PAID TO PLAY? BITCOIN PROVIDING ENTERTAINMENT REWARDS WITH ZBD

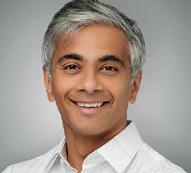

BULLISH ON AI BUD FINANCIAL THINKS LLMs ARE KEY TO CUSTOMER SERVICE REVOLUTION

PAID TO PLAY? BITCOIN PROVIDING ENTERTAINMENT REWARDS WITH ZBD

BULLISH ON AI BUD FINANCIAL THINKS LLMs ARE KEY TO CUSTOMER SERVICE REVOLUTION

BACK IN VEGAS WHAT’S DIFFERENT AT MONEY20/20 THIS YEAR?

With more options than ever, these fintechs are prepared...

6

Money20/20

It’s all happening here…

Ali Paterson spoke to Money20/20’s Scarlett Sieber and Zach Anderson Pettet to find out why fintech founders and startups should attend the US edition of the mega conference

8 Artificial intelligence

Proceed with care

ING Bank has taken a ‘prudent and cautious’ approach to the introduction of GenAI, following the same principles of safe design that it’s applied to all previous iterations, as Chief Analytics Officer Bahadir Yilmaz explains

10 Digital payments

Time to make the shift

Santander’s Greg Murray assesses the impact of transitioning to the new ISO 20022 global standard

CEO Ed Maslaveckas reveals how Bud Financial is delivering real and genuine AI use cases, for the banks who want in

Digital assets are coming. But maybe not in the way you think.

G&D’s Alex Gatiragas examines what decentralised finance could bring to financial institutions. Here’s what to expect

HSBC’s Vivek Ramachandran has an excellent vantage point from which to observe global trade. Here he explores its rapid transformation and why we ignore developing trends at our peril

ZBD’s Marca Wosoba and Ben Cousens discuss how utilising Bitcoin as a rewards system for gaming is opening up new horizons for users

"In the coming years, plastic may become optional."

It’s a bold prediction but no one can deny, that the point of sale is changing. In what direction and how fast, is not always clear cut. There are certainly prophets of revolution in these pages. Alex Benjamin from Aevi makes the case for a hybrid online and in-person approach to accepting payments, on page 32, allowing merchants to unlock serious benefits in the process.

A few pages later, Guillaume Leclerc from HPS wonders how long it will be before digital payment methods and wallets eclipse card use entirely. But there are also voices, such as those of fintech writer Ron Delnevo on page 25, who are flying the flag for cash use. Cash is far from dead even in major metropolitan centres such as New York, he says.

One thing’s for sure, merchants and PSPs alike can’t afford to take a gamble on what customers are going to pull out of their pocket or which button they press at checkout.

I had to get a Vegas reference in there somewhere, given this magazine is going live at Money20/20 USA 2024, once again hosted in Sin City – 27th-30th October, it’s Fin-City.

You may be reading this with a background hum of networking chatter, the distant ding ding ding of slot machines and the exciting sights and sounds of a conference like no other. Hear the vision behind it on page 6.

One thing Money20/20 does better than most is highlighting the exciting new technology coming out of the industry. We’ve got plenty of that in this issue.

Taking us into a possible future of earning money whilst you play games is ZBD, which is using existing Bitcoin technology to make rewarding entertainment easier.

G+D believes there are existing use cases for DeFi in traditional finance, Bud Financial is bullish on AI, Zingly wants to revolutionise customer service and iGCB is transforming banks in emerging markets. And that’s not all.

In this bumper issue of ThePaytech Magazine we’re not just speaking to payments specialists. We get the neobank view from Revolut and Kroo and commentary from the likes of Santander, ING, PayPal, SEB and HSBC.

Blimey. From the UK to America, I’m pleased to deliver some of the best fintech and finance coverage on the block. No matter when or where you read this, I hope you enjoy.

Tim Goodfellow, Editor

Revolut Business’ General Manager James Gibson reveals why the time is ripe for a fresh chapter in the neobank’s already successful story

Payment choice in The Big Apple Cash payments advocate, Ron Delnevo travelled to New York City to see how it advocates for payment choice and discovered many progressive features

iGCB’s Rajesh Saxena and Gerald Gore from NMB Bank Zimbabwe discuss how its core banking transformation took place amidst turbulent economic conditions

The automated bank UK challenger Kroo has a mass market brand proposition, but delivering it profitably means you must run a tight ship, says CTO Alexey Gabsatarov

SEB bank’s Allan Kissmeyer is a ‘big fan of clarity’. As more banks look to employ GenAI to help solve data-rich complexity in payment processes, he thinks there ought to be more of it from regulators

With so many payment methods now available, the need has never been greater for merchants to offer flexibility. Alex Benjamin from Aevi explores how to bring it all together

35

A tangled web

Integrating customer demand and payments orchestration is tricky but an unavoidable priority says HPS Consultant Guillaume Leclerc

36

Changing chatbots for the better Chatbots have failed to disrupt customer service effectively but Zingly.ai’s Gaurav Passi says the technology not only makes life easier for the consumer but could revolutionise the entire customer interaction

PayPal Ventures’ Ashish Aggarwal makes the case for fintech democratising access to finance

Viva Las Vegas: This year's Money20/20 USA will assess the present but also look to the future

It’s all happening here…

Ali Paterson spoke to Money20/20’s Scarlett Sieber and Zach Anderson Pettet to find out why fintech founders and startups should attend the US edition of the mega conference

Across the financial services and fintech industry, Money20/20 has become a household name. Regardless of which conference you prefer, one thing is for sure, Money20/20 events always provide a good time.

But what will make the USA version different from the rest? The upcoming election and inevitable political

Scarlett Sieber, Chief Strategy and Growth Officer and Zach Anderson Pettet, VP, Fintech Strategy at Money20/20

upheaval bring a certain unique backdrop to proceedings and will no doubt factor in conversations on and off stage. There are also undeniable opportunities to be had for fintechs in a market still ripe for further disruption.

The best people to really find out what makes Money20/20 USA tick, however, are people at the heart of the matter. Money20/20’s chief strategy and growth officer, Scarlett Sieber and VP of strategy/director of content for the US, Zach Anderson Pettet are close to the product, of course, but they have no shortage of passion for what they do.

So, if you’re a startup in Europe or Asia, why should you make the trip across the Atlantic (or Pacific) to Las Vegas this year? We spoke to them to find out.

The Fintech Magazine How are you going to make Money 2020 USA different from last year?

Zach Anderson Pettet: “We aim to reflect the industry, while also looking

ahead. We focus on what’s happening today and forecast what technology and infrastructure might look like, five to 10 years from now.

“The pace of change is so rapid that we don’t have to try to make it different each year – it just is.

“Take AI, for example. This year we have a distinguished architect from OpenAI alongside Klarna’s CTO discussing their earnings announcement.

“The landscape around Open Banking in the US has also shifted significantly, with some of those changes being announced at last year’s event. While we don’t know exactly what will be announced this time, we do know there will be representatives from the CFPB at the show.

“The world is moving so fast that we have no choice but to keep up and maybe stay a step or two ahead.”

Scarlett Sieber: “I always think about how we can surprise and delight our

customers. The way people attend events has shifted, and while there’s still a lot of business getting done, we’re focussed on facilitating that in smarter, more meaningful ways. In the next two weeks, you’ll see some exciting announcements on how we’re leveraging technology to help people do business.

“Zach’s focus is on making event experiences really resonate with our customers and the industry we love. One example is the ‘Off The Record’ stage, which we’re continuously refining. We have the world’s top speakers, but we also understand the need for open, transparent conversations. In these sessions, phones are put away, and there’s no media or press, allowing for real, focussed discussions.

“We’ve even had founders share their pitch decks in that room – it’s where genuine conversations happen, with no one distracted by a screen.

“Then there’s the press briefing stage, designed to give space for conversations where the audience can ask questions in an open Q&A with the fintech community. Each year, we keep improving these experiences.”

Zach Anderson Pettet: “We’re creating two different extremes. Something purpose-built for the media and also something where no media is allowed.”

The Fintech Magazine It’s certainly unique. Who’s going to be there? What are people speaking about?

Zach Anderson Pettet: “Lynn Martin, president of the New York Stock Exchange is the big one we’re very excited about. If you’ve been paying attention, the IPO market in recent years hasn’t been awesome for fintech, or great in general.

“But the signals and the macroeconomic context suggest that 2025 and 2026 could be a new dawn for fintech IPOs. The likes of Stripe, Plaid, Chime, are right on the verge of that. We might see fintech grow up this year.

“A lot of the bigger speakers are talking about AI but we’re mostly treating the topic horizontally rather than allocating chunks of time to it specifically. AI is going to touch every single piece of the stack.

“For example, we’ve got Varun Krishna, the CEO of Rocket Mortgage, the number one non-bank lender in the US. They’ve found some unique ways to apply AI to the underwriting process. I could keep going…”

The Fintech Magazine I’ve opened Pandora’s box! Scarlett, what else is impacting this year’s conference?

Scarlett Sieber: “What makes it so special

This year’s conference… happens to take place six days before a semiimportant election!

Scarlett

Sieber

is it just happens to take place six days before a… semi-important election in our country! We’re already getting a lot of questions around that, but our main focus is policy, rule-making and regulation.

“This year we have former White House CIO, Theresa Payton coming, as well as Spencer Cox, the governor of Utah and Kyle Hauptman, the vice chairman of the National Credit Union Association, who are all thinking about these topics.

“But beyond the US we also have the head of department for the Central Bank of Brazil.

“On topics, I’m still very bullish on embedded finance. It’s here to stay and we’re going to have some of the biggest companies and players in the world on our stages. There will be a global CEO from one of the largest payment companies in the world, who’s never spoken in the US before, talking on that.”

The Fintech Magazine There’s previously been a heavy domestic focus at the US event. Why should a company or startup in Europe and other parts of the world make that trip across the Atlantic?

Zach Anderson Pettet: “Each Money20/20 has a different focus, but we see Money20/20 USA as a global event. This year, we’re telling very Asia-centric stories and pulling in people from all over the world— so moving away from just focussing on the domestic market.

“We’re also placing a strong emphasis on Latin America, particularly with the success of NuBank. In fact, we’ll have more regulators from LATAM than from the US, largely due to the upcoming election happening just six days after the show.

“For startups, in my opinion, there’s no better way to spend four days. You can learn a lot, meet key people, and figure out whether expanding to the US or partnering with a US company or bank even makes sense.

“If you eventually decide not to invest in the US, four days at Money20/20 is a lot more efficient than the costly efforts some major neobanks have made trying to enter the market. Apart from that, it’s simply the best gathering of financial technology professionals in the world.”

Scarlett Sieber: “As far as content is concerned, with the amount of time our team spends on making sure it reflects what’s happening in the industry, you could get a PhD in fintech! And as Zach was saying, we also provide access to the ecosystem and decision-makers that attend.

“You’re not going to talk to one or two VCs. It could be 20. And you have all kinds of banks, big and small. You can make big moments happen and find your next partner immediately.”

The Fintech Magazine What does it take to make a great speaker?

Scarlett Sieber: “Sometimes the speakers I’m most excited about, only 20 people experience them. Sometimes the biggest people aren’t the most interesting, but we still work hard behind the scenes to get the value out and hone in on the exciting stuff. You can tell when you hit that sweet spot, because their eyes change, the engagement changes.

“Speakers don’t always work out but if you don’t take risks, then you’re not going to get the payoff. And if every single time it went swimmingly, then we’re not taking big enough risks.”

The Fintech Magazine Taking a step back and looking at the industry more broadly, should we be optimistic about the state of fintech and finance at this time?

Scarlett Sieber: “I’m always optimistic. Regardless of what is happening, there is always opportunity in moments like this. Even if things are not as rosy as we would hope, that’s often when the best startups are born. The ones who have the grit, the hustle, the perseverance.

“I do believe we’re going to see some success stories by the end of this year. Who that is, I have some personal opinions based on data points and who’s being hired and where the money is going. But in any case, it’s going to be an interesting time.

“As far as funding is concerned I think resetting was important for fintech to focus on businesses that are having a real impact,

Zach Anderson Pettet

We see it as a global event... pulling in people from all over the world

scaling and becoming profitable.”

ING Bank has taken a ‘prudent and cautious’ approach to the introduction of GenAI, following the principles of safe design, as Chief Analytics Officer Bahadir Yilmaz explains

“Applying AI and generative AI techniques to a business problem is only five per cent of the job. The other 95 per cent starts after that, building all the systems around it to make it safe.”

That’s Bahadir Yilmaz speaking, chief analytics officer in charge of a team of 400 data scientists, data engineers and product managers at European bank ING.

While they are at the coalface, weighing the risks and benefits of implementing AI, including large language models where appropriate, the other 60,000 or so of the bank’s employees are not left in the dark about the technology.

ING is building what Yilmaz has described as “an advanced data science workforce” and part of that involves awareness training that “highlights the opportunities but also the (largely unknown as yet) risks” associated with AI.

ING has taken a systematic approach to assessing those dangers.

“We have a 20-step process, which evaluates any AI system for 140 risks,” explains Yilmaz. “And only after we say OK to all of these 140 risks do we go into production.”

That applies to systems built in-house and – perhaps even more so – to those foundational models that, increasingly, the bank is sourcing from big tech and other vendors. Here, says Yilmaz, it works on the principle of “believe nothing you read on the declaration but test it yourself against banking standards.”

Developing those new methods and measures to really kick the tyres is one of the biggest challenges for the bank right now.

“These types of controls are necessary for organisations, but also for society to make sure that AI applications are safe and secure to use,” says Yilmaz.

From chatbots to reconciliations, lending to trading, it’s creating these protective systems around AI models that takes the most effort. But the bank’s plan is to position analytics and AI as “the most critical enablers in transforming ING’s operations”, so it has to get them right.

There is also, of course, a substantial cost associated with such computing power, which makes prioritising domains that present a key business risk – like KYC, detection of financial crime, fraud and sustainability – a prudent focus of time and money when it comes to developing an AI tool for the process.

GenAI is certainly more tricky to evaluate. It’s still in unchartered territory, so applications within the bank have been limited to those where perhaps it can do least damage and deliver the most benefit.

So far, this “prudent and responsible approach” has seen ING focus on five key areas: chatbots, personalised marketing, KYC solutions, coding/ software engineering and ING Wholesale Banking (WB) lending.

“We’ve been building chatbots since 2017 and have used several different

Bahadir Yilmaz, Chief Analytics Officer at ING Bank

technologies,” says Yilmaz. “All these solutions were super rudimentary. They weren’t really getting the answers that customers were looking for.

“But with the launch of large language models, and especially with ChatGPT, this changed. People saw how good they could be in getting the answer they were looking for, quickly and accurately.

“We noticed this at ING, too, and shifted our technology from a more statistical natural language program (NLP)-based approach to a large language model-based approach.”

The bank worked closely with McKinsey over seven weeks to build, test, and launch a bespoke customerfacing chatbot using GenAI technology.

Before any responses were sent to customers, a series of guardrails was applied (to avoid the chatbot giving advice on mortgages and investment products, for example), built using out-of-the-box tools from McKinsey’s AI and machine learning innovation hub, QuantumBlack Labs.

The new chatbot launched in September 2023, making it the first-of-its-kind, real-life customer-facing pilot conducted in Europe.

ING saw an immediate improvement: the more nuanced and contextual answers that GenAI could provide instantly translating to a 20 per cent uplift in customers not having to wait in queues to speak to an agent. The chatbot is projected to eventually impact 37 million customers when it’s scaled to all of ING’s 10 retail markets.

“Clients want instant answers to their questions and they want instant solutions to their problems. Chatbots are highly capable of doing that,” believes Yilmaz.

That makes it sound easy; it isn’t.

“By getting service from one of the big tech companies and plugging it into your website, you can have a chatbot that is able to be your client services channel in a day,” says Yilmaz.

“But the job is not complete until you have ensured there are no biases in all the systems around it, so you’re not discriminating against anyone, and that your system is safe and the information is secure.”

While “any problem can be optimised and made better with these techniques,“ he’s not advocating that banks apply them to solve all of their problems.

“You should put them in a priority order and start with the ones that really make sense for you. Key is finding the most suitable technique and applying it to your problem to generate real value,” he says. “Lending is, historically, one of the first areas where banks have started using

The key is finding the most suitable technique and applying it to your problem to generate real value

AI models, including advanced models. We see more institutions using the power of their transactional data and coming up with better lending propositions. They are able to provide loans in a matter of minutes instead of days.”

But his concern is that, as use cases multiply, the industry will lack the skills needed to build these systems and put appropriate guardrails in place and at scale.

“We need more and more people who know how to do it. We cannot just keep building these solutions with small teams of experts. So, that’s the first transition that we have to go through,” says Yilmaz.

“The second transition needs to happen in certain parts of our workforce where their job is changing. It’s not about extracting information from documents anymore but verifying information that is extracted by AI. That’s necessitates a different expertise and that transition also needs to be supported.

“Think about it: you’ve worked in anti-money laundering operations all your life, reviewing customers’ annual reports, then AI tools come along to answer all the questions. But they won’t be perfect. So your job is going to be reviewing whether that information is correct.

“That’s a slightly different skill that requires a different way of thinking. Your concentration has to be on different things. And that is a change that, as a bank, we also have to facilitate.”

The financial industry is undergoing a significant transformation with the adoption of ISO 20022, a new global standard for exchanging electronic messages between financial institutions.

It will replace older messaging formats like SWIFT MT, offering a more flexible, efficient, and data-rich way to process transactions and communicate across the financial landscape. But what exactly is ISO 20022, and why does it matter?

The new global standard promises to unlock a new era for banking, and for those institutions not already convinced or concerned about the changes, it may be time to get on board.

We spoke to Greg Murray, managing director of treasury services product management at Santander US, who shared his insights on the new standard and its potential impact. There is some concern about how smaller businesses will cope with the shift and to help with this Murray says the transition needs to be a collaborative one.

Speaking to our editor-in-chief Ali Paterson, he explains why it’s an exciting time for the industry.

The Fintech Magazine How are you at Santander and the rest of the industry responding to the new format?

Greg Murray “ISO 20022 has been in a state of evolution since it was proposed but the more intense focus on it has been in the last five years or so. A lot of that is driven by the adoption that global clearing systems want to see.

“You’ve got a lot of clearing systems in Europe, some of which are already ISO

Greg Murray, Managing Director of Treasury Services Product Management at Santander US

Santander’s Greg Murray assesses the impact of transitioning to the new ISO 20022 global standard

compliant. And in the US, we have the Fed’s system that plans to be compliant in March of 2025. We also have The Clearing House system, or CHIPS, here in the US that adopted the ISO format in April of 2024.

“In preparation, banks have had this as a major focus for at least three years in terms of investments, making sure we have the right funding and subject matter expertise to meet the deadlines.”

The Fintech Magazine What will be the impact of this change on your customers and partners?

Greg Murray “Fintechs and other vendors are going to need to adapt to the format to support the payment flow process. And for all our clients, whether that’s individuals, small businesses, or large corporations, I think it will be a bit of a mixed bag.

“Some of our clients are already ISO native. They’re using file-based systems that have been provided by ERP providers that are already in the ISO format. Your largest corporations are probably there whereas, for smaller companies, it’s more mixed. Some of our clients were not aware of ISO, even to this point.

“For individuals who typically use mobile devices or online web tools to initiate payments, we’ll see additional fields and or reformatted fields that they will simply have to adapt to. But it’s relatively straightforward for them.

“The reason why it’s a bit more of a challenge for businesses is that most of the time these companies are generating their payments from an upstream system.

“It’s not as if they’re just typing it in fresh where you just fill out the fields as they come along. Typically, you’re loading up a file of some sort from your ERP system and that ERP system also has to be updated.

“It’s important for the bank to be able to handle this, and ERP vendors will need to be ISO compliant too.”

The Fintech Magazine Will having these standards and regulations to adhere to, push people to constantly up their game?

Greg Murray “I’ve been on several forums related to ISO, and that’s a very good question. I think at the bottom line, ISO keeps us on our toes. As much as there’s a lot of work to do, it is also an indication that we are evolving to improve the way we serve our clients.

“When Swift came on the scene in the mid-70s and introduced the concept of structure, we had a fair amount of work to transition from Telex to this modern way. Over time, Swift has become the dominant way in which banks communicate. We all depend on each other.

“It’s companies like Swift and the structure that they introduced that enables banks to be able to communicate effectively. That progression helps us get excited about this, even though it is a lot of work. We know it’s ultimately going to improve things.”

The Fintech Magazine What are some of the challenges that banks face around cross-border payments and domestic transactions currently?

Greg Murray “Probably the biggest challenge is fraud. And most of that fraud

comes from business email compromise, which won’t be solved by ISO 20022. But by introducing structured data, we’ll have more interpretability in the fight against fraud, and the ability to render better decisions.”

“Internationally, payments have a reputation for being slow. And that’s one of the reasons why a lot of fintechs have become very successful in this arena because they’ve created a more straightforward or simple way of doing business.

“But settling and clearing payments is still done through a bank or clearing system that the bank belongs to. So delays can be caused by either confusing information or information that isn’t structured sufficiently to render a well-informed decision.”

a bank. One is implementing the changes themselves and testing to make sure it works. The second would be educating our clients. Answering the questions, ‘What is ISO?’, ‘What does it ultimately mean?’ ‘What benefits will it eventually provide?’, ‘Why should they care?’

“We can’t tell our clients what to do, but we can certainly advise them on what they need to consider so that they have a better perspective.

“And then the third role is helping them transition. We have been very careful at Santander not to call it a migration because we’re not migrating clients per se. They’re still going to use the same systems that they use today, but there will be a transition to extended data and more structured data.

“One of the most valuable pieces of advice that we’ve received in these discussions has been the necessity for partner bank testing. There’s a genuine vested interest from all parties to make sure that when we communicate, it’s seamless.

“Not just that it works here at Santander, but that the other bank is equally capable and ready to handle the format.”

The Fintech Magazine What will be the ultimate legacy of ISO 20022?

Greg Murray “I think the process of moving money around the world will be much faster and richer, if you will, meaning the information that is exchanged will be more robust. It should probably have been done earlier.

The Fintech Magazine Do you agree that when it comes to payments, if you’re operating 99.99 per cent correctly, you’re failing? It needs to be 100 per cent?

Greg Murray “That’s absolutely true. In full disclosure, I remember being somewhat reticent in the early days of ISO. The benefits weren’t entirely clear. But we’ve all come around, through industry forums, working with regulators and clearing systems to understand that it will ultimately result in a better experience for ourselves, and our clients. It’s an investment in the future.”

The Fintech Magazine What is Santander’s role in this?

Greg Murray “I believe we have three roles as

“Templates [for regular payments] will have to be edited and updated. So, we give them all the tools to help them through that transition.”

The Fintech Magazine You mentioned that you’re working with SWIFT in North America. Are banks talking to each other and sharing best practices?

Greg Murray “We compete with a lot of regional and global banks, but we also collaborate and share within the realm of what’s acceptable.

“So when it comes to an industry initiative like ISO, we do share lessons learned and we’ve had the benefit of good partnerships with a few other banks in the US. We’ve spoken with the clearing systems themselves to understand how they have gone about it.”

ISO keeps us on our toes… it’s an indication that we are evolving to improve the way we serve our clients

“The value will be so evident that we can move money more quickly, and provide more information. I definitely believe it will also spur innovation because we won’t be bound by some of the restrictions we have today in carrying capacity.”

CEO Ed Maslaveckas reveals how Bud Financial is delivering real and genuine AI use cases, for the banks who want in

AI is the buzzword of the moment, but some remain sceptical about the use cases in financial services.

Fintechs and banks alike have been quick to flaunt their own ‘AI’ offering, to embrace the hype and attract funding, regardless of how complex their use of AI is.

One company that can make a claim to being ahead of the curve on this is Bud Financial. “It’s been one hell of a journey,” says its CEO Ed Maslaveckas, who co-founded the company with George Dunning in 2015.

Long before ChatGPT arrived on the scene, it was a “consumer app using what they believed was data science to understand customers and make recommendations to them,” adds Maslaveckas.

However, its offering was limited by the technology available to them. “Now it’s much more scalable to build,” he says, and it’s well positioned to offer meaningful capability to banks themselves. On offer is increased productivity, the building blocks of a more compelling product, and greater efficiency.

Others agree that AI tech could present the future of banking. According to McKinsey, “GenAI could add between $200billion and $340billion in value annually… through increased productivity.” Whether or not banks are prepared to make that leap, is another matter.

“A lot of these organisations aren’t ready,” says Maslaveckas. “Some of the biggest banks are enabled by a very old structure, where they have hundreds of thousands of people performing manual tasks, such as data analytics, balance sheets, fraud reports, customer service etc.”

Ed Maslaveckas, Chief Executive Officer and co-founder at data intelligence fintech Bud Financial

With Bud’s new Drive product, Maslaveckas claims it “can perform data analytics tasks on banking data in approximately 15 seconds; data processing that would otherwise take two weeks.

“There’s a huge disruption coming in banking, and it’s actually in how they operate. We’re focused on the people that want to make a change today.”

That disruption has been on the way for some time now. Challenger banks and wealth management apps have adopted a digital-only approach, onboarding customers in minutes and providing tailored and helpful services through an app.

They’re using cloud technology by default and their market share is now growing. In Europe and the UK, the likes of Monzo and Revolut now firmly have a seat at the table. The US is increasingly seeing huge success with Chime leading the way.

In April 2024, Chime hit $1.5billion in annualised revenue and according to consumer research, it’s estimated roughly 22.3 million US consumers have an account. It’s a real statement that challenging norms in US banking can pay off. In August 2024 Monzo added two million new customers in 12 months, to cross the 10 million mark, the equivalent of one-in-five UK adults.

Rival firm Revolut recently received its UK banking license and gained a $45billion projected valuation, making it Europe’s most valuable startup, surpassing traditional banks NatWest and Lloyds Banking Group in the process.

A relatively young founder himself, Maslaveckas represents a growing population of people who have no interest in branch-based banking. He’s

frank about the change that is coming and those who will be left in the dust.

“We saw the first banks go into the cloud maybe in 2015 or thereabouts. But a lot of banks in the UK and the US are still on legacy on-prem systems.”

The customer’s own aversion to change will ensure that many of these banks will remain established “for the next five, 10 years.”

For the time being, it wants “to enable the people that are willing to try something out, the fintechs, but also bigger banks that have side projects where they experiment,” he says.

“We want to be provocative in our communication given how big we think the shift is going to be. I think our technology is a little bit ahead of what people are comfortable with. And I think we’ll continue to do that.”

“We need to be a little bit more outspoken about the leadership position that we have because we’ve been working on some of these core technologies since 2018.”

Increasingly AI will be used to change customer experience, through transaction enrichment and data analysis, something Bud has been working on for years.

Many banks are already using some kind of customer service chatbot but there is plenty of room for improvement and despite some hesitancy, we’re likely to see improvements across the board in the years to come.

“This next wave of personalisation is something we’ve completely lost in banking, which is finding new ways to serve customers,” adds Maslaveckas. Ironically, it’s the things that smaller institutions and building societies have offered, through proximity to the

customer, for over 100 years, that could increasingly be delivered by multinational banks using LLMs.

Maslaveckas reminisces about letters to his parents from regional banks in the UK, like Midland Bank, that acknowledged a house move or change in marital status, offering services that may help in that transition.

In other words, there is an opportunity for banks to go beyond offering the same products in the same rudimentary fashion they have been for years.

The role that AI plays in this, is manipulating data through transaction enrichment. “We focused on transaction enrichment when we were a consumer app. [it doesn’t have one anymore],” says Maslaveckas.

“We wanted to do personalisation, in order to be a financial assistant for the customer, which I think every bank needs to become to maintain the time and attention of the customer going forward.

“The bank primacy is increasingly about engagement. If you can control the customer engagement experience, and be as helpful as possible, you have the right to distribute different products to customers.”

The problem however is, he adds, “We didn’t know who the customer was

AI

because the raw data was hard to understand and process. So we did this whole enrichment thing, and went down the rabbit hole.”

Data enriched

“A lot of people say they’re doing data enrichment, but no one does it accurately enough to create good insight on the customer,” says Maslaveckas.

Even a relatively high accuracy of 86 per cent on transaction enrichment still represents a huge error rate across hundreds of thousands of transactions. By comparison, Bud’s

transaction categorisation is greater than 97 per cent accurate. Getting to the smallest possible percentage error rate on transaction enrichment was the key to unlocking everything else.

“With data like income, outgoings, spend data and CRA data you get a full customer picture,” says Maslaveckas. This is where its Drive product comes in. “We can understand the who, what, where of every transaction. Then we add our insights layer, which helps them

understand the customer based on the aggregate of those transactions. Drive sits over the top and finds insights across the customer cohort,” he says.

“Our new AI products actually identify customer behaviours and patterns, inform the banker and suggest personalised offerings such as tailoring a credit card towards them.”

At the end of the day, “banks want outcomes” and analytics is only as good as the potential revenue it can increase.

One concern around all of this is the impact it will have on jobs. It goes back to the numbers of people doing mundane back office tasks.

According to a report from The Institute for Public Policy Research (IPPR), “entry-level, part-time and administrative jobs were most exposed to being replaced by AI under a ‘worst-case scenario’ for the rollout of new technologies in the next three to five years.”

Of course, this concerns real people’s livelihoods, but pioneers like Maslaveckas say it’s important to look at the bigger picture.

“The higher cause is banks being really efficient because you want lending to be as low interest as possible and you want banks to be able to offer competitive rates,” he says.

“There’s going to be job destruction and job creation, like there always is, right? But I think there’s still a lot of need for humans to have oversight and take initiative. AI can only react to the input. They don’t have the agency to make decisions. So, I think there’s a huge cause for that. But ultimately I think more efficient banks are only a good thing.”

There will be a shift, and it may come sooner than people are prepared for, but new opportunities will also arise. The more optimistic outlook involves the augmentation of a human workforce, which according to the IPPR report would mean no jobs are lost and the size of the economy could be increased by four per cent, or about £92billion, a year.

Maslaveckas’ prediction for the future is clear. “In maybe three to four years, we’re going to see challenger banks or startups deliver a better model and create headlines. Share prices [at the big firms] will be hit and then those building the technology in the bank will be pulled into the boardroom.”

G+D

’s Alex Gatiragas explores the inevitability of decentralised finance

‘Digital asset management is no longer optional for financial institutions.’ That’s according to fintech writer Ian Horne who also leads content at one of the world’s leading fintech conferences. More and more people are starting to agree.

The use of digital assets as investment and decentralised finance more generally has grown from a desire to “facilitate peer to peer transactions, without the need for financial intermediaries.” But despite the promise of finance without borders, it would seem institutional support is needed in order to increase adoption amongst consumers.

A recent VISA study found that 59% of consumers believe digital assets require established financial institutions to achieve wider adoption. Responding to this, HSBC, JP Morgan, Deutsche Bank and many more established multinational financial institutions are working on digital asset management offerings.

There is clearly an appetite for digital asset investment that needs to be served. Interest has exploded in the last 5 years, with crypto and retail investor platforms offering ease of access to a new asset class. The total value of tokens deposited in DeFi applications is around $80bn. The good news for financial institutions is 39% of existing crypto owners say they will switch to a bank that offers crypto products this year, according to the VISA study.

Many countries are exploring the possibility of a Central Bank Digital Currency (CBDC) issued by central banks,

although a clear distinction is made between this and crypto assets as an investment vehicle. But given the popularity of Crypto as an investment asset, it’s now advisable for banks to get on board.

There may be a slight irony in digital asset investment only being palatable to the masses when a third party is involved, but we’re still intrigued to know what benefits remain for consumers and financial institutions in this area. Giesecke+Devrient have now entered this field, looking to make it easier for providers to offer digital asset management services, with their new product Convego TruSafe. Alex Gatiragas, their Director of Solution Experience, is cautiously optimistic about the future potential of this technology.

According to Gatiragas, one driver for established institutions to get involved is that fintechs and newer players are already there. Increasingly, the likes of Revolut offer easy ways to store crypto and other digital assets as well as popular exchanges such as Binance and Coinbase. “Traditional financial institutions are being challenged by the new entrants in the market.”

In theory for banks, once they “introduce similar capabilities within existing channels, accessing these services should be simpler.”

“The immediate opportunity,” says Gatiragas. “Is in laying the foundations for these digital assets by providing custody related services. A way to safely and securely hold onto those assets just

as I would hold shares in a company or precious metals for example.”

“Purchasing digital assets and holding them as an investment vehicle,” is currently the main use case for most consumers. The release of crypto based ETFs at the start of 2024 helped validate and establish them further as an asset class and major US banks have now given the green light for wealth advisors to sell them to clients. People now have a blend of investments from foreign exchange through to shares, ETFs and now Bitcoin and other digital assets.

However, for the time being the value of individual crypto assets fluctuates wildly, making it very difficult to see them as a reliable form of payment. CBDCs and stablecoins may have wider use in the nearer future, but both have their detractors.

The barriers and a way through Even as an asset class there are certain hurdles that need overcoming before digital assets can be widely used. “I think the main barriers are convenience, trust and security. We need to build trust in the market itself, because unfortunately there have been cases where hacking has occurred, consumers’ funds have been mishandled, or the experience has simply been too cumbersome.”

To repair the dent in consumer trust following such cases, regulation is needed. The MiCA (The Markets in Crypto-Assets) regulation in Europe should enable crypto firms, such as issuers, exchanges and wallet providers, to operate throughout the European Union if they secure licensing and

have provided some clarity on what you can and can’t do.

Gatiragas says “MiCA is a benchmark for global regulation. A lot of regulatory bodies are looking at MiCA, and taking the good bits out of it. Our entry into this market was highly driven by the regulatory environment so it made sense for us to closely follow what they were doing.”

Asia is further ahead still, with certain countries making huge strides forward in the digital asset space. In Singapore, a pilot run by the MAS looking at the adoption of DeFi protocols in regulated markets, identified the importance of regulated institutions acting as “trust anchors,” issuing and verifying the credentials and identities of participating entities.

card use is still significant, accounting for 46% of e-commerce and 74% of POS transaction value in 2023. Banks can’t move away from them yet. Offering secure digital asset custody however could present a fresh business opportunity.

Digital asset management is coming G+D are experts in enabling FIs to master mobile banking and digital wallets and Gatiragas can sense an increasing desire from banks to offer multiple services and added value through a one-stop shop platform. Digital asset capabilities are a natural extension of this, even opening the possibility of funding a digital asset account with another more typical account.

A new offering from them, Convego TruSafe, could present an opportunity for financial

and seamless digital payments experiences’ they are well versed in this area.

The product, Gatiragas explains, is a combination of a “card device, which is your cold storage, providing self-custody of your digital asset keys, and a mobile banking app that can interact with blockchains and shift your digital assets around and check the performance.”

Of course, one legitimate concern around digital assets is that their immutability can make them vulnerable. High-profile cases of owners getting locked out of their cold storage, after losing keys, add to the fear.

To guard against this, Convego TruSafe, which G+D with its SecurityTech expertise produced in partnership with digital asset specialists eSignus, doesn’t rely on a lengthy password.

Instead, they “fragment a key into ‘shards’, kept in various places. For instance, One can stay at G+D, one can stay with the service provider, the financial institution, and the other one stays with the consumer.”

“If one of those fragments were to get compromised, it has no intrinsic value. You cannot do anything with just a fraction of a key. The beauty is that we keep a backup, so if a consumer loses their card, they can swiftly order a new one, authenticate through the mobile app, and effortlessly activate the new card to regain access to their digital assets.”

It’s a noble and attractive offering that should allow more financial institutions to offer customers, whether tech-savvy or cryptocurious, a way into the digital asset space. It could be that tech like the one above does in fact hold the key to empowering trust and control of digital assets.

Safe and user-friendly

User experience also has a huge role to play. “For mainstream adoption as digital investment, we need to make sure it’s simple,” says Gatiragas. Digital wallets could be what’s needed to help with this.

Undergoing increasing adoption through the likes of Google Pay and Apple Pay, digital wallets are also being used for boarding passes, train tickets, and more around the world. According to a recent Worldpay report, digital wallets are expected to comprise half of all e-commerce spend in the UK by 2027, worth £203.5 billion. However, debit and credit

“As the digital asset landscape rapidly evolves, financial institutions have a unique opportunity to lead the charge. By integrating secure, user-friendly custody solutions into existing platforms, they can not only address customer concerns around security and

For mainstream adoption of digital asset investment, we need to make sure it’s simple… getting to something like the level of usability you get with existing payment instruments

institutions to get in on the action, combining physical cards with digital asset technology and security at the heart. And as ‘one of the largest providers and manufacturers of payment cards,

ownership but also unlock new revenue streams and position themselves at the forefront of this growing market, capitalising on early-mover advantages.”

HSBC’s Vivek Ramachandran has an excellent vantage point from which to observe global trade. Here he explores its rapid transformation and why we ignore developing trends at our peril

Vivek Ramachandran, General Manager, Head of Global Trade Solutions at HSBC

Global trade is changing at a significant pace, with trade in digital services increasingly taking up more of the pie.

China has been at the heart of international trade for, well, millennia, and along with Southeast Asia, is following this trend. This year, its capital Beijing will host Sibos, one of the world’s largest financial services conferences.

HSBC hardly need any introduction and has been in the business for more than 155 years, continuing to play a crucial role in the global trade finance ecosystem. We spoke to its head of global trade solutions, Vivek Ramachandran, to hear his overview of the current and future trends that are transforming this sector and why China is an exciting place to gather banks and financial institutions from around the world.

The Fintech Magazine How is trade and international business changing globally and what are some of the challenges that are facing banks like yours?

Vivek Ramachandran “Firstly, trade in services is outpacing trade in goods. Historically, we think of trade as products being shipped around the world on container ships. That’s still important. But almost 30 per cent of global trade today is made up of trade in services. It was 21 per cent a few years ago.

“And this isn’t just streaming on Netflix, it’s also cloud and software solutions. It makes the world a smaller place and opens a new set of challenges for companies to manage their working capital. This is a great opportunity but requires banks to understand new business models and the role we can play in helping with that.”

The Fintech Magazine How are supply chains being reshaped?

Vivek Ramachandran “Through a combination of cost considerations, geopolitics, sustainability issues or resilience factors. Some are getting shorter. Others are getting longer. And as new trading relationships are formed, a new set of challenges arise which bring with it its own risks.

“One huge change is around sustainability. Five to ten years ago, it was on the radar, but it’s now gone from a nice-to-have to a must-have.

Companies are realising their sustainability obligations extend beyond their own activities to their supply chains too. That includes managing emissions, transparency around labour, building safety, and more throughout your supply chains.

“Companies are either doing this on their own terms or on those dictated by regulators or other stakeholders.”

The Fintech Magazine It’s not just the items being traded that are digital, right?

Vivek Ramachandran “Yes, almost half of B2B trade is now digital too. It’s not happening through physical channels which requires us to understand new counterparties. Suddenly, you’re trading with counterparties under the cloak of anonymity.

“So there are new ways of onboarding customers and new partnerships are going to change things for financial services and for banks. But broadly speaking, trade digitisation can feel like a step forward, and a few steps back.

“If we were having this conversation a few years ago, we’d be talking about distributed ledger technology and blockchain. What’s clear is the way global trade is going to digitise will be very different.

“It’s going to happen with some government-led initiatives like the UK Electronic Trade Documentation Act, the model law that the UN passed for electronic transfer of records that’s now been adopted by France and countries like Germany, UAE, and Singapore are also looking at it.

“Regardless, I think we will see a very different world emerge in the next five years with a lot of new business models and new data available.”

The Fintech Magazine So, some of these technologies are not playing as big of a role as we thought they might?

Vivek Ramachandran “We are still experimenting with a lot of new technologies, but we need to stay focussed on the underlying business need and not get too excited by the technology in and of itself because technology will be an enabler to solving business problems.

“So, it’s a fantastic time to be in trade and because as a trade professional, if you’re interested in tech developments, if you’re interested in sustainability, if you’re interested in new business models, we’ve got a little bit of all of that in terms of challenges and opportunities to go after.”

The Fintech Magazine How do you see trade finance developing in APAC and Southeast Asia, in particular?

Vivek Ramachandran “Southeast Asia is at the heart of several themes I talked about in relation to global trade. In terms of supply chains, there are a lot more manufacturing activities going into Malaysia, Vietnam and Indonesia.

“Southeast Asia also happens to be at the heart of the e-commerce boom that we’re observing. So, business models are being challenged there, but there are also a lot of new opportunities emerging there. Singapore has been at the centre of trade digitisation.

“For HSBC, this is a very strategic region and we have a lot of our product development and innovation coming out of the region too.”

The Fintech Magazine With Sibos being hosted in Beijing (and indeed mainland China) for the first time, what are the opportunities for fintech and financial services companies in the country?

Vivek Ramachandran “It’s hugely exciting to have Sibos in Beijing. China has a thriving digital economy with a huge amount of innovation, often different to what you see elsewhere.

“For example, we observe deep-tier financing platforms coming out of China where you have large buyers able to finance suppliers all the way

through the supply chain, not just direct suppliers.

“It’s the largest exporter in the world. At least seven of the world’s largest ports are in China, so it continues to remain strategic to many supply chains all over the world. Our overseas direct investment out of China has also been growing. China has been active in investing and a lot of that is private sector-led.

“We have also been making partnerships with local platforms that fund suppliers trading internationally.

“The other point I’d make is that the manufacturing progress in China is very impressive. When I was last in Shanghai, I visited an EV manufacturer and it is

companies trade. So we’re incentivised to help digitise trade.”

The Fintech Magazine From the vantage point of well over 100 years of experience, what are the main areas of disruption you see taking place in this sector going forward?

Vivek Ramachandran “Beyond the big thematic issues, the single biggest factor will be the emergence of data. Digitisation will help us take out costs and introduce efficiency by gathering data in one place.

“This data will remove market inefficiencies, whether it’s informational asymmetries or other frictions. That

Data is king: the efficient gathering of information will drive change

genuinely inspiring to see the tech developments in factories there, whether it’s the EV space or the broader sustainable technology space.”

The Fintech Magazine Why is Sibos worth attending?

Vivek Ramachandran “Sibos is always fantastic because, beyond the huge business and commercial opportunities, we obviously work with other banks. So, it’s a great chance to meet our relationship banks. It’s also an opportunity to share some of the best practices that we’ve been leading in and collaborate on the big issues around sustainability and around digitisation.

“A more digital world is good for trade. And anything that’s good for trade is good for banks that help

A more digital world is good for trade. And anything that’s good for trade is good for banks

for me is the single largest opportunity for the industry and I don’t mean just the financial services sector, but for the broader trading ecosystem.

“Artificial intelligence will form a part of that. It need not be generative; it might be predictive AI. The first step though, is to make sure we’re aware of the business model opportunities that emerge out of that, and how we can sell clients with data-led solutions.

“That, for me, is going to be the single biggest change over the next five to 10 years.”

ZBD’s Marca Wosoba and Ben Cousens discuss how bringing real-time payments into gaming is opening new horizons

What if you could earn money playing video games? For people of a certain generation, it’s the stuff of dreams. In fact, for many, it may sound too good to be true.

Innovation in payments is opening up such opportunities. If we have the ability to send anyone online a fraction of a cent instantly and at (near) zero fees, suddenly players around the world can earn a bit of cash from games. Not life-changing amounts, but enough to make their time spent playing feel much more worthwhile.

After all, playing a game is, almost always, a revenue-generating activity. If a player is generating revenue for the game studio, why not share some of that revenue back?

The problem is, bringing in payments capabilities that allow players to claim these rewards and also use them in the real world introduces too much friction. Interacting with financial tech in the middle of a game simply isn’t fun or immersive.

Or, rather, that’s how it used to be. Enter ZBD, a payments innovator that set out to transform the interactive entertainment industry.

“We built a digital-first payments system specifically to modernise how the worlds of entertainment and finance interact and intersect,” says Ben Cousens, chief strategy officer of ZBD.

“That means instant transactions, no minimums and seamless integration into games and apps. Paying and getting paid needed to feel like play. After 5 years of building ZBD, we’re seeing that vision materialise.”

Cousens has a long history in video games and before coming on board, invested in ZBD as a VC. After learning more about the possibilities opening up and seeing the company grow towards its goals, he jumped ship and joined full-time.

After going to market with an ambitious vision, the startup found product-market-fit in the mobile gaming space, powering player rewards. “Many people still don’t realise how enormous gaming is,” says Cousens. “This industry generates more revenue than film, music and books combined, and mobile games are about 50 per cent of that market. Revenues per player may be small, but the scale of the user base is huge.”

This is a win-win for the games industry. Players get rewarded for time spent in a game with real value, while studios reap massive retention benefits as a result of the increased

player engagement. This in turn leads to much better monetisation per user, especially in games that monetise primarily through ads.

Bridging the gap between money and games

Building a system that allows mobile games to share revenue with players in a sustainable way that benefits both sides requires three things: the ability to send minuscule amounts of money to anyone online, the scalability to process high volumes of these nanopayments in real-time and the UX that makes it feel like part of the game, not an interruption.

To solve the first two requirements, ZBD turned to an unlikely candidate – the Bitcoin Lightning Network. This is a highly scalable payments system that runs on top of the Bitcoin blockchain, as a second layer.

The Lightning Network has existed for a number of years but was considered experimental tech until recently, with ZBD being the first company to utilise its potential at scale for a commercial use case.

While Bitcoin has firmly established itself as an investment asset among retail investors and is quickly being recognised by institutional investors with the rise of ETFs and increasing regulatory clarity, oversight and approval, it is still rarely seen as a medium of exchange.

For many people, when they hear Bitcoin, they think of price volatility and speculative investments. This thinking, though, is quickly

becoming outdated, as the $1.3trillion asset, now 15 years old, has matured far from its unstable beginnings.

ZBD is showing that not only does Bitcoin have a place in the world of payments, it can enable use cases that are simply not possible without it. You cannot send a fraction of a dollar cent instantly to the other side of the world with zero fees. ZBD currently does it millions of times per day with Bitcoin. And it all happens seamlessly as users play fun games.

This is a proposition that naturally resonates strongest with younger generations. And that’s not just a guess – ZBD has done its research. A recent report, released by ZBD but based on data gathered by a third-party market research firm, showed that 25 per cent of Gen Z in the UK and US already own Bitcoin, which is higher than any other asset class, including equities.

Furthermore, independent research showed that 65 per cent of Gen Zers game for more than three hours a day. There is also extremely strong interest in earning money by interacting with games, with over 90 per cent of those surveyed saying that is something they would be interested in.

And as Cousens says, “the market exists, as shown both by our business growth and research. The interest we see is not driven by Bitcoin, but it is also not hindered by it. Users only care that the system works, is simple to use, and gets them real value, which they can use in their everyday lives.”

Using the ZBD app, players can go from earning rewards in a game, to cashing out to a gift card, cryptocurrency exchange, or an app like Cash App, all within seconds, with all payments settled instantly.

For most of them, the fact that Bitcoin powers all these transactions is an afterthought. This is not a Bitcoin product, and ZBD is not a cryptocurrency company. It is a payments product launched by a US-licensed financial services company that needed to find new ways to address problems traditional approaches to finance are unable to solve.

“We use Bitcoin, because it is the best tool for the job. It also provided us with a route to market that allowed us to validate our proposition with

over a hundred gaming partners and millions of users,without needing to invest into expensive fiat infrastructure beforehand,” says Marca Wosoba, COO of ZBD.

“Now that we understand what the gaming industry needs from us, are generating scalable revenue and have a clear vision of how to build additional services, expanding from Bitcoin into USD, EUR, GBP and other fiat currencies is a much simpler and less risky step.”

Wosoba joined ZBD after building an impressive career across traditional banking and fintech, having held director-level positions ranging from derivative sales to Transaction FX at the Royal Bank of Scotland, to leadership roles in fintech and embedded payments, including a stint as managing director of Europe at Modulr.

ZBD was her first role working directly with Bitcoin as a foundational piece of the tech stack but says she “immediately understood the utility of the asset and how it fits as just one piece of a bigger puzzle built to unlock massive potential for finance in interactive entertainment.

“We’re on a mission to transform the interactive entertainment industry”.

Gaming is also only the beginning. “We’re starting with gaming,” Wosoba says. “Because we’ve got the specialism and because it’s a huge market for us,” but there’s no reason why the model and technology can’t be applied to other verticals too.

We’re on a mission to transform the

ZBD is already applying its tech to podcasting and music, powering pay-per-minute models for audio consumption as well as earn-per-minute models, where creators can pay users for listening to their content, with money streamed in real-time alongside

audio, for as long as the user keeps listening. Stop listening, the money stops flowing - in either direction.

And there are seemingly endless uses for this kind of instant and flexible payments. Cousens points out that for those who have grown up with social media and virtually unlimited internet access, even the use of social media is starting to be seen as a value exchange.

“‘I’m giving you access to my life and you’re surveilling me. What am I getting in return?’” he says.

More platforms are looking at ways of paying users but there are hurdles to overcome. Creating the seamless, native, frictionless experience that users expect becomes challenging when trying to embed traditional payment capabilities into a fast-paced digital environment designed primarily to entertain.

“Regulatory challenges and conversion fees have to be considered. Bitcoin’s Lightning Network is part of the solution, since it’s a digital rail already embedded in the internet,” says Cousens. “The other part is simply us doing the hard work of getting licensed, maintaining the highest standards of compliance and building the infrastructure that will allow our system to interface seamlessly with legacy financial systems all over the world.”

Wosoba adds: “We were able to build the Bitcoin-based rails and ledger ourselves, but the fiat world is a bit different. To extend our functionality into USD, EUR and more – not just as a cash-out mechanic for our users after they’ve earned rewards, but as a currency option for the kind of embedded payments we’re providing the interactive entertainment industry – we need to build a network of forward-looking partners, from banks to card acquirers and exchanges.

“That’s what we’re working on now and I’m very excited about the solutions we’ll be bringing to market in 2025.”

So while the common narrative positions Bitcoin and cryptocurrencies as something that may be useful in the future, ZBD is flipping that script on its head. Bitcoin is something that’s working for them today and proving transformative as a tool for next-gen embedded payments in entertainment.

The next step, ZBD says, is replicating this system with dollars.

Marca Wosoba, Chief Operating Officer and Ben Cousens, Chief Strategy Officer at

Revolut Business' General Manager’ James Gibson reveals why the time is ripe for a fresh chapter in the neobank’s already successful story

James

Gibson General Manager and partner at Revolut

For a while now, Revolut has been one of the big European and UK neobanks. Challenging the established order and providing a fully digital, accessible user experience and new exciting products for the modern consumer.

Amongst a small crowd of similarly disruptive companies, it’s now officially the largest challenger in Europe and has a presence around the world too. The digital-only bank recently announced 10 million customers in the UK, bringing its customer base across Europe to 45 million.

After finally receiving a longanticipated banking licence from the UK Prudential Regulation Authority (PRA) in July 2024, it is now eating up more market share, from incumbents. A new retail wealth and investment platform was recently added to their competitive offering.

Does this change of status and the similar growth of their competitors mean we’re entering a new era of challenger banking?

One sign of maturity in banking has to be the presence of a formidable business offering. This is certainly the case for Revolut, with the most recent global annualised revenues surpassing $500million.

According to Revolut general manager James Gibson, it’s now onboarding over 20,000 businesses every month and processing around £17billion worth of transactions.

After seven years of growth, Gibson still feels it is “at the start of a journey.” Already live in Europe and the US, there is more ground to cover in those regions, and this year it launched in Singapore too.

We asked him what business banking means to Revolut, some of the interesting products it’s offering, and whether or not that “challenger” label is still appropriate.

The Fintech Magazine How important is it to have a business-to-business offering as a bank?

James Gibson “I suppose every business is different, but this is a natural extension of the personal banking

option. Soon after launching the personal product, Nik and Vlad [co-founders Nikolay Storonsky and Vlad Yatsenko] and co. realised that a lot of their new happy customers had businesses as well, and faced similar problems, such as high foreign exchange fees and difficulty with international payments.

“Since then, Revolut Business has evolved to solve these, and more complex problems for businesses that maybe don’t have an equivalent on the personal side, but the core of the product – the app, the rates, the ease of use – is relatively similar.

“We’re a couple of years behind the personal product, and businesses have different needs to individuals, so there’s a lot for us to build. But it’s a key part of our overall strategy, not least for how both sides of the brand link to each other. A lot of our customers on the business side learned about it from being retail customers.”

The Fintech Magazine What are some of the key benefits of your business offering?

James Gibson “With Revolut Pay, you can have a retail customer in Singapore, buying from a merchant in the UK, and at checkout you can confirm payment on your phone, just by using your Revolut account, and merchants on the business side get paid directly by the customer. This is where there’s the crossover between retail and business.

“We also have a product called Revtags, which is using tags to pay anyone. So now we have this global network of 45 million-plus people, as well as all of our businesses, who can send money together, without going through complicated financial schemes.

“Recently announced Revolut BillPay is a little bit different, and there’s less crossover with retail there. If you have a business account and get sent invoices, through Revolut BillPay you can ingest them into your system without having to manually enter them, and it will schedule the payments for you rather than manually plugging them in. So it’s really a time-saving play for businesses.”

The Fintech Magazine Why did you want to expand into Singapore?

James Gibson “We launched there a couple of months ago and are seeing great traction.

Singapore is a tech-enabled, forward-thinking country and there are many, many businesses located there. It’s a hub within APAC for global businesses and a lot of them have some form of international operations, which obviously suits our product very well.

“We’re also seeing success on the personal banking side, which typically leads to growth on the business side too, something we’ve seen in other top markets, like Ireland.

“On top of that, we have a good working relationship with the Monetary Authority of Singapore (MAS), the regulator.”

The Fintech Magazine What opportunities are there for businesses in the APAC/SEA region?

skipping out this sort of middle ground, hybrid model we’ve had in the UK, which is obviously great for us.

“A number of these countries have quite forward-thinking regulatory regimes designed to help tech solutions flow. So lots of opportunities and lots of growing countries. You’ll see more of us in the coming years.”

The Fintech Magazine Has Revolut surpassed the challenger label?

James Gibson “It’s a good question that I’ve not been asked before! I think the change we’ve seen in the last five to 10 years has been quite significant, and we’re very proud to have played a part in that.

“For me, a challenger is someone who challenges norms and fundamentally improves customer experience. And this doesn’t stop when you reach a specific size.

“If you think about a company like Amazon, for example, it’s obviously one of the biggest companies in the world but I believe it is still a challenger to established norms and ways of doing things, despite the fact that it’s absolutely enormous.

“So I think it’s more of a mentality, and we still strongly have that. We see many areas for improvement in our products, but also new products that we can bring to market. So no, I would still give us the challenger label.”

The aim is to change how people interact with their money, and we want to do this for people around the world

James Gibson “It’s obviously a huge growth area in general, and for a company like ours, given the number of markets, and the amount of foreign exchange there is across the region, it’s a huge opportunity.

“Also, a lot of these countries are jumping straight into tech-enabled banking and

The Fintech Magazine What’s it like working for Revolut and what’s the “special sauce” that the company brings? James Gibson “I have a few more grey hairs than I did when I started working at Revolut seven years ago! But joking aside, it’s a great place to be. The thing I love most is the quality of people. We are lucky to have a very hard-working, passionate and diverse group of people who are truly committed to building something really exciting and solving our customers’ problems.

“The other is the level of ambition that the company has, we’re not just trying to create a new business or personal current account. That’s not the aim. The aim is to change how people interact with their money, and we want to do this for people around the world.

“And that level of ambition is very, very motivating. It probably sets us apart from a lot of other companies.”

Despite being the home to Visa and Mastercard, there has always been a strong resistance in the US to a “cashless” society.

Massachusetts became the first US state to ban cashless businesses in 1978, requiring all retail establishments to accept cash payments – and it has been rigorously enforced, even during the COVID pandemic.

Major cities like New York, San Francisco and Philadelphia have recently passed local laws requiring businesses to accept cash as payment.

Mastercard infamously declared a “War on Cash” in 2010 but with the implementation of “Prohibition of Cashless Establishments” regulations in New York City in 2020, that “war” doesn’t even have the support of the major city in their home state!

The authorities clearly decided the interests of the public – their voters – took precedence. And no American politician can be in any doubt as to what the public sees as being in their interests when it comes to cash.

A survey from neobank Chime in September 2024 revealed that only five per cent of American adults never carry cash and over 50 per cent still believe “Cash is King.” Furthermore, a whopping 88 per cent don’t want cash removed as a payment option.

I visited The Big Apple this month to find out how the “cashless ban” is working out in practice, four years after being passed.

The first cash “high” I experienced was on the New York buses. The local operator long ago found a convenient way for cash to be accepted, without the driver having to handle money.

Since 1969, bus riders have been able to deposit coins for their fares directly into the fare box, allowing drivers to concentrate on driving instead of multitasking. Fifty-five years on, cash continues to be accepted on New York buses.

On the other hand, in 2022, Van Leeuwen Ice Cream earned the dubious distinction of being by far the worst breakers of the cashless law in New York City. By October of that year, Van it had been fined a total of $107,250, compared to $98,725 for all other 56 offending businesses combined.

Van Leeuwen ultimately agreed a settlement with the New York City Department of Consumer and Worker Protection and met their legal obligations.

Yet, the business still doesn’t accept cash directly but instead, as is rather oddly permitted by law, they have installed “Reverse ATMs”. Those who want to use cash have to acquire a card from these ATMs and use it to make purchases. These cards – rather provocatively branded “cashless” – are hardly user-friendly. They are not reloadable, no receipt for the transaction is issued at point of sale, and balances left on the card have to be reclaimed from the issuer in a time-consuming process.

After three months of non-use, a charge of $3.95 a month is imposed and deducted from any balance on the card. And if the “Reverse

ATM” is not working – and I saw examples of this in New York - cash users cannot make a purchase. This is surely not the outcome envisaged by New York legislators when they passed the law.’

McDonald’s shows the way when providing genuine payment choice in New York, with cash acceptance machines alongside their ordering screens. Sweetgreen too has played its part. The first Sweetgreen restaurant opened in 2007 delivering “reimagined fast food”. They have only made one false step – going cashless in 2016.

However, in 2019, knowing a ban was coming, Sweetgreen reversed this decision and quickly moved to accept cash again. And not just in New York – at all their over 200 stores around the US.

When I visited the Sweetgreen branch at 86th and Broadway in Manhattan, it was a delightful experience. There was a warm welcome from the team in the branch and, when the time came to pay, cash was greeted with a smile and an “of course we accept cash. No problem!”

The whole experience, including paying, could not have been better. And the food? Delicious!

Firstly, the local politicians did absolutely the right thing in passing legal measures to prevent cashless being imposed on the consumer. The 88 per cent of the US public rejecting the notion in 2024 is in line with results delivered by YouGov when surveying the British public in 2023.

Secondly, forcing the public to acquire cards via a Reverse ATM is NOT truly respecting their legal right to pay using cash. It is simply another attempt to impose cashless.

Thirdly, if businesses innovate in terms of cash handling – as the New York bus operator did way back in 1969 – delivering payment choice can be easy for the public and businesses alike. In fact, by copying Sweetgreen, ALL businesses can hit the payment choice sweet spot!

How NMB Bank Zimbabwe managed a currency conversion project in just three days. NMB’s Gerald Gore and Rajesh Saxena from iGCB discuss how their core banking transformation took place amidst turbulent economic conditions