Q2 2024 LOWER MANHATTAN REAL ESTATE MARKET REPORT

Lower Manhattan’s office market wrapped up the first half of 2024 on a relatively stable footing. Leasing totals inched up slightly and net absorption remaned positive for two straight quarters as more underperforming office properties were converted to residential use. Sublet deals accounted for nearly half of leasing totals in the second quarter as businesses took advantage of tenant friendly pricing for turnkey space in high quality buildings. Other sectors of Lower Manhattan’s economy continued to expand last quarter as fourteen new retailers opened and residential prices increased. The district’s hotels appear to have recovered completely from the pandemic and continued to demonstrate strong occupancy and room rates. Lower Manhattan’s entertainment options expanded dramatically as “Life and Trust,” a major new immersive theatrical experience, began previews at 20 Exchange Pl.

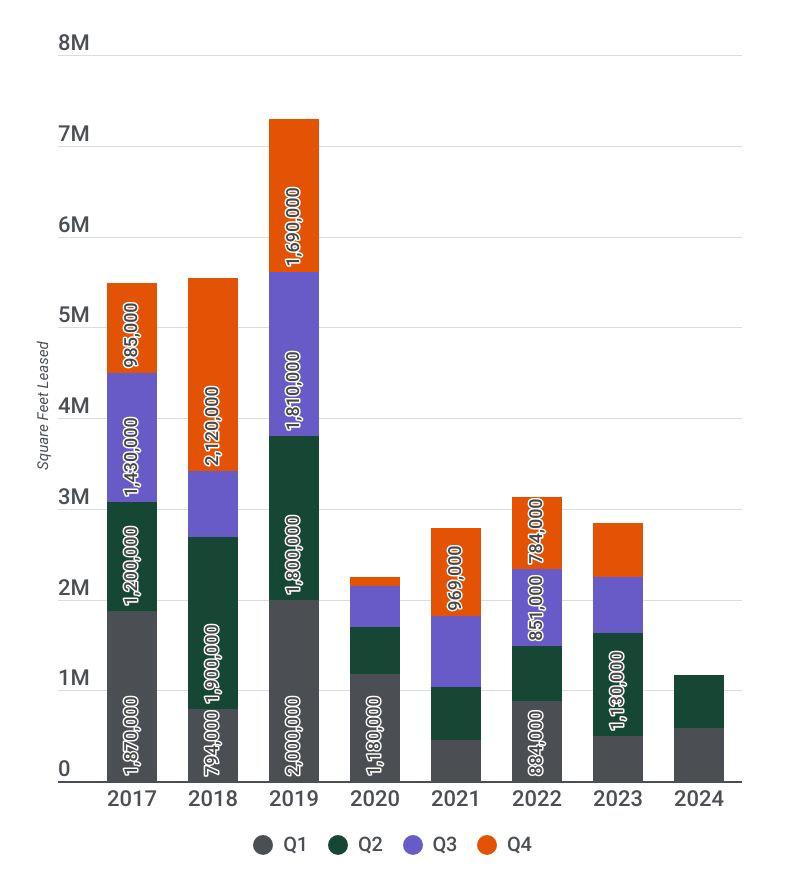

Lower Manhattan leasing activity totaled 589,000 sq. ft. in the second quarter of 2024, a 1% increase compared to last quarter. Leasing declined 48% year over year, reflecting the outsize impact of a very large city government lease inked in Q2 2023. Compared to every other quarter since 2023, this quarter represents a continuation of the “new normal.”

Lower Manhattan leasing was also low compared to the five-year average, lagging by 25%. It was closer to the post pandemic quarterly average, but still trailed that figure by 17%.

Midtown and Midtown South saw significant improvements in leasing this quarter. Midtown leasing rose to 3.89 million sq. ft, marking a 5% quarterly rise as well as a 54% annual

Lower Manhattan Annual New Leasing Activity, 2017-2024

Source: CBRE

589,000 Square Feet Of New Leasing In The Second Quarter

increase. Midtown South, which saw leasing rise to 1.56 million sq. ft. in Q2, had the best performance of all the Manhattan submarkets. Leasing in Midtown South is up 128% since Q1 and 114% year over year. Both districts also saw increases compared to their five-year averages.

On a positive note, Lower Manhattan recorded 26,000 sq. ft. of positive net absorption in the second quarter, bringing its year-to-date figure to 696,000 sq. ft – the highest among the submarkets. This large figure can mainly be attributed to the first quarter, when GFP Real Estate and Intervest Capital Partners took 1.6 million sq. ft. of office space at 111 Wall St. and 222 Broadway off of the market for residential conversion projects. Lower Manhattan has now experienced two consecutive quarters where there has been positive absorption, a possible sign of market stabilization.

The technology industry continued to lead leasing in the second quarter, taking up 36% of all new space leased. Stripe, a financial services and software company, had the largest lease of the quarter, a 148,000 sq. ft. sublet deal at 28 Liberty St. The company relocated from their WeWork space at 199 Water St, an indication that they would prefer to have a more permanent lease in the district. Nagarro, a digital product engineering and technology services firm, also subleased 42,000 sq. ft. of space at 195 Broadway.

The financial services industry made up 15% of second quarter activity, with the largest deal coming from Kroll’s 48,000 sq. ft. sublease at 1 World Trade Center. The next largest lease in this industry came from IDC Group, which took 16,000 sq. ft. at 5 Hanover Square. Law firms also captured 15% of total activity, with Douglas and London, P.C. signing a 13,000 sq. ft. lease at 1 State St. Another law firm, Haley Giuliano, inked an 11,000 sq. ft. deal at 75 Broad St.

Subleasing accounted for 49% of new leases; four of the five largest deals were subleases, as many large, new occupiers showed a preference for turnkey space.

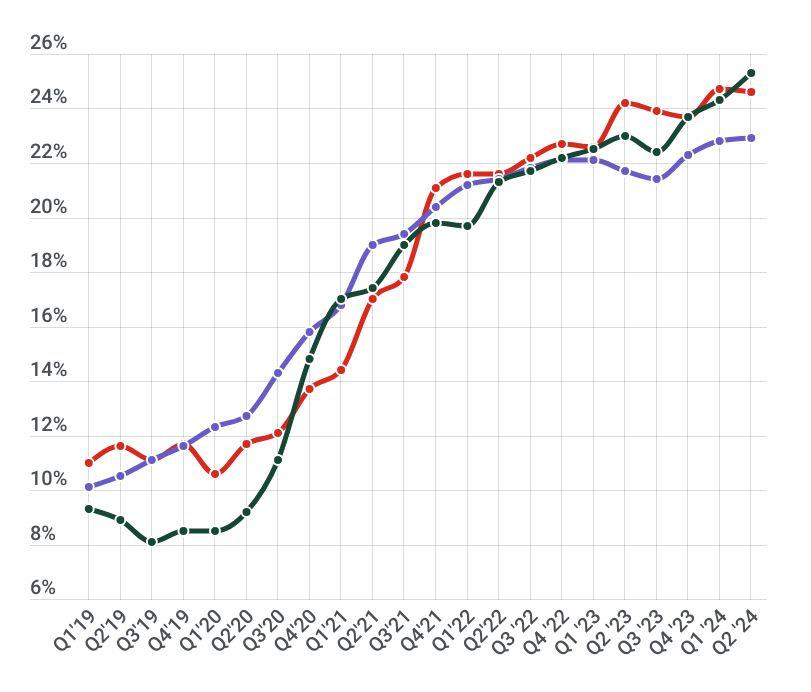

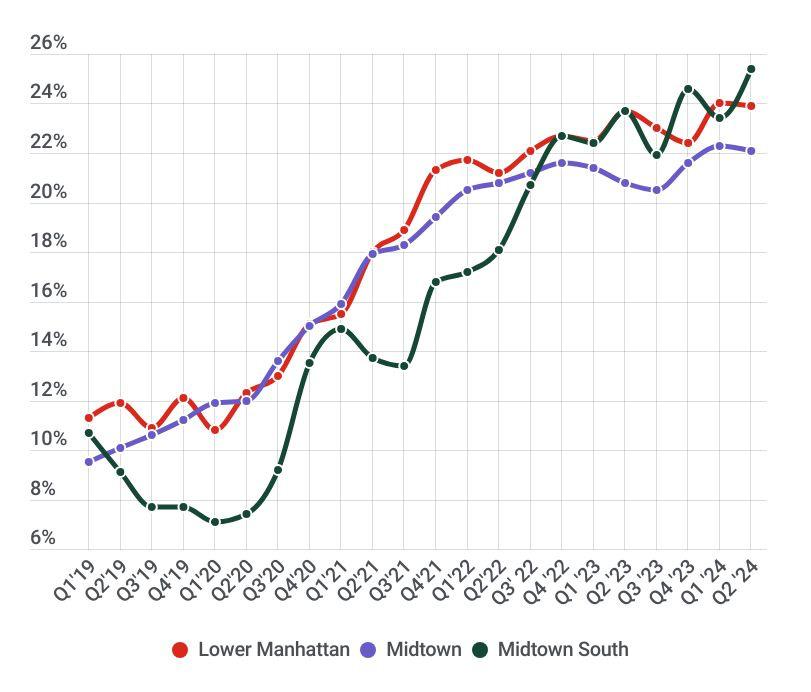

Lower Manhattan vacancy rates remained largely flat in the second quarter. The overall rate improved very slightly compared to Q1, dropping to 24.6%, and only shifted up by 0.4% compared to last year.

Despite strong leasing totals, overall vacancy rates in both Midtown and Midtown South increased in Q2. Midtown South set a city-wide vacancy record of 25.3%, marking a quarterly and annual increase of 1% and 2.3%, respectively. Midtown vacancy grew slightly quarter over quarter and exceeded the submarket’s record setting Q1 vacancy rate.

Class A vacancy in Lower Manhattan improved marginally over Q1, decreasing 0.1% to 23.9%. In contrast, the Class A vacancy rate in Midtown South jumped 2% to 25.4%, the highest vacancy rate in Manhattan for this property type. Furthermore, downtown underwent a minimal annual Class A vacancy increase of 0.3% while Midtown and Midtown South saw more substantial increases of 1.3% and 1.7%, respectively.

Source: Cushman & Wakefield

Source: Cushman & Wakefield

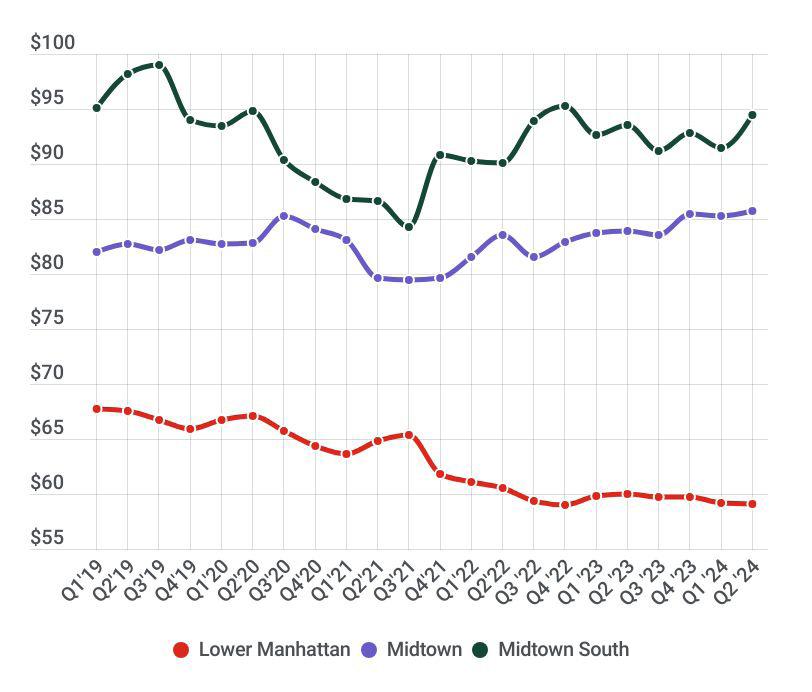

Lower Manhattan Class A, B, and C rents all remained relatively steady over the quarter with no class changing by more than a fifth of a percentage point. The district’s overall asking rents fell slightly to $55.62. The overall asking rent decreased more dramatically year over year, falling 1.2% compared to Q2 2023.

The Midtown and Midtown South submarkets experienced increases with respect to both overall and Class A asking rates. Midtown overall rents increased to $78.03 while Midtown South increased to $78.46, making it only the third time since 2020 that the Midtown South asking rent has surpassed Midtown’s. Class A rents for Midtown increased quarterly and annually to $85.72; Midtown South rose for both time periods as well, to $94.49, increasing by a considerable 3.3% over the quarter. Furthermore, Midtown and Midtown South both exceeded their five-year averages as prices have begun to stabilize at levels comparable to 2019.

• 112 Liberty St.: Hidrock Properties sold the vacant lot at 112 Liberty St. for approximately $21.7 million, which is nearly 46% less than its purchase price in 2018. The buyer is an entity associated with Hiwin Group USA, a real estate management company based in Flushing, Queens, and its CEO Xiaogang Wang.

• 60 Wall St.: The owners announced they refinanced the office tower’s $575 million mortgage at a much higher interest rate, paving the way for redevelopment of the empty building with a distinctive public lobby.

• 80 Pine St.: Joseph Hoffman’s company, Bushburg, is in contract to buy 80 Pine St. from the Rudin family. The building, which is 1.2 million sq. ft, is selling for approximately $160 million.

Residential:

• 160 Water St.: Construction nears completion on Pearl House, a 29-story residential conversion at 160 Water St. Developed by Vanbarton Group and designed by Gensler, the

Source: Cushman & Wakefield

Source: Cushman & Wakefield

project includes three additional floors and 588 rental units with amenities, marketed by Compass Development Marketing Group.

• 1 Park Row: The 3650 REIT team grew its footprint in Lower Manhattan, as Circle F Capital provided $50 million of financing to further develop 1 Park Row.

• 15 Warren St.: Listed for $6.5 million, the four floor-thru residential building (with a ground level retail space) is for sale at 15 Warren St. Tribeca Pediatrics, a prominent tenant, occupies that building.

• 25 Broadway: Even though 25 Broadway has a high level of occupancy, the $250M loan backing the 1 million sq. ft. office tower has been moved to special servicing after the borrower defaulted on the debt.

Lower Manhattan’s entertainment and cultural scene expanded this spring when an exciting new theatrical experience, “Life and Trust,” began previews at 20 Exchange Place. Developed by Emursive Productions, the impresarios behind the long running and wildly popular “Sleep No More,” this new immersive and interactive play joins Lower Manhattan’s growing roster of first class entertainment venues including The Perelman Performing Arts Center,Pier 17 and Mercer Labs.

Spanning six floors and occupying 100,000 sq. ft, “Life and Trust” has been in the works for a number of years. Theatergoers enter the venue through Conwell Coffee Hall (located at the 69 Beaver St. entrance), which transitions to a theater lobby and cocktail bar in the evening. The show features 30 characters, 250 overlapping scenes, and spans approximately three hours. It operates within what was a vacant bank headquarters that saw little usage over the past 50 years.

Retelling the story of “Faust” through the tale of a financier experiencing the fallout of the 1929 stock market crash, the script uses the elements of the bank to draw inspiration, such that the bare space of concrete and columns serve as components, rather than obstacles, to the play. In a quote from a New York Times review, director Teddy Bergman said, “The ghosts of [20 Exchange Place’s] functional history as a bank building and the vaults and thickness of the walls all gave off energy.” These elements, like the aforementioned vault doors and thick walls, are essential to the play as they inform the choreography.

The producers invested substantial capital to renovate the aged building facilities, installing a new HVAC and electricity

system, as well as two new elevators. “Life and Trust” is a shining example of how adaptive reuse can enliven vacant and underused commercial space. Rather than completely gutting and renovating the old bank, Lower Manhattan’s latest play leverages its environment for a truly unique, theatrical experience. What was once an office building, 20 Exchange Pl. now comprises residents, a one of a kind art deco cafe, and a six-floor immersive theater venue.

Fourteen retail establishments opened in the second quarter of 2024. Thirteen of them were food and beverage businesses, including:

• Yao NYC, a fine-dining, modern approach to Cantonese cuisine, opened at 213 Pearl St.

• Hutch & Waldo, a restaurant serving seasonal Australian dishes, opened at 300 Vesey St.

• Pho Maiden Lane, a Vietnamese cuisine, noodles and noodle soup restaurant, opened at 3 Maiden Lane.

• Yeh’s Bao, serving small plates, bao buns and noodle dishes, opened at 38 Rector St.

• Downtown Yogurt, a frozen yogurt establishment, opened at 185 Greenwich St.

• KoreatGo, a Korean BBQ express restaurant, opened at 225 Pearl St.

• Koko’s at Pearl Alley, a new bar within Pearl Alley, opened at Pier 17.

• Regular NYC, a coffee, breakfast and brunch spot opened at 19 Rector St.

• Baires Grill, an Argentine steakhouse, opened at 200 Chambers St.

• Brooklyn Bread Cafe, which has locations in Park Slope and Carroll Gardens, opened at 111 Murray St.

• Bar Tontine, a new rooftop terrace experience, opened at the Wall Street Hotel.

Only one shopping location opened:

• Miniso, a Chinese lifestyle and consumer goods chain, opened at 150 Broadway.

Looking ahead, eighteen retailers are looking to open shop later in 2024, including:

• All’Antico Vinaio, the famous Italian sandwich shop, plans to open at Brookfield Place.

• Remi Flower & Coffee, a flower and coffee shop, has plans to open later in 2024 at 130 William St.

• Naya, a fast casual Middle Eastern restaurant, will open at 75 Wall St.

• The Bridge Cafe, which closed after hurricane Sandy

in 2012, is reopening at 279 Water St.

• The Golden Mall is gearing up for an opening at 47 Broadway.

• Los Tacos #1 is eyeing an opening at 26 Broad St.

• Ateaz Cafe, which sells many types of tea, will open at 77 Greenwich St.

• Tutto Calcio Espresso Bar will open at the Artezen hotel, 20 John St.

• Otani, a new sushi restaurant, will open at 59 Nassau St.

• Wonder, a mini food hall that focuses primarily on pick-up and delivery, will open at 5 Hanover Sq.

• Heavenly Market Gourmet, a classic New York style deli, is coming to Church and West Broadway on the north side.

• Tribeca Olive Branch, a 24-hour deli, is coming to Chambers between West Broadway and Greenwich.

• Printemps, a luxury French department store, is set to open at One Wall St. in 2025.

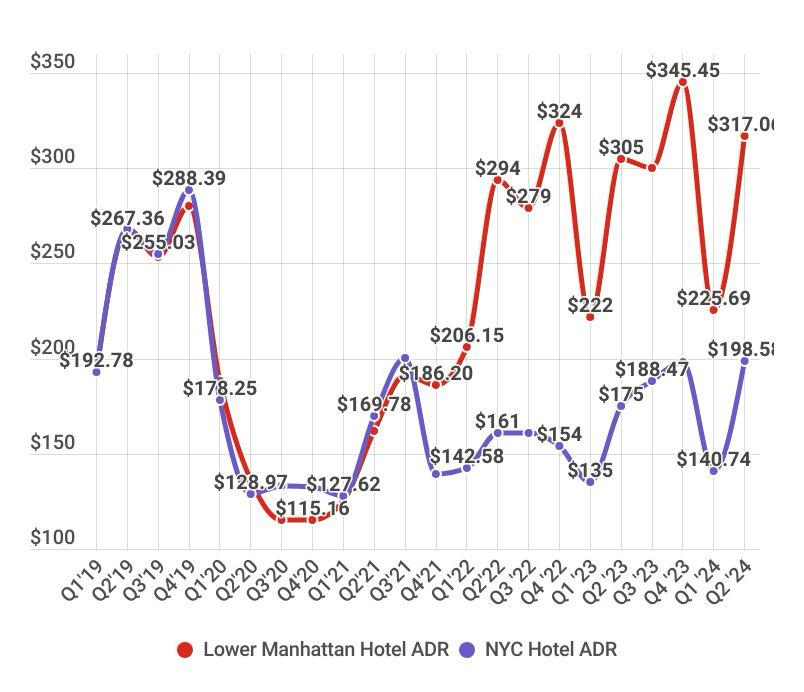

The second quarter saw Lower Manhattan’s hotels continue to record occupancy and ADR figures exceeding pre-pandemic levels, indicating a full recovery following the pandemic.

The Lower Manhattan Hotel market boasted an occupancy of 89% in Q2, which is the district’s highest rate on record. The percentage marked a significant increase in quarterly and yearly growth, and was above the pre-pandemic (Q2 2019) figure by 2 percentage points. The Midtown submarkets, as well as the city-wide hotel market, also saw a full return to pre-pandemic levels. But even with those submarkets improving, Lower Manhattan still outperformed Midtown and city-wide occupancy rates.

The Lower Manhattan Average Daily Room Rate (ADR) was also quite high, posting its highest Q2 ADR ever at $317.06. It is abundantly clear that Downtown room prices have surged since the onset of pandemic recovery as Lower Manhattan ADR has broken two district records in the past year and a half. This past quarter is the third highest it has ever been.

Lower Manhattan welcomed 9.4 million tourists in 2023, a 27% boost from 2022, as domestic and international travel continues to rebound from the pandemic. Though still below 2019’s 14 million tourists, 2023 tourism numbers indicate a full rebound in the coming years. Also, compared to 2020, the number of tourists has surged by 250%; the number of unique visitors rose considerably, too, by 150% since 2020–and stands at a total of 12.7 million as of 2023.

International visitors made up 54% of Lower Manhattan tourists, nearly double the 28% in 2021. Pre-pandemic, in 2019 that figure was 62%. Additionally, just like 2022, the largest share of international visitors hailed from Western

Hotel Occupancy in Lower Manhattan and New York City

Source: CoStar/STR

Hotel Average Daily Room Rate (ADR) in Lower Manhattan and New York City

Source: CoStar/STR

Europe: Germany, France, UK, Canada, Italy and Spain. Also, the share of first-time visitors to NYC (out of all visitors) reached 51% – the highest since 2019.

The current hotel inventory in Lower Manhattan stands at 8,498 rooms across 43 hotels. No hotels opened in the second quarter.

$317.06

Lower Manhattan Hotel Average Daily Room Rate

Lower Manhattan has 35,104 units in 347 residential buildings. There are 6,915 units in 17 buildings under construction or planned for development, with about 62% currently planned as rental units and 38% as condos. There were no new developments or issuances of certificates of occupancy in the second quarter:

Later in 2024, one additional residential development is expected to wrap construction and open:

• 1 Park Row: Construction topped out at 1 Park Row, a 23-story mixed-use building. The 305 foot-tall structure will yield 103,000 sq. ft. with 58 condominium units in one- to three-bedroom layouts, along with 19,000 sq. ft. of office and retail space on the lower levels. The most recent update is that Circle F Capital provided $50 million of financing to further develop 1 Park Row.

Over the next several years, seven new developments containing 2,979 units are expected to finish construction:

• 7 Platt St.: Moinian Group is building a new 250-unit tower that will also contain a hotel component. 7 Platt St. is expected to open in 2025.

• 8 Carlisle St.: Excavation continues at 8 Carlisle St., the site of a 64-story residential skyscraper. Designed by Handel Architects and developed by Carlisle New York Apartments and Grubb Properties, which closed on a $86 million loan for the project over the summer, the 712-foot-tall structure will yield 326,221 sq. ft. with 462 residential units, 7,000 sq. ft. of commercial space, and a 60-foot-long rear yard.

• 55 Broad St.: MetroLoft and Silverstein Properties announced the acquisition of 55 Broad St. for $172.5 million from the Rudin Family, who will retain an equity stake in the project. The partnership plans to convert the 410,000 sq. ft. building into 571 market rate apartments and is beginning the construction phase of development.

• 5 WTC: Poised for a potential $31 million government funding boost, Gov. Hochul announced that the 900-foot residential skyscraper to be built by Silverstein Properties and Brookfield Properties at 5 WTC would have one-third of its apartments set aside as affordable housing.

• 250 Water St.: In late 2021, the Howard Hughes Corporation was approved on its $850 million development

project. The firm will convert a parking lot into a 324-foot-tall building with 270 apartments (including 70 affordable units), Class A office space, retail and community space. The project will generate $50 million in funding for the South Street Seaport Museum, with $40 million generated from the Howard Hughes project and another $10 million committed by the City. The project broke ground in 2022, and remediation has since been certified through the New York State Brownfield Cleanup Program. In the most recent development, the New York State Court of Appeals shot down a motion from local groups opposing the new building on the grounds that it went against the landmark district designation and that the Landmarks Preservation Commission was wrong to approve the project. With the New York State Supreme Court overturning the previous decision to halt development, the project has cleared its final legal hurdle.

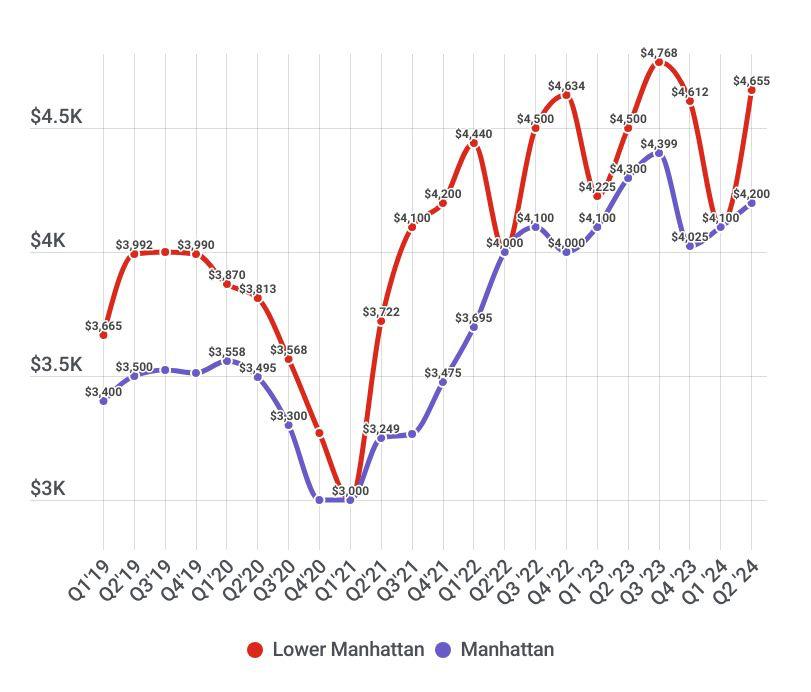

Lower Manhattan median rents surged to $4,655 this quarter, posting the second highest rent value the district has ever seen. This figure represents a quarterly, yearly and pre-pandemic increase. Moreover, the units that were leased spent on average 15 days less on the market than they did last quarter and eight days less than they did in Q2 2023. Manhattan median rent, which sits at $4,200, did not experience the same growth in Q2, as recent trends have shown that borough wide and downtown rents are closest at the beginning of the year and gradually diverge in the subsequent months. Moreover, Manhattan rental prices fell over the year and increased by only a small increment compared to last quarter.

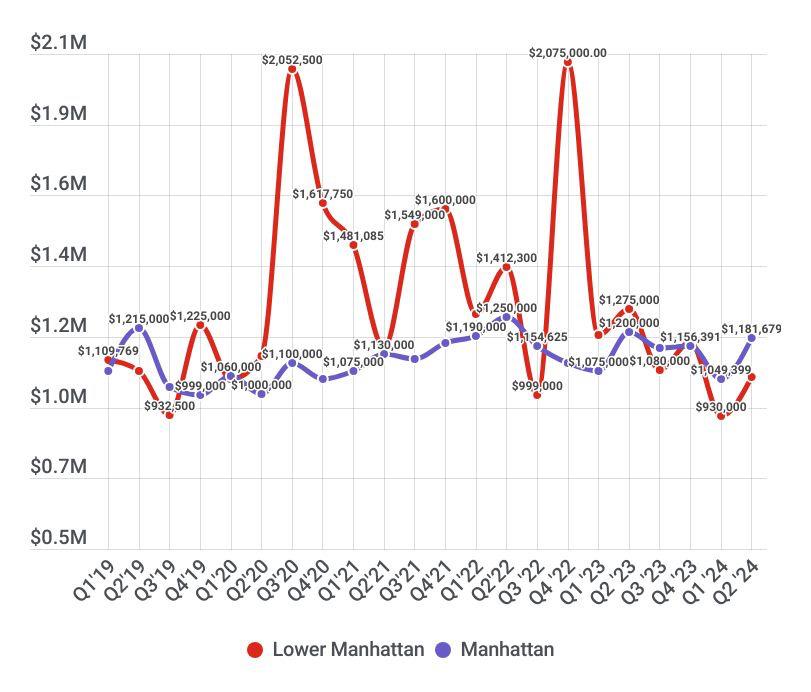

The median residential sales price spiked up to $1,057,000 in the second quarter after a sluggish Q1, posting a 13.7% increase over the three month period. Sales volume also increased to 74 deals, posting the second best quarterly performance in the past year and a half. Lower Manhattan’s Q2 is still overshadowed by its second quarter performance last year, though, where there were 47 more deals and a 17.1% higher median sales price. Manhattan as a whole, which had a Q2 median sales value of $1,181,679, also experienced quarterly sales growth alongside a year over year price decline.

Median Residential Rental Price

Source: Miller Samuel

$4,655

Median Rent in Lower Manhattan

Median Residential Sales Price

Source: Miller Samuel

A partnership between Brookfield and Silverstein Properties received approval from the Port Authority and Lower Manhattan Development Corporation (LMDC) to develop Site 5 at the World Trade Center, also known as 130 Liberty St. The site recently served as a Port Authority police depot and the southernmost area continues to function as a temporary public plaza.

The proposed 1.56 million sq. ft. tower is expected to include approximately 1,300 rental apartments, of which at least 30% will be affordable. LMDC approved an override to city zoning rules in order to build a tower larger than local regulations allow. Construction may commence later in the year. 5 WTC will also include roughly 10,000 sq. ft. of nonprofit community space to be occupied by the Educational Alliance, over 190,000 sq. ft. of retail and office space and a connection to Liberty Park.

It was recently reported that the apartment tower is poised for a potential $31 million government funding boost — using money designated after 9/11 for Lower Manhattan job creation and waterfront improvements.

In December 2022, Pace announced plans to renovate One Pace Plaza, adding new academic spaces, a modernized residence hall and a new performing arts center. The renovation will include the reconstruction of the lower floors of One Pace Plaza East and upgrades to the dormitory building at 182 Broadway. Construction is expected to be completed in 2026.

The university recently announced the formation of the Sands College of Performing Arts, as it has just finished construction. It is housed within a new performing arts center at One Pace Plaza containing a 450-seat proscenium theater, a 200-seat flexible theater and a 99-seat black box theater. Rob and Pamela Sands gave a $25 million

donation, which is part of a fundraising campaign that includes private donations and $30 million from the state and federal governments.

The new building serves as a replacement for Pace’s 50-year-old tower at One Pace Plaza East. 15 Beekman St. is the third property SL Green has built for Pace in the neighborhood. The developer previously built dorm buildings at 33 Beekman St. in 2015 and 180 Broadway in 2013. The building yields 213,084 sq. ft. and stands 338feet tall. It is alternately addressed as 126-132 Nassau St.

Reconstruction of Front Street between Old Slip and John Street began in January 2020 and is planned to be completed in December 2024. Greenwich Street reconstruction, between Barclay and Chambers streets, began in early 2022 and will be completed in October 2025; the adjacent sidewalks at 240 Greenwich St. will also be redone in tandem. Vesey Street reconstruction, between Church Street and Broadway, began in September 2022 and will be completed in September 2024. Nassau Street reconstruction, between Pine Street and Maiden Lane, will be completed in 2025. These projects will replace all underground infrastructure, including water mains, sewers, electric, gas and other utilities, as well as construct new streets and curbs.

The city began work on the streetscape and public-realm enhancement project along the Water Street corridor in May 2021, which is estimated to be completed in 2025. The $22.8 million project will transform two temporary public plazas at Coenties Slip and Whitehall Street into permanent public spaces featuring new landscaping, seating and concessions. The project will also plant street trees, rebuild sidewalks and enhance pedestrian safety from Whitehall Street to Old Slip.

Wagner Park

In July 2022 the Battery Park City Authority (BPCA) closed Wagner Park to begin work on the $221 million South Battery Park City Resiliency Project. Plans for the project call for the demolition and reconstruction of Wagner Park and the Wagner Park Pavillion, ultimately elevating the park by 10 feet and installing flood walls, berms and other resiliency infrastructure from the Museum of Jewish Heritage through Wagner Park and Pier A, moving along Battery Place over to Bowling Green Plaza. Construction resumed in May after the BPCA successfully appealed an injunction issued by a state Supreme Court judge in December 2022. Construction is scheduled to be completed in 2025.

The Waterfront Alliance announced that the South Battery Park City Resiliency Project has become the 13th project nationally to achieve WEDG® (Waterfront Edge Design Guidelines) verification, which is a national rating system and set of guidelines for resilient and accessible waterfront design. In the latest update, the BPCA has released a request for proposal (RFP) for a new restaurant in Wagner Park.

Resilient Infrastructure

Work continues on parts of the Financial District and Seaport Climate Resilience Master Plan, a resilient infrastructure plan released in 2021 to protect Lower Manhattan from future flooding. The master plan is part of the larger Lower Manhattan Coastal Resiliency strategy, with active capital projects in Battery Park City, the Battery and Two Bridges. The plan calls for the creation of a twolevel waterfront park that extends the shoreline of the East River by up to 200 feet.

The upper level will be elevated by 15 to 18 feet to protect against severe storms, while doubling as public open space. The lower level will be a waterfront esplanade raised three to five feet to protect against sea level rise, while offering access to the East River shoreline. The flood defense infrastructure is projected to cost between five and seven billion dollars and could be in place by 2035, pending funding and prioritization by regulatory agencies.

New York City selected a consortium led by Stony Brook University to develop a $700 million, 400,000 sq. ft. climate research and development campus on Governors Island that will be called the New York Climate Exchange. The campus will include two new classroom and research buildings, student and faculty housing and university hotel rooms. The campus is expected to host 600 college students, 6,000 job trainees and 250 faculty members and researchers. In addition to Stony Brook University, the development consortium includes IBM, Georgia Institute of Technology, Pace University, Pratt Institute and Boston Consulting Group. Governors Island was rezoned in 2021 to allow for the campus. Construction is expected to begin in 2025 and wrap up in 2028. The Trust for Governors Island announced that expanded ferry service running every 15 minutes will begin in the summer of 2024, including the addition of New York City’s first public, hybrid-electric ferry.