At Hudson Headwaters, our Primary Care providers are dedicated to meeting your specific health care needs, and keeping you in good health. We’re here for you—at every stage and every age.

• Stress-free, maintenance-free living in beautiful apartments and cottages.

• Engaging activities that allow you to enjoy an active lifestyle.

• Delicious chef-prepared fine and casual dining options.

• Continuing care, ever-adapting to meet a resident's changing needs.

SIX EXCEPTIONAL COMMUNITIES LOCATED IN:

• Niskayuna • Latham • Troy • East Greenbush

• Queensbury • Slingerlands

Contact us today to begin your new lifestyle!

(518) 280-8385 | EddySeniorLiving.com

Hear what MVP Health Care® (MVP) Medicare Advantage plans have to offer—from NEW preventive and comprehensive dental benefits, to coverage when you’re away from home, and personal support to make sure you understand your plan, benefits, and more. Come to a FREE MVP Medicare Seminar!

MVP Health Plan, Inc. is an HMO-POS/PPO organization with a Medicare contract. Enrollment in MVP Health Plan depends on contract renewal. Out-of-network/non-contracted providers are under no obligation to treat MVP Health Plan members, except in emergency situations. Please call our customer service number or see your Evidence of Coverage for more information, including the cost-sharing that applies to out-of-network services. For accommodations of persons with special needs at meetings, call 1-800-324-3899 (TTY 711).

MVP Health Care complies with applicable Federal civil rights laws and does not discriminate on the basis of race, color, national origin, age, disability, or sex (including sexual orientation and gender identity).

ATENCIÓN: si habla español, tiene a su disposición servicios gratuitos de asistencia lingüística.

Llame al 1-844-946-8010 (TTY 711) 注意:如果您使用繁體中文,您可以免費獲得語言援助服務。請致電 1-844-946-8010

Y0051_9005_M

In a kitchen, everything should work around you and reflect your style. At Marcella’s, we have the Capital Region’s best selection of premium kitchen appliances, including Miele, the perfect match for your every need –with intuitive technology designed around you and quality ahead of its time.

Get started on the kitchen of your dreams and new culinary adventures.

33 Does Your Makeup Need a Makeover? Yes, you do need to rethink your makeup as you age

38 Learning Curve Cheap (or FREE) college courses for just about everyone on just about anything

47 The Ghost Cancer Potential ovarian cancer symptoms no woman should ignore

49 Think You’re Too Old to Need a Gynecologist? 4 big reasons you’re wrong

52 Nature Nurtures

Getting outside is good for the mind, body & soul

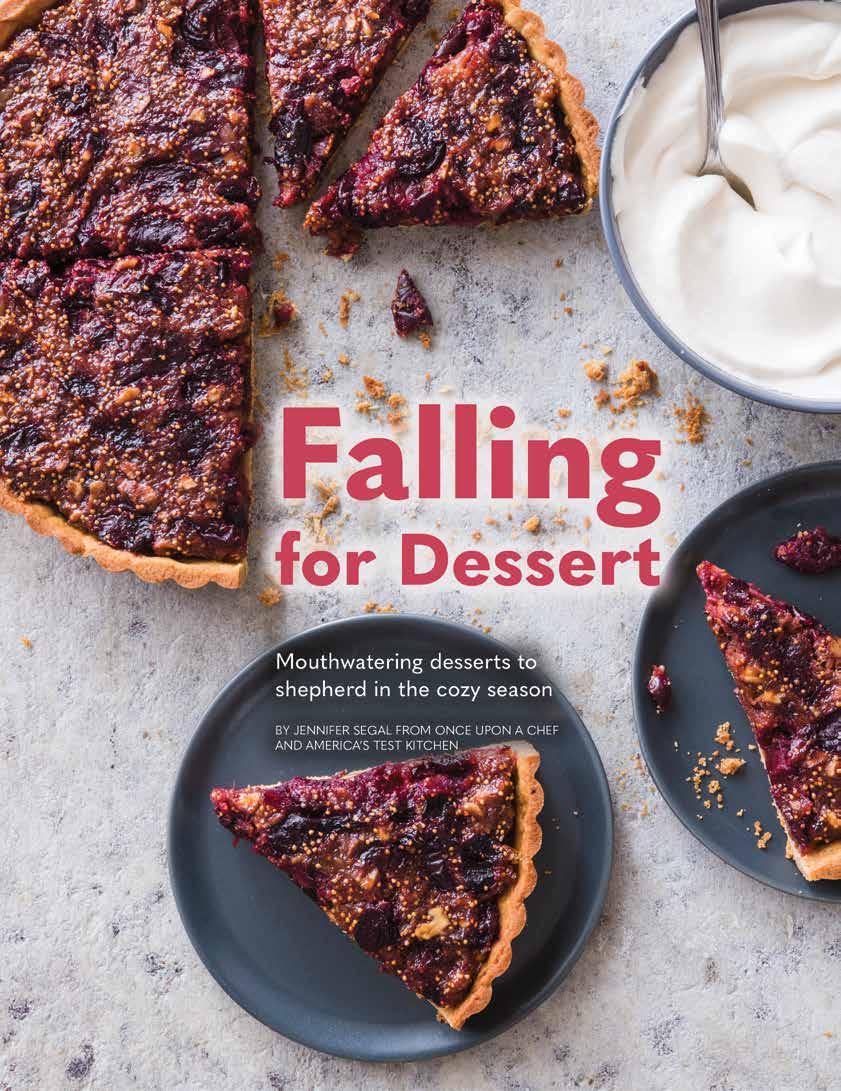

59 Falling for Dessert

Mouthwatering desserts to shepherd in the cozy season

64 Time for Company

A new cookbook for gatherings large and small

68 Putting Your Garden to Bed

The time to prepare your yard for next spring is now travel

74 Is a Vacation Club Right for You? A look at what these travel options offer

79 Travel Steals and Deals

Off-season travel can yield savings and breathing room from crowds

columns

16 Publisher’s Note Alison reflects on fall

56 Be Your Best Benita Zahn on making dreams come true

82 The Vine Rod Michael on creating legacies plus!

40 Making Sense of Medicare Special advertising supplement

Interest is credited to the contract daily (based on a 365-day year) to achieve an annual yield that’s equal to the declared rate. The money must remain in the annuity (without any withdrawals) for the entire year to achieve the full rate. The initial interest rate on the single premium is guaranteed for the selected rate term. When the selected interest rate term expires, future interest rates will be declared annually, based on current market conditions. Current initial interest rate is subject to change at any time before the contract is issued. Withdrawals above the free amount are subject to a withdrawal charge schedule for three years (7%, 7%, 7%) No withdrawal charge or market value adjustment will be imposed on a full or partial withdrawal made within the last 30 calendar days of an existing guarantee period. At the end of the initial guarantee period, you can renew your contract for a period of one, three, four, or five years. (All periods may not always be available.) Withdrawals may be subject to federal and/or state income taxes. A 10% federal early withdrawal tax penalty may apply if taken before age 59½. Partial withdrawals may reduce benefits and contract value. You should consult with your own tax advisor before engaging in any transaction.

Broadview Insurance Agency is a wholly owned subsidiary of Broadview Federal Credit Union.

Alison Michael | alison@55pluslifemag.com

Consulting

Janet Reynolds

Marketing

Terri Jacobsen

Consulting Art Director

Tony Pallone

Consulting

Caitlin Manner

Contributing Writers

Joanne Cleaver

Rebecca Gatto

Jennifer LaRue

Caitlin Manner

Rod Michael

Sheryl Nance-Nash

Traci Neal

Janet Reynolds

Cari Scribner

Brianna Snyder

Benita Zahn

If you’re looking for the perfect balance between small-town living and modern convenience, discover Juniper Ridge. This new family-friendly community is happily situated among the beautiful rolling hills in the historic Town of Halfmoon. When completed, Juniper Ridge will include over 220 single-family homes and community walking trails.

Situated between Albany and Saratoga Springs, Juniper Ridge offers the accessibility of big-city living, without the stress. Being part of the Shenendehowa Central Schools and its close proximity to great shopping, dining and the Northway make it the perfect spot for families of all sizes. Plus the Halfmoon Town Park and all its amenities (walking trails, baseball fields, picnic areas, and more) are just a short walk away.

• Close to shopping, dining & the Northway

• 20 minutes from Albany & Saratoga Springs

• Shenendehowa Central Schools

• Variety of floor plans (ranch, primary down, primary up)

• Pricing from the mid-$500s

For more information or to schedule a tour, contact Spencer Lewis: 518-512-9646

spencer@belmontebuilders.com

This time of the year reminds me of the fragrant smells of growing up. Remembering the aroma of flavors synonymous with fall pumpkin, apple, cinnamon, maple, cranberry, and cinnamon emanating from our kitchen. My mother enjoyed baking on weekends, either for our family or for company she and my dad were expecting. I hope you capture your favorite seasonal flavors this autumn and perhaps make some of our mouthwatering fall desserts (page 59), courtesy of our recipe partners, America’s Test Kitchen and Jenn Segal of Once Upon a Chef. The luscious maple cheesecake on our cover is certainly on my list.

If you’re part of the 55-and-over crowd, retirement is going to be a topic of conversation when to retire, where to retire, and what you want your post-retirement life to look like. Retirement is personal, and it can be complicated. I find it interesting as I talk to people of “retirement age” how each is choosing to do it their own way, often reinventing the traditional path we typically imagine when someone says they’re retiring.

Rebecca Gatto, one of our contributing writers, sat down with Dr. Dorian Mintzer, a professional retirement coach, speaker, and co-author of The Couple’s Retirement Puzzle: 10 Must-Have Conversations for Creating an Amazing New Life Together. Mintzer shared her advice on how to transition into this stage and she explains how retirement isn’t so much a des-

tination anymore, but rather a transition, a journey (page 23).

Money is another important topic for those considering retirement. For many couples the reality of going from one, or often two, paychecks to no paychecks can feel as if you’re free-falling. While we like to think we are good at communicating about money with our partners, this is not always the case. When it comes to savings, spending, and future plans, it’s important to learn to overcome the hurdles and talk productively about retirement finances. Writer Jennifer LaRue spoke to industry experts and she shares their tips in “Money Talks” (page 19).

Lastly, I’d like to give a special thank you to our editor at 55+ Life of the past 3 years, Janet Reynolds. Janet has played an integral part in helping to make 55+ Life synonymous with great, engaging and credible content. As she transitions into semi-retirement, all of us at 55+ Life wish her the best! She will be missed, but we’re excited to introduce you to our new editor, Traci Neal, in 2024.

Warmly,

BY JENNIFER LARUE

BY JENNIFER LARUE

For many couples, moving from a steady flow of dual paychecks to no paychecks at all can feel like stepping into the abyss especially if the two partners are not on the same page when it comes to planning, saving, and priorities.

Couples who have a history of talking openly and honestly about finances from the get-go may find the transition to retirement a bit easier. Unfortunately, that is not the norm: the 2021 Couples and Money Fact Sheet issued by Fidelity Investments indicates that one in five couples say money is their

greatest relationship challenge, with 44 percent of couples saying they argue about money at least occasionally. When it comes to retirement, Fidelity found that 48 percent of couples disagree about what age they plan to retire, 51 percent disagree about how much savings they need to reach retirement, and 34 percent disagree as to whether they’re savers or spenders.

But even if you and your partner have never been terrific at talking about money, you can still take steps to help make conversations around finances more comfortable, less scary, and healthier all around.

Bill Selig is a financial advisor with CP Capital Management LLC in Clifton Park. During the seven years he has shepherded couples through their retirements, he’s seen a number of patterns. For starters, Selig says, couples seeking his expertise typically follow some basic scenarios. “There’s the couple that comes in that’s been conservative and have saved, and they’re on the same page about saving and future spending. They’re already in good shape.”

Other couples, though, are not on the same page at all when it comes to saving, spending, or future plans; they’re the ones who are going to have to work hard to get in good financial shape, Selig says. “The most difficult cases are those involving mixed families, couples who have been together for 20 years but have different ideas about, say, paying for a kid’s wedding. One partner may feel strongly that he or she should pay for the wedding, and the other may say, ‘No, that’s not how it works.’”

Other couples may have relationships where one person typically took the financial lead. Perhaps that person was the breadwinner, while the other partner oversaw the family and homefront. Retirement can change that dynamic, which can be tricky, Selig says.

The good news is that couples can and do overcome the hurdles of learning to talk productively about retirement finances and those that do may find their relationships enriched by the process.

As Adina Saperstein, MMHC, a therapist and couples counselor at Families Together Counseling Services in

Catskill, puts it, “There always is the possibility to heal at any stage.” Saperstein, who works with many couples as they navigate the many issues that surround retirement, says things often get very bad before they get better.

“Overwhelmingly, most couples don’t come in for counseling until they’re on the brink of splitting up,” Saperstein says. “Any time they come in sooner than that happens, they’re already ahead of the game.”

“When it comes to planning for retirement, there’s often a disconnect between the partners,” Saperstein explains. “One partner may want to retire sooner and enjoy life, while the other may want to continue working, either because they truly enjoy [their work] or perhaps it’s a new relationship, one that’s not fully established in terms of financial security.”

“Financial issues are often just one piece of a lifetime of unresolved issues,” Saperstein says. A key point of contention that can come to a head as retirement approaches involves the couple’s reckoning with each partner’s relative contribution to the union in terms of employment.

A common dynamic involves a breadwinner (often a man) and a partner (often a woman) who hasn’t worked outside the home but has been caring for the household, for her partner, for their offspring, and perhaps for a parent. That partner “finds herself in a position of not having the bandwidth to work outside the home,” Saperstein says. “When one partner’s been contributing such invisible labor for decades and the other has a sense of entitlement, saying, ‘Sorry, I’ve been the one working,’ resentment can creep in. That resentment can peak when retirement grows closer, and it creates an unhealthy dynamic on multiple levels.”

“In the many cases where there are financial constraints

The good news is that couples can and do overcome the hurdles of learning to talk productively about retirement finances — and those that do may find their relationships enriched by the process.

that make it necessary to adjust, scale back, or delay hopes and dreams for retirement that may be impossible, it’s important for both partners to make space to feel and acknowledge grief about that,” Saperstein continues. “Practicing what we call ‘radical acceptance’ involves acknowledging experiences of distress and disappointment without letting them fester into resentment and suffering.”

So just how does a couple address these sensitive issues in a loving, productive manner?

Saperstein says she often advises that couples “adopt basic relationship and couples-counseling approaches that have applications beyond retirement.” Taking that approach can enhance the relationship generally. “The process can really lead to second acts of relationships as couples shift gears on finances,” she says. “Even when people have been stuck in patterns for decades, they can reset at any stage.”

Here are the five steps Saperstein encourages couples to take:

l “E ach partner should get clear for themselves about their hopes, needs, desires, and requirements” for retirement. “From there, the partners should communicate in a straightforward manner using ‘I’ statements such as ‘I hope to spend more time with the grandkids,’ or ‘I want to travel more.’ … In and of itself, that approach may be new to the couple,” Saperstein adds. “The ability to claim and express hopes and desires can be really revolutionary, especially for the generation of women now retiring.”

l “Be prepared to listen, reflect, and validate what the other person has said. In practice, I’ll guide the first person to express their needs and desires, then ask the other partner to reflect and summarize what the first person said. Often they’ll jump in with an emotional, triggered reaction. But instead they can say something like, ‘I heard you say …,’” which is more respectful and productive, Saperstein says.

l “E xpress any reaction calmly with an ‘I’ statement: ‘I hear you say you want to travel extensively, but I’m afraid we can’t afford it.’”

l “E xplore compromises required to create a viable plan and budget. Reframe the conversation away from defensive, reactive, and contentious to collaboration and compromise.”

l “Prioritize allocating a budget for activities that keep both partners healthier, more active, and more fulfilled. Hobbies, classes, learning something new that involves mind/body connection, such as learning a new style of dance, or reading specifically, reading fiction novels, which, because you have to keep track of characters and plot in a way you don’t need for reading nonfiction, is super powerful for memory and cognitive function. Instead of saying, ‘This is a waste of money,’ get creative about finding free or inexpensive options.”

As couples proceed through retirement, these communication skills can help them address and manage all kinds of matters, including those involving their children, real estate, and pretty much anything that comes up along the way. “The common denominator,” Saperstein says, “is that the sooner these questions are broached and discussed, the better.”

“Each partner should get clear for themselves about their hopes, needs, desires, and requirements” for retirement.

— Adina Saperstein, MMHC Families Together Counseling Services

Admittedly, Kim and Mike McMann of Stephentown are not a textbook retired couple. As Kim readily relates in a phone conversation, their situation differs from that of many other couples. They have been communicative about finances since the start of their 20-year marriage, they’ve retired a bit younger than the norm (Kim’s about to turn 60, and Mike turns 58 in December), and, with no children or other direct heirs, their planning didn’t entail leaving inheritances or other legacies.

Having said all that, Kim and Mike were thrust unexpectedly into retirement when Mike, a professional musician, was offered an early-retirement package during the COVID pandemic, at a time when demand for gig players like him dried up. Lucky for the McManns, Mike worked for a company that offered a buyout package that allowed for him to receive his hard-earned pension, though he was a year away from retirement.

At the same time, Kim, who was helping run a program that provided free meals to those who needed them, found demand increase even as staffing shrunk; the program let all of its volunteers go during the pandemic, leaving just Kim and her kitchen manager — and their spouses — to continue

providing this much-needed service.

“I was exhausted,” Kim says, “and nobody knew what was going to happen next. I loved the job, so I just kept my head down and kept going.”

Kim had crafted a plan for keeping the program running should she get COVID; when eventually that did happen, she was gratified to see that nobody missed a meal during her absence. That drove home the fact that the organization could survive without her. So she decided to find work that was more fun and less demanding — and that offered health insurance.

Kim now works part-time in visitor services at an art museum, and the McManns are living on her paychecks and benefits and his pension. “We decided we can live — frugally — but live, so long as I provide health insurance.”

“Some people thought we were crazy, cutting out 10-12 years of prime earning time. But if we’d kept working the way we were, we’d be cutting out 10-12 years of healthy life,” Kim says.

“The best advice I would give to others is to know what’s important to you and stick with it, even when people tell you you’re crazy.” n

Retirement brings couples face to face with a new reality. As partners step away from their careers and settle into a phase of life characterized by more leisure time, they may be surprised to find their joy tempered by uncertainty.

“You can be really excited about retiring or working in a different way, but there’s still some loss and grief,” says Dorian Mintzer, Ph.D., a professional retirement coach, speaker, and co-author of The Couple’s Retirement Puzzle: 10 Must-Have Conversations for Creating an Amazing New Life Together

Complicating an already challenging transition is the growing number of ways to retire. The days of retiring directly and completely from a full-time job seem to be numbered.

In fact, a 2018 research brief by the RAND Corporation asserted that fewer than four in 10 American workers followed that pattern. Instead, many pursue new career paths, take on part-time work, or even start small businesses.

In the United States, a quarter of all seniors now stay in full- or part-time work past the age of 70. According to the RAND research from 2018, 14 percent cut back their hours

as a prelude to full retirement, and 17 percent left the workforce only to reenter it later.

“Retirement isn’t so much a destination anymore; it’s a transition, it’s a journey,” Mintzer says.

But regardless of what your path looks like, it’s important to approach retirement intentionally with your partner, because this phase of your life is likely to be a long one. Over the past 50 years, the number of years people spend in retirement has risen dramatically.

In 1970, men in the U.S. could expect 12.8 years of retirement and women could expect 16.6 years, according to the Organisation for Economic Co-operation and Development. By 2020, those numbers had risen to 18.6 years for men and 21.3 years for women.

Mintzer, whose book takes a lighthearted approach (Chapter One is “Twice the Husband, Half the Income”), has helped many couples reevaluate their dynamics, goals, and individual pursuits. Success starts, she says, with conversation.

But don’t feel bad if you and your partner find yourselves unexpectedly struggling with communication. Learning to not only express yourself clearly, but also listen attentively, are skills that develop with practice. Keep in mind that it’s easy to misunderstand our closest companions during times of change if we mistakenly believe we already know what they want, need, and feel.

Planning for retirement requires a deliberate approach to communication, especially because of the sensitive and emotionally charged nature of the topics that arise. From living arrangements and finances to health, obligations, and spirituality, it helps to have somewhere to start.

Mintzer says couples should try to have a BLAST during tough conversations by remembering the following acronym:

B: Blaming gets in the way

L: Listen without interrupting

A: Agree to disagree, and don’t assume

S: Set a safe space for discussion

T: Take time to talk without distractions

This template can help you allocate your newfound free

— Dorian Mintzer, Ph.D. Co-author, The Couple’s Retirement Puzzle“ It’s almost like there’s no map. You know, there’s a map for going to college, and there’s a map for getting a job, and there’s a map for raising your kids, but there’s no map for what happens next.”

time, whether you choose to pursue new hobbies, volunteer, travel, or simply relax. Some couples may have plenty of expectations in common, while others will have more to negotiate. The important thing is to patiently put everything out in the open so you can work together.

“The frame I’ve used with my co-author is the concept of a puzzle,” Mintzer says. “I like it because it’s a noun and a verb.”

If you’re approaching retirement, you’ve likely worked toward and hoped for it for decades. So, after all the congratulation and celebration, you may be surprised to find yourself occasionally feeling down. While some people may feel this way immediately, others enjoy a “honeymoon period,” only to find themselves unexpectedly sad a few months into their new normal.

“It’s almost like there’s no map. You know, there’s a map for going to college, and there’s a map for getting a job, and there’s a map for raising your kids, but there’s no map for what happens next,” Mintzer says.

It’s hard to know what a change will feel like before it arrives, but Mintzer suggests reflecting on previous transitions for insight. For example, if you have grown children, what emotions came up when they left home? If you’ve weathered a big move as a couple, what were each of your strengths? And if COVID-19 lockdowns meant you spent more time at home, how did it suit you?

Each of these changes, and many others, disrupt established routines and redefine daily purpose just like retirement. “Have you had more trouble with the ending, with the period of unknown, or with the new beginning?” Mintzer says. “All transitions have those components.”

By that measure, Jim Marks and Liz Hester were well

prepared to face retirement after decades of negotiating courageous new beginnings. The pair met in graduate school and married almost 40 years ago. They have frequently moved and changed careers, often working in different fields. Their professions have taken them all over the United States and around the world.

Like most modern professionals, the couple’s transition to retirement was gradual. Jim made the first move, shifting from genetics research to consulting and eventually starting a specialty food business in their home. Liz transitioned from a career in banking to becoming a speech pathologist before finally retiring.

Throughout their many moves, whether to Kansas or Saudi Arabia, Marks says the pair always kept their own identities and interests, which have continued to sustain them.

Retirement opens a rewarding new chapter for couples, complete with the opportunity to enjoy each other’s company in new ways thanks to the slower pace of life. Still, the sudden

abundance of time can lead to feelings of purposelessness, creating relationship strain.

One key aspect that both Mintzer and Marks emphasized was the idea of, as Mintzer puts it, a healthy mix of “time together and time apart.” Marks and Hester, for example, have shared interests such as hiking, biking, cooking, and playing music. But when Hester proposed a trip to Paris, Marks, who doesn’t enjoy crowded cities, declined. She went with her sister instead.

“I think the important thing is to have interests that you can share with your partner or friends, but also interests that you can just do on your own,” says Marks, who ran a specialty food business out of his kitchen from 2011 until his wife retired in 2015.

“You have to have interests to fill the hours in the day,” he says. “You have to have things you can do alone and be comfortable with yourself.”

Some factors in retirement naturally influence all others.

In particular, Mintzer and Marks agreed, it’s important to nurture your mental and physical well-being and the state of your finances.

When making time for those important conversations having a BLAST remember to include focused discussions about balancing expenses and income. Marks says he has noticed that a lot of people worry about having enough money in retirement, but he has good news. “You don’t really need as much money as you might think you need when you retire,” he says. “If you keep busy and don’t overspend, you end up saving a significant amount of money.”

Plus, limited resources can help focus your priorities. “I think you have to think about what really gives you pleasure,” he says.

Major changes like retirement can also disrupt your health by interrupting your eating habits, fitness schedule, and mental health. Talk openly with your partner about how you’ll stay active, prioritize self-care, and maintain a healthy lifestyle. The more you support each other’s well-being and proactively address potential health-care concerns, the better.

“The longer we live, the more likely one or another is going to be a caregiver,” Mintzer says. “It really is important to take care of our health.”

Remember that solo trip to Paris that Hester took? While she was away, Marks worked on some overdue home maintenance projects and they just kept coming.

“At some point during that time when she was gone, it’s like, ‘I don’t know how much longer I want to keep doing this,’” he recalls. When Hester returned, they began to consider downsizing.

Today, they’re part of The Spinney at Van Dyke, a 55+ community in the Capital Region. The change meant less housework and more freedom to travel and socialize.

“We have a number of friends around here, mostly people that we know through music, old school friends around here, and some relatives,” Marks says.

Mintzer recommends that, like Marks and Hester, every couple make time to evaluate their living situation as they transition into retirement. Take into account financial goals, realistic expectations of health and wellness, and your personal values and preferences.

Bottom line, retirement is not the end of an era but a bold new chapter. “There can be a shift from working and doing so much to really thinking about being, getting more in touch with what’s going on inside,” Mintzer says.

By communicating openly, embracing change, and actively nurturing relationships, you, too, can embark on this fresh phase with a sense of purpose, joy, and fulfillment. n

Help your adult kids with their cellphone bill? In THIS economy?

Yes, exactly. This economy, as we’re all painfully aware, is stacked against younger people in more and more challenging ways as the wealth gap widens, rent prices soar and wages stagnate. Not to mention a little economic blip called COVID-19, which destabilized younger and older people alike, something many are still struggling to recover from. For millennials, the homeownership rate is about five percentage points lower than it was for Gen X when they were in

their 30s. And it’s about seven percentage points lower than for baby boomers when they were in their 30s, according to U.S. Census data. And, according to the news site The Hill, nearly half of American parents with adult children continue to support them financially spending $1,442 a month on average.

Citing a Savings.com survey, The Hill notes that parents who pay bills for an adult child are most likely to cover relatively modest expenses such as groceries and cellphone plans. Yet, they add, more than half help pay a child’s mortgage or

86% of women say that achieving financial security is very important

Yet, only 12% are very confident they will have enough saved to live comfortably in retirement.

Individuals who plan ahead financially report experiencing an increase in their financial well-being. AARP**

Women outlive men on average by 5 years

Many will be solely responsible for their personal finances later in life.

70% of women change financial advisors after their partner’s death to better align with their personal goals and needs.

McKinsey*

The Center for Women, Wellness and Wealth encourages active participation in financial decision making to help women understand their personal finances, feel more confident about money, and develop an active working plan to ensure a promising future.

Our team of advisors have exceptional expertise in managing investments and will customize portfolios that align with your unique objectives, values, and risk tolerance with innovation and personal guidance improving your overall wellness.

rent, a monthly expense that averages more than $800.

So, in the realm of adulthood, where independence collides with the enduring bonds of family, a new paradigm is emerging managing adult children and their finances. A task fraught with emotional complexities and financial considerations, this chapter of parental guidance is one that requires empathy, clear communication, and a strategic outlook.

Meet Jared Paul, a seasoned certified financial planner and the managing director of Capable Wealth in Albany. With over 15 years of experience, Paul has encountered scenarios where families grapple with the desire to provide for individual members while also maintaining financial stability overall. As he affirms, understanding the full scope of the situation is crucial before embarking on this journey.

“Understanding the full situation is this a one-off thing that you need cash for the month instead of a multiyear perpetual thing? that’s very key to understanding how to give advice,” Paul says. It’s not just about the financial aspect but also about the long-term implications and the underlying dynamics of the parent-child relationship.

The balance between assisting and enabling is delicate. Parents might feel compelled to always help their children, but this should align with their financial capacity. Financial Consultant Gretchen Meyer, owner and president at Gretchen Meyer Financial in Latham, agrees that communication is important in navigating finances with your kids. But, she says, she’s also seen rising interest among Gen Z young adults to learn more about financial health and hygiene. “We can help them invest in themselves for what they want for their own next stage,” Meyer says.

In fact, to meet this rising demand, Meyer has launched Core Planning, an affordable ($75 per month) service for young people just getting on their financial feet. “The new offering provides financial coaching, career advice, cash flow guidance, debt analysis, and more,” she says. “It’s designed to bridge the gap for young individuals who may not meet the asset criteria of traditional advisors. This program addresses their financial needs and helps them make informed decisions.”

That financial literacy will help in conversations about how much you’re helping them, and for how long. But many families shy away from discussing financial matters, because it can be awkward, vulnerable, and uncomfortable. We’re taught that money matters are private.

Parents might not realize, though, that their adult children are under significant and substantial financial pressure and, conversely, adult children might not recognize the constraints of their parents. “Kids might not know what the financial situation is,” Paul notes, emphasizing the importance of open dialogue.

If both parents and adult children have evaluated their cir-

cumstances for what they have and what they need, however, the numbers can essentially do the talking. When you have your comprehensive financial plan, both Paul and Meyer say, then you see clearly what you’re able to spend while still making progress toward your goals of retirement, buying a first or second home, or anything else you’re planning for.

So gradual transition is key, especially when it comes to support that has been ongoing. Paul and Meyer advise against abruptly cutting off assistance, especially when it involves emotional support. Finding a middle ground and developing a game plan together can make the transition smoother and maintain the integrity of the parent-child relationship.

Strategies may vary based on circumstance. If you’re covering a rent payment, for example, and your adult child isn’t able to make the payment on their own or with roommates, are you willing to help them find a new place? Or even allow them to move back home and save some cash? These decisions should be rooted in a clear assessment of financial capacity and the potential strain it might place on your family.

Empathy is a vital thread that weaves through this narrative. “People don’t always come to a situation with empathy,” Paul says. People’s financial situations are complex and unique and can even be quite stressful; assuming motives without understanding the full context can lead to misinter-

pretations. Suggesting or accusing your adult child of being lazy, entitled, or codependent won’t be productive. Remember: It’s hard out there, for everyone.

Still, the ultimate goal is self-sufficiency, no matter what generation you’re a member of. “I think people, no matter what the generation, want that ability to stand on their own two feet,” Paul says.

For parents and adult children alike, education is a potential bridge to understanding. Meyer notes that budgeting and tracking spending in a mostly cashless society is much more challenging than it was during the checkbook-balancing years. Knowing that money and finance is ever-evolving and assuming good intentions are keys to keeping harmony. That’s why she recommends working on a plan together, with clear deadlines and outcomes, so that there’s no misunderstanding about what your child can count on and what they need to figure out.

With a clear roadmap and communication, managing adult children and finances doesn’t have to be a fight. The journey involves balancing present support with future independence, and embracing empathy as a guiding principle. As Paul sums up, “Navigating this terrain requires thoughtful planning, a willingness to adapt, and above all, understanding.”

12 WEEK PROGRAM (broken into 3 phases of 4 weeks each)

PHASE 1 is $600 and includes instructional videos, weight vest, resistance band, and follow-up videos.

PHASE 2 is $400 and includes a guidebook for healthy lifestyle tips for osteoporosis.

PHASE 3 is $350 & includes a continuation or discharge plan.

TIME & DAY: Tuesday and Thursday 12, 1:30, or 3 PM.

(6 person maximum)

PROGRAM LOCATION: Weight Lifting Battleground Fitness, 426 Maple Ave. Unit 1, Saratoga Springs

SIGN UP: Email info@inmotionintegrativept.com

Free 20-minute phone consultation from website to learn more inmotionintegrativept.com

Take a peek inside your cosmetic bag. If you see products you’ve worn for 10 years or more it’s time to give your makeup a makeover.

Your personal history of wearing makeup is likely a long one. Most women remember the life-changing year that they were officially allowed to wear it.

This milestone does not include junior high years when you snuck lip gloss and some peachy blush in your backpack, and applied it using the mirror inside your locker. All evidence of these amateurish attempts at cosmetics had to be scrubbed off before you got home, of course.

The ’70s were a time when Bonne Bell soda-flavored

lip balms and Love’s Baby Soft perfume were all the rage. With role models from Cher and Charlie’s Angels to Wonder Woman and the Pink Ladies in Grease, teenage girls had plenty of inspiration to draw from.

Disco makeup, meanwhile, featured techno-colored eye shadow and butterfly false eyelashes. The popular lipstick was (and still is) classic cherry red. Hair spray was a huge hit that launched a Broadway show, but that’s another story for another time.

As we finished school and found our own personal style, many of us eschewed cosmetics for a natural look. Years of motherhood probably meant a swipe of lipstick on the way

Yes, you do need to rethink your makeup as you age

out the front door.

In your 40s and early 50s, you likely had a stash of reliable skin care, eye shadow, lipstick and blush products. Fast forward to current days, when we have time and energy to finetune our signature look and yet most of us don’t, instead relying on what we’ve done for years.

Why do so many of us avoid switching up our cosmetics?

“Women get comfortable in their routine,” says Rachel Duncan, owner of Color Me Gorgeous in Altamont. “They want something quick and easy and fall into a habit. As time passes, your skin isn’t the same, so your goals can’t be the same decade after decade.”

Alayne Curtiss, owner of Make Me Fab in Saratoga Springs, likens this to falling into a proverbial rut. “What is it about makeup and changing our look that’s scary?” she

says. “We want to look like a version of ourselves from 20 years ago. It’s an identity we’ve had for so long. Listen, you don’t have to make huge changes. You can take small steps to update your look.”

The question is where to start. Local makeup experts have plenty of advice for updating and enhancing your cosmetic efforts, whether you want a subtle flush of color or something suitable for a dinner party.

First, consider the lighting in the room where you’re putting on cosmetics. “You want to mimic daylight, which is a white, not yellow cast,” says Tayla Janowicz, owner of The Makeup Studio Saratoga.

Since most of us don’t apply our makeup on our front porch, Janowicz says the best lighting is a 6400 Kelvin bulb, which you can find at most home stores. This bulb creates a

pure light, with a slight bluish-white tint.

Next question: What kind of mirror are you using to apply your makeup? If you answer “magnifying,” it’s time for a change.

“Using a magnifying mirror will only show more problems than you really have,” Janowicz says. “You will have no self-control. You will over pluck your eyebrows and pick at blemishes.”

A good beauty routine starts with hydration. Sure, you want to drink plenty of water for myriad health reasons, but it also boosts the appearance of a fresh, glowing complexion.

After cleansing, dab on a complexion serum, which is a liquid enhanced with a variety of ingredients ranging from vitamins and minerals to elements based in nature, such as kelp and floral or plant extracts. “Serums are something

many women aren’t using because they think they will cause breakouts,” says Duncan. “Just use a drop or two, then gently press the product into the skin. Rubbing can irritate skin.”

Save that heavy hand for moisturizers that are designed for the face, i.e., not Jergens hand lotion or whatever’s on your nightstand. “Put on a good layer of moisturizer,” says Janowicz. “Spread it evenly across the face and let it sink in.”

Once your skin is hydrated and ready to glow, reach for foundation, available in creams, sticks, powders and liquids. “Older women should stick with a water-based foundation,” says Autumn Wright, owner of Seraphina Divine Beauty in Ballston Spa. “Foundation with oil is great for 22-year-olds, but for a more mature skin, you don’t want shimmer because it accentuates wrinkles. Stick to water-based.”

Think layers, not gobs of foundation. Then blend, blend,

Yes, cosmetics have an expiration date! If it looks old or changes texture, get rid of it. Most foundations, concealers, liquid eyeliners and face creams need to be replaced anywhere from 3 to 12 months out. Check the Period After Opening (PAO) symbol on most cosmetic product labels for a guideline.

blend. Makeup sponges and brushes are available in all sizes, but there’s nothing wrong with using your fingertips. (Always wash hands first).

On to mascara, which comes in many shades, from black to brown to blue (skip the latter). Choose the brand you like, but make sure it isn’t labeled “waterproof.”

“Waterproof mascara will make lashes dry and brittle,” Janowicz says. “If this happens, try a lash serum to rehydrate.”

If your current eyeliner strategy is reminiscent of the singer Joan Jett, who used a thick stroke of black, it’s time to switch it up. “That’s a 1980s trend to trace eyes with dark pencil lin-

er,” says Lari Manz, owner of Lari Manz Hair and Makeup in Chatham. “Instead, use a soft eye shadow like a soft gray or smudged brown that won’t create harsh lines.”

When it comes to eyebrows, it’s time to toss the tweezers. “As we get older, our brow lashes thin out,” says Duncan. “Avoid plucking them, even if they’re gray, because that damages the root, and they won’t grow back in.”

Instead, reach for a brow pencil, powder or tinted gel, and gently fill in sparse brows with a color one or two shades lighter than your hair. “Pencils with wax in them will be easier to apply,” says Janowicz. “Eyebrows sculpt the face. Pay attention to them.”

Let’s move from your face to your nails. Whether you wear yours long or short, acrylic or natural, there are a couple of ways to make sure you, um, nail your look as a mature woman. “The main rule with nails and a youthful appearance is to go lighter,” says Janowicz. “Stay away from anything loud, like fluorescent pink or even black or dark shades.”

Nail polishes these days come in a dizzying array of colors, even when you choose a neutral. “Pick something close to your skin color with some warmth to it,” Janowicz says. “It will make you look well-groomed and healthier.”

Ultimately, the motto “less is more” is the best approach when applying cosmetics. “As we mature, stay away from bright and shiny and go for a more natural look,” says Manz.

The potential exception is lipstick. “The only bright color you should have on your face is lipstick,” says Manz. “Stay away from harsh dark berries. I love the classic red.”

Last of all, cast your worries to the wind! “Be willing to try new things,” says Duncan. “Makeup is something to play with, to reconnect with that youthful side of ourselves.”

good beauty routine starts with

Whether you join us

a brief stay, or call us home, we are here for you.

Who says women are the only ones who should update their appearance as they mature? Switching up the out-of-style hair cut and considering a rethink on the facial hair can help men step into the 2000s.

“Mustaches used to be a way for men to try and look younger, but now it’s more about facial hair and beards,” says Dominic Figliomeni, owner of Dominic’s Classico Barber Shop, with locations in Loudonville and Clifton Park.

You don’t have to be George Clooney to rock a scruffy salt-and-pepper look. “The five o’clock shadow is a great look for all men,” Figliomeni says.

If you are follicly challenged, please resist the urge to fall back on the comb over! That’s a dated style where men grow hair longer on one side and comb it over their bald spots. “No comb over, no way,” Figliomeni says. “It will take men from 60 to 90.”

The good news is that men are paying more attention to their hair, and it shows. “Older men over the last 10 years look so much better,” says Figliomeni. “You get smarter with age.”

Men can also take advantage of new styling tricks to thicken and hold hair in place, no matter how windy

it gets this autumn. Figliomeni just released his own brand of pomade, fiber and clay products designed to leave hair with a dry appearance rather than a shiny gel.

“You want to be able to run your fingers through your hair,” he says. “Trying too hard is not the best idea. Listen to your stylist.”

Women aren’t the only ones that can treat themselves to spa services that make them feel like a million bucks. The Medbury Spa in Ballston Spa, for instance, offers a “Gentlemen’s Facial” that includes cleansing, exfoliation and hydration.

Many men have already jumped on this self-improvement trend. “It used to be that women had to drag their partners in for spa treatments,” says Carolyn Barter, spa manager. “Now men come in on their own and look much better groomed when they leave. It can be an ongoing part of looking their best.”

Barter advises men to skip shaving a day or two before their facial, because freshly shaven skin can be irritated by the exfoliating product. Other services for men include mineral bath soaks, acne treatments, and chest or back waxing. n

Aging is an inexorable process, but what can often make a person feel truly old is inflexibility of the mind. After so many years we can get set in our ways, so comfortable in what we know that we often forget how much we don’t know. Curiosity, then, can be what prevents us from feeling truly old.

Finding ways to stay curious as we age, however, can be a challenge. Left to our own devices, we often seek information that fits our preconceived notions. This tendency is called confirmation bias: when we almost accidentally search for or interpret information in a way that confirms or supports our prior beliefs. Therefore, to stay intellectually flexible it is important to seek knowledge from expert sources that takes us beyond our preconceived notions.

Under that logic, the fountain of youth does exist and the secret lies in MOOCs, or massive online open courses. These classes are offered from institutions of higher learning like Harvard, Columbia, and Yale … for free. Anyone can enroll and benefit from the collective wisdom of top collegiate professors, purely for the sake of learning. If you want to earn a certification, you can do that too for a lot less than if you tried to enroll the traditional way. We spoke with Professor Trudi E. Jacobson, distinguished librarian emeritus at the University of Albany, to learn more about MOOCs and how to get the most out of these programs.

Massive open online courses are exactly what they sound like: college courses offered via the internet aimed at un-

limited participation and open access. When MOOCs first started to become popular around 2012, Jacobson and her colleagues wanted to explore how MOOCs could allow students to build their own interactive learning experiences. Unfortunately, they found that this open format of learning was difficult for the typical college student to embrace. “[Students] are used to being told what they need to do,” she says.

Since then, MOOCs have evolved to become more like the massive lecture courses we’re familiar with from our college days. They consist of a combination of traditional course materials such as filmed lectures, readings, and posted problem sets, blended with interactive opportunities like user forums and social media tools.

This format of higher education has been criticized by some for setting unrealistic time-commitment expectations for the typical student, and for the assumption that the student can self-regulate and set their own goals. But while those issues may be problematic for your typical 20-year-old seeking a degree, retirees or even empty nesters still working have more free time and often the self-motivation to learn simply for learning’s sake.

The MOOCs that Jacobson has taught have been taken by people from all age groups all over the world. But she particularly encourages people from a more mature demographic to take advantage of them: “I think for those who are older, who are coming to this with their own motivation doing it because they want to do it it probably works better than [for] those who are doing it because they have to,” she says.

Take, for example, the course Jacobson offered through

Cheap college courses for just about everyone on just about anything

Coursera called Metaliteracy: Empowering Yourself in a Connected World. Being metaliterate means being able to evaluate information for bias, reliability, and credibility and then understanding how to apply that information in context. Jacobson says that when students take the course, they are often surprised to find that metaliteracy can change your whole point of view. “This is a way of thinking both about the assessment of the information they’re using and consuming, but also their responsibilities as creators of information,” she says. In the past, you needed to write a book or be some kind of credentialed expert to disseminate information or knowledge. Thanks to the internet, all you need is access and the ability to hit “share.” So Jacobson’s course discusses the responsibility we all share when we participate in social media to assess the truth of what we are seeing as well as what we pass along.

Jacobson is also excited about the unique way that MOOCs can help people expand their horizons beyond what is included in the lectures and readings. “Depending on the platform and how it is structured, [MOOCs] can be very interesting if there are discussions going on with people all over the world because it gives you a new perspective and a chance to share your knowledge,” she says.

MOOCs are available through a variety of online platforms. The most well known are probably Coursera and edX, which collaborate with leading universities and companies to provide free courses, professional certificates, and even degrees. Before you enroll, however, consider what you want to get

out of the experience. Are you looking for a more passive role, where you can simply absorb the information at your own pace? Or are you looking to be a more engaged learner, which requires interaction between yourself and other students and professors around the world? Jacobson, as you can probably guess, enthusiastically encourages people to opt for the latter. “If there is the opportunity to engage with others and do peer review or assessments, think about doing it,” she says. “We see a lot of people who go through MOOCs doing the minimum, but those who go that extra step say how enriching it was to do that.” Either way, before you select a course read through the syllabus and make sure it offers the experience you prefer. The structure of the classes can vary quite a bit from platform to platform and are dependent upon the area of study, so shop around.

While perusing your options, keep your end goal in mind. Partially taking a course is totally fine, for instance. “There might only be a few modules that you want to learn from; you might not need everything the MOOC offers, but don’t feel guilty for not doing the whole thing,” she says. “It is all self-directed; you know what it is you want to get out of the course. Don’t let [the specter of failure] deter you.”

Ultimately, there’s nothing to lose by enrolling in a MOOC. In the end you won’t be saddled with hefty student loans, and no one is going to hound you about your grades. You could seek certifications that might further your career, or merely broaden your horizons in the pursuit of eternal youth. “Give it a try. You may not decide to do it all the way through,” Jacobson says, “but you might be very surprised at how fulfilling it is.”

Simplify Medicare is a full service agency in Rotterdam, N.Y., with 30 Licensed Insurance Agents serving the entire United States. We take pride in helping seniors remove the confusion from the Medicare process. We are Licensed Insurance Agents and Advocates who help to streamline a somewhat complicated system. We align ourselves with top rated insurance companies that ensure access to affordable high quality health care. We offer Medicare Supplements, Medicare Advantage Plans and Prescription Drug Plans and will assist you in finding the best plan that fits your health & financial needs.

At Simplify Medicare our core values are: Compassion, Education and Advocacy. It is a privilege to serve and guide our clients through their personal health care journey.

RESOURCES FOR EVERYTHING YOU NEED TO KNOW

1 2 3

To be eligible for Original Medicare, you must be a permanent legal resident (green card holder) or an American citizen who has lived in the United States for at least five years AND one of the following:

l Age 65 or older

l Under age 65 and receiving Social Security Disability Income for 24 months

l Diagnosed with End-Stage Renal Disease or Amyotrophic Lateral Sclerosis

To enroll in Original Medicare, you may be required to reach out to your local Social Security office in some circumstances.

You will automatically be enrolled in Medicare at age 65 if you are receiving Social Security benefits or railroad retirement board benefits at least four months before you enroll in Medicare. However, suppose you are not receiving Social Security benefits or railroad retirement board benefits. In that case, you will need to contact your local Social Security office to enroll in Medicare up to three months before your 65th birth month.

If you must contact your local Social Security office, you can sign up for Part A and Part B at the same time. Once you complete the application and provide the required documentation, you will begin receiving benefits on the first day of your 65th birth month.

While it is not mandatory, we recommend you enroll in Medicare Part A coverage as soon as you become eligible if you qualify for premium-free Part A coverage. However, if you delay Medicare Part A, you will be able to enroll later during the General Enrollment Period or a Special Enrollment Period if you qualify. But, if you delay enrollment to the General Enrollment period, you will be required to pay late enrollment penalties.

If your employer offers creditable health coverage, you do not need to enroll in Medicare Part B if you are working past age 65. Creditable coverage is health care coverage that provides at least equal benefits to Original Medicare. Suppose you do not have creditable coverage and do not enroll in Medicare Part B when you first become eligible. In that case, you may have to pay the Medicare Part B late enrollment penalty as long as you have Medicare Part B.

Remember that even if you have creditable coverage, it is essential to compare your current plan to Original Medicare with a Medigap plan and Part D. Often, combining these Medicare plans will provide you with the most comprehensive coverage possible.

Medicare Supplement plans and Medicare Advantage plans are not the same things. While both Medicare Supplement and Medicare Advantage plans bring additional benefits to Original Medicare, they work very differently. Medicare Supplement plans, also known as Medigap plans, work as a secondary to Original Medicare (Medicare Part A and Part B). The plan will only pay after Original Medicare has paid its portion. These plans have no networks, no restrictions, and no referrals to see specialists.

Medicare Advantage plans, also known as Medicare Part C, on the other hand, become your primary coverage over Original Medicare. They often require you to follow a strict network of doctors and have higher out-of-pocket costs. However, they often provide additional benefits.

These additional benefits provided by Medicare Advantage plans often include dental, vision, hearing, and prescription drug coverage, as well as transportation assistance and gym memberships. However, not every plan or every carrier is required to offer these additional benefits.

For most, the Medicare Part A premium is $0 per month. However, if you do not qualify for zero-premium Part A, the premium can be as high as $506. To qualify for zero premium, you must have worked at least 40 quarters or ten years paying Medicare taxes. If you did not meet this qualification, you would be required to pay the Medicare part A premium.

The standard Medicare Part B premium in 2023 is $164.90. This can increase based on income. This difference in premium reflects your Income Related Monthly Adjustment Amount (IRMAA).

For example, if you and your spouse make $230,000 combined, you will each pay $230.80 monthly for Medicare Part B. If you are subject to IRMAA, you will receive a determination letter with your new monthly premium.

Register today to secure your spot Make plans to attend one of our FREE seminars to get your Medicare questions answered and learn more about your coverage options.

• Tuesday, October 24 10 am - 12 pm

• Tuesday, November 14 10 am - 12 pm

• Tuesday, December 5 10 am - 12 pm

7 Southwoods Blvd., Suite 301, Albany

Hosted by Simplify Medicare and Herzog Law Firm

Space is limited! Reserve your spot today at 55pluslifemag.com/medicare

We’re honored to join you in supporting our seniors.

We’re honored to join you in supporting our seniors.

Thanks for standing with the Albany community.

Thanks for standing with the Albany community.

Ready to learn more about Humana plans? Get in touch with a licensed Humana sales agent.

Ready to learn more about Humana plans? Get in touch with a licensed Humana sales agent.

Paul Leo 518-210-9558

Paul Leo 518-210-9558

Monday – Friday, 8 a.m. – 5 p.m.

Monday – Friday, 8 a.m. – 5 p.m.

BY DAVID A. KUBIKIAN, ESQ. | HERZOG LAW FIRM

BY DAVID A. KUBIKIAN, ESQ. | HERZOG LAW FIRM

If you are reading this article — that is, if you got past the title — it probably means you are already somewhat knowledgeable about all the things Medicare can provide for you when it comes to health insurance and all the complexities that go with it: The enrollment periods. The advantage plans. The TV commercials. The seemingly constant inclusion of Medicare in political ads. Medicare is everywhere.

As well it should be. Our country’s over-65 population is at its largest number ever and with advancements in health care, that number will only go up in the future. It is important to know what Medicare covers — but with the average lifespan increasing (absent worldwide pandemics), it may well be more important to understand what Medicare doesn’t cover.

Unfortunately, dozens of my clients end up in the hospital each year because of both figurative and literal bad breaks from falls in their home. It’s a very familiar pattern, and it is also a good example of the limits of Medicare at the place where the worlds of health care and long-term care meet. These falls often lead to surgery and stays of a week or more in the hospital. Sometimes a debilitating condition or an infection can land a client in the hospital for more than a few days. As we saw during the last few years, potent strains of communicable diseases can have the same power.

Regardless of the reason, spending three-plus days in a hospital bed may very well require a week of rehabilitation to strengthen those muscles and bones before returning home. Medicare can provide coverage for the hospitalization and the rehab in this example. Following

a three-day inpatient hospitalization, Medicare can provide up to 20 days of 100% coverage for rehabilitation in a skilled nursing facility.

If the length of rehabilitation extends beyond 20 days, Medicare can cover a portion of costs up to the next 80 days (days 21-100) — leaving the patient responsible for a daily co-pay that can add up to thousands of dollars per month. Some Medicare recipients have additional gap coverage that can cover this co-pay, but most people do not. That means that if a loved one has a lengthy rehab stay — say, 80 days total — the final two months (60 days) may cost in excess of $11,000 out of pocket. Still, Medicare’s coverage is quite substantial.

So what’s the problem? Well, the devil is in the details. You may have noticed that Medicare’s coverage levels vary at stages “up to” the first 20 days and “up to” the next 80 days. If your loved one initially refuses rehab or plateaus in their recovery, Medicare can refuse to

cover any additional rehab — whether that is on day 3 or day 93. If your loved one is not ready to go home despite Medicare’s assessment, they may have to pay out-of-pocket for skilled nursing facility treatment going forward. That means daily rates in excess of $575 per day, or $17,000 per month. In addition, Medicare’s rehab coverage kicks in only after the requisite three-day inpatient stay at the hospital. Being placed on observation status, regardless of length of stay, doesn’t count toward the threshold needed to trigger Medicare benefits.

It is a confusing part of life, and the simple way to remember where the line is drawn is that Medicare covers events from which you can recover Break a leg? Medicare can cover the hospital visit, the surgery, and the rehab (as long as you are getting better). But if you’re left with a bad leg and your 100% is no longer a “full tank,” so to speak? Medicare will not help with your longterm care realities and needs.

BY JANET REYNOLDS

BY JANET REYNOLDS

There’s a reason ovarian cancer is known as “The Silent Killer.” Unlike many other cancers, its symptoms are often ignored by both women and doctors alike until the cancer has progressed so far that it is often too late to successfully treat it.

The Mayo Clinic reports that only about 20 percent of ovarian cancers are found at an early, more treatable stage. If the cancer is discovered early, about 94 percent of patients live more than five years after diagnosis.

Dr. Heidi Godoy, who practices at New York Oncology Hematology cancer center, says that about 75 percent of patients are diagnosed at an advanced stage. “It’s the silent killer,” she says, “because the

most common stage [of diagnosis] is stage 3. It’s a lethal diagnosis to have.”

While about 75 percent can go into remission with chemotherapy, Godoy says, there is a 75 percent chance of recurrence. “There is a high recurrence rate with this type of cancer,” she says. “It’s treatable, but that’s different from curable. The average survival rate is five to six years.”

Paying attention to symptoms that many women and doctors can easily attribute to something else often something seemingly more benign is critical to successful treatment, Godoy says. This is especially true because unlike many other cancers, ovarian cancer does not have any screening tools as effective, say, as a colonoscopy or mammogram.

Photo: iStockphoto.com/Panuwat Dangsungnoen.A list of the symptoms that may suggest ovarian cancer (see box) proves how easy it is to dismiss until it’s too late.

What woman hasn’t felt fatigue, had abdominal bloating or felt the need to frequently urinate? “For bloating, we often write it off as we ate something wrong,” Godoy says. “We often don’t put all the symptoms together. As women, we tend to be caregivers for everyone else. We put down these annoyances every day and don’t link them together until it’s an advanced disease.”

• abdominal bloating or swelling

• quickly feeling full when eating

• weight loss

• discomfort in the pelvic area

• fatigue

• back pain

• changes in bowel habits, such as constipation

• a frequent need to urinate

Godoy is direct about why creating ovarian cancer screening tests is not on the top of the medical research list. Only about 100,000 women get ovarian cancer annually. In contrast, while prostate cancer is the most common cancer among men with 288,300 men in the U.S. likely to be diagnosed in 2023 the death rate from the disease continues to drop because of screening guidelines and prostate-specific antigen testing, according to cancer.net.

“There’s no money put into (ovarian cancer) because it’s considered rare,” she says. “The problem with ovarian cancer

is the tumor is … made up of different tumor clones so it’s hard to pinpoint one screening test. There’s no good imaging or blood test.”

So what’s a woman with some of these symptoms to do?

Even post-menopause, women should still see their OB-GYN annually, Godoy says. “Have a pelvic exam yearly. You still need this even if you no longer get a Pap smear.” (See our story on page 49 about why you still need to see your gynecologist later in life.)

If you have symptoms, see your primary doctor. “Don’t let them blow you off,” says Godoy. “Ask for a specialist. Consider your health as important as the people you care for. Be the squeaky wheel.”

Family history is an important part of this story too, Godoy says. “Be sure your family history is taken seriously. Family history is something we think is static, but it’s not. And your children should know it too.

“The big thing,” she concludes, “is an annual exam with an internal exam. Listen to your body.” n

4 big reasons you’re wrong

BY TRACI NEALNot unlike a lot of women, for whatever reason busy schedule, working full time, raising then-teenagers, no longer having babies and no major issues “down there” I stopped going to my OB-GYN for my annual exams once I hit my 40s.

“Unfortunately, that’s very common,” says Dr. Emmekunla Nylander of Buffalo OB/GYN. “As soon as they’re done having children, many women forget about themselves. It shouldn’t be that way. A lot of times I’ll see an older new patient who hasn’t seen their gynecologist since their last child was born.”

It’s fairly typical for women to put off gynecological vis-

its, agrees Dr. Benjamin Margolis, assistant professor of gynecologic oncology at Albany Medical Health System. “But as a specialty, OB-GYNs also perform a lot of primary care functions,” he says, ticking off screenings for bone density, breast cancer, cervical cancer, sexual health, weight and diet as examples. “Clearly there’s a lot of overlap with a primary care doctor, but there are a lot of things we do that a primary care provider may not.”

As the baby boom generation ages, gynecologists are increasingly urging older women to get back into the habit of an annual visit. Here’s why.

The risk of gynecological cancers cervical, uterine, ovarian, vaginal, and vulvar increases with age. Your gynecologist can spot any changes during your annual exam. “Cancers can still develop after age 55,” says Nylander. “So you want to screen to try to prevent these things from happening or catch it early.”

Human papillomavirus, or HPV, can lead to cervical and other cancers, but can lay dormant and go undetected for decades until menopause, according to doctors. “People get exposed to HPV early in life, or when they become sexually active without using any protection,” says Nylander. “Most people don’t have signs or symptoms until something causes something to affect the immune system. I’ve seen patients in their 50s and 60s who suddenly have HPV,” which if untreated can lead to cancer.

By age 55, most women have already gone through “the change” and may be experiencing the symptoms hot flashes, mood swings, memory issues, problems sleeping, loss of libido, weight gain, painful sex, and other issues that accompany the loss of estrogen and other hormones brought on by menopause.

“Menopause is not just ‘having a bad day,’” says Woods, who specializes in treating menopause. “We’re talking (symptoms lasting) 20 years of a woman’s life.”

While menopause symptoms were brushed off in the past as part of aging and something women just had to live with, Woods says health complications related to menopause are “enormous.” Hot flashes, for instance, can increase a woman’s cardiovascular risk, he says, and osteoporosis can cause falls and fractures that lead to premature death.

Woods, whose practice is certified by the North American Menopause Society, recommends that women see their providers simply to stay up to date on treatments, such as estrogen creams and patches, that can significantly reduce symptoms. “I spend so much time unraveling the misin-

The North American Menopause Society urges: “Baby boomer women, and all women who have had multiple partners, should not stray too far from their Pap smear or HPV test at menopause until we know more about the increased risk of HPV flareup at menopause.”

Most women, says Margolis, “don’t think about the vulva and things that can impact the vulva.” But abnormalities on the external part of the vagina, such as precancerous lesions or melanomas, are more common with age, he says, “and something we can really only screen for by looking.”

Treatment of lesions early on may be fairly noninvasive, says Dr. James Woods, a professor of obstetrics and gynecology at the University of Rochester. However, left untreated, the lesions can develop into cancer and invasive, potentially disfiguring surgery may be necessary.

Nylander agrees. “We don’t want to have to deal with issues after they become active problems,” she says.

formation” that women get from their friends or remember from a widely reported Women’s Health Initiative hormone replacement therapy study in the early 2000s, says Woods, who also writes monthly online essays addressing specific symptoms of menopause.

The 2002 study, Margolis adds, gave hormone therapy “a bad rap” when it reported higher incidences of breast cancer among women taking hormones. Since then, he says, “the data has been combed through and refined and it’s found there’s a subset of people for whom estrogen does seem to be very safe and effective and widely prescribed.”

Speaking with their gynecologist can help women sort through the information they get from what Margolis calls “Dr. Google and Dr. Facebook.” “Otherwise it can be really tricky for people in terms of knowing what information they can trust,” he says.

Woods agrees the panic created by the study in the early 2000s persists today. He notes there are safe low-dose hormone replacement therapies that can “reverse most symptoms of menopause” and leave women “very happy in their menopause years.”

Sometimes, menopausal changes can impact a woman’s sexual function, says Margolis, noting that vaginal dryness, painful sex and decreased libido or hy poactive sexual desire disorder are common. “That, in and of itself around their 50s and 60s is an important time for people to be talking to their OB-GYNs about their sexual function, their anatomy, and interventions that can help,” he says.

Medications and other non-medication-based therapies can help maintain vaginal elasticity and moisture, increase sexual satisfaction and function, and boost libido, he says. “Honestly, even kind of normalizing sexual issues, putting a name to something, and acknowledging that something is a problem can provide a lot of reassurance and relief to someone who is struggling,” Margolis adds.

Prolapse, or protrusion of the uterus from the vagina, back and pelvic pain, and urinary and fecal incontinence are all pelvic disorders that become more common as women grow older. “Age is definitely a big risk factor,” says Margolis.

Prolapse is more common in women who have had vaginal deliveries, says Margolis, and there are surgical and nonsurgical treatments. Incontinence has “many treatment options,” he says.

“When it comes to urinary incontinence it’s all about quality of life,” he adds. “There are surgeries, medications and lifestyle changes that can all be employed to help people.” n

To learn more about ovarian cancer see our story on page 47 Those interested in getting more information about local specialists who can help with menopause and postmenopause issues can find a list at the North American Menopause Society website.

BY TRACI NEAL

BY TRACI NEAL

The first time Sandie Lee Butler went mudlarking on Glass Bottle Beach in Dead Horse Bay in Brooklyn 10 years ago, she filled her two Trader Joe’s bags so full of finds she had to stop every 10 steps or so to put them down and rest.

An avid beachcomber, Butler, 72, a mixed-media artist and self-described “longtime collector of stuff,” hadn’t known what to expect on that first trip to the debris-strewn beach, a National Park Service-managed site on the Atlantic along Jamaica Bay. She’d heard stories of treasure-hunting along the shoreline there, where thousands of vintage glass bottles, along with leather shoes, porcelain doll heads, broken pottery and bones, lots of old horse bones from a 19th-century rendering plant emerge from the sand and muck, litter from long-ago landfills washed up or uncovered at low tide. (The beach was recently closed to the public after potentially

hazardous material was found among the debris.)

“At first you just see bottles, broken glass everywhere,” says Butler, a former photography and art teacher, “and then you look past that and you go, ‘Oh, look! There’s a plate that’s intact!’ I found a beautiful little pink Depression-glass vase that was perfect. Not everything is broken. When I find a treasure I say, ‘It was meant just for me.’”

Being out in nature, hunting for sea glass or old children’s toys or shards of vintage dinner plates while imagining how her finds will be repurposed for her artwork is a meditative process, Butler says. “I always feel so happy and relaxed when I’m out looking for stuff and I’m always looking for stuff,” she says. “I used to tell the kids I taught, I want to teach you how to see, how to really look at things and not just walk through life with your head at one angle. That’s what it is for me, the art of seeing, the excitement of finding, and then it’s ‘What am I going to make with it?’ This stuff, it’s abandoned

The time Butler spends outdoors is not only good for her imagination, but it may be good for her mental and physical health, according to several studies on the benefits of exposure to the outdoors. The American Psychological Association says time in nature can improve our mental health and sharpen our minds.

The New York State Department of Environmental Conservation, citing several studies, says exposure to forests and trees boosts the immune system, lowers blood pressure, reduces stress, improves mood, increases ability to focus, accelerates recovery from surgery or illness, increases energy level, and improves sleep.

“I see spending time in nature as something that’s tremendously helpful for folks,” says Jeremy Asgari, founder of the Outsiders, a New York adventure and social club that sponsors daylong activities locally, ranging from surfing and a

beach party to canyoneering and waterfall hiking to an afternoon sunflower farm visit, or an outdoor picnic at a New York art installation.

“People who spend time outdoors have better mindsets, are happier and more present, and it helps combat anxiety and depression,” says Asgari, who founded the Outsiders in 2016.

Still, screen time hogs our attention. According to the Pew Research Center, people aged 60 and older spend more than half of their daily leisure time, four hours and 16 minutes, in front of screens, while time spent on other recreational activities has ticked down slightly.

Getting outdoors can help balance those numbers. From hiking to birding to snowshoeing and more, a number of New York clubs organize trips, provide equipment and transportation, and serve as community hubs to bring people together outdoors.

The Capital Region has a plethora of group options to help you start getting outdoors. Here are few suggestions:

l Meetup offers a ton of different outdoor groups within the region for all kinds of interests: meetup.com/topics/outdoorsand-adventure/us/ny/albany/

l Albany Area Amateur Astronomers: facebook.com/ groups/808216819909372/

l Adirondack Riverwalking and Forest Bathing: adirondackriverwalking.com CONTINUED

Asgari, who left a job in the entertainment industry to found the Outsiders, says he has recently started chapters in Los Angeles, Chicago and Stockholm, Sweden. In addition to their local outings, the Outsiders also hosts nature-inspired trips.

“We provide transportation,” he says, “so when we bring people out to an activity I’ll use hiking as an example by the time they’re 30 minutes into the hike, their energy feels lighter as though they’re more present. There’s less weight on them from everyday living, the stressors of the city, and all the stimuli we’re constantly exposed to. I think the community makes a huge difference. It’s easy to feel alone, even in the city. Our goal is to make people feel like they have a community for themselves.”

Researchers are increasingly confirming the benefits of spending time in nature. One recent study found that spending 120 minutes outdoors per week, either all at once or broken up into several outdoor activities, is associated with better health and well-being, including among older adults and those with long-term health issues.