February

February

By Shane McGraw, Co-Branch Manager | Mortgage Insiders Branch

2024 has been a year of resilience and adaptation for many of us in the mortgage industry. The challenges we’ve faced have shown our strength but also left us yearning for renewal. As 2025 begins, we have the opportunity to reset and realign—both personally and professionally.

In this article, we’ll explore two frameworks of the 7 F’s—one for personal growth and the other for professional excellence. Together, these frameworks offer a holistic approach to goal setting, helping you create a blueprint for success in every area of your life.

True success starts with a foundation of balance. These seven pillars of personal goalsetting—Faith, Family, Fitness, Friends, Finance, Field, and Fun—are designed to help you thrive in all areas of your life.

• Faith: Cultivate a deeper connection to your spiritual life or purpose. Start each day with gratitude, meditation, or prayer, and align your actions with your values.

• Family: Strengthen bonds with those who matter most. Schedule regular family dinners, engage in meaningful conversations, and prioritize quality time.

• Fitness: Invest in your health. Create a sustainable routine that incorporates exercise, healthy eating, and rest to fuel your energy and resilience.

• Friends: Build and maintain enriching relationships. Make time to connect, celebrate, and support your friends, remembering that joy multiplies when shared.

• Finance: Audit your personal finances. Build an emergency fund, invest wisely, and establish habits that support long-term financial security.

• Field: Pursue personal development. Whether it’s learning a new skill or embracing a passion project, grow in ways that challenge and inspire you.

• Fun: Life is meant to be enjoyed. Make time for hobbies, adventures, and experiences that bring you genuine happiness.

Professional success requires focus, discipline, and a clear vision. These seven pillars of professional goal setting— Faith, Focus, Fitness, Family, Field, Finance, and Fun—offer a structured path to achieving excellence in your career.

• Faith: Maintain belief in your purpose and the value you bring to clients. Confidence and integrity are cornerstones of professional success.

• Focus: Prioritize your efforts. Time blocking, planning, and managing distractions are essential for maximizing productivity and results.

• Fitness: Success requires stamina. Take care of your physical and mental health to stay sharp and energized.

• Family: Remember that your work supports those you love. Align your professional goals with the needs and dreams of your family.

• Field: Master your craft. Sharpen your skills, innovate your strategies, and be a thought leader in the mortgage industry.

• Finance: Track, manage, and grow your business income. Ensure your pipeline is full and that your spending aligns with your goals.

• Fun: Celebrate your wins. Build camaraderie with your team and create a work environment that inspires motivation and joy.

Whether personal or professional, the 90-day sprint method is a game-changer. It breaks down big ambitions into manageable steps, fostering momentum and accountability.

Step 1: Choose 2–3 impactful goals to focus on.

Step 2: Break these goals into milestones to achieve weekly.

Step 3: Reflect, rest, and recommit during the 13th week before starting the next sprint.

The beauty of this approach is its adaptability. If something isn’t working, you can adjust without losing an entire year.

Take a moment to visualize your ideal future—personally and professionally. What would your life look like if every aspect of the 7 F’s were in harmony? Use the tools from this guide to create actionable goals that bring this vision to life.

Remember: success isn’t just about closing deals or hitting numbers—it’s about thriving in all areas of life. Let’s support one another in making 2025 a year of growth, achievement, and joy.

Are you ready to sprint? Let’s make this the year we don’t just survive—but thrive. Together, we can crush 2025!

February 10-14, 2025

Mark your calendars!

The AFN 2025 Virtual Kick-Off is happening February 10–14, 2025.

This week-long event is designed to bring us together as a team, featuring webinars, roundtables, presentations, and meetings to inspire, inform, and energize us for the year ahead.

Stay tuned for the full agenda and details on how to join. Let’s make 2025 our best year yet!

A warm welcome to those who joined Team AFN in October, November & December.

Aaron Bravo

Loan Officer

Alyssa Abreu

Sr. Processor

Anaivett Araoz

Transitional Loan Officer

Ariel Gomerez

Loan Officer

Ayman Tabbaa

Loan Officer

Brandon Lee

Loan Officer

Brayden Abadilla

Social Marketing Assistant

Brittany Como

Processing Manager

Candace Ravelle

Loan Officer

Christopher Dahl

Business Development Manager

Craig Daliessio

Branch Manager

Dani Huskins

Underwriter

David Cooper

Loan Officer

Dennis Donahue

Transitional

Desmond Reed

Joe Ryu

Transitional Loan Officer

Drew Lesce

Dro Gharapetian

Ed Vega

Business Development Manager

Edward Kenmure

Regional VP

Eric Stephens

Business Development Manager

Erica Waxman Grant

Transitional Loan Officer/LOA

Hector Bracero Kuilan

Sales Manager

Iris Guevara

Jason Behun

Branch Manager/LOA

Javier Tavares-Nava

Loan Officer

Jeff Bubenchik

Jenn Minnich

Branch Manager/LOA Underwriter

Joe Bird Loan Officer Team Leader Branch Manager

Branch Manager/LOA

John Berardino

Branch Manager/LOA

John White

Sales Manager

Jonathan Suda

Branch Manager/LOA

Jonathan Yuen

Transitional Loan Officer

Juergen Hoehne

Business Development Manager

Justin Reyes Gutierrez

Loan Shipper

Katia Pereira

Business Development Manager

Kee Chan

Transitional Loan Officer

Keith Gordon

Transitional Loan Officer

Khani Reed

Business Development Manager

Kristina Johnson

Loan Officer Assistant

Larry Hall

Branch Manager/LOA

Leslie Mathews

Transitional Loan Officer

A warm welcome to those who joined Team AFN in October, November & December.

Liam Halforty

Business Development Manager

Linda Kugelmann

Processor

Lori Crane

Sr. Processor

Manuel Sanchez

Loan Officer

Margaret Vierra

Business Development Manager

Marilou Pangan

Executive Assistant

Mario Damiao

Loan Officer

Mario Teixeira

Regional Sales Manager

Mark Masters

Corporate Counsel

Martha Blanco

Business Development Manager

Matthew Burris

Transitional Loan Officer

Matthew Gilday

Loan Officer

Melissa Chavez

Compliance Analyst

Michael Everhardt

Business Development Manager

Monica Diaz

Nicholas Luciano

Business Development Manager Loan Officer

Priscilla Teixeira

Randi Scott

Transitional Loan Officer Loan Officer

Richard Berg

Branch Manager/LOA

Robert Alasia

Sherry Jenkins

Loan Officer Assistant

Sina Abdollahi

Loan Officer

Tania Dalia

Transitional Loan Officer

Terri Klusman

Business Development Manager

Tia Payne

Loan Officer

Tom Anderson

Transitional Loan Officer

Robert Kaye

Processor Loan Officer

Ross Ivey

Sanya Cameron

Schanda Maney

Scott Allgood

Transitional Loan Officer Loan Officer Assistant Underwriter Loan Officer

Seamus Mckeever

Seven Rico

Shara Rubenstein

Opener Loan Officer Business Development Manager

Tony Rodriquez

Transitional Loan Officer

Vanessa Arellano

Jr. Processor

Verena Johnson

LOA/Marketing Assistant

William Nuckols

Business Development Manager

Yusleidy Roque Viera

Transitional Loan Officer

Zilca Diaz

Transitional Loan Officer

1,175 Units for $429,296,668

Total Banked & Brokered

Retail Banked 639 units for $220,450,301

Wholesale Orion Lending finished at 456 units for $189,668,280

Total Banked for all: 1,095 units for $401,012,326

Retail Brokered Out Another 80 units for $28,484,326

Top 10 Branches by Volume

units for $17,677,054

units for $9,306,550

Branch 13 units for $4,582,922

Top 10 Branches by Units Burlington

Top 3 Retail Divisions by Volume

Northeast Division

Patriot Division

48 units for $18,416,983

468 units for $146,764,393 Southwest Division

33 units for $12,014,996

Top 3 Retail Regions by Volume

Brian Eller/Ryan Sloper Region

units for $17,677,054

$14,108,886

$7,749,004 Landmark Mortgage Planners

20 units for $9,306,550

$6,352,920

16 units for $5,977,045

$4,582,922

89 units for $30,036,942 Southwest Region 33 units for $12,014,996

Central Mountain Region 62 units for $17,373,076

units for $4,308,078

The Carter Group 12 units for $3,560,779 Athens Virtual 12 units for $5,216,104

Joseph

Cynthia Urbano/Jennifer Jurs

Sam Rumi

Daniel Munoz/Jacob Emmel

Juan Kelley/Gary Thompkins

Courtney Lalonde/Creagan

$156,980,140

Top 10 Branches by Volume

Top 3 Retail Divisions by Volume

Northeast Division

352 units for $107,764,728

Division

units for $17,005,344

Division

units for $8,909,020

Top 3 Retail Regions by Volume

Brian Eller/Ryan Sloper Region

units for $27,758,703

units for $13,656,743

units for $12,191,040

Top 10 Branches by Units

units for $12,789,114

$4,230,078

units for $2,908,200

Production 1,151 Units for $384,445,057 Total Banked & Brokered

Retail Banked 533 units for 160,144,832

Wholesale Orion Lending finished at 558 units for 203,181,813

Retail Brokered Out Another 60 units for $21,118,412

Top 10 Branches by Volume

units for $11,361,371

Top 3 Retail Divisions by Volume

Northeast Division

403 units for $124,766,392

Patriot Division 33 units for $10,134,619

Winblad Division 21 units for $6,804,930

Top 3 Retail Regions by Volume

Brian Eller/Ryan Sloper Region 107 units for $35,187,645

Central Mountain Region

units for $16,243,138

Landmark Region

units for $9,483,749

units for $7,733,558

units for $3,912,742

units for $3,325,095

units for $3,223,045

Top 10 Branches by Units

units for $11,361,371

units for $8,207,075

units for $7,733,558

$3,223,045

units for $3,912,742

Myrtle Beach II 13 units for $$2,854,249

units for $3,387,177 Smiley Region

$6,593,178 Cook Team

$2,554,017

Santa Rosa 9 units for $3,143,065 Pinellas 9 units for $2,509,306 Hillsborough 9 units for $3,076,743

9 units for $5,014,800

Top 10 Branch Managers

Joseph Lose/John Bruno

Jason Turner

Traditional Retail

Cynthia Urbano/Jennifer Jurs

Traditional Retail

Fritz Reichardt/Rob Ziebart

Traditional Retail

Frank Contreras

Traditional Retail

Gabriel Garza Traditional

Sean Smiley

Courtney Lalonde/Creagan Berry

Traditional Retail

Daniel Munoz / Jacob Emmel

Traditional

Eliseo Carrillo Jr

Traditional

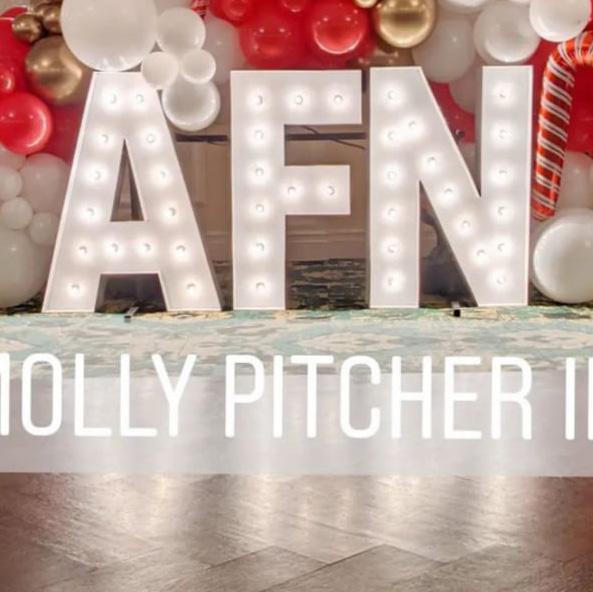

Attention: Loan Officer, Processor, Underwriter, Doc Drawer, Funder | Encompass Newsflash #523

To ensure that Conventional loans utilizing LPA with an LTV >95% are underwritten correctly, we have added a new alert and hard stops in Encompass.

If the alert is present, users will need to update the loan program to CF30 HomeOne, if the loan was underwritten as HomeOne, or select an Offering Identifier on the Freddie Mac Additional data screen if proceeding with a different product (e.g., Home Possible).

If the alert is not cleared, hard stops will appear at the following milestones or events:

• PTD Reviews milestone

• Why Can’t I Order Docs

• Doc Request

• Funded Date

Calculating business liquidity can provide powerful insight when assessing the financial health of a business. Find out exactly what liquidity tells us, how it is calculated, and the 3 ways this information is used while cash flowing a business in this video from MGIC.

Thank you for participating and sharing your appreciation for your fellow Team AFN members. We encourage you to keep submitting props for your co-workers! Below are just a few that were submitted in October, November and December.

Awarded to: Courtney Moore, Closing/Funding Manager

I'm truly fortunate to have Courtney as my boss. She is always welcoming and informative, and no matter how many times you call, she never makes you feel like a bother. Always in your corner, she's a true team player with the kindest, biggest heart. I hope you enjoy your day! :)

GIVEN BY: LAKEISHA BRAXTON | CLOSER/FUNDER

Awarded to: Kirstin Rowley, Creative Marketing Manager

Kirstin continues to be my go-to for great marketing emails! She is super responsive & so creative. AFN Marketing rocks! :)

GIVEN BY: SARA THOMPSON | PRODUCT MANAGER

Awarded to: Laiza Estrada, Operations Analyst

Laiza is always willing to help out and disclose files. She helps the files keep moving quickly and has great response time.

GIVEN BY: JULIE WALDRON | LOAN OFFICER

Awarded to: Taylor Albaugh, Doc Drawer / Funder

Taylor was the real Hero this month for us, not only did he tolerate a ton of loans with a difficult Closing Agent, but he worked to try to solve the issues we were having with them, and to say I appreciate him so much is an understatement, our branch cannot thank him enough. He was amazing!

GIVEN BY: GINA MCGINLEY | LOAN PROCESSOR

Congratulations to our October winner:

Courtney Moore

Congratulations to our November winner: RJ Vora

Congratulations to our December winner:

Awarded to: RJ Vora, Underwriting Manager

RJ takes the time to research, takes initiatives to reach out to investors even prior to the branch asking for it. He makes sure to give prompt direction to his UW in the time of needs. His responses are more than amazing. His knowledge with the nonQM guidelines is super great. It is very encouraging for our loan team to continue to bring in the deals in house. We can't thank RJ enough for all his help and super fast responses to our team despite his super busy schedule.

GIVEN BY: VAN NGUYEN | NON PRODUCING MANAGER/LOAN PROCESSOR

Awarded to: Nina Nabiyeva, Senior QA Analyst

Excellent quality of work and superior level of testing and overall outstanding individual. Nina has been a most reliable and kind co-worker. I'm so lucky to have her on my work team. She is the best of the best at her job. When AFN hired Nina, it was a great day. Specifically, for SNAP Suite she has caught so many outlier bugs, prior to production, she is invaluable. Cheers to Nina and all the extra work you do for us in SNAP Suite!

GIVEN BY: SEAN PATRICK, REGIONAL BRANCH MANAGER

Awarded to: Ferris Hundertmark, VA IRRRL/FHA Streamline Underwriter

October was a challenging month for our team, we had several streamlines, and no back up team. I just really appreciate Ferris; he made sure to communicate with me constantly all month, and it really helped! He was really terrific, and we appreciate all he did!

GIVEN BY: GINA MCGINLEY | LOAN PROCESSOR

I've been working with Brian for years and his knowledge and experience are always exemplary. Thank you!

Sarah and her team were so easy to work with. They are knowledgeable, communicative and working hard to get the job done. I can't thank them enough for all they did for me.

John went above and beyond to ensure I was fully prepared for the homebuying process. He explained each step clearly, making sure I felt comfortable and informed throughout. John genuinely cared about my family’s journey to closing and crossing the finish line—I never felt like just another number. Even when I had to pause at the beginning, John checked in with me, asked the right questions, and provided the encouragement and confidence I needed to move forward. I couldn’t have asked for a better loan officer!

My experience was great for a multitude of reasons. Marlene 's approach, however, made me comfortable throughout the entire process. For example, all questions I had were answered, Marlene kept me informed, and she and her team demonstrated professionalism.

When I bought my first home Sue and her team made it seamless and easy so I knew Landmark is who I would go with when I went about purchasing my second home! I had just as great if not better of an experience!

If I could give more stars I would! The level of expertise is unmatched. Alex and the whole team are beyond incredible! They made a stressful process easy to understand and navigate. The time and investment they give to each of their clients makes referring them and continuing to work with them in the future an easy choice!

Jen and her team kept us informed throughout the process of our loan. It was more difficult for us because we are self employed, however Jen did not waiver. She even went out of her way to help our co-signer sign paper work so we could stay on track with closing . Sarah Gray was also great! Very polite and informative team!

entire process with an incredible amount of patience. Our situation required a great deal of urgency and they made it happen. We are beyond happy and in our home! We will continue to use Hector and his team for our lending needs.

HUD announced the new FHA 2025 Nationwide Forward Mortgage Limits, effective for case numbers assigned on or after January 1, 2025. Utilize this marketing package to inform your database of this increase!

Find flyers and emails in iConnect with keyword "2025 Loan Limit."

The new baseline limit for mortgage loans to be acquired by Fannie Mae and Freddie Mac in 2025 for one-unit properties is $806,500. Utilize this marketing package to inform your database of this increase!

Find flyers and emails in iConnect with keyword "2025 Loan Limit."

A free and easy to use social media platform is available to AFN Loan Officers to help you manage your social media pages. Gain access to AFN content that automatically posts to your pages and keeps your social feeds full!

Don't miss this opportunity to stand out on your social feeds.

Powered by

The weekly social media content email has transitioned to full automation through Social Coach.

The weekly content email no longer includes content suggestions as all content will be accessible in the Social Coach library and campaigns. If you do not have a Social Coach account or need help connecting your social media profiles, please reach out to marketing@afncorp.com Explore our training page for comprehensive details on how Social Coach will seamlessly deliver all the familiar content you've come to expect directly to you. Social Coach Trainings

By Leonard Kupersmith, Divisional Controller, NE Division | January 2025

In a world often dominated by numbers, charts, and serious discussions about economic trends, the role of comedy relief in finance can seem counterintuitive. However, humor plays a crucial role in making financial concepts more accessible, engaging, and even enjoyable. Let’s explore how comedy can enhance our understanding of finance and the benefits it brings to both professionals and the general public.

By Lenny Kupersmith, Divisional Controller | September 2023

Finance is filled with jargon and complex theories that can be intimidating to many. Comedians and humorous content creators often break down these concepts using relatable analogies and witty commentary. For instance, comparing stock market fluctuations to the unpredictability of a dating app can help demystify investing for a younger audience. This accessibility fosters a better understanding of financial principles among individuals who might otherwise shy away from the subject.

The mortgage industry can be a fickle business, with fluctuating interest rates, changing regulations, and unpredictable economic conditions. However, one thing that has remained constant over the years is the need for resilience in the face of adversity. In times of economic downturn, the mortgage industry has proven time and time again that it can weather the storm and emerge stronger on the other side.

Financial stress is a common issue faced by many. By incorporating humor into financial discussions, comedians can help alleviate some of this anxiety. Jokes about money problems, budgeting mishaps, or the struggles of saving can create a sense of camaraderie among listeners. When individuals see that they are not alone in their financial challenges, they may feel more empowered to tackle these issues head-on.

One of the key factors that contributes to resilience in the mortgage industry is a focus on risk management. Lenders who can identify and mitigate risks early on are better positioned to weather economic downturns. This means conducting thorough due diligence on potential borrowers, carefully evaluating the value of collateral, and maintaining a diversified portfolio of loans.

In an age of information overload, capturing and maintaining an audience's attention is vital. Financial content infused with humor can be far more engaging than dry, technical explanations. Podcasts, YouTube channels, and social media posts that feature comedic elements attract larger audiences, which can help spread essential financial knowledge to those who might not otherwise seek it out.

Comedy can serve as a bridge between different generations, particularly when discussing topics like investing and saving for retirement. Humorous skits or memes that resonate with younger audiences can spark interest in financial literacy. Conversely, older generations can appreciate humor that reflects their own experiences, creating an opportunity for intergenerational dialogue about money management.

Another important aspect of resilience in the mortgage industry is a commitment to customer service. During an economic downturn, borrowers may be struggling to make their mortgage payments, and lenders who are able to work with them to find solutions are more likely to retain their business in the long run. This may involve offering forbearance or loan modifications, or simply being responsive and communicative with borrowers who are experiencing financial difficulties.

Financial literacy is a critical skill that can improve an individual’s quality of life. By using humor in educational content, financial advisors and educators can make learning about money fun. For example, animated videos that feature humorous characters navigating financial pitfalls can teach valuable lessons in an engaging way. This approach not only entertains but also leaves a lasting impression on the audience.

Finally, a willingness to adapt and innovate is critical for resilience in the mortgage industry. As economic conditions change, lenders must be able to pivot their strategies and offerings to meet the evolving needs of borrowers. This may involve developing new loan products, leveraging technology to streamline processes and improve efficiency, or exploring alternative sources of funding.

While humor can enhance financial discussions, it’s essential to use it wisely. Misinterpretation of jokes or satirical content can lead to misunderstanding of serious financial principles. Therefore, creators must strike a balance between humor and clarity to ensure that the comedic elements do not overshadow the educational value.

Overall, resilience in the mortgage industry during an economic downturn requires a combination of risk management, customer service, and adaptability. Lenders who can embody these qualities are more likely to emerge from challenging economic conditions with their businesses intact and their customers satisfied.

Comedy relief in finance is more than just a tool for entertainment; it’s a powerful means of communication that can enhance understanding, reduce anxiety, and promote financial literacy. By making financial discussions more approachable and engaging, humor can play a vital role in fostering a financially literate society. As we continue to navigate the complexities of the financial world, let’s embrace the power of laughter to enlighten and empower individuals on their financial journeys.

Congratulations to those with an AFN Anniversary in November!

MONIQUE BANKS

AFTON BROWN

CHANDA TIMSINA

DANIEL TIBOCHA

DAVE DRUCKER

ISABEL RIBAU

NATE PASS

PERLA VASQUEZ

RICK SPANO

TINA COLEMAN

MARK MANALO Four Years

DARRIE AQUINO

JACKIE STATON

KATHERINE MEMITA

ASHLEY GARZA

CHARLES COLETTA

EDWARD AGUIRRE

EMMANUEL RODRIGUEZ

GABRIEL GARZA

ILIANA AGUILAR

JIMMY MYERS

KAZUFUMI KOGAWA

KIMBER SHAN

KRISTIN FRAZHO

MARIA ROSA

RUFINA GUINTO

SHANNON GOLLOWAY

SULMA GUERRERO

TERESA FISHER

TIFFANY LENZ

ANTHONY GONZALEZ

MICHAEL CARRILLO

Ten Years

GEORGE DALOU

CHIP HOPKINS

HEATHER ANN HUGHES

JOEY JIMENEZ

Five Years

AMINAH ST FLORANT

HEMANTH KOTHANDA

JOCILYN HOPPER

REBECCA SKILES

RYAN SLOPER

Eleven Years

STEPHANIE RONQUILLO

KAYLA TRUJILLO

KRISTINA GARCIA

RICHARD YONIS

RACHEL PENAS

RICCI MERENDINO

TIMOTHY TRAYWICK

TIFFANY BOGERTY

VICTORIA STEIN

ZAIRA FLORO

Six Years

AIME PAZ

Eight Years

CAMERON SARANCZAK

GRACE KHOR

LISA PETRAS Fourteen Years

JOSEPH SAVINO

RYAN MATLACK

ANDREW MENTE Sixteen Years

Congratulations to those with an AFN Anniversary in December!

One Year

ASHLEY CRUGNALE

BETH YOUNG

BRIAN HALL

CAROL HASLER

COLLEEN BUTLER

DANIEL SHOEMAKER

ENMANUEL SANCHEZ

Two Years

AMBER FUTCH THOMAS

ANGELA WILSON

BOB DEICHMAN

BONNIE VORWERK

CLEM CABILES

DAMIAN BURRIS

Three Years

CARRIE ANDRADE

CHRISTOPHER HERRERA

ABREU

COURTNEY LALONDE

CREAGAN BERRY

DAVID ARCHER

DEANO TRACEY

Four Years

CHRISTY LOGHRY

JESHANA TUDIAS

MARINEL MAQUILING

PRECIOUS LANTO

ISABEL BARROWS

JONATHAN CHICAS

JONATHAN HUGHES

LIBBY KRONTHAL

RALPH LOPEZ

RAUL LEYVA

TERI RAGON

ENAN FRIAS

GLENN KINNEY

JESSICA PHONGSYMAY

DAVID GAFFNEY

ENZO CORDEIRO

JUSTIN PIERCE

KOREY DOUCETTE

MIKI PEREZ

NOELLE KHALIL

HUNTER FISH

JENNIFER OLLER

KEITH WILLIAMS

KEVIN MCGRANER

LENA DEVERY

SHANIA VILLARAMA

VIVIANNE MADEIRA

WILLIAM LAMB

WILLIE MORGAN

Six Years

JOSEPH LOSE

KYLIE QUEEN

JULES FORD

NICOLE COLLIER

SEBASTIANO VASTA

Seven Years

ROSSELYN MORATAYA

Eight Years

ARIANA MOORE

BASIL LEONETTI

Nine Years

ANDREW KALYVIARIS

APRIL HONG

GINA MCGINLEY

KEVIN MCRAE

MARLENE SMITH

STEVE RODGERS

WESLEY CHAVEZ

Ten Years

ASHLEE BUCKLEY

JUDE BRENNAN

Eleven Years

COURTNEY MOORE

Fourteen Years

EFREN PADILLA

Congratulations to those with an AFN Anniversary in January!

CAMERON MCGINLEY

DANIELA CUEVA

DEVIN ANDREW

ELIZABETH COOK

JB BOLAND

AL REED

ARIEL RODRIGUEZ

BRITTANY MOORE

GARY SCHICK

JENNIFER SAING

JONATHAN HOFFMAN

KASEY BOONE

LOU CARTER

MARYBETH VALLEJO

JILLIAN VAUGHN

JUSTIN EDWARDS

MUHAMMAD PATEL

RON CASTRO

MELISSA ALCOCER

MICHAEL GRAFFEO

SAMANTHA DWYER

ROY BOYD

TRENT HECKMAN

TYLER MOORE

CATHERINE HA

LOVELY DELACRUZ

MICHELLE SCARPA

RICK ASRANI

SARAH SPICER

SUSANNAH BROEGLER

CELISSE PENSON

CHRISTIAN BELIC

JOSE ACEVEDO

KATHERINE BERNARDO

MATT SANDERS

GUSTAVO BERDEJA

KELLY OAKES

NINA DELA CRUZ

ROLLIE MABBUN

SAMUEL SPITZER

SARA THOMPSON

TATIANA HERRERA

MIKE HAJJAR

WILLIAM KOUMPARIS

Eleven Years

SUSIE SENSENBACH

Twelve Years

HECTOR ESTRADA

MATHEW GRUBER

THOMAS SHERMAN

Six Years

BRANDON FINDLEY

CANELLA KUMKE

DANIEL BARRON

DONALD MANUEL

JOHN BRUNO

JULIE HULBERT

MARC DE STEFANO

RONNIE SOLOMON

SEAN TATE

STEVEN RICHMAN

Fifteen Years

CATHY OLIVEIRA

JODI LIMB

KENT REID

MARIA GUILLEN

MITCHELL OLIVEIRA

MORGAN SISSENER

TIM PRINDLE

Seven Years

JUSTIN PRIEST

MARY TRUJILLO

MICHELLE GRAZIANO

VINCENT SINEX

Eight Years

BRIAN NGUYEN

DEBRA MAXEY

NICHOLAS GALLICCHIO

TED CLAVEL

Sixteen Years

LUIS VASQUEZ

E rli za Do blu i s

Je re my Alle n

Rai n e Bu co

S o a Gan dari o

S te ph an y Garci a Vladi mi r Ki sli n ge r M arc Padlan Rach e l Pe n as

Bri an C u sh i n g

C h ri sto ph e r M adaski

C ri s Oclari t

E ri ca Rami re z

Ju sti n Jarbo

Ki mbe rly He ste r

Ro be rto M e n do za

Vi n ce n t Di me lla C h ri sto ph e r M cdo u gall

ANTHONY

JOSEPH

MARTHA

C h ri sty Lo gh ry

NATALIE WATSON

C lau di a S an ch e z

WILLIAM

Je e rso n Bu tle r

S ydn e y W i lli ams

BRITTANY

JEFFREY ROSENBERG

LORI PIKE

MICHELLE BOBBITT

NICOLE COLLIER

PAIGE GIFFORD

TAMI RADFORD

C lau di a Zambran o Jai me Bo we n T ri sh a M o rri so n W alte r Parke r Dan i e lle S ti lle y

Li sa M aso n

Pre ci o u s Lan to Rad De lan y

De smo n d Ree d

Ke vi n T h o mpso n S h ann o n Lan ge n

DANIEL SHOEMAKER

DANIELLE KREAMER

ROBERT ALASIA

TOMASINA TATTERSON

SCHAFFER

HALEY MARTI

JESHANA TUDIAS NOEMI PEREZ

CHUNG TSAI TONG HIRSCH UNGAR

BRANDON LEE PEGGY HINES

CHRISTINA MAINE

JONATHAN CHICAS 11 12 13 14

ACAIA MAYFIELD

BRUCE NOHE

HAILEY CASTILLO

JD TORRES

JOSEPH SAVINO

LIZ RIVERA

DAVE HECHT

MARC DE STEFANO

ROBYN WILL

JESSICA TARRIELA

JOSEPH DILUCCHIO MOBIN HOSSAIN

ERICA HARPER PRISCILLA TEIXEIRA

ALEJANDRA CHANELO

JOHN HARDY

RACHEL CARMICHAEL

STEED

AMY HART

ANNA MARIE MASSIESHLEMAN 25 26 27

JEREMY MCBEE NANCY CONNORS

ASMITA THAPA MARINEL MAQUILING

CRISTINE ZAFE

KYLIE QUEEN

PAUL LATERZA

SHANNON GOLLOWAY

E rli za Do blu i s

Je re my Alle n

Rai n e Bu co

S o a Gan dari o

S te ph an y Garci a Vladi mi r Ki sli n ge r

ADOLPHUS

CHRISTIAN BELIC

Bri an C u sh i n g

EMMANUEL RODRIGUEZ

arc Padlan Rach e l Pe n as

C h ri sto ph e r M adaski

GURPREET KAUR

C ri s Oclari t

JOHN BERARDINO

E ri ca Rami re z

NODIA HASKINS

Ju sti n Jarbo

Ki mbe rly He ste r

Ro be rto M e n do za

Vi n ce n t Di me lla

BRIAN SLODKI

SAMUEL

C h ri sty Lo gh ry C lau di a S an ch e z Je e rso n Bu tle r

S ydn e y W i lli ams

ELIZABETH PAPARO

MARGARET VIERRA

MATT CASON

JAMES CHAMBERS

JILLIAN VAUGHN

WILLIE MORGAN DEANNA ASHTON

C h ri sto ph e r M cdo u gall

C lau di a Zambran o Jai me Bo we n T ri sh a M o rri so n W alte r Parke r

MAYRA CALDERON

SARAH BEASLEY

EDWARD AGUIRRE

ERIC STEPHENS

LUKE SPARKS

Li sa M aso n Pre ci o u s Lan to Rad De lan y

BOHDANOWICZ

VALLEJO

JESSICA MCRAE

JUSTIN PRIEST

KATHERINE BERNARDO

LARAH MANALO

PHILLIP ELLER

i e lle S ti lle y De smo n d Ree d Ke vi n T h o mpso n S h

d

o n Lan ge n

AMARIS COSTA

KIRAN GANDHAM

LAUREN AYALA

MORGAN SISSENER

SARA THOMPSON

ANGELICA CATACUTAN

ANTHONY CATO

CARISSA CABANILLA

DIANA SANCHEZ GALLO

ELLA BODOSO

JENNY TORDECILLA

JESTER MORENO

JUSTIN REYES GUTIERREZ

KEN DUPAN

ALEX ROSALES

TODD WAUHOB

YESICA BARRIOS

CAMERON SARANCZAK

JACOB SPARKS

OLGA VOROBYOFF

SARAH BROWN

TANIA DALIA

DANIELA CUEVA

NIGEL NEWLAND

ASHLEY CRUGNALE

CHRISTOPHER ULDRICKS

DENNIS DONAHUE

ELLAI OCLIAZO

STEVE RODGERS

JOSE BUGARIN

MARITZA NIEVES

AJ BEFUMO

ANNMARIE DELIA

ARIEL RODRIGUEZ

HOLLIE GRIFFIN

KENNEDY HUDSON

ALYSON PIERCE

DAVID AZOROH

NOAH AGUIRRE

BRETT LABADIE

GARY MILLER

JOHN CAINZOS

SHERRY JENKINS

ERIKA BEFUMO

GELEEN BORELA

JOEY JIMENEZ

JUSTIN EDWARDS

MICHAEL LEBRUN

MICHELLE GRAZIANO

NINA DELA CRUZ

JOY PRESCILLA TERRI KLUSMAN

KATIA PEREIRA

TAYLOR ALBAUGH

AMBER FUTCH THOMAS

ANDRE MORETTO

CHANDLER BLANCHET

DEBRA BARRON

JOAN WALSH 29 30 31

BILLY SANTOS

TAYLOR OLBRANTZ

TIFFANY BROWN

HECTOR BRACERO KUILAN

JENNIFER BOWMAN

E rli za Do blu i s

Je re my Alle n

Rai n e Bu co

S o a Gan dari o

S te ph an y Garci a Vladi mi r Ki sli n ge r M arc Padlan Rach e l Pe n as

Bri an C u sh i n g

C h ri sto ph e r M adaski

C ri s Oclari t

E ri ca Rami re z

Ju sti n Jarbo

Ki mbe rly He ste r

Ro be rto M e n do za

Vi n ce n t Di me lla

C h ri sty Lo gh ry

C lau di a S an ch e z

Je e rso n Bu tle r

S ydn e y W i lli ams

C h ri sto ph e r M cdo u gall

C lau di a Zambran o Jai me Bo we n T ri sh a M o rri so n W alte r Parke r Dan i e lle S ti lle y

Li sa M aso n

De smo n d Ree d

Ke vi n T h o mpso n S h

Pre ci o u s Lan to Rad De lan y Davi d

LORI

ALISON MCCARDEN KELLIE ARMES 5 6 7 8

BENJAMIN BENAVIDEZ AL REED GIOVANNI EVANGELISTA

RICCI MERENDINO 12 13 14 15

ALENA WATSON

CAIRO CARRILLO

DAVID COOPER

ELISEO CARRILLO JR

ENZO CORDEIRO

FERNANDO KERR

GULMIRA SHAISLAMOVA

HOOMAN MIRZAEI

CONNIE CLICHE

DANNY TERRY

DEBORA KERR

MARCUS HILLS

ROSEMARIE PUGASA

TIFFANY ALFARONE

HASNUL QAZI

MATT SANDERS

REEMA SHAHEEN

CHRIS GREENIDGE

JASON BEHUN

KATHY MURISON

KATZ TENGCO

KOREENA CUCALON SAMUEL KEMPTER 19 20 21 22

FRANCIS COLOSA

IAN SMITH

JOSEPH AGANOWSKI

ERIKA MONTEIRO 26 27 28

CHRISTOPHER JOLLIFF

CYNTHIA URBANO

DEBORAH ARMSTRONG

JUAN KELLEY

KIMBERLY CAREY-IVY

RUFINA GUINTO

Join AFN Loan Officer Ian Smith and Community Options, Inc. in supporting individuals with disabilities! Participate in the 2025 Silver Spring Cupid's Chase 5K to help provide housing, transportation, recreation, and employment resources for over 5,000 individuals. Not in Silver Springs, MD? This year’s race spans 46 cities across 11 states, bringing together nearly 10,000 runners, donors, and volunteers. View below for ways to donate and to find a race near you!

Goodbye 2024

O n w a r d s & U p w a r d s

A h e a r t f e l t t h a n k y o u t o e v e r y o n e w h o

j o i n e d u s f o r t h e c o r p o r a t e h o l i d a y

l u n c h e o n a n d m a d e i t s u c h a j o y f u l

c e l e b r a t i o n . T h i s e v e n t w a s a

w o n d e r f u l r e m i n d e r o f t h e i n c r e d i b l e

t e a m s p i r i t t h a t d r i v e s e v e r y t h i n g w e

a c c o m p l i s h t o g e t h e r .

L A F i r e R e s o u r c e s

T h e L A f i r e s h a v e b r o u g h t i m m e n s e

d e v a s t a t i o n , a f f e c t i n g c o u n t l e s s l i v e s .

W e e n c o u r a g e y o u t o r e v i e w t h i s f l y e r

w h i c h c o n t a i n s d o n a t i o n

o p p o r t u n i t i e s , a n d r e c o v e r y r e s o u r c e s

f o r t h o s e d i r e c t l y a f f e c t e d , a n d s h a r e

i t w i t h a n y o n e w h o m a y n e e d s u p p o r t .

C o s t o f L i v i n g A d j u s t m e n t a n d

U p d a t e d 4 0 1 ( k ) C o n t r i b u t i o n s

L i m i t s f o r 2 0 2 5 - I n c r e a s e s t o

$ 2 3 , 5 0 0 f o r t h o s e u n d e r 5 0 .

I R A C o n t r i b u t i o n s s t a y e d a t $ 7 , 0 0 0

f o r t h o s e u n d e r 5 0 y e a r s o f a g e .

G i f t i n g L i m i t s i n c r e a s e d t o $ 1 9 , 0 0 0

p e r d o n e e .

R e q u i r e d M i n i m u m D i s t r i b u t i o n s

( R M D s ) c u r r e n t l y s t a r t a t a g e 7 3

a n d e q u a t e t o a w i t h d r a w a l o f a

l i t t l e u n d e r 4 % o f t h e 1 2 / 3 1

r e t i r e m e n t a c c o u n t b a l a n c e .

S e e a t t a c h e d f o r m o r e d e t a i l s !

AFN is pleased to announce the addition of a new floating holiday! This benefit allows you to take a paid day off on a holiday of your choice when AFN remains open for business.

To use your floating holiday: Select your chosen holiday. Submit your request for time off through Paycom. Ensure you indicate it is for the floating holiday to receive your paid day off.

We hope this provides you with greater flexibility to celebrate holidays that are meaningful to you!

Regular full-time, non-sales employees are eligible for holiday pay.

To qualify for holiday pay, you must work the scheduled workday immediately before and after the holiday.

Please reference the employee handbook for more details.

Contributors

April Hong

VP of Processing

John Sherman

Chief Executive Officer

Kristin Sensenbach

Social Responsibility Specialist

Lenny Kupersmith

Divisional Controller, NE Division

Nasim Tourigny VP of Underwriting & Credit Policy

Yvette Hildago

Assistant Director of HR

Raul Esparza

Branch Relations Manager

Stephanie Esparza VP of Closing and Funding

Twyla Hankins

Chief Operating Officer

Editor-In-Chief

Lisa Petras

Director of Corporate Communications

Managing Editor

Corey Trujillo VP of Marketing & Events

Designers

Ashlee Buckley Director of Marketing

Kirstin Rowley

Marketing Creative Manager

Hanz Lucero

Graphic Designer