8 minute read

Certainty in an uncertain world

times during the exchange, when he also mentioned several other markets and spoke about record sales there

“ India is an incredibly exciting market It’s a major

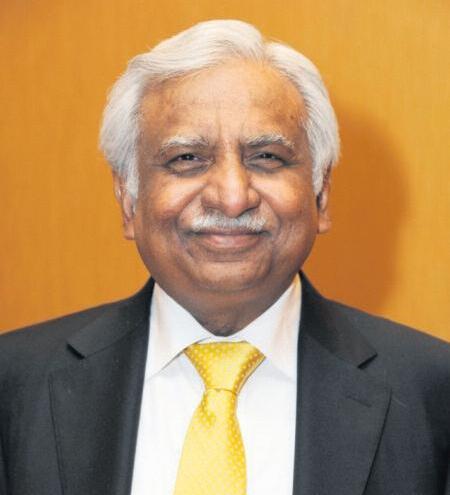

CBI searches sites linked to Jet Airways, its founder

The CBI has searched seven sites, including the offices of Jet Airways and its founder Naresh Goyal, in connection with an alleged bank fraud case totaling £53 8 million

On May 3, the organisation lodged a formal complaint against Goyal, his wife, and the former airline director G aurang Anan da Shet ty

Last week's searc hes were spread across residences of Ani ta and Shetty as well, sources said

The FIR, filed on the complaint of Canara Bank, had detailed alleged siphoning of funds through payments made to process and consultancy expenses

“It was noted that £115 26 million was incurred towards professional and consultancy expenses during the review period 1 4 2011 to 30 6 2019 Out of these, suspicious transactions to the tune of £19 75 million were identified in the case of entities which were linked to JIL, i e key managerial personnel of JIL were also linked to these entities,” the FIR claims

“It is observed that professional and consultancy expenses to the extent of £42 04 million out of £115 26 million were paid to entities whose nature of business is different from the service description in their invoices raised on JIL,” it further reads

The bank also noted that the turnover of these firms was comparable to the expense amount JIL was recording against those entities as professional and consultancy fees focus for us I was just there, and the dynamism in the market, the vibrancy was u n b e l i e v a b l e There are a lot of people coming into the middle class, and I really feel that India is at a tipping point, and it’s great to be there," he said The Apple CEO said that the company - which reported global revenues of $94 8 billion for the March quarter - had record numbers in India

He said that the company has been expanding its operations in India to serve more customers, and gave the example of the Apple Online Store that went live around three years ago “We've got a number of channel partners in India as well that we're partnering with, and we're very happy with how that's going overall Overall, I couldn't be more delighted and excited by the enthusiasm I'm seeing for the brand there ”

Credit Suisse sends legal notice to halt RCap’s sale

Cred it Suis se (C S) ha s written to the administrator of Reliance Capital, stating that a resolution plan for the compa ny c ann ot b e implemented as the Swis s lender’s petition against the rejection of its claims on RCap is still pending with the National Company Law Tribunal

CS, through their lawyers, have written to the administrator of RCap, Nageswara Rao, informing him about their claim for a debt of £66 million

Following the rejection of the two lenders' claims in the bankruptcy case, CS and Axis Bank filed a motion with the tribunal last year Both lenders had wished to be acknowledged as creditors The overall debt, according to the notice from the CS lawyer, is £66 million as of December 2021

CS has claimed it is a secured creditor with a pledge on the bankrupt company ’ s shares in its subsidiary, Reliance General Insurance, with IDBI Trusteeship company being a trustee The notice states there have been reports of a second round of auction on April 26, where IndusInd International Holdings has emerged as the sole bidder, and discussion regarding the finalisation of the resolution plan is underway

The administrator has been instructed by CS to hold off on even discussing the resolution plan, let alone finalising it According to the notification, the resolution plan s completion while a decision was pending would constitute a complete failure to comply with regulation 38 of the corporate insolvency resolution plan regulation

Go First files for bankruptcy, blames US engine maker

In dia's te le com r eve nues have reached a record high of £30 billion for the first time as income increas ed 20% in FY23 due to rising d ata a nd con ten t c ons umpt ion as w ell as f ina nc ia l rel ief fr om t he g over nme nt' s r ef orm pa c kag e D ue to t he expansion, the government was also able to increase its r eve nue s hare , w hic h t otal ed over £1 6 7 bil lion through licence fee receipts

Ac cording to sourc es, the In dian tel ec om indus tr y c l os e d FY23 with gr oss r eve nues of £31 bill ion, significantly higher than the £26 billion in 2021-22

B e s t - p e r f o r m i n g

Reliance Jio and Bharti Airte both experienced growth as a result of rate increases and increased customer usage of data and other services

However, Vodafone Idea, the third-biggest private operator in the nation, has yet to deliver as it works to turn things around, particularly after the government decided to become the company's largest shareholder by turning its unpaid interest liabilities into equity

“There has been a credible and strong revival of the telecom industry, indicating that reforms ushered in by the government have been in the right direction Also, the commencement of 5G rollout by the mobile operators and further investments into network expansion will give a fresh impetus to the industry and its revenues which will only get stronger over the coming years, ” sources said

Go Ai rli ne s, the low-c ost carrier owned by billionaire Nus li Wadi a, f il ed for bank ruptc y, acc usi ng US engine manufacturer Pratt & Whitney for forcing half of its fleet to be grounded The 2005- la un ched ai rli ne, which was renamed Go First in May, b eca me the f ir st Wadi a Group company to file for bankruptcy in its 287year existence and the third si gni fi ca nt ai rli ne to g o un der si nc e 2 012, af ter Kingfisher and Jet

When the National Company Law Tribunal in Delhi grants the bankruptcy plea, Wadia, his son Ness Wadia, airline chairman Varun Berry, other board members, and the management would hand over authority to a resolution specialist chosen by the forum

Civil aviation minister Jyotiraditya Scindia said “it’s incumbent upon the airline to make alternative travel arrangements for passengers so that inconvenience is minimal ” On its website, Go First said: “ due to operational reasons, Go First flights scheduled for May have been cancelled A full refund will be issued to the original mode of payment shortly committed to providing all the assistance we can ”

The airline, which has 61 aircraft in its fleet, said it moved the NCLT under the Insolvency and Bankruptcy Code (IBC) “due to the everincreasing number of failing engines supplied by PW which has resulted in Go First having to ground 25 aircraft (nearly 50% of its Airbus A320neo aircraft fleet) as of May 1, 2023 ”

Vagjiani, Sow & Reap Properties Ltd

We are exploring an interesting deal in West London The reason it’s of interest is not architectural, it’s the numbers More specifically the certainty of the numbers

The property is a mixed use building, a shop and uppers The uppers consist of two flats, both producing a decent rental, due to the location

There is a separate office building which is currently used as an office This can be converted into residential, under PD This means this can be done without the need for planning, thus removing the uncertainty associated with planning permission

The commercial itself can be converted into residential under the same rules; thereby negating the risk associated with obtaining planning permission

The reason why this is a good deal is the risk associated with obtaining planning in both these scenarios has been mitigated

This of course does not mean the deal is without risk You still have interest rates, build costs, and market conditions etc to contend with

In a project, gaining planning permission is usually a big variable, therefore mitigating this gives much certainty to the project

Not only is it defined but the time period within which the council has to grant the permission is also laid out in stone – 56 days is the rule On a previous development the permission was granted bang on the 56th day Otherwise, my understanding is you have the permission by default

The first option for the commercial element would be to keep it as commercial This removes the need for any refurbishment, or only a minimal level in order to appeal to the prospective tenant

The second option is to consider splitting the premises into smaller units, this would enable the prospective unit to fall below the threshold of paying business rates This then becomes very appealing for any tenants Under the new Class E the usage of a commercial premises is not only variegated but one can switch between the two, it is not locked This means it can even operate as an office during the day and be a café in the evenings There exists much flexibility with this class

There is of course always the potential to create residential This will require development In comparison, commercial rental is more favourable, as you don’t have voids, no maintenance, and the tenant is responsible for the upkeep of the external, at least partially

However, if the goal is to extract money then the route to go would be residential This would give the greatest uplift in values, which would mean this can be extracted on completion by way of refinance

The cost of the deal is £2M, and requires an investment of £1M It is income producing from day one, and one can expect to receive a large chunk of the £1M back at completion; and have an asset which is income producing in a strong location, where values are only expected to increase

For the w ee k en din g April 28, India's foreign ex cha ng e r ese rv es incr ea se d t o a 1 0month high of $588 8 bil lion , accord ing t o data released by the RBI (Reserve Bank of India)

Tha t is $4 5 b ill ion more from the prior week

The reserves had dropped by $2 2 billion to $584 3 billion in the previous reporting week In October 2021, foreign exchange reserves had touched an all-time high of $645 billion The central bank intervenes in the spot and forwards markets to prevent runaway moves in the rupee Changes in foreign exchange reserves also stem from valuation gains or losses

Earlier this week, media reported, citing traders, that the RBI was likely buying dollars via public sector banks to ensure that the rupee remained in a narrow range The rupee had a weekly end value of 81 61 and had moved in a range of 82 01 to 82 61 versus the US dollar The data on foreign exchange reserves was released last week The local currency reached an intraday high of 81 61 on April 27 This was a threemonth high