Economy GREEN journal ISSUE 57 | 2023 INTERVIEW WITH SAPVIA CEO 24 WIND TURBINE SOURCING 30 INFRASTRUCTURE: ARRESTED DEVELOPMENT? 44 Just Energy Transition for AFRICA

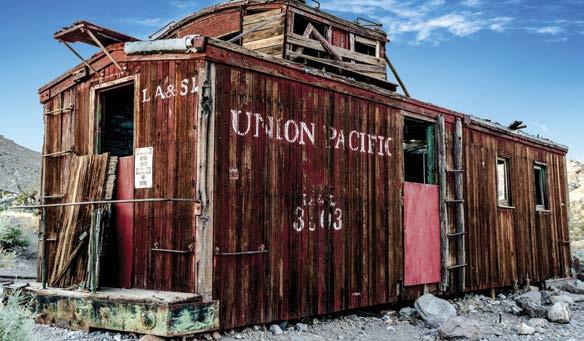

Strive for Net Zero while saving money at the same time!

Rooftop, solar car-ports, ground mounted solar, and agri-voltaics represent the best value energy available to the energy customer in South Africa.

Blue Sky Energy are experts in the design, procurement and construction of such plants. Battery energy storage installations provide access to solar energy daily during peak hours when the sun is not shining and enable users to bridge their primary energy needs through grid interruptions. While the levelised cost of hybrid solar + battery storage installations is significantly greater than solar PV only, appropriately sized solutions can be commercially feasible. Would you like to know if your property or business can achieve energy security at the same cost or less than what you are paying currently?

Agri-Voltaics and Solar Car Ports

Blue Sky Energy works with leading light steel frame construction suppliers to offer a range of innovative solutions such as agrivoltaics and solar car-ports.

Have you considered putting your spare space to work? Whether you have low value land or large parking spaces, bring them to life through solar PV installations that create energy and high value spaces such as shade for parking or tunnels for agriculture.

Website: www.blue-sky.energy Email: enquiries@blue-sky.energy

123RF

Did you know that Section 12B of the Tax Act allows for the accelerated depreciation of your power generation capex resulting in a 27.5% saving on your project installation?

CONTACT THE EXPERTS AT BLUE SKY ENERGY RIGHT NOW!

123RF

NATURE RESERVE

Recently a new ministerial portfolio was created, and the Honourable Minister of Electricity, Dr Kgosientso Ramokgopa, was appointed. But what do we know about him? According to Wikipedia, Kgosientso “Sputla” Ramokgopa is a South African politician who was the Mayor of Tshwane from 2010 to 2016. His academic background includes a Bachelor’s degree in civil engineering, Master’s degrees in public administration and business leadership and a PhD in public affairs. He was born in 1975.

I read in media that Ramokgopa left the City of Tshwane bankrupt after the legal settlement with PEU Capital Partners over a deal to roll out smart electricity meters across the City ended in litigation.

I would like to share a few first-hand details about Ramokgopa’s performance at City of Tshwane. It may give an idea as to how he will tackle his current monumental challenge.

We ran the Sustainability Week conference in partnership with the City of Tshwane from 2011 to 2016, and Ramokgopa was the patron of the event. Among a great many other positive projects and happenings in the green economy that the event’s many sub-sector conferences focused on, we also showcased the work of Tshwane’s City Sustainability Unit under the leadership of Dorah Modise, subsequently influential CEO of Green Building Council SA.

The team under Romokgopa were trailblazers. Aside from many other achievements, they developed the first Green Service Delivery Strategy in South Africa and were mandated to act into all City departments to guide the implementation of interventions aimed at achieving the stated objectives.

Their projects ranged from the first wheeling deal which facilitated the Bio2Watt biogas project in Bronkhorstspruit, making electricity out of various waste streams including sorted municipal solid waste (MSW) and supplying power to the BMW Rosslyn plant and free WiFi to all Tshwane residents, to the first fully-mechanised materials recovery facility (MURF), and the roll-out of smart electricity meters that would enable net metering for small-scale embedded generation.

Ultimately, Ramakgopa was unseated by an ANC opponent before they lost the City to the DA.

Having worked with Ramokgopa, albeit at some distance, I feel optimistic that if anyone in the ANC can pull this mandate through, it is him.

Economy GREEN journal

EDITOR: Alexis Knipe alexis@greeneconomy.media

CO-PUBLISHERS: Gordon Brown gordon@greeneconomy.media

Alexis Knipe alexis@greeneconomy.media

Danielle Solomons danielle@greeneconomy.media

LAYOUT AND DESIGN: CDC Design

OFFICE ADMINISTRATOR: Melanie Taylor

WEB, DIGITAL AND SOCIAL MEDIA: Steven Mokopane

SALES: Gerard Jeffcote

Glenda Kulp

Nadia Maritz

Tanya Duthie

Vania Reyneke

PRINTERS: FA Print

GENERAL ENQUIRIES: info@greeneconomy.media

ADVERTISING ENQUIRIES: alexis@greeneconomy.media

REG NUMBER: 2005/003854/07

VAT NUMBER: 4750243448

PUBLICATION DATE: April 2023

www.greeneconomy.media

Publisher

EDITOR’S NOTE

Africa is blessed with land and resources, enough to supply the whole world, and needs to capitalise on this in a sustainable way. We have sunshine for solar, water for hydro and wind for renewable capacity and an abundance of biomass and waste that can be converted to energy. Chris Whyte, ACEN, points out that the key focus here is energy, and the simple reality is that Africa will never be able to achieve the SDGs without energy. Everything is reliant on energy: we need to avoid the expensive mistakes of before and rather implement viable energy generation (page 18).

The push for renewable energy is showing an increase in solar PV across the country, which in turn drives demand for components and services. Don’t miss our interview with the CEO of SAPVIA (page 24) or our article on wind turbine sourcing (page 30).

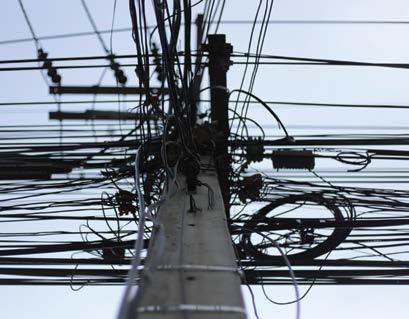

Our thought leadership article indicates that despite the speed with which solar and wind power plants could be built, South Africa’s grid itself does not have the capacity to distribute that power (page 44).

Alexis Knipe Editor

Alexis Knipe Editor

6 All Rights Reserved. No part of this publication may be reproduced or transmitted in any way or in any form without the prior written permission of the Publisher. The opinions expressed herein are not necessarily those of the Publisher or the Editor. All editorial and advertising contributions are accepted on the understanding that the contributor either owns or has obtained all necessary copyrights and permissions. The Publisher does not endorse any claims made in the publication by or on behalf of any organisations or products. Please address any concerns in this regard to the Publisher.

PUBLISHER’S NOTE

THOUGHT [ECO]NOMY

To access the full report in our Thought [ECO]nomy report boxes: Click on the READ REPORT wording or image in the box and you will gain access to the original report. Turn to the page numbers (example below) for key takeouts of the report.

7 Economy GREEN journal 18 30 44 CONTENTS 8 NEWS AND SNIPPETS ENERGY 12 What the world is learning from SA’s energy transition 18 The Just Energy Transition – what it should be ... 24 It’s time for solar to shine: interview with SAPVIA CEO 28 Business Partners urges companies to go solar 30 The future of onshore wind turbine sourcing 34 Wind energy’s leading role in SA’s Energy Action Plan 38 REVOV says that we are morally bound to demand environmentally sound batteries 40 Bringing power back to LiFe: we interview REVOV CEO WASTE 22 NCPC-SA’s waste minimisation programme is improving lives DECARBONISATION 36 Climate impact imperatives by SRK Consulting WOOD PULP AND PAPER 10 PAMSA on the circular economy 42 Forestry: a greener more sustainable future THOUGHT LEADERSHIP 44 Quo vadis infrastructure development 48 DQS Academy: simply leveraging quality READ REPORT

greeneconomy/report recycle key takeouts of the report key takeouts of the report key takeouts of the report 02 01 03

SA WELCOMES CLIMATE CHANGE REPORT

South Africa welcomes the release of the Intergovernmental Panel on Climate Change (IPCC)’s Summary for Policy Makers and a longer synthesis report of the Sixth Assessment Cycle.

“The report brings together the work of leading global scientists over the past six years and clearly shows that more than a century of burning fossil fuels and unsustainable energy and land use worldwide, but in particular in developed countries, has led to global warming of 1.1°C since the start of the industrial revolution,” says the Minister of Forestry, Fisheries and the Environment, Barbara Creecy.

The IPCC finds that with every increment of warming, the risks, impacts, related losses and damages escalate. When these risks combine with other adverse events, such as pollution and loss of biological diversity, they cascade across sectors and regions and become increasingly difficult to manage. Nothing less than an emergency response will suffice.

“It is therefore important, particularly in this decade, to accelerate efforts to adapt to the reality of a rapidly changing climate and to close the existing adaptation gap,” says Minister Creecy.

The scientists tell us that global emissions should already be decreasing and be cut by almost half by 2030. Ultimately, the only way to stabilise warming is to reach net zero CO2 emissions. To limit warming to 1.5°C would require net zero CO2 in the early 2050s, followed by net negative CO2 emissions in the decades thereafter.

“Through the Just Energy Transition Investment Plan (JET-IP) we have identified measures in the electricity, transport and hydrogen sectors and value chains to contribute to decarbonisation of our economy. It is not just an energy transition plan, but a just one –and this puts workers and communities at the centre of defining their future in a low carbon economy. The JETP-IP will require over R1.5-trillion to be fully implemented. We have challenged our partners and multilateral development banks to increase finance for climate investments. This is important to achieve global climate goals and our view is that there is sufficient global capital to close the gaps.”

The IPCC indicates that these finance gaps and opportunities are greatest in developing economies. A rapid scaling up of finance flows from global capital markets and supporting public funding from developed economies for enhanced mitigation and accelerated adaptation, can act as a catalyst for accelerating the global shift to sustainable development.

More importantly, the IPCC indicates that grant-based public financing is crucial to accelerate adaptation activity, which is severely underfunded. The greatest gains in wellbeing can be achieved by prioritising finance to reduce climate risk for the most vulnerable regions (especially in Sub-Saharan Africa), and for the most vulnerable, low-income and marginalised communities.

Mitigation faces a different challenge: leveraging private finance through public financing by reducing some of the risks inherent in upscaling mitigation, especially in newer sectors, and in developing regions, including those facing debt and public financing macroeconomic constraints. The JET-IP needs to support social justice, including in financial terms.

JET MUST CONSIDER AFRICA’S NEEDS

Africa must be given the space to transition from high carbon usage to low carbon at a pace and cost that it can afford, says Minister of Mineral Resources and Energy Gwede Mantashe.

“Their voice [African people] on the energy transition must be heard. That is the voice that says, energy production in Africa must be aligned to Africa’s socio-economic development. This means that there must be a balance between energy demand for socio-economic development and energy supply that is premised on low carbon emissions,” he says.

Africa’s mineral resources

Mantashe says the continent’s rich endowment with minerals that are suitable for clean energy production could mean a boost for the continent’s economies. “We believe that it is in the interest of Africa that a rigorous mineral exploration programme is implemented to uncover these unknown deposits in many other countries of our continent. For its part, South Africa continues to mobilise investments in exploration informed by the understanding that it is the lifeblood of mining, which has been the backbone of our economic development for over 150 years.”

NEW CEO FOR PRO ALLIANCE

The Paper and Packaging PRO Alliance has announced the appointment of Dorah Modise as its new chief executive officer, effective from 1 April 2023. Modise’s personal philosophy, backed by considerable experience, is fully attuned to her new set of responsibilities.

“I look forward to working with alliance partners in leading this great organisation that will demonstrate the power of collective action in a dynamic sector that is largely untapped. Waste is the new gold and with industry taking the lead on massifying recycling, recovery, beneficiation and market enhancement programmes, we will take several steps towards achieving sustainability,” she says.

8

NEWS & SNIPPETS

Minister Creecy.

WOLF WIND BREEZES CLOSER TO NATIONAL GRID

An 84MW Wolf Wind project in the Eastern Cape has reached financial close and is projected to start generating electricity for the national grid by the first quarter of 2024.

Juwi Renewable Energies reports that exploding public and private demand for large-scale renewables because of South Africa’s energy crisis has led to the rapid expansion of its national footprint, with more than 1.5GW of wind, 2GW of solar and 500MW of hybrid projects incorporating storage in development for private and public energy users.

The Wolf Wind project was successfully bid by Red Rocket in Round 5 of the government’s Renewable Energy Independent Power Producers Procurement Programme (REI4P). Wolf Wind is the second wind project developed by Juwi to reach financial close under the REI4P – the first being the 138MW Garob Wind Project, which reached commercial operation in 2021. The Wolf Wind Project is expected to generate more than 360GWh of clean electricity for the South African grid each year, offsetting 374 400 tons of CO 2 each year.

Positive economic contribution

Wind has significantly demonstrated its positive economic contribution with a total procurement by wind IPPs during construction and operations to date exceeding R9-billion in value.

SAWEA’s chief communications officer, Morongoa Ramaboa, says the Association welcomes the government’s approach to accelerate private investment in generation capacity, through the removal of the licensing requirement for generation projects of any size, the

RECYCLABLE WIND TURBINE BLADES

Nordex Group is participating as one of the 18 partners, in a sustainability project funded by the European Union, to drive the recycling of high-value rotor blade materials from wind turbine blades.

Currently, 85% to 95% of a Nordex wind turbine is recyclable. For many of the materials used, there are established recycling processes for environmentally-friendly disposal – especially for steel and concrete, which make up the largest share of a wind turbine in the tower and foundation.

Turbine rotor blades consist of a combination of different materials such as wood, various metals, adhesives, paints and composites. The composites are glass-fibre-reinforced plastics, as well as carbonfibre-reinforced plastics. At the end of their life, rotor blades are more challenging to recycle due to the heterogeneity of the material and the strong adhesion between the fibres and polymers. Recycling processes for these materials are not yet fully established, and reuse of recycled materials is not widespread.

reduction of timeframes for regulatory approvals, as well as the establishment of a “one-stop shop” for energy projects through Invest SA.

“The ideal is to create an environment that encourages and accelerates investment injection into the economy, removing the pressure from public fiscus, and to stimulate the private sector to invest in their own energy supply and create new industries,” she says.

Niveshen Govender, SAWEA CEO, says a clearly defined queueing system needs to be urgently implemented with a balanced view between publicly and privately procured electricity.

“Ministerial determination for over 18 000MW of new generation capacity from wind, solar and battery storage should be prioritised since it was published in August last year,” he says, noting that the intention to enable businesses and households to invest in rooftop solar is a good start towards addressing the country’s energy crisis. This requires the development of a net billing framework for municipalities to enable customers to feed electricity from rooftop solar installations into the grid.

“To realise our vision of becoming a thriving commercial wind power industry that supports government in its mandate to secure energy for South Africa, we cannot afford a repeat of the latest failed public procurement bid window (BW6), which has resulted in the loss of investment and market confidence.

“The current system for allocating grid access remains a pressure point as it marginalises capable and willing organisations that can contribute significantly to the supply of electricity,” Govender says.

By Neesa Moodley. Courtesy Daily Maverick.

“In line with our group’s Sustainability Strategy 2025, ambitious goals have been set, including offering the market a fully recyclable blade within the next decade, with the target set for 2032,” explained Nordex MD, Compton Saunders.

To reach this goal, Nordex have conducted and participated in several Research and Development projects, one of which is the European-funded “Wind turbine blades End of Life through Open HUBs for circular materials in sustainable business models”, or EoLO-HUBS for short.

The objective of the EoLO-HUBS project is to demonstrate and validate a set of innovative composite material recycling technologies which will provide answers to the three main areas involved in endof-life wind farm recycling: de-commissioning and pre-treatment of wind turbine blades; sustainable fibre reclamation processes addressing two alternative routes: low-carbon pyrolysis and green chemistry solvolysis; upgrading processes for the recovered fibres addressing mainly glass fibres as well as carbon fibres.

9 NEWS & SNIPPETS

What the world is learning from SA’s nascent

What the world is learning from SA’s nascent JUST ENERGY TRANSITION INVESTMENT PLAN

Ramaphosa has been praised by global leaders for South Africa’s efforts to prevent and avert the worst effects of human-induced climate change as part of its Just Energy Transition Investment Plan.

BY ETHAN VAN DIEMEN

South Africa’s Just Energy Transition Investment Plan (JET-IP) is designed to accelerate the move away from coal in a way that protects vulnerable workers and communities and develop new economic opportunities such as green hydrogen and electric vehicles (EVs). It is part of South Africa’s efforts to prevent and avert the worst effects of human-induced climate change.

UK Prime Minister Rishi Sunak, US President Joe Biden, French President Emmanuel Macron and German Chancellor Olaf Scholz have commended South Africa for its commitment to clean energy but importantly the country’s emphasis on assisting workers and communities who will be affected by job losses as we become less reliant on the coal industry.

12

ENERGY

Earthlife Africa director Makoma Lekalakala welcomed the five-year R1.5-trillion investment plan, summing up why our JET-IP is a gamechanger for South Africans. “We need clean, cheap renewable energy to end the loadshedding caused by our failing coal fleet, and to address the energy poverty that is hampering social justice and development for all.”

South Africa is among the top 20 highest emitters of planet-warming greenhouse gases in the world and accounts for nearly a third of all of Africa’s emissions, due in large part to Eskom’s legacy dependence on coal for electricity generation. From the way we move people and goods around to how we light up our streets and homes, the plan seeks to clean up South Africa’s act without leaving anyone behind.

Mandy Rambharos, former general manager of the Just Energy Transition office at Eskom said several banks, including the World Bank and African Development Bank, said South Africa’s plan is the best they had seen on the table out of 14 plans from around the world. “While I was at Eskom, we were approached by the Vietnamese, Indonesians, Philippines and Indians ... wanting to collaborate with us.”

One of the reasons that South Africa is recognised as a leader in its moves towards JET is because of the multistakeholder consultative process that saw the drafting of a Just Transition Framework.

The Presidential Climate Commission (PCC) in July last year released

the framework that sets out a shared vision for JET, principles to guide the transition, and policies and governance arrangements to give effect to the transition from an economy that is predominantly reliant on fossil fuel-based energy, towards a low-emissions and climateresilient economy. Dr Crispian Olver, executive director of PCC, said that “a lot of the international partners … are looking to build a model [such as] in South Africa, and then expand it and replicate it elsewhere.

“We’ve also heard the same from many of our sister developing countries and they’re not looking to exactly replicate what we’re doing … but we’re acutely aware that countries like Indonesia, Vietnam, India, Brazil and several African partners are all embarking on very similar energy transitions and they’re having to grapple with the economic and social consequences of those transitions”.

Olver shared some of the lessons that South Africa offers to other countries. These include to:

• Be consultative

• Be inclusive

• Make use of forums such as climate commissions

At COP26, in what was hailed as a “watershed” moment for South Africa and international collaboration, a political declaration announced the mobilisation of $8.5-billion to accelerate our move away from its ageing,

13

ENERGY

polluting and unreliable coal fleet towards renewable energy sources. The declaration heralded the first step in developing a pioneering model for climate-focused partnerships and collaborations between developed and developing countries.

United Nations (UN) Secretary-General António Guterres, at the conclusion of the conference said, “To help lower emissions in many other emerging economies, we need to build coalitions of support including developed countries, financial institutions and those with the technical know-how. This is crucial to help each of those emerging countries speed the transition from coal and accelerate the greening of their economies.

“The partnership with South Africa announced a few days ago is a model for doing just that,” the UN chief added.

The model was formed after the governments of South Africa, France, Germany, UK, US and the European Union – collectively known as the International Partners Group (IPG) – signed the political declaration. The coalition of rich countries and South Africa came to be known as the Just Energy Transition Partnership (JETP) and spurred the development of both the investment plan as well as a framework for how best to move away from coal in a way that doesn’t leave workers along the coal value chain – particularly in Mpumalanga – stranded and destitute.

Plans and pledges became reality when South Africa signed separate, highly concessional loan agreements with the French and German public development banks, AFD and KfW, worth €600-million (R10.7-billion). France and Germany are two of the partners in South Africa’s JETP, along with the US, the UK and the European Union. With associated interest rates for loans agreed at 3.6% and 3%, respectively, the loans are more palatable than the 8.9% the government would expect to raise an equivalent loan today in the open market.

Amar Bhattacharya, a senior fellow in the Centre for Sustainable Development, housed in the Global Economy and Development programme at Brookings Institution, described our investment

PIPELINE OF PROJECTS

Fumani Mthembi from Knowledge points out that what is needed is increased investment in improving capacity and competence amongst policymakers, investors and project developers. In addition, the development of specialised vehicles for project incubation and aggregation; working with existing project portfolios to effect change; reforming financial institution and financial sector incentive structures, reporting, benchmarks and project valuation frameworks and improving flexibility of public sector financing frameworks.

Mthembi explains that the potential to upscale community projects was hampered by several factors including regulatory challenges. She explains that “just transition projects, by their nature, introduce technologies and ways of generating value that are novel, to the extent that decarbonisation has not historically been central to the impetus of job creation. Consequently, they often run into regulatory challenges, requiring changes to be made to enable project viability.”

She says that “funding typically supports the operational aspects of project rollouts but the demand on developers to advance the more systemic changes required to enable scale is not incorporated into the funding package, placing added burden on project developers. Regulatory change is, therefore, often the product of the unpaid labour of developers who stretch and strain themselves to generate the public good that is an enabling regulatory environment.”

Other issues include the need for public-private partnerships; the need to factor in the broader political context of implementing such projects especially at a community level and time is a key factor in developing community projects for scale. Finally, there is the issue of gender when it comes to small-scale projects and how so-called “women’s work” often is under-remunerated.

14

ENERGY

To help lower emissions in many other emerging economies, we need to build coalitions of support including developed countries, financial institutions and those with the technical know-how.

plan as “precisely the kind of model that is needed to lay out an actionable plan. It has got justice running through it … I want to emphasise something … this is a sustained effort, five years to start with is good but it will require a generational shift.”

Lebogang Mulaisi, head of policy at COSATU, was lukewarm about the JETP and the investment plan that came of it. “It’s a start for a broader conversation around how to finance the transition … I’m not convinced, as yet … that we go deep into how we’re going to address ownership structures in South Africa.”

She said reskilling and upskilling is great, “but we have an ownership crisis in our country … and I just don’t feel we’ve addressed the issue of addressing inequality decisively”.

Indonesia and India are two developing countries with similar coal dependencies and are at different stages of their transitions.

Dr Sandeep Pai is a senior research lead with the Global Just Transition Network at the Centre for Strategic and International Studies (CSIS). His expertise spans the political economy of energy transitions, coal sector dynamics, energy access and just transitions.

“Indonesia is very interested in multilateral financing to phase out coal in the long term. India, not so much. India considers coal as a key energy security source. Generally, India is not interested in any deals that focus on coal phase-out or phase-down. However, both countries are in JETP negotiations with G7 countries. G7 and Indonesian negotiations are at advanced stages but negotiations with India are going slow,” he said.

Asked whether South Africa’s JETP can be considered a model, Pai said “Yes, JETP partnerships theoretically could be a model for catalysing a coal phase down in India and even Indonesia. However, not the way it has played out in South Africa. India and Indonesia need to learn many lessons from South Africa’s JETP model. India and Indonesia need to come up with investment plans … do their homework, identify projects they want to execute, and then negotiate JETPs with rich countries … I don’t think either of these countries has done their homework yet.

“[The] South African JETP model – although very relevant for India and Indonesia – won’t be meaningful for workers and the climate in its current form.

“India and Indonesia have a lot to learn from South Africa about how to run and engage a variety of stakeholders, including unions, regions and municipalities in Mpumalanga, to very concrete technical issues such as how to repurpose coal plants being undertaken by Eskom.”

Dr Rahul Tongia, a senior fellow with the Centre for Social and Economic Progress in New Delhi, largely concurred with Pai. He is also a non-resident senior fellow in the Energy Security and Climate Initiative at the Brookings Institution. He explained that while lessons can be drawn from the South African experience, the country’s JETP is more accurately described as a “reference point” for India and other countries with heavy coal dependencies. “South Africa is heavily coal dependent, more so for its power sector, but there are critical differences with, say, India, that make South Africa’s JETP more useful as a reference point than as a template. Most South African coal power plants are multiple decades old, and thus close to end of life. “In contrast, the median age of India’s fleet is close to just over a decade old.”

Sinthya Roesly is director of finance and risk management at Perusahaan Listrik Negara (PLN) – an Indonesian state-owned electricity distribution monopoly which supplies most of the coalfired power to the country. PLN, for all intents and purposes, can be considered the Indonesian Eskom. She acknowledged that while there were lessons to be learnt from South Africa’s experience, Indonesia needs to “look into every aspect of the transition” and that it is important to be “cautious in early retirement [of coal power plants]… balancing all energy sources to support the economy”.

Roesly’s sentiments accorded with those of Gwede Mantashe, Minister of Mineral Resources and Energy, who in a parliamentary debate on JET said, “Our transition cannot only be about reaching climate change targets. It must also address energy poverty, which includes lack of access to energy, unaffordability of energy and electricity interruptions or loadshedding. A pendulum swing from coal-powered energy generation to renewable energy does not guarantee baseload stability. It will sink the country into a baseload crisis.”

Amos Wemanya, the senior renewable energy and just transition

JET-IP, SET, GO

JET-IP identifies USD98-billion in financial requirements over the next five years to come from both public and private sectors. The JET-IP goal is to decarbonise our economy to within the NDC target range of 350-420MtCO2 by 2030 in a just manner. JET-IP is centred on decarbonisation, social justice, economic growth and inclusivity as well as governance. The investment criteria for the Plan include projects that deliver on greenhouse gas emissions reduction and JET outcomes and are catalytic in nature and ready to implement. Key investments include:

• Electricity. Decommissioning (repowering and repurposing with clean technologies), transmitter grid strengthening and expansion, and renewable energy.

• New Energy Vehicles. Decarbonising the automotive sector and supporting supply chain transition towards green manufacturing.

• Gaseous Hydrogen. Essential planning and feasibilities including port investment to enhance exports and boost employment and GDP.

• Cross-cutting. Investment in skills development and municipalities.

15 ENERGY

Article courtesy Daily

Maverick

ENERGY

JET POLICY DEVELOPMENTS

The National Development Plan (NDP), draft Integrated Energy Plan (IEP), Renewable Energy White Paper, Nationally Determined Contribution (NDC), Just Transition Framework and enabling policies under development and in implementation, outline the policy foundation for energy transition in South Africa and the move away from carbon-fuelled energy.

The Integrated Resource Plan (IRP) 2019 covers the government’s plans for power until 2030 and outlines a decreased reliance on coal-powered energy and an increased focus on a diversified energy mix that includes renewable energy, distributed generation and battery storage.

The Renewable Energy Independent Power Producer Procurement Programme (REIPPPP), introduced in 2011, outlined the procurement of renewable energy in the country. The sixth round of the REIPPP kicked off in 2022 and aims to procure 2.6GW of solar and wind power.

To incentivise the self-generation of renewable energy, the government has indicated that it proposes to scrap the threshold for distributed energy generation of 100MW.

Other developments include, inter alia, the South African Automotive Masterplan, Climate Change Bill, Green Taxonomy and carbon tax increases. Further policies such as the National Energy Efficiency Strategy and Green Transport Strategy also have a role to play.

Trading in carbon offsets in the carbon market, where companies can pay other entities to offset their emissions for them, is also growing in popularity in emerging markets. In August 2022, the JSE announced that it was investigating the possibility of introducing a carbon trading market in South Africa.

In February 2022, the South African Hydrogen Society Roadmap was published by government. The roadmap is an important marker on its path towards implementing hydrogen development.

Eskom identified 18 IPP bids in terms of an auction relating to the use of vacant land it owned in Mpumalanga situated in proximity to its coal-fired power stations with direct access to the national transmission network that will enable wheeling. The projects will add almost 1 800MW of renewable power to the grid.

Recent amendments to the Electricity Regulation Act were proposed by DMRE and are likely to address the electricity supply deficit, vertical structure of the market and lack of competition, introduction of a multi-market including IPPs as well as the formation of a central purchasing agency. The amendments will address the introduction of a day-ahead market to accommodate hourly supply and demand, direct procurement of power by municipalities, increase in the threshold pertaining to self-generation, need to accommodate low carbonemitting generation technologies, timing of licensing applications, changes in transmission system operation including power trading and the creation of additional regulatory capability. The aim is to accelerate affordable, decentralised, diversely-owned renewable energy systems.

THOUGHT [ECO]NOMY

adviser at Power Shift Africa, a Pan-African think-tank, called for caution. He said, “If done right, JETPs could offer an opportunity for piloting transformative approaches to addressing aspects of the energy transitions – like early coal retirement – in a principled way. They can also potentially help aspiring oil and gas producers such as Senegal choose climate-friendly development pathways.

“However,” Wemanya added, “JETPs could also perpetuate the continuation of a troubling donor-driven approach to climate finance that maintains unequal global power relations, picks winners and losers, and serves geopolitical interests. JETPs must be considered within the wider climate finance architecture and as a mechanism to put more and faster climate finance on the table, particularly from major historical polluters.

“It is also important to recognise that ambitious goals such as achieving just energy transitions in Africa will require solutions that lie well outside the boundaries of JETPs.”

JET-IP SETTER

Discussing her research which focused on just transition project needs and finance response, Chantal Naidoo from Rabia Transitions says, “Projects are the primary channel where finance is exchanged in pursuit of the just transition vision.” She adds, “The distinguishing features of just transition projects are their focus on regenerative and transformative outcomes to people and planet due to deliberate shifts in systemic conditions and factors outside

SOUTH AFRICA’S JUST ENERGY TRANSITION INVESTMENT PLAN (JET IP) FOR THE INITIAL PERIOD 2023-2027 | The Presidency Republic of South Africa | NDP 2030

The JET-IP focus on electricity, new energy vehicles and green hydrogen (GH2) is a deliberate strategic decision, based on a clear understanding that as South Africa’s electricity sector decarbonises, there are significant gains to be made by unlocking growth in these sectors at the same time.

South Africa’s exports from “hard to abate” sectors and of ICE vehicles will be negatively affected by the proposed border tax adjustments of some of the country’s main trading partners, if accelerated mitigation measures in these sectors are not implemented. As the energy transition advances globally:

- More complex linkages between sectors will develop, as zero-carbon electricity use replaces the use of fossil fuels in industry, transport and other sectors, and thus the benefits of an integrated energy policy approach, which incorporates energy policy closely with other key policy areas such as industrial policy are significant.

- Technologies will become progressively cheaper through economies of scale and where policies mitigate investment risks and/or technological breakthroughs. When they pass below the cost levels at which such technologies become pervasive, the technologies are described as “disruptive” and are said to have passed “tipping points”. Sector coupling means that tipping points in different technologies reinforce each other.

- Clean energy investments scale up most rapidly when they experience certainty about demand for their production. Security of demand mitigates investment risk.

- Investments in existing storage technologies such as pumped storage; emerging technologies which include utility-scale batteries at all scales; thermal storage in concentrating solar power (CSP) plants and elsewhere; and other potential technologies such as GH2 will enable faster uptake of renewable electricity generation in electricity systems and will become more and more important as the electricity system is decarbonised.

16

READ REPORT

report recycle

greeneconomy/

AfricaBusiness.com

ESG | MINING WATER | ENERGY INFRASTRUCTURE

THE JUST ENERGY TRANSITION – what it should be…

There has been a lot of press recently regarding the Just Energy Transition Partnership in South Africa with links to international funds to facilitate this transition – but what exactly is a “just” energy transition? First, we need to contextualise the problem and understand the solutions.

BY CHRIS WHYTE, ACEN*

Africa currently has a population of about 1.34-billion people, and this is expected to rise to almost 2.5-billion by 2050. Globally, there is a focus on understanding this dynamic regarding sustainability, and climate change is a key component of this focus. World leaders urge sustainability and achievement of the UN Sustainability Development Goals (SDGs). This vision and reality are somewhat different for Africa. Africa currently faces massive unemployment and poverty with its existing population. Some 650-million people on the continent currently have no access to electricity.

The key focus here is energy, and the simple reality is that Africa will never be able to achieve the SDGs without energy. Everything is reliant on energy: access to reticulated water, agriculture, foodsecurity, agri-processing, manufacturing, transport, infrastructure, tourism, mining, education, health and just about any other sector you can name.

To put into perspective, Africa relies on around 700 000GWh electrical

consumption capacity. South Africa, as one of 54 countries on the continent, supplies more than 30% of this. In 2018/19, South Africa sold 208 319GWH of electricity for consumption which made up close to 30% of the estimated 700 000GWh of electricity used in Africa in 2018. To put this into a global perspective, South Korea generated 530 000GWh at 0.33% the area of Africa and only 3.4% of Africa’s population. The size of Africa is often underestimated because of traditional Mercator projections on maps – the reality is that we can fit all of Europe, USA, China and India into Africa with space for many other countries. Africa is blessed with land and resources, enough to supply the whole world, and needs to capitalise on this but must follow a sustainable path. We have sunshine for solar, water for hydro and wind for renewable capacity and an abundance of biomass and waste that can be converted to energy.

What we need to do as a continent, is avoid the expensive and unsustainable mistakes of the developed North and rather implement scaled, sustainable and viable energy generation. Transmission in

18 ENERGY

traditional high-voltage lines is inefficient and the massive distances needed to transmit power across the vast mass of Africa simply does not make sense.

The intense capital required for this also excludes normal people from benefitting from this abundance, so governments and global corporates control energy and drive the equality gap even further.

The Gini index is a measure of the distribution of income across a population, and South Africa had the highest inequality in income distribution globally in 2021 with a Gini score of 63. This can be changed, and all the technology and applications are available to do this to ensure a just transition to energy access.

The focus needs to be changed to small-scale systems tied into microgrids, where ordinary citizens can benefit from cheaper and more reliable electricity, but importantly also be direct beneficiaries of this (Power to the People!). Renewable and sustainable energy can be scaled from the household to the village to the city:

• Scaled applications in solar energy can change the dynamic in Africa, reducing the reliance on poor service delivery from the public sector.

• Hydropower can be delivered at microturbine level from as small as 1kW output without the need for billion-dollar hydroelectric schemes that displace communities, create cross-border conflict and destroy biodiversity and riverine ecology.

• Vertical and horizontal wind turbines can work at the household or community level.

• Waste organics can be scaled to provide gas or electricity.

• Biomass can be grown or harvested to supply small-scale gasifiers, avoiding the need for deforestation and charcoal production.

• The East African Rift Valley provides massive potential for clean geothermal energy, untapped to date.

• Waste plastics (where there is no local circular market for recycling) can be converted to fuel for generators or gasified directly into electricity.

• Water can be reticulated for household or irrigation use using ram-pumps that need no electricity.

19 ENERGY

Africa is blessed with land and resources, enough to supply the whole world.

There literally is no need for massive hydro investments or fossil fuel extraction that impact the land and the air and destroy biodiversity and ecosystems. In South Africa, the biggest polluter by some margin is our own debt-ridden Eskom. The Mpumalanga Highveld region has 12 coal-fired power stations, which have gained a reputation as being the most toxic and polluting group in the world.

South Africa is the 12th biggest emitter of sulphur, Nitrogen and carbon dioxide in the world. Most of this comes from our 80% energy dependence on coal and the US$8.94-billion concessional funding pledged to us at CoP26 in Glasgow is intended to wean us off this dependence. Not because we are a good investment destination, but rather because we are globally recognised for literally killing thousands of our own citizens every year from respiratory illnesses considering the above rankings.

A just transition is not just about equitable economic distribution. It is also about environmental and social justice to achieve a healthy and safe South Africa for all our citizens. The remainder of Africa still needs to attain energy independence, and it is essential that we follow a just transition approach across the continent.

20

ENERGY

*African Circular Economy Network (ACEN)

The focus needs to be changed to small-scale systems tied into microgrids, where ordinary citizens can benefit from cheaper and more reliable electricity.

• Long term sustainability through resource savings

• Economic growth

• Environmental compliance

• Contributes to social development

Services include:

Green skills development

Industry and sector knowledge sharing

Company technical support

Funded by the dtic, hosted by the CSIR

Invest in Industrial Efficiency

National Cleaner Production Centre

A national industrial support programme that partners with industry to drive the transition towards a green economy and save money. Contact us for a free assessment www.ncpc.co.za ncpc@csir.co.za THA 05-2023

South Africa

Waste minimisation programme IMPROVING LIVELIHOODS in Limpopo

Waste management, inadequate diversion and the depletion of landfill space remains a challenge in South Africa. However, there are opportunities to not only alleviate the waste but also create jobs and positively impact livelihoods.

BY NCPC-SA

Arecent event hosted by the Limpopo Department of Economic Development, Environment and Tourism in collaboration with the National Cleaner Production Centre of South Africa (NCPC-SA) highlighted the impact made through a waste minimisation programme in the province over the past three years.

Since taking off in 2019, the Industrial Symbiosis Programme or ISP as it is more commonly known has successfully diverted 49 518 tons of waste from landfills, saving 181 370 tons in CO2 emissions and unlocked economic opportunities in the province.

National programme manager, Victor Manavhela, says, “This event is evidence that we can transition to a waste-free society and use waste as a resource to change lives. We are looking to replicate this work in all the provinces in the next few years.”

The ISP, facilitated by the NCPC-SA, has been a successful partnership project in many provinces that aims to reduce waste to landfills and encourage waste circularity or resource exchanges.

NATIONAL PROGRAMME, LOCAL IMPACT

A year after establishing the industrial symbiosis partnership, Dziphathutshedzo Green Surfacing and PWK Waste Management Recycling has already diverted 11 tons of waste from the landfill. Dziphathutshedzo Green Surfacing recycled HDPE plastic that was collected and stockpiled by PWK Waste Management and manufactured it into eco-friendly and durable paving bricks and stepping stones.

This is just one of the 40 IS success stories that were celebrated at the Limpopo ISP impact and information-sharing workshop. The

workshops demonstrated how Limpopo ISP assisted industry in the surrounding area to recover and redirect residual resources for reuse by employing IS principles.

The ISP is a free facilitation service that promotes the exchange of one company’s residual resources (material, energy, water, waste, assets, logistics and expertise, etc) with another that can benefit from them.

Including Limpopo, the NCPC-SA implements the ISP in Gauteng, KwaZulu-Natal, Mpumalanga and the Free State. The NCPC-SA is a national industry support programme managed by the Council for Scientific and Industrial Research on behalf of the Department of Trade, Industry and Competition.

To find out more about the ISP and/or the work of the NCPC-SA, please visit www.ncpc.co.za or email ncpc@csir.co.za

23 WASTE

Victor Manavhela, NCPC-SA national programme manager at Limpopo ISP.

The NCPC-SA team: Victor Manavhela, Annah Mothapo and Matimba Makhani.

We can transition to a waste-free society and use waste as a resource to change lives.

It’s time for SOLAR TO SHINE

Green Economy Journal interviews the CEO of SAPVIA

SAPVIA CEO, Dr Rethabile Melamu, believes that the wide deployment of solar PV and broader renewable energy technologies can support a resilient energy system in South Africa. Will the tax relief programme anchor our green economy transition? The Journal caught up with Dr Melamu, the illustrious leader at the coalface of it all.

Please tell us about your first year as CEO of SAPVIA. It has been an incredible year. A year of immense growth, stretching and learning. I inherited a good and a growing brand, with a lean but supportive team and the Board. Leading a member-led organisation is unique and it is like nothing I’ve done before. It is rewarding to be of service, but is it not without its unique demands of attending to the vastly different needs of 500+ members.

I hope to continue to meet and to add value to all members. This year has been challenging for all South Africans, but together with our members, we are providing an alternative and immensely sustainable solution to the loadshedding and energy security challenges. Overall, it is a privilege to work with and alongside those that are providing solutions to the most pressing challenges.

Does government consult with SAPVIA for matters relating to the development, regulation and promotion of solar PV in South Africa?

Most definitely, we have had good engagements with different spheres of government, from national, provincial and to the local level. For instance, we have supported the Department of Mineral Resources and Energy (DMRE) as well as the Department of Trade, Industry and Competition (the dtic) in the development of the South African Renewable Energy Masterplan (SAREM).

We have contributed to Eskom’s grid planning and access processes in partnership with our sister association, South African Wind Energy Association (SAWEA) and we enjoy a great relationship with the Independent Power Producers Office (IPPO).

That said, we have called on the powers that be for more involvement in the decision-making that involves our sector and members. For instance, we would have valued engagement in the design of tax incentives for the solar PV sector. We have views on areas that needed to be prioritised.

Please talk to us about policy certainty in this space.

There is generally a commitment to the transition towards a lowcarbon energy mix. This is evident in government’s recent regulatory reforms that removed the need for independent power producers who develop private projects to hold a generation licence, which has been touted a good move. This aims to speed up the addition of new generation capacity to the grid. The results are beginning to show, with 0.5 GW of utility scale projects registered with the National Energy Regulator of South Africa (NERSA) in the first months of 2023.

The Integrated Resource Plan is being updated to comprehensively address the current change and long-term planning. However, there is more to be done to effectively enable the roll-out of embedded

24 ENERGY

generation projects and the development of grid infrastructure to enable uptake of new generation capacity, in particular renewable energy projects. That requires for Eskom and municipalities to create rules, regulations and tariffs. A clearer articulation of Just Energy Transition action as well as the envisaged role of the industry is needed. A nationwide wheeling framework for private projects will further enable ease of project developments.

How will a rapid growth in solar installations affect the market?

SAPVIA estimates that the installed solar PV capacity exceeded 1 GW for the first time in 2022. We have seen substantial growth in private projects registered with NERSA and not signed up. We are expecting sustained growth, especially in the private sector where investment in utility scale renewable energy projects both for direct consumption, i.e. behind the meter or embedded generation, and for wheeling, where generation and consumption are at two different sites.

Dr Melamu, do you have any reservations about the rooftop solar PV tax incentives? If so, what are your concerns?

The individual tax incentive has prioritised middle to high-income households who already have access to capital to invest in solar PV systems. This completely leaves out low-income households, who are not able to access instruments availed by financial institutions and other industry players. The fact that incentives cover modules alone while most households install hybrid systems (PV, inverter and battery system) is a surprise. The administrative requirements for accessing the tax incentive are confusing – mainly that only a certificate of compliance is required for accessing the incentive, which covers the part of the system that is not incentivised.

SAPVIA has indicated that the waiting period for the installation of solar PV is increasing. Why is this?

There is a shortage of skilled installers with adequate experience and training. Those reputable installers tend to be inundated. As such, SAPVIA is working with various partners such as the Energy and Water Sector Education Training Authority (EWSETA), the Small Enterprise Finance Agency (SEFA) and the Small Enterprise Development Agency (SEDA) to increase the pool of installers.

Please talk to us about the importance of economies of scales and predictable demand for facilitating investments needed for the manufacture of solar PV installation components. This is mainly driven by increased demand for PV components, exacerbated by the frequent episodes of loadshedding. First, there needs to be an understanding of localisation potential, that’s why SAPVIA developed a study to assess opportunities along the solar PV

THE RENEWABLE ENERGY TAX INCENTIVE

The tax incentive available for businesses to promote renewable energy will have no thresholds on the size of the projects that qualify and the incentive will be available for two years to stimulate investment in the short term.

Businesses can deduct 50% of the costs in the first year, 30% in the second and 20% in the third for qualifying investments in wind, concentrated solar, hydropower below 30 MW, biomass and PV projects above 1 MW. Investors in PV projects below 1 MW can deduct 100% of the cost in the first year. Under the expanded incentive, businesses will be able to claim a 125% deduction in the first year for all renewable energy projects with no thresholds on generation capacity.

The incentive will only be available for investments brought into use for the first time between 1 March 2023 and 28 February 2025.

SOLAR TAX BREAKS

In the 2023 Budget Speech, a R9-billion tax relief programme was introduced to support the clean energy transition. While R4-billion is for households that install solar panels, R5-billion will go to companies through an expansion of the renewable energy incentive. The tax incentive available for businesses will be temporarily expanded to encourage rapid private investment to alleviate the energy crisis. The current incentive allows businesses to deduct the costs of qualifying investments over a one- or threeyear period.

Government’s proposed rooftop solar incentive for households means that individuals will be able to receive a tax rebate to the value of 25% of the cost of any new and unused solar PV panels. To qualify, the solar panels must be purchased and installed at a private residence and a certificate of compliance for the installation must be issued from 1 March 2023 to 29 February 2024.

Solar-related loans for small and medium enterprises on a 20% first-loss basis were confirmed by government.

25 ENERGY

There is a shortage of skilled installers with adequate experience and training.

ENERGY

value chain. With this better understood and with recommendation from the advanced SAREM, there will be clarity on which aspect of the value chain localisation should be pursued in the immediate, medium and long term.

What stands in the way of the domestic market penetration of key solar PV components?

There are a list of designated materials and components that should be procured in South Africa, the extent to which that is implemented, especially for private projects, is unclear.

Why does SAPVIA advocate for the incentivisation of domestic systems to contribute to demand-side management efforts?

It reduces the national electricity demand during peak times, but it also shields end users against the impact of loadshedding. Lastly, energy efficiency and adoption of roof-top solar PV is the quickest and the most cost-effective way to address current energy shortages.

What is your personal wish for the future of the solar industry?

My personal wish is properly aligned with SAPVIA’s: for solar PV to be a significant and reliable contributor to the South African electricity mix towards an energy secure country. Also, my wish is for the sector to achieve policy and market alignment. Lastly, for solar PV to significantly contribute to decarbonising the energy mix environmental and for the sector to contribute towards economic development imperatives in the country.

BRIEF BIO

A chemical and environmental engineer by training, Dr Melamu is renowned for her global expertise in the green economy and energy sectors. She has leveraged both the theoretical and practical to harness innovative smart technologies to mitigate the impact of climate change in society with a dedicated focus on African sustainable development.

INSIGHTS INTO THE SOLAR PHOTOVOLTAIC MANUFACTURING VALUE CHAIN IN SOUTH AFRICA | Trade & Industrial Policies (TIPS) |

The push for more electricity generation, particularly renewable energy generation, is showing a significant increase in Solar PV projects across the country. This in turn drives demand for the components and services.

While South African renewable energy stakeholders focus on building local capabilities, there are a range of geopolitical and macroeconomic challenges beyond domestic borders that are likely to impact the work and potential. This presents challenges and opportunities. For manufacturers supplying private Solar PV projects that are outside of REI4P, there appears to be considerable opportunity for expansion, not just in South Africa but also into the rest of the continent (and, indeed, South African firms are already doing so).

Plans for future solar PV manufacturing in South Africa will need to consider global shifts and future volatility in renewable energy markets in addition to local conditions and industry potential.

26

It is a privilege to work with and alongside those that are providing solutions to the most pressing challenges.

WWF South Africa | Kate Rivett-Carnac | [August 2022]

READ REPORT

THOUGHT [ECO]NOMY greeneconomy/report recycle

Go green with Business Partners Ltd finance.

It’s time to harness renewable energy, go o grid, harvest rainwater, and ultimately reduce your business’ running costs.

Our Green Buildings Finance Programme provides up to 100% property finance ranging from R500 000 to R50 million to established entrepreneurs with a viable business who want to invest in green buildings and achieve green building certification. We finance the purchase, construction, and/or retrofit of buildings if their designs are certified under an eligible green building certification.

Extra benefits:

The cost of green certification is covered by a nonrefundable grant of up to R150 000. We offer a rebate of up to 40 percent of the capital expenditure needed to green your building and achieve green buildings certified status.

Business Finance Property Finance Property Joint Venture Fund

Mentorship and Technical Assistance Green Buildings Finance

www.businesspartners.co.za

Small businesses urged to

GO SOLAR

or small businesses looking to ride this wave on the path to post-pandemic recovery, the key is to go solar. This is the opinion of Jeremy Lang, chief investment officer at independent small- and medium-sized enterprise (SME) financier, Business Partners Limited. Prior to the Budget Speech, Lang aired hopes that “large-scale interventions” would be on the cards for the small business sector in the form of much-needed relief measures.

In light of the almost single-minded focus on boosting embedded generation efforts through various fiscal measures and policy reforms, this year’s speech delivered little in the way of SME-specific relief. It did, however, propose several measures that speak to the urgent need for government to address the resounding impact that rolling blackouts

On this, Lang suggests that South African small businesses review the viability of installing solar energy systems to power their operations. “Not only will this help to alleviate pressure on the national grid, but it will also ensure business continuity – a vital factor given that loadshedding will likely persist for a long while longer. This could also bring good news for small businesses in the formal sector, who will realise gains in the form of a 125% deduction in tax in the first year for

Further state-led interventions aimed at benefiting the SME sector include the government’s proposal to provide solar-related loans for SMEs on a 20% first-loss basis. “What this means essentially is that going forward, small businesses will be able to secure loans from finance providers where the National Treasury will assume 20% of the initial loss. This will help to mitigate the total risk on behalf of lenders and hopefully make these loans more accessible to a wider base,” explains Lang.

in reaching out to the thousands of small businesses in need of relief, facilitating a streamlined loan application process and deploying funds efficiently,” says Lang.

Overall, government’s R5-billion investment into the expansion of the renewable energy tax incentive is a welcomed development, in tandem with the decision not to increase fuel levies.

Additionally, this year’s extended Budget Review revealed that the Department of Small Business Development has been allocated R2.8-billion as part of a fund to support 12 000 townships and rural enterprises. The measures on which these funds will be spent remain unclear, but as Lang asserts, “a meaningful impact on informal SMEs and the economy can be made by funding a concerted effort to formalise the many township and rural businesses that exist in South Africa.

“In pushing the agenda to formalise these businesses, government will achieve the dual purpose of ‘providing more support and regulatory protection to small businesses, while expanding the tax base.”

This development will likely form part of the proposed Energy Bounce Back Scheme, set to launch in April 2023 – an extension of the Bounce Back scheme initiated during the pandemic years to assist SMEs in recovering Covid-19-related losses. On the effectiveness of this particular measure, Lang remains hopeful that the new solar-directed slant of the scheme will attract more uptake than its predecessor which saw only R140-million in loans being approved and R77-million disbursed of the proposed R15-billion.

“This is where the cooperation of state entities, governmental departments, private sector players and financiers will play a crucial role

On this Lang believes the temporary diversion of focus to a more consolidated effort to solve the energy crisis is well-warranted and that a “solution that includes and benefits small businesses is a solution that benefits all South Africans”.

As he concludes: “In light of the changes that are afoot in South Africa’s tax regime, small business owners would do well to seek the advice and guidance of tax professionals and remain informed, via the available knowledge bases, to understand how they can make the most of the tax-related benefits on offer for the foreseeable future, this is where further relief will stem from.”

011 713 6600

enquiries@businesspartners.co.za

www.businesspartners.co.za

29 ECONOMY

If anything, the 2023 Budget Speech revealed that devising a targeted plan to solve South Africa’s ongoing energy crisis remains the government’s top priority. The immediate future will see a concerted and collective focus on bringing together the public and private sectors in a bid to fuel the clean-energy transition and end loadshedding.

For small businesses looking to ride this wave on the path to post-pandemic recovery, the key is to go solar.

Jeremy Lang, Chief Investment Officer, Business Partners.

The future of ONSHORE WIND TURBINE SOURCING

With bold decarbonisation targets, the demand for renewable energy will skyrocket with an estimated 2 400GW of new capacity installed by 2030. The strong pressure to deliver against these targets will escalate demand-side competition.

BY KEARNEY CONSULTING*

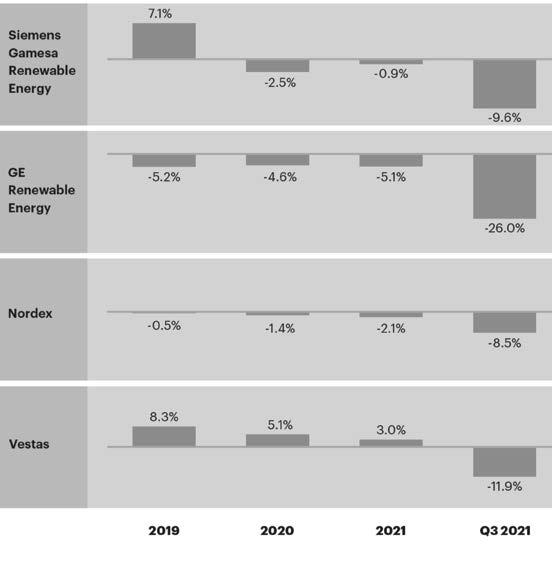

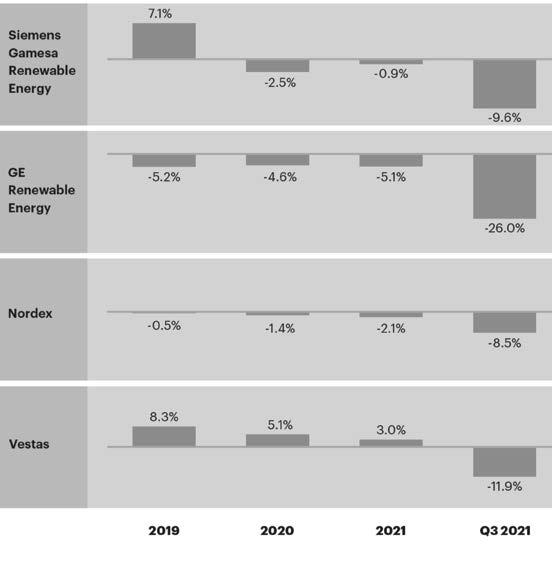

At the same time, original equipment manufacturers (OEMs) for turbines are in financial trouble despite having full order books and receiving record-level order intakes (see figure 1). GE Renewables reported a sharp drop in their EBIT margin, from -5% in the past few years to a devastating -26% in 2022 Q3. Siemens Gamesa recently announced a layoff of roughly 2 900 employees, and Nordex and Enercon have been facing financial troubles over the past few years. Even Vestas, the only profitable large western OEM up to now, has reported a -11.9% EBIT margin year-to-date.

30 ENERGY

Three factors are triggering OEMs’ troubled performance. First, the historically strong negotiating power of large utilities has been upholding strong pressure to reduce the levelised cost of energy (LCOE). Here, their relentless focus on capex reduction and a limited view on the full potential of project optimisation decreased the margin of turbine sales to a bare minimum. Second, OEMs are facing protracted costs of quality issues caused by the high pressure on fast innovation cycles. Third, the current supply chain issues and sharp

rises in raw material costs cause severe troubles. Contracts with long lead times and often limited contractual inflation clauses make it difficult for OEMs to fully pass rising costs on to their customers, pushing the companies into the red.

CHANGES LIE AHEAD

In an oligopolistic market structure, these losses are unsustainable and limit investments in additional capacity. In a market with fast-growing demand, this puts the sufficiency of wind turbine supply in the short- to medium-term future at a heavy risk. Market fundamentals will shift the negotiating power from the demand side to turbines suppliers – a process that has already started.

This will impact costs and ultimately capacity access for utilities and project developers:

• Suppliers will gain more pricing power, driving turbine prices up beyond the already elevated level of more than 30% year-on-year.

• Suppliers will select their preferred customers, and ill-prepared customers will find it difficult to place orders at all.

This new paradigm will require a strategic shift in wind turbine sourcing.

CLOSER COLLABORATION

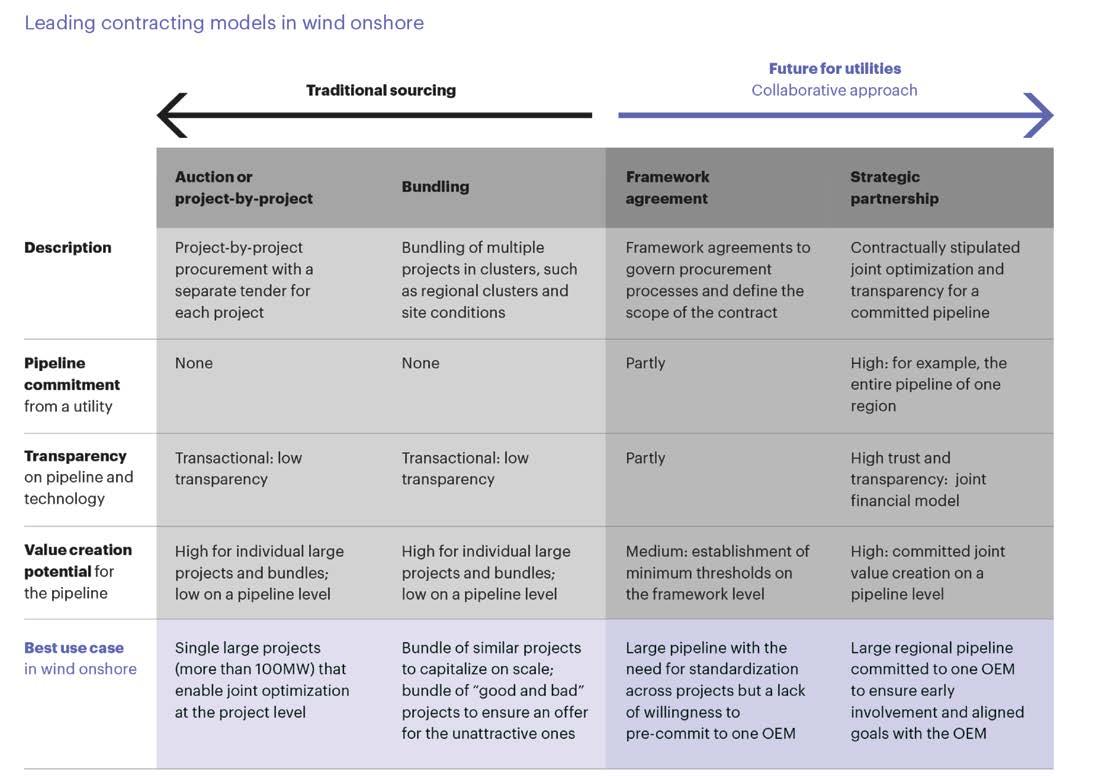

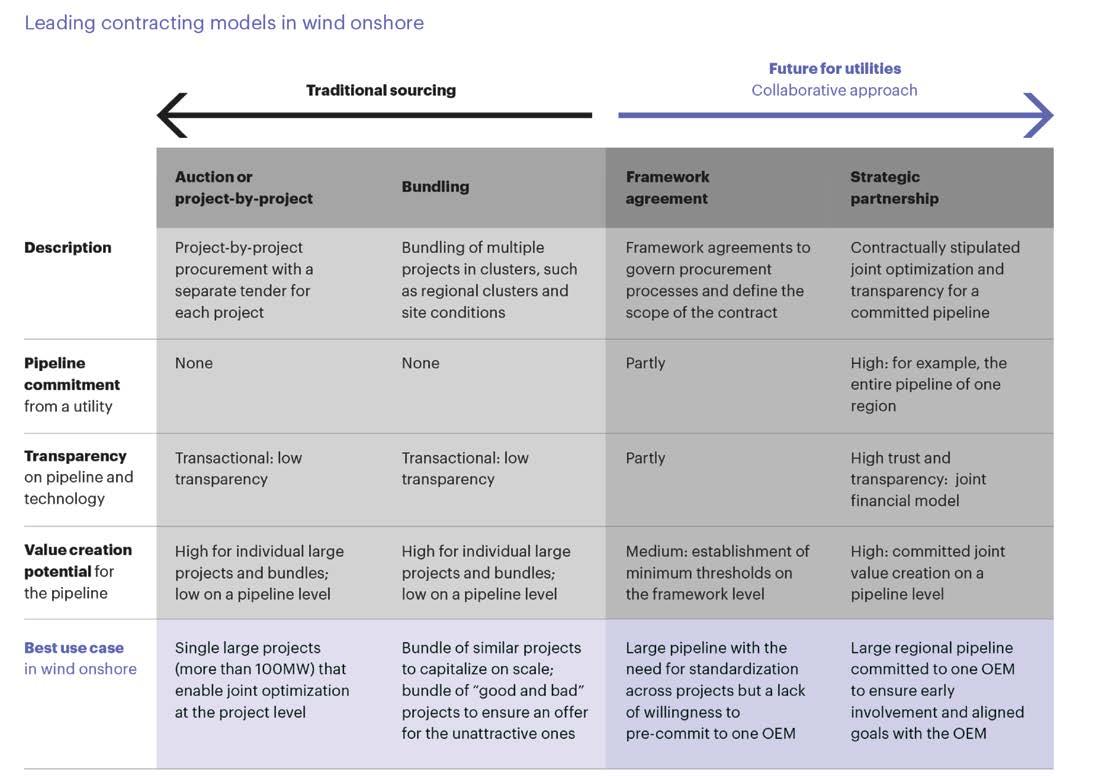

In traditional sourcing approaches, turbines are procured project by project in individual tenders, sometimes enhanced with bundling of multiple projects to make use of the economy of scale. This approach is best used in cases of very large, complex projects where the sheer size of the projects is enough to entice the OEM to collaborate closer. However, it fails to unleash the full potential to create value over the complete pipeline.

Framework agreements create value by standardising procurement processes across projects and by capturing scale advantages for large pipelines. Best-in-class framework agreements contractually stipulate a higher degree of collaboration by the OEM – and in exchange offer the commitment of projects to be built with the participating OEM’s turbines.

31 ENERGY

In times of uncertain supply, setting up an even closer supplier relationship – a strategic partnership – can be very attractive for both parties.

Figure 1. Turbine manufacturers are reporting sharp drops in their margins. Kearney Analysis

In times of uncertain supply, setting up an even closer supplier relationship – a strategic partnership – can be very attractive for both parties (see figure 2). The utility company commits to equipping a large share of its pipeline with wind turbines from one OEM. In return, the utility receives preferential access to turbines, extended transparency on costs and technical specifications, and most importantly, the OEM’s support in the development phase to optimise the project.

Although there is no silver bullet and the contracting method will need to fit the unique needs of the business, leading industry players with broad pipelines have been turning to more collaborative approaches. The goal is to establish successful long-term partnerships to shift the dynamic to a more balanced and mutually-beneficial relation.

HOW TO WIN

Setting up a successful strategic partnership is not straightforward and requires sound preparation. In our experience, there are three main elements to sustainable win-win outcomes:

Securing a reliable and resilient project delivery. Enhancing the reliability and resiliency of project delivery requires trust and extensive two-way transparency between the utility and the OEM. Greater visibility on the utility’s pipeline lengthens the planning horizon for the OEM, which can consequently profit from enhanced operational and strategic optimisation leeway. The utility, on the other hand, can count on timely turbine deliveries and execute projects better on time and on budget. In addition, extended transparency on

32

Figure 2. Utilities and turbine suppliers can create win-win partnerships.

ENERGY

OEM-proprietary technical data, especially for upcoming turbine types, can benefit both parties for joint first projects with the new turbine generation.

Collaboratively optimising projects to enlarge the value pool. By jointly optimising projects in early development phases, the OEM and the utility can unlock value pools that would not be achievable for the utility alone. Tackling the full envelope of cost and yield can reduce LCOE by up to 30%. Without fair sharing of the additionally generated value, the OEM would not optimise projects to their full potential, but only to the point it is profitable for the OEM (for example, up to a certain threshold value, such as target LCOE).

Important elements of joint optimisation include:

• Comprehensive optimisation of turbine selection and layout in iterative workshops across the OEM’s and utility’s turbine, electrical, and civil engineering. Configuration decisions and power curve customisation are made on a component level, based on net present value and LCOE impact.

• Transparent, bottom-up planning of operations and maintenance costs over asset lifetime, leveraging OEM data and best practices.

• Lifetime operations and maintenance cost and yield optimisation, enabled by access to anonymised turbine data beyond the own fleet, such as historical failure rates.

Going beyond traditional partnerships. Best-in-class partnerships go beyond joint LCOE reduction and supply security – pushing the

potential to create value even further.

Successful extended partnerships in the market include:

• Joint M&A activity. Combined market knowledge to identify opportunities and exclusivity for a first call in M&A opportunities.

• Asset and liability pooling. Pooling assets and liabilities across projects to enable portfolio-level benefits.

• Joint market-entry strategies. Entering new markets with combined power and aligned interests.

• Equity stakes. Perfectly aligning long-term incentives, such as with a joint venture or acquisition of an equity stake in a partner.

THE WAY FORWARD

So how can you find out if closer OEM collaboration and a partnership approach are the right strategies for you? We suggest starting with three steps:

• Review your project development approach and identify the most pressing issues.

• Assess the robustness of your current procurement strategy and your collaboration model with OEMs.

• Analyse your portfolio fit for a partnership and quantify the potential joint value creation.

33

ENERGY

*Article written by Hanjo Arms, partner, Oskar Schmidt, principal and Jan Weber, consultant.

Framework agreements create value by standardising procurement processes across projects and by capturing scale advantages for large pipelines.

Wind energy’s LEADING ROLE in South Africa’s ENERGY ACTION PLAN

SAWEA believes that for the country’s energy security challenges to be addressed, a holistic view of available renewable energy sources should be considered. Not only does this provide consumers and businesses with options; it will also enable a fertile economic environment.

BY SAWEA

Following the National Energy Crisis Committee’s six-month progress update on implementation of the Energy Action Plan (EAP), released earlier this year, the South African Wind Energy Association (SAWEA) has commended the government’s transparency and inclusion of the public on its progress towards addressing energy security, and has welcomed the changes. However, it has advised that there are a number of key focus areas that require additional intervention and swift action within the five objectives outlined in the plan, with a clearer scope of wind energy integration, mainly infrastructure investment in wind projects. Wind, as one of the most cost-effective renewable energy sources, has significantly demonstrated its positive economic contribution with a total procurement by wind IPPs during construction and operations to date amounting to over R9-billion.

Fundamentally, the Energy Action Plan is a tool that will hold government accountable to ensure thorough deployment of the identified objectives to ensure an energy secure future that includes the integration of wind energy.

Unpacking these objectives and what the expectations for the wind sector are, SAWEA’s chief communications officer, Morongoa

34 ENERGY

Accelerated procurement through the REIPPP programmes and increased private offtakes is what is needed to resolve the energy crisis in the country.

Ramaboa, explains in relation to the EAP’s overall long-term objective to achieve energy security, “We support the various interventions and those that are in the pipeline. More so, we welcome the fact that renewable energy is being embraced by government through the Cabinet’s endorsement of the Just Energy Transition Investment Plan, as well as the prioritisation of solar, wind, gas and storage projects at nine of Eskom’s power stations. We believe that this will ultimately support our urgent need for energy security, effectively reducing loadshedding and the resulting detrimental impact on our green economy.”

Furthermore, the Plan’s approach to accelerating private investment in generation capacity, through the removal of the licensing requirement for generation projects of any size, the reduction of timeframes for regulatory approvals, as well as the establishment of a “One Stop Shop” for energy projects through Invest SA, are interventions that SAWEA welcomes.

However, SAWEA also values public procurement that allows a baseline of investment and creates stability in a growing industry, noting that there is room for both markets to ensure that energy security is achieved across the entire value chain in both private and public spheres. “The ideal is to create an environment that encourages and accelerates investment injection into the economy, removing the pressure from public fiscus, and to stimulate the private sector to invest in their own energy supply and furthermore create new industries,” adds Ramaboa.

SAWEA believes that the reduction of timeframes for regulatory approvals based on the streamlining of environmental processes will significantly accelerate the development of large-scale transmission infrastructure. And, while it acknowledges that the state utility has conceptualised various programmes that will allow for the procurement

of additional power when the grid is significantly constrained, it expects government to maintain consistency in as far as the capacity procurement is concerned.

While a step in the right direction, the Association warns that accelerated procurement through the trusted REIPPP programmes and increased private offtakes is what is needed to resolve the energy crisis in the country. SAWEA reiterates that a clearly-defined queueing system needs to be urgently implemented with a balanced view between publicly and privately procured electricity. It additionally advocates that Ministerial determination for over 18 000MW of new generation capacity from wind, solar and battery storage be prioritised since it was published in August last year.

The EAP’s intention to enable businesses and households to invest in rooftop solar is viewed as a good start to providing reprieve from the adverse effects of interrupted electricity. This requires the development of a net billing framework for municipalities to enable customers to feed electricity from rooftop solar installations onto the grid by the utility.

“To complement this move, SAWEA is looking at investment opportunities to integrate wind energy for the use of businesses and households to supplement the use of PV panels, especially in areas that prone to strong wind conditions,” continues Ramaboa.

SAWEA has welcomed the establishment of a National Energy Crisis Committee (NECOM) as it demonstrates government’s willingness to collaborate with a wide variety of expertise across different spectrums within the energy mix. The Minister of Electricity’s role of coordination and working with the Minister of Mineral Resources and Energy to provide the solutions to transform the energy sector certainly inspire confidence in the industry and amongst investors.