3 minute read

MARKET I.Q.

“Our Home Prices Are Cool!”

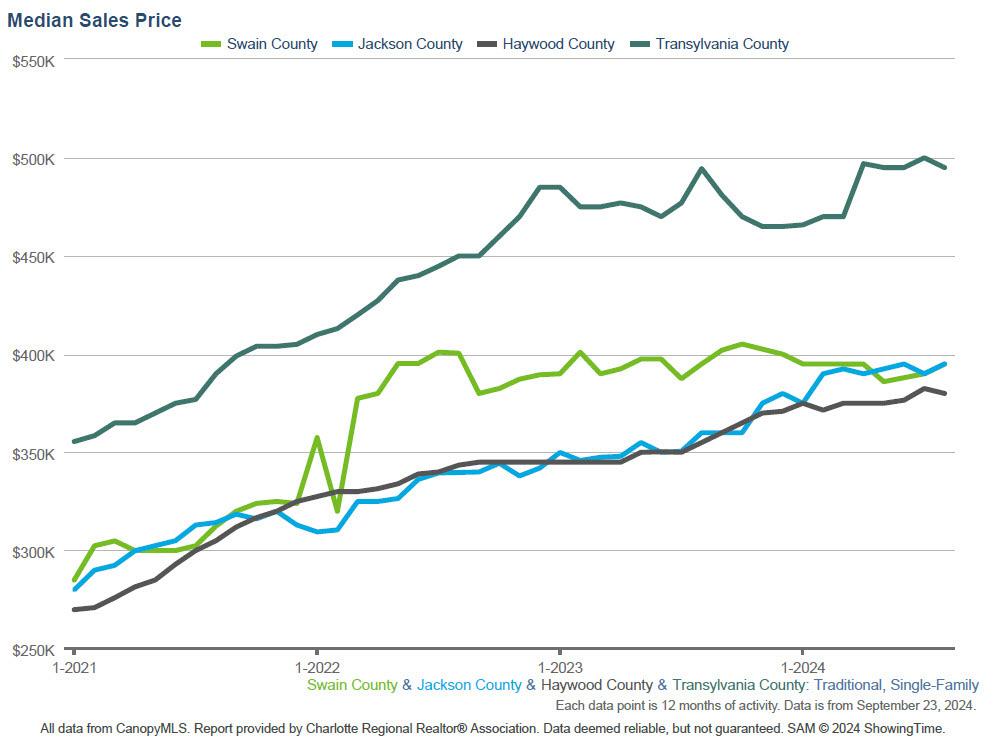

Historical single-family median prices show that investing in Western North Carolina real estate is smart and affordable! While homeowners have experienced a good return on their investment over time, home prices remain palatable for buyers as they enter the market. We back our buyers and sellers with data and insights so they can make smart moves. Contact one of our associates today for a comprehensive local area market report and/or a complimentary home evaluation.

Historical Median Sales Price by County

Housing Market Predictions: What to Expect

The September housing report from the National Association of REALTORS® (NAR), released at the middle-end of October 2024, found that year-over-year housing sales volume is down 3.5%, housing prices rose 3%, mortgage interest rates were lower—to 6.44% from 7.63% a year ago— and housing supplies have increased 23%. Inflation is easing and wages are rising. Most market conditions are finally moving in homebuyers’ favor.

Yet, some homebuyers are still reeling from spikes in the cost of living. They, along with home sellers, may be watching for mortgage interest rates to fall further. And some may simply believe that buying a home in 2025 will be more advantageous.

What do housing experts believe the housing market will do in 2025?

Household Formation

Households, whether composed of one person, a couple, or several generations of family members, are the beating heart of the housing industry, because they drive demand. Household formation has averaged 1.19 million per year over the past 30 years, according to the bipartisan Congressional Budget Office (CBO).

The burgeoning financial crisis of 20072009 was severe enough to reduce

household formation to 0.92 million annually between 2004 and 2013. By 2014, growth in household formations rebounded to about 1.50 million annually.

The fact that households continued to form during the Great Recession and beyond helped put supplies in a bind by 2014. Between 2010 and 2020, single-family home construction totaled 6.8 million units, far below the 9.3 million units built in the 1960s to 12.3 million homes built in the 2000s.

As of June 2024, household formation was 1.349 million year-to-date but is anticipated to be weaker over the next decade due to boomers aging and passing on, and slowing immigration, among other reasons. If formation slows even a little, it will help increase the availability of homes to rent or buy.

New Homes and the Availability of Property to Buy

The problems facing builders were and remain numerous—strict monetary policies, slow demand by skittish homebuyers, the high cost of building materials, and a severe shortage of labor brought on by the furloughing of sub-contractors during the housing crisis.