You can ALWAYS use the QR code in the bottom right-hand corner to access this issue, as well as any issue we’ve printed in the last ten years.

WANT TO GET AN ELECTRONIC VERSION OF CONNECTIONS MAGAZINE? Scan and update your physical mail preferences! Look for the Members-Only Publications section, then find Connections Print Magazine and select “Unsubscribe.”

Want to keep getting the printed version of CONNECTIONS Magazine? Then you’re all set!

For those members who do not actively change their Physical Mailing Preference on their account, a printed magazine will continue to be mailed via USPS and arrive in their mailbox the first of each publication month.

We plan to print ALL remaining issues for 2023 as scheduled, so look for those in your mailbox!

Do you questions or recommendations for CONNECTIONS Magazine? We would love to hear them! Contact Communications Director Megan Hughes at your convenience.

(334) 386-5755 | mhughes@alabama.cpa

USE YOUR PHONE’S CAMERA TO OPEN SEE THIS ISSUE, PLUS SO MUCH MORE!

2022-23 ASCPA BOARD OF DIRECTORS

S. Jon Heath, Chair

James White, Jr., Chair Elect

Mandy Barksdale

Stacy Cummings

Keary Foster

Matthew Hilburn

Kendra James

Michael Kassouf

Amanda Paul

Paul Perry

Sarah Propper

Joseph Wynn

Dennis Sherrin, AICPA Council Rep

Jamey Carroll, AICPA Council Rep

James Moody, Past Chair CHIEF EXECUTIVE OFFICER

Jeannine Birmingham, CPA, CAE, CGMA

Casey Bartok

Becky Sproul

Caleb Taylor EDITOR Megan G. Hughes, APR

Happy March and April means happy Spring - my favorite time of the year. So, welcome warmer weather, longer days, chirping birds, and blooming flowers. And, on the ASCPA front, welcome student scholars, new strategic initiatives, productive busy season work, and our upcoming 104th Annual Members Meeting.

Let me begin there - the 104th Annual Members Meeting. Following last year’s success, ASCPA will meet June 13 in Birmingham at The Club for our annual gathering of Alabama CPAs. We have secured an excellent agenda of speakers and sessions including a Professional Issues Update with the dynamic Kimberly Ellison-Taylor, past AICPA chair and current CEO of KET Solutions. KET Solutions is a consulting firm that focuses on business growth, innovation, strategy, and technology. Many of us have heard from Kimberly over the past few years and will agree that her excellent knowledge of professional issues, coupled with a contagious, positive personality, make her a class favorite. We are thrilled that Kimberly once again accepted ASCPA’s invitation to speak. For a glance at the full agenda, as well as registration

opportunities, visit us online at alabama.cpa/AnnualMeeting.

In the area of strategic work, one of this year’s board initiatives was to create a solution offering preferred service providers that Alabama CPAs use or make inquiry of using. In this space, we think of the smaller to mid-sized organizations that do not always have the time to research the who, what, where and why. ASCPA is currently working with a number of technology and cloud-based service providers that we can recommend to you and hopefully save you time. For example, many of you need talent. We hope to make a recommendation to you of a vetted, leased employee company that can fit your needs. We also know that members are searching for ways to be more efficient with day-to-day workflow such as payroll, HR benefits, 401k, credit card processing, and more. Again, we hope to make ASCPA preferred partnership recommendations to you very soon. If you want to know more about this strategy, please feel free to reach out to me. The more we know, the more we can help you grow.

The Alabama Legislative session is off to a late start this year since it is the first year of a new quadrennium, or fouryear cycle. The legislature will begin March 7 with Governor Ivey’s State of the State Address. Here, Alabama will be informed on the governor’s key 2023 legislative pursuits. The legislature has 30 days to do the work of the people with June 8, 2023, being the absolute latest day to be in regular session. One hint of a legislative hot topic, and an area that is of interest to CPAs and clients, is the Alabama Jobs Act, as well as the Growing Alabama Tax Credit Program. Both of these acts are set to expire July 31, 2023, and both programs are vital to Alabama’s ability to continue to attract innovative industries and high paying jobs in our state. Together, there is

approximately $350 million in tax credits, including credits to taxpayers who make contributions to economic development organizations for approved projects, medical research and development tax credits, public utilities license credits, and more.

I was fortunate to be able to attend a recent business leaders forum where the guest panelists were Lt. Governor Will Ainsworth, new Speaker of the House Nathaniel Ledbetter, and House Minority Leader Representative Anthony Daniels. Each of the leaders agreed that incentives legislation is a top priority. Alabama must stay competitive with neighboring states by not simply renewing the existing incentive laws, but by providing enhancements. For example, the current $350-million cap will need to be raised and mega-sites will need to be developed for new businesses. There are many leaders working to make all of this happen and you may be one who is running numbers behind the scenes for your legislator. It is important for everyone to have a voice. As a reminder, if you have a key connection with an Alabama legislator, please send me an email at jbirmingham@alabama.cpa.

Before we meet again, I want to tell you how proud I am of your ASCPA Board of Directors. This group of CPAs has really taken a keen and active interest in the ASCPA and its goals. Please take a moment to read about Pipeline progress thanks to Stacy Cummings and Matthew Hilburn on page 12.

I hope that everyone is able to enjoy the beginning of Spring and that ASCPA’s team will be able to see you at the 104th Annual Member’s Meeting.

I’m not “good at math.” If I had a nickel for every time I’ve heard that in response to sharing, “I’m a CPA,” or “I’m an accountant,” then I would need to be much better with math… and investing! We have an identity crisis that is one of the root causes of our pipeline concerns. We interact with people (I have yet to see that accountant wearing the green eye shade and pocket protector in the closet that speaks to no one – you know, the stereotypical one). We deal with rules, words, people, and process as much or more than “math.” We help our clients, businesses, organizations, governments, and students thrive – not simply “comply.” We serve people and help them build careers, businesses, livelihoods, financial futures, communities, and so many other things. The idea of “doing math” or “doing taxes” barely scratches the surface of what we really do – we serve; we share; and we enhance.

Writing this Business and Industry message reminds me that our members are diverse both socio-economically and in skillset. Can we improve diversity and inclusion in the profession?

Absolutely. While we can improve, we should recognize and celebrate the various:

• industries our members serve (too many list);

• ways our members contribute (public, private (business and industry), government, education, volunteer, etc.);

• roles our members play (accountant, internal auditor, tax director, educator, data analyst, CFO, etc.);

• tools our members use (rules and regulations, codes, software, hardware, data visualization tools, project management and workflow tools, etc.); and

• areas that our members touch (accounting, tax, finance, HR, compliance, IT, ESG, etc.).

As we all address pipeline issues, one thing that consistently comes to mind is how overwhelmingly blessed I am to be in and serve our profession. I cannot think of a profession that provides as many avenues and opportunities as the CPA profession. CPAs can literally be anything we desire. We can take our careers and earning potential to any level. The CPA value proposition that needs reinforcing is simple – CPA = unlimited opportunities.

The ASCPA Board and Staff are constantly looking for different ways to help you expand those opportunities for your organizations, owners, and teams today and into the future. We want to position you to maximize those opportunities. You will see examples included inside this issue.

In addition to the great ideas included inside this edition, we are excited about the upcoming 104th Annual Meeting, scheduled for June 13, 2023 at The Club in Birmingham. We will get a Professional Services update from one of the most dynamic speakers in the profession – Kimberly Ellison-Taylor! Based on your feedback from last year’s Annual Meeting, we’ve brought back sessions covering A&A (Jim Martin) and Tax (Karen Miller). We will also address generational diversity with Kristin Scroggin.

As a final note regarding this outstanding agenda, we’re introducing the Leaders Educating Advocating Diversifying and Including the Next Generation – the LEADING Panel. We have three outstanding panel members who have committed their lives, time, and talent to advancing the profession – Dr. Mary Stone (University of Alabama), James White, Sr. (Banks, Finley, White &

Company), and Bill Carr (Carr, Riggs, & Ingram). These innovative influencers in the profession will share with the audience their experiences in, as well as their outlooks regarding, the future of the profession. We are honored that they have agreed to be the inaugural LEADING panel and believe it will be a robust discussion and excellent opportunity to learn from these pioneers of the profession.

Speaking of opportunities, I want to take this one to express gratitude and appreciation. The profession provides us with endless opportunities – we are blessed to be involved in an evolving and bountiful profession. I, and the ASCPA Board, thank you for representing the profession with honor, integrity, respect, compassion, and commitment. We thank you for your trust in, and support of, the ASCPA and for the opportunity to connect, protect, and educate you – our members.

New State Rep. Kerry Underwood (R-Tuscumbia) is hoping to use his certified public accountant (CPA) credentials and mayoral experience to help Alabama small businesses and attract more high-paying jobs to the state.

According to his campaign site, Underwood has been a CPA since 1998. He started his own accounting firm in 2004 and joined a new CPA firm partnership in 2021 in downtown Tuscumbia.

“By profession, we’re not very famous for people skills, but CPAs are conservative by nature...historical [and] analytical,” Underwood told 1819 News in a recent interview. “I think that works well if you can develop some people skills too and the right reasons for doing things. I think the CPA profession itself gives me something to offer to my community here and to the state. I’m going to do my best to be as good as I can in that regard.”

According to Underwood, the firm has about nine employees. He’s also served as the Mayor of Tuscumbia since 2016 before being elected to represent House District 3 in Colbert and Lauderdale counties in 2022.

“I spent more time at the Mayor’s Office than I did at the CPA office,” Underwood said. “I still have a firm here in Tuscumbia. I’ve been doing this since 2007 and have a new partner as of two years ago almost now. I did that because I like politics so much that I couldn’t take care of my clients, so we found a guy that I worked really well with. He fills in the gaps when I’m out of pocket and stuff so I can keep doing what I’m doing.”

According to his campaign site, Underwood’s wife, Anna, works as an occupational therapist for the Colbert County School System. He has one son, Walker and three stepdaughters, Holly, Victoria and Faith.

Underwood told 1819 News that he’d like to focus on two issues: helping small businesses and industry recruitment.

He said he’d favor renewing Alabama’s economic development incentive programs next year.

“I believe in employment and the value that that provides to a family [and] the freedom it provides is unparalleled,” Underwood said. “I’m all about employment and goodpaying jobs and people having options to stay home instead of moving away. That’s what I’d like to focus my time on predominantly.”

Underwood told 1819 News that he hoped the Alabama Legislature “could find a way to be flexible with some [tax] rebates, but be cautious about making sure that we don’t get hit with something that we’re not prepared for” in a possible recession.

“I know it’s being discussed between rebates and lower tax rates,” Underwood said. “Those are healthy discussions to have. What makes it more complicated this time is we’re entering into a recession that we don’t know the length of it, or the breadth of it, or the width of it. There will be some hesitation, I’m sure, regarding how aggressive do you get with it. Had it been a normal year … I think it would have been a pretty simple task to come up with either the one-time rebate or a lower rate. I think at this point, we’ll just have to make sure that we see the trends and make sure where we’re at going forward with how the money is allocated between the General Fund and the Education Trust Fund. It has been some good years lately, and that’s encouraging.”

Thank

Freshman Legislator Focus: Kerry Underwood - ‘I’m all about employment and good-paying jobs.’

Saturday, January 28, members, staff and friends of the Alabama Society of CPAs teamed up in a coordinated effort to bring some relief to Selma, Alabama.

After a tornado tore through the small town, leaving much destruction in its path, there was a sense of wanting to help, but not knowing where to start.

“Anytime you hear of such destruction and devastation, you immediately want to help,” said Jeannine Birmingham. “We made contact early with Church Street United Methodist Church and coordinated our efforts with them to both fill their greatest need, and not rush in too soon to be in the way.”

Church Street United Methodist Church, who was also serving as a Volunteer Resource Center (VRC), coordinated weekend projects like this one to allow their resident volunteers time to rest and recharge. “We were happy to fill that need,” said Jeannine.

Early Saturday morning, with the help of Regions Bank and their “big ‘ole grill,” a fire was lit and hamburgers and hotdogs began to cook. Our volunteers cooked and packaged 1,000 meals that were then distributed to those volunteers helping in the community cleanup efforts that day, as well as neighbors who had lost everything. Small groups traveled out into the community and made sure

those who needed it most received a warm lunch for that day, and sometimes even one or two to keep for dinner that night.

Regions Bank’s Central Alabama market executive, Robert Birmingham, said working with ASCPA was a great way to meet a specific need.

“ASCPA had the food, Regions had a grill, and both organizations had members wanting to help,” he said. “Selma is a historic community with an impact that is known far and wide, so we are grateful for the opportunity to give back to a community that means so much.”

“There are still a ton of people who are working to remove large debris items in the Selma area,” said Jeannine. “People of the community can see that organizations are coming together and collaborating resources, time, dollars, etcetera.”

Speaking of partners and collaborating - we would like to extend a special thank you to another partner who helped make this happen: Mike Hryniw of Montgomery, Manager of Piggly Wiggly’s Atlanta Highway location.

To see photos from the day, visit alabama.cpa/Selma.

As a member of the only statewide organization for CPAs in Alabama, you have access to an array of member benefits ranging from deals on quality CPE, discounts on products and services as well as many networking and leadership opportunities to help you make the most of your profession.

If you’re a member of ASCPA, you have access to a suite of members-only discounts from some of the business world’s leading providers. We’ve partnered with these organizations to bring you tools and services that will help you advance your career, and in many ways enhance your quality of life. To access a full list of these member benefits, visit alabama.cpa/member-savings.

ASCPA members save 20% OFF flowers, gift baskets and more through 1800flowers.com. Deliver smiles to friends, family, employees, clients and customers.

The GE Appliances Store is an exclusive, online shopping site where ASCPA members can purchase high-quality appliances direct from GE Appliances at discount member prices. Full service, in home delivery available to most homes.

20% OFF Harry & David gift baskets, fruit and gourmet food delivery. Perfect for holidays, anniversaries, work events and other special occasions.

Enjoy quality hand-cut steaks, food gifts, seafood, wine and great side dishes. Enroll with NPP to save on the entire Omaha Steaks online catalog and receive free shipping on select offers.

PODS combines moving and storage into one easy solution. Enjoy the convenience of portable storage containers delivered to your door. Save on delivery, rental and long-distance transportation when you enroll with NPP at no cost.

ASCPA members receive national account contract pricing on paints, coatings and supplies. Also receive free services like order planning and specification recommendations.

Eligible businesses can receive 22% OFF monthly access fees and up to 35% OFF select accessories. Enroll your business to start saving with America’s most reliable 5G network.

Winc is an online wine club that delivers right to your door. ASCPA members save $20 OFF their first month’s wine shipment.

ASCPA and UPS took the guesswork out, and put the easy in. Members now have access to new and improved flat pricing with savings of 50% on Domestic Next Day/Deferred, 30% on Ground Commercial / Residential and up to 50% on additional services. In addition, members can take advantage of UPS Smart Pickup® service for free.

The Alabama Society of CPAs Dues Committee met in January and reviewed several reports including state dues comparisons, a multi-year comparative dues report of ASCPA, and the current membership profile.

The committee voted in 2022 to fold chapter dues into membership dues. COLA in 2022 was 6%, which was also taken into consideration for the 2022-23 annual dues. Life members and student members have long had a $0 dues amount.

Following much discussion, the committee recommended FYE April 30, 2024, annual membership dues increase, with the following in mind:

• COLA. Increase of 8.7%

• Pipeline Initiatives. Investing in new human resources/ human capital talent to address pipeline initiatives for members, while protecting and retaining our current staff.

• Technology/Service Offerings. Investing in new platforms and establishing new service offerings to better serve our members.

For more information, or for questions about membership dues, contact Bethany Booth at (334) 386-5751 or by email at bbooth@alabama.cpa.

Recently ASCPA members Stacy Cummings, of Wilkins Miller in Mobile, and Matthew Hilburn, of Crowne Health Care in Monroeville, spoke to Personal Finance, Economics, and Business Management classes at Handley High School about the advantages of having a career in Accounting.

“I was fortunate to have a dad who was an accountant and a mom who was a teacher,” said Cummings, “but I went to school with many who didn’t have any good, sound financial advice or good examples to follow. So, I recognize and appreciate how helpful that was for me and my future, and that’s why I love talking to kids.”

The pair partnered with the Career Coach for Roanoke City Schools, Robin Cottle, and made a lasting impression on the students they met.

“The students have been buzzing about those ‘special guests’ we had at the school yesterday,” said Cottle, in an email to Cummings. “Apparently, you both made quite an impression!”

The presentations did not fall on deaf ears. According to Cottles, the information about Accounting as a profession was brought up in conversations by students with their friends and family in the days that followed.

“The information forced (the students) to take a good look at the decisions they are making about their future careers,” said Cottles. “Not only did you enlighten them about a career in accounting, you made them think about how they need to be responsible about their finances at this time of their life.”

In Hilburn’s opinion, the students and faculty at Handley High School were welcoming, engaged, and inquisitive.

“It was incredibly insightful as to the challenges that lie ahead for our profession,” said Hilburn. “Very few people knew an accountant and even fewer knew what a career in accounting looks like.”

When Hilburn asked if any students knew an accountant personally, one student replied, “Yes. You.”

“While this certainly provided comedic relief,” said Hilburn, “it has left a few questions worth asking: ‘How do we solve our pipeline challenges if so many don’t know we exist? If we aren’t pounding the pavement in our communities with the same energy that we commit to business development, is it possible to move the needle?’”

Cummings and Hilburn are not the only CPAs who have made classroom visits in their communities, and ASCPA thanks all those who have been champions for the profession. If you are interested representing the profession in your community, contact Zack Camerio at zcamerio@alabama.cpa or call (334) 386-5763.

“We need to sell our profession as the American Dream,” said Cummings. “Looking for a better life? Looking to be a business owner? Be a CPA.”

“I am hopeful this will just be one of many experiences that we as members of ASCPA will collectively undertake and build upon as we continue to wrangle with pipeline challenges,” added Hilburn.

James C. White, Jr., CPA serves as Managing Partner of Banks, Finley, White & Co. As Managing Partner, he leads the Firm’s efforts in Quality Control and coordinates its steady growth in the markets where the Firm has practice offices. White holds a Bachelor’s degree in Accounting from the University of Maryland, College Park. He has coordinated audits for several multi-national, publicly-traded corporations in various industry sectors. James has extensive experience in providing services to publicly-traded companies, including Securities and Exchange Commission (SEC) reporting requirements, compliance with the Sarbanes-Oxley Act and other Public Company Accounting Oversight Board (PCAOB) standards and related rules. Additionally, he has managed accounting and reporting for public equity and debt offerings, business combinations and dispositions, advised internal audit departments on plans and strategies to enhance corporate governance, and has extensive experience in SEC filings and related accounting services. He has considerable experience in audits of state and local governments, not-for-profit organizations, including school districts, colleges and universities. James holds CPA certificates in five states.

Sarah Propper, CPA

Sarah is a member of the Board of Directors of Pearce, Bevill, Leesburg, Moore P.C. She is a native of Huntsville, Alabama and a 1998 graduate of Birmingham Southern College with a Bachelor of Science in Accounting. She has over 15 years of experience in public accounting and joined the firm in 1999. Sarah focuses her practice on tax planning for businesses and individuals. Her concentration is in business consulting, including the preparation of financial statements, business tax preparation, and other business consulting for a variety of industries including real estate, retail, manufacturing, and professional services including both legal and medical practices.

Cathy Dover, CPA, Audit Partner in the Birmingham office of Carr, Riggs & Ingram, LLC, is passionate when it comes to building longlasting relationships with the clients she serves and strives to listen and find new ways to help them meet their evolving needs. Leveraging more than 20 years of public accounting experience, Cathy works with community banks and financial institutions by offering them internal and external audit services, FDICIA internal controls testing, and compliance audits. She also works with small and medium–sized businesses in the manufacturing and distribution industry. Cathy is not only passionate about her clients and community but also the talent within the profession. She serves as the Human Capital Champion for her office playing a key role in the firm’s internship program and driving campus recruitment activities at area universities including the University of Alabama where she earned her Bachelor’s degree in Commerce and Business Administration-Accounting.

Cathy has been married to her husband, Nicholas, for seventeen years and they have two sons, Cole and Cade. When she is not working, Cathy and her husband spend a lot of their time at various practices and sporting venues cheering on their two sons. She is also very involved in her church and has served for many years in the children’s ministry department.

Bruce Fryer, CPA is the Senior Regional Finance Manager for the East Lime Division of Lhoist North America. In this role he is the primary financial business partner for a $700M division of the $3B international Lhoist group. Bruce leads a decentralized team of accountants that support the business with sales and manufacturing accounting and reporting, SAP expertise, internal/ external audit compliance and analysis of all aspects of business strategy. Bruce is a CPA in the state of Alabama and has more than 25 years of manufacturing and mining experience with

roles in controlling, financial reporting, forecasting and budgeting, developing financial training, and leading functional and cross-functional teams. He has a Bachelor’s degree in Commerce and Business Administration (Accounting) and his Master’s degree in Accountancy from the University of Alabama.

Bruce is a past member of the Greater Shelby County Chamber of Commerce Board of Directors and former head of Lhoist’s East Lime Community Action Team. In 2013 Bruce was honored to receive the Lhoist North America Finance Department’s Integrity and Trust award. Outside of work, Bruce is an avid baseball fan and a Bible study teacher at the First Baptist Church of Columbiana. Bruce and his wife Twyla have three adult age children. He is active in supporting the University of Alabama and Shelby County High School athletic teams

Jeremy Mosteller, CPA is a Partner in the Tax Advisory Services Department. He has over 20 years of experience in public accounting, and he supports the Firm’s management and operations as a member of the board. Jeremy earned his Bachelor of Science in Accounting from Auburn University. Jeremy focuses on client relationship development to understand clients’ needs and how the Firm can continually strive to deliver an exceptional client experience. In addition to supporting the Firm’s growth and strategy, he also provides tax advisory and consulting services for high net-worth individuals and corporations, provides tax review oversight and technical expertise, and provides comprehensive tax planning and advisory services. He also supports the Firm’s Research & Development (R&D) tax practice, provides Employee Stock Ownership (ESOP) services, and assists with wealth management planning. Jeremy’s industry focus includes health care and government contracting.

Jeremy serves as a member of the Alabama State Society of CPAs Tax Committee, AICPA Tax Section, and ESOP Association. Jeremy’s advisory and consulting services support clients to make sound decisions that position their business for growth and continued success.

Each year members of the Nominating Committee select individuals nominated by their peers from across the state and various segments of the CPA profession to join the ASCPA Board of Directors. We are excited to work with the newest incoming board members to gain their insights on how to make the Society stronger and stay relevant for our members.

can’t do math or bake a pie, but she knows her stuff when it comes to Generational Diversity and Communication! Kristin has a Master’s degree in Communication Studies, a Bachelor’s in Communication Arts, and has been a Communications Professor at the University of Alabama in Huntsville for 15 years. In 2017 she launched her company, genWHY Communications, and has been a Keynote Speaker at more than 100 conferences and 250+ organizations across the United States, ranging from Fortune 500 companies to tiny non-profits. Her research has been published in magazines, and she’s been a guest on multiple podcasts. Kristin consults on attracting, developing, and retaining Rockstar Millennial and GenZ talent. Obsessed with travel, and desperate to see the world, she and her husband try to keep their four children alive while trying to keep their heads above water.

June 13, 2023

The Club, Birmingham

8:25 a.m. Opening Remarks

8:40 – 9:40 a.m. Business Growth and Revenue with High Performing Teams

Kimberly Ellison-Taylor

9:40 – 9:55 a.m. Break

9:55 – 11:35 a.m. 2023 A&A Update that You Can Use

Jim Martin

11:35 – 12:50 p.m. Lunch & Recognitions

12:50 – 1:40p.m. LEADING Panel Discussion

Bill Carr, Mary Stone, Jim White

1:40 – 2:55 p.m. Generation “THEM”: Managing a Multi-Generational Workforce

Kristin Scroggin

2:55 – 3:05 p.m. Break

3:05 – 3:55 p.m. Key Federal and Alabama Tax Developments for 2023

Karen Miller

3:55 p.m. Closing Comments, James White

CPE 6.7 Hours

Hear from these outstanding presenters:

Mike Frost Surgent

Bruce Ely Bradley Arant Boult Cummings LLP

Jim Martin Real World Seminars

Mike Frost Surgent

Bruce Ely Bradley Arant Boult Cummings LLP

Jim Martin Real World Seminars

Make plans to join us in Gulf Shores in July!

We are partnering with the Arkansas, Louisiana, Florida, and Oklahoma CPA societies for a fun-filled week of learning and lounging. This conference will offer 4 hours of CPE each day, leaving the rest of your time free to explore the park, kayak the Gulf, or simply chill on the beach. The conference agenda is still being finalized. In the meantime, make your reservations to join us in July!

The Alabama Society of CPAs has four membership categories: Public, Business and Industry, Government and Education. Business and Industry members make up 28% of ASCPA’s total membership. Trey Michael, CPA is one of those members.

Michael went to the University of Alabama, where he earned his bachelor’s degree in accounting, then earned his master’s degree in tax. After a few years in public practice with EY’s tax department in Nashville, he got the opportunity to return home to Dothan and work for a small public accounting firm. After two years of broadening his expertise, a new opportunity presented itself with a local company called SpectraCare, and nine years after making the switch from public practice to industry, he has not looked back.

SpectraCare, a community mental health center, was created by Act 310 of the legislature and formed in 1968. Since it was legislatively created, the state of Alabama is split up into catchment areas for mental health needs and SpectraCare was designated to serve five southeastern counties in Alabama: Houston, Dale, Geneva, Barbour, and Henry counties.

“We’re basically the safety net of the state’s mental health needs,” said Michael. “We have 10 residential facilities, we have beds at Dale Medical, and we have semiindependent living.”

Michael has been working for SpectraCare for almost nine years, and has served as CFO since January 2020 – right before COVID.

“I remember back in March/April of 2020 there wasn’t a lot of information about anything,” said Michael. “Not just on the financial side, but I mean, people were scared, my staff were scared. And, of course, we’re a mental health company. I think now everybody’s recognizing that mental health really exploded during COVID.”

SpectraCare is a 24/7 facility and, much like many businesses, they had to figure things out on the fly.

“And we didn’t stop,” said Michael. “We didn’t get to stop doing what we do. So that was a big challenge.”

“I started out as the assistant CFO,” said Michael. “They had just gone through a big growth phase and needed additional staff. They created my position and when the CFO, who had been here for 28 years, retired I advanced up into that role.”

While there is a certain sense of flexibility working with the business and industry realm, Michael says the challenges that each industry faces are becoming more and more similar.

“There’s something new every single day,” he said. “The department’s always coming up with new stuff, whether it’s new regulations, social security, or CMS, all these things impact us.”

Especially in the face of pipeline issues, Michael says staying competitive is key.

“We’ve got to be competitive with everybody, not just nonprofits, not just with health.”

What makes an organization competitive?

“We’re not going to be able to compete on salaries all the time,”said Michael. “But there are other things - benefits, retirement, those kind of things - we can really have an impact on.”

Another example he used was paid time off.

“I think people are wanting that because they want that time to be with their family and you need time to recharge.”

“We have the same staffing shortages that I know CPA firms are having right now. That labor shortage just in accounting in general is, I think, is more and more prevalent.”

What keeps Michael coming back?

“I do enjoy industry accounting,” said Michael. “There’s certain things I miss, probably about the public accounting really, because there’s that support system. If you don’t know something, or you have a question, you can ask.”

But Michael’s not on an island by himself. His company, SpectraCare, is part of a coalition, or a group of mental health centers, called The Council for Mental Health for the state of Alabama. This group includes all the CEOs of each one of the mental health facilities.

“We are able to talk about all these different things,” said Michael. “If something new is coming up, then we connect with the Department of Mental Health if we need something explained.”

“My wife and I have four kids,” said Michael. “I coached T-ball last year. I never missed a game.”

>> To read the full interview, visit alabama.cpa/Meet-Trey-Michael.

“Ithinkpeople arewantingthat timetobewith theirfamily.”

Data and analytics (D&A). Automation. Artificial intelligence. Machine learning. Companies across industries are rapidly developing, implementing and investing in emerging technologies to remain competitive in today’s market. As auditors, it is our directive to stay ahead of this ever-changing technological landscape to provide the highest level of quality for our clients.

Advanced technologies must be matched with people who know how to use them effectively and how to exercise professional judgment in examining transactions. KPMG is helping shape professionals for the future of audit by upskilling the next generation — graduate students — through its Master of Accounting with Data and Analytics (MADA) program.

KPMG recently expanded the MADA program, adding seven universities, including Historically Black Colleges and Universities (HBCUs) such as Alabama State University’s Percy J. Vaughn, Jr. College of Business Administration. The expansion brings the total participating universities to fifteen, including four HBCUs.

As part of the expansion, KPMG will provide more than $7 million in scholarship funding over three years to the participating universities to encourage underrepresented individuals to pursue a graduate accounting education supplemented with D&A skills.

Professionals entering the accounting field are expected to bring fine-tuned quantitative skills, strong critical thinking and a clear sense of purpose to protect our capital markets with the utmost level of ethics and integrity. These attributes are well understood and strongly embedded across the industry, from new hires to the highest levels of management. However, a fundamental understanding of auditing standards and accounting frameworks is no longer enough.

We live in a data-rich world where professionals are increasingly expected to demonstrate that they can speak the language of data and engage with it through the lens of accounting principles. This means translating data patterns and anomalies into actionable audit insights, staying abreast of the latest in data mining and visualization, and developing a deep knowledge of emerging technologies, such as artificial intelligence, automation, blockchain and more.

This is a tall order. And getting early exposure to these D&A topics is an advantage that benefits all parties: students, the firms they ultimately join and the profession more broadly. There is a clear opportunity for leading firms and the colleges and universities that feed their pipelines to collaborate on D&A education and training.

KPMG launched the MADA program in 2017. The goal was clear: Prepare a diverse group of students for the highly complex business landscape by combining the practical use of D&A technologies with a D&A-focused accounting curriculum. Students participating in the MADA program benefit from graduate-level coursework that blends accounting and STEM education, providing them with specialized skills so they can hit the ground running after graduation with the latest analytics acumen.

The MADA program is just one example of the concrete steps KPMG is taking to close the gap between academic preparation and accounting career readiness. And central to closing that gap is providing underrepresented talent with new and streamlined pathways into the profession.

Empowering underrepresented talent to join, thrive and lead the accounting profession is a significant undertaking, and one that cannot be taken lightly. It is a core tenet of the MADA program and KPMG’s broader strategy.

Recognizing this important responsibility, KPMG has deepened its relationships with many HBCUs, increasing hiring in fiscal year 2021 by more than 40% while taking steps to improve near- and long-term retention of HBCU alumni. After all, it’s not just about hiring diverse talent but also about empowering them to succeed and advance into leadership roles. KPMG is also exploring similar relationships with Hispanic-Serving Institutions and Tribal Colleges and Universities with the aim of investing in a diverse, sustainable pipeline that promotes outstanding quality and innovation.

As the rise of D&A indicates, the realm of work that falls into CPAs’ purview is rapidly expanding. With this change, there are new career paths for prospective talent, new hires and experienced professionals to explore. For those with strong IT know-how, technology assurance is a fastpaced, data-driven field rife with opportunity. For those passionate about helping companies reduce their carbon footprints, environmental, social and governance (ESG) reporting and assurance are hot topics. These examples only scratch the surface, and they demonstrate that the accounting skills learned both in school and on the job are applicable to a broad range of emerging areas in and around the profession.

As career paths evolve, we anticipate that emerging skill sets — D&A, technology fluency, ESG and other related capabilities — will become embedded into professional development alongside traditional accounting training. These pathways give professionals greater control over their careers while enhancing quality, promoting innovation and delivering exceptional experiences for clients and employees alike.

The accounting industry is evolving — so too must the next generation of CPAs. And the future of the profession is more diverse, more data-oriented and more purpose-driven than ever before.

The KPMG Master of Accounting with Data and Analytics Program provides the specialized skills needed for today’s data-driven accounting environment.

Learn more at kpmg.com/us/masters

The Alabama CPA PAC is a non-partisan political action committee (PAC) comprised of CPAs who uphold the political voice of the CPA profession. Formed in 1990, the CPA/PAC pools members contributions and contributes funds to friendly state legislators and candidates who support CPA and business interests and encourages and supports our own CPAs as political candidates.

By combining financial resources, the PAC is able to leverage its impact for positive results.

Your contribution to the PAC benefits the future of the profession:

• It ensures that your profession’s best interest are represented

• It supports state legislators and candidates who support CPAs and business interests

• It allows us direct access to decision makers

To make a contribution visit alabama.cpa/legislative-advocacy.

The Legislators’ Tax Guide is provided on a complimentary basis by the ASCPA to help answer our Alabama Legislators tax questions and those of you who assist legislators with their tax preparation.

The purpose of this tax guide is to examine federal and Alabama tax aspects of payments received from the state by Alabama legislators. Conclusions reached for federal taxation purposes usually will apply for State of Alabama taxes on income. By virtue of the provisions of Sec. 29-1-8.1, Code of Alabama 1975, the State Department of Revenue must accept and follow the travel expense provisions of the U.S. Internal Revenue Code as amended by the Economic Recovery Tax Act of 1981 for state legislators.

This guide is intended to deal only with the tax consequences under federal and Alabama tax laws of legislators’ per diem, expense, and mileage receipts as elected officials, and does not cover any personal tax matters (such as capital gains or losses, rental income and expenses, salary from private employment, or business income and expenses).

A copy of the latest edition of the 2022 Legislators’ Tax Guide can be found online by visiting alabama.cpa/tax-guide.

The following individuals have successfully passed all four parts of the CPA exam - Congratulations !

Christine Baclig Alvarez, Madison

Clifford Clark Atfield, Birmingham

Leah Hope Benefield, Montgomery

Adele Woodward Bird, Birmingham

Robert Jacob Bowden, Samson

Justin Thomas Brown, Tuscumbia

Hannah Faith Burkhardt, Elberta

Latoya Shonta Moye Bush, Semmes

Stephen Micheal Clark, Montevallo

Gregory Lee Creech, Owens Cross Roads

Adrian Renee Davis, Birmingham

Evan Lee Eppich, Birmingham

Craig W Feight, Owens Cross Roads

Caroline Grace Gentle, Birmingham

Bryant Welsey Harris, Rainsville

Misty Willis Head, Auburn

Kimberly Rachel Huerta, Birmingham

Julia Catherine Jordan, Owens Cross Roads

Emma Grace Kerlin, Huntersville

Samar Khan, Philadelphia

Katey Alexis Lichtenstein, Birmingham

Khang T Luu, Mobile

Dakota Keith Maples, Huntsville

Jacob David McDowell, Hoover

Charles Edward Murphy, Scottsboro

Candida Secrest Nicastro, Leeds

Margaret Hope Novak, Opelika

Malik Shaquan Pegeas, Birmingham

Bryan Francis Rodopoulos, Montgomery

John Paul Rumore, Hoover

Susan Marie Rykowski, Tuscaloosa

Mark D Schneider, Brownsboro

Jonathan Edmund Smith, Birmingham

Preston Thomas Spratt, Huntsville

Tara Mcgee Ward, Auburn

Frederick Gene Wright, Denver, Co

Melanie Baxter Wright, Auburn

Avizo Group, Inc., one of the Gulf Coast’s leading CPA and business consulting firms, has announced the appointment of Rachel G. Young, CPA, CGMA, MAcc as the organization’s President and Chief Executive Officer.

Rachel has been with Avizo Group, Inc. for 21 years, serving as a shareholder for 6 years and as Director of Assurance Services for 8 years. Her expertise includes providing auditing, financial regulation reporting, governance and consulting services to the firm’s clients with a special focus on governmental entities, not-for-profit organizations and small-to-mid-sized businesses. Through her career with Avizo Group, Rachel has contributed to pushing the firm into innovative spaces by developing goal planning processes and training staff to be proactive problemsolvers.

Rachel is a graduate of the University of West Florida where she earned a Bachelor of Science in Business Administration in Accounting followed by a Master of Accountancy. She is a member of the Alabama Society of Certified Public Accountants, the Florida Institute of Certified Public Accountants, the American Institute of Certified Public Accountants, and the Government Finance Officers Association.

As director of the firm’s location in Brewton, Alabama, Rachel resides in Flomaton, Alabama with her husband, Josh, and their children, Edy and Silas. Rachel is the 2015 Bridging the Gap Winner through the Emerging Leaders Council. Due to her unique ability to create streamlined processes for a collaborative team approach to major projects, Rachel is an annual presenter at conferences and events on the topics of processes, technology, and innovation.

Having served in multiple leadership roles for the firm over the past 32 years, Dennis Sherrin, CPA, CGMA will transition from Chief Executive Officer to Chief Value Officer. In this role, he will continue to influence efforts on transformation within the firm and the accounting profession with a focus on enhancing value to clients and our communities. Sherrin says, “It’s exciting to know Avizo has chosen such a talented leader, in Rachel, with a passion for serving, coaching and helping others. Great things are ahead for Avizo and those we serve.”

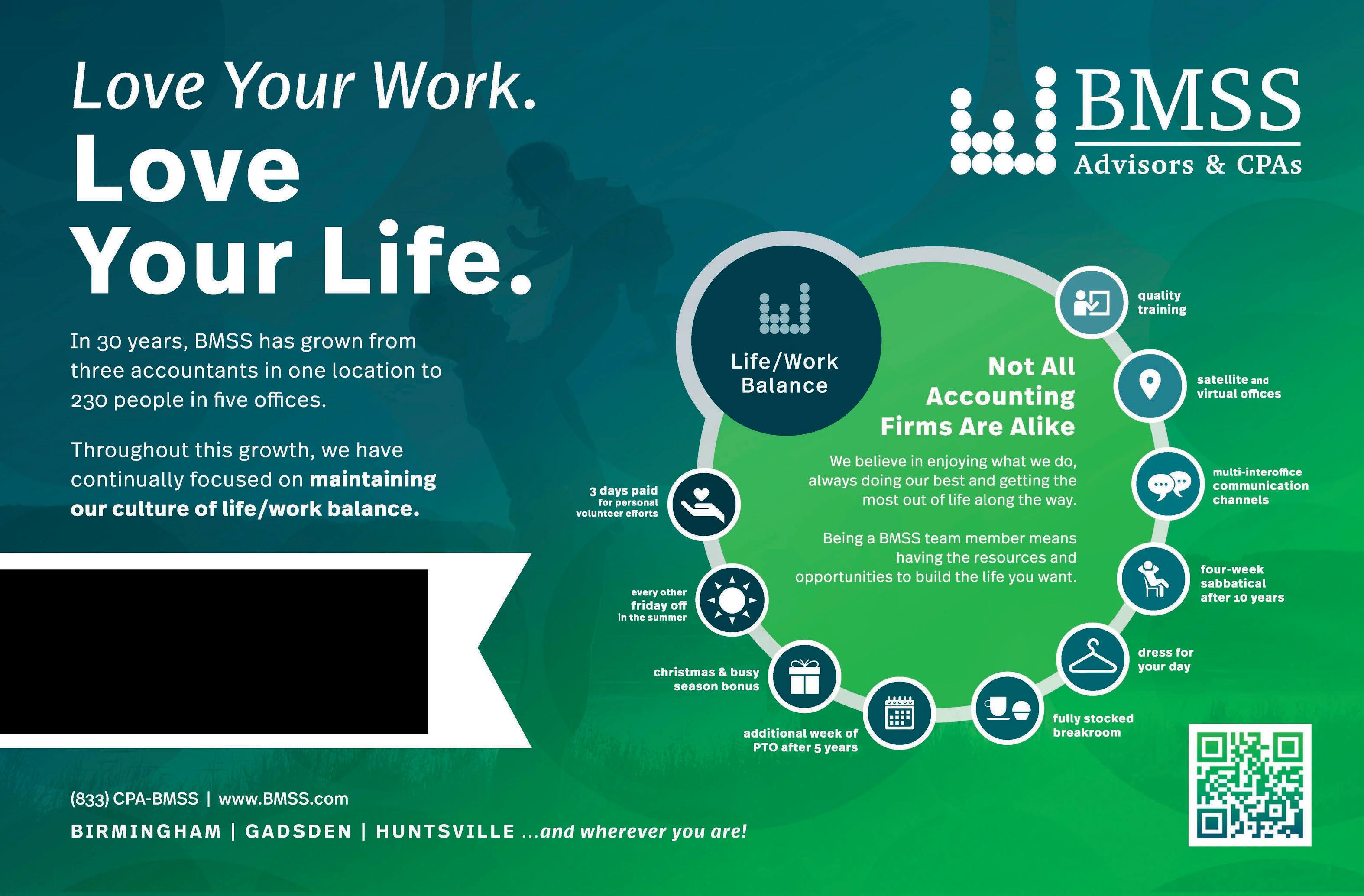

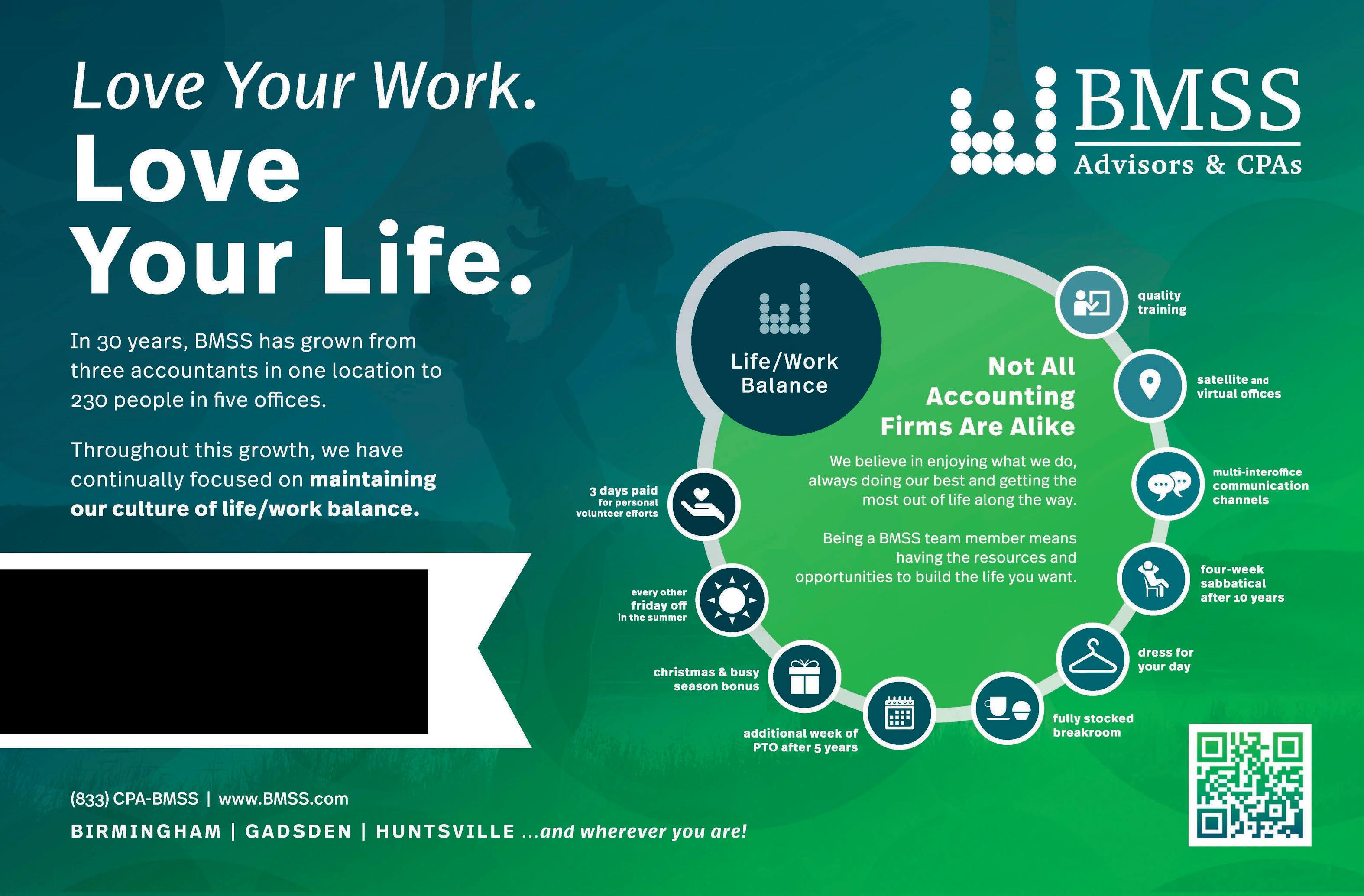

BMSS Advisors & CPAs would like to recognize all of the efforts and contributions that Steve Smith gave to BMSS over the past 28 years. Steve joined BMSS in 1994 and has over 40 years of public accounting experience.

As a senior member of the BMSS tax department, Steve managed the tax quality control process for the firm across all five offices. During his tenure at BMSS, Steve helped countless clients and employees alike and has a passion for furthering the accounting profession.

Steve has served as board member, chair and president of professional organizations, including the Birmingham Tax Forum and the Federal Tax Clinic. In October, he began serving a four-year term as a member of the Alabama State Board of Public Accountancy. His sense of humor and willingness to help will be greatly missed by all at BMSS.

BMSS Advisors & CPAs also recently announced that Mark Waters, CPA joined their ranks at the end of 2022 to lead EOS implementation for Alabama-based companies. With over 35 years of experience managing finance departments, Mark is a pro at helping businesses refocus and grow.

Abby Roveda, CPA, has been promoted to Audit Manager for Crow Shields Bailey. Abby specializes in audit, review, and compilation services for non-public companies and audits of employee benefit plans. Abby also assists clients with business valuation services and consulting and is heavily involved in on-campus recruiting.

Jack Lovelady, President and Chief Executive Officer at First Southern State Bank, recently announced the promotion of veteran banker Barry Kennedy, CPA to Executive Vice President and Chief Financial Officer. Kennedy joined the Bank in 2020, previously serving as Shareholder of CK Business Solutions, PC in Albertville, an affiliation that spanned 27 years. Mr. Kennedy said, “Changing jobs late in life is not an easy feat. However, with the great team of professionals assembled here at First Southern State Bank, the change has been a challenging, but joyous time. I want to thank Jack Lovelady, Mike Ellenburg, and the Board for providing me the opportunity to continue my professional growth and development in the community banking environment. It is with this enthusiasm that I look forward to the future with the team at First Southern State Bank.”

Kennedy earned a Bachelor of Science degree with honors in Accounting from Jacksonville State University. Mr. Kennedy is a member of American Institute of Certified Public Accountants and the Alabama Society of CPA’s.

Throughout his career, Mr. Kennedy has been active in a host of civic, charitable and community organizations. He is a member and Paul Harris Fellow of the Albertville Rotary Club and is a Past President and Charter Member of the Boaz Rotary Club. He previously served as the Chairman and Board member of the Albertville Chamber of Commerce, and as a member of the Jacksonville State University, College of Commerce and Business

Administration’s Board of Visitors. He has served as an USSF and AYSO Certified Soccer Official and coached youth soccer in Albertville for 10 years. Mr. Kennedy is a member of the First Baptist Church of Albertville.

Dan holds a Bachelor of Accounting Science from Southern Illinois University and a Masters of Accounting Science from Northern Illinois University. He is a licensed CPA in Illinois and Alabama.

Scott Goldsmith, the Managing Shareholder of JamisonMoneyFarmer PC (“JMF”) is pleased to announce the addition of Dan Johnson and Jennifer Stripling as new shareholders in the CPA firm. Both Johnson and Stripling bring a wealth of experience and expertise to the team and will play a vital role in helping clients navigate the ever-changing business landscape. They join ten other shareholders at one of the state’s top certified public accounting and advisory firms. JMF has offices in Tuscaloosa and Selma. “We are thrilled to welcome Jennifer Stripling and Dan Johnson to the JMF shareholder team,” said Scott Goldsmith. “Their knowledge and strategic advice are valuable assets to our clients, and we are confident that they will help us to continue providing the highest level of service to our clients. Their leadership over the last several years during difficult times has been extremely well received within the firm.”

Jennifer Stripling is a certified public accountant with over 18 years of experience in tax and accounting. She joined the firm in 2016 after working in a global accounting firm in Birmingham. She specializes in helping businesses and their owners with tax strategy, planning and compliance. “I am thrilled to become a shareholder. We have a great, dynamic team that built a 100 plus year legacy and I look forward to continuing that effort.” Jennifer received a floral arrangement from the other female shareholders, which is a long-standing tradition at the firm. The late B. Jean Hunt, JMF’s first female partner and one of the first 15 female CPAs in Alabama, started the tradition when other females made partner. JMF has a legacy of hiring and promoting women, including the first female CPA in Tuscaloosa, the late Doris Grammas. Six of the current twelve shareholders are female.

Jennifer holds a Bachelor of Science degree in Commerce and Business Administration and a Master of Tax Accountancy from The University of Alabama. Dan Johnson is also a certified public accountant with over 15 years of experience.

Dan joined JamisonMoneyFarmer in 2013, after he provided business and accounting consulting services to a non-for-profit in Turkey, and many years in another public accounting firm. He provides financial statement audits and other assurance services, with expertise in various industry accounting (NFP & Government) and international accounting standards (IFRS, German GAAP). He also provided advisory services to owners of partnerships and closely-held corporations, including tax compliance, business sales or mergers, and tax planning.

Kassouf promoted nine team members in January, naming three new principals. Kassouf’s vision of upward mobility and continuous improvement drove these promotions.

“With these promotions, our senior leadership team has grown by 37.5%, ensuring a sustainable, bright future for Kassouf,” said Kassouf Director and Shareholder Gerry Kassouf.

Kassouf’s team members who were promoted to principal include Sally Bradley, James Dicks, and Rachelle North

Bradley graduated from The University of Alabama at Birmingham (UAB) and is a Certified Public Accountant (CPA) and Certified Global Management Accountant (CGMA). She works in Kassouf’s Business Services Group, specializing in accounting, financial reporting, tax, and consulting services for small businesses and individuals. Bradley is involved with her alma mater through the UAB Accounting Alumni Chapter Board, UAB Accounting Advisory Board, and UAB National Alumni Society Board. She is a Girlspring board member and a member of the Alabama Society of Certified Public Accountants and the American Institute of Certified Public Accountants.

Dicks is a two-time graduate of Troy University, holding an undergraduate degree and Master of Business Administration from the university. He works in Kassouf’s Healthcare Group, providing accounting, tax compliance, advisory, and practice management services to healthcare clients. Dicks is a Certified Public Accountant (CPA) and Certified Valuation Analyst (CVA) and is involved with the Alabama Society of Certified Public Accountants, the American Institute of Certified Public Accountants, the Alabama Bourbon Club, and Corn and Cane.

North graduated from Lee University and is a Certified Public Accountant (CPA). She works in Kassouf’s Healthcare Group, specializing in accounting, tax, and consulting services for small businesses with an emphasis on physician practices and practice management. She is a member of the Alabama Society of Certified Public Accountants and the American Institute of Certified Public Accountants.

2023 Promotions include:

Sally Bradley, CPA, CGMA – Principal James Dicks, CPA, CVA – Principal Rachelle North, CPA – Principal Julie Myers, CPA – Manager

Levi Blalock, CPA – Supervising Senior Accountant

Meghan Custer, CPA – Supervising Senior Accountant

Johnson

Stripling

Bradley

Dicks

Johnson

Stripling

Bradley

Dicks

“We are incredibly proud of these team members and can’t wait to see all they accomplish in their new roles,” said Kassouf Director and Shareholder Jonathan Kassouf.

Machen McChesney, one of the region’s leading CPA and business advisory firms, announces it has named R. Murry Guy, III, CPA, a new partner.

“The focus of our growth is grounded in our continual effort to best serve our clients. We understand having a large, competent, and highly motivated team provides our clients access to deep advisory knowledge and industry-specific expertise while receiving individualized attention and timely service,” says Managing Partner Marty Williams. “We are very proud of Murry and his commitment to continually seek ways to Return Value to our clients, friends, community, and firm.”

Murry Guy, CPA, has 20 years of experience providing accounting, tax, audit, and advisory services to individuals and small businesses. Murry has expertise in restaurant, healthcare, professional, and retail service industries and specific skills in client accounting systems, streamlining monthly financial operations and reporting, tax planning advisory, and CFO advisory services.

Murry is instrumental in the firm’s sister company, FocusPay Solutions, where he is responsible for operations development, client management, and overall delivery of services.

In addition to serving clients, Murry Returns Value to Machen McChesney through his involvement in the community and in the firm’s core process, mentoring, and staff training teams.

Murry is a graduate of Auburn University with a Masters and a B.S. in Accounting. Murry resides in Auburn, Alabama, with his wife, Tiffany, and their three children.

Machen McChesney, is also excited to announce Michael D. Machen, CPA,CVA, has been named the firm’s new Managing Partner.

Marty Williams, former managing partner, said: “It has been my privilege for 14 years to serve as Managing Partner for Machen McChesney. I will continue serving clients and working side by side with the leadership team Returning Value to our clients and community. I am confident Mike will lead the firm forward by striving to deliver exceptional client experiences while progressively navigating through ever-changing technological, economic, and regulatory changes. The firm looks forward to his leadership.

Michael D. Machen, CPA, CVA, a lifelong resident of Auburn, AL, has 33 years of experience providing accounting, tax,

and advisory services to individuals and businesses. Mike regularly Returns Value to clients needing his expertise in the areas of accounting & auditing, taxation, business valuation and business advisory services. He also has extensive industry expertise in construction, real estate, manufacturing, distribution, retail and professional services.

Mike has been a partner for 25 of the 29 years with Machen McChesney providing leadership in administration, process improvement, quality control, peer review, marketing, business development, client service, mentoring and staff training. Prior to joining the firm, Mike was employed as an accountant and supervisor at Warren Averett in Birmingham, AL. Mike is a graduate of the University of North Alabama with a B.S. in Accounting and Finance.

Mike is passionate about giving back to the community. He currently serves voluntary positions in multiple community organizations and is a past president of the Auburn Chamber of Commerce and the Foundation for Auburn’s Continuing Enrichment for Schools.

We are honored to be named one of America’s Top Recommended Tax and Accounting Firms by Forbes for the fourth year in a row.

Employees from every office and sister company came together in 2022 for our biggest Christmas party yet! This major planning feat was undertaken by our Employee Experience Specialist, who works to insure our team members experience the best of BMSS.

In January, BMSS launched the Wellness Way, a health initiative for our team members, encouraging movement and clean eating through monthly challenges. Each participant submitted their reason(s) for joining the Wellness Way along with goals to revisit at the end of the year.

Accounting Biz Brokers has been selling CPA firms for over 18 years and we know your market! Our brokers are Certified Business Intermediaries (CBI) specializing in the sale of CPA firms. We are here to help you navigate through the entire sales process. Contact us TODAY to receive a free market analysis. Listings inlcude:

• NEW: Chattanooga, TN Area $2.115M;

• W Middle TN $318k;

• NEW: Metro DeSoto County, MS (Memphis Area) $1.1M;

• East Memphis Area $520k-SOLD;

• East Memphis Suburb $950k-SOLD;

• Knoxville 600k-SOLD;

• Bartlett, TN Gross $550k-SOLD;

• NE MS Tax & Bookkeeping Firm Gross $850k-SOLD.

For more information Kathy Brents, CPA, CBI. Cell 501.514.4928 | Office 866.260.2793 | Kathy@AccountingBizBrokers.com or visit us at www.AccountingBizBrokers.com .

Thinking about selling your practice? Accounting Practice Sales delivers results, bringing you the best price, optimal terms and a buyer who represents an ideal fit for your clientele. Contact us today for a confidential discussion. Our current listings include:

• Tuscaloosa CPA grossing $175K * Available *

• Montgomery area CPA grossing $280K * New *

• Okaloosa County, FL (near AL border) CPA grossing $365K * New *

• Pensacola, FL area Enrolled Agent grossing $130K * New *

• Southwest TN / Northeast MS tax practice grossing $160K * Available *

• East Nashville CPA grossing $210K * Available *

• South of Knoxville, TN CPA grossing $405K * Available *

• Near Tuscaloosa & Birmingham CPA grossing $55K * Sold *

For more information on these listings or to sell your practice, contact Lori Newcomer, CPA and Tim Price, CPA at (888) 553-1040 or PNgroup@APS.net, or visit www.APS.net.