CRAFT SPIRITS

BOOSTING BUSINESS

STATE SPIRITS BOARDS

TECHNOLOGY & E-COMMERCE BUILDING A FIREWALL AGAINST CYBERCRIME

IT’S THE AGE OF AGAVE

BUT ARE THERE MORE HOPES OR HINDRANCES FOR U.S. PRODUCERS?

BOOSTING BUSINESS

TECHNOLOGY & E-COMMERCE BUILDING A FIREWALL AGAINST CYBERCRIME

BUT ARE THERE MORE HOPES OR HINDRANCES FOR U.S. PRODUCERS?

At La l l e m a n d D i s t i l l i n g, o u r s i n g l e s o u rce p h i l o s o p hy p rovi d e s t h e h i g h e s t q u a l i t y i n g re d i e nt s, t a i l o re d te c h n i c a l s e r v i ce a n d e d u c at i o n , a n d i n d u s t r y l e a d i n g expe r i e n ce to s u p p o r t yo u r n e e d s. Yo u r spir i t s a re o u r p a s s i o n , yo u r nee d s a re o u r m o t i vat i o n .

Contac t us to learn more today.

34 The Agave Dilemma

U.S. distilleries see obstacles and opportunities in crafting their own agave spirits.

BY KATE BERNOT

BY KATE BERNOT

42

42

State Spirits Boards Help Put Craft on the Map

Heeding the example of the wine industry, craft distillers are creating state boards to generate more visibility for their products.

BY ANDREW KAPLAN46

DISTILLING DESTINATIONS

Spirits of Enchantment

Craft distillers in New Mexico create spirits with a sense of the Southwest.

BY JOHN HOLL

BY JOHN HOLL

Cover photography: @sactownbites

RETAIL : ON - PREMISE

56

The Sipping Scene

Exploring the wide world of bars and tasting rooms

SUPPLIER SHOWCASE

58

Finding Common Ground in Nashville

Exhibitors at Craft Brewers Conference/Brew Expo America continue to court the distilling side of the beverage alcohol business.

BY JEFF CIOLETTI

BY JEFF CIOLETTI

TECHNOLOGY & E - COMMERCE

62

Igniting Your Firewall

A cybersecurity expert details a new generation of cyberthreats and the solutions that make your operation less vulnerable.

BY JEFF CIOLETTILEGAL CORNER

64

Minding Compliance

Understanding comliance and why it matters to craft distillers

BY TERI QUIMBYPRODUCTION

66

Going Kosher

Stephen Gould of Golden Moon Distillery shares details on attaining kosher certification.

BY JON PAGE

BY JON PAGE

DATA DISTILLED

68

Agave Spirits Growth Trends

CRAFT SPIRITS MAGAZINE

CEO, AMERICAN CRAFT SPIRITS ASSOCIATION | Margie A.S. Lehrman, margie@americancraftspirits.org

EDITOR IN CHIEF | Jeff Cioletti, jeff@americancraftspirits.org

SENIOR EDITOR | Jon Page, jon@americancraftspirits.org

ART DIRECTOR | Michelle Villas

MEDIA SALES REPRESENTATIVE | Annette Schnur, sales@americancraftspirits.org

CONTRIBUTORS | Kate Bernot, Lew Bryson, John Holl, Andrew Kaplan and Teri Quimby

AMERICAN CRAFT SPIRITS ASSOCIATION

EDUCATION MANAGER | Kirstin Brooks, kirstin@americancraftspirits.org

ADMINISTRATIVE ASSISTANT | Albab Melaku, albab@americancraftspirits.org

DIRECTOR OF MEETINGS & EVENTS | Stephanie Sadri, stephanie@americancraftspirits.org

ACSA ADVISORS

STRATEGIC COMMUNICATIONS | Alexandra S. Clough, GATHER PR LEGAL | Ryan Malkin, Malkin Law, P.A.

PUBLIC POLICY | Jim Hyland, The Pennsylvania Avenue Group STATE POLICY | Michael Walker, The Walker Group, LLC

ACSA BOARD OF DIRECTORS, 2022-2023

PRESIDENT | Gina Holman, J. Carver Distillery (MN) VICE PRESIDENT | Kelly Woodcock, Westward Whiskey (OR)

SECRETARY/TREASURER | Jessica J. Lemmon, Cart/Horse Distilling (PA)

EAST

Jordan Cotton, Cotton & Reed (DC)

Becky Harris, Catoctin Creek Distilling Co. (VA)

Jessica J. Lemmon, Cart/Horse Distilling (PA)

Tom Potter, New York Distilling Co. (NY)

Colin Spoelman, Kings County Distillery (NY)

Jaime Windon, Windon Distilling Co. (MD)

EX OFFICIO

Thomas Jensen, New Liberty Distillery (PA)

CENTRAL & MOUNTAIN

Gina Holman, J. Carver Distillery (MN)

Colin Keegan, Santa Fe Spirits (NM)

Amber Pollock, Backwards Distilling Company (WY)

Mark A. Vierthaler, Whiskey Del Bac (AZ)

Thomas Williams, Delta Dirt Distillery (AR)

ACSA PAST PRESIDENTS

2020-2023 | Becky Harris, Catoctin Creek Distilling Co.

2018-2020 | Chris Montana, Du Nord Craft Spirits

2017-2018 | Mark Shilling, Genius Liquids/Big Thirst

2016-2017 | Paul Hletko, FEW Spirits

2014-2016 | Tom Mooney, House Spirits

CRAFT SPIRITS MAGAZINE EDITORIAL BOARD

PACIFIC

Lucy Farber, St. George Spirits (CA)

Jake Holshue, Spirit Works Distillery (CA)

Jeff Kanof, Copperworks Distilling Co. (WA)

Kelly Woodcock, Westward Whiskey (OR)

ACSA PAC

Jordan Cotton, Cotton & Reed (DC)

Lew Bryson, Alexandra Clough, Sly Cosmopoulos, Dr. Dawn Maskell, Teri Quimby

For advertising inquiries, please contact sales@americancraftspirits.org For editorial inquiries or to send a news release, contact news@americancraftspirits.org

P.O. Box 470, Oakton, VA 22124

© 2023 CRAFT SPIRITS magazine is a publication of the American Craft Spirits Association.

As you’ll read on page 58, I was recently in Nashville for the annual Craft Brewers Conference & BrewExpo America, an event whose importance to our industry continues to increase as more and more brewers—and the vendors that supply them—continue to cross over into distilling.

During my stay in Music City, I finally got to check out a bar that a fellow spirits writer recommended to me in late 2019. I pledged to get there in 2020 and, well, we all know how that played out.

The bar in question is Chopper, which fuses tropical cocktails and tiki décor with a sci-fi robot motif (I was promoting a book called “Drink Like a Geek” four years ago, so the writer who recommended the place knew it would be right up my alley). I enjoyed the experience so much that I just had to include it in this issue’s edition of The Sipping Scene (page 56).

Venues like Chopper make me excited for a possible new golden age of escapism in the on-premise.

I’m old enough to remember when immersive theme bars were something at which we rolled our eyes. Anyone remember Mars 2112? The cavernous, Martian-themed establishment tilted a bit more toward the restaurant side, but its real breadand-butter was the overpriced drinks it served prior to both the respective craft cocktail and craft spirits revolutions. They weren’t making money off of the chicken fingers and burgers that the kids were devouring, it was the day-glow interstellar adult beverage concoctions that their parents were sipping amidst the red rocks of the 22nd century Martian landscape.

As a tiki bar guy, I’m certainly not above a little kitsch and cosplay. But a drinkery needs to have true affection and respect for its audience to pull it off. It has to be forged with passion, directly from the hearts and souls of the owners and expert staff. Theme bars of the late ‘90s ilk were forged mostly with cynicism. I pulled up a eulogy for Mars 2112— which, believe it or not, closed in 2012, exactly a century “before” it supposedly “opened”—and the term “tourist trap” was in the very first line.

The tropical bar renaissance obviously helped usher in this new era of escapism. The island-evoking establishments were part of the vanguard, along with Prohibition-era speakeasy-

style joints. And those concepts continue to evolve, fusing other aesthetic elements (like robots), or adapting it to give it more of an immediate sense of place and local flavor. My favorite example of the latter is the Blind Pig in Dublin, Ireland. As you’d guess from the name, it is a speakeasy—which, of course, is a uniquely American concept transplanted across the pond. It’s got the whole secret entrance thing, but what it doesn’t have is the art-deco, derby hats, suspenders and Capone romanticization. You are escaping from modern Dublin, but only because you’re in an arched, brick cellar with no evidence of the outside world. It feels more like you’re in the deep recesses of a centuries-old castle—but not in some kind of contrived, over-the-top way. And the drinks are top-notch, some even including a further taste of home with poitin, the Emerald Isle’s traditional moonshine.

Bars like Chopper and the Blind Pig offer a momentary retreat from a world that gives us so many reasons to want to escape it. We’ve only just escaped from the confines of our own homes when we were forced to stay there by a virus that nearly decimated the on-premise as we know it. And the world that awaited us is filled with so many unsettling things—as the cybersecurity piece on page 62 and the artificial intelligence story in the previous issue will attest.

But mostly, it’s’ the far less sinister things from which we want to escape: the everyday, the mundane, the mainstream, the cynical—you know, all of the things for which craft has always been the alternative. ■

Jeff Cioletti Editor in Chief

Lew Bryson has been writing about beer and spirits full-time since 1995. He was the managing editor of Whisky Advocate from 1996 through 2015, where he also wrote the American Spirits column, and reviewed whiskeys. He is currently a Senior Drinks Writer for the Daily Beast, and also writes for WhiskeyWash.com, American Whiskey and Bourbon+. He is the author of “Tasting Whiskey” (Storey Publishing, 2014), a broad survey of the whiskeys of the world, their history and manufacture. He has also written four regional brewery guidebooks.

Kate Bernot is a reporter covering beer, food and spirits. She regularly contributes to Good Beer Hunting and Craft Beer & Brewing; her work has appeared in The New York Times, The Washington Post, Imbibe and elsewhere. She is a BJCP-certified beer judge and the director of the North American Guild of Beer Writers. She lives in Missoula, Montana.

Teri Quimby, JD, LLM is an attorney, president of Quimby Consulting Group and a former state alcohol regulator. She is known for her outspoken position on the need to modernize alcohol laws and regulations. Writing on legal, compliance and alcohol issues, her work has appeared in places like USA Today, Detroit News, Governing, Reason and American Spectator. In 2017, Crain’s Detroit Business recognized Teri on its list of Most Notable Lawyers in Michigan.

John Holl is a journalist covering the beer industry. He’s the author of several books including “Drink Beer, Think Beer: Getting to the Bottom of Every Pint” and “The American Craft Beer Cookbook.” He is the co-host of the podcast Steal This Beer, and his work has appeared in The New York Times, The Washington Post, Wine Enthusiast and more. John has lectured on the culture and history of beer and judged beer competitions around the world.

Andrew Kaplan is a freelance writer based in New York City. He was managing editor of Beverage World magazine for 17 years and has worked for a variety of other food and beverage-related publications, and also newspapers. Follow him on Twitter @andrewkap.

Michelle Villas is an art director with more than 20 years experience in publication design. After spending 16 years working on magazines in New York for a variety of titles, including Beverage World, Michelle headed out to California where she now calls the South Bay home. She is the creative director on a range of lifestyle publications for The Golden State Company. A true typophile, she carries her obsession with fonts into every project.

ABE Equipment will drive cutting-edge innovations and industry-leading service to ensure entrepreneurs can maximize their opportunities to succeed. Our parent company is Norland International, a leading supplier of turn-key beverage equipment and more. abeequipment.com

ABM Equipment has been the leading provider of integrated grain handling solutions to craft distilling spaces for nearly 30 years. Their unique value proposition is “sturdy, creative layouts that are built to move and scale with your space.” abmequipment.com

Amoretti specializes in super concentrated natural infusions for artisan craft beverages. Amoretti sources the freshest and tastiest fruits, herbs, spices and more, paying attention to quality and consistency to ensure an impeccable, consistent brew in every barrel. amoretti.com

Fermentis is an agile and expanding company, dedicated to fermented beverages. It is a unit of Lesaffre Group, global key player in yeast for over 160 years. Our roots are strong while having an audacious spirit. As things happen during the fermentation … our goal is to discover them in terms of taste, flavor and pleasure. fermentis.com/en/

Malkin Law focuses on serving the needs of the alcohol beverage industry. We regularly assist with licensing, review of industry specific agreements, trade practices and navigating state laws. Malkin Law is also honored to be Legal Counsel for ACSA. malkinlawfirm.com

FIVE x 5 Solutions believes that distillery software should scale with you. We’re more than a service provider: we’re a committed partner in your distillery’s success and take pride in providing the most complete solution for your growing operation. We take your business as seriously as you do. Fx5solutions.com

The Barrel Mill is a familyowned cooperage specializing in premium white oak aging barrels, infusion spirals, and more. Our products are made from the finest materials we can find, hand-selected, hand-crafted, and aged to perfection. thebarrelmill.com

Glencairn Crystal is a leading manufacturer of bespoke crystal and glass. For over three decades, this family business, based in Scotland, has gained an international reputation for fine crystal and glassware. Best known for the creation of the Glencairn Glass, the official glass for whisky. glencairn.co.uk

Berlin Packaging, the only Hybrid Packaging Supplier® of plastic, glass and metal containers & closures, supplies billions of items annually, along with package design, financing, consulting, warehousing and logistics services. berlinpackaging.com

Harvest Hosts connects over 225,000 self-contained RVers to a network of thousands of small businesses (hosts). Hosts simply offer RVers a one-night stay on their property, and, in return, RVers patronize the business while spending the night. Our program is a cost-free opportunity and 100% of the money spent onsite goes straight to the Host. harvesthosts.com

At MGP, every step of creating a premium distilled bourbon, whiskey, rye, gin and vodka is guided by a passion bordering on obsession. We tirelessly collaborate with our partners, regardless of size, to develop and consistently produce the exact flavor profile that’s right for their brand. And for their discerning consumers. mgpingredients.com/distilled-spirits

The nation’s premier educational distillery, bringing together specialists from every facet of the industry to provide education, training and professional services to start-ups and existing companies. Moonshine University is housed next door to sister company Flavorman, an international custom beverage development company. moonshineuniversity.com

Park Street delivers productivityenhancing and cost-saving back-office solutions, advisory services, working capital, compliance management, export solution, integrated accounting and human resources management solutions. parkstreet.com

Saverglass provides for premium and super-premium spirits, still & sparkling wines and craft beers. Recognized for its innovation, its glass-making expertise and the quality of its glass, products and designs, Saverglass is the partner of choice. saverglass.com

Supercap has been producing closures for spirits since 1999. We are present in the United States with a great sales network with partners and agents, thus being able to help and advise you in the choice of the best stopper for your spirits. supercap.it

Tapì is an international group specializing in the design and production of miniature packaging design masterpieces. Our closures are based on cutting-edge functionality and technology, with an exclusive style that elegantly showcases each product. tapigroup.com

Thousand Oak Barrel Co. manufactures barrels to age and serve your spirits. All products offer a variety of options for customizing and branding with your personalized design. 1000oaksbarrel.com

The American Craft Spirits Association would like to thank all of our annual sponsors and our key supporters of education. We are grateful for all of your support throughout the year. Cheers!

Since 1876, we’ve been supplying the highest quality malts in the industry. We’ve distinguished ourselves by developing the most extensive line of specialty malts made by any malting company in the world. We provide everything from malts to pure malt extracts, brewers flakes and filtering aids. briess.com

As the craft distilling industry grows, BSG Distilling has been focused on supplying distillers with the best ingredients from around the world. Today, the craft distilling market trusts BSG Distilling to deliver the finest ingredients at competitive prices, without sacrificing customer service. bsgdistilling.com

Chevalier Casks is a distributor of high-end wine and whiskey casks and a broker of bulk spirits. chevaliercasks.com

CIE is a state-of-the-art, 75 million wine gallon, beverage and industrial graded, commercial scale, alcohol facility located in Marion, Indiana. CIE supplies pure and denatured alcohols to customers in the spirit, beauty, personal care, medical, food-flavor and industrial markets. cie.us

We’ve been in this industry for over 100 years, during which time we’ve learned a thing or two about what makes a great barrel to age great spirits. Partnering with distillers, we think outside the box to develop new products that push your vision forward. iscbarrels.com

ISTS

ISTS makes workplaces safer, employees ready and compliance uncomplicated. ISTS has extensive experience working with the spirits industry, so our programs are totally customized to address your site. istsky.com

Kason Corporation is the industryleading global spent grain processing equipment manufacturer that distilleries can count on for efficiency, cost savings and reducing waste and disposal costs. kason.com

The leader in supplying fermentation products and services to the distilled spirits industry, we specialize in the research, development, production, and marketing of yeast, yeast nutrients, enzymes, and bacteria. lallemanddistilling.com

Soderstrom Architects’ Ferar Wine & Spirits Studio has been involved in the design and master planning of more than 70 wineries and distilleries. Our studio was founded with a passion for design that conveys the special sense of place inherent in the site. sdra.com

Sovos ShipCompliant has been the leader in automated alcohol beverage compliance tools for more than 15 years, providing a full suite of cloudbased solutions to distilleries, wineries, breweries, cideries, importers, distributors and retailers. sovos.com/shipcompliant

Since 1984, Specific Mechanical Systems has handcrafted brewing and distilling systems for the craft beer and spirits industries, in addition to supplying various industries with complex processing equipment. specificmechanical.com

The Steric Systems PureSmooth process is a method of “polishing” distilled spirits to reduce alcohol burn, open up and balance flavors, and improve mouth feel. It works on both aged and unaged spirits. stericsystems.com

Signature Spirits, a division of Ultra Pure, is the leading independent supplier of bulk spirits in the U.S. and has the largest selection of alcohols stocked across its nine warehouses. We supply approximately 1,000 distilleries and brand owners with virtually every type of alcohol. ultrapure-usa.com

Whalen Insurance is a second-generation insurance agency owned and operated by Peter Whalen. He started a program for craft breweries in the mid 1980s and expanded to craft distilleries almost 10 years ago. It provides all property and liability coverages needed to safely operate a distillery. whaleninsurance.com

The Wine & Spirits Wholesalers of America (WSWA) is the national trade association representing the wholesale tier of the wine and spirits industry. It is dedicated to advancing the interests and independence of wholesale distributors and brokers of wine and spirits. wswa.org

WV Great Barrel Co.

The best-performing whiskey barrel on the market, precision built in the heart of Appalachia. Infrared toast and controlled char standard on every barrel.

wvgbc.com/

River Falls, Wisconsinbased Tattersall Distilling announced the launch of its 90-proof Kernza Perennial Grain Whiskey, distilled from 100% Kernza. This release has taken more than three years to come to life and was made in collaboration with the University of Minnesota’s Forever Green Initiative and The Land Institute. Tattersall’s whiskey joins just a handful of Kernza-based spirits available in the U.S. debuting this Earth Day.

Portland, Oregon-based Wheyward Spirit announced the launch of its new barrel-aged spirit: Wheyskey

According to Wheyward Spirit, it is the first aged specialty whey spirit in the U.S. The 80-proof spirit is a barrel-aged version of Wheyward Spirit, which enables the distinct Wheyward Spirit flavor that is naturally created during the fermentation and distilling process to fully blossom and mature through oak aging.

Blackland Distillery of Fort Worth, Texas, announced the launch of its highly anticipated flagship bourbon, Prairie Gold Texas Straight Bourbon Whiskey. Aged for a minimum of three years in new oak American barrels, the 100-proof Prairie Gold is cooked, fermented and distilled on-site using 100% Texas grains from Texas farmers.

Brush Creek Distillery of Saratoga, Wyoming, unveiled its limited-edition release, the 97-proof Brush Creek Carboy Winery Cabernet Franc Cask-Finished Straight Bourbon Whiskey. This release represents a collaboration between Brush Creek Distillery and Carboy Winery, Colorado’s largest in-state winery. Multiple barrels of sixyear-old Straight Bourbon Whiskey were selected from the Distillery’s premium on-site collection, blended, and finished in ex-Carboy Winery Cabernet Franc wine barrels.

Ragged Branch Distillery of Charlottesville, Virginia, announced the launch of 100-proof Secretariat Reserve Virginia Straight Bourbon Whiskey, a special bourbon celebrating the 50th anniversary of Secretariat’s historic Triple Crown win. “A lot of people think that Secretariat was a Kentucky horse because he won the Kentucky Derby, but he was actually from Virginia,” says Alex Toomy, founding partner and head distiller at Ragged Branch Distillery. “The best racehorses can come from here, and so can the best bourbon.”

Wiggly Bridge Distillery of York, Maine, has released its long-awaited New England Single Malt Whisky The 92-proof spirit is made from 100% malted barley. It is an unpeated single malt that utilizes an heirloom Scottish whisky yeast. The barley is grown in northern Maine and floor malted at Blue Ox in Lisbon Falls, Maine, where it is then cooked, fermented, distilled and barrel aged at Wiggly Bridge Distillery in Southern Maine.

Cedar Ridge Distillery of Swisher, Iowa, launched its 116-proof Barrel Proof Straight Bourbon Whiskey. Crafted from 74% corn, 14% rye, and 12% malted barley, the whiskey is then aged in char No. 3 barrels and non-chill filtered. All of the barrels are aged in non-climate controlled rick houses, exposing them to temperature swings of more than 100 degrees each year, resulting in a unique flavor profile particular to Iowa’s climate.

Seattle-based Copperworks

Distilling Co. recently announced the release of Copperworks

American Single Malt Whiskey

Doubleback Cabernet Cask, a 115.8-proof collaboration with Doubleback Winery of Walla Walla, Washington. The whiskey matured in new American oak casks for three years and five months and was finished for 11 months in a French oak cask that previously held Doubleback Cabernet Sauvignon.

Petaluma, California-based Lagunitas Brewing Co. and Griffo Distillery have concocted a rare spirit: Still Waldos, an 84-proof single malt whiskey accented with hops. The teams dreamed up distilling a version of Waldos’ Special Ale—a triple IPA made in honor of the origins of 420 and the dankest and hoppiest beer ever brewed by Lagunitas. The mash was created at Lagunitas and it was distilled at Griffo.

Blanco, Texas-based Milam & Greene Whiskey has unveiled Bobcat Single Barrel Bourbon, the second release in the Wildlife Collection, a limited-edition series of cask-strength, single-barrel whiskies. This release was distilled in Tennessee with a mash bill of 80% corn, 10% rye, and 10% malted barley. It was barreled on March 15, 2018, and was bottled on March 31, 2023, at 119.48 proof.

Georgetown, Kentucky-based Blue Run Spirits has announced its first-ever single barrel rye whiskey: Blue Run Kentucky Straight Emerald Single Barrel Rye Whiskey. This single barrel offering was contract distilled by Blue Run liquid advisor Jim Rutledge at Castle & Key Distillery in Frankfort, Kentucky. Shaylyn Gammon, Blue Run’s whiskey director, carefully selected these barrels to echo the rich, complex flavors from Emerald Rye Whiskey, but with each featuring its own personality found only in a single barrel release.

Wisconsin-based La Crosse Distilling Co. recently announced the inaugural release of Buck Dancer Straight Bourbon Whiskey—a four-year aged, ethically produced organic bourbon. It is distilled from an heirloom variety of red corn and the distillery selected wine grade barrel staves made from regionally grown and harvested American white oak trees. Buck Dancer is barreled at cask strength at approximately 120 proof.

Garrison Brothers Distillery of Hye, Texas, celebrated the release of Lady Bird, a Texas straight bourbon whiskey infused with Texas wildflower honey and finished in a cognac cask. This new expression, almost eight years in the making, is Garrison Brothers’ ninth addition to its bourbon portfolio and its sales will benefit the Lady Bird Johnson Wildflower Center in Austin.

Milwaukee-based Central Standard Craft Distillery has expanded its successful Pour Ready Premium Cocktail line with the addition of Red Cabin Lemon Honey Bourbon Smash and Red Cabin Peach Bourbon Smash Cocktails, which are both 30 proof. They join the original premium cocktails in the lineup of Pour Ready Door County Cherry Vodka Lemonade and the Pour Ready Door County Cherry Vodka Mule, which launched last spring.

Sagamore Spirit is bringing a hometown classic cocktail to the masses with the national release of its Orange Crush Craft Canned Cocktail. Inspired by the original cocktail made famous in Ocean City, Maryland, this 8% ABV RTD is made with orange juice, lemon juice, lime juice and natural orange flavor paired with the distiller’s straight rye whiskey, replacing the traditional vodka and adding richer character.

Thompsonville, Michigan-based Iron Fish Distillery and Short’s Brewing Co. of Bellaire, Michigan, are collaborating to create Soft Parade, a new fruit-infused vodka. The 80-proof, fruitinfused vodka will be made using the same fruit selected for Soft Parade Beer. The result will be a one-of-a-kind vodka that combines the smoothness of traditional vodka with the subtle natural flavors of real strawberries, blueberries, blackberries and raspberries.

Key West, Florida-based Papa’s Pilar Rum has added a Rye-Finished Rum to its national portfolio, marking this as the fourth expression added to the flagship fleet. The 86-proof rum is made using the brand’s Dark Rum, which is solera blended with rums sourced from Barbados, Dominican Republic, Panama, Venezuela and Florida. The rum is further finished in once-used straight rye whiskey barrels made from heavily charred white oak.

San Antonio-based Maverick Distilling released its limited-edition Samuel Maverick Barrel Aged Texas Dry Gin just in time for warm-weather cocktail season. The 90-proof spirit was distilled in small batches using local-grown Texas ingredients and aged in bourbon barrels on-site in the vaults below the distillery in the historic Lockwood National Bank building located steps from the Alamo. Just 250 bottles were produced for this smallbatch release.

Sugarlands Distilling Co. of Gatlinburg, Tennessee, announced the newest flavor in the award-winning craft distillery’s moonshine portfolio—Sour Blue Raspberry—made in partnership with Folds of Honor, a national 501(c)(3) nonprofit that provides educational scholarships to spouses and children of America’s fallen and disabled military service members and first responders. Sugarlands will donate 5% of proceeds from sales of the 40-proof spirit to Folds of Honor.

Freeland Spirits of Portland, Oregon, has released a limited-edition Cherry Blossom Liqueur, featuring locally harvested cherry blossoms. The 70-proof liqueur is a delightfully floral and citrusy spirit, created with handharvested flowers from the Pacific Northwest, including blooms from the stunning Portland Japanese Garden. It is light, with a delicate floral flavor. Perfect as a creative cocktail ingredient, or plays nicely in a classic gin Martini.

Fires, Floods, Explosions, and Bloodshed: A History of Texas

Whiskey

Author: Andrew Braunberg

Publisher: State House Press

Release Date: May 11

When Americans settled Texas in the 1830s, they brought their booze with them and found some made by the locals when they got there! Before long, the Lone Star State had a thriving distillery business, more than a century ahead of modern craft distillers that are changing the face of the spirits industry today. This is a fascinating history filled all too frequently with floods, fires, explosions, and lots of bad luck. Had the development of Texas happened a little differently, the state might have well become a major whiskey producer intertwined with barbed wire, refrigeration, cattle, railways, oil, and cooperage all coming into play.

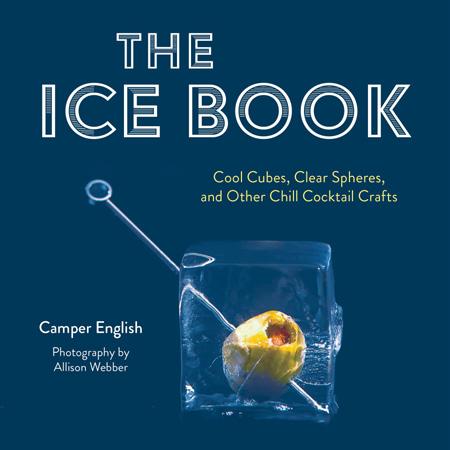

The Ice Book: Cool Cubes, Clear Spheres, and Other Chill Cocktail Crafts

Author: Camper English

Publisher: Red Lightning Books

Release Date: May 23

Internationally renowned cocktail icepert Camper English details how to use directional freezing to make perfectly pure ice in a home freezer, carve it up into giant diamonds and other shapes, and embed it with garnishes, including edible orchids and olives. You’ll learn how to create a frozen bowl for Negroni punch, serve a Manhattan inside an ice sphere, and infuse cubes with colors and flavors to create cranberry cobblers, a color-changing Gin and Tonic, and other awesome drinks.

Strong, Sweet and Bitter: Your Guide to All Things Cocktails, Bartending and Booze from Behind the Bar

Author: Cara Devine

Publisher: Hardie Grant

Release Date: May 16

“Strong, Sweet and Bitter” is the debut cocktail recipe book by hostess of popular YouTube series Behind the Bar, Cara Devine. Using the Flavor Triangle (strong, sweet and bitter or sour flavors) as the basis, this book shows you how to master the fundamentals of flavor and craft a drink from anything available on hand. Drawing upon her expertise as cocktail bar Bomba’s manager, Devine explores the different ingredients and techniques required to craft anything from classic cocktails to their lesser-known but equally delicious counterparts.

The Book of Cocktail Ratios: The Surprising Simplicity of Classic Cocktails

Author: Michael Ruhlman

Publisher: Scribner

Release Date: May 23

New York Times bestselling author Michael Ruhlman applies the principles of his innovative book Ratio—about the relationships of ingredients to each other—in this delightful back-to-basics cocktail book, sharing the simple recipes and fundamental techniques that make for delicious and satisfying libations. As Ruhlman explains, our most popular cocktails are really ratios—proportions of one ingredient relative to the others. Organized around five of our bestknown, beloved, classic families of cocktails, each category follows a simple ratio from which myriad variations can be built: The Manhattan, The Gimlet, The Margarita, The Negroni, and the most debated cocktail ever, The Martini.

The Northwest Whiskey Trail, the first of its kind to cross an international border, launched in May and is ready to welcome enthusiasts and newcomers to the world of single malt and pot still whiskey. The brainchild of Graeme Macaloney Ph.D., CEO and Whiskymaker at Macaloney’s Island Distillery, the Northwest Whiskey Trail is an international adventure taking visitors through British Columbia, Washington State and Oregon. This self-guided trail features seven distilleries, each with its own character and history, offering visitors an unforgettable whiskey experience.

“Collectively, we export our whiskies to every continent and can’t wait for whiskey enthusiasts from around the world to come and explore this beautiful region and all it has to offer,” said Macaloney. The trail showcases the best award-winning

Shiner, Texas-based Spoetzl Brewery, brewer of Shiner Bock, announces the addition of a new onsite distillery, the K. Spoetzl Distilling Co., which is distilling a line of Shiner Craft Spirits.

After more than 114 years of crafting innovative brews, Spoetzl is introducing a new line of craft spirits, including vodka, gin and moonshine—also known as Shiner Shine—with barrel-aged spirits to follow.

“The town of Shiner and surrounding areas have a colorful history of distilling that dates back to before Prohibition and ties into Shiner’s rich brewing heritage,” said Tom Fiorenzi, director of brewery and distillery operations. “We believe our brewing experience crafting award-winning beers uniquely positions us to similarly craft the highest quality spirits for the demanding spirits consumer. The entire process—from grain to glass—will all be done by our team right here in Shiner; after all, great beer is the basis for great spirits.”

Nestled in one of the oldest cellars of the historic brewery, Shiner commissioned a world-class distillation system, including a copper pot still and copper rectifying columns

hand-crafted in Scotland. As an ode to the past, each batch of spirits passes through the collection vessel copper grant designed by Shiner’s legendary brewmaster Kosmos Spoetzl in 1947. “The copper from Kosmos’ grant refines the batch prior to its introduction to the still,” says Jessica Michalec, Spoetzl distillery manager. “From there, each batch receives the same care and attention from our distillers that our brewers would apply to our craft beers.”

Visitors are invited to tour the distillery and sample spirits seven days a week. The distillery also has a menu of craft cocktails, each tailored to incorporate the local heritage and flavors. Bottles of spirits are also available for purchase exclusively from the hospitality room for at-home enjoyment.

“The incredible support from Shiner Beer fans over the years led us to this point where Shiner begins a new chapter distilling unique craft spirits that deliver on quality while paying homage to the brewery’s historic past,” said Nick Weiland, Shiner’s director of marketing.

whiskies in the Northwest, including those made by Westward Whiskey in Portland, Oregon; Copperworks Distilling and Westland Distillery in Seattle; Macaloney’s Island Distillery in Victoria, B.C.; Goldstream Distillery in Cowichan Valley, B.C.; Shelter Point Distillery in Campbell River, B.C.; and Deep Cove Brewers & Distillers in Vancouver, B.C. Visitors will have the opportunity to explore each distillery’s unique distilling process, sample their signature whiskey and learn about the history and culture behind each brand.

“When Graeme first approached us with the idea of creating an international whiskey trail featuring like-minded craft distilleries in the Pacific Northwest, we thought it was a brilliant idea,” said Copperworks Distilling Co. president, co-founder and co-owner Jason Parker. “We’re excited for more people to visit, learn about the distilleries, and most importantly, taste the difference between each distillery.”

One of the highlights of the trail is the Northwest Whiskey Trail passport. Visitors can collect stamps at each of the participating distilleries along the trail, and once they fill up their whiskey passport, they can redeem it at their final distillery for an exclusive, limited-edition Northwest Whiskey Trail Glencairn whiskey glass, pictured to the left.

Middle West Spirits, of Columbus, Ohio, has announced a multi-year expansion of its distillery, operational facilities and a 14-acre campus at 1165 Alum Creek Dr. According to the distillery, the expansion makes Middle West Spirits a top 10 grain-to-glass whiskey and spirits producer in the United States overall and the largest distillery in Ohio.

The growth will create about 80 new jobs over the next three years, with hiring to begin immediately.

In 2020, the company acquired the vacant Alum Creek Campus and completed initial renovations to relocate and expand operations. The new expansion plans, with MA Design serving as lead designers on the project, include a state-of-the-art 75,000-square-foot distillery, a grain recycling center, packaging and bottling facility and more.

In addition, the Middle West Spirits project will create new office space to support growing its headquarters and positioning the site for the possibility of a future hospitality space. Distilling will also continue at the original Courtland facility in the Short North, which houses the company’s retail Bottle Shop

and acclaimed Service Bar restaurant.

“We are excited about the Alum Creek development and the future of our company. The expansion of our operations allows us to hit capacities, aging goals and the volumes needed to continue to develop our brands and partnership programs,” said Ryan Lang, founder and chief executive officer for Middle West Spirits. “Our team has worked tirelessly

over the last 15 years to bring us to this point, and we are excited to start the next chapter of Middle West.”

“Middle West is making an immense impact on the local community by creating jobs and revitalizing a key property on the east side of Columbus that hopefully brings further investment to that corridor,” said Andrew J. Ginther, mayor of Columbus.

The Glass Packaging Institute (GPI) recently announced the winners of the 2023 Clear Choice Awards (CCA), which recognize North America’s top brands and manufacturers creating remarkable glass product designs that form dynamic consumer experiences.

Castle & Key Restoration Rye Dark Label won in the spirits category, and a complete list of winners can be found at gpi.org.

Since 1989, the Clear Choice Awards has honored consumer product goods manufacturers that find noteworthy ways to use glass packaging to tell the story of their brand, create glass packaging designs that stand out from others, and help brands meet their sustainability goals.

“I want to congratulate the winners of the 2023 Clear Choice Awards,” said Scott DeFife, president of GPI. “It’s been two years since we’ve held these awards, and I especially want to recognize the glass container manufacturing industry for their support in providing premium and sustainable glass products to consumers around the world. It is amazing to see each of these companies and North American manufacturers receive

recognition for all of their hard work in creating unique glass design and packaging.

Congratulations to every one of our winners, we truly appreciate the work you are doing!”

The winning glass containers were selected by an independent judging panel of food and beverage packaging professionals which consisted of John Neata, wine director at Ristorante TOSCA in Washington, D.C.; Tom Bobak, founder and editor-in-chief at American Craft Beer; and ACSA’s Jeff Cioletti, editor-in-chief of this magazine. They

determined the winners for each category based on four criteria: package design (including container, label and closure), shelf impact, storytelling strength of the brand or product, and innovation (in container form and product category).

Uncle Nearest Premium Whiskey of Shelbyville, Tennessee, announced that it has expanded its home, Nearest Green Distillery, to a massive 432 acres. With the purchase of an adjacent property on Eady Road and combined with its original 313 acre distillery property in the hills above Lynchburg, Tennessee, the distillery has increased its footprint, to a total of 745 acres in Bedford and Moore Counties. This acquisition makes Uncle Nearest Premium Whiskey one of the largest, if not the largest, Black landowners in Tennessee.

Nearest Green Distillery, which opened to the public in 2019 with 270 acres, has quickly become a popular tourist destination, attracting between 5,000-8,000 visitors every weekend. With the expansion, the company expects that number to swell to 10,00015,000 visitors per weekend in the coming months. “We are always thinking ahead and doing our best to keep pace with our continuously increasing demand,” said Fawn Weaver,

founder and CEO of Uncle Nearest.

Named after the legendary Black-American master distiller, Nearest Green Distillery boasts a range of unique experiences for guests to enjoy. The distillery is home to Humble Baron, which holds the Guinness World Record for the longest bar at a mindboggling 518 feet with a 17-station bar. Additionally, Barrel House BBQ II, known for the world-famous Grilled Cheese on Crack, is the distillery’s BBQ joint which draws visitors from all over the world.

“When a member of the press dubbed us ‘Malt Disney World’ when we opened in 2019,” said Victoria Eady Butler, a fifth-generation descendant of Nearest Green and the fourtime Master Blender of the Year for Uncle Nearest, “we took that quite seriously and built out a distillery worthy of that moniker.”

With its expanded footprint and unique experiences, Nearest Green Distillery is quickly becoming a must-visit destination for whiskey enthusiasts and teetotalers alike.

The Colorado Grain Chain (CGC), a nonprofit organization of businesses and consumers that seeks to grow and connect a vibrant community-centered grain economy in the state of Colorado, has announced the Brewers & Distillers Microgrant Program. The program will award four participants—one from each of Colorado’s four major watersheds—with $4,000 each to craft a beverage made exclusively from Colorado-grown grains.

According to the CGC, the goal of the program is to collect specific information about the use of Colorado grown grains in craft beverages, promote its member businesses, and raise awareness and demand for Colorado grown grain products. The CGC is accepting applications for these grants until May 29.

“We’re very excited to be launching this microgrant program and to be supporting small businesses and Colorado grown grains,” said Lisa Boldt, co-founder of Primitive Beer in Longmont, Colorado, and grant coordinator with the CGC. “Colorado has many amazing craft beverage producers, and we’re hoping this program helps inspire more breweries and distilleries to use local grains and explore the

companies behind them.”

Colorado’s four major watersheds are the South Platte River (northeast), the Arkansas River (southeast), the Rio Grande River (south central), and the Colorado River (western slope). The CGC will award one brewery or distillery from each region with a $4,000 grant to be used for ingredients, packaging, artwork, release day event and other expenses incurred in creating the beverage. Applicants must be a Colorado-based business, use only state-grown grains in the beverage, document their spending, and be willing to gather information about the grains used and share their findings and experiences. A portion of the beverage produced must be packaged for sale (bottles, cans, bag-in-box, etc.) so that it can be shared with others. However, grant recipients keep all profits they generate from the beverage.

Additionally, applicants must include the Colorado Grown Grains Co-Brand (Co-Brand) logo and QR code on the packaging and in event promotion. The Co-Brand seeks to increase demand and create awareness of the value in locally sourced, nutritious, and whole-

some grains and grain products. Registered Co-Brand users are encouraged to become CGC business members and are eligible for a limited time reduced rate of $99 for annual CGC membership.

The CGC hopes grant recipients are able to use grains from their regional watershed, and strongly encourages collaborations such as breweries and distilleries working together or with bakers and other grain-related businesses. The CGC will be available to help plan and promote a fun release day event where multiple facets of the Colorado Grain Chain are highlighted.

Blue Run Spirits has revealed the first look at its planned whiskey distillery and headquarters in Georgetown, Kentucky, designed by international architect firm Bjarke Ingels Group (BIG).

The 35,000-square-foot distillery and a 20,000-square-foot rickhouse will break ground in 2023 at the Lanes Run Business Park. Projected to open in 2025, distillery operations are anticipated to bring at least 45 full time jobs to the local economy, which was heralded in a statement by Kentucky Governor Andy Beshear last fall.

“We are thrilled to be able to reveal an early look of Bjarke Ingels Group’s design for the new Blue Run Spirits distillery in Georgetown, giving everyone a glimpse at where we are heading in developing a welcoming, unexpected and modern facility with a true focus on sustainability,” said Blue Run Spirits CEO and co-founder Mike Montgomery. “This will be a game-changing addition to Blue Run’s longrange business plans, allowing us to meet forecasted and unforeseen demand, while also giving our whiskey director Shaylyn Gammon and liquid advisor Jim Rutledge a home base

of operations.”

The design, called Meander, is meant to evoke the journey of the limestone-rich water of the Royal Spring in Georgetown as it winds its way through the distilling, aging and blending process to becoming fine Blue Run bourbons and rye whiskeys. The Royal Spring, dubbed the Blue Run by one of the founders, serves as the company’s namesake.

Founded in 2005, Bjarke Ingels Group is based in Copenhagen and New York City and has offices in London, Barcelona and Shenzhen. BIG’s practice includes architecture, planning, landscape, urbanism, interior design, product design, research and development. Notable projects include Google Headquarters, Lego Brand Museum, Audemars Piguet Museum and Hotel, the San Pellegrino Flagship Factory, and world-renowned Copenhagen restaurant Noma.

“For Blue Run, we have boiled the entire process of whiskey-making down to a single linear sequence—from distilling to maturing to bottling,” said Bjarke Ingels, founder and creative director, BIG. “The half-mile long process meanders through the gentle hillsides

creating bends and banks, inlets and outlooks. A single shingled roof of photovoltaic tiles twists and turns to maintain optimal orientation even as the activities underneath require grandeur or intimacy. In the same way the Royal Spring is shaped by how the water flows through it, Blue Run Distillery is shaped by the flow of the whiskey and the processes and people who make it.”

Next Century Spirits of Raleigh, North Carolina, announced the addition of Tom Spisak as CFO. Spisak joins the organization after three years at Reed’s Inc.—a craft soda company with over $55 million in sales. While at Reed’s Inc., Spisak served as chief financial officer where he enacted financial disciplines across the firm, established key banking relationships and guided the company during the macroinflationary environment spawned by covid.

perience in the craft soda and liquor industry to bring the organization to new heights.”

Prior to his time at Reed’s Inc., Spisak spent 26 years at Diageo and held multiple financial positions in North America. While at the multinational alcoholic beverage company with over $16 billion in net sales, Spisak served as the vice president of finance and controller of North America. Previously, he served as vice president of commercial finance as well as

Covington, Kentucky-based Wenzel Whiskey has acquired assets and an inventory of aged spirits from Savannah, Georgia-based Ghost Coast Distillery, which closed its tasting room doors in September of 2022.

Wenzel reached an agreement with Ghost Coast to purchase all equipment used for distilling and nearly 500 barrels of aged bourbon and rum. The equipment includes a pot still and cooker from Vendome Copper & Brass Works, and the barrels of aged spirits includes a considerable amount of bourbon that is upwards of seven years old. Distillery Now Consulting served to broker the sale of the distillery and also handled the decommission and relocation of the equipment and barrels to Covington.

“The opportunity to acquire a fully functioning distillery, especially one with the reputation of Ghost Coast, was one we could not pass up,” said Tony Milburn, senior partner of Wenzel. “This will jumpstart our Wenzel brand by about three years.”

If I had to pick the two biggest trends in craft spirits—as a consumer—I’d have to go with store picks and cask strength whiskey bottlings. Both have their attractions, both have downsides that have to be considered. But you don’t need whiskey, or even barrels, to play the game. Your brandy, rum or gin can play that game too.

Here’s how it works for whiskey.

Store picks have grown tremendously, and it’s no surprise. A bottle from a store-picked barrel lets the average customer get in on something that was once reserved for people with the time, money and persistence to buy an entire barrel, then wrangle it through bottling, taxation and delivery across borders. The up-front costs were substantial, the process subject to change at a moment’s notice. Now it’s as simple as picking a whimsically labeled bottle off a shelf.

And it does make sense for the distiller. Herman Mihalich, at Dad’s Hat Rye in Bristol, Pennsylvania, told me why they do it.

“There are [several] factors that figure into this,” he said. “If we are selling the entire barrel at one shot, we would tend to look at the lower side of the [wholesale price] scale to make the volume purchase a bit more attractive, and we sell all 30 six packs in one go. We also take into consideration the promotional value of having a single barrel on the shelf, where the store team is now educated about our brand and motivated to sell the six packs they purchased.”

Cask strength bottlings give consumers an opportunity that is arguably even more rare. They give us the chance to do what only master blenders could do: taste the spirit as it was created, and then choose what proof is the best for it. Or just pour the fiery stuff right into our craws as God intended. Hell, I just did that last night.

The question of whether to bottle at cask strength is a bit more subtle than the store pick. You get fewer bottles per barrel, and the labeling is different, so you’ll need to charge more, but how much more? I didn’t know, so I

asked Phil Brandon, the founder at Rock Town Distillery in Little Rock, Arkansas. He gave me this example that shows how charging a reasonable premium for these bottles yields significant additional revenue.

“[Take] a 25-gallon barrel that we bottled as a single barrel last week,” he says. “The barrel yielded 20.63 proof gallons at a proof of 115.94 which yielded 98 cask strength 750-mL bottles. If we had proofed it down to 92 proof (our standard bottling proof), it would have yielded 116 bottles. Doing the math: 98 bottles at $60 a bottle = $5,880, vs. 116 bottles at $40 a bottle = $4,640. This equates to an additional $1,240 in revenue at cask strength vs. standard proof.”

An additional $1,240 from a single 25 gallon barrel? Not to be sneezed at.

Can you get in on this with other spirits? For anything that’s aged in a barrel—brandy, fruit brandy, rum, barrel “rested” gin and yes, even aquavit—all it takes is the same label and selection work as whiskey, and a modest amount of promotion and education. People see it as fun, special and educational, that glimpse behind the blender’s curtain.

But can you really do cask strength without the cask? You bet, you just have to be a bit imaginative with the nomenclature. Navy Strength gin and unaged rum are already out there, at a stiff 114 proof that’s backed by authentic tradition. I still remember the super gin I had at a small distillery in Cologne, Germany, Sünner im Walfisch: it was over 120 proof, a crisp explosion of botanicals.

Store picks? Like whiskey, all it takes is a little tweak and hook work. Shift your botanicals charge in a more floral or citrus or juniper direction, and bingo, you’ve got ‘Our Gin: the Autumnal Mix,’ or whatever. Aquavit, same thing. Rum, twist the cuts a bit. Just make it different … and make it good.

One last word from Mihalich is worth adding. “Be mindful of what the final price on the shelf will be,” he said, “and how it will compare to what else is out there.” Because in the end, these projects are fun, but if you do it right, they can definitely contribute to your bottom line. ■

Lew Bryson has been writing about beer and spirits full-time since 1995. He is the author of “Tasting Whiskey” and “Whiskey Master Class.”

But can you really do cask strength without the cask? You bet, you just have to be a bit imaginative with the nomenclature.

The American Craft Spirits Association (ACSA) in March announced the election of Gina Holman of J. Carver Distillery (MN) as the President of the Board of Directors. She has served as a member of the organization’s Board of Directors since 2020, and as Vice President since 2022. Kelly Woodcock of Westward Whiskey (OR) has also been elected as the organization’s Vice President and Jessica J. Lemmon of Cart/ Horse Distilling (PA) has been re-elected as Secretary/Treasurer.

Together, Holman, Woodcock, Lemmon and the current and newly-appointed Board of Directors will work with CEO Margie A.S. Lehrman to address the key issues facing the craft distilling industry, including the organization’s continued push for direct-toconsumer (DtC) shipping.

The elections will usher in the second consecutive year during which an all-women-identifying-led board will steer a national trade association. Additionally, women currently

make up more than half of the elected Board members. ACSA is also proud to announce the results of its national election for Board of Director members, adding four new members with one returning.

“It is a tremendous honor to be leading the ACSA Board of Directors as president, and it is a responsibility that I do not take lightly,” said Holman. “As we usher in ACSA’s second decade as a leading industry trade association, I look forward to serving our growing craft spirits community and building on the organization’s remarkable accomplishments thus far. We’ve certainly got our work cut out for us, but I’m excited to be working alongside such an esteemed group of fellow Board members to make great things happen for our vibrant industry.”

Lehrman added, “As a woman in drinks, particularly at a trade association level, I’m thrilled to announce that for a second year, our women-led Board will steer our organization to support our growing community of

craft distillers. Though ACSA remains focused on critical industry issues such as postal shipping reform, trade, fair competition, and direct-to-consumer shipping, we continue to pour our hearts and efforts into the STEPUP Foundation, the 501(c)3 non-profit immersive internship program we helped create two years ago. Through STEPUP, our work is narrowly focused on an important mission: to change the face of the drinks industry, one intern at a time. While we still have so much work to do—particularly within the communities that have been most marginalized historically—we are beginning to see a shift in drinks. Our 2023 Board of Directors is proof that our industry continues to move in the right direction.”

The newest members of the Board include Colin Spoelman (Kings County Distillery, NY), Jaime Windon (Windon Distilling Co., MD), Thomas Williams (Delta Dirt Distillery, AR) and Jordan Cotton (Cotton & Reed, D.C.).

Following these elections, the ACSA Board of Directors is also appointing leadership to its governing committees. Those committees include Membership, Ethics, Convention, Education, Elections, Safety, ACSA PAC, Mentorship, Judging, Government Affairs, State Guilds, Technology, Finance, DtC and Development.

ACSA is excited to announce that Jordan Cotton of Washington, D.C.-based Cotton & Reed is the incoming chair of the ACSA political action committee (PAC) and is also our newest member of the Board of Directors. Jordan has worked closely in ACSA governance, serving on the government affairs committee, and we look forward to his energy, vision and guidance as we begin the 2023-2024 term of office.

We are also extremely grateful to our outgoing PAC chair Stephen Johnson, who served as chair since the PAC’s inception in 2018.

ACSA’s public policy advocacy on behalf of its members is critical to making sure our community’s voice is heard on Capitol Hill and in state legislatures. A crucial piece of this strategy is a strong political action committee (PAC). ACSA created a PAC years ago to make sure the voice of our small businesses in an emerging industry is heard.

To learn more, go to our website and log in

Should you have any questions about ACSA’s PAC, or ACSA’s public policy initiatives, please write to acsapac@americancraftspirits.org

Participating state corn associations recently announced that the 2023 Heartland Whiskey Competition will take place August 1-2 in St. Louis, Missouri. This is the fourth biennial Heartland Whiskey Competition that state corn marketing associations have sponsored. The judged competition is sanctioned by ACSA and strictly limited to craft whiskeys that contain some amount of corn as an ingredient. Any craft distiller in the U.S. is eligible to enter products for judging in multiple whiskey categories (e.g., bourbon, bottled in bond, rye, etc.). The most coveted awards are Best of State, which are limited to only those states sponsored by their respective corn associations. Best of Show, which represents the top scoring whiskey across all categories, is also limited to sponsored states.

New for the 2023 competition is a national, cross-category award: Top Farmer-Distiller. This award will go to the top-scoring whiskey across all categories that is produced by a distillery whose owner(s) operates a working farm. The first three competitions saw farmerdistillers walk away with scores of medals and trophies including several Best-of-State. The new farmer-distiller award recognizes the heri-

tage of craft distilling and farming, and offers the opportunity for one accomplished distiller to earn bragging rights.

“We are pleased that as our craft spirits industry expands—the number of craft distillers has grown by 54% since the inaugural 2017 competition—corn growers across the heartland have stood behind us and sponsored this important competition,” said Margie A.S. Lehrman, CEO of ACSA. “Most craft distilleries source corn grown nearby for their mash and that amount has grown considerably in recent years. It’s exciting to add a new award for best farmer-distiller which recognizes the critical relationship of our two, overlapping industries.”

Competition awards such as medals and trophies are important to craft distillers because they recognized great product which positively influence consumer retail purchases.

ACSA will select judges from accomplished industry professionals and mixologists who have demonstrated experience with craft spirits. The actual judging will occur on August 2nd and winners will be announced by early September.

The following state corn marketing associations collectively sponsor the 2023 Heartland Whiskey Competition and state-level competitions in 21 states representing more than 75% of all U.S. craft distillers:

Colorado Corn Promotion Council

Illinois Corn Marketing Board

Indiana Corn Growers Association

Iowa Corn Promotion Board

Kansas Corn Growers Association

Kentucky Corn Growers Association

Maryland Grain Producers Utilization Board

Corn Marketing Program of Michigan

Minnesota Corn Research & Promotion Council

Missouri Corn Merchandising Council

Nebraska Corn Board

New York Corn & Soybean Growers Association

Corn Growers Association of North Carolina

Ohio Corn Marketing Program

Pennsylvania Corn Growers Association

Texas Corn Producers

Tennessee Corn Promotion Board

Wisconsin Corn Promotion Board

Craft spirits from other corners of the earth took center stage in New York City in March at Drinks America, the spirits-centric companion to VinExpo America. Japanese spirits, especially awamori from Okinawa Prefecture, were a particular focus (top image: an awamori 101 session). Gin also commanded a considerable share of the spotlight.

U.S. distilleries see obstacles and opportunities in crafting their own agave spirits.

BY KATE BERNOTThere are several challenges facing U.S. craft distilleries interested in producing agave spirits. But the most significant of these is an immovable problem of timing: Drinkers are clamoring for all things agave now—but such spirits are made from plants that require, at minimum, five or six years to grow and harvest. Every agave tequilana plant nestled into the ground today is an investment in a bottle that could, at the earliest, be sold in 2029.

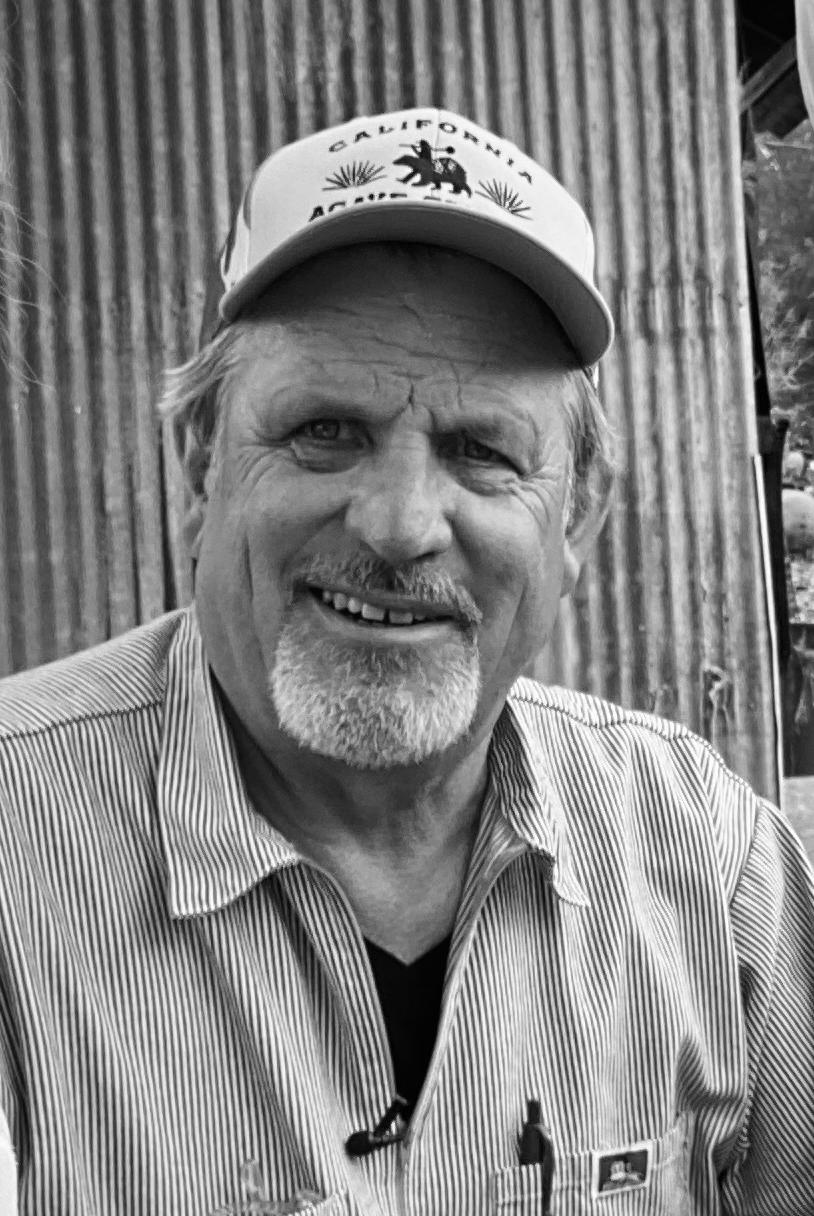

“The only frustrating part for me is I can’t just make agave with a 3D printer. It’s aging in the ground, not the barrel,” says Craig Reynolds, an agave farmer, former agave spirits importer and founding director of the California Agave Council. “People have got to be patient. This is going to take a while.”

Reynolds is speaking about Californiagrown agave, which is a still-nascent agricultural industry with merely a few hundred acres planted in the state. Hawaii is the only other state Reynolds knows of that is currently commercially farming agave for fermentation and distillation. Distilleries selling agave spirits in the U.S. are therefore overwhelmingly using agave nectar (i.e., syrup) imported from Mexico—a supply chain with its own difficulties.

Because U.S. distilleries can’t legally label their bottles tequila or mezcal, they’ve responded to the popularity of those Mexicanmade products with their own versions, called simply: agave spirits. Since April 2020, when the U.S. Alcohol and Tobacco Tax and Trade Bureau (TTB) approved “agave spirits” to refer to domestically produced cousins to tequila and mezcal, Reynolds has tallied 257 label approvals. He knows of just four distilleries that have released agave spirits made from California-grown agave since 2019, including Jano Spirits, Shelter Distilling, Ventura Spirits and Venus Spirits. (St. George Spirits has also made spirits with California-grown agave but has yet to release them.) Reynolds expects more, however, which spurred the California Agave Council to successfully lobby for a legally protected term: “California agave spirit.” Such spirits must fulfill two requirements: be made from 100% California-grown agave, and contain no flavor or coloring additives.

Another certification body, The Degave Organization, also launched to certify U.S.made agave spirits, which it requires to be made of only water and the blue agave plant; be mashed, fermented, and distilled to no more than 160 U.S. proof; and be bottled at no less than 80 U.S. proof.

The modest uptick in U.S.-made agave

“... when you talk about roasting California agave, that’s a real opportunity and there’s a real story there.”

—Sean Venus of Venus SpiritsSean Venus

spirits is born of drinkers’ unquenchable thirst for tequila. They’ve purchased enough of it this year for the spirit to leapfrog American whiskey as the number-two spirits category by dollar sales behind vodka, which tequila is projected to overtake before the end of 2023. Global beverage analysis firm IWSR reports that tequila and mezcal contributed $1.6 billion to the U.S. spirits industry last year, and were responsible for 70% of the industry’s overall volume growth during that period. But domestic agave spirits represent barely a fraction of that.

“By the numbers, what’s being distilled here [in the U.S.] is a miniscule drop in the bucket,” says Emma Janzen, the author of “Mezcal: The History, Craft & Cocktails of the World’s Ultimate Artisanal Spirit,” and a writer who has covered Mexican spirits for more than a decade. “There were 600 million liters of tequila made last year and 9 million liters of mezcal. I think we’re in the thousands of liters of agave spirits made in the U.S.”

To really establish a seat at the table, domestic producers of such spirits need to resolve both existential and practical questions about their products. Are they simulacrums of tequila and mezcal, or something else entirely? How can U.S. producers ensure a high-quality supply of agave plants or nectar? Cultural issues need addressing as well. Tequila and mezcal have roots hundreds of years deep, entwined with the history, geography and people of Mexico. These spirits also have mixed perceptions in the U.S., where a generational divide seems to separate skeptics who associate mezcal with worms in bottles from more enthusiastic drinkers who love high-quality margaritas, mezcal Negronis or sipping añejo neat.

The most intriguing path forward, most producers agree, requires U.S. distilleries to contribute something new to the world of agave spirits—something with a uniquely American vantage point, style and even terroir.

“I love our agave spirit; I drink it all the time. But to me, it’s not tequila on tequila’s terms,” says Nicholas Hammond, founder and head distiller at Pacific Coast Spirits in Oceanside, California. “Other producers are working on

agaves being grown in California. That’s very small production, but I think there’s a long future down that road.”

U.S. distilleries that attempt to precisely recreate tequila are on a fool’s errand. It’s a fact

syrup or plants—is no doubt the largest hurdle facing U.S. distillers of agave spirits.St. George Spirits has produced a spirit made with California-grown agave but has yet to release it.

inherent in the agave ingredients themselves: Most distilleries are using agave nectar, which won’t produce the range of flavors that baked agave piñas will. And for the handful of distilleries using domestically grown agave, the specific soil and climate conditions will never completely mimic that of Jalisco or Michoacán. It’s almost a given that U.S. agave spirits will have to forge their own identity distinct from, but still related to, tequila and mezcal.

“I don’t think that American agave spirits are doomed to be a lesser quality expression of agave. I think that there is so much potential to become a very distinct addition to the conversation,” Janzen says. “But it’s going to take smart, talented, compassionate distillers who are thinking outside the box and not just looking to carbon copy what Mexican producers have been doing so well for so long.”

Currently, U.S. producers must journey down a long road to get their hands on the raw materials that would enable that to happen. Unless a distiller has a farmer source in California, the likelihood of that person getting their hands on actual agave plants is almost zero. The vast majority turn to nectar from Mexico, imported directly or through a broker. But sourcing is complicated, and some bulk agave is cut with corn syrup or other undesirable additives, or has inconsistent quality and Brix readings. One distiller says brokers only wanted to sell him agave wine. When distillers do find a source, it’s often

from the same supplier other U.S. companies are using.

“Everyone can get the same agave nectar, right? It’s like everyone making whiskey from the exact same grain—there’s not going to be much flavor difference,” Hammond says. “If we can get more control of the raw ingredients—which we’re working on—we can start standing out from the masses of ‘locally made agave spirits.’”

Venus Spirits in Santa Cruz, California, is the rare distillery to have worked with both agave syrup and California-grown agave, the latter of which it pit roasts over California almond wood to produce its El Ladrón Yolo agave spirit. It sources that agave through Reynolds, and founder and head distiller Sean Venus says the difference in the spirits produced from fresh agave plants versus agave nectar is night and day.

“The plant provides those deep vegetal notes—the fibers inside the agave really lend all that flavor,” Venus says. “We don’t have as many ways to make [a spirit produced from agave syrup] taste special. We do have the opportunity to use a specific type of yeast to bring out fruitiness and some more tropical notes and flavors, and that’s different. But when you talk about roasting California agave, that’s a real opportunity and there’s a real story there.”

That local sourcing offers a business and an agricultural story, as well as opening the

door to true discussions of agave terroir. Californians—and wine drinkers nationally—largely understand this concept when it comes to grapes. Janzen says terroir is even more influential in agaves, because grapes are harvested annually, meaning they have only one year to allow soil, climate, and ecosystem influence their taste.

“If you consider agave within the same framework, it gets mind-blowing because the youngest plants harvested to make tequila and mezcal are five or six years old,” Janzen says. “That’s five or six times longer for the plant to soak up all these unique characteristics that make flavor.”

Sourcing the best agave—whether syrup or plants—is no doubt the largest hurdle facing U.S. distillers of agave spirits. But there are many more jumps to clear before the spirit gets to drinkers’ glasses.

Chief among these is fermentation. Venus calls fermenting agave “the trickiest thing we do.” Hammond says “you have to really baby it.” Gian Nelson, a partner in Jano Spirits, calls it “an emotional rollercoaster.” Nelson uses California-grown agave americana from the Central Valley farm of Reynaldo “Henry” Garcia; but whether it’s the juice of freshly harvested plants or nectar, fermenting the resulting liquid is universally considered more difficult than typical grain fermentation. Nelson and his other partners in Jano rely heavily on their experience with winemaking to correct temperature issues or stuck fermentations.

“From harvest to end of fermentation, we treat it like wine more than we do anything I’ve distilled before. It’s definitely different from taking a sack of grain and putting it in

“The only frustrating part for me is I can’t just make agave with a 3D printer. It’s aging in the ground, not the barrel.”

—Craig Reynolds of the California Agave CouncilEmma Janzen

hot water,” Nelson says.

For distillers employing natural fermentation, the process is a seasonal one. Yeast and microbes require high temperatures to effectively ferment agave liquid, which constrains when and where the process can happen.

Wiggly Bridge Distillery in York, Maine, only produces its Agave Blue line of spirits— Añejo, Reposado, and Platinum—in July and August, when the heat plus ambient pollen and microbes from nearby agriculture lend a hand in fermentation. Cofounder and head distiller Dave Woods calls this “letting nature help us along.”

But he can’t only rely on nature. Wiggly Bridge’s agave spirits are equally indebted to engineering: The distillery has built its own pot stills which Woods says contribute Maillard reactions to the final distillate. He also installed pumping equipment that allows for a 20-day decanting process before the agave spirits reach the bottle; the process pumps and circulates the finished spirit daily to blow off volatile ethanol vapors, resulting in what Woods considers a smoother, less “biting” final product.

Still other distillers combine modern distilling technology with traditional production methods for tequila and mezcal, roasting agave piñas (the plant’s core or heart) in pits or over wood. Jano Spirits employs this method, a process Nelson admits is time-intensive and costly, especially given the higher labor costs in the U.S. compared to Mexico. While acknowledging there are multiple methods to producing agave spirits globally, this is the only one that feels right for Nelson.

“We wanted to do it this way because of the integrity and respect for the genre that we have,” Nelson says. “From harvest to bottling, we try to pay our respects to Mexican people who have been doing it for hundreds of years, and Native Americans who transplanted these agave across deserts and valleys.”

Whether roasting piñas or purchasing highquality agave nectar, distillers know that good agave spirits are not cheap to make. (“I’ll never become rich selling agave spirits. We just don’t do the volume,” Woods says.) Those made from U.S.-grown agave are especially costly. A bottle of Jano Spirits retails for about $120; Venus Spirits’ El Yadrón Yolo retails for $90.

But given that demand for such spirits is vastly outpacing supply right now, this isn’t a catastrophic problem. Nerds and aficionados

have proven willing to pay these premium prices, a trend in line with the broader tequila and mezcal market. IWSR forecasts that super-premium-and-above tequilas will continue to be the major drivers of not only category dollars but volume, reaching 40% of global tequila volume by 2026.

Ultra-premium pricing conveys to drinkers that U.S. agave spirits are special and rare—setting up an expectation that they’re on par with the best tequilas and mezcals coming out of Mexico. It behooves U.S. producers, then, to make sure that their bottles live up to that reputation.

“They’re in the same [price] tier as mezcal and tequila from Mexico that’s made in an incredibly high-quality way with a depth of soul that’s incalculable,” Janzen says. “I think there is some skepticism of: Why would I pay that much for this spirit when right now it doesn’t hold a candle to what’s being made in Mexico?”

The answer again recalls the existential question facing U.S. makers of agave spirits: What can these contribute to a well-loved and storied class of spirits that’s new, unique and authentic? That’s exactly the legacy Nelson is working to build not only for Jano Spirits but for California agave and U.S. agave spirits more broadly: He wants the American West to have a reputation for these spirits on par with Kentucky bourbon or Tennessee whiskey. “I love the pioneering spirit and culture we have out here,” Nelson says. “I hope we can go back to growing and doing something with agave in a way that makes our culture proud of who we are.” ■

PERFOMANCE AND BALANCED AROMAS

SafTeq™ Silver

IDEAL FOR NEUTRAL FLAVOR PROFILE

SafTeq™ Blue

Heeding the example of the wine industry, craft distillers are creating state boards to generate more visibility for their products.

BY ANDREW KAPLAN

BY ANDREW KAPLAN

Kelly Woodcock, a partner and vice president at Westward Whiskey, says she and other craft distillers in Oregon have long cast admiring eyes on their state’s wine board. “We feel very jealous of the success they’ve had,” she says. “I think for a long time Oregon was kind of thought as a crazy place to grow wine and now, with the help of the promotion of the Oregon Wine Board, Oregon wine is considered some of the best in the world.”

She might not have to be jealous much longer. Woodcock—who is also the vice president of the American Craft Spirits Association’s board of directors—and the rest of the Oregon craft spirits community are driving an effort to create their own version of the wine board. A bill to establish the Oregon Spirits Board is currently winding its way through committees and could come up for a vote before the legislature soon.

As the craft spirits industry gains in size and importance across the United States, Oregon’s proposed spirits board is part of a movement gaining steam to attach more of a local identity to spirits produced in each state. In some cases, these boards also fund additional research and education for their local industry.

The idea of creating spirits boards is a

popular one in the industry. In a recent ACSA town hall survey, 82% of respondents were in favor of the ACSA supporting efforts to expand such boards in states across the country. “It’s an emerging trend,” says Michael Walker, ACSA’s state policy advisor.

Some other states that have already created such industry boards are Virginia, whose spirits board recently hired a professional marketing firm; Maryland, which has expanded its wine board to include all beverage alcohol products; and Michigan, which has a craft beverage-focused board. Distillers in Iowa and Indiana are also currently working to create their own state boards. And those in Oklahoma have also expressed a strong interest in creating one as well.

Virginia’s is one of the furthest along. Its new marketing office will handle promotions as well as provide a much-needed physical headquarters for board business. Just a few years into the board’s authorization in 2020, the Virginia Spirits Board currently has an annual budget of approximately $1 million, generated from 20% of the 20% excise tax on spirits, which amounts to 4% of each bottle sold.

“We are kind of ahead of the game compared to others across the country,” says David Cuttino, Virginia Spirits Board chairman and CEO of Richmond-based Reservoir

Distillery. “Ours is fully up and running and I think that kind of makes us an industry leader in it.” Today, Virginia distilleries represent an economic impact of more than $163 million and support 1,500 full-time jobs in the state.