position in respect of non-marital property transfers

Capital Acquisitions Tax Thresholds

Sandra Meade looks at various aspects of CAT thresholds, including implications for foster children

Where there’s a Will

Caitriona Gahan sets out key considerations in making a will

Contents 01 Editor’s Note 04 President’s Message 24 News 63 Photocall Spring 2024 dsba.ie the Parchment 3

REGULAR FEATURES 26 46 50 46 50 56 60 42 52

Multiple Issues Right Now

As members will be aware, the LSRA has indicated its recommendations to the Minister in relation to certain matters, identifying priority areas of reform in relation to the operation of Ireland’s complex conveyancing system and the provision of conveyancing services by solicitors to clients.

The DSBA notes that clients are happy with the services provided by their solicitors in residential conveyancing. This is no doubt thanks to the high standards and care afforded by our colleagues to their clients.

As part of its submission, the LSRA was asked to report to the Minister of Justice with regard to the creation of a new profession of Conveyancers in Ireland.

The LSRA, having considered the above matters, the report of Indecon Research Economists, the pros and cons of creating a conveyancer profession together with models for its regulation and further having considered an analysis of any barriers to new providers and reviewing how digital technology could transform the manner, cost and speed of carrying out a conveyance in Ireland, has concluded that the creation of a new professional conveyancer would only be viable as part of a wider range of more significant and pressing reforms to digitalise conveyancing and ensure greater cost transparency for consumers thereby enhancing competition. The press release furnished by the LSRA is available through their website.

The DSBA welcomes the LSRA’s report and conclusions at this point in time. We would point out that the solicitors profession is heavily regulated by the Law Society and indeed by the LSRA and has onerous obligations to provide detailed estimates of conveyancing fees and outlays under the Legal Services Regulation Act 2015 to all clients prior to undertaking any transaction.

Furthermore, solicitors are required to hold Professional Indemnity Insurance and undergo substantial training to qualify and acquire expertise in the area of conveyancing.

The creation of the profession of conveyancer separate from the solicitors profession requires very careful consideration across a number of headings but particularly in terms of training, regulation and Professional Indemnity Insurance so as

to ensure that any service offered to the public is professionally and safely delivered given the enormous importance for the consumer of conveyancing transactions. It is of utmost importance that any provider of conveyancing services has received all necessary training in what can be a complex and difficult area of law not least due to our system of registration of title in Ireland.

The DSBA is aware that there is an overwhelming number of queries and significant concerns in relation to access to justice regarding family law matters.

We are instructed by our members on a daily basis and each of our committees have been inundated from practising solicitors, barristers and clients in relation to the immense delay in appointments and the grind to almost a halt to the issuance of family law papers.

We have also received many examples of particular cases of the significant difficulties in merely having the proceedings issued. This creates a barrier to access to justice for our clients who wish to have their Consent Orders ruled, notwithstanding the fact that the Court still has their own discretion and jurisdiction in relation to these matters.

We are also informed by our members that a large number of solicitors are experiencing delays after they post their documents to be filed or issued and, in some cases, have had these documents returned. We also understand from our members that there are significant delays in obtaining Orders.

We understand that these delays extend pre-December 2023 for Consent Orders to be issued and this has caused knock-on effects from clients and delays in their own welfare payments, lone parents’ payments or other vital payments being made to them.

We have asked the Circuit Court Family Law Office to consider these issues as a matter or urgency.

The DSBA is most concerned with the decision by the Decision Support Service (DSS) which compels solicitors to log on to their online portal and act as if they are their client rather than act for their client.

We have sought immediate clarification as to whether or not the DSS intend to create a mechanism whereby solicitors can create their own online account and log on for clients rather than as clients.

The DSBA is acutely aware of the significant difficulties which solicitors are encountering on the important issue of enduring powers of attorney. We welcome feedback from our members in advance of a meeting with the DSS and other stakeholders on this issue.

The DSBA is aware of the significant delays in payments to solicitors under the criminal legal aid scheme. This is an urgent issue that we have raised with the Department of Justice.

As President of the DSBA, I am working with my Council on all of these issues for the betterment of the profession.

Matthew Kenny, DSBA President

4 the Parchment

Message from the President

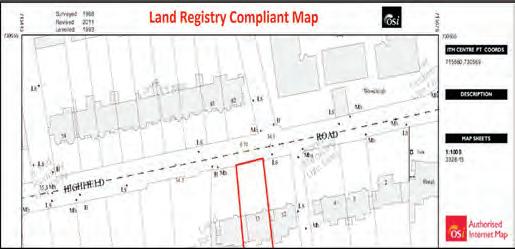

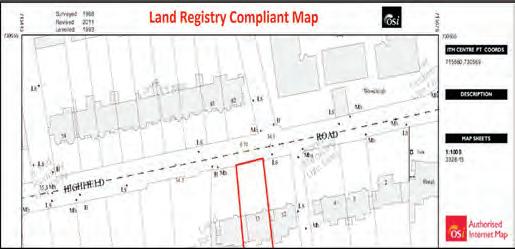

YO UR LEG AL COST S PAR TNE R Mc CannSa dl ier, LegalCos t s A ccoun t ant s ha s ov er 10 0 years ofcombi n ed l ega l co s ts e xperie n ce. We ar e a r esult s drive n t eam of l ega l co sts pr act iti one r s suppo rt ed by s pec ial is ed sta ff T 01 84 07 069 E INFO@McCAN NS ADLIER. IE W McCANN SA DL I ER. IE SWORD S: 11 NOR TH ST REE T BUSINE SS PAR K, SWORD S, D UBLI N, K67 XH29. DX 9101 0 BLACK ROC K: 12 PR IOR Y O FFICE PARK, STILLO RG AN ROAD, BLACK R OCK , D UBLIN, A 9 4 N2V 3. DX 7003 d y s AN McCA P CK m 67 XH29. UBLI Legal Costs Management, A Legal Practitioner’s Guide is published and updated annually by our firm. If you would like a courtesy copy of this guide, apply by email to info@mccannsadlier.ie. Please visit our website at mccannsadlier.ie/news for further details LAND REGISTRY MAPPING & BER CERTIFICATION SPECIALISTS COMMERCIAL ENERGY RATINGS LTD Unit 3, Churchtown Business Park, Churchtown, Dublin 14. t: 01-2983000 e: info@cerl.ie www.cerl.ie l Land Registry Compliant Maps from €250+VAT l 650 Land Registration Maps produced yearly l 2,000 Commercial & Residential BER Certs issued annually l Qualified team of Architects & Engineers registered with SEAI & Engineers Ireland l Prompt Efficient Service l Full PI Insurance

DSBA Irish Law Book Awards

The shortlist for the Annual DSBA Law Book Awards has been announced. Here we highlight the runners and riders for the prestigious accolade of Irish Law Book of the Year and Practical Law Book of the Year

In this edition of the Parchment we publish the shortlist of the Irish Law Book Awards nominees. The winners will be showcased in the Summer edition of the Parchment The judging panel for the DSBA Irish Law Book Awards are Stuart Gilhooly, Aine Hynes, John Geary and Chair Keith Walsh. Sponsors of this year’s Irish Law Book Awards are Peter Fitzpatrick & Co., Legal Costs Accountants, Law Society Finuas

A. Irish Law Book of the Year

Simons on Planning Law (3rd Edition)

David Browne, 2021, 1,878 pages, Round Hall, €485

Employment Equality Law (2nd Edition)

Marguerite Bolger, Claire Bruton and Clíona Kimber, 2022, 1,088 pages, Round Hall, €289

Skillnet and Byrne Wallace Solicitors.

There will also be a Lifetime achievement award/outstanding contribution to the legal profession and/or legal scholarship. Each year, the Judging Panel recognise and honour one individual who has made an outstanding contribution to the legal profession and/or legal scholarship. Previous recipients have included: Tom Courtney, Mr. Justice Michael Peart and Professor Geoffrey Shannon.

Limitation of Actions (3rd Edition)

Martin Canny, 2022, 630 pages, Round Hall, €267

Criminal Liability (2nd Edition)

Finbarr McAuley and J. Paul McCutcheon, 2022, 1,666 pages, Round Hall, €210

Consumer and SME Credit Law

Nora Beausang, 2021, 2,560 pages, Bloomsbury Professional, €325

6 the Parchment

Keith Walsh solicitor and SC practises in the area of family law in Dublin where he is a partner in Keith Walsh Solicitors LLP

Irish Securities Law

Paul Egan SC, 2021, 720 pages, Bloomsbury Professional, €215

Medical Negligence Litigation (2nd Edition)

Michael Boylan, 2022, 448 pages, Bloomsbury Professional, €195

Essentials of Irish Law

Mary Faulkner and Dáithi

Mac Cárthaigh, 2022, Clarus Press, €45

Summary Summons

Practice and Procedure

Kenneth P. Hyland, 2021, 442 pages, Round Hall, €175

Criminal Procedure in the Circuit Court

Matthew Holmes, 2022, 606 pages, Round Hall, €273

Succession Law, Christopher Lehane, 2022, 1,144 pages, Bloomsbury Professional, €275

Wylie on Irish Landlord and Tenant Law (4th Edition)

J.C.W. Wylie, 2022, 1,008 pages, Bloomsbury Professional, €295

An Introduction to Irish Company Law

Gráinne Callanan, 2021, 500 pages, Clarus Press, €59

B. Practical Law Book of the Year

Arthur Cox Employment Law Yearbook 2020 & 2021

Arthur Cox, 2021, 536 pages, Bloomsbury Professional, €99

Criminal Procedure in the District Court (2nd Edition)

Genevieve Coonan, Kate O’Toole and Mary O’Toole, 2022, 1,018 pages, Round Hall, €191

Practice and Procedure in the Superior Courts

Benedict Ó Floinn, 2022, 2,688 pages, Bloomsbury Professional, €295

Civil Litigation of Commercial Fraud

Arthur Cunningham, 2022, Clarus Press, €249

Drunken Driving (2nd Edition)

David Staunton, 2021, 586 Pages, Round Hall, €213

Medical Inquests

Roger Murray, Doireann O’Mahony and David O’Malley, 2022, Clarus Press, €75

Book Awards

Spring 2024 dsba.ie the Parchment 7

Law on Domestic Violence Book Launched

Dublin Solicitor Keith Walsh has co-authored the leading book in Ireland on domestic violence law in Ireland. The former DSBA President and former editor of the Parchment is the co-author of Domestic Violence – Law and Practice in Ireland which was launched recently by the Attorney General, Rossa Fanning. Barrister Sonya Dixon co-wrote the impressive new book

Launching the book, Attorney General Rossa Fanning SC said: “Keith is, as you all know, one of the most prominent family law solicitors in the jurisdiction and is a ubiquitously cheerful presence at DSBA and Law Society events. He is an impressive and frequent contributor to public debate on these topics and was the first family law solicitor in private practice to be awarded a patent of precedence.”

Managing Partner of Keith Walsh Solicitors LLP, Keith is a native of Ballinrobe, County Mayo and qualified as a solicitor in 2001. He has since become the pre-eminent advocate in the country on divorce and family law.

The Attorney General paid tribute to barrister and co-author Sonya Dixon BL, saying: “Sonya has been in practice for almost two decades and over that time has developed a significant family law practice. She has lectured extensively in the field and has previously cowritten a Handbook in Relation to Pensions for family law practitioners, so this is her second important foray into publication in the family law context.”

District Court President Judge Paul Kelly wrote the book’s foreword and said that each day in Dolphin House, there are a queue of people, mostly women, waiting to make ex-parte applications for protection orders. He said that was ‘an indication of how prevalent the problem is’ of domestic violence and he pointed to an increasing trend of parents applying for domestic violence orders against adult children. “It beholds the justice system and the District Court, to whom the overwhelming majority of those applications are made, to be able to deal with them as expeditiously, as compassionately, as sensitively and as accurately as possible.”

The book provides a comprehensive overview of the Domestic Violence Act 2018, with analysis of all measures contained in the Act and procedural developments including new crimes of forced marriage and coercive

control. It also explores the related criminal legislation concerning victims of crime and other criminal legislation dealing with related offences.

Speaking at the book launch which took place at Blackhall Place in front of a large gathering, the Attorney General said that, unfortunately, the topic of the new work could not be of greater significance to the lived experience of thousands of Irish citizens. “Globally, it has been estimated that one in three women are likely to experience violence at the hands of their partner or another perpetrator. No community is unaffected. No class is immune. Published research suggests that incidence of domestic abuse only increased during the Covid-19 pandemic, where persons were often increasingly isolated from support networks and in prolonged proximity to perpetrators.

“There was a measurable 25% increase in criminal charges for breaching domestic violence orders in 2020. In the same year, An Garda Síochána reported a 16% increase in call-outs to domestic violence incidents, with around 43,000 calls registered.

“At the very start of the book, the authors observe the reality that ‘domestic violence cases are difficult cases for all involved, not least because of the subject matter’. This book traces the important changes introduced by the Domestic Violence Act 2018, and the lived experience and practice of wider legislative framework across this country, but it goes significantly beyond that. The authors critically analyse modern legislative reforms and usefully set the current Irish legislative approach against the backdrop of a more international context. The authors also devote a significant part of the text to suggested further reforms of the law in this area.

“Their approach recognises that to stand still in this area is actually to fall behind, and their discussion of the topic certainly provides food for thought as to whether further legislative change is warranted,” commented the Attorney General.

8 the Parchment

the Parchment 9 Book Launch Spring 2024 dsba.ie

Above: Keith Walsh SC, Attorney General Rossa Fanning SC, Soyna Dixon BL and Judge Paul Kelly, President of the District Court

Left: Aine Hynes SC and Michael Hayes

Far left: Judge Kathryn Hutton, John O’Donnell SC, Judge Marguerite Bolger

Right: Olive Doyle and Diego Gallagher

Far right: Patrick Murphy BL and Keith Walsh SC

Married to Solicitor Moira O’Connor from Headford, Co. Galway, Keith Walsh and his co-author Sonya Dixon BL have provided an invaluable guide for solicitors, barristers, judges, social workers, individuals and rights groups and organisations seeking a practical and easily digestible explanation of recent case law and changes in this area of the law, such as the protections now available to victims of domestic violence including giving evidence by live television link.

Walsh is a former chairperson of the Law Society’s Child and Family Law Committee and a fellow of the International Academy of Family Lawyers.

Attorney General Fanning concluded his address by noting that political agreement was reached in February on an EU Directive on combatting violence against women and domestic violence. “This was a long-awaited milestone, with the Government having sought to constructively engage in the negotiations towards the finalisation of this Directive as far back as June 2022. The Directive provides a comprehensive legal framework to tackle all types of violence against women, and sets new standards for protection, support and cooperation amongst Member States.”

A large gathering of colleagues, Judges and members of the legal profession were in attendance for the book launch on the 10th April at the Law Society’s headquarters at Blackhall Place. Speakers at the auspicious event also included President of the District Court, Judge Paul Kelly, co-author Sonya Dixon BL and Keith himself. The book is published by Bloombury Professional. P

10 the Parchment

Ms. Justice Nuala Jackson, Margaret Farrelly BL, Oisin Crotty BL and Dymphna Devenney BL

Sonya Dixon BL, Senator Vincent P. Martin SC and Keith Walsh SC

Right: Ms. Justice Nuala Jackson, Marian Moylan, Tabitha Wood BL

Far right: Attorney General Rossa Fanning SC and President of the District Court Judge Paul Kelly Right: Authors Keith Walsh SC and Sonya Dixon BL

Far right: Padraig Whelan and Hilda Clare O’Shea

the Parchment 11 Book Launch Spring 2024 dsba.ie

Left: Mary Hallissey and Judith Tedders Far left: Ms. Justice Nuala Jackson, Michael O’Connor SC, Ms. Justice Leonie Reynolds and Attorney General Rossa Fanning SC

Left: Anna, Kate and Rory Walsh Far left: Marian Berry BL and Niall Buckley SC

Right: Michelle Ni Longain, Barry McCarthy, President of the Law Society and Richard Hammond SC Far right: Ken Breen, Elaine Given and Hilda Clare O’Shea

Left: Shane Coyle, Ciaran Dunne, Graham Kenny and Parchment Editor John Geary Far left: Tony O’Sullivan and Colette O’Malley

Last Line of Defence

The Parchment’s Killian Morris met with Matthew Kenny, President of the DSBA and Partner in O’Sullivan Kenny Solicitors, for a broad-ranging discussion on his career to date and being at the helm of the DSBA

The DSBA’s first citizen is leading the fight to restore the pay for solicitors doing criminal legal aid work. “I don’t agree with some solicitors who think we need to be quiet about the fact that we want pay restoration,” he says when articulating how he thinks solicitors need to do more to advocate for decent pay for their work. He mentions with some pride the successful ‘Kenny Shoes’ business established by his grandfather and continued by his father, pointing out “my dad used to make a living selling shoes. When people bought a pair of shoes, they paid for them. It’s the same when you go to a doctor or a dentist.”

The restoration of pay for criminal legal aid solicitors is top of the agenda for Matthew during his tenure at the helm of the DSBA. We discuss how the pay for solicitors practising in this area is still 30% below the levels paid prior to the financial crisis. He points out that this work, being carried out by so many solicitors throughout the country, is crucial to a functioning society. “The State has a legal obligation to provide legal aid. It has no choice – it is the same as having to provide public medicine. We don’t have a public defender system like in the United States. We outsource it to private defence solicitors, such as myself and others, in the towns and cities around the country. There is no question of the politicians voting for a public defender system. They have done the sums, and the private provision of legal aid is far more cost-effective.”

While we cannot condone or promote anybody breaking the law, I think we need to do something so that we can have a unified voice but not be in breach of competition law

Clearly Matthew and his criminal defence colleagues have had enough, but the constraints of competition law have made this fight a difficult one. The legislation restricts competing businesses from acting together in relation to the pricing for their services, but Matthew believes they need to be imaginative and come up with solutions to this: “While we cannot condone or promote anybody breaking the law, I think we need to do something so that we can have a unified voice but not be in breach of competition law. We need the full 30% [reduction] to be restored and that is just so we can continue to provide the service.”

He points out that, particularly outside Dublin, the provision of this legal service is no longer economically viable for some solicitors. He mentions how, in some parts of the country, there may, in the future, be no solicitors available to step forward at important times, such as to attend Garda Stations for interviews ‘out of hours’. For those of us not involved in criminal legal practice, he explains how he might be called out on a Saturday or Sunday to a Garda Station, to assist somebody he has never met, for the princely sum of €93 for the first hour. Despite this and the fact that he has built a strong private practice (and not reliant on legal aid work), he still responds to the call when it comes through. He notes that, in most of these situations, the advice/ assistance needed by a person in custody

12 the Parchment

Cross Examination

Spring 2024 dsba.ie the Parchment 13

Killian Morris is a partner at AMOSS LLP and a member of the DSBA Parchment committee

If you are good at what you do and you work hard, the work will always come but if you take somebody short you might be fine but more likely you will have a less enjoyable work life

is “probably the most important piece of advice they're ever going to get in their life”. It is clearly unfair that government has consistently refused to recognise this.

The Gardai, he points out, will also be badly affected if people are unwilling to do this work anymore. What happens, for example, if they can’t find a solicitor who is prepared to come down to the station to do an interview for a murder or a sexual crime?

The whole system would grind to a halt in that situation, where the accused person can’t be questioned – “this not only compromises the Gardai in doing their job but also in the vindication of victims’ rights,” he says.

Further, we speculate that, to the extent that solicitors may be happy to work at these

rates, these are likely to be junior or newly qualified solicitors who will not have the requisite experience to properly represent the accused person’s interests. Clearly this could create the worst of all worlds, where the quality of representation is diminished to levels associated with an American-style public defender system, whilst still operating under the umbrella of the apparently better Irish system of private provision of criminal legal aid. Matthew feels the main reason government hasn’t reacted to these demands is because solicitors haven’t properly organised or mobilised in response to the situation.

Getting paid for an honest day's work is something that was drummed into Matthew

Kenny as a trainee/apprentice in Sheehan & Partners, in the early 2000s. He recalls one of the partners, Bobby Eagar, as being great at sitting down to explain the economics of the practice of law. On one occasion, when trying to impress his senior colleagues, Matthew remembers deliberately speaking loud enough on the phone to a prospective client, so the entire office could understand how much he knew about a particular issue! Later on, and far from being impressed, Bobby sat the young Matthew down and explained to him that he was better off not sharing such valuable advice without ensuring he was going to get paid for it.

Matthew spent 13 years working in Sheehan & Partners – first as an intern, then as an apprentice through to qualification, and ultimately as a partner, until his departure in late 2015. When leaving UCD, he didn’t have any particular desire to have a career in law and had been working in a thriving online hotel reservations business. Then, when his housemate, Jessica Goldrick (now solicitor with KOD Lyons), was doing her FE-1s, Matthew decided to give it a go himself. He really enjoyed studying legal subjects, more so than anything he had studied before. He says he liked criminal law, contract law and even equity. However, when he finally had all his FE-1s completed, he found it very difficult to get an apprenticeship, as he knew he wouldn’t be suited to one of the big firms.

As it happened, Matthew managed to secure a one-month internship in Sheehan & Partners, having been told, in no uncertain terms, that there were no apprenticeships available. Attending court on his first day, Matthew immediately realised criminal defence work was his true calling and he set about making himself indispensable around the office. After two months, Peter Mullan (one of the partners) agreed to take him as his apprentice.

He is proud to have had such great mentors over the course of his career to date, including Peter, as his master, but also the other partners in the firm. He singles out Garrett Sheehan as being such an influential figure generally across the profession and notes that he was held in such high esteem by the partners in the office and everybody he dealt with. “He was brilliant. He was the perfect advocate, he knew that ‘less was more’, he knew when to say something and not to say something. His work rate was ‘off the charts’ and this seeped down to everyone else in the firm who would be at their desks at 7.30 in the morning because they wanted to be,” he recalls fondly.

Growing up in Rathmines in Dublin with his three siblings, Matthew’s mother was to go on to become a Presbyterian Church of Scotland Minister. With his father having

14 the Parchment

Photography: Bryan Meade

sold the shoe business, the Kenny family emigrated to Edinburgh when Matthew was 12. He completed his second-level education in Scotland but, missing Dublin, he then returned to UCD in 1997 to study history and politics. He was involved in debating in both the Law Society and the L&H and remembers current Attorney General Rossa Fanning being one of the adjudicators on the night of his maiden speech.

Now working in his own firm, post Covid-19, Matthew is happy with his work life balance: “One of the main reasons I set up on my own was I wanted to see my son Patrick grow. He is 12 now. So, I take every Friday afternoon off and it has worked out great.” He is particularly busy Monday through Wednesday and then, unless he has a trial on, he takes Thursday to plan the week ahead. He enjoys hiking, swimming and running, and loves watching football. His new year's resolution this year is ‘to put down the phone’ and read more books. At the moment, he is reading “The Buried Giant” by Kazuo Ishiguro and has rejoined Rathmines library – “I have this habit of buying new books but never reading them, so the library is probably a good idea!” he says.

Matthew isn’t sure that Patrick will follow in his footsteps as a lawyer, but he can certainly be very proud of what his dad has achieved. In setting up his own firm in 2016, Matthew and his partner Mark O’Sullivan have built an enviable practice with a good private client base. “When I left Sheehans, I wanted to work for myself. I had agonised over it for a couple of years before making the decision. It was so hard to leave, as they treated me so well, and I enjoyed going to work there. But I knew I needed to be the boss.” After a brief stint as a sole practitioner, Matthew realised he didn’t enjoy being completely on his own, particularly with the early stress of wondering whether enough work would come in the door. Mark O’Sullivan, a criminal defence colleague, was himself looking for office space and Matthew was only too happy to oblige. Within a couple of months, they were getting on well, covering each other’s work, so it made sense to form a partnership. They have been operating as O’Sullivan Kenny ever since.

Matthew has been involved in the DSBA since 2012 when Keith Walsh was president of the association. At that point, the DSBA Criminal Law Committee was at a low ebb and needed to be re-established. Keith had reached out to Sheehan & Partners to see if they could assist, and they put Matthew forward for the role. Initially, he felt he was too busy with work and life generally and he didn't feel the need to get involved. He met up with Keith and started attending events and realised there was something to it. He

enjoyed the social side of the DSBA and, he admits, as a criminal defence solicitor, it isn't often that you interact with or socialise with colleagues you are normally competing with for business. He notes with disappointment that things have been difficult between some criminal law colleagues but having an outlet like the DSBA has been a valuable tool in trying to break down barriers and defuse situations.

Which brings us to the number one theme of Matthew’s year in office – the promotion of collegiality amongst Dublin solicitors. “You need to look at the bigger picture,” he says. “Clients come and go but you will have your colleagues throughout your career. If you are good at what you do and you work hard, the work will always come but if you take somebody short you might be fine but more likely you will have a less enjoyable work life.” This, he thinks, is the number one benefit of an organisation like the DSBA: when people work alongside each other, they get on better, which can only help.

When I ask him about advice he would give to younger members of the profession

he remembers how he cringes a little bit when he thinks of how he would operate as a newly qualified junior solicitor. “I was too aggressive in court and I was too aggressive in the Garda Station,” he says. “I think it comes from not knowing what you're doing and it comes from being ‘scared’ because you're not really sure what you're doing is right. But then, the longer you're qualified, in my opinion, you should become far more removed from the job you do.” Nowadays, he deals with even the most contentious situations with calm, knowing that antagonising others working in the system, be it judges, Guards or other colleagues, can only make life more difficult for him and his clients, in the long run.

We talk about the other challenges facing the profession and he mentions the recent controversy around enduring powers of attorney. The process of making an enduring power of attorney, which had been working well, has been brought online in an apparent attempt to marginalise the role of solicitors to the detriment of often vulnerable clients. Again, as with the campaign to restore pay, there doesn't seem to be much sympathy for

Cross Examination

Spring 2024 dsba.ie the Parchment 15

I don't think we should want to be popular because our job is not to be popular. Our job is to do a job for our clients. We should be like a referee in a good football match: be seen and not heard!

solicitors on this issue, either in government or from the public. He believes that many of these public relations difficulties are compounded by the poor relationship between us and the media. Matthew believes that, to a large extent, we are burdened by our professional duties of confidentiality – “other than in general terms, journalists don't appreciate that and they think that we're

being difficult, that there’s some sort of a lack of transparency in our profession. Actually, we're one of the few professions that choose to regulate ourselves and do so to a level which is actually quite a burden for a lot of people in our profession. But we choose not to engage with journalists because, almost always, it's not in our client’s best interest.” We talk about whether there is a solution to this and, ironically, he doesn’t

think we should be striving to be more popular: “I have to say I think it's a dangerous, dangerous step to take [to try to be popular with the media]. I don't think we should want to be popular because our job is not to be popular. Our job is to do a job for our clients. We should be like a referee in a good football match: be seen and not heard!”

Halfway through his presidential year, Matthew is clearly enjoying his time at the helm of the country’s largest bar association. Advocating for colleagues on important issues and going around the city and country meeting with colleagues reminds him of why he first got involved in legal politics. Of course, the day job isn’t suffering and, while I hope never to require his professional services – I know I would be in good hands if I did. P

16 the Parchment

Have you searched for the Deceased’s Will?

Ensure you administer the estate correctly with...

Prices start as low as €79 (+ VAT) for a standard Will search

Start your search today at

www.willfinder.ie

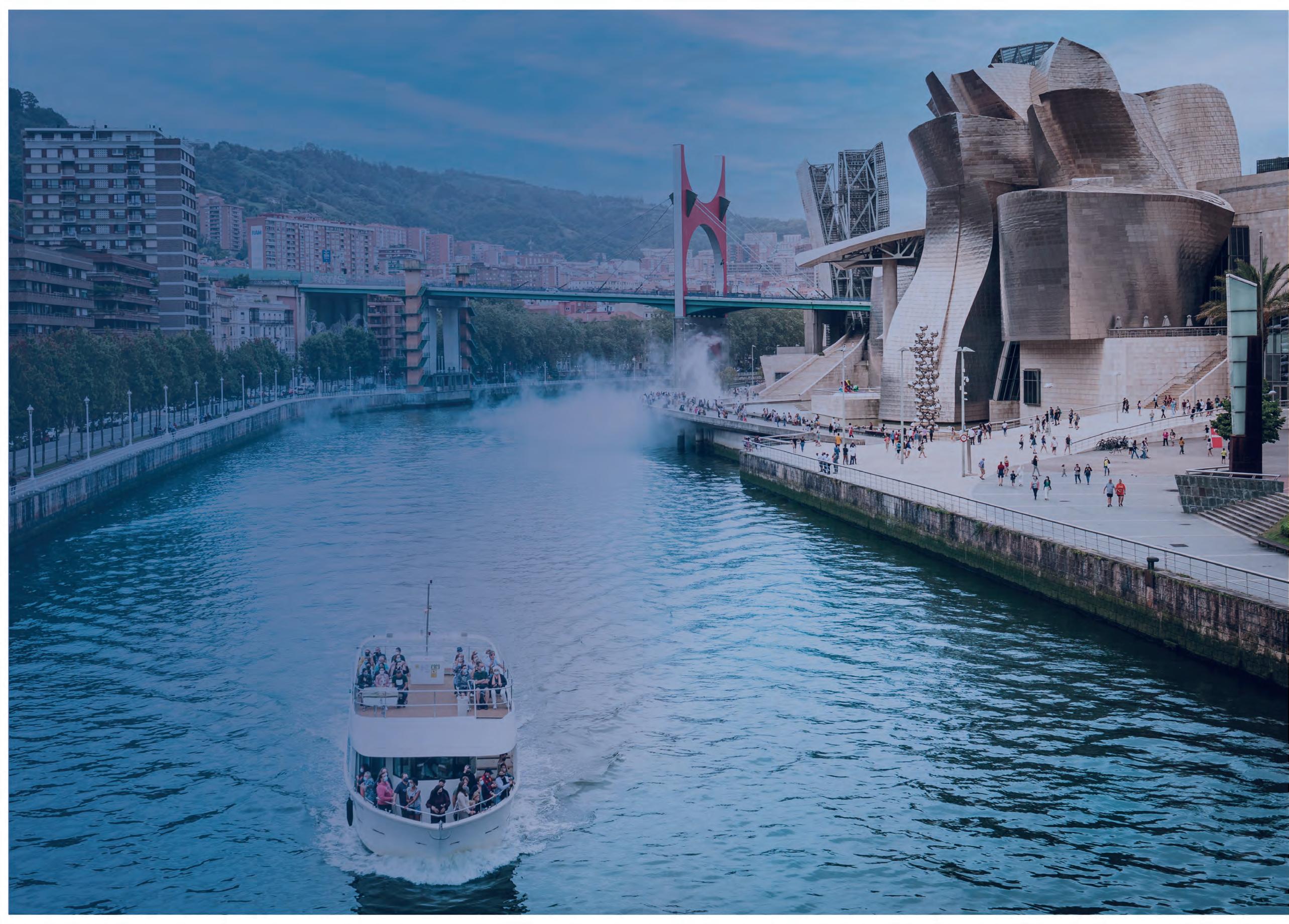

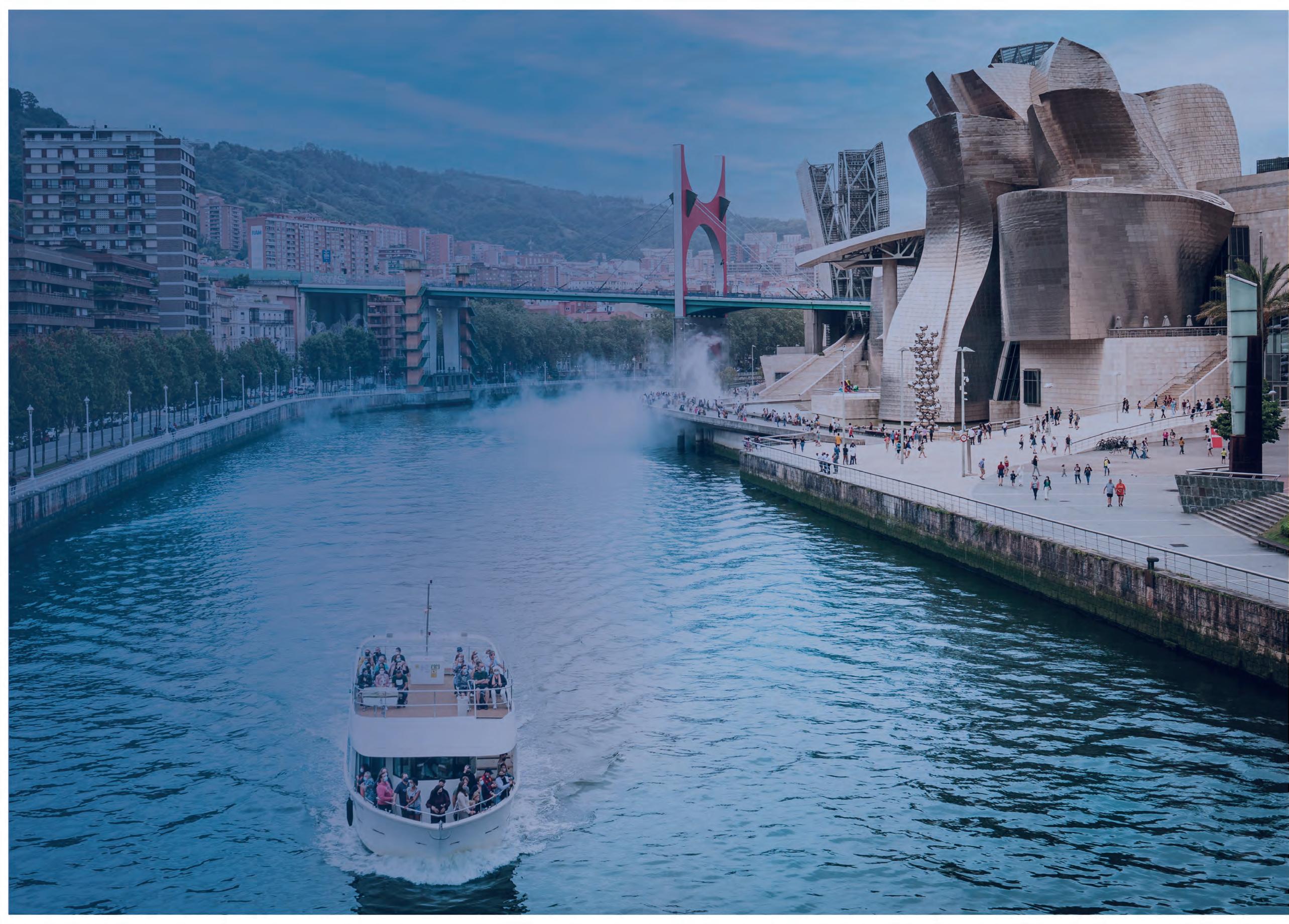

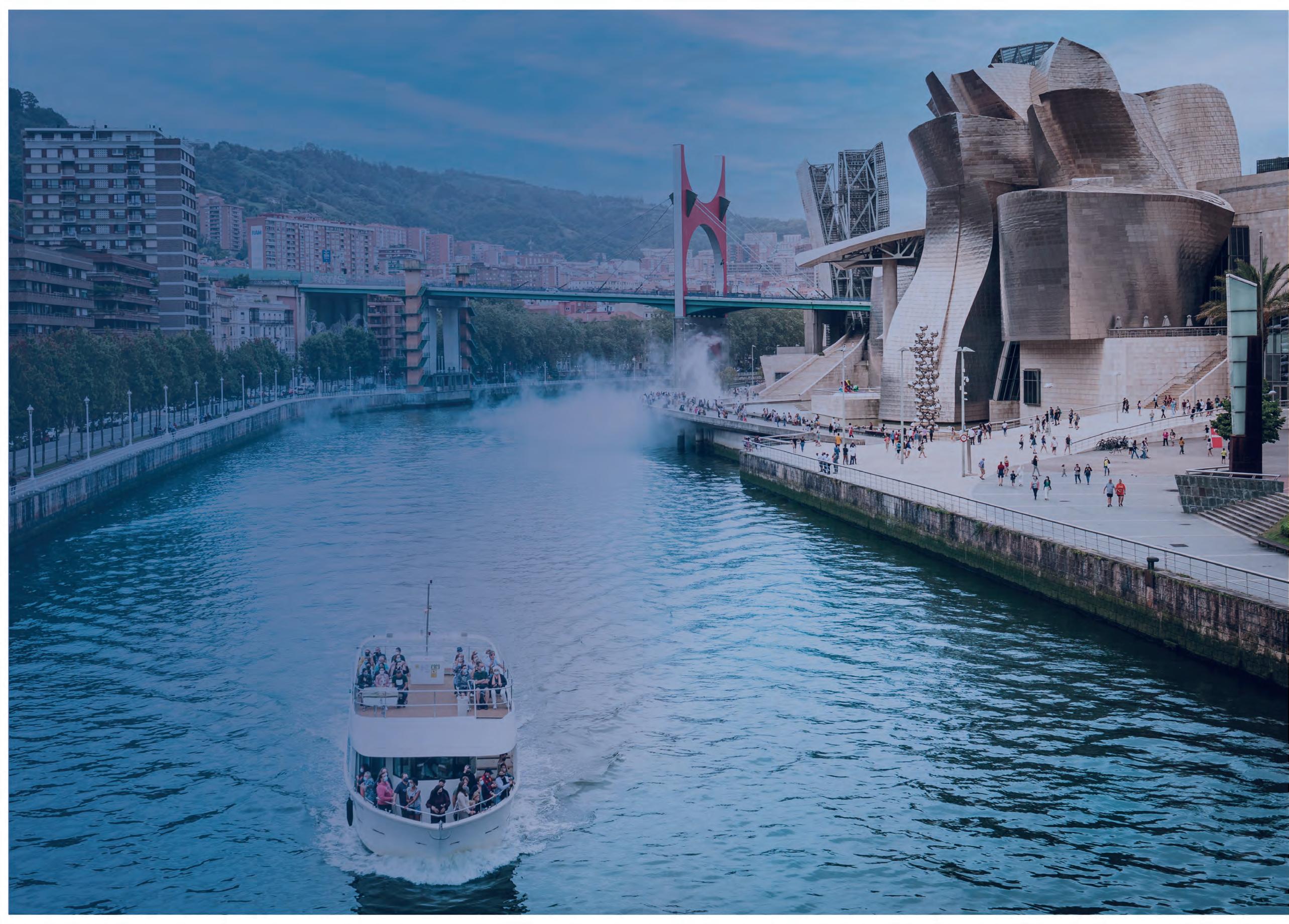

•3 Nights in the 5* Gran Hotel Domine Bilbao

•Welcome Buffet Dinner at the Gran Hotel Domine with wine on Thursday 19th September

•Optional tour to La Rioja wine region with lunch

•Business session at the Biscay Bar Association

•Optional group dinner on Friday 20th September

• Optional tram & walking tour of the old town of Bilbao

• Gala Dinner with wines at the Sociedad Bilbaina

€1,095 per person sharing

Visit the 2024 Annual conference link on the DSBA website www.dsba.ie to view

Conference Brochure & Booking Form

Now Limited Availability

Book

Probate Tips

Padraic Grennan of Erin International gives some practical tips for probate applications – and how to ensure yours gets finalised quickly

Probate as a process is slow. For a multitude of reasons, it wouldn’t be unusual for the administration of an estate to take in excess of two years. Such time frames can cause undue frustration and anger among solicitors, their clients and beneficiaries.

During a recent conversation, one extremely frustrated practitioner expressed his disillusion to me over the delays in grants of representation being issued. Why does it take five months to look at his file, only for it to be rejected over a very minor clerical error? This attitude reflects the general feeling among many practitioners nationwide, who are under pressure from their clients to close out estates and distribute. The waiting times are understandably frustrating. But who, if anyone, is to blame, and what can be done?

Two Sides of the Coin

Taking a holistic view, we need to look at both sides of the coin here.

On one side we have the Probate Office, the main function of which is to issue grants of representation. Although it offers a (by all accounts very effective) support service to personal applicants, it is not an advisory service for solicitors. With the closure of the Seat Office, the option to meet in person to discuss file-related queries is now gone. Phone queries are limited, again because the focus is on assessing applications, issuing grants and placing all available resources towards carrying out this function.

The Probate Office is currently fully staffed. A number of the resources are responsible for the assessment of Solicitor Applications, with some further resources being responsible for the Personal Applicant section. Between both the solicitor applications and personal applicant applications, there are between approximately 10,000 and 11,000 grants issued in the Dublin Probate Office per annum. Based on this figure alone, I think it’s fair to say that this team is not slacking.

If you know probate, you’ll know it’s rarely straightforward and only time and experience teach one how to navigate the unique nuances of each individual case. Marry that with the newly introduced mobility initiative (where civil servants can apply for a lateral transfer from one department to another), and the departure of a number of highly experienced senior staff members within the past 3-4 years, and you’ll begin to understand the challenges faced by team Probate Office.

On the other side of the coin is the practitioner. Given the high rejection rate, some level of responsibility has to be taken for the quality of applications being submitted. The reality is grim. Approximately 60% to 70% of applications are rejected on the first submission attempt. This is old news as this figure seems to have remained the same for a number of years.

On top of the constant influx of new cases that need to be assessed, Probate Office staff also have to check a steady flow of resubmissions, many of which are

20 the Parchment

rejected a second or third time. These ‘resubmits’ will then work their way back into the queue for further assessment and eventual approval.

Facts

Given the persistent delays, it is important that practitioners understand what exactly is going on. Below are some pointers that will hopefully dispel any probate application misgivings.

• It’s currently taking between 16 and 18 weeks for your application to be assessed (note that these waiting times apply to the Dublin office only, and that regional registries may have reduced waiting times). All applications are logged in order of date of receipt and will sit in a queue for 4-5 months before they are opened and examined for the first time.

• If errors exist, your application will be queried and, in some cases, rejected, and some or all of your papers are returned to you. When you resubmit, your file joins the “resubmitted” queue, which contrary to common belief, only takes 2-3 three weeks to process.

• The Probate Office staff want to issue grants. They do not want to be returning your papers but must do so if the application is incorrect. It is not their responsibility to correct any errors.

• The Seat Office is closed and will remain so for the foreseeable future. The harsh reality is that to man a public office where general enquiries are fielded, means diminishing a team whose purpose is to assess applications and to issue grants.

Main Reasons for Rejections

The vast majority of rejections boil down to very simple errors being made prior to submission. A lot of the queries could be avoided if a little more care was applied before the applications are lodged. The following are examples of reasons as to why an application might be queried and/or rejected.

No or Incorrect Title:

This may seem obvious, but if the title is incorrect, it follows that your entire application will be wrong. This means that you have not clearly set out in your oath your client’s legal entitlement to extract a grant in your oath.

The Probate Office will not assess applications where the applicant is not showing their correct entitlement to the grant. The file is returned marked “No Title”, and the rest of the papers will also have gone unchecked.

Jurats:

A faulty jurat is one of the top three reasons why probate applications are returned. It may happen that your application has been checked but a badly completed or incomplete jurat prevents the application from progressing.

A jurat must be signed by the applicant before a commissioner for oaths or a solicitor, on a particular date, at a particular place. The applicant must be known to the solicitor/commissioner, identified by a third party (who must sign the jurat and certify as to

The vast majority of rejections boil down to very simple errors being made prior to submission. A lot of the queries could be avoided if a little more care was applied before the applications are lodged

the Parchment 21 Probate Spring 2024 dsba.ie

International

Padraic Grennan is the Chief Executive at

Erin

Probate

The introduction of a new digitaloriented system will hopefully mean that Ireland can bring itself in line with other jurisdictions where grants of representation issue more expeditiously

their knowledge of the deponent) OR the deponent must be identified by means of an official document e.g. a passport or driving licence. The reference number and type of document must be indicated. (See S.I. 95 of 2009).

General Inconsistencies:

Another major reason for rejections is a lack of consistency across the application. Simple errors are being made where details on one document do not match the details on another. Practitioners are encouraged to thoroughly proofread their applications prior to submission so as to ensure any minor errors are spotted in advance. This can often be the difference between the application progressing and your grant issuing, and your application being queried and/or rejected.

The Future: e-probate

In light of the obvious shortcomings in the current system, one cannot but wonder if a digital system would expedite probate and shorten the waiting times. This, thankfully, is in the works.

As part of the Courts Modernisation Programme, an e-probate project is now underway. Funding has been approved and a project board has been established to develop an online probate system. Additional resources have been assigned to the office as part of the e-probate project. The project is still at the planning stage, but it is hoped that the first version of an online probate system will be launched in the first quarter of 2025.

The basic idea of the e-probate platform will be to digitise the collection of most of the information

required for a probate application. Practitioners will register for and gain access to a secure online portal, similar to Revenue’s SA2 platform, where they can enter the data as required throughout the probate process. Original wills and death certificates will still need to be lodged with the Probate Office, but it is hoped that everything else will be submitted digitally.

The new system will be applicable to deaths that occur post 5th December 2001, and any applications where deaths occur prior to this date will be processed by physically lodging the entire application, as is the current norm. It will also contain an in-built title checker which will require the applicant to answer specific questions, thus preventing them from proceeding until the title is deemed correct.

E-Probate will be a revolutionary change in the probate process, and it is hoped will significantly reduce the errors and waiting times. The introduction of a new digital-oriented system will hopefully mean that Ireland can bring itself in line with other jurisdictions where grants of representation issue more expeditiously.

Until then, we as stakeholders have to be content with working within the confines of the current regime, which, while not perfect, is certainly robust in ensuring that grants issue to those entitled to extract, and in turn lawful beneficiaries receive their rightful entitlements.

As to who is to blame for these constant delays?

Let us not point fingers. It appears that everyone is doing their best under the circumstances. It does seem though that a transition to a more digitally focussed approach makes sense and will hopefully help ease stakeholder frustrations over time.

22 the Parchment

P

FREECPD hub.erininternational.com REGISTER NOW!

It is hugely welcome news and essential that the new Family Courts complex is built as soon as possible

Hammond Lane Family Courts get Green Light

The long-awaited and overdue good news that the Dublin Family Courts complex is to proceed arrived recently. The Commissioners of Public Works have granted planning permission for the 19-courtroom Family Courts complex which is to be built on the brownfield site located at Hammond Lane/ Church Street in Dublin 7 adjacent to the Four Courts

The DSBA has campaigned and lobbied tirelessly for almost a decade to have the Hammond Lane project advanced. Family lawyers, court staff, judges, witnesses and litigants have been waiting in unsuitable court accommodation. This is great news for all court users.

Conditions at the existing central Dublin family court venues at Dolphin House, Chancery Street and Phoenix House are basic, with problems of overcrowding, lack of privacy, inadequate waiting areas and an absence of child and family friendly spaces all adding to the stress of participating in Family Law proceedings.

Writing in the spring edition of the Parchment in 2022, leading family law solicitor Keith Walsh said: “We still await a sod being turned on the new Hammond Lane Building. Childcare in Dublin is still being run from

nineteenth century courts set up to deal with criminal and civil cases and the family law lists around the country are bursting with cases, many of which will not be reached. We can but hope that family law will at some point move from being the poor relation to the prodigal son or daughter.”

In May 2019 the Irish Examiner reported the then Chief Justice Frank Clarke’s views on the condition of the family courts in Dublin. Mr. Justice Clarke told the government that the family law courts in Dublin required “the most urgent attention” and operated in “dreadful conditions”. He said of Dolphin House that “the office block carved out of the remains of the old Dolphin Hotel provides wholly unsuitable facilities for what are inevitably difficult and delicate cases”. He said many other premises in Dublin being used for family law were “not much better”. In a typically memorable phrase, he also said: “Hammond Lane is, as they say, shovel-ready, subject to planning, and planning is ready to go once funding is in place.”

That was five years ago, and those shovels now look to be finally getting ready. It is hugely welcome news and essential that the new Family Courts complex is built as soon as possible to meet the demands and pace of the high volume of family cases before the Dublin courts.

The Courts Service has warmly welcomed news that planning permission for Hammond Lane Family Law Centre has got the green light. A spokesperson for the Courts Service said: “The Dublin Family Courts complex will replace the current fragmented and inadequate facilities with a modern, purposebuilt facility where family law cases can be held in a dignified, secure and non-threatening environment. Court facilities will be provided in an integrated complex alongside mediation, family support and related services.”

The National Development Finance Agency (NDFA) is now expected to procure and deliver the Dublin Family Courts complex in conjunction with the OPW, on behalf of the Courts Service, as a Public Private Partnership.

It is anticipated that construction will commence during 2026 and complete in 2028. P

24 the Parchment Family Law/News

Personal Injuries Supreme Court Ruling

The highly anticipated judgment in the case of Brigid Delaney -v- Personal Injury Assessment Board, The Judicial Council, Ireland and the Attorney General was delivered recently amid much expectation.

The seven-judge court delivered five separate judgments (with the remaining two judges concurring with two of the delivered judgments) but Ms. Delaney ultimately lost her appeal, and the Court upheld the Personal Injuries Guidelines as valid.

In a statement by Justice Minster Helen McEntee, she said: “The Supreme Court’s decision was both very significant and very welcome, upholding, as it did, the personal injury guidelines which were adopted on my watch back in April 2021.

That is really good news because we really believe these guidelines are key to our plan to make insurance more affordable.

“I think in the past we all felt uneasy at some personal injury payouts. No one wants to see a person badly injured left without adequate compensation, but at the same time, we were aware of very high payouts for many quite small and even insignificant injuries.”

The Justice Minister continued: “While the court upheld the guidelines, it has identified deficiencies in the underpinning legislation which will have to be fully considered by my officials with the advice of the Attorney General. I will bring forward any necessary amendments to the legislation in light of that consideration.

A majority of Supreme Court judges recently held that the relevant section of the Judicial Council Act 2019 is unconstitutional, but that the Personal Injuries Guidelines are nonetheless binding because they had effectively been ratified by the Oireachtas in a separate 2021 Act P

“The guidelines were introduced to help standardise awards for common injuries. That introduction was challenged, but today, in a complex judgment by the Supreme Court, they were upheld.

“Meanwhile, we will also keep a close eye on the impact of reduced awards under the guidelines, as we want to make absolutely sure that they are reflected in reduced premiums.”

the Parchment 25 Personal Injuries/News Spring 2024 dsba.ie

Recent Developments in Employment Law

How many different types of leave are employees in Ireland potentially entitled to? A good quiz question for certain select gatherings! Varying leave entitlements and other entitlements for employees have recently been introduced, significantly changing the employment landscape that all employers should be aware of. Ciara O’Kennedy gives her overview on recent employment law developments

Extension of Statutory Obligations under the Protected Disclosures Legislation

The scope of the protected disclosures legislation was extended on 17 December 2023 from employers with 250+ employees to employers with 50+ employees. Inscope employers are now obliged to establish internal reporting channels and procedures in their workplace for the making of a protected disclosure.

In summary, employers are required to ensure that secure channels are in place for receiving a protected disclosure and to acknowledge receipt of the disclosure within seven days. A designated person or persons within an organisation must be appointed to undertake this role. This person is responsible for providing feedback to the discloser and must keep the discloser informed of the progress of the investigation and the outcome no later than three months from receipt of the disclosure. A failure to establish, maintain and operate the reporting channels and procedures may lead to significant fines and penalties being imposed, ranging from €75,000 to €250,000, and/or imprisonment for up to two years.

There is no obligation to accept and follow up on anonymous complaints, but an employer may choose to do so.

The Government published updated Statutory Guidance in November 2023 for public bodies and prescribed persons under the Protected

Disclosures Act 2014, as amended, which can be viewed at https://www.gov.ie/en/publication/ e20b61-protected-disclosures-act-guidance-forpublic-bodies/?referrer=http://www.gov.ie/protecteddisclosures. Whilst aimed at public bodies, the Guidance is useful for all employers who come within the scope of the legislation.

Employers who fall within the scope of the legislation should look to update their whistleblowing/ protected disclosures policies as soon as possible if they have not already done so.

Leave Entitlements

Domestic Violence Leave

Domestic violence leave, introduced by the Work Life Balance and Miscellaneous Provisions Act 2023, is a new type of leave that came into force on 27 November 2023. It provides for five days paid leave for an employee who is suffering, or has suffered, domestic violence, in any period of 12 consecutive months, at their full rate of pay. There is no minimum service requirement to avail of this leave and employees will not be obliged to produce evidence in support of their application for leave. It is, however, acceptable for an employer to seek sufficient explanation from the employee in order to ascertain if an entitlement to domestic violence leave arises.

26 the Parchment

The intention of the leave is to enable the employee (or a ‘relevant person’ as defined under the legislation) to seek medical assistance, obtain support services and counselling, relocate either temporarily or permanently, seek legal advice or assistance, seek assistance from an Garda Síochána or to obtain a safety or barring order from the courts.

Parent’s Leave and Parent’s Benefit

It was announced in Budget 2024 that Parent’s Leave and Parent’s Benefit will be extended from seven to nine weeks of leave from August 2024.

Parent’s leave is available to employees who are a ‘relevant parent’ (e.g., a parent or adopting parent of a child; or a spouse, civil partner or cohabitant of the parent of the child; or a spouse or civil partner of the adopting parent of the child) and whose child was born or adopted on or after 1 November 2019.

Parent’s leave is available to each parent and there is no minimum length of service requirement for parent’s leave. The leave, which may be taken in one continuous block or as two separate blocks (of no less than one week), must be taken within the first two years of the child’s birth or adoption. There is no obligation on the company to pay an employee on parent’s leave, but an employee may be entitled to the State Parent’s benefit, provided the employee has sufficient PRSI contributions.

Statutory Sick Pay (SSP)

The Sick Leave Act 2022 came into force in January 2023 on a phased basis. The leave entitlement from 1 January 2023 was three days and was then increased to five days on 1 January 2024. It is intended that it will increase to seven days in 2025 and ten days in 2026.

SSP is provided to all employees at a rate of 70% of their wage but subject to a daily threshold of €110 per day. It is expected that this maximum cap may change and be amended over time to take account of changes in income and inflation. It applies to all employees with continuous service of 13 weeks or more.

The entitlement to sick leave applies from the first day of absence and does not need to run consecutively. To avail of statutory sick leave, employees are required to furnish a medical certificate from a registered medical practitioner covering each day of absence and stating that the employee is unable to work.

Employers who already operate a sick leave scheme are exempt from the obligations provided for under the Act where they can show that existing company benefits are as favourable or more favourable than the statutory entitlement.

If an employer fails to provide statutory sick pay, then an employee who submits a complaint may be awarded four weeks’ pay in addition to their statutory sick leave entitlement.

Where an employer maintains it cannot afford to

the Parchment 27 Employment Law Spring 2024 dsba.ie

Ciara O’Kennedy is a partner in the Litigation and Dispute Resolution Team at LK Shields. She is chair of the DSBA’s Employment Law Committee

Where an employer maintains it cannot afford to discharge its sick pay obligations, an exemption can be granted by the Labour Court, but availing of this exemption will require an employer to establish that it is suffering severe financial difficulties

discharge its sick pay obligations, an exemption can be granted by the Labour Court, but availing of this exemption will require an employer to establish that it is suffering severe financial difficulties.

In the recent case of Katerina Leszczynska v Musgrave Operating Partners ADJ-00044889, the WRC examined for the first time an employer’s obligation to pay SSP and the circumstances in which a company sick pay scheme is exempt from the obligation to pay SSP. The WRC found that employers who have company sick pay provisions that are more favourable to employees than the statutory sick pay will not be affected by the legislation. In assessing whether sick pay provisions are on the whole more favourable, the WRC took into account the following factors:

• The period of ser vice of an employee before sick leave is payable.

• The number of days that an employee is absent before sick leave is payable.

• The length of time for which sick leave is payable.

• The amount of sick leave payable.

• The reference period of the sick pay scheme.

The Work Life Balance and Miscellaneous Provisions Act 2023 introduced other additional leave entitlements:

• Employees are entitled to up to five days unpaid leave for medical care purposes.

• Transgender men (who have given birth) can now access maternity and pregnancy related leave and entitlements.

• The number of weeks during which mothers are entitled to take paid time off work for breastfeeding purposes has been increased from 26 to 104.

The right to access to these entitlements has been in force since 3 July 2023.

Right to Request Remote Working & Flexible Working Arrangements

The right to request remote working arrangements and flexible working arrangements for caring purposes have finally come into force in Ireland following the recent publication of the long-awaited Code of Practice.

In brief, Part 4 of the Work Life Balance and Miscellaneous Provisions Act 2023 (the “Act”) required a code of practice, and the Workplace Relations Commission (“WRC”) has now published that Code of Practice on the Right to Request Remote Working and the Right to Request Flexible Working Arrangements. The Code provides practical guidance for employers and employees regarding compliance with the requirements of the Act in relation to applications made by employees for remote working or flexible working arrangements. Employers and employees are obliged to have regard to the Code in respect of all applications for remote or flexible working arrangements and when terminating such arrangements.

Gender Pay Gap Reporting

The Gender Pay Gap Information Act 2021 came into force on 31 May 2022. In June 2022, employers with 250+ employees were required to choose a ‘snapshot’ date within that month, to prepare a report on the gender pay gap (GPG) for the employees in their company on that date and to publish that report in December 2022 and December 2023. GPG reporting initially applied to public and private sector organisations of 250+ employees on the snapshot date in 2022 and 2023, but the scope is set to be extended to organisations with 150+ employees in 2024 and to organisations with 50+ employees from 2025.

An employer will have to report on:

• The mean and median wa ge gap for full time, part time and temporary employees.

• The mean and median bonus gap for full time, part time and temporary employees.

• The proportion of men and women that received bonuses.

• The proportion of men and women that received benefits in kind.

• The proportion of men and women in four quartiles. Specific regulations and guidance apply to how the calculations should be carried out.

Employers are required to publish a statement setting out, in the employers’ opinion, the reasons for the gender pay gap in their company and what measures are being taken or are proposed to be taken by the employer to eliminate or reduce the pay gap. An employee can bring a claim to the Workplace Relations Commission (WRC) in respect of non-compliance with the legislation. The WRC can make an order requiring the employer to take a specified course of action to comply with the GPG legislation, but there are no provisions for compensation to be awarded or fines to be imposed for non-compliance. All decisions of the WRC are published with the parties named.

The legislation does empower the Irish Human Rights and Equality Commission to apply to the Circuit Court or the High Court for an enforcement order where there is suspected non-compliance.

Pensions (Auto-enrolment)

On 29 March 2022, the Minister for Social Protection announced the details of the Automatic Enrolment Retirement Savings System for Ireland, which is to operate on an ‘opt-out’ rather than an ‘opt-in’ basis. The scheme is expected to begin in the latter half of 2024.

28 the Parchment

Auto-enrolment is expected to be gradually phased in over a decade, with both employer and employee contributions starting at 1.5%, and increasing every three years by 1.5% until reaching 6% in by 2034.

The scheme provides that the employer should match the employee contributions up to a maximum of €80,000 of earnings and the State will provide a corresponding top-up of €1 for every €3 saved by the employee up to a maximum of €80,000. That means that for every €3 saved by an employee, a further €4 will be credited to their pension savings account between the employer and the State contribution. All employees who are not already in an occupational pension scheme, aged between 23 and 60 and earning over €20,000, will be automatically enrolled.

National Living Wage

The Government announced the introduction of a national living wage for employees at the end of 2022. The national living wage will be set at 60% of hourly median wages. It will be introduced over a four-year period and will be in place by 2026, at which point it will replace the national minimum wage.

The National Minimum Wage Order 2023 set the national minimum hourly rate of pay from 1 January 2024.

Aged 20 and over€12.70

Aged 19 €11.43

Aged 18 €10.16

Under 18 €8.89

The Payment of Wages (Amendment) (Tips and Gratuities) Act 2022

On-the-spot fines were introduced in late December 2023 for employers who are failing to comply with this Act. In addition, a public consultation on the Payment of Tips was launched in January 2024 to review the impact of the legislation that came into operation in December 2022 and to assess whether any further measures are required in relation to the fair distribution of tips and gratuities.

Thoughts

Employers should be advised to review these developments and consider those that are relevant to their organisations. Changes may be required to ensure compliance with the obligations on employers and the entitlements for employees. That is likely to mean introducing new policies and procedures or amending those that are already in place.

the Parchment 29 Employment Law Spring 2024 dsba.ie P

Navigating the Transition

Mary O’Donoghue of the DSBA In-House Committee outlines some challenges for solicitors moving into In-House Practice

TUnlike in private practice, where the focus is primarily on providing legal advice to clients, inhouse lawyers are integral members of the company, or organisation, involved in strategic decisionmaking and risk management

ransitioning from a private solicitor role to an in-house legal position presents a unique set of challenges for practitioners. While the core legal skills remain the same, adapting to the nuances of in-house practice requires a shift in mindset and approach for individual solicitors. In this short article, some of the key challenges faced by solicitors making this transition and insights into how colleagues overcome them are discussed:

1 Understanding the Business Context

One of the most significant adjustments for solicitors moving in-house is understanding the business context in which they will be operating. Unlike in private practice, where the focus is primarily on providing legal advice to clients, inhouse lawyers are integral members of the company or organisation, involved in strategic decisionmaking and risk management. This shift requires a broader understanding of the organisation’s goals, operations, and industry landscape.

2 Balancing Legal and Commercial Considerations

In-house solicitors often find themselves navigating between legal and commercial interests. While legal advice remains essentially the same, it must be delivered in a way that aligns with the company’s commercial objectives. This requires a delicate balancing exercise as an in-house solicitor must assess legal risks involved while also considering the practical implications for the business that employs him/her.

3 Developing Soft Skills

In addition to legal expertise, successful in-house solicitors must possess strong interpersonal

and communication skills. Building effective working relationships with colleagues across various departments is crucial for providing proactive legal support and integrating legal considerations into business decisions. This will require solicitors making this transition to enhance their collaboration and negotiation skills so as to effectively engage with non-legal stakeholders in this new role.

4 Managing Workload and Priorities

In-house practice often involves managing a diverse workload with competing priorities. Unlike the billable hour model of private practice, in-house practitioners often face tight deadlines and unexpected demands from their employer, requiring them to prioritise effectively and manage their time efficiently. Adapting to this fast-paced environment can be challenging for solicitors accustomed to a more structured and predictable workflow in private practice.

5 Navigating Ethical and Confidentiality Issues

Maintaining ethical standards and confidentiality is paramount for all legal practitioners, but in-house solicitors can face unique challenges in this regard. They may encounter situations where legal advice intersects with business interests, requiring careful navigation to avoid conflicts of interest or breaches of confidentiality. Private practice solicitors transitioning to in-house roles have to familiarise themselves from the get-go with their employer’s protocols for handling sensitive information considering their responsibilities as a member of the Law Society and officer of the Court.

6 Overcoming Challenges through Adaptation and Continuous Learning

While the transition from private practice to in-house practice presents its challenges, it also offers opportunities for personal and professional growth. By actively engaging with business and embracing the dynamic nature of in-house practice, solicitors can successfully navigate this new role with support from colleagues. Continuous learning and a willingness to adapt to these new challenges are key to thriving in the ever-evolving landscape of in-house legal practice.

If you have any suggestions for CPD training you’d like to see offered through the DSBA in-house committee for practitioners please contact the current in-house Chair or any committee members to discuss further. Contact maura@dsba.ie for more information.

30 the Parchment In-House Practice

P

Mary O’Donoghue serves as the vice chair of the DSBA In-House Committee and has over 16 years of experience as a prosecutor in the Office of the Director of Public Prosecutions. Since 2020, Mary has focused her expertise in the area of judicial review in the DPP’s Office

DSBA ANNUAL DINNER 2024

WESTBURY HOTEL FRIDAY APRIL 19 Drinks 7pm Dinner 8pm Black Tie Tickets – €140 or tables of 10 – €1,400 contact maura@dsba.ie

Irish Pre-Nups

Pre-nuptial agreements have long been considered a necessity for the very wealthy only. However, where people are pursuing careers and acquiring assets before considering settling into long-term relationships and marriage, pre-nuptial agreements are becoming more commonplace regardless of whether or not either or both parties are of significant means. Avril Mangan assesses the position

With the world becoming more global, and where in many European and Civil Law jurisdictions couples prior to marriage get to elect whether or not they wish for the assets acquired during the marriage to be deemed community property (or in Irish terms ‘marital assets’), and where Ireland has become a multi-cultural society, people’s expectations around protecting their assets and regulating their affairs have changed. Many couples now are taking a pragmatic view rather than romanticised ideals in respect of managing their marital finances.

To a lesser extent, another factor which has raised awareness of regulating rights when entering a romantic relationship was the introduction of the Civil Partnership and Certain Rights and Obligations of Cohabitants Act, 2010. This Act introduced the concept of a cohabitation agreement. A cohabitation agreement allows people to make a decision as to whether or not their relationship will be governed by the cohabitation legislation and the rights and obligations that could potentially arise under that Act.

As a specialist family law practitioner, enquiries are regularly received by couples getting married in relation to how they can protect assets which they have acquired prior to meeting their partner. This is particularly so where one or both of the parties own property prior to marriage and/or where parties anticipate receiving an inheritance from their parents into the future which they want to protect. Whilst

pre-nuptial agreements are not recognised at law in Ireland and are not enforceable in Ireland, they can be used to show the intention of the parties.

When a couple looks into entering into a prenuptial agreement, issues in relation to how they will manage their money, assets, the funding of the family, the fact of whether or not they are going to have children, all come up in the context of considering the appropriate terms to be included in a pre-nuptial agreement. It is always very surprising, as a family law specialist, how many couples never discuss these fundamental aspects of their relationship and how they will be managed in advance of getting married. Pre-nuptial agreements should always be based on full financial disclosure by each party, usually done in the form of a sworn Affidavit of Means, which means both parties are fully aware of the financial status of the other before getting married. Pre-nuptial agreements also deal with matters relating to the financial support of any dependent members of the family: this means couples have to have a discussion in advance of getting married as to how they see their finances being managed and their requirements and needs being met during the course of their marriage, prior to getting married.

At present, pre-nuptial agreements are not enforceable under Irish law as it is against public policy in this jurisdiction to agree terms which contemplate the end of a marriage. The law in Ireland in this respect could change and there is certainly a strong lobby for change. As such, if there was a change

32 the Parchment

in the law relating to pre-nuptial agreements, then such agreements could in the future be enforceable. At this time there is no way of knowing if any legislative changes in this respect will act retrospectively. In circumstances where we have cohabitation legislation allowing an unmarried cohabiting couple to regulate their affairs and to opt out of the potential obligations arising in the context of a relationship under that legislation, and where our society has become more global and where there is strong societal and political will to reform the current family law structure in Ireland, in my view it should only be a matter of time before pre-nuptial agreements are given legal recognition in Ireland.

As the law presently stands, a pre-nuptial agreement entered into by two people prior to marriage, in circumstances where the marriage subsequently breaks down and legal proceedings issue, may be viewed by an Irish Family Law Court as an indication of the intention of the parties as to how they wished for the financial aspects of a separation to be dealt with. If the marriage breaks down in a relatively short period of time, and there are no children of the marriage, then the Court may be more likely to take cognisance of any pre-nuptial agreement which has been signed by the parties. The longer the marriage is, and where there are children of the marriage, the less influential the terms of any pre-nuptial agreement will be in an Irish Court.

It is important that couples who are considering entering into a pre-nuptial agreement are made aware

that there is a likelihood that a Court could take the document seriously as evidence of intention. Whilst the Irish Courts are not bound by the agreement’s terms, the agreement could potentially have significant persuasive value if the Court were deciding on any matrimonial proceedings before it. Therefore, both parties must be very sure that the agreement truly reflects what they want. The obtaining of specialised legal advice will enhance the agreement’s robustness.