8 minute read

SCORING BOXES

OFFICERS

Chairman: Gene Marino, Akers Packaging Service Group, Chicago, Illinois First Vice Chairwoman: Jana Harris, Harris Packaging/ American Carton, Haltom City, Texas Vice Chairs: Matt Davis, Packaging Express, Colorado Springs, Colorado Gary Brewer, Package Crafters, High Point, North Carolina Finn MacDonald, Independent II, Louisville, Kentucky Immediate Past Chairman: Jay Carman, StandFast Packaging Group, Carol Stream, Illinois Chairman, Past Chairmen’s Council: Joe Palmeri, Jamestown Container Cos., Macedonia, Ohio President: Michael D’Angelo, AICC Headquarters, Alexandria, Virginia Secretary/General Counsel: David Goch, Webster, Chamberlain & Bean, Washington, DC AICC Canada: Renee Annis

Advertisement

DIRECTORS

West: Jack Fiterman, Liberty Diversi ed Industries, Minneapolis, Minnesota Southwest: Michael Drummond, Packrite, High Point, North Carolina Southeast: Ben DeSollar, Sumter Packaging Corp., Sumter, South Carolina Midwest: Casey Shaw, Batavia Container Inc., Batavia, Illinois Great Lakes: Josh Sobel, Jamestown Container, Macedonia, Ohio Northeast: Stuart Fenkel, McLean Packaging, Pennsauken, New Jersey AICC Canada: Terri-Lynn Levesque, Royal Containers Ltd., Brampton, Ontario, Canada AICC Mexico: Sergio Menchaca, Eko Empaques Carton, Guanajuato, Mexico

OVERSEAS DIRECTOR

Kim Nelson, Royal Containers Ltd., Brampton, Ontario, Canada

DIRECTORS AT LARGE

Kevin Ausburn, SMC Packaging Group, Springfi eld, Missouri Eric Elgin, Oklahoma Interpack, Muscogee, Oklahoma Guy Ockerlund, OxBox, Addison, Illinois Mike Schaefer, Tavens Packaging & Display, Bedford Heights, Ohio

EMERGING LEADER DELEGATES

Cassie Malone, Corrugated Supplies Co. LLC, Chicago, Illinois Lauren Frisch, Wasatch Container, North Salt Lake, Utah John McQueary, CST Systems, Atlanta, Georgia

ASSOCIATE MEMBER DIRECTORS

Chairman: Joseph Morelli, Huston Patterson Printers, Decatur, Illinois Vice Chairman: Greg Jones, SUN Automation Group, Glen Arm, Maryland Secretary: Tim Connell, A.G. Stacker Inc., Weyers Cave, Virginia Director: John Burgess, Pamarco, Roselle Park, New Jersey

Immediate Past Chairman, Associate Members:

Pat Szany, American Corrugated Machine Corp., Indian Trail, North Carolina

ADVISORS TO THE CHAIRMAN

Joseph M. Palmeri, Jamestown Container, Macedonia, Ohio Al Hoodwin, Michigan City Paper Box, Michigan City, Indiana Joseph Morelli, Huston Patterson Printers, Decatur, Illinois

PUBLICATION STAFF

Publisher: Michael D’Angelo, mdangelo@aiccbox.org Editor: Virginia Humphrey, vhumphrey@aiccbox.org

EDITORIAL/DESIGN SERVICES

The YGS Group • www.theYGSgroup.com Vice President: Serena L. Spiezio Content & Copy Director: Craig Lauer Managing Editor: Julia Berley Senior Editor: Sam Hoffmeister Copy Editor: Steve Kennedy Art Director: Alex Straughan Account Manager: Max Lalwani

SUBMIT EDITORIAL IDEAS, NEWS & LETTERS TO:

BoxScore@theYGSgroup.com

CONTRIBUTORS

Maria Frustaci, Director of Administration and Director of Latin America Cindy Huber, Director of Conventions & Meetings Chelsea May, Education and Training Manager Laura Mihalick, Senior Meeting Manager Patrick Moore, Membership Services Manager Taryn Pyle, Director of Training, Education & Professional Development Alyce Ryan, Marketing Manager Steve Young, Ambassador at Large Richard M. Flaherty, President, ICPF

ADVERTISING Taryn Pyle

703-535-1391 • tpyle@aiccbox.org

Patrick Moore

703-535-1394 • pmoore@aiccbox.org

AICC

PO Box 25708 Alexandria, VA 22313 Phone 703-836-2422 Toll-free 877-836-2422 Fax 703-836-2795

www.aiccbox.org

ABOUT AICC

PROVIDING BOXMAKERS WITH THE KNOWLEDGE NEEDED TO THRIVE IN THE PAPER-BASED PACKAGING INDUSTRY SINCE 1974

We are a growing membership association that serves independent corrugated, folding carton, and rigid box manufacturers and suppliers with education and information in print, in person, and online. AICC membership is for the full company, and employees at all locations have access to member benefi ts. AICC o ers free online education to all members to help the individual maximize their potential and the member company maximize its profi t.

WHEN YOU INVEST AND ENGAGE, AICC DELIVERS SUCCESS.

The Right People in the Right Seats

Icannot recall a time when our industry was presented with the people challenges we presently face. Recent studies provide dismal news on what we can expect long-term, with an onslaught of sobering facts amid an already challenging and fatiguing pandemic. While we can certainly add pre-feeders and down stackers at machine centers, we are still and always will be a business that requires skilled talent in the form of operators, forklift drivers, designers, customer-facing staff—you get the picture.

There will never be a magic bullet for solving this issue, but proactively asking yourself what you can do on a daily, weekly, monthly, or quarterly basis to drive talent development in your business should go a long way in reducing turnover, aligning the right talent, and attracting new talent in a tough time that shows no signs of relief.

It is my opinion that the work Jim Collins did in Good to Great on getting the right people in the right seats is as “great” as it gets. The right person is someone who embodies the core values that define who you are and what you want from the culture of your organization. The right person is like a hand to a glove. If you could replicate this person, they would lead your organization to market dominance. Is that something you could say about every one of your people today? Because, make no mistake, the right person could point out the wrong person in an instant, and the wrong person is like carbon monoxide in a large room—you will not smell it or see it, but it will kill.

The right seat means that they are in the position they will be most successful in. They have the skills, experience, ability, and desire to be great at their job. They clearly understand the role, the responsibilities, and the expectations as clearly defined, and they succeed.

This is where I can sense the “yeah, I get it. That’s not the problem. I cannot even find any people.” Part of the magic is that when you define the core values, the responsibilities, and the expectations for every person and position, you can reward and recognize people more objectively.

You must review and course-correct performance with a quarterly conversation, and not only get more with less but begin to create a more solidified culture based on concrete principles that will have existing employees inviting like-minded prospects to you, regardless of the sign-on incentive. This isn’t easy. It requires work daily by you and your executive team. It must be done, and there are employers in our industry today that work at this with the discipline and energy that it requires to be successful. If it were a lack of customers, I doubt your response would be, “Gee, what will I do? There are no good customers available anymore.” On the contrary, you would dig deep, develop a plan, and execute. This is no different.

Gene Marino Executive Vice President, Akers Packaging Service Group Chairman, AICC

Infl ation Takes Center Stage

BY DICK STORAT

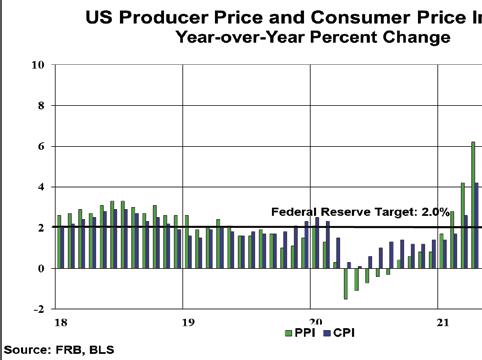

One year ago, infl ation was not even on the radar of most economists. Back then, the headlines were about vaccinations, more fi scal stimulus checks, and when and how the economy would recover. Little mention, if any, was made of labor shortages and wage hikes. Th ere was little awareness that the hyperstimulated consumer spending side of the economy would couple with pandemic issues that would soon strain the supply chain and result in higher prices for almost all goods. Th e consensus annual average forecast of infl ation for 2022 was 2% last January.

Six months ago, as supply chain bottlenecks became apparent, there was some concern about rising infl ation, but analysts were focused on shortterm commodity prices, opining that infl ation would be transitory and abate as commodity prices retreated. For example, the price of softwood lumber had gone through the roof, but it soon returned to trend levels. Th e forces driving labor shortages and higher wage off erings to attract needed labor were just developing. Th e consensus average annual forecast for the consumer price index (CPI) for 2022 had risen to 2.4%, but the emphasis was on its temporary nature, which would be resolved as soon as the supply chain diffi culties were corrected.

As this year begins, it seems likely that the supply chain bottlenecks will persist longer than earlier thought and that wages will continue to rise as manufacturers and service businesses still fi nd it diffi cult to attract enough employees. Th e omicron variant of COVID-19 has brought fresh headwinds to the economy, driven by both demand and supply challenges. Th e CPI for December 2021 grew by 7% from the previous December, the highest year-over-year growth in 39 years. Th ere is now a high probability of three or four interest rate hikes by the Federal Reserve in 2022 to tame the infl ationary growth, which is now seen as persisting at least through this year, perhaps beyond, depending on whether higher prices lead to additional wage hikes to keep up with infl ationary costs. Early in 2022, the consensus forecast is that the CPI will be up 4.8%, far above the Federal Reserve’s growth target of 2%.

Signifi cant concerns remain about COVID’s impact on personal health, education, and child care matters, coupled with an unpredicted record number of employees quitting the workforce and retiring early or searching for better pay and working conditions. Th e chart above traces the annual employee quits as a percentage of the total workforce at year-end. From a low of 12% during the depth of the 2008–2009 recession, it rose slowly over the next 12 years to 18% as the pandemic began aff ecting workforce

30%

25%

20%

15%

10%

5%

0% Annual Employee Quits as % of the Workforce

26%

16% 12% 13% 13% 14% 15% 16% 17% 17% 18% 18% 18% 18%

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

Source: Bureau of Labor Statistics

Change in Select Consumer Prices

December 2020-2021 (Overall Change = 7.0%)

Gasoline Used Vehicles Beef Steaks Bacon Lodging Furniture Eggs Fresh Seafood Apples Total 21.40%

19%

13.90% 11.80% 11% 10.20% 7.80% 7.00% 37.30% 49.60%

0.00% 10.00% 20.00% 30.00% 40.00% 50.00% Source: Bureau of Labor Statistics