3 minute read

NEW TECHNOLOGY FOCUS

Extending Digital Twins to Digital Financial Twins

The central theme of this article will be to show readers the case for AI Driven techniques to enhance data integrity and visualize the commercial impact of airworthiness data prior to taking decisions about an Aircraft, Engine or a Maintenance Visit. But let’s start by talking about the importance of data exchange platforms and financial twins in a landscape where profit margins are challenged by Supply Chain and Labor price spikes.

A DIGITAL FINANCIAL TWIN — FINTWIN

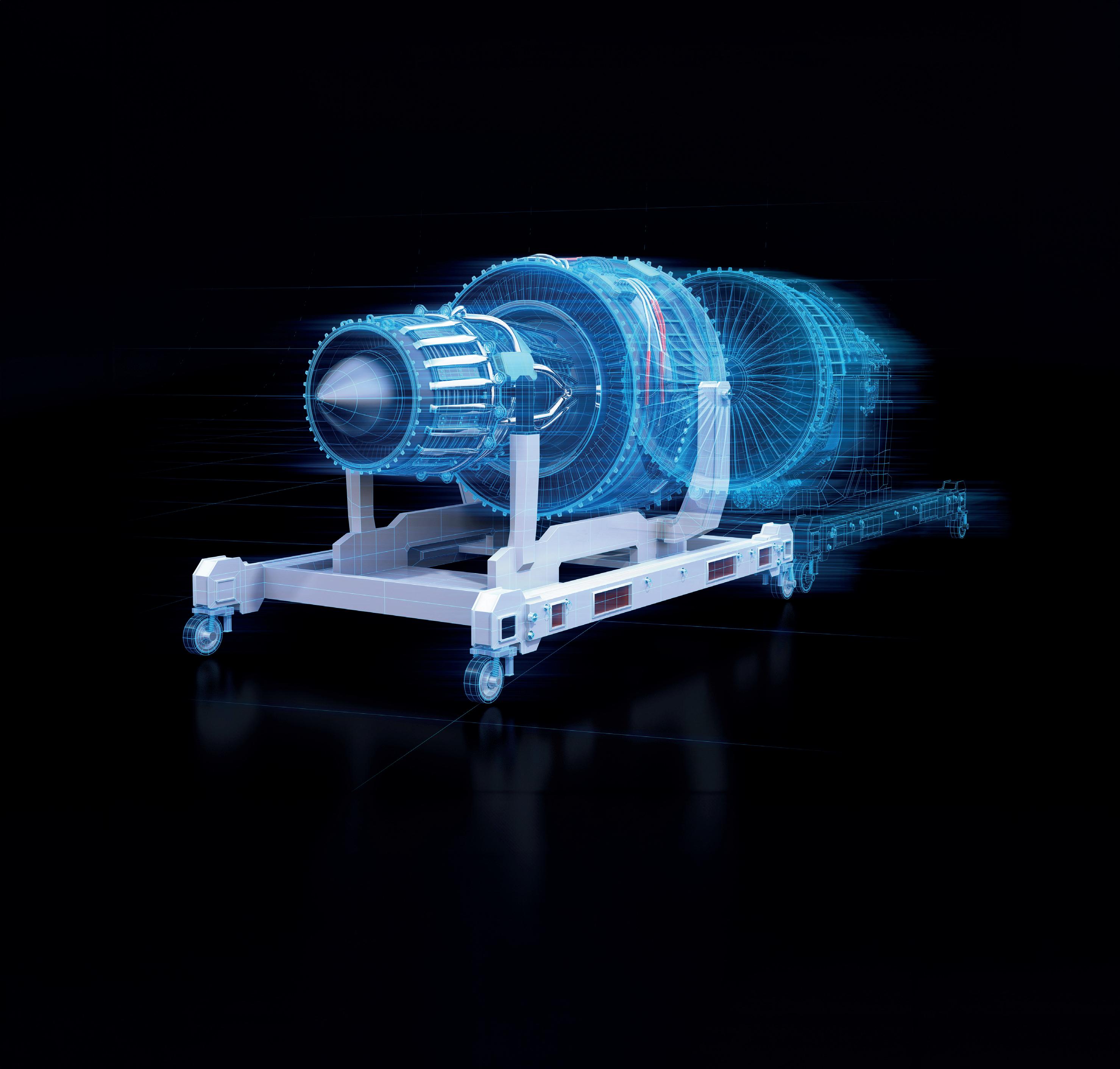

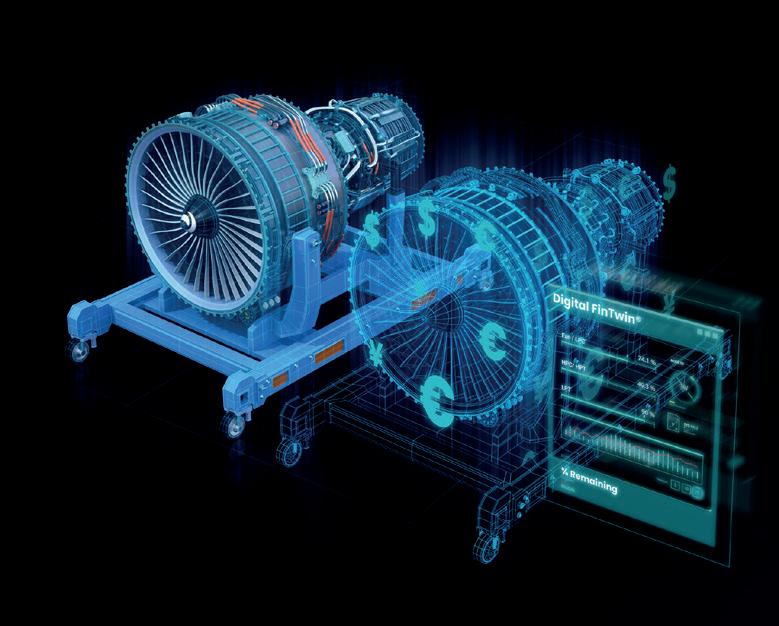

There is a lot of focus on predictive maintenance and digital twins these days whereas in reality, during the course of the pandemic, very little was being done to build tools that used the underlying airworthiness and maintenance data of an Aircraft, Engine or Component to build financial / commercial profiles. Our question was: “how can one visualize the commercial impact of a decision being taken about an Aircraft or an Engine before taking it?”. So, we are going to look at a digital financial twin ‘Digital FinTwin®’ (figure 1) which can offer insights with financial implications of decisions.

W hat is a Digital Financial Twin?

A Digital Financial Twin allows you to transform the integrity of your Maintenance and Airworthiness Data and convert them into commercial insights It will help visualize the commercial impact of your decisions before you make them - i.e. an Asset trade, an upcoming Shop Visit & Build Goal, Scrap Rates, TAT risks, Redelivery risks etc.,

Figure 1

A Digital Financial Twin (Digital FinTwin®) allows you to transform the integrity of your Maintenance and Airworthiness Data and convert them into commercial insights. That then begs the question, what is integrity? For many businesses, data is held in a variety of sources (Excel sheets, scanned PDFs, CMS, MIS, M&E / MRO systems) across departments. So, the first step is to make sense of the data because, only if you can make sense of the data can you apply financial insights on it. That is what a FinTwin® can power. It enables you to understand or realize the commercial impact of decisions before they are made, i.e., an asset trade, an upcoming shop visit, scrap rates (how much will it make, what will be the cost?), TAT risks, redelivery risks etc.

How data science enables the Digital FinTwin®

Let’s start with an opportunity statement focusing on how the industry can achieve Return on Investment (RoI) using such data platforms powered by the FinTwin® (figure 2).

Opportunity Statement

• Enhancing Maintenance & Airworthiness Data Integrity from paper / scanned PDFs

• Defining Aircraft, Engine & Component type behavioral profiles as a factor of Technical, Operational & Environmental parameters

• Building Maintenance Cost profiles as a factor of projected utilization (Technical, Operational, Environmental)

• Maximizing Residual Lives of Components, Minimizing TATs, Visualizing Costs

When dealing with unstructured data, it is important that any data model being built is Asset-type specific. This means that the model recognizes the nuances of an A320, or a B737 or a CFM56-5B or a V2500 when creating commercial profiles of each Asset. The fundamental principle to this is what the world is talking about today — Large Language Models. Large Language Models tuned to Aviation and Asset specific semantics power the engine that processes large streams of unstructured data that an Aircraft or Engine carries as part of its historic maintenance and airworthiness profiles. This is crucial in achieving accuracy when making predictions around Residual Lives, Redelivery Risks, Maintenance Cost Forecasts, Shop Visit Work Scope levels to help visualize commercial impact of decisions around a lease or a tear down, or profitability margins of an incoming Aircraft or Engine maintenance visit.

Paper and metal

The metal has value only when the paperwork supports it: the back-to-birth paperwork related to the metal is very important. That is exactly where a context driven OCR (Optical Character Recognition) is needed to extract only the data that is relevant for the Aircraft or Engine in place. Extraction of this data is followed by a set of rules inherent to the Aircraft or Engine type to check for sanity around LLP lives, applicable ADs, Configuration completeness, statuses of ARCs that are crucial to ascertaining value and mitigating risks during trades. other related parameters (operational, environmental, technical).

This further assists other departments — e.g. Supply Chain — to plan for procurement in case scrap rates are accurately predicted prior to engine arrival. With the supply chain TAT constraints today, this can be a valuable cost saving measure that the FinTwin® can power.

An extension of this use case allows the FinTwin® to help procurement and inventory cost savings through enhanced AOG procurement metrics, smarter stock level management to minimize inventory holding costs and Asset ground times.

Calculating Remaining Useful Life

An LLP status report typically shows utilization of LLPs across thrust ratings and shows remaining useful life based on cycles limit by LLP, and thrust rating minus cycles accumulated. But trained data sets with reliability models can help gauge the impact of environment, thrust rating, derate, EGT margin and other parameters on the failure rate and an accurate calculation of the remaining useful life.