WANDERING STARS

MEETING THE NEEDS OF A BILLION DIGITAL NOMADS – AND WHY BUNQ ’S ON THEIR TRAIL

SPRECHEN SIE DACH?

NEXI TALKS PAYMENTS PARTNERSHIPS IN GERMANY, AUSTRIA AND SWITZERLAND

PUTTING THE FIS IN FINTECH HOW THE TECH GIANT IS SHAPING AN INDUSTRY’S FUTURE

SHOW STOPPER! WHY MONEY20/20 EUROPE KEEPS US COMING BACK FOR MORE

Rajesh Saxena CEO at Intellect Design Arena

Rajesh Saxena CEO at Intellect Design Arena

Steering change at the core

Genki ● Netcetera ● Ratepay ● Makaira ● Shopware ● Bond ● Centuro Global INSIGHTS FROM

ISSUE#32

THEFINTECHMAGAZINE

MONEY20/20 EUROPE

4 The conference that listens Money20/20 Europe’s Head of Content, Gina Clarke, explains how the premier event stays evergreen by constantly refreshing that feedback loop

COVER FEATURE

6 The core question

With 329 microservices, 1,757 APIs and 535 events, Intellect Design Arena’s eMACH.ai open finance platform is transforming the way banks operate. Intellect’s Global Consumer Banking unit (iGCB) has worked with leading banks across the globe for the last 30 years. Rajesh Saxena, CEO of iGCB, describes the five key trends he sees driving technology change at the very heart of banks – and how they can devise the best strategy to embrace it

FINTECH FOCUS

10 Reaching for the stars

Technology giant FIS took a bold approach to delivering innovation for customers four years ago, which is simultaneously helping populate the fintech universe with successful startups

PAYMENTS

12 A cashless society: Where did it all go wrong?

The Payment Choice Alliance is pushing all the major political parties in the UK election race to make manifesto commitments to compel businesses to accept cash – since there’s clearly no shortage of people wanting to use it. Chair of the Alliance, Ron Delnevo, says the UK is not the only country to rethink the wisdom of going cash-free

DIGITAL NOMADS

15 Moving with the times

One billion digital nomads are predicted to be roaming the world by 2035. Dutch mobile bank bunq aims to go with them, says Chief of Staff Bianca Zwart

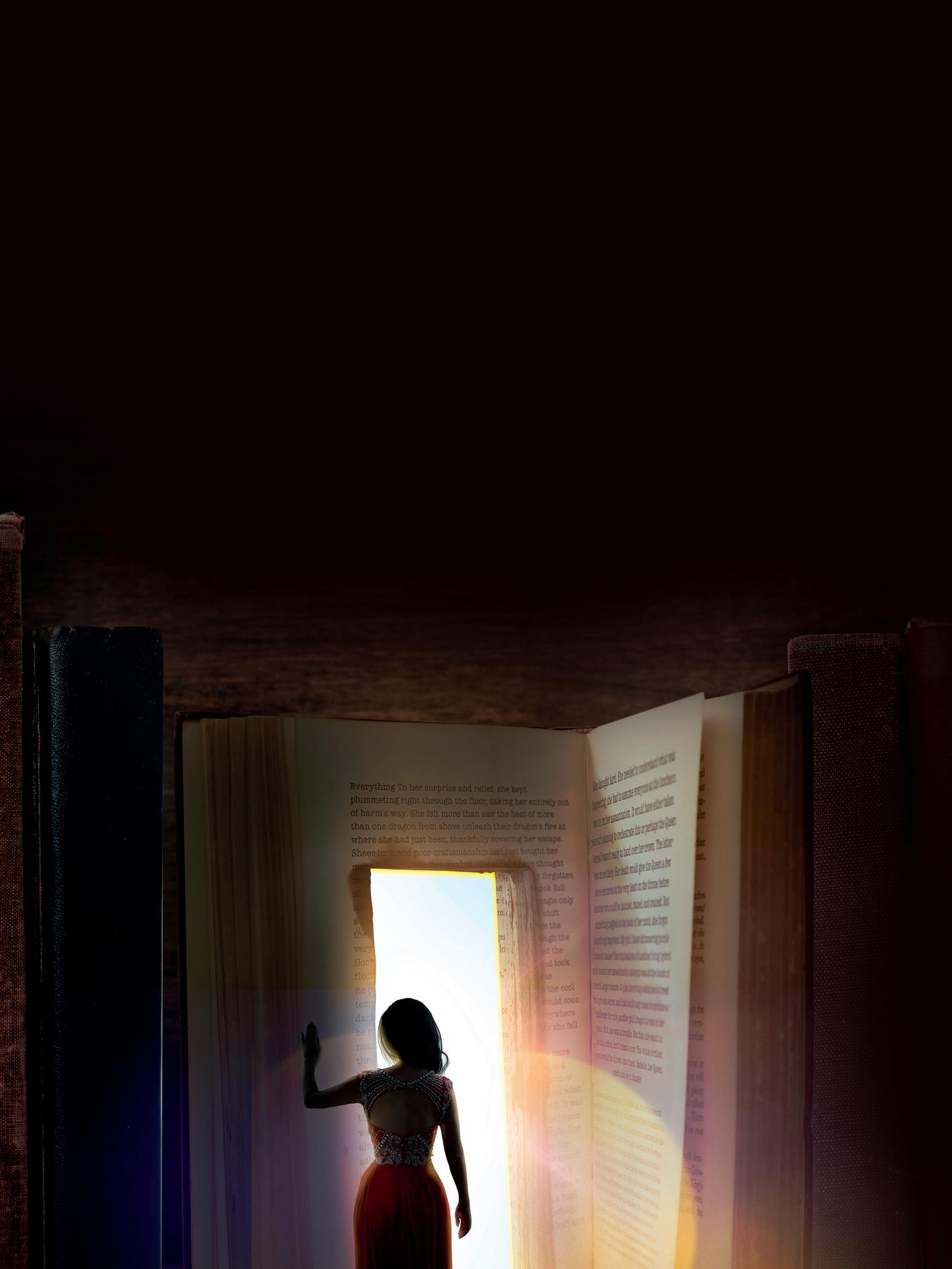

18 Everything but the elephant

The meteoric rise of the digital nomad as a customer segment has exposed gaps in insurance and banking provision that imaginative startups have started to fill. Natalie Marchant explores the world of the remote worker, the risks and benefits

FOCUS ON DACH REGION

22 The key to e-com security

There’s a lot more that can be done to improve consumer confidence in online transactions and reduce merchant losses in the DACH region, says G+D’s Stephan Hackenberg. The answer is less not more complexity

24 The language of partnership

The German-speaking DACH region is a key focus for the Nexi Group. But it can’t realise its ambitions alone, as Nexi’s Martin Pitcock and Ratepay’s Charlotte Paauwe explain

28 A never-ending story

The next chapter in the development of e-commerce is being written by system operators, independent software vendors, design agencies and payment specialists such as Nexi, working in partnership to create the best online experience for merchants and customers. We brought together just some of them to look at how the story is unfolding in the DACH region

CONTENTS

12

Issue 32 | TheFintechMagazine 3 15 24

FINTECH M A G A Z I N E

6

All Rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, photocopying or otherwise, without prior permission of the publisher and copyright owner. While every effort has been made to ensure the accuracy of the information in this publication, the publisher accepts no responsibility for errors or omissions. The products and services advertised are those of individual authors and are not necessarily endorsed by or connected with the publisher. The opinions expressed in the articles within this publication are those of individual authors and not necessarily those of the publisher. THEFINTECHMAGAZINE 2024 ISSUE #32 EXECUTIVE EDITOR Ali Paterson GENERAL MANAGER Chloe Butler EDITOR Sue Scott ART DIRECTOR Chris Swales PHOTOGRAPHER Jordan Drew ONLINE EDITOR Lauren Towner ACCOUNTS TEAM Tom Dickinson Leksy Volkova CONTACT US ffnews.com DESIGN & PRODUCTION www.yorkshire creativemedia.co.uk PRODUCT & CONTENT MARKETING Matt Sarkar CHIEF REVENUE OFFICER Shaun Routledge ONLINE TEAM Katy Garnham Lauren Hinton FEATURE WRITERS David Firth Tim Goodfellow Tracy Fletcher James Grant Natalie Marchant Fiona McFarlane Sue Scott Fintech Finance is published by ADVERTAINMENT MEDIA LTD. Pantiles Chambers 85 High Street Tunbridge Wells, TN1 1XP PRODUCTION Taylor Griffin VIDEO TEAM Max Burton Luke Evans Louis Jean La Grange IMAGES BY www.istock.com PRINTED BY JamPrint "PROUDLY NOT ABC AUDITED"

The conference that listens...

Money20/20 Europe’s Head of Content Gina Clarke tells Tim Goodfellow how the premier event stays evergreen by constantly refreshing that feedback loop

There are a wealth of industry conferences with slightly different focusses, but not many that can claim to have royalty and whistleblowers on the same bill.

It’s the sort of daring content we’ve come to expect from Money20/20 Europe, though – and this year it’s more than lived up to its reputation.

To maintain its status as the mecca for fintech and financial innovators, a lot of creativity goes on behind the scenes, and former financial journalist, now Money20/20 Europe content director, Gina Clarke, has a big hand in that.

“It’s like putting a story together,” she says. “I am contacting all the key players and finding the background in lots of research. But instead of writing the story, I see it play out on stage.”

The European iteration of the Money20/20 event, which takes place in Amsterdam, has a broad regional focus, and, as a result, catering to various jurisdictions and stakeholders can be a challenge. What apparently isn’t, is the organisers’ penchant for surprises.

Think flash-mob brass bands and an inland beach this year. That certainly shakes up the networking.

The show invited Prince Constantijn of the Netherlands, a vocal supporter of the local startup sector, to open the 2024 event and take part in the first discussion, while the main keynote speaker, ex-French President Franćois Hollande, reflects France’s rising standing in tech, particularly AI.

Then we come to that whistleblower – a one-on-one slot billed as ‘What the Wirecard Whistleblower Did Next: Pav Gill’s Confide’ with the man who uncovered one of the most significant financial scandals in European history and went on to found his own startup to

4 MONEY20/20: AMSTERDAM

TheFintechMagazine | Issue 32 ffnews.com FINTECH M A G A Z I N E

help avoid another. Confide makes it easier for employees to call out company wrongdoings – and for companies to act before a story hits the media.

Talking of fraud, a free signed advance copy of journalist Geoff White’s new book Rinsed (released June 13) about money laundering in the modern age came with the entry ticket price this year – a healthy indication of the organisers’ willingness to welcome all sides of the ecosystem.

CONTENT FOR EVERYONE

If you’ve never been to Money20/20 Europe, USA or Asia, it’s hard to put into words the scale of these events. The RAI conference centre in Amsterdam is filled with colourful stands, booths and stages. Plus there’s plenty of other mini-events going on around it. There’s some showmanship in all this, clearly, but the content itself is paramount.

“We get our crystal ball out every year and try to predict what trends are coming up,” says Clarke. “I think this year, we’ve done a pretty good job.”

For Clarke and her team, the feedback from the previous year’s attendees plays

a big part in the decisions they make in organising the next event.

“We’ve listened and what they said was they want to book their time around the content. So we chose five big topics for 2024, programmed back to back.”

The clear structure meant people could make the most of the awesome networking opportunity that is Money20/20.

“We always think, how do we top last year? For me, it was about finding a place for everyone,” says Clarke. “We know that networking is so high on people’s priorities, so we looked at adding it into the content, which we did with the Singularity Stage.”

These first-come, first-served deep dives on particular topics, give opportunities for networking around a single topic focus

– ‘to hear some fabulous content and meet people who are also interested in the same content as you’, as Clarke explains it.

With any Money20/20 there’s also content that isn’t listed on the programme, including behind-closed-doors events that aim to ‘bring in the retailers, the insurers, the wealthtech people’.

All this is in the service of finding that ‘something for everyone’, which is a tough task when you have 100 countries represented, 8,500 attendees and 2,300 exhibitors. It’s one Clarke’s been willing to accept, though.

“The difficulty of being such a prominent European event is there’s different regulatory practices to think about, and different organisations with different needs,” she says. “Obviously, there is harmony in regulation for Europe, but from an implementation perspective, the UK is very different. And then you add what’s going on in LATAM or Canada or Australia. We’re trying to tell that whole story as a bit of a journey.”

The location for Money20/20 Europe helps, says Clarke. “Amsterdam is such a vibrant city and a banking hub in Europe, being in good reach for many high-profile

in the European loop. That’s especially the case when you have the European equivalent of Open AI – Mistral AI – being grown in France and the upcoming, world-first EU AI Act being introduced.

THE AI REVOLUTION

And that brings us to the overall theme at the heart of the 2024 conference, Human X Machine. Clarke says AI leaked into planning for every aspect of the show this year, but it was thoughtfully managed, attempting to cut through and provide some clarity about the technology to attendees.

Among of the five sub-themes, Signal vs. Noise was designed to help them ‘choose which path to follow’ and provide useful case studies, explains Clarke. Meanwhile, after a year when venture capital was less than adventurous, The Business Of Money sub-theme was designed to address ‘the whole profit-versus-growth conversation’, and another, The Customer Universe Of One, put the focus on customer centricity.

There’s obviously a keen awareness of the stuff that really matters, and Clarke also talks about the balance the show strikes between deep dives and something more

We always think ‘how do we top last year?’. For me, it was about finding a place for everyone

European banks.” And that’s not just the established players, many of whom have speaking slots at the conference, but the challengers too, which, she argues, aren’t really challengers at all any more, but an established part of the ecosystem.

Regardless of how many countries may be represented in total, it’s notable that Clarke admits: “When we look at our audience breakdown, the majority do still come from the UK.”

Of course, proximity helps, but their presence en masse is possibly indicative of the UK sector’s desperate need to stay

high level. As she puts it: “It’s OK to hear CEOs on stage deliver the headlines and get an idea of where the industry is going, but if you’re already embedded in that, you really want some tangible takeaways.”

That’s where the deep dives come in, talking about the slightly less sexy (but no less discussed) topics of digital identity, regulatory compliance and cybersecurity.

What stands out is that the team really builds the show around their customers – practising what should be an industry standard. So, if you want a conference that listens, this could be the one for you.

5

ffnews.com Issue 32 | TheFintechMagazine

6 TheFintechMagazine | Issue 32 ffnews.com

The value of experience: Rajesh Saxena says having a broad and deep understanding of financial services is vital

With 329 microservices, 1,757 APIs and 535 events, Intellect Design Arena’s eMACH.ai open finance platform is transforming the way banks operate. Intellect’s Global Consumer Banking unit (iGCB) has worked with leading banks across the globe for the last 30 years. Rajesh Saxena, CEO of iGCB, describes the five key trends that he sees driving technology change at the very heart of banks – and how they can devise a successful strategy to embrace it

THE FINTECH MAGAZINE: What are the main drivers of change when it comes to core banking technology?

RAJESH SAXENA: Over the last 365 days, I have spent significant time in understanding client needs and ambitions across our key markets. I have probably met more than 100 senior bankers. I have concluded that while each country and customer is different, there are certain common trends and common pain points

The first trend gaining momentum is the rise of open banking and open finance. The wave started with the UK and Europe and is now being required by most markets. The Middle East has also seen increased traction over the last couple of years

The integration of an open finance-enabled ecosystem in a bank can offer contextual and curated solutions and experiences for the end customer. In fact, iGCB has clients like Cater Allen in UK and OTTO in Germany who are leveraging open finance to deliver superior banking to their customers. We have similarly implemented open finance-enabled banking solutions in APAC, Middle East, Africa, and Oceania.

The second trend is the increased competition from fintechs and other banks. Banks are looking at options to disrupt the status quo and increase their addressable market by transitioning from a product provider to a marketplace where customers can find a product or service catering to all facets of their lifestyle.

The third key trend, which iGCB has been advising banks for the last few years on, is the use of cloud, either private or even, in some cases, public cloud. Cloud technology has

matured over the last five to six years and regulators and large banks are gaining confidence about its security aspects.

A couple of years back, when we were doing a core banking transformation for a UK private bank, we could not take them to a public cloud because the regulator was not ready. Today, the same customer is planning to migrate to an AWS cloud with us being the core technology partner. I am also happy to share that we’ve just upgraded India’s central bank Reserve Bank of India, which is one of our premier clients, to next-generation core banking and we have taken them to a private cloud on VMware.

The fourth trend, mostly seen in

Transformation is a long journey and you need to be able to work well with a vendor to deliver it. The cultural fit is very important. It can make or break the project

one is the EU AI act. These constantly evolving regulations, too, are motivating banks to consider transforming themselves to a more agile bank.

TFM: So banks globally are under tremendous pressure to transform. However, banking transformations are never easy. Can you talk us through a successful transformation and what, in your view, needs to be in place for that to happen?

RS: For years, banks were very reluctant to change their core. What most of them opted to do instead was to hollow it out and put systems in place around it that could take care of part requirements.

Trend#2

Marketplaces/ ecosystem partnerships

developed markets, is the focus on ESG. The banks’ customers are looking to be net zero, with the ability to greenify/reduce the carbon footprint created by their transactions. Once a niche product feature, now, it’s a fundamental requirement. A report by Alvarez & Marsal stated that the global annual revenue pool for banks related to environmental, social and governance products and services will reach €295billion, or $300billion, by 2030. So we can see the potential of ESG on a bank’s profitability.

Trend#1

Open banking/ open finance

The fifth and final trend is an increasing amount of regulation around privacy and security that banks have to cope with. The recent

But banks have now realised that, as a strategy, hollowing the core can only give you a limited benefit. It could still be phase one of your strategy, but if you really want to transform your bank and compete with the new-age digital banks, you need to have a comprehensive core with an ability to evolve.

Also, what we are seeing now is that banks are adopting multi-core strategies.

Take RBI as an example.

We built a bridge between RBI’s old core and a new core, so the bank could use either one or the other, depending on the requirements and what had been implemented. This coexistence capability is gaining traction amongst banks for core transformations.

Apart from the product and technology, I would also emphasise the importance of delivery strategy.

It might sound obvious, but most delays in implementations occur due to a gap in understanding between the bank and the technology provider.

7 COVER STORY: iGCB FINTECH M A G A Z I N E

ffnews.com Issue 32 | TheFintechMagazine

As a partner in the bank’s transformation journey, we not only create a thorough plan but we also do detailed design thinking sessions with each client to create an implementation plan that focusses on the stated and unstated needs of the bank and prioritises business impact.

We are further building regional delivery teams to work with banks more closely. Strategies like these are further reducing the risk of large transformation.

TFM: So how does one create a powerful core? Are there some architectural tenets a CIO should consider?

RS: I strongly suggest that banks invest in a comprehensive core which consists of events, microservices, APIs, cloud, headless architecture and embedded AI use cases. Intellect is the first to bring all these elements together. We at Intellect call it eMACH.ai.

We moved all our architecture into eMACH.ai so that the APIs, microservices, events, are all open. It’s completely born on the cloud and that gives banks the ability to integrate, to scale up, and to connect with ecosystem players. We have also created a country-ready ecosystem for several countries, reducing go-to-market for banks.

Most of our peers are now in the process of moving from a monolithic architecture to this kind of advanced infrastructure. Our investment in eMACH.ai brings considerable advantages to us and puts us ahead of the curve. But, it’s not just to do with the architecture.

Intellect’s sweet spot as a company is between domain and technology. Intellect’s talent comes with deep banking expertise, and that really helps, because just giving banks a tech framework, which is what some of our competitors do, is not enough. We have depth and breadth in the financial services space. From lending to origination, savings accounts to current accounts, we are able to offer a comprehensive platform, built on the same architecture. Also, we co-create and co-innovate with the banks, and that also helps in the transformation journey. We have seen significant success with the co-create and co-innovate model with our clients in Africa.

TFM: You say that one of the things that sets you apart and one of the reasons

you’ve been successful in terms of some of the transformations you’ve implemented in various banks is the fact that you only work in this domain. Can you give an example of how that helps? RS: Having come from banking, I know financial services is not a simple domain, it requires deep understanding. Companies that are horizontal in nature will not be able to bring the vertical depth of knowledge that is required for it.

I’ll give you an example to do with AI. Today, AI is at the forefront of every conversation, including in the banking space. When we talk to people about AI most of them, because they use Microsoft Windows, will have an Azure Copilot bundled along with it. But having a horizontal AI play like that is not enough. What you really need to know is how to use

Intellect’s sweet spot as a company is between domain and technology. Intellect’s talent comes with deep banking expertise, because just giving banks a tech framework is not enough

AI to create, for example, an underwriting use case or a wealth use case or a corporate use case. Our credit-focussed Gen AI solution has created waves in the market with its capabilities in underwriting.

Those vertical domain use cases are the key and that’s why I’m of the firm belief that companies like ours, with a sole focus on the banking domain and 30 years of experience transforming Tier 1 banks across the globe, add significant value.

TFM: iGCB is a sponsor for Money20/20 Europe this year. Can you tell us more about the products you’ll be focussing on there?

RS: Money20/20 is a flagship event for iGCB. This year, we’ll be focussing on three things specifically. One is our Digital Engagement Platform, which is a single, common platform for the retail customer, the SME customer, and

the corporate customer. If you are a Tier 2 or a Tier 3 bank with a strong retail business, and a moderate-sized commercial business, you do not need two portals for them, because two portals come with huge expenses and involve a huge amount of work. So we have created one common, no-code platform for both. The advantage of no-code is that the bank itself can make changes on the digital layer – because time to market is very important. We believe that the Digital Engagement Platform could be a game changer for banks across the globe, including European banks still using legacy digital banking.

At Money20/20 we will also showcase how we can help banks implement dual-core strategy, our Gen AI platform built for banks and our digital lending suite, iKredit 360.

TFM: So, finally, what would your advice be for banks that want to implement a successful transformation? RS: I can’t emphasise enough the importance of choosing a platform that is open finance-enabled and completely cloud native. A platform is going to be with you for the next eight to 15 years, depending on your appetite, right? So you definitely need to choose one that has the latest architecture and which is completely cloud-native – not just ‘cloud-ready’ or ‘cloud-enabled’.

The second thing I’d say is that transformation is a long journey and you need to be able to work well with a vendor to deliver it. So the cultural fit of your organisation with the vendor is very important. It can make or break the project.

Finally, in my view, transformation has to be driven from the top. Sometimes we’ve seen it being driven by the technology group in a bank. Sometimes it’s being driven by the business group. And sometimes there is a friction between these two. But it has to be both a business and a technology agenda. All the parties have to be joined at the hip for this. You can have a great product, but if the culture piece, the team piece, the agile working, and the buy-in from both the business and technology groups aren’t there, it won’t be the success that it could be.

8 COVER STORY: iGCB TheFintechMagazine | Issue 32 ffnews.com

FINTECH M A G A Z I N E Trend#4 ESG Trend#3 Exponential cloud adoption Trend#5 Regulation

Technology giant FIS took a bold approach to delivering innovation for customers four years ago, which is simultaneously helping populate the fintech universe with successful startups. We talked to four key FIS insiders about the strategy

In April 2020, just as the pandemic took a vicious hold on economies across the world, financial technology company FIS bet big on innovation.

Its then newly created corporate venture investment division was given $150million to target promising startups, putting it at the forefront of the fintech-financing scene.

It had a specific focus on the fields of artificial intelligence, automation, analytics, security, distributed ledger technology and financial inclusion, and the goal was to target smaller companies that could contribute piece-by-piece to the overall portfolio of services that FIS was able to offer, enabling an agile and responsive approach to meeting specific customer requirements.

FIS further committed to partner with these companies, using complementary areas of strength, to help those entrepreneurs fulfil their long-term growth ambitions.

Four years down the track, and the first of the companies to benefit from the FIS strategy is now the most successful fintech in Africa. Indeed, payment

infrastructure provider Flutterwave, already a unicorn, recently revealed it was preparing for an IPO.

The investment in Flutterwave in 2020 was closely aligned to another major acquisition by FIS, which had happened the previous year, in as much as it opened the door on Africa to FIS’ then recently acquired merchant processor WorldPay. The deal allowed WorldPay to leverage Flutterwave technology to process domestic payments there.

As it turned out, the WorldPay/FIS merger didn’t pan out; FIS sold its majority

As the fintechs grow in their role, so will FIS

Johnny Moreland, VP Sales, FIS

stake in February this year, but the FIS/ WorldPay/Flutterwave colab had proved that this ecosystem-building strategy was sound. And, going forward, FIS is focussing on those smaller investments to unlock bigger potential long-term.

“The vision is a number of selective acquisitions,” said James Kehoe, chief

financial officer at FIS, at a recent UBS Investors Conference. “We’re trying to speed up the development cycle, and by that I mean we would buy a combination of very strategic assets that either bring a product or people capability to speed-up the development.”

A recent example of that is FIS’ acquisition of Bond, a company that offers enterprise-grade embedded finance solutions, and helps brands integrate financial services, from bank accounts to credit cards, so that these services can be flawlessly offered to customers as part of the emergence of banking-as-a-service (BaaS) business models. To make a success of this model, scalability is key and that’s what becoming part of the FIS portfolio gave Bond, says Roy Ng, co-founder and, following Bond’s acquisition, now EVP of Atelio by FIS, the new platform that leverages existing FIS technology to offer banking-as-a-service ‘building blocks’ for financial institutions, businesses and software developers.

“We have customers now that are publicly listed companies, using our platform to reach audiences that they

10 FINTECH FOCUS: FIS INNOVATION

TheFintechMagazine | Issue 32 ffnews.com FINTECH M A G A Z I N E

were not able to before,” says Ng. “Being part of FIS really opens up the opportunity for us to engage with financial institutions themselves who have ambition to drive embedded finance as part of their revenue and their strategic ambitions.”

For those involved, this doesn’t only represent a change to the way Bond does business, and the services that FIS is able to offer, but a more fundamental restructuring of how these services and capabilities are brought to customers in the market.

“It’s a really attractive value proposition that no other player in the industry can offer,” says Ng. “FIS is bringing the merchant side, the issuing side and the banking side all together.”

FIS has made a dozen or so similar investments over the past four years. Pre-seed and early-stage investments are always high stakes, but FIS derisks them by working closely with the FIS Accelerator. A flagship, 12-week mentoring programme for early-stage companies (generally created in the previous 18 to 24 months), applications are open for it's ninth year. Flutterwave, Neural Payments and Themis are notable graduates.

“They get a lot of different mentoring, they get to speak to a lot of our customers

Being part of FIS really opens up the opportunity for us to engage with financial institutions themselves

Roy Ng, Bond

and understand and test some of the ideas,” says FIS Accelerator lead Tatyana Kratunova of entrepreneurs’ experience on the programme. “We support with funding for proof of concepts and we really look at what are the right use cases that we could align on as the future of innovation. We look at what it means for our customers, how we can ensure they can have the right technology to progress their own businesses, and we look at the connectivity of the overall ecosystem for that.”

This approach yields two core benefits. Firstly, it increases the scalability of solutions from providers who may otherwise be limited by the specificity of their application or by their small size. FIS’ support enables smaller providers to scale up their capacity to match their customers’ needs.

In addition, rumblings from the Federal

Deposit Insurance Corporation and Office of the Comptroller of the Currency in the US hint at increasingly intense regulation making its way towards the fintech sector. This may mean that fintech companies who have never had to deal with this kind of scrutiny need to comply fast, or else risk having their services shut down. In this scenario, being able to rely on an experienced, compliance-minded organisation like FIS can provide a further boost to scalability.

“The difference in our strategy over the last couple of years is in pushing our services more directly to the frontline – servicing those fintechs directly, in conjunction with the services that we're providing to the banks as well,” says Johnny Moreland, VP of sales at FIS.

“They [the fintechs] are concerned that as they grow their user base, their systems [aren’t] going to be scalable to handle the transaction volumes that they need. The breadth of our services brings infrastructure to support them in their growth… whether that’s call centre support or card production or card processing – all the things we’ve had in the market for more than 50 years.

“Our ability to deliver those services on a consistent basis is what they're looking for. And then FIS benefits from the relationships that we've expanded into the ecosystem.

We have a strategic partnership team that walks with the companies throughout their stages of investments and funding Tal Sigura, FIS Venture Investments

“Our mantra is to be able to service companies that are servicing the end users on the front end. And as the fintechs grow in their role, so will FIS.”

The second core benefit is that it allows FIS customers to mix-and-match different features, products and solutions from within FIS’ own ecosystem, allowing financial institutions to deploy gradational updates to achieve the most desirable featureset.

This ecosystem-like structure represents a more fundamental re-imagining of how banking services are evolving. A 2022 report by EY doubled down on predictions it had been making since 2020 for the potential of API-based applications to allow financial institutions to ‘move out of the traditional

bank perimeter, embedding themselves in the value chains of other industry domains’.

Such is the promise of this approach, that one report by Grand View Research estimated the banking-as-a-service market to be worth as much as $19.65billion in 2021, with expected CAGR growth of 16.2 per cent from 2022-2030.

FIS frames its own portfolio of services along similar lines, promising the ability to ‘incrementally modernise their bank and services’ as part of FIS’ BaaS provision. For Tal Sigura, head of FIS Venture Investments, the importance of this path is clear.

“This year we’re focussed on the Atelio business and three pillars come to mind: embedded finance, automated finance (accounts receivables, accounts payables), and fintel (financial intelligence).”

Sigura posits four key mandates in ensuring the continued success of FIS’ strategy: “The first one is knowledge, helping founders and operators solve their biggest challenges. The second is product integrations, and making those introductions to the right partners. The third is our customers: we like to facilitate introductions to the right fintechs or banks. And lastly, it’s the investment ecosystem. We like to introduce our founders to the VCs and corporate venture capital. Our strategic partnership team walks with the companies throughout their stages of investment and funding.”

We support with funding for proof of concepts and we really look at what the right use cases are that we could align on as the future of innovation

Tatyana Kratunova, FIS Accelerator

Then, to make sure that everybody in the ecosystem feels part of something bigger, there are the FIS Fintech Hangout networking events that rotate around US cities and bring together the entire community, informally – cool events designed for a crowd of forward-thinkers, helping to stimulate even more opportunities for growth.

In acquiring or working alongside cutting-edge startups with promising applications, FIS is shaping not only its own supernova future but that of countless new fintech stars.

11

ffnews.com Issue 32 | TheFintechMagazine

A cashless society? Where did it all go wrong?

The Payment Choice Alliance is pushing all the major political parties in the UK election race to make manifesto commitments to compel businesses to accept cash – since there’s clearly no shortage of people wanting to use it. Chair of the Alliance, Ron Delnevo, says the UK is not the only country to rethink the wisdom of going cash-free

Sweden was the poster child for cash-free lobbyists everywhere. By 2017, it seemed unstoppable. Cash access had been slashed, with ATM locations substantially reduced, most

remaining bank branches refusing to handle cash over the counter, and many businesses declining to accept cash.

In fact, a ‘cashless’ Sweden became such a certainty that the prestigious Wharton Business School saw it sensible to publish an article in 2018 in which 24 March 2023 was identified as the day it would happen. But in 2023, cash use in Sweden actually increased over 2022 levels!

So, where did it all go wrong for the cashless collaborators?

Well, firstly, the pro-cash movement in Sweden stubbornly refused to accept the seemingly inevitable. They campaigned with great energy and found that their message wasn’t falling on entirely deaf ears.

And then they got a bit of help from an unexpected quarter: Vladimir Putin.

Long before the invasion of Ukraine, the Russia leader’s posturing and a spate of suspected Russia-backed cyberattacks around the world had understandably

made many people in Sweden nervous – including the government. Its concerns became so acute that in 2019 Swedish citizens were advised to keep a week’s supply of cash ‘under the bed’ as insurance against man-made or natural disasters rendering digital payments inoperable. (I leave you to decide if Mr Putin is a man-made or natural disaster.)

However, the Swedish government realised that there was no point advising citizens to keep cash at home if banks were refusing to supply it. So it took steps to make the Swedish banks change their ways and on January 1, 2021, an amendment was introduced to the Swedish Act on Payment Services, requiring banks to provide access to cash services.

‘Cashless’ bank branches were outlawed, with banks compelled to offer over-the-counter cash withdrawal and deposit facilities for customers. And all this was before Russia actually invaded Ukraine.

12 PAYMENTS: CASH

Money matters: The death of cash has been greatly exaggerated TheFintechMagazine | Issue 32 ffnews.com FINTECH M A G A Z I N E

The rumour now is that as and when the Eurozone brings in a law mandating businesses to accept cash, Sweden will follow suit. The poster child for cashless is clearly never going to get the opportunity to reach maturity.

Meantime, in the UK, perhaps sensing that Sweden was about to go very wrong for them, the cashless collaborators stepped up their efforts to impose their will on the British public.

It was a great drawback, of course, that cash remained rather popular in the UK Indeed, the number of free-to-use ATMs – ATMs deliver 95 per cent of the cash used by the public in their daily lives – peaked at more than 54,500 in 2017. Cash was becoming conveniently available everywhere. What’s not to like about that, for the man and woman in the street?

Mysteriously, however, even though the public were very happy, at the end of 2017, the UK ATM Network LINK announced that it had decided there were too many ATMs in the UK. Its way of addressing this ‘excess’ was quite brutal. It told ATM operators that the already tiny payments – the lowest in Europe – they received for cash withdrawals were to be further reduced by up to 20 per cent.

Since LINK announced the reductions in payments for ATM cash withdrawals, the number of free-to-use ATMs has fallen from that 2017 peak of above 54,500 to less than 37,000 today – a fall of more than 32 per cent, or roughly one third.

Meantime, more blows were being rained down on access to cash withdrawal and deposit facilities. On average, two British bank branches closed each day between 2015 and the end of 2021 – and the Big Five banks closure programmes have continued unrelentingly since then. And then the ‘cashless’ collaborators also got a bit of help from an unexpected quarter: Covid.

Suddenly, in 2020, the British public were basically told they were not allowed to leave their homes. Between 2019 and 2021, the value of online sales in the UK went up from £75billion to £120billion, an increase of 60 per cent. Almost none of those additional sales featured cash.

On top of that, when the public did actually make it to bricks and mortar retailers, they often found their cash was refused. Health concerns about

handling cash was the main, though unsubstantiated, excuse.

So, taking all the negatives stacked up against cash since 2017, have the British public given up on cash as a payment method? Not a bit of it.

Today, the much-depleted LINK ATM estate continues to dispense 70 per cent of the value of cash dispensed pre-pandemic – and post offices, where cash services are available over the counter, have seen a substantial increase in the value of both cash withdrawals and deposits.

All this cash activity meant that UK Finance – the trade association of the British banks – was forced to report that in 2022 cash use for retail payments had actually risen. A seven per cent growth in transaction numbers year-on-year is really very impressive.

And then the roof started to fall in on those seeking to impose cashless on the British public.

Around the country, organisations large and small that had gone cashless were making the headlines when they started to recognise that their customers were very unhappy and that cashless needed to be binned. There are many examples.

UK Finance was forced to report that in 2022 cash use for retail payments had actually risen. A seven per cent growth year-on-year is really very impressive

Perhaps the first great piece of news for cash was Greggs the bakers making clear after Covid that all its 2,400 stores across the UK were definitely accepting cash again. Greggs, of course, had the wisdom of its commitment to cash underlined when, in March 2024, an IT glitch”meant that cash was the only payment method it could accept in its thousands of stores!

In March 2023, a kids’ uniform outlet in Worcestershire, The School Shop, reversed its cashless policy – had customers given it a hundred lines: “You Must Not Tell Us How We Can Pay”?

Greene King, the pub company, in

October 2023 took the decision that all its pubs would accept cash again. In November 2023, the Royal Albion Hotel in Broadstairs, where the famous Chariots of Fire athletes trained for the 1936 Berlin Olympics, abandoned the race to cashless.

In March 2024, York City Council reversed its decision to make its car parks cashless, having been faced with relentless opposition from local residents. Also in March 2024, a major veterinary group, based in Herne Bay in Kent, admitted it had been barking up the wrong tree and started accepting cash again.

Not far away, The Glass House pub in Ashford, Kent, made the same move.

Customers telling the publican that they would never drink there again, meant it didn’t take long for the cash tills to start ringing again.

Daventry Town Football Club found that cashless was an own goal, so kicked it into touch in April this year and welcomed its supporters’ hard-earned cash again.

Most recently, the Imperial War Museum in Manchester, renounced its cashless policy. Faced with criticism from so many in the city, including the Manchester Civic Society, it was inevitable it would concede this particular battle.

Not all businesses are listening to their customers, of course, which is why we need legislation compelling them to accept cash.

ASDA for one seems to be deaf to customer threats to boycott its card-only petrol forecourts. It’s a curious stance to take when Sainsbury’s and Tesco steadfastly keep the flag for cash flying at their pumps.

What all these examples illustrate is that the public will not be told how they can and can’t pay. So, the Payment Choice Alliance is pushing all the major political parties to make manifesto commitments in the upcoming election to pass legislation to compel businesses to accept cash. This reflects the response of the British public to a YouGov survey in 2023, which revealed that 71 per cent of adults want a law put in place, guaranteeing they can use their cash, when and where they choose.

Many neighbouring countries already have such legal measures in place, including the Irish Republic. But businesses really shouldn’t need to be forced to do the right thing by law. All British businesses that say they truly care about their customers should be accepting cash now.

13

ffnews.com Issue 32 | TheFintechMagazine

Revolutionising your payment ecosystem Fan Engagement and Experience Club Profitability Data Insights Operational Efficiency Branded Debit Cards Partnerships and Ecosystem Embedded Finance in the sports industry Andaria Financial Services Limited is authorised by the Malta Financial Services Authority (‘MFSA’) as a Financial Institution in terms of Article 5 of the Financial Institutions Act, 1994 (Chapter 376 of the Laws of Malta). Andaria Financial Services UK Limited, is authorised by the UK Financial Conduct Authority (“FCA”) as an Electronic Money Institution under the Electronic Money Regulations 2011. andaria.com

One billion digital nomads are predicted to be roaming the world by 2035. European mobile bank bunq aims to go with them, says Chief of Staff Bianca Zwart

the previous 12 months. More than 12.5 million users are now logged on.

“We’ve seen a shift in people working remotely and living internationally. Home, work, travel are all just nicely blending in,” says the bank’s chief of staff Bianca Zwart.

According to Statista, more than 35 million people – roughly half of them millennials (28-43 years old) – had already placed themselves in the digital nomad employment category in 2022. That’s likely a ludicrously conservative figure now, given the proliferation of visas made available over the past 12 months by countries chasing the ‘nomadic dollar‘ or, in some cases, just an injection of youth into an ageing demographic.

well-known companies in the US, a recent Gallup survey showed that eight in 10 remote-capable employees there expect to work hybrid or fully remote this year. And a Gartner survey of bosses in 2022/3 showed 82 per cent plan on incorporating more remote work and digital nomad-adjacent policies for their employees in the future.

But these seismic shifts in lifestyle haven’t, by and large, been ones that legacy financial institutions have kept up with. And, in Zwart’s opinion, that comes down to the wrong strategic priorities being baked into their organisations, as much as a technology timelag.

There’s a handy feature on the bunq mobile banking app that allows users to review and share experiences that they’ve paid for on their card. Want a great café in Zagreb where you can drink coffee for hours over a laptop without getting the hard stare from staff? Or perhaps a fab shabby-chic pension in West Berlin that rocks Weimar-era style at pre-War prices. They’re the kind of crowd-sourced recommendations on which the world’s new generation of worker-travellers thrive. Liberated from conventional employment routines, they’re highly mobile, constantly updating, digitally well-equipped – and creating a demand for services fashioned in their own image. Products like bunq, the ’bank of the free’.

Founded in 2012 in the Netherlands, in 2023 it became the first neobank in Europe to turn an annual profit (€53million), driven by a huge surge in customer demand over

And it’s not just the ‘pull’ but the ‘push’ driving what Harvard Business Review terms these ‘fluid’ as opposed to ‘solid’ lifestyles – ones noticeably not rooted in one place or one concept of community.

In the UK, for example, more than seven in 10 people in a Post Office survey of 2,000 UK employees said they didn’t just like the thought of travelling while working remotely, but were also actively planning to do it. Perhaps that’s partly due to the fact that, in the current cost-of-living squeeze, a UK salary goes a lot further abroad. As one nomad puts it: “Honestly, if I’m going to struggle, I’d rather struggle in the sun.”

And employers have responded. Notwithstanding some backsliding by

Moving times

“A lot of sectors have already been playing to these needs. We believe that something as vital as your finances – the banking sector – cannot stay behind,” she says.

So how has Bunq’s approach as a bank been different?

“In the beginning, instead of chasing vanity metrics, we put a lot love and effort into creating something of value,” says Zwart. “We had a very simple conviction: if we built a product that people truly love to use, they’ll be willing to pay a couple of euros for it. User-centricity is in our DNA; you can feel it in the product.

“When I use the app, it feels as though it’s tailored for me. That’s a fundamental shift, focussing on the user, rather than focussing on what serves the bank.”

DIGITAL NOMADS: BANKING FINTECH M A G A Z I N E

15 ffnews.com Issue 32 | TheFintechMagazine

It was important that unity of purpose was reflected across the whole organisation from the start, she adds – and Zwart speaks as one who was recruited the year of bunq’s launch as a junior member of staff, working her way up, before leaving to do the hard yards as an entrepreneur, and returning in 2022 to become second-in-command to founder Ali Niknam.

“The company structure completely mirrors the user journey,“ she says. “We don’t create roles for the sake of creating roles. Rather, we look at ownerships, as we call them – validated problems that our users have. Someone creates an ownership and truly focusses on that.

“Secondly, any proposal within the bank starts with the most important question: what is in it for our user? If you cannot answer that question, we’re not going to do it. And, last but not least, we work with great, ambitious people who just truly want to get things done and make the experience better every day. We really make sure that our commercial reality is in line with our user happiness.“

For a bank focussed on serving not just the financial but the lifestyle needs of the digitally nomadic, America is a key market. Americans make up over half of all workers who assign to the label, while the US is one of the top three destinations worldwide for nomads, alongside Spain and Thailand.

“We want to focus on this very specific group that I think suits our proposition well,“ says Zwart. “People that have ties to both Europe and the United States, so people on both sides of the Atlantic, who want to have accounts in USD and Euros, and to seamlessly transfer between the two. Our product is amazing for that.“

bunq inhabits similar territory to N26, Tomorrow, Monzo and Revolut in Europe. But, unlike them, it waited significantly longer to seek external funding, Niknam instead choosing to bootstrap its expansion until 2021 when it set the record for the largest Series A funding round for a European fintech at €193million.

It’s a fundamental shift, focussing on the user, rather than focussing on what serves the bank

That injection of cash by Pollen Street Capital was used partly to buy an app for splitting expenses, Tricount and the Irish business lender Capitalflow, partly to invest in Al-driven customer service and, having expanded to 30 European countries, it also gave bunq the resources to look at re-entering the UK after Brexit and establish operations in the US.

cultural and economic shift: Mobile working is becoming the new norm

“London is a digital nomad hub – not just the people travelling there, but also for people from the UK who travel abroad a lot. Spain is one of the hot spots for them and we can offer them that pan-European experience – and not just in currencies.

“For example, if you need to pay your landlord in Spain there are not many people who will accept a non-Spanish bank account. We offer just that. You can open a Spanish IBAN as soon as you land in Spain, so you have everything set up and you can truly live like a local.”

Home, work, travel are all just nicely blending in

The UK product launch, meanwhile, will be something of a re-run for bunq, which was operating there up until Brexit. In its absence, of course, the banking landscape has changed somewhat. German neobank N26 left, but Revolut (also now in profit, but still without a UK banking licence) has expanded. Fully UK-licensed Monzo now regularly makes the charts as a bank for digital nomads, working both inside and outside of Britain.

Work culture has altered, too, over the past four years. Many more millennials and Gen Z-ers have entered the workforce –the generations who were most enthusiastic about changing location, according to that Post Office survey –while a third of UK companies now claim they allow employees to log on from different countries.

“We love the UK market and our product is a great fit for it,” says Zwart. “And that’s not based on assumptions… we saw that when UK customers were able to use it before, because it basically gives them the ability to bank like a local.

As the Harvard Business Review observed, the image and reality of a nomadic lifestyle are often very different. “Unrooted living requires effort, including finding short-term housing, work, health care, financial services, and education for nomadic families,“ it says, adding, “These are also market opportunities.“

And that’s what bunq has seized on. The bank is all about making life – not just money management – easy for users. It was one of the first to completely open up its API ‘because it adds more value to the user, so why wouldn’t we?’ says Zwart. And, like its user base, its horizon is endless.

Back in 2015, Pieter Levels, another Dutch entrepreneur and founder of the NomadList – a subscription-based online community, used by millions of nomads and would-be nomads every month, with 35,000 paying members – predicted that by 2035 there will be one billion digital nomads. They will all be looking for services tuned to their needs.

“We’re already on our way to becoming a global neobank,“ says Zwart. “Next is looking at how we can make our users’ lives even easier, maybe beyond banking by doing great partnerships and integrating into services that our users already use.“

16 DIGITAL NOMADS: BANKING TheFintechMagazine | Issue 32 ffnews.com

A

FINTECH M A G A Z I N E

Everything but the elephant

The meteoric rise of the digital nomad as a customer segment has exposed gaps in insurance and banking provision that imaginative startups have started to fill. Natalie Marchant explores the world of the remote worker, the risks and benefits

“The biggest thing for me is being able to travel and learn more about myself and the world,” says business consultant John Munn, explaining why he joined the 35-million-strong tribe of digital nomads.

Munn describes himself as a ‘time optimisation expert’ who – perhaps appropriately – helps entrepreneurs work less. He also runs an environmental business that helps clients offset their carbon emissions with his partner Eliana Vanekova. Together, the 29-year-olds have spent much of the past few years working remotely – most notably in Spain and Thailand, but they also used those as bases to explore further afield. And they’re far from alone in escaping the traditional 9-5 work routine.

The number of digital nomads looks set to soar, with more than 50 countries around the world now offering specific visas to capitalise on the growing trend for a self-determined work routine. Indeed, a recent study showed that Google searches for ‘digital nomad visa’ went up by a staggering 1,135 per cent this year, prompted by the addition of Spain and Italy to the ever-growing nomad-friendly list. Just as the booming digital nomad sector offers opportunities for local economies,

particularly in parts of the world badly hit by lack of tourism during Covid, it also opens the door to new markets for digital platforms servicing their financial needs abroad – be it foreign exchange services, e-wallets or, for when problems arise, insurance.

While there are many borderless banking options already on the market, traditional insurance models can find it hard to meet their needs – which is where the opportunities lie for neobanks, insurtechs and the more agile legacy insurance providers.

Dutch neobank bunq is one of the latest companies seeking to capitalise on the remote working trend by partnering with insurtech Qover to build out its product offering for digital nomads. Its Easy Bank Pro XL plan enables users to activate travel insurance through the Activities tab of the bunq app, as part of its commitment to making borderless banking seamless and creating a portfolio of other services around the needs of its customers.

Similarly, US-based WorldTrips Insurance Services earlier this year launched its Atlas Nomads policy designed for an era ‘where remote work is not just a possibility, but a lifestyle’, while France-based insurtech Qiti in 2023 launched its AI-driven health insurance app targeted at digital nomads and frequent travellers.

So what exactly are digital nomads?

Digital nomads are location-independent, or remote, workers who use technology to carry out their business wherever they choose to be in the world. They are similar to more traditional expats in that they both live and work in a country that’s not their own, but there are some notable differences in lifestyle and commitment. Expats tend to move to another country for work or retirement, often

on a semi-permanent basis, while digital nomads are far less likely to establish roots. Accordingly, expats are likely to build a life in their host country, and work on-site for a particular company or organisation, while digital nomads have tended to be freelance or business owners and have more of a ‘visitor’ mindset – giving them greater flexibility to travel as and when they see fit.

That said, digital nomads are increasingly also salaried employees who have permission to work remotely. In the US alone, the number of digital nomads with traditional jobs rose by nine per cent in 2022, from 10.2 million in 2021 to 11.1 million, according to consultancy MBO Partners. This was on the back of the number of digital nomads doubling in 2020 and increasing 42 per cent in 2021.

Digital nomads are generally assumed to be highly skilled and tech-savvy, with many working in fields such as IT, digital marketing and education services such as language teaching and tutoring – although people working in more ‘traditional’ professions such as law and accountancy are increasingly working remotely abroad, as well.

Long hours and working at odd times of the day from those ‘back in the office’ is a common challenge for digital nomads in very different time zones – even if having a break from the traditional 9-5 work routine is the key attraction in itself.

Then there can be language barriers and, sometimes as a consequence of these, loneliness. Some digital nomads get caught out by realising that they do eventually miss the comforts of home, and, even if they really enjoy living in a particular country – unless they have a good visa option – moving on to somewhere else is going to be inevitable at some point.

In addition, there can be practical hurdles to overcome, most notably technological

18 DIGITAL NOMADS: INSURANCE

TheFintechMagazine | Issue 32 ffnews.com FINTECH M A G A Z I N E

ones. Wifi needs to be good to stay connected, while technical support and other assistance – not to mention electronics stores – can be few and far between in more remote locations. If a laptop or mobile suddenly dies, for example, replacing it quickly can be a fraught experience, which is where good insurance for technology and income cover can prove invaluable – navigating your way out of problems abroad can be challenging, especially if you’re based in one of the more exotic locations high on nomads’ destination list, such as Indonesia or Costa Rica.

Borderless banking and financial services have greatly matured in recent years and leading the way have been online banking apps such as Wise (formerly TransferWise), Revolut and N24, whose benefits include multi-currency accounts, real-time exchange rates and competitive ATM withdrawal fees wherever you are in the world.

Incumbent banking giants such as JPMorgan Chase have also sought to target the borderless banking market with the launch of its online bank Chase, which offers fee-free debit cards for use abroad and also relies on real-time exchange rates.

But while companies such as William Russell and Expat & Co have been providing insurance for expats for some years, insurance offerings for the bespoke needs of digital nomads

remain comparatively few and far between. So what are they looking for, and what should insurance providers seek to provide if they want to tap into this growing market?

Centuro Global is a company that helps businesses expand globally through its tech-driven platform, which supports businesses on global talent deployment by navigating visa regulations, tax requirements and other issues.

When it comes to remote workers selecting insurance, Centuro Global CEO Zain Ali advises: “Nomads should take a ‘Goldilocks’ approach to selecting

Knowing what kind of activities you can do is really important. We knew we’d be riding mopeds in Thailand, but a lot of insurers exclude elephants

John Munn, digital nomad and business consultant

insurance. If your coverage is too limited, you’ll just be at risk of falling through the cracks if an unexpected disaster strikes. But if your coverage is too broad, you’ll just be throwing money away – for instance, there’s no need to buy a package deal that features home insurance if home is wherever you lay your head.”

When Munn and Vanekova set off to be digital nomads, insurance was something they took very seriously. Using a popular UK price comparison site, the pair were recommended to take out backpackers insurance – digital nomads were less of a trend then – and they chose a one-year policy that covered the world, minus the US as they didn’t plan on travelling there.

However, they’re the first to stress how important it is to read the finer details of insurance policies. “All of them are slightly different, so we built a shortlist and then read the contracts specifically,” says Munn.

“Knowing what kind of activities you can do is really important. For example, when we were travelling, we knew we’d be riding mopeds in Thailand but a lot of insurers exclude elephants [which are commonly on a nomad’s to-do list].”

It’s not just elephants. Many adventure sports, such as surfing, are specifically excluded by insurers – and yet it’s precisely the type of thrill many nomads seek.

When it came to health and accident cover, Munn and Vanekova made sure they had repatriation and indemnity, but were also aware that they could pay for certain aspects of healthcare privately and at a considerably lower price than at home, should that be required.

They were also covered for baggage, passport and cash loss, but steered clear of additional policies for mobile phones and technology that often be replaced far cheaper in Asia than in Europe.

19

ffnews.com Issue 32 | TheFintechMagazine

Big challenge: Traditional travel policies fall short of nomadic requirements

Such a detailed approach to selecting insurance is advocated by Neville Mehra, co-founder of Genki, a German startup that offers a health insurance subscription service, supported by insurers Allianz, Barmenia, and DR-Walter. It currently has more than 20,000 digital nomads signed up in more than 170 countries.

“Digital nomads, by definition, typically spend time living in, travelling between and working in multiple locations –sometimes even in completely different parts of the world. And traditional health insurance isn’t designed to cover people who have that kind of lifestyle,” says Mehra.

Traditional health insurance isn’t

designed to cover people who have that kind of

lifestyle

Neville Mehra, co-founder, Genki

“Most local health insurance and national health systems only cover people in their home country. Sometimes they offer international coverage, but it’s typically limited to short trips abroad and often comes with a lot of restrictions on the types of activities and the types of treatments that are covered.”

Founded by travellers for travellers, in 2021, Genki launched a worldwide travel health insurance subscription called Genki Explorer for people who want the ‘flexibility to change plans on a moment's notice’. Two years later it added Genki Resident, a long-term international health insurance with complete health cover, including dental and mental health care, pregnancy and childbirth, physiotherapy, and alternative medicine.

“Travel health insurance is great for digital nomads who are travelling for a few months, and who also have local health insurance or access to the national health system in their home country,” says Mehra.

“But those digital nomads who plan to travel for a few years at a time, and those who do not maintain any other health insurance or access to the public healthcare system in their home country should instead opt for international health insurance, as it offers long-term coverage and may also cover preventative care, vision, dental and maternity/childbirth.”

There is, of course, another very good reason for digital nomads to take out health

insurance for the duration of their intended stay: it is very often a key requirement if applying for a digital nomad visa. But there are other policies that can be invaluable for digital nomads that may be less obvious –for example, if their technology fails or they lose the ability to work for another reason – and which are generally not covered by traditional travel insurance policies.

As Centuro Global’s Ali advises: “Nomads almost always depend on their laptops to make a living, so technology insurance is a must. The life of many digital nomads is quite comfortable, particularly for those taking advantage of geographical arbitrage to earn US or UK salaries while living in the developing world. But one accident could leave you both unable to work and stranded a long way from home. That’s

enabling users to sign up online for gadget insurance from wherever they are within two minutes. Claim-making processes need to be quick and easy to complete online, too, and not require an expensive phone call abroad during office hours.

The best policies are built around the traveller. SafetyWing, for example, offers continuous coverage for 30 days (15 for US residents) for every 90 days abroad and flights home in an emergency.

As for Munn and Vanekova, they are now back in the UK. The appeal of having the same home to go to and a job in an office with colleagues was extremely tempting for Vanekova.

“It has been very interesting and constantly changing, but we have been doing it for five years and I think I’m

Checking out:

The number of digital nomads opting for an alternative workstyle is

set to soar

why we’d strongly recommend nomads to think about getting income protection, especially those who are self-employed.”

A nomad’s choice of insurance also needs to reflect their personal mode of remote working.

“Digital nomadism is a spectrum,” says Ali. “There’s a difference between someone who takes a ‘workcation’ every now and again and a fully-fledged nomad, out on the road for months at a time. Each will require different forms of cover, depending on how long you’ll be away from home and how much country-hopping you plan to do.”

Insurance providers looking to attract digital nomads must also consider how their tech-savvy clients could best access their services should they need them.

For example, 24-hour emergency telehealth services such as those offered by Allianz Care can be invaluable if someone isn’t within easy reach of in-person medical services. Simplesurance lives up to its title by

There’s a difference between someone who takes a ‘workcation’ every now and again and a fully-fledged nomad, out on the road for months at a time. Each will require different forms of cover

Zain

Ali, CEO, Centuro Global

starting to lack stability,” she explains. “It’s been amazing, and we’ll still travel more than just a week’s holiday every year, but we’re looking to form a base somewhere.”

There’s a lot more of the world to explore and they might yet move on. Meanwhile, millions of 20- 30- and 40-somethings are looking to follow in their footsteps, fashioning a new, borderless, flexible approach to living and working that will continue to challenge banking and insurance providers.

20 DIGITAL NOMADS: INSURANCE

TheFintechMagazine | Issue 32 ffnews.com FINTECH M A G A Z I N E

KEY TO SECURITY? E-COM THE

There’s a lot more that can be done to improve consumer confidence in online transactions and reduce merchant losses in the DACH region, says G+D’s Stephan Hackenberg. The answer is less not more complexity

E-commerce payments fraud is an increasing problem in the DACH region, as it is across the globe.

Mastercard’s, report, E-commerce Fraud Trends And Statistics Merchants Need To Know In 2024, states that two out of every three online retailers in Germany identified an increase in e-commerce fraud in 2023, and more than 85 per cent of online merchants in Switzerland.

While that’s partly a reflection of a year-on-year increase in online sales – in Germany, for instance, 78 per cent of 25 to 50-year-olds having ordered and purchased items online in the previous three months – it still has a major impact on a business’s bottom line.

Analytics company CRIF found that 94 per cent of online stores in Germany have been affected, 20 per cent of them suffering losses of more than €100,000. In Switzerland, 86 per cent had been hit by losses, and in Austria 64 per cent. The vast majority of e-commerce companies that CRIF interviewed felt that fraud risks had risen over the past 12 months.

However, arguably the bigger problem facing the DACH e-commerce and payments sphere is the perception gap between merchants and their customers.

A survey by fraud prevention solutions provider Riskified, published by Forbes, showed German respondents are more nervous about making online payments than merchants believe them to be. While 53 per cent of merchants said their customers felt safe, only 34 per cent of consumers agreed. There were similar sentiments in other DACH countries.

Their crisis of confidence has resulted in – and possibly been exacerbated by –them being presented with a plethora of

alternative payment methods. Although PayPal remains the method of choice for 46 per cent (Statista) of online shoppers, DACH is a particularly fragmented payments region, which perhaps explains why cash is favoured by more people in Germany, Austria and Switzerland than in any other part of Europe.

Stephan Hackenberg leads the global eCOM paytech solution sales team at payments security company G+D, where he’s responsible for security-enhancing solutions, working with the digital powerhouse division of G+D, the paytech Netcetera. He believes the unintended consequence of market and consumer reaction to fraud risk has been to add counter-productive complexity to new security measures.

The DACH region [is] highly fragmented when it comes to e-com payments, adding real complexity to any potential fraud prevention solutions

“The wariness of consumers in the DACH region is exacerbated by the issues faced by its banks which, with their legacy systems, tend to be a bit slower to implement the very solutions required to tackle the issue,“ says Hackenberg, who is based in Munich. “This has led to the DACH region becoming highly fragmented when it comes to e-com payments, adding real complexity to any potential fraud prevention solutions.

“Alternative payment methods have grown and leapt into that space, and so

there are multiple different schemes in the region, which really is a challenge for merchants and payment services providers (PSPs). Supporting a plethora of different payment methods in that market is cumbersome.”

He adds: “It’s also research and development-prone and companies have to certify their solution, needing strong partners to do that, all the while being attacked by fraud and therefore facing uncertainty from shoppers.”

Whether or not they realise it, there is clearly a job for merchants to do when it comes to building customer confidence, and G+D believes that can be achieved with risk-reduction solutions that don’t introduce the kind of friction that is known to be a turn-off for shoppers, leading, in the worst-case scenario, to cart abandonment.

Traditionally, merchants have sought to increase check-out ease and speed using methods like card-on-file payments, where they would store a customer’s payment details for seamless future transactions. However, this has led to instances of customers’ details being compromised when data breaches have occurred, and potentially added friction back into the process if cards expire, are lost or stolen. Every declined transaction forces the customer to go through authentication all over again.

Yet, newer network tokenisation technology allows customers to use unique, merchant-specific tokens in lieu of their cards to complete transactions –reducing the risk of data breaches or fraud because no actual card data is transmitted. G+D offers network tokenisation via tools like its eCOM Tokenizer solution, providing

22 DACH REGION: FRAUD PREVENTION

TheFintechMagazine | Issue 32 ffnews.com

FINTECH M A G A Z I N E

aggregated original scheme-based, card-on-file tokens of the leading brands like Mastercard, Visa, Elo, Discover and others. It’s an approach that goes hand-in-hand with its implementation of Click-to-Pay, successfully launched with several PSPs, enabling thousands of merchants to offer convenient guest checkout, says Hackenberg.

G+D also offers the first EMVCo-approved 3-D Secure technology in Europe, providing an extra layer of biometric authentication behind transactions to verify customers through its Convego® AUTH-U offering, based on the global industry alliance FIDO’s payment authentication standard.

It ‘transforms two-factor authentication into one effortless action’, says G+D. Its website claims that this reduces cart abandonment by 70 per cent by offering ‘up to 85 per cent faster’ transaction speeds. Its exchange of 10-times more data points also improves transaction risk assessment and risk reduction, which, says G+D, shields businesses from fraud.

The company believes this tech makes ‘guest checkout… as easy as in-store payment with no passwords or account details to remember and all major debit and credit cards stored in one convenient wallet, requiring customers to only enter their details once, with registration via biometric authentication further streamlined when used together with mobile apps and browser-based web applications’.

“It’s about making the checkout experience much easier while providing the security of card schemes, which, –especially for high-value transactions, is of utmost importance to DACH market e-commerce,” says Hackenberg. “At the same time, we are also keeping a close eye on the account-to-account (A2A) transfer options emerging in the market. We’ve seen that account-to-account payments in other regions of the world are really solving consumer needs.”

Most recently, Berlin-based payment processor Micropayment partnered with Sweden-based open banking platform Tink to add Pay by Bank to its payment offering across the DACH region. And open banking platform TrueLayer, which is one of the first to join the SEPA Payment Account Access scheme, also recently indicated it was doubling down

on its efforts in the region, having seen significant year-on-year growth in A2A payment volumes in Germany since 2021.

“We’re also looking into making customer onboarding itself secure, using banking apps as a means of second-factor authentication,” says Hackenberg. “We strongly believe in FIDO for this.

“We don’t see one-time passwords via SMS as the future. Instead, pass keys combined with biometrics will be a very important factor. Getting people to use these in a natural way will be central.”

The third Payment Services Directive (PSD3), meanwhile, may help consumers feel more secure.

“PSD3 is the scheme being talked about all over the place, with providers asking what’s coming with it, when it will be implemented and how it will improve on the PSD2 regulation in terms of inclusion, security, convenience and, of course, authentication,” says Hackenberg.

G+D is well-placed, he says, to develop next-gen payment technologies that meet these specifications.

“Looking at both sides of the coin, we serve customers in the e-com space (the acquiring side)as well as leading issuers, which gives us great insights when it comes to providing these technologies.Putting the consumer back in control of what they're doing is another important angle to ensure a confident shopping experience,” he explains.

Partnerships are a key enabler for G+D – with PSPs like Nexi now in the DACH, banks and paytechs.

“We have some contact directly with merchants if they do their own orchestration, for example – and orchestrators themselves are one of our main customer groups, providing our solutions to merchants,” he says.

“We have to be close to the merchants and, for the most part, we do it through our partners and even vice versa, bringing the partners to customers if we can’t provide the technology.

“Cooperation is really key and once a year, we invite people around to Lake Stamberg, close to Munich, for our innovation summit, bringing together keynotes and leading speakers from across the industry, developing new ideas and really making use of our memberships of EMVCo and other organisations.

“Partnerships will be key to driving forward payments technology and innovation in the region. Nobody can do it alone. It’s about the schemes informing their clients and customers about new options. It’s about issuers providing the technology, easy banking apps, et cetera, to give access to it, and PSPs offering different means.

“And it’s about us as an engagement partner making this simple, enabling these kinds of technologies so they an go out fast and at a reasonable cost.” Thinking outside the box:

23

ffnews.com Issue 32 | TheFintechMagazine

in digital shopping has brought online fraud challenges for DACH countries

An increase

The language of partnership

The German-speaking DACH region is a key focus for the Nexi Group. But it can’t realise its ambitions alone, as Nexi’s Martin Pitcock and Ratepay’s Charlotte Paauwe explain methods have now arrived and spread in these three countries, payment habits today still differ from other European countries.”

Having become one of, if not the largest European digital payments operator, Italy’s Nexi Group is advancing at pace towards a very specific target: the DACH region.

It follows the merger and integration of Nexi, Nets and Sia, three of the biggest regional players in digital payments, which created a paytech with the scale, capabilities and proximity to provide simple, fast, and safe payment solutions to consumers, SMEs, large international corporations, banks, institutions and public administrations across Europe. So what makes the three countries that together make up the DACH region such a golden egg, worthy of strategic focus?

Well, the cash-centricity of Austria, Switzerland, and Germany for one thing.

“History shows that these countries have held cash transactions for much longer and in larger quantities than the adjacent countries. They did not follow the norm when it comes to payment,” says Nexi partner marketing lead for e-commerce in DACH, Jennie Johansson Carnhamre,

“And although this development has not prevented the introduction of digital payment methods, it has inhibited speed. So although all payment

According to Charlotte Paauwe, partnership manager at white label buy now, pay later (BNPL) provider Ratepay, an independent brand within the Nexi network, it’s important that customers can quickly see what payments are accepted online – and that those payment methods are relevant to them.

“That is very region-specific,“ she says. “For example, Ratepay is very successful with buy now, pay later in the DACH region because open invoice arrangements are so important here. Focussing on what needs to be available at checkout from a regional perspective – especially if you’re an international merchant – will ultimately improve the customer lifetime value.”