“We are ready for this

we are already at work to deliver our transformation plan for the new Caterpillar dealership in West Africa.”

Jean-Luc Konan, the new Cat dealer principal for West Africa

MOULDS

www.africanreview.com FEBRUARY 2023 59 YEARS SERVING BUSINESS IN AFRICA SINCE 1964 P28

A fast, reliable and cost-effective means of construction P31 POWER Creating suitable environments for renewable expansion P23 LIFT TRUCKS Sophisticated machinery meeting modern materials handling demands P17 MINING Growing interest in autonomous solutions P44

CONCRETE

challenge and

P22 P36 ENGINE MAINTENANCE Top tips to keep engines functioning effectively P BUILDING SELF-RELIANT ECONOMIES Actionable policies to create sustainable growth INVESTING IN AFRICAN MINING INDABA A pivotal meeting point for one of the continent’s key industries

Cover picture: SAG mill installation at the Séguéla Gold Project in Côte d’Ivoire

© Fortuna Silver Mines

Cover Inset: Jean-Luc Konan, the new Cat dealer principal for West Africa

© COFINA Group

Editor: Robert Daniels

Email: robert.daniels@alaincharles.com

Feature Editor: Martin Clark Email: martin.clark@alaincharles.com

Editorial and Design team: Prashanth AP, Fyna Ashwath, Miriam Brtkova, Praveen CP, Shivani Dhruv, Matthew Hayhoe, Leah Kelly, Rahul Puthenveedu, Madhuri Ramesh, Madhurima Sengupta, Louise Waters and Minhaj Zia

Publisher: Nick Fordham

Sales Manager: Vinay Nair

Email: vinay.nair@alaincharles.com

Magazine Manager: Jane Wellman Tel: +44 207 834 7676 Fax: +44 207 973 0076 Email: jane.wellman@alaincharles.com

India TANMAY MISHRA Tel: +91 98800 75908 Email: tanmay.mishra@alaincharles.com

Nigeria BOLA OLOWO

Tel: +234 80 34349299 Email: bola.olowo@alaincharles.com

UAE MURSHID MUSTAFA

Tel: +971 4 448 9260 Fax: +971 4 448 9261 Email: murshid.mustafa@alaincharles.com

UK RICHARD ROZELAAR Tel: +44 20 7834 7676 Fax: +44 20 7973 0076 Email: richard.rozelaar@alaincharles.com

USA MICHAEL TOMASHEFSKY

Tel: +1 203 226 2882 Fax: +1 203 226 7447 Email: michael.tomashefsky@alaincharles.com

Head Office: Alain Charles Publishing Ltd, University House, 11-13 Lower Grosvenor Place, London SW1W 0EX, United Kingdom Tel: +44 (0)20 7834 7676, Fax: +44 (0)20 7973 0076

Middle East Regional Office: Alain Charles Middle East FZ-LLC, Office L2-112, Loft Office 2, Entrance B, PO Box 502207, Dubai Media City, UAE, Tel: +971 4 448 9260, Fax: +971 4 448 9261

Production: Rinta Denil, Ranjith Ekambaram, Nelly Mendes and Infant Prakash

E-mail: production@alaincharles.com

Chairman: Derek Fordham

Printed by: Buxton Press

Printed in: JANUARY 2023 ISSN: 0954 6782

SUBSCRIPTIONS:

To subscribe: visit www.africanreview.com/subscribe For any other enquiry email circulation@alaincharles.com

Editor’s Note

Welcome to the February issue of African Review. While Covid-19 remains a persistent thorn in the side of economic recovery, thoughts are increasingly moving away from the pandemic and towards future growth. This month, we explore the actionable policies sub-Saharan countries can pursue in order to cope with a turbulent global environment and translate resources into prosperity (page 14).

Certainly Africa’s power sector is one with seemingly endless potential Hussain Al Nowais from AMEA Power explains how to create suitable environments to realise the renewable opportunity (page 23) and Ali Hjaiej of Karpowership explores the impact plug-and-play solutions could have when incorporated into Africa’s energy landscape (page 20).

One of the biggest stories to break in recent months was the news that Delmas Investissements et Participations and the Delmas family have signed a transfer agreement for their Cat dealership activity in West Africa. In this issue, find our exclusive interview with Jean-Luc Konan, the new Cat dealer principal for West Africa, as he reveals his vision for the region (page 28).

To help guide attendees at Investing in African Mining Indaba this month – and to keep those who cannot make it in the loop – our preview inspects a selection of the key exhibitors at the conference (page 36) alongside a report on Zambia’s mining prospects (page 35) and an interview with Bushveld Minerals co-founder and CEO, Fortune Mojapelo, ahead of his attendance at the show (page 42).

Discover these features and more inside, alongside our regular updates on the latest equipment ready to shape Africa’s key industries in the future.

Robert Daniels, Editor

Contents

Moin Siddiqi explores the actionable policies which subSaharan countries can pursue in order to encourage sustainable growth.

Lift trucks

Increasingly robust and sophisticated machinery ready to meet the demands of modern materials handling.

Plug-and-play Karpowership’s Ali Hjaiej explains why plug-and-play solutions can fill the electrification gap felt by many countries in Africa.

Engines Experts from Perkins Engines supply key advice to help users keep their equipment running effectively.

Cat’s new West African flagbearer Jean-Luc Konan, the new Cat dealer principal for West Africa, describes his vision following the takeover.

Scaffolding

Layher’s scaffolding solutions have proven their worth at projects in Mozambique and South Africa. 36

Investing in African Mining Indaba

A preview of the continent’s largest mining event as it returns to Cape Town, complete with an exclusive interview with Fortune Mojapelo, co-founder and CEO of Bushveld Minerals, ahead of his attendance at the conference. 46

Minerals processing

Intelligent minerals sorting is helping the mining industry prepare for the environmental challenges ahead.

Data centres

Cloud-based services demand growth paves the way for data centre market expansion.

Serving the world of business

14

Economy

17

20

22

28

32

50

P44 P31 P30

P23

Tunisian solar plant receives funding boost

The board of directors of the African Development Bank Group (AfDB) has approved a US$27mn and a EU€10mn (approximately US$10.7mn) loan package to co-finance the construction of a 100MW solar power plant in Kairouan, Tunisia.

The approval covers funding from the bank, and concessional financing from the Sustainable Energy Fund for Africa (SEFA), a special multi-donor fund managed by AfDB. Additional financing will come from the International Finance Corporation (IFC) of the World Bank Group and the Clean Technology Fund (CTF).

The project entails the design, construction, and operation of a greenfield solar photovoltaic (PV) plant with a capacity of 100MW under a build, own and operate (BOO) scheme. The project is located in El Metbassta, Kairouan North region, about 150 km south of the Tunisian capital, Tunis. Société Kairouan Solar Plant S.A.R.L., developed by Dubai-based AMEA Power, will manage the project.

Kevin Kariuki, vice president of power, energy, climate and green growth at AfDB, commented, “The 100MW Kairouan Solar PV project will not only be a pioneer for other grid-based solar and wind independent power projects currently under development in Tunisia but also a benchmark for bankability of renewable energy projects in the country as it is underpinned by robust and sustainable agreements negotiated over the last three years under extremely onerous market conditions.”

“We are delighted to support the first solar IPP project in Tunisia,” said Wale Shonibare, director of energy financial solutions, policy and regulation at AfDB. “The success of the transaction, which has reached the highest bankability standards following months of negotiations with the Tunisian authorities, provides a useful template for future projects that will help move the country closer towards achieving the Government’s 35% clean energy target.”

The Kairouan Solar project aligns with Tunisia’s Nationally Determined Contribution and goal of reducing carbon emissions through the transition to renewable energy sources. It is also consistent with AfDB’s New Deal on Energy for Africa and the ‘Light up and Power Africa’ High-5 strategic priority.

VNG AND SONATRACH TO COLLABORATE ON GREEN HYDROGEN

German gas group VNG AG (VNG), and Sonatrach, an Algerian state-owned energy company, intend to join forces in ramping up a German-Algerian value creation chain for green hydrogen.

Both companies have signed a memorandum of understanding (MoU) to jointly examine possibilities for the realisation of long-term hydrogen and ammonia projects with a view to importing green hydrogen from Algeria to Germany in the future.

Hans-Joachim Polk, member of the VNG executive board, explained, “Hydrogen is set to be a key component of our energy future. Large amounts will have to be imported, however, to satisfy the demand for hydrogen in Germany. Green hydrogen from Algeria could play an important role here as the potential in this respect is huge. So I’m delighted that today we have laid an important foundation with Sonatrach for ramping up the GermanAlgerian hydrogen industry.”

The project will have a capacity of 100MW.

GENIE EXPANDS SERVICE SOLUTIONS

Genie has announced the expansion of Genie Service Solutions (GSS), a comprehensive service agreement plan, for Genie equipment owners of all fleet sizes throughout the EMEAI region (Europe, Middle East, Africa and India).

GSS allows equipment owners to feel confident in the quality of their service and maintenance, while optimising the timing and cost of servicing their equipment and increasing fleet uptime. Fleet owners can select the GSS plan that best meets their needs for specific Genie equipment in their fleet.

Matt Brint, Genie service director for the EMEAI region, commented, “Genie’s commitment to delivering quality for our customers extends well beyond delivery of the machine. By offering different service programmes, for any number of machines, we are able to customise the support our customers receive based on their business needs.”

BRIEFS

The programme is based on achieving full carbon neutrality by 2040.

OCP Group, a Moroccan state-owned phosphate rock miner, phosphoric acid manufacturer and fertiliser producer, has launched a new strategic programme for 2023-2027 devoted to raising fertiliser production and investing in new green fertilisers alongside renewable energy. The programme provides for a global investment of around US$13bn over the 2023-2027 period. It aims to increase production capacity from 12mn tons of fertiliser to 20mn tons by 2027.

Fethi Arabi, member of the Sonatrach executive board, added, “Sonatrach is part of Algeria’s national hydrogen roadmap, which aims to kick-off pilot projects by 2030. The international infrastructure connection between Algeria and Europe that can be used for transporting green hydrogen and the availability of solar energy potential enables us to pursue a long-term strategy for realising green hydrogen projects at competitive cost. Today we are signing a MoU with a recognised strategic partner in the emerging hydrogen sector to examine long-term collaboration on joint commercial hydrogen projects.”

Initially, VNG and Sonatrach intend to work together on associated financial/technical issues such as hydrogen infrastructure and the potential for joint commercial hydrogen projects.

Talgo’s intercity trains begin operations in Egypt

Talgo, a company specialised in design, manufacture and maintenance of rolling stock, has announced that its trains have begun commercial operation in Egypt. ENR, Egypt’s national railway company, has started utilising the trains for services connecting Cairo to Alexandria. This milestone confirms the satisfactory progress of the project for the supply of six units and their maintenance for eight years which has also involved the construction of new Talgo facilities.

OCP launches green investment strategy

Image Credit: AfDB Image Credit: OCP Group Image Credit: Talgo NEWS | NORTH AFRICAN REVIEW OF BUSINESS AND TECHNOLOGY | FEBRUARY 2023 www.africanreview.com 4

The trains supplied to Egypt for daytime services increase capacity and service quality and reduce energy consumption per passenger.

Equinix steps into South African market with data centre investment STRENGTHENING INTERNET CONNECTIVITY IN SA

Equinix, Inc., a digital infrastructure company, has announced plans to enter the South African market with a US$160mn data centre investment in Johannesburg that augments its current footprint on the African continent in Nigeria, Ghana and Côte d'Ivoire. The new data centre is expected to open mid-2024.

With its South African expansion, Equinix is entering one of the largest and most digitally developed nations on the continent. Already a strategically important connectivity hub for digital networks, South Africa boasts a significant network of submarine communications cables. These strategic links between countries and continents are established at several points across the country’s 2,850 km of coastline.

“We entered the African continent earlier this year with the acquisition of MainOne, the leading West African data centre and connectivity solutions provider with presence in Nigeria, Ghana and Côte d'Ivoire,” said Eugene Bergen, president, EMEA, Equinix. “This investment will give both South African businesses the opportunity to expand internationally and global businesses to expand into South Africa.”

Equinix is seeking out sustainable and reliable sources of energy for this new data centre as is customary when it enters a new market. While the exploration for sustainable and reliable sources of energy continues, this new facility is expected to feature many unique sustainable attributes including hyper-efficient cooling with outside air economisation using minimal water, allowing the company to limit its carbon footprint and maintain energy efficient operations with industry leading PUEs.

MTN South Africa and MTN GlobalConnect, in partnership with the 2Africa consortium, have landed the 45,000 km 2Africa cable in Yzerfontein and Duynefontein, South Africa.

For MTN GlobalConnect, this landing is the first in a series of six across five countries: South Africa, Sudan, Cote D’Ivoire, Nigeria and Ghana. This will allow MTN GlobalConnect to showcase, in a tangible manner, the importance of connectivity and creating cross border networks, that connect Africa to the rest of the world. The 2Africa cable connection will go live in 2023.

This subsea cable will lay the foundation for improved global Internet access, connecting people and continents. Once live, it will play a big part in delivering muchneeded capacity in Africa from Europe, the Middle East and Asia.

MTN Group president and CEO Ralph Mupita, said, “Strategic partnerships such as the one we have with the 2Africa consortium will help us accelerate and deepen Internet adoption and socio-economic progress across the African continent. Data traffic across African markets is expected to grow between four and five fold over the next five years, so we need infrastructure and capacity to meet that level of growth and demand.”

The board of Noronex Limited has confirmed that the company’s first diamond drilling programme is underway at the Snowball Joint Venture in Namibia.

Diamond drilling has been selected to drill the shallow Kalahari sand cover and provide detailed geological information in a previously undrilled part of the Kalahari Copper Belt. The Mitchell Drilling rig was deployed to test the highly ranked Helm prospect.

The base of the Kalahari cover, a thick calcrete sequence, was intersected at 53 m depth downhole, shallower than expected above the interpreted D’Kar Formation sediment sequence, potential mineralisation can be developed below this at the NPF contact. The first hole 22HED01 is testing the NPFD’Kar contact on the southern limb of the ‘domal’ target. Ground magnetic profiles have been collected to pinpoint the contact under the Kalahari cover.

BRIEFS

ACE Green Recycling (ACE) and Tabono Investments (Tabono) have signed a term sheet to form a joint venture to build and operate two environmentally sustainable battery recycling facilities in South Africa. Through this venture, the companies aim to bring radical change to the management of South Africa's battery waste. Both facilities will be greenfield projects.

MTN GlobalConnect CEO, Frédéric Schepens, commented, “The initiative complements our terrestrial fibre strategy to connect African countries to each other and to the rest of the world. We are building scale infrastructure assets to meet the explosive growth in data traffic and accelerate the digital economy on the continent, by creating a pan-African fibre railroad driving affordable connectivity.”

This cable landing adds to another milestone to the digital railroads that are being built around Africa, making telecommunications accessible and available.

Volvo expands electric truck range in South Africa

Volvo continues to expand its range with the launch of several new, extra heavy electric trucks, making it possible to electrify even more transport routes in cities and regions. Thanks to multiple battery, cab and chassis options, the new trucks can be designed to carry electric superstructures for a wide range of specialised transport assignments, including goods distribution, refuse collection and construction work.

Production will begin in Q1 of 2023.

ACE and Tabono form joint venture

NORONEX’S FIRST DIAMOND DRILLING PROGRAMME UNDERWAY

Image Credit: Equinix Image Credit: Adobe Stock Image Credit: Volvo NEWS | SOUTH AFRICAN REVIEW OF BUSINESS AND TECHNOLOGY | FEBRUARY 2023 www.africanreview.com 6

Equinix is seeking out sustainable and reliable energy sources for this new data centre.

Without dedicated recycling facilities, South Africa is losing materials like lithium and cobalt.

Volvo Trucks has introduced new electric variants.

Tietto begins wet commissioning at Abujar Gold Project

Tietto Minerals, a West African gold explorer and developer, has commenced wet commissioning its 4.5 Mtpa CIL processing system at its 3.45 oz Abujar Gold Project in Côte d’Ivoire.

Tietto managing director, Caigen Wang, said, “To build a gold mine the size of Abujar in less than 12 months is a monumental achievement. To do it during Covid-19 with supply chain issues, escalated pricing and skilled people shortage made it, almost, mission impossible. Our in‐house construction team has demonstrated it can be delivered through careful planning, diligent management and hard work. I would like to thank our mine construction team, ESG team, mining team, contractors and consultants, local communities, government authorities at various levels and many more. We would also like to thank our shareholders who have put us in a position where we have no debt, zero hedging and in a position to produce c.260,000 ounces in the first 12 months of production once we reach commercial production.”

Tietto chief operating officer, Matthew Wilcox, commented, “I am extremely proud of the team who have delivered the project in less than 11 months from pouring first concrete, which I believe, is the most challenging schedule for a project of this magnitude that has been achieved in the last decade in West Africa. A schedule made possible by an outstanding owners’ team and a great team of contractors and consultants who achieved the job safely and on budget.

“I would like to thank the construction team led by Daniel Kotzee, our outstanding engineering consultants in Primero and ECG, as well as our key contractors: Wacom (concrete), Friedlander (field erected yanks), NCP (mill installation), EPSA (mining), Peloton (electrical labour) and Enikon (SMP), as well many other local contractors, who all went above and beyond to achieve the schedule.” Wilcox added, “A great effort by the projects commercial team, led by Hesbon Okwayo, who achieved an outstanding result under difficult global conditions, and supported by Antrak Logistics and Bolloré, who managed to get the equipment to site in the time frames required. Also, special thanks to our owners’ earthworks team, led by Guillaume Hubert, and supported by Citland (HDPE lining), who achieved amazing work under difficult conditions.”

BAOMA 1 ACHIEVES COMMERCIAL OPERATIONS

Serengeti Energy, a private company backed by shareholder KfW, Norfund, NDF, Proparco, Stoa and Swedfund, has announced that Baoma 1, Sierra Leone’s first independent power project (IPP) has achieved commercialisation.

The 5MW solar power plant is the first phase of a 25MW solar PV power project in Yamandu, near Bo in Sierra Leone. The project will add approximately 15% to Sierra Leone’s total electricity generation capacity. The company expects to commence building the second phase of the project in 2023.

Chris Bale, Serengeti Energy’s CEO, commented, “The project will supply low-cost electricity to the local power grid for many years to come and will help to diversify the electricity mix in the country. We look forward to hosting the official launch event for the plant that will be held in early 2023 to celebrate the success of this achievement.”

BRIEFS

West African Resources has awarded Metso Outotec an order for comminution equipment to be delivered to their greenfield Kiaka gold project in Burkina Faso.

Metso Outotec’s delivery includes two Planet Positive Premier grinding mills with a total installed power of 2MW, as well as Metso Outotec’s proprietary metal and rubber mill linings and spare parts. The order value is around EU€30mn (approximately US$32mn).

WORLD BANK TO INCREASE GRID-CONNECTED RENEWABLE CAPACITY

The World Bank has approved its new Regional Emergency Solar Emergency Solar Power Intervention Project (RESPITE), representing US$311mn in financing. The new project includes a US$20mn grant to help facilitate future regional power trade and strengthen the institutional and technical capacities of the West Africa Power Pool (WAPP) to undertake its regional mandate.

The main objective of the RESPITE is to rapidly increase grid-connected renewable energy capacity and strengthen regional integration in the participating countries of Chad, Liberia, Sierra Leone and Togo.

It will finance the installation and operation of approximately 106MW of solar photovoltaic with battery energy and storage systems, 41MW expansion of hydroelectric capacity, and will support electricity distribution and transmission interventions across the four countries.

“Solutions supported by the new project are manyfold and have substantial benefits for the countries and the region. Among others, it will provide fiscal space for countries to address food crisis resulting from the war in Ukraine, initiate development of competitively tendered gridconnected clean energy to alleviate current power supply crisis, positively address climate change by helping countries to move away from expensive and polluting fuels, and help synchronise the WAPP network to enhance regional integration in the energy sector,” said Rhonda Jordan-Antoine, World Bank task team leader of the project.

The project will encourage leading international private developers to enter smaller and more fragile economies and to also demonstrate the viability of competitively tendered grid connected solar and battery storage in participating countries.

Gravita commences aluminium recycling in Togo

Gravita India Limited, a leading recycling company with a global presence, has announced that its subsidiary Gravita Togo SAU has started commercial production of aluminium cast-alloys from a new recycling plant.

The opening of the facility builds on the company’s presence on the continent, having already opened similar sites in Tanzania, Senegal and Mozambique. The plant in Togo will help the company augment its aluminium segment capacity in Africa.

Metso Outotec wins West African order

A first gold pour has now been completed at the mine. Image Credit: Adobe Stock Image Credit: Metso Outotec Image Credit: Adobe Stock NEWS | WEST AFRICAN REVIEW OF BUSINESS AND TECHNOLOGY | FEBRUARY 2023 www.africanreview.com 8 Metso Outotec’s delivery includes two Planet Positive Premier grinding mills. The plant has an annual capacity of around 4,000 MTPA in phase 1.

Singrobo hydropower plant reaches financial close OPEC APPROVES NEW GLOBAL SUPPORT

Financing for the Singrobo-Ahouaty 44MW hydropower project in Côte d’Ivoire has reached a close on EU€174.3mn (approximately US$188mn) with the African Development Bank (AfDB) as mandated lead arranger.

The package is made up of capital supplied from AfDB, with additional financing provided by the Africa Finance Corporation (AFC), the Germany Investment Corporation (DEG) and the Emerging Africa Infrastructure Fund (EAIF).

Singrobo-Ahouaty is the first hydro independent power producer project to be developed by a local sponsor in the country. Located on the Bandama River, the plant will connect rural inhabitants in the surrounding villages to the national grid and will improve power supply and reliability. It will also reduce the local dependence on fossil fuels during peak demand periods – providing a welcome climate-boost – and increase the share of renewables in Côte d’Ivoire’s energy mix.

AfDB director for energy financial solutions, policy and regulations, Wale Shonibare, commented, “The Singrobo-Ahouaty power plant will leverage the huge potential in Côte d’Ivoire to provide clean energy from hydropower. Despite the current global challenges induced by the Covid-19 pandemic and supply-chain related cost escalation, the project reflects the bank’s resilience and leadership in the African energy marketplace in guiding it to financial close.”

Paromita Chatterjee, an investment director at EAIF’s managers, Ninety-One, said, “The project has seen EAIF and the Private Infrastructure Development Group deliver on three core objectives: mobilising private capital, enabling economic development and contributing to increasing Africa’s stock of renewable energy infrastructure.”

DEG head of infrastructure and energy, Africa and Latin America, Andreas Cremer, added, “As a development finance institution, DEG is proud to be part of the financing consortium for Côte d’Ivoire’s first hydro independent power producer and to support the country’s path towards more climatefriendly green energy production. The financing fits well into DEG's business strategy with its focus on climate and impact.”

MANAGEM ACQUIRES ASSETS IN WEST AFRICA

Managem Group, a pan-African and full integrated mining group, has entered into a definitive agreement with Canadian mining company IAMGOLD Corporation for the acquisition of the company’s 90% interest in the corporation holding the Boto Gold Project in Senegal; Boto West, Daorala and Senala Ouest also in Senegal; all assets in Diakha-Siribaya in Mali; and Karita in Guinea. It also includes the acquisition of the company’s interest in Senala joint venture in Senegal.

“These transactions will enrich our already solid portfolio of assets, reinforce our role as a regional leader in the gold activity in Africa and consolidate our position as a top-performer within the African mining industry,” commented Imad Toumi, chairman and CEO of Managem. “We are very excited to work with Boto, Diakha-Siribaya and Karita teams to advance these projects by drawing on the expertise and the experience of our teams as well as the obvious synergy between these assets.”

BRIEFS

First phase of LRMT Blue Line complete

The Governor of Lagos State, Babajide SanwoOlu, has commemorated the completion of the first phase of the Lagos Rail Mass Transit (LRMT) Blue Line in Nigeria.

The completion of the first phase includes a 13 km stretch of rail as well as five stations and marks an important milestone in the delivery of the entire 27 km long Blue Line. The project is being handled by the Lagos Metropolitan Area Transport Authority (LAMATA).

The OPEC Fund for International Development has approved more than US$500mn in new financing, with 15 new projects being pursued.

The announcement follows the launch of its Food Security Action Plan and the adoption of its Climate Action Plan in 2022. The new engagements will support infrastructure development and investments to improve communities in the Fund’s partner countries.

Included in the development is a US$25mn loan to the Niger Solar Plant Development and Electricity Access Improvement Project which aims to connect 80,000 households to the national grid through the construction and integration of a 10MWp solar PV plant. The OPEC Fund will also co-finance the construction of electrical transmission lines in the southern region of the country and in the capital city Niamey.

In regards to food security, the Fund has approved US$14mn and US$10mn to Benin and Liberia respectively to support agricultural development.

US$50mn has been allocated to a regional multilateral development bank in Africa to bolster infrastructure and a further US$40mn will be loaned to a private sector institutions to support the import and export of agricultural commodities and fertiliser across the continent.

For Côte d’Ivoire, a programme-based load will contribute to financing the Economic and Social Reform Support Programme intended to promote reforms aimed at providing access to basic social infrastructure for disadvantaged people.

A US$40mn loan will also be provided to the Kiffa Water Supply Project to contribute to financing a water treatment plant, four pumping stations and more than 300 km of pipeline to deliver potable water to the city of Kiffa in Mauritania.

APM’s truck appointment system goes global

APM Terminals has announced plans to roll out further its online truck appointment system which was piloted in 2022.

The system aims to reduce truck turn times, streamline gate access and improve logistics planning worldwide.

It is currently being rolled out to the West Africa Container Terminal in Onne, Nigeria, and APM Terminals Yucatan where it will be available to customers at the start of 2023.

|

WEST | NEWS www.africanreview.com 9 FEBRUARY 2023

AFRICAN REVIEW OF BUSINESS AND TECHNOLOGY

According to

the electricity required to

the line will be delivered

The system is going global. Image Credit: APM Terminals

media reports,

power

by a single, stand-alone power plant.

Image Credit: AfDB

Image Credit: Lagos State Government

AfDB’s vice president of power, energy, climate and green growth, Kevin Kariuki, speaks to the media during a visit to the plant.

Intex opens second unit in Ethiopia KENGEN TO SCALE UP RENEWABLE ENERGY

Intex Technologies UAE, a reputable brand in consumer goods such as mobile phones, computer accessories, power products, and consumer electronic products, has set its second unit in Ethiopia to cover the increasing demand in the African market, the company has announced.

“With this launch, we have strengthened Intex’s dedication to improving everyone’s life through the best consumer technology while also boosting brand recognition,” said Sanjay Bansal, managing director at Intex Technology UAE.

The company has a network of manufacturing and distribution units in India, UAE and China, having more than 600 distributors and a dealer base of over 25,000 globally.

In addition, with more than 900 service contact points, 13 warehouses, and 31 test and repair centres worldwide, Intex provides users with high-end product support.

To fill the gap between demand and supply, Intex Technologies has launched its unit in Ethiopia offering its leading products. It is set to collaborate with partners and investors to expand its product line in the region.

Intex Technologies is offering domestic to commercial products, including UPS, cables, inverters, monitors, toner and cartridges, batteries, IT and mobile accessories, and home appliances. In addition to that, Intex Technologies R&D team in India is working on German design for all the company’s products to meet quality standards suitable for the African market.

Recently, the company has unveiled 24-inch LED monitors with a streamlined appearance for a variety of environments including the workplace, home and gaming studios. The company has guaranteed top colour performance and sharp visibility with this product.

RWANDA TO GET ITS FIRST BIONTAINER

BioNTech SE has reached the next milestone in the establishment of scalable mRNA vaccine production in Africa. The six ISO-sized shipping containers for the first BioNTainer have finished construction in Europe, underwent quality checks by BioNTech experts, and are being prepared for shipment to Kigali, Rwanda, where they are expected to arrive in the first quarter of 2023.

In parallel, BioNTech continues to develop and build its state-of-the-art manufacturing facility in Kigali, following the groundbreaking in June 2022. The facility will be housing the first BioNTainers and is expected to become a node in a decentralised and robust end-to-end manufacturing network in Africa. BioNTech also expects to ship BioNTainers to Senegal and potentially South Africa in close coordination with each respective country and the African Union. Vaccines to be manufactured in this Africa-wide network will be dedicated to people residing in member states of the African Union.

BRIEFS

The board of directors of the African Development Bank Group (AfDB) has approved a US$40mn trade finance package in favour of Bank One Limited of Mauritius. The financial package comprises a US$25mn risk participation agreement and a US$15mn transaction guarantee. This facility will allow the bank to provide up to 100% guarantee to confirming banks for the nonpayment risk arising from the confirmation of trade finance instruments issued by Bank One.

Kenya Electricity Generating Company PLC (KenGen) has announced a new plan to scale up the deployment of renewable energy in the country by an additional 3,000MW. This new campaign will be driven largely by deploying up to 2,000MW drawn from geothermal and hydro sources as baseload power to stabilise the country’s energy sources, thereby diversifying away from expensive thermal sources.

At the same time, KenGen, which is listed on the Nairobi Securities Exchange (NSE), said it has put in place plans to optimise the existing hydro sources even as it pushes for the development of new hydropower stations, and expansion of existing ones, particularly within the Tana River basin.

Speaking from KenGen’s Stima Plaza Headquarters in Nairobi, managing director and CEO, Abraham Serem, said the company had revamped its corporate strategy and rolled out a 10-year strategy that seeks to add 3,000MW within the next 10 years. He further added that the company will be seeking to rehabilitate its existing power plants to make them more efficient for sustainable generation.

Serem said that KenGen would be looking to tap into the vast potential of geothermal energy in the Rift Valley region, which is estimated to be about 10,000MW of clean and renewable energy.

“So far we have only exploited about 0.9GW of the 10GW geothermal potential and that is why a huge chunk of the additional capacity will be drawn from geothermal. Our focus going forward is to secure the baseload capacity to stabilise Kenya’s energy supply mainly from green renewable energy,” commented Serem.

He singled out the upcoming 305MW geothermal projects, with 280MW coming from Olkaria and 25MW from the Eburru geothermal power plant.

Finclusion Group consolidates position in Africa

Finclusion Group is now known as Fin, with subsidiaries in its core markets following suit. The company is thus consolidating its footprint across Africa and aiming to be the leading international neobank across eastern and southern Africa. The company is also injecting a further equity injection to fuel growth which will be used to add new, fully-integrated territories to its business and development offerings, specifically in support of microfinance banks.

AfDB approves trade package for Bank One

Image Credit: Intex Technologies Image Credit: AfDB Image Credit: Fin NEWS | EAST AFRICAN REVIEW OF BUSINESS AND TECHNOLOGY | FEBRUARY 2023 www.africanreview.com 10 The

The company is now called Fin.

The unit will help cover the increasing demand in the African market.

financial support is expected to help Bank One increase its capacity to support the trade finance needs of key sectors.

REMA and UNDP launch hazardous waste management project

The Rwanda Environment Management Authority (REMA) and the United Nations Development Programme (UNDP) have launched a five-year project to protect human health and the environment from the adverse effects of hazardous wastes.

The five-year ‘Hazardous Waste Management Project’ will contribute to the Government's ambition to support public and private institutions to improve hazardous wastes management by enhancing the introduction of ‘Reuse, Reduce, Recycle and Recover’ approach in priority industries and economic sectors to ensure the sound management of wastes.

The project will follow the ‘Reuse, Reduce, Recycle and Recover’ approach.

“This project will support Rwanda to inventory, and understand the quantities and types of hazardous in Rwanda, raise awareness of the different categories of people who are at the centre of generating wastes, and come up with best disposal mechanisms for hazardous wastes which will then create green jobs in the process of collection, transportation and disposal,” said Juliet Kabera, director general, REMA.

To achieve its objectives, the US$7mn project support will be used to develop a legal framework for the sound management of chemicals, hazardous and toxic waste as long as safer alternatives. It will also support in identifying the types, volumes and locations of chemicals, toxic and hazardous waste generation, and identify important sectors to target.

The project will also support the establishment of hazardous waste treatment facilities including interim storage, as well as raise awareness on the sound management of waste at all levels.

“This project came at the right time when we look for sustainable solutions to minimise waste generated, strengthening our policies and strategies that promote sustainable production and consumption, and it kicks off the implementation of the National Circular Economy Action Plan and roadmap we launched,” said Jeanne d’Arc Mujawamariya, Rwandan Minister of Environment.

Rwanda has made great steps forward in managing waste from banning plastic bags in 2008 and establishing the e-waste recycling facility in 2018

MPDC TO EXPAND TRACTOR AND TRUCK FLEET

Cargotec’s Kalmar has secured an order from Maputo Port Development Company (MPDC) in Mozambique for 14 T2i terminal tractors and three forklift trucks – two heavy models and one medium model. The order was booked in Cargotec’s Q4 order intake and the machines are scheduled to be delivered towards the end of Q2 2023.

MPDC, a joint venture between the Mozambican Railway Company and Portus Indico, was first awarded the concession to run Porto de Maputo in 2003. The company also acts as the port authority with responsibility for maritime operations, piloting, stevedoring, and terminal and warehouse operations as well as port planning and development.

MPDC currently operates a fleet of more than 35 Kalmar forklift trucks and terminal tractors, which are used to transport bulk material in skips between the quayside and trailer loading area.

BRIEFS

Iristel expands into Kenya

Iristel, a global telecommunications service provider, has announced its expansion into Kenya, giving the company a presence on the continent as it looks to expand into the emerging market.

CEO Samer Bishay said, “We will begin with our best-in-class wholesale services and expand our product offering in the coming months.”

For the initial rollout, Irstel will provide the capability to purchase SIP trunks, which can be aggregated with its onnet footprint, and DIDs.

GLOBELEQ ADVANCES GEOTHERMAL IN KENYA

Globeleq, a private power company in Africa, announced that it has signed financing agreements with the African Development Bank (AfDB) (as mandated lead arranger), the Eastern and Southern African Trade and Development Bank (TDB) and Finnfund, with regard to the US$72mn debt funding for the 35MW Menengai geothermal project in Nakuru County, Kenya.

Globeleq, which is owned 70% by British International Investment and 30% by Norfund, is providing equity, project development and construction management experience. The announcement follows the recent joint commitment by the Kenyan and UK Governments at COP27 in Egypt to fasttrack green investment projects in the country, including the Menengai project.

Menengai is a greenfield geothermal project and part of the first phase of the wider Menengai complex, which is the second large-scale geothermal field being developed in Kenya after Olkaria.

Construction of the project is expected to commence during the first quarter of 2023 once financial close has been reached. Globeleq will operate and maintain the power plant once it has reached commercial operations in 2025.

Steam will be supplied to the project by the government-owned Geothermal Development Company (GDC), under a 25year project implementation and steam supply agreement. Once operational, electricity will be sold to Kenya Power, the national distribution company, under a power purchase agreement for the same timeframe. The project also benefits from a signed and effective letter of support issued by the Government of Kenya. The project will deliver clean and cheap baseload power to the national grid and enable GDC to monetise the available steam resources from the Menengai steam field.

Solarise Africa to grow Kenyan operations

Solarise Africa has been awarded US$3mn by EDFI ElectriFI to provide tailored financing solutions for decentralised energy solutions to selected commercial and industrial (C&I) customers across the continent.

Solarise Africa provides reliable and affordable renewable energy solutions to businesses in Africa. The ElectriFI Country Window for Kenya is developed in partnership with EU Delegations and host governments.

|

EAST | NEWS www.africanreview.com 11 FEBRUARY 2023

AFRICAN REVIEW OF BUSINESS AND TECHNOLOGY

The company will begin with wholesale services. The company will provide renewable energy solutions. Image Credit: EDFI ElectriFI Image Credit: REMA

Credit:

Image

Adobe Stock

Upcoming Events Calendar 2023

FEBRUARY 6-9

INVESTING IN AFRICAN MINING

INDABA

Cape Town, South Africa https://miningindaba.com/ 23-25

MINEXPRO AFRICA 2023

Dar es Salaam, Tanzania https://expogr.com/minexpotanzania/

MARCH 7-9

AFRICA ENERGY INDABA

Cape Town, South Africa https://energyindaba.co.za/ 7-9

MIDDLE EAST ENERGY

Dubai, UAE https://www.middleeastenergy.com/en/home.html

7-9

SECUREXPO EAST AFRICA

Nairobi, Kenya https://www.securexpoeastafrica.com/ 13-16

NAEPEC Barcelona, Spain https://www.naepec.com/Default.aspx?lg=en 14-16

PROPAK EAST AFRICA

Nairobi, Kenya https://www.propakeastafrica.com/ 14-18

CONEXPO-CON/AGG 2023

Las Vegas, USA https://www.conexpoconagg.com/ 30-1 April

MEGA CLIMA KENYA 2023

Nairobi, Kenya https://megaclimaexpo.com/kenya/

APRIL 17-21

HANNOVER MESSE

Hannover, Germany https://www.hannovermesse.de/en/ MAY 9-11

SECUREX WEST AFRICA

Lagos, Nigeria https://www.securexwestafrica.com/ 16-18

ENLIT AFRICA

Cape Town, South Africa https://enlit-africa.com/ 23-25

OMC RAVENNA

Ravenna, Italy https://www.omc.it/en/

CONSTRUCTION INDUSTRY LOOKS AHEAD TO BIGGEST CONEXPO-CON/AGG TO DATE

CONEXPO-CON/AGG, the largest construction trade show in North America, is aiming to push the construction industry to the next level by helping professionals elevate their expertise, experience the latest equipment on the market and make new connections within the sector.

The show, which is held every three years in Las Vegas, USA, is expected to be the biggest edition to date, having sold all available exhibit space. It will arrive in Las Vegas from 14-18 March 2023.

“The addition of the new West Hall and Diamond Lot at the Las Vegas Convention Center gave us, and our exhibitors, a number of new opportunities to show how we are taking the construction industry to the next level,” commented CONEXPO-CON/AGG show director, Dana Wuesthoff. “Now at 2.8 million square feet of exhibits, there’s more for construction pros to see than ever before.”

More than 1,800 exhibitors are showcasing their products and solutions at the event which will reportedly be nearly 5% bigger than the record-setting 2020 edition. Included in these ranks are CASE Construction, Caterpillar, Hitachi, SANY, Hyundai Construction Equipment, Bobcat, John Deere, Kobelco, Bomag, Komatsu, Liebherr, Sandvik, Terex, BAUER, Bell Equipment, Doka, and CDE.

Supporting this will be 150 education sessions to help attendees discover ideas and create lasting connections within the construction community.

More than 1,800 companies are exhibiting at the trade show.

At present, the current pace of attendee registration is nearly double what it was at this time for the 2020 show.

“This is the event that construction professionals, especially those making company-level decisions, and those needing professional development hours, can’t miss,” said CONEXPO-CON/AGG show chair and Caterpillar senior vice president, Phil Kelliher. “Seeing the new equipment and techniques on a screen doesn’t compare to seeing it all in person. At the show, you can see the equipment, ask questions of the manufacturers themselves, and really understand what the equipment and education can do for your career and business.”

For more information on CONEXPO-CON/AGG, visit https://www.conexpoconagg.com.

EVENTS | CALENDAR AFRICAN REVIEW OF BUSINESS AND TECHNOLOGY | FEBRUARY 2023 www.africanreview.com 12

CONEXPO-CON/AGG

Credit: CONEXPO-CON/AGG

Image Credit:

All available exhibit space has been sold. Image

Building selfreliant capacity in turbulent times

Exacting global headwinds as manifested by a looming recession in the U.S. and Europe alongside the increasingly troubling global warming situation are weighing on economic activity across SSA. As a result, GDP expansion in 2023 could remain below pre-2020 trend-growth amid low financial buffers and higher regional debt burden.

In the face of these delicate challenges in the post-pandemic recovery period, the region needs actionable policies to build economic resilience to future crises. It must seize opportunities to unlock productivity-enhancing growth by investing in agriculture, human capital, digitalisation, green energy infrastructure, and supply chain diversification as well as forging greater intraregional trade and investment.

Regional and trade integration within the continent offers an opportunity to enhance the resilience of African economies and militates against downturn in overseas markets. The African Continental Free Trade Area (AfCFTA) can be leveraged to coordinate and scale up investments in regional infrastructure (especially transport and electricity), transborder natural resource management, and innovation dissemination – thus fostering participation in regional value chains. Currently, however, poor road infrastructure hinders the development of intraregional trade as well as export-import of finished goods in many African countries.

“By exploiting economies of scale, intraregional trade in agriculture and food may lower the unit cost of marketing and distributing food, thus creating additional incentives for investments in transport and other logistics that facilitate the trade of goods and inputs within and across borders,” stated the World Bank.

Trade diversification will facilitate intra-regional trade, especially in agribusiness. But agricultural goods trade within SSA remains very restrictive, with regional trade in agricultural raw materials very low. Leveraging regional trade agreements can increase food supply by removing technical barriers (mainly sanitary and phytosanitary measures) that restrict food trade. Agriculture and food exports are expected to grow by as high as 80% following the implementation of the AfCFTA, while agricultural intra-Africa trade is expected to rise by 49% (according to the World Bank).

Trade facilitation

Removing tariff barriers (i.e. taxes) and non-tariff barriers (quotas, licenses, and complex rules of origins) as well as improving ‘trade facilitation’ measures like simplification and harmonisation of export/import processes, can underpin resilient regional trading systems. Long waiting times at African borders, excessive fees, and heavy customs formalities continue to affect traderelated development.

There is a need to strengthen the capacity of countries to comply with food safety standards. Regional trade in agriculture faces the highest non-tariff barriers, including sanitary and phytosanitary restrictions. Countries should also foster competition by avoiding the imposition of roadblocks to the movement of goods and investments across borders.

Eliminating non-tariff barriers can increase intra-regional trade, whilst reducing inflation. Estimates show that domestic prices in SSA are, on average, 13% higher due to sanitary/ phytosanitary measures alone. Other non-tariff barriers account for 50-60% of marketing costs and hike up domestic transportation costs. Addressing regulatory barriers and poor compliance will also lower trading costs of agricultural services and boost competitiveness.

“Removing trade and technical barriers to food trade, investing in regional trade facilitation, and enabling the free flow of capital across borders (foreign direct investment) are essential for building resilient regional food systems, with digital technologies playing a critical role,” noted the World Bank.

Power sector

Energy deficiency is a fundamental bottleneck to growth since half of SSA’s population lacks a reliable supply of electricity, limiting the ability to start and run businesses. Yet, primary-energy resources (coal, natural gas, biofuels, geothermal, hydro, solar and wind power) are sufficient enough to generate more than 12TW of capacity (according to the International Energy Agency), which is substantially larger than Africa’s current and projected power consumption.

Africa will need investments of US$190bn per year between 2026 and 2030 to meet its energy demand, with two-thirds going to clean energy,

ECONOMY | REPORT

Removing trade and technical barriers to food trade, investing in regional trade facilitation, and enabling the free flow of capital across borders are essential for building resilient regional food systems.”

THE WORLD BANK

Regional and trade integration within the continent offers an opportunity to enhance the resilience of African economies.

AFRICAN REVIEW OF BUSINESS AND TECHNOLOGY | FEBRUARY 2023 www.africanreview.com 14

Image Credit: Adobe Stock

Economist Moin Siddiqi reports on the actionable policies available to sub-Saharan (SSA) countries as they continue to cope with a turbulent global environment in 2023.

according to Egbin Power Plc, Nigeria’s biggest thermal power plant, which cited findings from the International Energy Agency. Nigeria, South Africa, the DRC and Ethiopia are the countries with the most investment needs.

Capitalising on energy resources requires both innovative private finance and reforms. It needs colossal funding in generation, new storage technologies, regional interconnectivity, and offgrid power systems – beyond the scope of most governments. Development banks can encourage potential investors taking project risks by providing guarantees, which cover principal repayment and/or interest up to a predetermined amount and ‘full credit guarantees’ (i.e., 100% of debt service due).

Such facilities (albeit limited) improve the riskreturn profile of commercial financing by extending maturity, reducing interest rate costs and facilitating access to capital markets. Similarly, improved electricity sector governance can enhance the investment environment.

Africa can play a pivotal role in global decarbonisation thanks to abundant natural resources: the continent’s forests absorb an estimated 1.1-1.5bn tons of CO2 annually. It boasts 60% of the best solar resources globally, of which a paltry 1% is utilised. Yet solar PV is the cheapest source of power across SSA. According to the International Renewable Energy Agency (IRENA), solar PV theoretical potential could yield more than 660,000 TWh of electricity a year.

East and southern Africa possess the highest solar potential, estimated at 200,000 and 160,000 TWh per year respectively. The clean energy transition will be a critical part of the region’s development. Africa is a potential supplier of goods that are in high demand from it, including minerals for low-emission technologies such as gas, cobalt, copper, aluminium, and lithium.

Building productive capacity

Africa’s resource producers are among the world’s least diversified economies – hence the reliance

on global commodity markets. Approximately 50% of the fluctuations in the business cycle of African countries can be explained by ‘terms of trade’ (i.e., the ratio between export-and-import prices). Unfavourable terms of trade directly affect growth, inflation, public debt, and to some extent access to financial markets.

Despite holding sizeable mineral and hydrocarbons resources, Africa represents a tiny share of global industrial production. Thus, it relies on imported petroleum products and manufactured goods – a major constraint on balance-of-payments. With a shrewd industrialisation strategy, Africa can build aluminium smelters, steel plants, oil refineries, petrochemicals industry and gas-to-liquid facilities – hence monetising valuable domestic resources. The region accounts for 80% of platinum, 66% of cobalt, and more than 50% of manganese and bauxite production. Furthermore, Africa produced 8% and 6.4%, respectively, of global oil and natural gas production (BP 2021 data).

The continent is endowed with almost 60% of the world’s uncultivated arable land, plus ample water endowment. The agriculture sector, which employs half of SSA’s workforce and generates just-below one-fifth of its GDP, is severely underfunded. Consequently, Africa is a net importer of basic foodstuffs (including cereals, dairy products, edible oils and fats, and meat products) despite vast land and water resources.

Agricultural productivity per hectare in SSA falls well below other regions – reflecting a lack of modernisation, limited use of irrigation to raise crop yields, an unpredictable climate, and low energy inputs. However, investment in agricultural skills, market connectivity and infrastructure could prompt a green revolution, thus boosting food production per capita.

Africa’s population is among the fastest-growing and youngest in the world. Within 10 to 15 years, more than half of the globe’s job market entrants will come from SSA, according to the International Monetary Fund (IMF). To reap ‘demographic

dividends’, investing in human capital (higher education, vocational training, and health) are prerequisites for skilled jobs in mid high-end manufacturing, engineering, and ITC.

Inclusive development

Ultimately, future prosperity and resilience depend on high-quality growth. The IMF advises SSA to pursue a policy framework based on three key pillars. These include a well-defined redistributive fiscal policy with a clear investment strategy to assist underserved regions; macroeconomic stability to foster inclusive growth; and stronger institutions to ensure political stability and equitable public service delivery.

Governments should prioritise and increase the efficiency of public spending. More progressive tax systems and increasing their collection (particularly with property and/or land taxes) will support core public services. In advanced countries, revenues from property taxation constitute more than 2% of GDP, but only 0.6% in developing countries and even less (0.38% of GDP) among African countries (according to World Bank data).

Strengthening tax incentives towards growthenhancing activities such as research and development, high-tech start-ups, as well as for small and medium-sized enterprises will also underpin private-sector growth.

At the same time, international assistance is critical in Africa’s path to self-sufficiency. The World Trade Organisation (WTO) and other multilaterals can also play a role in limiting distortionary trade practices and fostering a fairer/more effective trading system. Debt restructuring for countries at high risk or already in debt distress are essential. More recently, the G20 approved a common framework to streamline debt relief for least developed countries.

In sum, translating Africa’s resource endowments into sustainable growth requires infrastructure investments aimed at diversifying economic growth, along with prudent legal/regulatory regimes and institutional capacity to implement them. ■

Moin Siddiqi, economist

www.africanreview.com 15 FEBRUARY 2023 | AFRICAN REVIEW OF BUSINESS AND TECHNOLOGY

The agricultural sector is severely underfunded.

REPORT | ECONOMY Image Credit: Adobe Stock

Africa can play a pivotal role in global decarbonisation thanks to abundant natural resource.”

The urgency of climate adaption

According to the report, for the period of 1990-2010, Africa’s GDP per capita was, on average, 13.6% lower than it would have been if human-induced climate change had not occurred.

This statistic highlights the continent’s vulnerability to climate risks with the livelihoods of 53% of SSA’s labour force under threat. In 2020, more than one in five people in the region faced hunger, which is double the proportion in any other. Climate change is compounding these issues and interacting with other stress factors such as inequality, reduction in natural resource, conflict and the fallout from Covid-19.

In addition, the worsening climate is likely to hamper economic growth across SSA with the report highlighting that African countries are projected to experience an 80-89% decrease in GDP per capita in a 4°C warming scenario compared to a scenario without global warming after 2010. The increasing number of extreme events caused by climate change are projected to exceed countries’ capacity to respond themselves. Within these, droughts and floods have the greatest effect on the population and their livelihoods. From 2005-2020, flood-induced damage in Africa was estimated at more than US$4.4bn, with East and West Africa representing the most affected regions.

The need for adaption

In response to these increasingly pressing challenges, the AAI report highlighted the urgent need to adapt and plan for the rapidly changing environment. As of October 2022, only thirteen countries have submitted their national adaption plans (NAPs) to the UNFCCC. The need to transition is made pressing by the urgency of climate change and the need to achieve meaningful progress in vulnerability and risk reduction. The AAI expects that discussions on climate change at international and national levels are will have a stronger focus on how countries can make progress in the implementation of adaptation in the future. By tracking lessons learned and good practice around the implementation of adaption across the continent, the report highlighted key areas where progress can be made.

Technology

The absence of appropriate technology can limit the ability of adaption actions to be fully effective, according to the AAI. Nations have expressed how development and climate goals cannot be reached without sufficient technology development and use, most notably in relation to water management, agriculture and enabling early warning. Technology transfer is mentioned as a conditional requirement for the achievement of many national determined contributions. The report added that patenting adaption technology will be key here as it enables cheaper and quicker technology deployment and replication across the continent without having to overcome difficult hurdles relating to intellectual property.

The report highlighted the importance of digital technology which can help to implement emergency measures, inform decisions to protect lives and assets and help with long-term decisionmaking on climate change risks.

A unified voice

Another point made clear in the AAI report was the need for a unified continental voice on the urgency of implementation. It stated that African governments should reflect the urgency of the

implementation of adaption in international communications and national policies and urge finance institutions to give equal priority to the implementation of adaption alongside planning.

It continued that although African countries are engaging in the mobilisation of domestic finance for adaption, international actors still need to scale-up finance. This included developed countries meeting their promise of mobilising US$100bn a year and doubling adaption finance as well as making more ambitious commitments to enable African countries to meet the costs of adaption to current and future climate change.

International development finance institutions can also play a big part in meeting the finance demands here and the AAI suggests that they should commit to distributing finance with balance allocation among all sectors that are critical to adaption such as agricultural, water, coastal adaption and health. Concessional investments can also benefit African youth startup investments in digital technologies for adaptation in relevant sectors.

The full AAI report can be found online with further information around the potential of the domestic private sector to contribute to adaption and the role of SMEs in accelerating this trend.

AFRICAN REVIEW OF BUSINESS AND TECHNOLOGY | FEBRUARY 2023 www.africanreview.com 16

The Africa Adaption Initiative (AAI) has published its State of Adaption in Africa 2022 report, highlighting the worsening impact of climate change on sub-Saharan Africa’s (SSA) economy and why adaption implementation must be ramped up.

■

SUSTAINABILITY | REPORT

Addressing water scarcity will require investments in infrastructure.

Image

Credit: Adobe Stock

The unsung heroes of Africa’s logistics sector

Modern materials handling calls for increasingly robust and sophisticated machinery.

Mobile lift trucks, or forklifts, play an integral role in the lifting and movement of loads throughout any warehouse facility or logistics centre.

Designed to carry, pull, lift and stack crates and other materials, these small mobile units can be outfitted with various attachments – standard forks for pallet-based unit load picking, or clamps or grippers for handling loads that are not palletised. And it is a competitive marketplace. Major companies supplying lift trucks to the African market include the likes of Caterpillar, Konecranes, Toyota, Hyundai and KION Baoli, among others. All continue to innovate by upgrading power, performance and energyefficiency in their lift trucks.

Linde Material Handling’s forward-looking 12XX generation of IC forklift trucks pack a load range of 3.5 to 5 tons, ensuring high pallet turnover.

The new crop of machines introduce other innovations such as more electrical power, and alternative diesel oil for cleaner combustion. Fleet operators utilising its diesel forklifts can now reduce their CO2 emissions by up to 90% through the use of hydrotreated vegetable oil (HVO), which is made from totally renewable raw materials. Comfort and ergonomics also continue to improve for best operator experience.

GLTC expands

One of the better-known suppliers to South Africa is Goscor Lift Truck Company (GLTC), which recently opened a new branch facility in Richard’s Bay to add to its national network.

The new site affords quick and easy access for clients across the KwaZulu-Natal (KZN) region and follows the launch of a separate Durban branch. Industrial equipment group, Goscor, is a BUD group company and represents leading brands across several sectors, including Bendi, Crown, Doosan and DEC Tow Motors (forklifts and materials handling equipment), Bobcat (compact & construction), and Genie (aerial lift equipment), among others.

Michael Keats, GLTC’s KZN director, said the new Richard’s Bay site would exploit synergies among

all the group companies operating under one roof.

“The location affords quick and easy access for our clients in the Zululand area,” he commented. “It is also a modern and comfortable facility to host our clients.”

Keats added that the new site also complies with the highest safety standards, and affords ample space to offer training to both employees and customers.

GLTC was recently named materials handling equipment supplier of choice once again by Famous Brands, a leading branded food services franchisor on the continent. It marks the seventh year in a row that it has won the award.

The company now has a total of 80 different types of machines currently deployed at various Famous Brands locations across South Africa. Its turnkey solutions approach means that the company can offer its client the flexibility it needs for lift trucks and other items, by offering options such as outright purchase, short and long-term rental, as well as maintenance plans.

This is complemented by its nationwide forklift sales, service, rentals and equipment spares through its comprehensive dealer network.

Other important regional distributors serving the southern Africa market include Centrocar, with its hubs in Angola and Mozambique, selling forklifts from Doosan, as well as a range of other products to customers in the former Portuguese territories. ■

www.africanreview.com 17 FEBRUARY 2023 | AFRICAN REVIEW OF BUSINESS AND TECHNOLOGY REPORT | LIFT TRUCKS

Linde MH’s forward-looking 12XX generation of IC forklift trucks.

Image Credit: Linde MH

Goscor has opened a new branch in Richards Bay.

Image Credit: Goscor

Africa’s extraordinary green hydrogen potential GRIDWORKS TO INVEST IN RENEWABLE ENERGY

A new study the European Investment Bank, International Solar Alliance and the African Union has detailed the potential of green hydrogen in Africa as well as the steps required to achieve this.

Supported by the Government of Mauritania, HyDeal and UCLG Africa, ‘Africa’s Extraordinary Green Hydrogen Potential’ report revealed that harnessing Africa’s solar energy to produce 50mn tons of green hydrogen per year by 2035 can help secure global energy supply, create jobs, decarbonise heavy industry, enhance global competitiveness and transform access to clean water and sustainable energy.

Representing the first detailed research of the feasible development of green hydrogen across the continent, the new study combines analysis of investment opportunities focusing on three hubs: Mauritania - Morocco, southern Africa, and Egypt with a roadmap of technical, economic, environmental and financial solutions to unlock commercial development.

Ajay Mathur, director general, International Solar Alliance, said, “Solar photovoltaic technology has provided us with the cheapest electricity. Thanks to this low-cost electricity and decreasing electrolyser costs, the next step is providing access to a clean fuel, cheaper than all the current fossil fuels. It will enable us to decarbonise the power sector and most hard-to-abate sectors – fertilisers, steel manufacturing, and refineries.”

Approximately US$1.06 trillion green hydrogen investment can deliver the equivalent of more than one third of Africa’s current energy consumption, boost GDP, improve clean water supply and empower communities.

The study outlines how production and transmission of green hydrogen can lead to investment yielding seven exajoules of energy and a correlative huge increase in GDP, creating hundreds of thousands of permanent and skilled jobs across Africa.

The new analysis estimates that green hydrogen investment could reduce carbon emissions in Africa by 40%, replacing 500mn tons of CO2 a year.

HIMOINSA PROVIDES POWER FOR LNG AND HELIUM PLANT

HIMOINSA

The

Eight fully synchronised generator sets, neutral earth transformers, fuel tanks and a control room were installed to run the site at 8MW prime capability, compliant with all health and safety requirements. A 200kVA unit was also provided for temporary use during the construction phase.

The plant ran efficiently on a fully turnkey solution, including the necessary manpower and operational planning requirements for the contract term, and beyond, until the utility connection was successfully installed, and the temporary power plant decommissioned.

BRIEFS

Eni launches second FLNG project

Eni has signed a contract with Wison Heavy Industry for the construction and installation of a Floating Liquefied Natural Gas (FLNG) unit with a capacity of 2.4 million tons per annum (mtpa). The FLNG will be deployed offshore the Republic of Congo.

The 380 m long and 60 m wide vessel will be anchored at a water-depth of around 40 m and will be able to store more than 180,000 cu/m of LNG and 45,000 cu/m of LPGs.

Gridworks, the UK government-backed investor in Africa’s electricity networks, announced it will invest up to US$50mn in Virunga Power.

Gridworks’ investment will fund new projects across the continent, including in Burundi, Malawi, Zambia and Kenya. It will also support the substantial growth of the Zengamina hydro-backed rural utility in northern Zambia, resulting in increased generation capacity and the addition of thousands of new connections.

According to the World Bank, Zambia, Malawi and (in particular) Burundi have some of the world’s lowest rural electrification rates (15%, 6% and 2%, respectively).

The impact of the investment will be measured in several ways, including new GW hours generated, new connections made, and CO2 emissions avoided.

Virunga Power’s current institutional backers include EDFI ElectriFI, the EU-funded Electrification Financing Initiative, and the Camco-managed Renewable Energy Performance Platform (REPP,) who are leading investors in early-stage energy access and renewable energy companies in Africa. Together, they provided Virunga Power with critical growth capital during its ‘Series A’ investment round which closed in 2019.

Gridworks’ CEO, Simon Hodson, said, “I’m delighted to announce our investment in Virunga Power. Access to reliable, clean, affordable energy is a catalyst to a better life, but this is currently out of reach for people in the rural areas that Virunga Power wants to serve. We’re committed to making Virunga Power our platform to build hydropowered rural utilities in at least four countries in southern and eastern Africa. Our capital will help them to close the energy access gap and unlock opportunities for people across the region.”

Cemex supports Synhelion in solar fuel production

Synhelion has raised US$22.6mn in another successful financing round. The funds were primarily provided by existing investors and selected new strategic investors.

Solar fuels are a crucial solution in combatting climate change as they significantly reduce net CO2 emissions by directly replacing fossil fuels.

The company’s drop-in fuels can be blended into the existing fuel distribution network and are fully compatible with existing vehicles and machinery.

Southern Africa has supplied rental equipment with 8MW of prime power for an LNG and helium plant in Free State, South Africa.

Virginia Gas Project by Tetra4, a wholly owned subsidiary of Renergen, will produce LNG and liquid helium, making it the first helium facility in sub-Saharan Africa.

Green hydrogen investment could reduce

40%. Image Credit: Adobe Stock Image Credit: Adobe Stock Image Credit: Adobe Stock NEWS | POWER AFRICAN REVIEW OF BUSINESS AND TECHNOLOGY | FEBRUARY 2023 www.africanreview.com 18

FLNG will be

carbon emissions in Africa by

The

deployed offshore the Republic of Congo. Solar energy is crucial to combatting climate change.

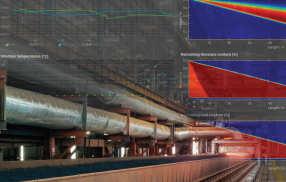

Yokogawa’s sustainability focus

Yokogawa has completed the installation of an IoT system for the Kenya Electricity Generating Company which utilises mobile communications and other technologies to integrate the remote management of the geothermal power stations at the Olkaria geothermal complex.

This project was carried out under an agreement with the United Nations Industrial Development Organization, an agency of the United Nations which promotes sustainable, industrial and economic development.

Meeting Kenya’s energy needs

Over the past twenty years, Kenya has seen its power consumption triple due to population and economic growth.

As most Kenyan power plants

depend on expensive imported fuels, attention has turned to the use of the country’s geothermal resources to ensure a reliable supply of power and reduce greenhouse gas emissions. Yokogawa has risen to this challenge by providing an IoT system that enables the integrated management of the widely distributed facilities at the Olkaria geothermal complex.

Through digital transformation and other means, Yokogawa is committed to doing its part to achieve environmental sustainability by providing its customers the support they need to optimise operations and ensure safety across entire supply chains, including those for the production, supply, and use of diverse renewable energy sources. This project has been a showcase for the provision of advanced technological solutions that address

the challenges posed by a changing climate and the need for inclusive and sustainable industrial development.

Championing sustainability

Following the adoption of the Paris Agreement and the formulation of the Sustainable Development Goals (SDGs), Yokogawa set three key sustainability goals that it wishes to fulfill by 2050.

The first goal is ensuring the wellbeing and quality of life for all through the achievement of safe and comfortable workplaces and pursuits in such areas as the life sciences and drug discovery. The company promotes human resource development and employment creation in local communities, as well as diversity, equity and inclusion.

The second goal is achieving netzero emissions to stop climate

change. This can be accomplished through the introduction of renewables and the efficient use of energy.

The third goal is transitioning to a circular economy through the realisation of a social framework and ecosystem in which resources are circulated without waste and assets are utilised effectively. The company continually contributes to the efficient use of water resources and the supply of safe drinking water.

Success with carbon neutrality

Yokogawa has met with success in its efforts to attain carbon neutrality and has expressed its intention to partner key players in Africa in order to ensure the continent’s contribution to a sustainable planet by harnessing its local resources in the most optimal manner. ■

www.africanreview.com 19 FEBRUARY 2023 | AFRICAN REVIEW OF BUSINESS AND TECHNOLOGY SPONSORED CONTENT

Japanese multinational electrical engineering and software company Yokogawa Electric has demonstrated its commitment to sustainability through a green power project in Kenya.

Yokogawa has provided an IoT system at the Olkaria geothermal complex.

Image Credit: Yokogawa

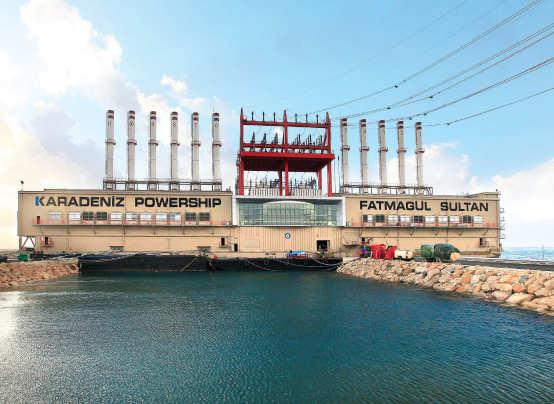

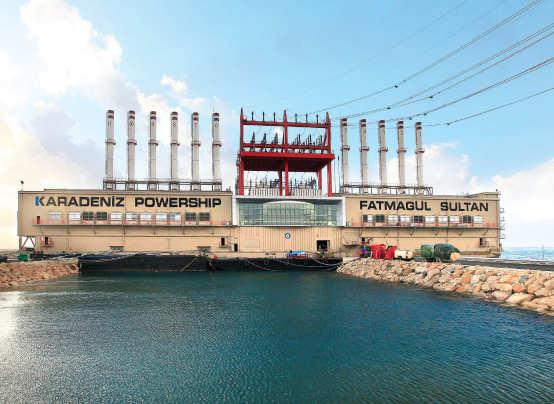

Achieving energy security through plug-and-play solutions

While the world struggles with one of the most keenly felt energy crises in living memory, affecting all nations regardless of their development status, the importance of flexible power solutions that offer an alternative way to meet this challenge has perhaps never been more pertinent.

As Hjaiej commented, “With climate change and unstable bilateral relations between countries, the energy crisis is in front of all economies and can affect any country. In such times, a diversified energy portfolio is paramount for energy security. When it comes to Africa, many countries are facing issues in delivering stable power plants and getting electricity to its people. There are many reasons for this from lack of planification to infrastructure issues. Very importantly, the continent faces too much instability in terms of politics, government chains and decision chains and this can make it very difficult to bring projects which take several years to develop into the fold.”

“It is for this reason that fast, reliable, plug-and-play power solutions can make a big difference. The problem with power generation is like the chick and egg conundrum: you need demand to develop power, but you need power to create demand. If you install power before demand you may not be able to finance it and can lose money, whereas if you create demand and there is no power your industries will suffer and may not succeed. Plug-and-play solutions can help fill this gap and meet demand quickly when required. This is where we operate and with the solutions we have available today I truly believe there is no reason for countries to justify the lack of electricity, as we are open for business.”

Arrive, connect, and deliver

First established in 1948, it was not until the early 2000’s that Karpowership conceived the idea that is now the staple of their global identity: the Powership. With the first floating power station delivered in 2009, the fleet has now grown to no less than 36 fully constructed and ready to operate vessels.