Business Overview

Q1 2023 UPDATE REPORT FOR ACORN PROPERTY INVEST

Constantine Bay, Cornwall

Constantine Bay, Cornwall

Cross Farm, Wedmore, Somerset

Q1 2023 UPDATE REPORT FOR ACORN PROPERTY INVEST

Constantine Bay, Cornwall

Constantine Bay, Cornwall

Cross Farm, Wedmore, Somerset

Welcome to our first Business Overview. Within this document it is our pleasure to take you through our activity and achievements over the past year and update you on our objectives for 2023 and beyond. As you’ll see, 2022 was a great year for us, with over 200 new sets of residents moving into their new homes, further residential and commercial development acquisitions, and another year of growth within our team.

Our long-term strategy of building sustainable, rural and coastal homes throughout the South West where demand remains at a level substantially higher than supply available. We believe the level of long-term demand in the South West combined with the continued planning delays throughout the United Kingdom will underwrite house values and continue to support increased values.

We are delighted to support investors keen to take advantage of new ways to diversify into the UK property market, and we look forward to sharing our successes with you.

Thank you again for your interest, and we look forward to working with you.

Melanie Omirou Executive Group Manager Director

230 Sales completed

£108,232,537

Value of sales (Q1 - Q4 2022)

7

Throughout 2022 Acorn completed 230 sales with a value of £108,232,537 (Q1 – Q4 2022).

4

New residential sites Commercial acquisitions

£85,500,000 Gross Development Value

Acorn completed on the purchase of seven new residential sites with a combined Gross Development Value of £85,500,000. We have agreed to the purchase of a number of further sites which are currently in solicitors’ hands and we will be completing the purchases over the coming months.

40 Acres purchased

£19,600,000 Combined value of sites

Acorn has expanded its commercial portfolio through the acquisition of Emery Gate shopping centre and the adjoining former Woolworths building in Chippenham along with the purchase of two office buildings in central Exeter. These sites have a combined value of £19,600,000 and it is our intention to launch a new investment product for our commercial portfolio.

£13,000,000

Sale of 12 acres

Acorn’s strategic land team completed the sale of 12 acres of land at Braintree to Crest Nicholson for £13,000,000 and completed the purchase of a further 40 acres of land for the remaining phases.

Acorn successfully obtained Listed Building and Reserved Matters planning approval at Ashton Fields, a 40-acre site in The Cotswolds.

Planning permission was achieved on a former hotel in Lee Bay, North Devon which Acorn has owned for a number of years and will be moving to development phase shortly.

Acorn has accelerated efforts to reduce third party contractor risk by expanding direct construction activities and as a result the percentage of the portfolio built directly by AHCS has continued to increase. This has also had the added bonus of ensuring better quality control and significantly reducing aftercare issues in projects where Acorn is the contractor.

We have continued to promote our Acorn Green initiative and construct energy efficient homes which are proving to be hugely in demand and one the most resilient sectors of the housing market countrywide. RICS has specifically mentioned that new build energy efficient homes are recognised as being the strongest product on the market and that current demand remains strong. This bodes well for Acorn’s portfolio which, under our Acorn Green initiative, produces energy efficient homes.

02 Acorn’s 2022 Activity

Acorn’s 2022 Activity Current development pipeline of £1,245,428,099

Listed Building and Reserved Matters planning approval was obtained in December 2022 meaning that we can now move to the development phase of this scheme. The development is located within the Cotswold Water Park and will comprise 75 new homes ranging from 2 bedroom bungalows to 3, 4, & 5 bedroom houses and will provide homeowners with exceptional lake and countryside views while enjoying the comforts of living within a friendly neighbourhood.

The development will be constructed in phases, with Phase 1 construction commencing in May 2023.

Acorn purchased and has been developing the 3.8 acre site known as Brooks Dye Works in St Werburgh’s, Bristol in Joint Venture with the Landowner. The development comprises 113 affordable and open market 2 - 4 bedroom sustainable new homes and is a key regeneration scheme in the area.

All the units are sold, with the final completions currently underway.

The residential element of Alliance House in central Bristol is now fully sold with values exceeding projected expectation. This project performed exceptionally well and demand for the units was high.

The commercial parade of six retail units on the ground floor are fully let and provide a strong market rent. Acorn continues to manage the commercial element and it is our intention to retain these units as a long-term investment.

Phase 1 of the development in central Somerset is fully sold, and all sales have completed. Phase 2 is progressing well with construction due to complete in Summer 2023. Phase 2 is 78% sold (as of January 2023) with only 14 units remaining and our sales team are continually dealing with new enquiries and viewings.

Development funding has been agreed for Phase 3 and construction will commence immediately. It is expected that demand for Phase 3 will be similar to the level on Phase 1 and Phase 2, so we are therefore anticipating this development to be highly successful and exceed expectation.

In November 2022 we opened the doors to our Marketing Suite and launched the first phase of 65 homes to an extremely strong database of over 2,900 applicants and released the first six apartments for sale.

The launch led to a great amount of interest, with plenty of bookings and walk ins. We have received particular interest from the Exeter University and hospital staff. Following the launch, we have reserved eight units so far which are all at least 10% over the valuation prices. We are planning a further launch with more units being offered at an appropriate time in Spring 2023.

Acorn completed on the purchase of The Former Lee Bay hotel in early 2021 and in May 2022 obtained planning permission to develop the site into 17 x 1 – 3 bed apartments and four x 4 bed new-build detached houses along with a café building and beach car park for the National Trust on the opposite of the valley.

We are in the process of obtaining development funding and construction works will commence in late Spring 2023.

Acorn completed on the purchase of Green Park, Chillington in the desirable South Hams area of Devon and obtained planning permission in 2022 for 62 residential units, made up of 40 x 3 and 4 bed open-market houses which will be constructed over two phases, and 22 affordable plots.

Development funding has been obtained and pre-constructions works have completed, and works will commence on site in Spring 2023.

Acorn purchased and are developing 10 residential apartments on a brownfield site in central Padstow, Cornwall. The site is located above and behind the Harbour Hotel in Padstow, a prominent feature in Padstow’s core town centre and has views to the east and west around the hotel of the Camel Estuary.

All units are sold and sales have exchanged with the first sale expected to complete in May 2023. Site completion is expected in May 2023 with the final sale due to complete in July 2023. The units sold for well in excess of 15% above valuation figures. Demand for the units was high as supply in the area is slow so this project has been extremely successful for Acorn.

The development on the North Cornish coast provides 8 houses and 20 apartments. All the units have been pre-sold and have all exchanged, with sales completions having commenced in October 2022. The final unit is expected to complete in Spring 2023.

This development has performed exceptionally well with the units being in high demand and the sales values achieved being well in excess of anticipated prices and valuation figures.

Acorn exchanged on the purchase of a 1.23 acre Freehold site in Greet, Cheltenham in November 2022 and completed on the purchase in January 2023. The site has full planning permission for six houses and Acorn’s proposed development will provide five houses being developed to form an attractive courtyard with the sixth house being detached with private access.

Development funding has been obtained and the construction team intend to start on site imminently with construction expected to complete in Spring 2024.

Acorn Property Group, through their commercial arm, First Oak, purchased the Emery Gate Shopping Centre and adjoining former Woolworths building in Chippenham. The property sits in the heart of the town’s main shopping area and high street adjacent to the River Avon and local park.

Emery Gate is made up of a large 42,145 sqft multi-storey shopping centre of 27 units and a 28,000 sqft. store currently occupied by Tesco. Alongside this is a former Woolworths building with ground floor retail space of 20,176 sqft which now comprises Poundland, Costa and Sports Direct and above is 14,165 sqft of upper parts.

Acorn Property Group completed the purchase of a 1.46 acre Freehold site known as Hazel Green in the desirable award-winning village of Urchfont in Wiltshire in March 2022.

The site has the benefit of a full planning permission and works have commenced to provide 13 x 2 – 4 bed detached new homes within an attractive landscaping setting. Construction is currently underway with the first sales expected spring 2023.

Acorn Property Group completed on the purchase of a Freehold site known as Gatcombe Orchard, Wrington in Somerset. The site is predominately surrounded by fields and woodland, and is located 700m from the centre of Wrington village in the prime Bristol commuter belt.

Works have commenced on site and the development will provide 37 x 2 – 4 bed semi-detached, detached and terraced new-build homes within an attractive landscaping setting.

Acorn Property Group completed on the purchase of a c3.14 area Freehold site known as Land at Trendlewood Way, Nailsea in Somerset within the prime Bristol commuter belt. The site occupies a small pocket of undeveloped private land and offers an exciting development opportunity in a popular location within Nailsea.

The development will comprise 17 x 2, 3 and 4 bedroom detached houses along with 7 x 1 - 3 bedroom affordable homes. The new homes will provide a variety of type, size and tenure with a lower density area to the south-west.

Acorn Property Group, through their commercial arm, First Oak, purchased Buildings 1, 2 and 3, Manor Court in central Exeter in December 2022.

Building 1 & 2 are currently vacant and Acorn will be undertaking a full refurbishment prior to agreeing a letting. We have already received strong interest from two parties for the building, both of which are Government bodies. Building 3 is let and produces a strong market rent and substantial income.

Acorn Property Group completed on the purchase of a large 60,000 sqft. Freehold vacant, non-trading, hotel in Woolacombe, North Devon.

The new scheme will provide for modern high specification accommodation, increased parking provision; meeting the desired expectations of owner occupiers, holiday homeowners and buy-to-let investors. The site is situated in an elevated position on Beach Road in the desirable seaside resort of Woolacombe, situated on the north-west coast of Devon.

In September 2022 Acorn Property Group completed on the purchase of a former creamery in Trevarrian, Cornwall for a mixeduse development scheme of 24 houses plus a 5,090 sqft of commercial space to be used as a retail or farmer’s market space.

A planning application has been submitted for 14 x 3 – 4 bed detached and semi-detached houses, plus 10 x 2 – 3 bed houses which will either be shared ownership or discounted open market (affordable) units.

Acorn Property Group completed on the purchase of this elevated 0.3 hectare site with sea views and full planning permission in July 2022. The development will provide 4 new detached homes within an attractive landscaping setting and works have commenced on site.

The site is located within the groups of property known as ‘Arcady’, within the confines of the coastal historic settlement of Newlyn.

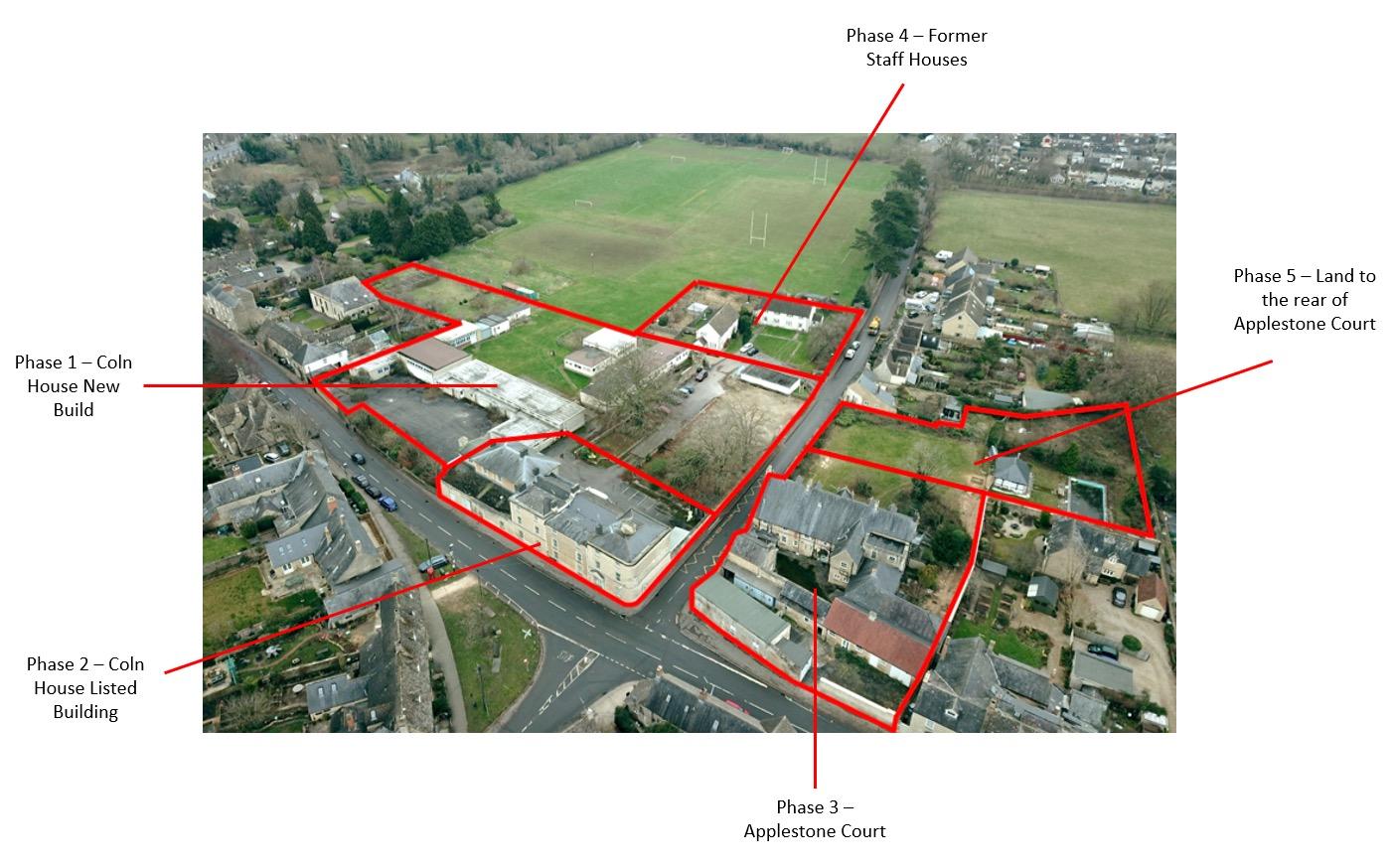

Acorn has acquired a prime, new build residential and conversion site in the popular Cotswold town of Fairford. The site comprises a former school, playing fields and a number of ancillary buildings, and is divided into a number of phases.

Phase 1 – The New Build Houses at Coln House. Acorn will undertake demolition of the current buildings on the site and construct 17 new build, private residential homes with a proposed unit mix of 1 to 3 bed apartments, terraced houses and detached houses.

Phase 2 – The Listed Building at Coln House. Acorn will convert the existing building and construct 7 private residential homes with a proposed unit mix of 1 – 6 bed apartments and houses.

Phase 3 – Applestone Court. Acorn will convert the existing building and construct 4 private residential homes with a proposed unit mix of 1 – 6 bed houses and bungalows.

Phase 4 – The Former Staff Houses. Acorn will convert the existing buildings and construct 4 x 3 bed private residential houses.

Phase 5 – Land to the rear of Applestone Court. Acorn will submit a planning application for this land and achieve permission to construct at least one large bungalow.

Acorn has agreed the purchase of two large long-leasehold development parcels within the Hensol Castle Park in the Vale of Glamorgan.

Gardener’s Mews: this parcel of land extends approx. 1.65 acres and was previously comprised a range of outbuildings and workshops which have now been demolished in preparation for the sites redevelopment. The site adjoins the north wall of the adjoining Grade I Listed Walled Garden, which forms the sites southern boundary and has planning permission for 10 detached dwellings.

Castle Villas: this parcel of land extends approx. 1.75 acres and forms part of a previously undeveloped field enclosed, located between two existing executive style dwellings and has planning permission for 6 detached dwellings.

Acorn has agreed the purchase of one large listed building and two smaller listed units at the Caerleon Campus development. The site also includes a significant area of landscaping and space for car parking extending to 3.5 acres.

The buildings have full Planning Permission and Listed Building Consent for conversion to 42 apartments and 4 semi-detached houses.

Acorn is purchasing three Grade II Listed Buildings:

The Main Building – large educational style building

Principals House – detached house

Caretakers Lodge – detached house

The importance of having an energy-efficient home has never been greater as the impacts of climate change become more evident and the energy prices and utility bills continue to rise.

As we have always done, each development we design and build is evaluated on its own merits. There is no standard layout or design and this approach also applies to sustainability. As technology evolves, so do our homes. The way in which we live is constantly changing and Acorn’s innovative thinking ensures we can respond in a proactive way.

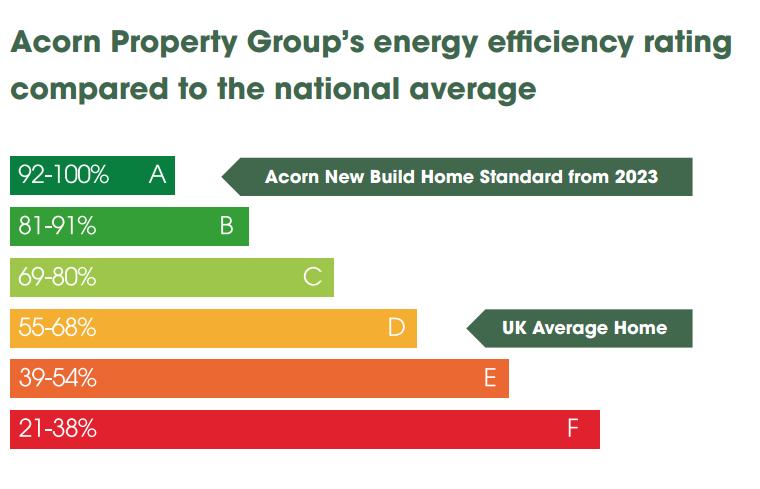

New build homes are constantly rated with much higher EPCs than existing properties and Acorn’s new build homes are all energy-efficient rated EPC-A or B meaning that new build homeowners could save on average over £2,600 a year on running costs compared to an older home.

Second-hand houses also generate nearly three times as much carbon as their new build equivalent, paving the way for the Future Homes and Buildings Standard in 2025, which ensures all future homes are net zero ready and will not need retrofitting.

As the pressure on the climate increases, and with residential property in the UK accounting for more than 20% of the country’s emissions, the positive impact that new build homes can have on our progress towards net zero is vital

The RICS has specifically mentioned that new build energy efficient homes are recognised as being the strongest product on the market and that current demand remains strong. This bodes well for Acorn’s portfolio which, under our Acorn Green initiative, produces energy efficient homes.

We are fully committed to driving a more sustainable and green future across our business, and as part of this Acorn has pledged:

• All new build developments and future new-build phases from August 2023 much have an EPC rating of A (92% – 100%) based on current SAPS.

• Acorn will aim to no longer use gas in new homes on the commencement of new developments or phase from August 2023 with heat instead being supplied by a heat pump (air/ground/water).

• To commit to comprehensive tree and shrub planting to help with carbon offsetting, provide enhanced landscaping and increase biodiversity.

• All landscaping must be bee friendly and peat free to help with carbon reduction and encourage wildlife through elements like hedgehog tunnels and bee bricks.

• We have partnered with carbon offset natural solutions provider, Wanderlands, to help drive down our core and residual carbon footprint.

In line with our focus to reduce carbon emissions associated with the design, build and function of our homes, we are delighted to announce that we have now embarked on our journey to make the operational side of our business net-zero carbon.

We are all seeing the ever-increasing detrimental impact of climate change across the world and with the UK Government commitment to become carbon net-zero by 2050 and to reduce carbon emissions by 78% by 2035 against 1990 levels. Protecting the environment is a subject that Acorn is passionate about and believe we need to fully embrace the commitment by setting our own targets.

In addition to our sustainability pledges, wherever possible Acorn developments must include:

Due to the striking nature of the building and the fact that it is Grade II listed, the design process saw us stand back and take a more holistic view of sustainability, thinking about the re-use of the existing building and long-term place-making. Working on a site, such as The Links, that already has a rich history, to then design from that as the core and build in additional sustainable features such as maximising the thermal performance of the building’s envelope with a fabric-first approach, bio-diversity solutions, or tailored engineering solutions to reduce carbon emissions, it enhances the design process and creates a rich mix of place and space that communities that can thrive in for years to come.

The Links has benefited from a replacement roof and new double and triple glazed windows in order to maximize thermal efficiency and meet present day building regulations, as well as to enable residents to magnify the majestic coastline of Rest Bay through ample glazing. Energy efficient appliances come as standard, while Mechanical Ventilation Heat Recovery systems provide a modern alternative to regulating inside air temperature. There are also communal car charging ports are in situ for residents with electric vehicles. The Links is the perfect example of bringing a historic building back to life with modern sustainable technology.

Our magnificent development, The Links, at Rest Bay, South Wales is a fantastic example of bringing new life to existing buildings and is one of our most fascinating regeneration projects.

Located above the popular fishing port of Newlyn in Cornwall, Acorn completed on the purchase of this elevated site with sea views in July 2022. The development will provide 4 new detached homes each rated EPC A.

Designed to meet superior standards of energy efficiency, the homes at Arcady will have the ability to create as much regulated energy as required to help lower running costs and further drive down resident’s carbon footprint.

Each home will include several exciting sustainability features, including:

• Timber frame construction, the most sustainable construction form which benefits from superior levels of insulation as well as the lower embodied Co2 of any building material. It is also non-toxic and naturally renewable.

• Large double glazed, argon-fitted windows and doors to minimise heat loss and maximise solar gain.

• Rooftop Photovoltaic (PV) panels to convert energy from sunlight into electricity with zero net energy useage.

• Option of adding a battery to further reduce energy bills.

• EPC A rating.

• Air source heat pumps to generate low-carbon renewable energy without the use of fossil fuels.

• Peat free landscaping to help with carbon reduction.

• Additional native planting to help with carbon offsetting and contribute to wildlife and biodiversity.

Superior thermal insulation in walls & roof

Solar PV Panels with battery storage

A-rated integrated kitchen appliances Integrated recycling bin

Sunamp thermal storage system for heating hot water

(MVHR ) Mechanical Ventilation Heat Recovery System

Dual flush toilets to save water

Timber frame construction

Low energy light fittings

Electric vehicle charging point

Smart meters

Air Source Heat Pump

Underfloor heating

High performance double glazed argon filled window systems

Acorn Green

Acorn Green

Includes units currently under construction or within the agreed development pipeline.

Includes units currently under construction or within the agreed development pipeline.

Includes units currently under construction or within the agreed development pipeline.

Includes units currently under construction or within the agreed development pipeline.

Includes units currently under construction or within the agreed development pipeline.

Rightmove published their latest House Price Index report which provides the largest monthly sample of residential property prices and housing market activity. The report, headlined “Bigger than usual New Year bounce after extended year-end lull” and issued in January 2023, reported that overall, the housing market has grown by 6.3% nationwide since the previous year.

These statistics give reason for some positivity and the numbers suggest that the market has bounced back with leading market indicators starting to identify some growth that will go on to strengthen in the second half of 2023.

The majority of Acorn’s buyers tend to be later life buyers with a significant number being mortgage free and many of the remainder having small mortgages. This means that the demand for our homes is less sensitive to mortgage rate increases than for developments aimed at first time buyers or investor buyers. We also specifically operate in areas of very high demand and low supply and therefore, even though demand has recently been affected by mortgage rate increases and the cost of living crisis, there is still considerable excess demand over supply for good housing in the areas where we operate.

Gareth Overton, Head of Residential Sales at Henry Adams noted, “As mortgage rates start to lower and inflation moves under control, we are seeing higher demand from those who have taken a long-term view to investing in their next home. Along with increases in viewing levels seen so far in 2023, we are also receiving more requests for valuations. Across our network of offices, we’ve certainly been cheered by the volume of sales activity immediately following the Christmas break. People are now looking ahead and putting their moving plans into action for the new year. This bodes well for a reasonable balanced market in the months ahead where supply and demand are more evenly matched”.Construction works on site in Somerset: Longcroft at Cubis Bruton, Bruton

Rightmove noted that the South West had seen the biggest rise in house prices in England over the last year, an increase of 13.5% on the same period in 2021.

Rightmove said the demand meant 53% of UK properties were selling at or over the full asking price - the highest level ever seen. According to Rightmove, there is a supply and demand imbalance in the South West, which is driving up prices.

Affordability constraints caused by the rising interest rates, cost of living and a dampened economy are expected to slow the pace of price rises later next year but high buyer demand in our sector, which is largely mortgage free and wealthier, older buyers, together with and limited stock for sale suggests prices will remain robust in our market place.

Rightmove’s Director of Property Data, Tim Bannister noted,

It is therefore anticipated that the sales completions being achieved by Acorn, through the delivery of a number of new developments in and around the South West and Wales over these years, will continue to increase significantly.

The Liner, Falmouth which Acorn completed construction and all sales on during 2022

Construction works on site at Rolle Gardens, Exmouth

The Liner, Falmouth which Acorn completed construction and all sales on during 2022

Construction works on site at Rolle Gardens, Exmouth

“The South West is really interesting. Quite early on in the pandemic, Cornwall overtook London as the most searched for area on Rightmove. Many people came out of the pandemic wanting to make a big change to move to the coast or rural areas, to get more green space. We saw that initially very clearly, and I think that is continuing. We are still seeing really strong demand for people to live by the coast and the South West has stunning coastline and rural areas. Demand for top hotspots, such as Cornwall and Devon, looks like it will continue for some time.”

Leading industry analysts, Savills, had forecast in August 2022, that sales values throughout the South West would increase by 8.2% and 16.8% respectively over the next five years. When publishing these Capital Value Forecasts, Lucian Cook from Savills noted,

This view nationally has changed due to the predicted recession and the impact of interest rates on first time buyers and investment buyers. However it is accepted that our section of the market which is broadly mortgage free or low mortgage will be less impacted by rising interest rates.

There will be some disruption to the market and purchaser chains in the short term but all forecasts are that the market will return robustly in 2024 as the supply and demand dynamics are so in our favour that prices will remain at current levels and indeed continue to increase to reflect the swap to low energy greener homes suitable for the wealthy older buyers and the communities we serve.

Brooks Dye Works, Bristol King’s Court, Acton“A lack of supply and strong buyer demand fuelled by the experience of the pandemic has turbocharged house price growth over the past two years, despite growing economic headwinds.”

Savills’ predictions prior to the Autumn Budget indicate that the Bank of England Base Rate will rise to 4% in 2023, but inflation will fall very quickly, with interest rates falling to 1.75% by 2026 (chart 1).

More importantly, the predictions of a recession, as shown in the Economic Growth and Unemployment (chart 2) below, predicts a very shallow recession followed quite rapidly by growth. Acorn believes that a recession of this nature with unemployment remaining under 5% means that Acorn’s market will not be materially impacted by the current economic circumstances.

Furthermore, although Savills believes that prices will fall in 2023 they have accepted that is very sector driven and the most relevant factor is the reliance of mortgages, which as expressed, is not Acorn’s marketplace and all indications are that the hugely excessive demand, although dampened, will mean that prices remain stable at the levels predicted. Since then, the RICS has specifically mentioned that demand remains strong for new build energy efficient homes which is in line with Acorn’s offering.

However even with Savills’ negative 2023 prices, they indicate that over the next five years that prices will rise by 6.2%, chart 3. Based on Acorn’s £1 billion plus portfolio, this would provide for value increases of between £60 - £70 million. It is on this basis that Acorn believes the location and quality of the portfolio provide Acorn with a secure pipeline and the regional business plans likewise.

On 12th October 2022 the Homebuilders Federation published a pretty substantial report on ‘the financial benefits and carbon efficiency of new homes’ which showed how the improved energy efficiency of new build homes has a significant impact on their energy use.

The back up for their figures is data samples of over 1.6 million properties from The Department for Levelling Up, Housing and Communities (DLUHC) and their stats on EPCs and data from British Gas on average annual bills.

Looking at the average cost per kWh of gas and electricity combined, based on the prices set by the Government’s Energy Price Guarantee for bills from October 2022, the bills and savings that new build homeowners will see each year are vast.

Average carbon dioxide emissions per dwelling (tonnes per annum), year to June 2022

The average new build property uses approximately 9,094 kWh a year, compared to older properties which use an annual average of 21,621 kWh.

Perhaps the biggest advantage of new build homes is the long-term cost savings associated with using and wasting less energy.

The HBF report found that on average, buyers of new homes save more than £2,000 on household bills per property each year, equivalent to £173 a month. For buyers of houses, as opposed to flats, the savings are even greater at £220 per month.

Acorn believes this will increase demand for new build homes significantly more than demand for second-hand homes.

Cross Farm, Wedmore, Somerset

Cross Farm, Wedmore, Somerset

For more information

Head Office and London Office

1 Frederick Place London N8 8AF

020 8341 2222

Acorn Bristol 50 Clifton Down Road Bristol BS8 4AH

0117 244 0400

Acorn Blue 79 Mount Wise, Newquay, Cornwall TR7 2BP

01637 876000

Acorn Cardiff

Thorens House Beck Court Cardiff Gate Business Park Cardiff C23 8RP

029 2010 0657

Acorn Exeter 50 Topsham Road Exeter EX2 4NF

020 3820 6359

St Leonards Quarter, Exeter, Devon

The Links, Rest Bay, Porthcawl, South Wales

The Liner, Falmouth, Cornwall

Newham’s Yard, SE1

St Leonards Quarter, Exeter, Devon

The Links, Rest Bay, Porthcawl, South Wales

The Liner, Falmouth, Cornwall

Newham’s Yard, SE1

*The information contained within this document is confidential, privileged and only for the information of the intended recipient and may not be used, published or redistributed without the prior written consent of Acorn Property Group.

www.acornpropertyinvest.com | app.acornpropertyinvest.com